The global economy is a very complex and multifaceted area, which is not so easy to understand without the appropriate education. However, some facts are fundamental to it. For example, the economy is based on gold and foreign exchange reserves, global and national, of each country. Therefore, not only the exchange rate, but also the price of gold has a great influence on state economies.

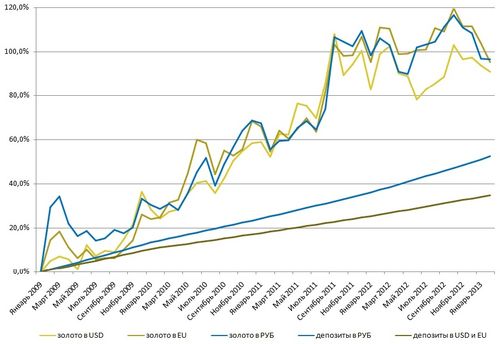

Gold price growth chart

Therefore, it makes sense to consider this indicator in more detail, especially to look at the chart of gold prices for a certain period, say, for 5 and 10 years, focusing on the readings of Sberbank.

Global market

The concept of the world gold market, in a broad sense, includes all stages of the circulation of this metal: its extraction, processing, distribution and sale. More narrowly, it should be understood as the wholesale trade of gold in the form of measured bars and coins.

The gold market has its own characteristic features:

- In fact, each country has its own insurance and reserve fund;

- The total world reserve according to recorded data is about 31 thousand tons and can be put on the market at any time;

- Much larger volumes of gold are held by the population in the form of jewelry, coins and simply scrap. Some of this gold is also present on the market.

Even in our time, most countries have a gold reserve fund.

These facts are quite interesting: despite the fact that a significant part of the supply is designed for gold mining, the second part, sold by banks and investors, has great variability, which means a significant impact on the exchange rate.

At the same time, gold mining companies do not have much leverage on the world market:

- They can influence the largest banks, persuading or forcing them to intervene in sales volumes;

- Reducing costs, increasing production profitability.

Gold buying rate

Please note that the purchase rate for gold will always be influenced by the exchange rate of world currencies and, in particular, by the US dollar. There is a certain correlation between gold prices and the value of the dollar. As a rule, it is inversely proportional. In other words, as the dollar rate rises, the cost of an ounce of gold decreases slightly. When it falls, it grows. World gold prices are fixed in US dollars. Accordingly, if in Russia the value of the national currency decreases against the dollar, prices for purchasing gold in rubles will increase.

World prices

It is curious that the value of 4.24 troy ounces, established back in 1717 by Isaac Newton himself, remained for two hundred years.

The prices for the yellow metal changed for the first time after 1932. Further, gold was stable in price until 1971, when gold standards were abolished. In recent years, price dynamics have begun to replicate those for non-ferrous metals: strong growth is followed by a long decline in value, and this happens cyclically.

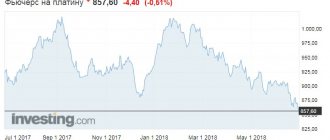

Dynamics of the cost of a troy ounce in recent years.

Having refused to back their national currency with gold, most countries were faced with an increase in the money supply and subsequent inflation. At the beginning of the 1980s, it became obvious that such a policy worsens the economic situation and creates unnecessary problems. The process of stagflation (a decline in production coupled with inflation, which began in most developed countries) caused gold prices to skyrocket. A troy ounce began to cost 850 dollars, instead of the previous 43. Taking into account dollar inflation, in our time it would be 2,000 dollars.

The authorities of the countries, realizing the deteriorating situation, introduced measures to combat inflation, reducing the issue of paper money. Such measures contributed to a decline in prices.

The dynamics of gold prices have stabilized and the graph of the rise and fall of gold prices has begun to steadily move downwards.

The biggest price low was recorded in 1999, after which an interbank agreement was created to limit the amount of gold sold from their reserves. Gold stabilized for several years, and its price dynamics began to rise only in 2002, the reason for which was the issue of securities started by an American bank. Which once again confirms the cyclical nature of quotes.

