Author Said Gafurov

25.05.2016 12:17

Economics » Finance » Investments

Is gold still a reliable means of storing funds? How to invest in gold? What risks exist? Who determines the value of the dollar? What role does Shanghai play in the gold market? The vice-president of the Golden Coin House, Alexey Vyazovsky, answers these questions for Pravda.Ru.

Why is Russia investing in gold?

Where can you invest in general?

The simplest option is a bank deposit with the possibility of replenishment. However, interest on deposits does not compensate for inflation in any way, and the banking system itself is far from stable. In an emergency situation, when something happens to your bank, the insured deposit can only be returned in an amount not exceeding 700,000 rubles along with interest. The number of insured events is limited to only two points:

- Deprivation of a bank's license.

- Moratorium of the Bank of Russia on payments to creditors of this bank.

This type of investment will not protect you from possible political instability.

Buying foreign currency is not for the faint of heart. The exchange rate of foreign banknotes fluctuates in the most inexplicable way, which makes their owners simply helpless. In addition, there are rumors about the introduction of the so-called “amero” instead of the dollar or about the complete abolition of the circulation of foreign money in the country. Even professional experts cannot predict which of the world’s currency units will be reliable and profitable in the long term. That is why the Bank of Russia focuses on the dollar-euro bi-currency basket. Its price in rubles is calculated by adding the cost of 45 euro cents and 55 US cents. At the same time, the national currencies of Asian countries appeared on the world stage.

Healthy accounting skepticism also arouses the desire of some investors to buy shares in the vain hope of dividend payments and subsequent profitable sales. Exchange games with securities are not designed for the long term and require a more than professional approach from participants.

Since we are considering the accumulation of funds accessible to an ordinary person, and not the investment of medium and large capital, we will not consider investments in real estate. We are left with only eternal values. Is this gold.

For several millennia, the yellow metal has been a unique investment instrument. The volume of paper money is constantly growing at an annual rate of up to 9%. At the same time, gold production does not increase by more than 1%. The money supply is growing faster than the world's gold reserves. Therefore, an ever-increasing amount of paper money buys an ever-smaller amount of precious metal. This is the reason for the constant increase in the value of gold.

Why gold anyway?

Why do we think it is better to invest in physical gold? What is its advantage over platinum, palladium and other precious metals? Of all the listed values, only gold has interstate strategic significance.

The Russian gold reserve is the basis of the country's gold and foreign exchange reserves. It is considered federal property, meets the state's emergency needs and serves as an instrument of financial policy. It consists of refined gold bars. Purifying a precious metal from impurities and bringing it into compliance with state technical regulations approved by law is called refining.

Part of the Russian gold reserves are stored in the Bank of Russia, and partly in the State Fund of the Russian Federation. The country's gold and foreign exchange reserves also include gold coins with a purity of at least 995. Standardized bars, as well as such coins, are the so-called “monetary gold”. It accounts for approximately 8% of the total volume of government gold and foreign exchange reserves.

For ordinary citizens, purchasing gold for investment purposes is available through the intermediary of banks, traders or licensed coin dealers.

From an accounting and financial point of view, gold is a highly liquid asset that can be stored indefinitely, while constantly increasing in price. When summing up the balance, the yellow metal is often included in the cash equivalent. As the Bank of Russia changes discount rates, as in the case of foreign currency, the company can timely recalculate the price of the gold it owns, changing the balance sheet ratio in its favor. This is exactly what many credit institutions do.

The procedure for registering a deposit

If you decide to invest in gold, you must choose among the banks the one that provides the best opportunities. Although, first of all, they pay attention to the reliability rating, because such deposits do not belong to the deposit guarantee system.

If you want to make a deposit by purchasing gold bars, you must make sure that the selected institution has weighing instruments and equipment that allows you to verify authenticity.

Before opening a bullion deposit, consider how you plan to store it. After all, purchasing from one bank and opening a deposit in another is accompanied by additional costs.

Clients have the right to choose a safe deposit box for storage. This will increase costs, but will provide additional guarantees. After all, if something happens to the metal, responsibility falls on the bank.

