16.08.2019

Among the enduring values that are significant to a person throughout his entire existence, only gold has never lost its original value. It has always been used to exchange for goods; people and entire states have been bought with its help. To own gold, they went to death and murder.

►

watch video

►

gold price online

►

market analytics / forecasts

And today the yellow metal remains an object of desire, a valuable commodity and a means of saving and increasing wealth. Among the reasons for the increased demand for this precious metal are the difficulty of its production, small quantities and special chemical properties.

Professional investors always include gold in their investment portfolio, at least partially. They use the precious metal itself, or derivative instruments from it - stock indices, gold coins, bars, futures and compulsory medical insurance.

Just 4 years ago, gold was four times cheaper. Those who owned it all this time received an income equivalent to 26% per annum. But no one claims that such investments are stable. Over the past four-year period, the value of the yellow metal has risen and fallen many times. Therefore, it is not suitable for short-term investment with the aim of making immediate profits. Gold completely protects funds from depreciation and brings benefits only over a long period of time.

Benefits of investing in gold

Throughout human history, gold price dynamics have been only positive. However, this rule only applies over a long period of time. Let us list several main advantages of the yellow metal as an investment instrument:

- This precious metal is in demand at all times and in all countries due to its high liquidity.

- Gold is not tied to a specific state, like a currency, and the demand for it is the same all over the world.

- The yellow metal has been accumulated by people for thousands of years, passed down from generation to generation, and has also historically been the best means of accumulating and preserving wealth.

- Gold is not subject to corrosion; it can lie in water and soil for centuries without changing shape or color, without reacting with chemically active substances, without deteriorating, without disappearing or losing its value.

It is for these qualities that people all over the world value and love gold. And in order to preserve their savings and make money on them, every investor should turn to this precious metal.

The price dynamics of the gold market in recent years have experienced both ups and downs. Today it is no longer subject to such significant fluctuations and is stable. A major collapse in value was observed after the entry into force of the Frank Law, which prohibited the trading of gold by banks and exchanges. An even greater price decline occurred after the Soros fund began selling its securities.

These days, similar shocks are typical for Bitcoin and other cryptocurrencies. Their quotes collapsed due to legislative obstacles. If we talk about gold, its value is influenced by many market factors, which are extremely difficult to predict. But based on the amount of yellow metal in circulation, it is clear that its price will only increase. Gold cannot simply be printed, as states do with their national currencies. Therefore, its price increase over time is inevitable.

Alternative to gold

At the moment there is no alternative to gold. After abandoning the gold standard (in the 1970s), the world chose an inflationary model of economic development. In this model, inflation of 2-3% is considered desirable. Lower inflation is a cause for concern. To protect your savings from currency depreciation, investing in gold is recommended. Other raw materials can be used for these purposes. But gold is not just a raw material. It performs monetary functions (even if it is excluded from mutual settlements). It is protected from losing its relevance in industry.

But price fluctuations are still significantly less than for oil and other metals. Diamonds could be a substitute for gold. But they have already learned how to grow them artificially. And their pricing is quite complicated. Yellow metal is convenient for exchange, transportation and storage. Unlike liquid oil, it does not spread or burn. It does not rust and is chemically very inert. It has a high melting point. And its price allows you to accumulate a significant fortune in small bars. Platinum metals could compete with gold. But they were discovered relatively recently.

Since the collapse of Bretton Woods, American authorities have been promoting the idea that gold is a relic of the past. But their interest in such rhetoric is understandable. After all, the dollar is the world's reserve currency. However, no world currency can be a substitute for gold. The reason is the presence of a single issuer. If one country becomes the master of the world currency, then all other countries are at a disadvantage. Risks regarding the issuer's country are borne by the entire world. Problems in the economy through the threat of inflation and deflation affect other states. Also, the issuing country can manipulate commodity prices.

But in addition to economic and financial risks, there are also geopolitical risks. In the event of a war between the United States and China or Russia, the outcome is unknown. Empires have come and gone. And gold has been performing monetary functions for thousands of years. It does not have a single issuer. The deposits are scattered all over the world. No one can be the master of the yellow metal. America naturally says that the dollar has replaced gold. But this is obvious biased propaganda. In the United States, they never mention that the dollar became the world reserve currency precisely through its peg to gold.