Gold rate for today

The main benefit of investing in gold is that this method of investment makes it possible to preserve your finances even during a period of serious economic crisis and high inflation in the country. You can find out the cost of one gram of bank gold on a specific day on the official website of the Central Bank of the Russian Federation. On average, at the moment the rate fluctuates and is about 1320 rubles per 1 gram (information as of the beginning of July 2021). Price dynamics largely depend on what the situation will be on the global gold market. The course is quite “sensitive” to various kinds of economic and political changes in events taking place on the world stage.

Price dynamics over the last ten years

The increase in the cost of gold over the last ten years is impressive; at the beginning of the 2000s, an ounce cost $272; in 2011, the cost was already $1,600. Experts say that this is not the “ceiling” yet and it may further increase its value. The first reason is the events of September 11, 2001 and the further decrease in the cost of home mortgages in the United States. The buying boom of credit real estate ended with an economic crisis in America and the world as a whole.

The dynamics of gold, if we look at quotes over the past 5 years, have stabilized somewhat, and gold has lost a little in price. But the effective adoption of anti-crisis measures, the deterioration of the stability of the EU economy, and events in the Middle East caused a new surge in prices. Over the past and current years, there has been a steady increase in gold prices.

Record growth

Obviously, in the long term, investing in gold is the most effective investment. Questions arise only in cases where you have to invest money for a short period, say, for several months. Then the risks increase significantly, as evidenced by any gold chart for the year, which shows ups and downs.

In any case, it makes sense to look at trends by looking at different time periods to see how prices behave.

If you look at this figure over 10 years, considerable growth is obvious. A particular difference was noticed between 2001 and 2011. In the first case, the price of a troy ounce (about 30 g) of gold is $272. And in 2011, this figure increased to $1,600, that is, the increase was a record 588%.

According to experts, such an indicator can be defeated by new jumps in gold prices, which can be expected at any moment.

Another large increase in value occurred at the beginning of 2008, when the price of gold reached more than a thousand US dollars per troy ounce. But already in 2009 there was a sharp drop in prices. It is clear that such changes were caused by problems in the global economy, which in the second half of 2008 was experiencing one of the worst moments in its history. However, by the end of 2009, the cost of a troy ounce of gold increased to a then record $1,200. This chart of gold growth only confirms how effective investing in this precious metal can be. And in just 5 or 10 years you can earn good money.

A new decline was noticed in 2010, but by the fifth month the cost again reached last year’s $1,200. And if in 2009 the rise was explained by the adoption by the Americans of the government anti-crisis program, then this year a decision was made on the solvency of the EU countries. Already in May the cost reached $1,240. And if the summer was quiet, the fluctuations were insignificant; at the end of 2011, the cost of a troy ounce of the precious metal increased to $1,420.

Further growth continued, as evidenced by the 10-year gold chart provided by Sberbank.

Seasonal price changes

An important point worth paying attention to is the annual exchange rate fluctuations, the reason for which does not depend on the situation in politics and the economy.

You should not buy gold on the eve of major holidays such as Thanksgiving.

If you are planning to purchase gold, you should not do it on the eve of Thanksgiving in America, Christmas holidays in the US and EU, or before the Indian autumn holiday, because that time is characterized by increased demand for jewelry, and India is a major producer and buyer of the yellow metal in the world. New Year in China also contributes to some exchange rate fluctuations.

Seasonality

The exchange rate, as is known, is determined by two factors that depend on each other. It's about supply and demand. With precious metals, things are a little different. If you analyze the price chart for gold, annual periods when there is an increase and decrease in the price level for the precious metal become obvious.

Demand for the precious metal definitely depends on calendar holidays. For example, when the marriage season begins in India, prices for gold jewelry immediately increase. Sales of products in America also increase significantly during the Christmas and Thanksgiving holidays. Another increase is expected at the onset of the New Year.

As a result, we can note the following trends in gold price fluctuations according to the chart for the year from 2005 to 2015:

- second half of October – first half of February – growth;

- March – May – another significant increase, but smaller;

- the first half of August - the first half of October - the increase in prices, as a rule, is slightly higher than in the previous period.