Next, an agreement is concluded that takes into account various norms, obligations, and conditions.

Legislative initiatives

Back in 2012, the State Duma considered a bill that appreciated the properties of precious metals as investment instruments. This legislative initiative proposed, according to draft Federal Law No. 35712-6, to enable Pension funds to store funds financing the funded part of labor pensions in gold and other precious metals. Previously, such investment activities were prohibited by law.

A special explanatory note to the bill argued for the solutions planned by the developers. It stated that the management company of the state-owned Vnesheconombank is unable to ensure the growth of the funded part of the population's pensions. Negative investment performance of VEB can lead to mass protests, unrest and riots. An alternative to this bill should be investments in the gold and silver markets, the growth dynamics of which are more than impressive.

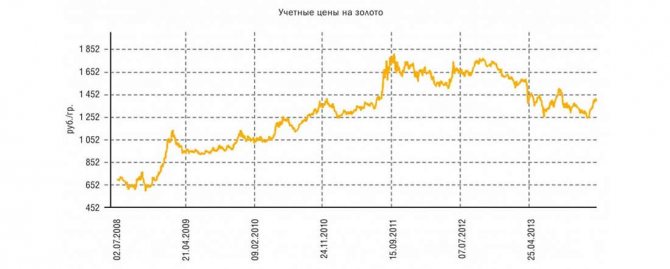

The statistics provided in the explanatory note to the legislative initiative are limited to 2011. What do we have now? The official Internet resource of the Bank of Russia provides and constantly updates information on the book value of refined precious metals. Everyone can familiarize themselves with it. Based on the analysis of the information provided, the following conclusions can be drawn:

- Over the past five and a half years, the price of gold has doubled;

- Over the period 2012-2013, the cost of the yellow metal changed and according to the results fell by 23%;

- In the first month of 2014, the price of gold jumped by 11%.

Data on accounting prices of gold:

It is important to remember not to worry about short-term changes in the value of gold, as it is a long-term investment vehicle. The legislative initiative described above remained mired in Duma discussions. It was not allowed to proceed because the Russian government was against such a bill. After all, for such passive investment it would be necessary to withdraw from circulation a huge amount of funds (our pension money), partly thanks to which the country’s economy continues to remain afloat during the period of stagnation.

Types of “metal” accounts

There are two types of bank deposits in precious metal:

- safekeeping – storage of precious metals that are transferred by the client to the bank;

- OMS (unallocated metal account) – purchase of a certain amount of precious metal from the bank and crediting the weight in grams to the client’s personal account.

Compulsory medical insurance has the following advantages:

- You will not have any difficulties with storing, certifying, and transporting gold;

- You have a chance to make money on changes in the value of the metal, as well as on bank interest;

- The increase in the value of the precious metal will not be taxed;

- You do not need a special registration certificate.

Do you prefer coins or bars?

To create a personal gold reserve, commercial banks offer citizens two options - gold coins and bars weighing from 1 gram. Which is better to choose? They say that everything here comes down to VAT. Is it so?

According to the Tax Code, transactions of purchase and sale of precious coins that are recognized as legal tender on the territory of the Russian Federation or another state are not subject to tax.

The Bank of Russia even issued a special instruction dated June 21, 2013, which regulates the circulation of investment coins and allows them to be sold and purchased not only at face value, but also taking into account the value of the precious metal contained in them, without the need to pay VAT.

As for coins of foreign countries, their circulation is regulated by letter No. 02-29-7/3313 of the Bank of Russia dated 09/06/2013. It says that the status of precious coins as a legal means of payment is established only by the competent issuing structures of the respective countries. In this case, the main criterion is an official statement of a given issuing structure or another method of informing about legal tender, legally established in the issuing country. Such structures are financial ministries, as well as national or state central banks. There is another letter No. 03-07-05/35 of the Ministry of Finance of the Russian Federation on this topic dated November 9, 2011, but its content is controversial.