Author of the article, financial expert

Dmitry Tachkov

Hello, I am the author of this article. I have a higher education. Specialist in finance and banking. Worked in commercial banks of the Russian Federation for more than 3 years. I have been writing about finance for more than 5 years. Always on topic about the best deposits and cards. I make profitable deposits and receive high cashback on cards. Please rate my article, this will help improve it.

about the author

Useless

4

Interesting

40

Helped

23

Ways to invest in gold

Thanks to the progress and development of technology, investing in gold today is not just about buying it in metallic form. Let us list the main modifications and derivatives of the yellow metal that are in demand on the market and in which you can profitably invest:

- Gold bars.

- Gold coins.

- Compulsory medical insurance (unidentified metal accounts).

- Jewelry.

- Exchange stock indices.

Any of the listed investment methods has advantages and disadvantages. It is impossible to say unequivocally that one of them is ideal and the other is unpromising. We need to consider them all.

Gold Pricing Factors

There are a number of events that could cause precious metals prices to rise or fall to varying degrees. Before investing in gold, you need to assess the risk level of these factors.

- Internal or external political conflicts;

- The state of the country's gold and foreign exchange fund;

- The economic situation of the state at the present moment and in the near future;

- Legislation in the field of gold trading;

- Dollar exchange rate.

Investments in bullion

One of the safest ways to invest in gold is to purchase bullion. The weight of a standard bar is 1 kilogram of gold. Before selling, its weight is measured, a certificate of conformity and contract documentation are prepared. Many banks trade bullion. If desired, you can choose the required weight and shape. Changes in the situation on the market or in legislation, dependence on the reliability of the bank are not scary for investors who have “live” gold in their hands in the form of metal.

Buying a gold bar is easy, but storing it safely is difficult. To do this, you can rent a safe deposit box or buy your own home safe. At the same time, only you will be responsible for the safety of your property, even in the case of a safe deposit box, the bank, like a bad wardrobe, is not responsible for the safety of things.

Another problem associated with purchasing bullion is the need to pay value added tax of 20% of the purchase price. If you then sell the metal back to the bank, VAT is not refunded. Therefore, in the absence of significant price rises, the buyer always remains at a loss when selling bullion. In addition, potential profits from subsequent sales also require taxes. You can really make money on bullion only if its value increases by more than 31%. This probability exists over a time period of at least 7-10 years.

Hence the conclusion is that while we win on bullion in terms of reliability, we lose in terms of associated costs. To invest in molded gold metal, you need to have a large amount of money, since affordable standard bars weighing a few grams are not produced. The acquisition will inevitably be followed by a headache - where to store it and how to pay taxes. Bullions have low liquidity. They are difficult to implement quickly. And when buying back, the bank will start looking for the smallest damage in order to reduce the price.

Method 6: Advanced – buy an option or futures

This option is for sophisticated investors. In terms of risk level, futures instruments are somewhere between stocks and forex. But this is the only real way to make millions in a few successful trades, regardless of the value of the underlying asset. A common mind and sober calculation are enough.

An option is a derivative financial instrument that allows you to buy an underlying asset at a previously agreed upon price. This is not the disgrace that is happening at binary options brokers, but a full-fledged exchange asset.

Futures are almost the same, but the seller and buyer are obliged to conclude a transaction, no matter what the price of the underlying asset turns out to be. In the case of an option, the seller may not exercise his right and not sell the instrument if the price does not suit him.

And here’s another interesting article: Rostelecom dividends in 2021: timing and amount of payments

The price of options and futures themselves varies depending on the underlying price of the asset, its prospects in the market and the volume of the derivatives themselves. Well, for example, if gold becomes cheaper, then expensive options become unprofitable for sellers, and they urgently get rid of them. And if the price rises, then enterprising buyers can outbid cheap options and get gold at a price below the market.

Investing in gold coins

If you do not have a lot of money, but want to own real gold, then there is the following investment method especially for you - buying gold coins. As with bullion, you will have to worry about how to store and how to sell the coins later. Their value is also not growing quickly. Such investments are always designed for a long period of time.

In addition to the pure weight of the precious metal contained in the coin, its price is affected by the quality of mintage, circulation and prevalence. The rarer a piece is considered, the greater the demand for it among numismatists, and such coins can be sold for large sums of money.

Gold coins are also sold in banks. It is easy to buy a gold coin at Sberbank. Selling later is difficult. Even minor damage found will be grounds for refusal. To avoid this, transparent capsules, special numismatic albums and cotton gloves are used to store and protect coins if you still need to pick up a coin.

It is more difficult to deal with collectible coins than investment coins, despite the fact that their numismatic value, rarity and better quality of minting determine a much higher price. This is explained by the need to find an interested buyer who can pay the required amount.

The main advantage of precious coins over bullion is that there is no need to pay VAT. Over a period of 3-5 years, the price of a coin can increase significantly, which will provide you with a corresponding profit. But in order to get this benefit and not make a mistake in choosing coins for investment, you must have knowledge of the conditions of the numismatic and gold markets.