According to Russian legislation, transactions for the purchase and sale of gold and other precious metals are carried out at negotiated prices. This means that any Russian bank has the right to set its own price conditions.

For example, Sberbank, like other market participants, bases its figures on data from the Central Bank, as well as the fixing of the London Stock Exchange.

At Sberbank, the exchange rate in rubles for precious metals depends on the following factors:

- change in demand;

- cost of banking services;

- regional variations;

- bank profit;

- other factors.

Accordingly, the higher the value of these parameters, the higher the rate will be. Of course, for Sberbank, with its developed structure, the regional factor is of great importance. The difference in quotes in different branches (in different regions) can vary by up to 10 percent.

In addition, depending on the location of the Sberbank branch, profit is also included, which generally significantly affects the price difference. The cost is fixed every day, and the data is immediately displayed on the bank’s official website.

Let's not forget that the cost of gold in Sberbank is also determined by the form of acquisition of this precious metal:

- ingot;

- metal bill;

- coins.

In rubles, bars are more expensive than other options, and coins will cost about the same, but in the end they will cost more, taking into account the peculiarities of taxation. After all, you will have to pay 18% VAT. The total cost will include this amount. If an account is opened, then there is no actual purchase of gold; there is only a link to the quotes for this precious metal.

Let's summarize

As you can see, the chart of changes in gold prices is a dynamic indicator, which over the course of several years is constantly growing. Therefore, you can make long-term investments in rubles, for example, even in 2015, realizing that in a few years the investment will bring good income, especially if the investment amount is considerable. And don’t panic if there is a drop in value. This trend has been typical for many years. However, practice shows that some time will pass, there will definitely be a jump caused by some events in the world: a crisis, a disaster, political statements or actions, and so on. Therefore, you just need to wait for the benefits.

What else can affect the rate?

Production and technical factors:

- Increased demand from jewelry manufacturers;

- Opening new gold mining “points” and closing old ones;

- New methods of mining “yellow” metal;

- Growth of energy and labor resources.

The factors described above do not take into account an important feature of gold, not only its investment potential, but also the fact that it is a raw material. Gold is a mineral; the dynamics of its value depend on the cost of production and how high the demand from industry is.

The opening of new and modernization of old production points also affects its price.

Financial factors

The following factors have the most significant impact on the price of gold on the world market.

When the world economy suffers another round of economic problems, gold prices rise. What is the reason?

Experienced investors, seeking to preserve their assets in unstable economic times, prefer conservative methods of storing capital. Naturally, gold has been a proven means of payment for centuries, which “saves” investments in times of crisis.

The dynamics of price changes in stock markets have an impact on gold and other precious metals, taking into account the “maneuvers” of large investors.

A good indicator for investors is the price of gold on the spot market. When active transactions occur there, it affects the rest of the “chain” involved in trading.

Factors that influence price growth or decline

The key factor is always the demand for gold in relation to supply. Statistics show that an increase in quotations of precious metals is observed when exchange rates of reserve currencies fluctuate.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

Investors try to protect their money by investing in gold. It provides maximum stability, because it is not only a currency, but also a commodity.

Thus, changes in accounting policies in the United States contributed to an increase in demand and value of the asset and led to changes in quotations.

The latest crisis has forced entire countries to reconsider the composition of their foreign exchange reserves, increasing the share of physical gold in them. This increase in demand for this type of investment, apparently, provoked a sharp jump in prices for precious metals in 2011-2012. Subsequently, demand decreased somewhat and over the past few years there has been no significant rise or significant decline in prices.

When the situation is stable, noticeable fluctuations in quotes can cause actions by major players. For example, the sale of a significant amount of precious metal is quite capable of influencing a decrease in the price of gold.

The situation will worsen even more when other investors rush to get rid of their depreciating asset. However, this consequence of speculative operations is quickly corrected in accordance with the laws of the market.

Depletion, or, on the contrary, the launch of new large mines, the emergence of a cost-effective method of extracting precious metals from alternative sources can also cause fluctuations in stock prices.