The first mentioned letter informs that the Bank of Russia does not operate with foreign coins, which credit institutions independently acquire using the secondary market. Ordinary citizens are also allowed to import them from abroad into the territory of the Russian Federation. However, according to Federal Law No. 173, regulating exchange control, dated December 10, 2003, foreign coins are considered foreign currency, since they are legal tender and are in circulation in the territory of the issuing country. This may cause difficulties in their circulation in Russia.

We will not delve too deeply into the complexities associated with foreign coins. Let’s just say that for a novice domestic investor it is easier to buy Russian gold coins. As we already know, their acquisition and subsequent sale are exempt from paying value added tax. But that's just for now.

Commemorative coins are also not subject to VAT, but due to their artistic and collectible value, their value is much higher. Such specimens are of more interest to numismatists.

The official Internet resource of the Bank of Russia regularly reports on the release of coins into circulation. Here you can always find information about the catalog number of the coin, its design, nominal value, number of issued copies, name, theme, dimensions, minting technology, as well as the characteristics of precious metals - fineness and net weight.

The turnover of gold bars is regulated by Article No. 149 of the Tax Code (clause 3, subclause 9). The sale of precious metal bars is not subject to VAT only if they are deposited in a bank (according to letter of the Russian Ministry of Finance No. 03-07-05/44 dated May 25, 2012). If the owner wishes to pick up his bullion, then in addition to its cost, he will have to additionally pay a value added tax of 20%. In a practical sense, the size of the tax itself is not a decisive factor, as we will show later in the examples.

Family stash

In 1993, during construction work in an underground parking lot in Trier, more than 18 kilograms of gold coins from the Roman Empire were discovered. They were in a leather bag, which was stored in a metal pot. It appears to have been a family stash that was replenished over many decades.

Treasures found by German residents

Buy and never sell

According to Federal Law No. 41-FZ (Article 21, paragraph 1), when conducting transactions with precious metals, their value is determined by international market prices. They are formed on the precious metals exchange in London. Every day, the official Internet resource of the Bank of Russia publishes this information, following the instructions of its management No. 1283-U dated May 28, 2003, regulating the formation of the accounting value of refined precious metals. All professional participants in the gold market follow the prices indicated on the website, regardless of whether they are selling or buying.

Simple example

Let us carry out a simple analysis of the conditions for the purchase and sale of gold in one of the Moscow branches of Sberbank of Russia according to data as of 02/05/2014. As a starting point of 100%, we will take the book value of gold in the Bank of Russia on this date. In the table below, we have rounded all values to whole numbers.

The bank's profit from the sale of 1 gram of gold in the form of coins is 39%. It exceeds the profit from the sale of bullion, equal to 28%. It is not so important that the markup when selling an ingot already contains value added tax. It will not be deducted again. It doesn’t even matter here that the “Sochi 2014” coins were not made in the best quality (“uncirculated”). This minting technology is more often used in the production of change coins used as a means of payment at face value. Hence the conclusion: the high cost of bullion due to the value added tax is imaginary. The quotation spread, or the difference between the purchase price and the sale price, for coins and bars is approximately the same, 28% and 24%, respectively, relative to the purchase price. It is because of the spread that it is more profitable to store gold in coins and bars without selling it for several years. For foreign currencies, the spread is much smaller.

The above calculation is quite specific. Before investing your hard-earned savings anywhere, carry out similar calculations and evaluate the possible return on investment.

Any sale must be accompanied by another tax payment - personal income tax. You can avoid it if you have owned the property being sold for more than three years. Therefore, papers on the purchase of gold coins and bars must be kept.

Golden tips

- Do not sell bullion and jewelry to private traders, this will reduce the cost by 50% of the original;

- It is recommended to withdraw investments from compulsory medical insurance only after the price of the metal has risen by 13-18%, this is guaranteed not to leave you at a loss, and for profit you should wait for a greater increase;

- Buy valuables for the weakest currency, this will increase your income in the future;

- When keeping bullion in your home, ensure good conditions so that the metal does not lose its shine and color, do not tell anyone about the value you have and do not keep it in the public domain;

- If you have invested in jewelry, then you should not sell it at a pawnshop - the latter accepts used jewelry for the price of scrap.