Investments in compulsory medical insurance

If you have insufficient financial resources, you can take a closer look at investing in the form of compulsory medical insurance (impersonal metal accounts). You can open such an account even for 1-2 grams of precious metal in almost any bank. In this case, you will not own physical metal, but will be able to carry out transactions with it through a bank that fulfills monetary obligations to you. If you want to withdraw metal from your account in the form of an ingot, you must pay VAT.

Among the advantages of compulsory medical insurance are the absence of worries about storage and the ability to sell at current quotes at any time. However, compulsory medical insurance does not fall under the deposit insurance program. Here a lot depends on the reliability of the bank.

You can invest profitably in an impersonal metal account with only 1-2 thousand rubles in your pocket. But, if you sell precious metal from your account earlier than three years after purchase, you will have to pay VAT. So, you can count on profit only after a three-year holding period.

Opening compulsory medical insurance is available on the online platform of Sberbank or in its offices. When concluding an agreement, a bank record is created about the amount of metal in the account, which the client then manages himself, buying or selling gold.

Method 4: Tricky - buy shares of gold mining companies

If you personally don’t want to bother with gold, but want to make money from precious metals, you can buy yourself a piece of a gold mining company. To do this, it is enough to have an account with any Russian broker and several free thousand rubles in the account.

And here’s another interesting article: Rosneft dividends in 2021: what to expect from the oil giant?

I will not talk about the features of investing in shares, the pros and cons of this financial instrument - this is beyond the scope of the article. I will only note the shares of which Russian public companies you can buy:

- Lenzoloto;

- Buryatzoloto;

- Pole.

There are also LLC securities, but they are traded outside the market and their purchase should be approached with caution. There are also GDRs (global depositary receipts) traded on the Moscow Exchange of the following Russian companies:

- Nordgold (“subsidiary” of Severstal);

- Polymetal International plc.

There are also foreign companies, but their shares are traded mainly on the London and New York stock exchanges, for example, Barrick Gold (ticker ABX), Newmont Mining (ticker NEM), GoldCorp (ticker GG), so it is difficult for a Russian investor to approach them get there.

Well, still a couple of tips. You should buy shares of gold mining companies when the price of metals begins to rise significantly, and sell them at the peak of their value, without expecting prices to fall. Well, it’s better to diversify the risks by adding shares of some reliable mining companies, for example, Gazprom or Alrosa, into the “gold” portfolio.

Investing in Jewelry

Here are the most controversial issues. If coins and bars hidden in a safe are just waiting for their finest hour in the form of an increased price, then jewelry can make you happy every day when you wear it.

Jewelry products cannot be called an investment instrument due to negative returns. Their price includes the store's markup and the cost of the jeweler's work. At the same time, jewelry is not made from pure gold, but uses alloys, stone inserts, etc. If you want to sell jewelry at a pawnshop, they will accept it as scrap at a price three times lower than in the retail chain.

But the sale of scrap can also bring profit in years to come, when the price of gold has risen sufficiently. One gram of gold scrap, which cost 1,400 rubles in 2021, was valued in the form of jewelry in 2010 at only 1,000 rubles per gram. And this is already 5% of annual income.

If you buy exclusive handmade gold jewelry, then their artistic value may in the future attract connoisseurs, who, however, will need to be looked for.

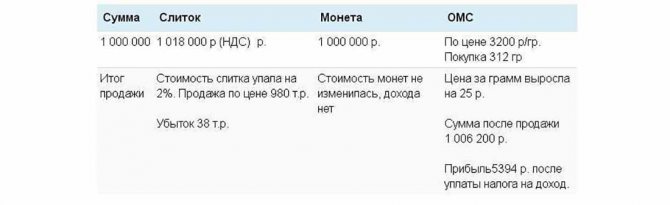

Comparison of the return on investment in gold over the year

Let's say you invested 1 million rubles in one of the types of investments in gold. What will you get in a year? This is clearly illustrated by the table below.

As you can see, investing in gold is interesting for saving and increasing savings. Choosing the right option depends on the amount of money you have and the period for which you want to invest the funds. All investment options have advantages and disadvantages.

In the long term, it is more profitable to buy gold coins (we wrote earlier about the profitability of gold St. George the Victorious) and bars. You can try stock indices and compulsory medical insurance on a short-term period.

Related links:

- How to profitably invest money in the second half of 2021?

- Why are millionaires and central banks buying gold?

- Monetary stimulus from A to Z

to the list