Greetings to all readers of the Webinvestor Blog! Precious metals turned out to be an interesting topic, I continue to understand it with pleasure. This time I want to talk about investments in palladium - a metal that has been growing for the last 5 years and has no intention of stopping.

You may not have heard of him before, but he is now the star of the precious metals market. For a moment, palladium is already more expensive than gold. To find out why palladium is constantly becoming more expensive, I studied the metal market and at the same time made my forecast for palladium prices in 2021.

If you missed it, read articles about other precious metals:

- How to invest in gold - 8 ways

- Investing in Silver in 2021

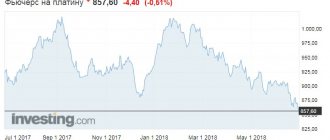

- Platinum : price forecast and prospects

Online course schedule

Investments in precious metals are classified as long-term investments and require the right moment when buying and selling an asset. This is what will ensure maximum income.

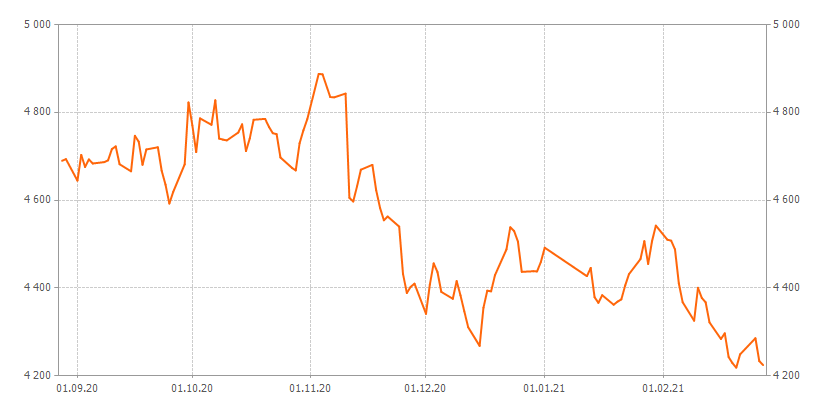

To choose the right time to purchase or sell palladium at a good rate, I recommend using an online chart. This tool allows you to instantly obtain information that is relevant for today, as well as track the dynamics of changes in value over a certain period of time.

Price of 1 gram of palladium in Sberbank of Russia

For players from Russia, in addition to stock exchange quotations of the metal, exchange rates are no less important. After all, even a decrease in the cost of palladium on the world market against the backdrop of a weakening ruble can provide a good income when working with compulsory medical insurance.

If you are planning or have already opened an impersonal metal account with Sberbank of Russia, then the chart below will serve as an excellent assistant when carrying out trading operations with precious metals.

Palladium price per gram in unallocated metal account and physical palladium in bullion

When purchasing non-cash palladium using compulsory medical insurance at Sberbank of Russia, its rate today will be higher than the discount rate of the Central Bank by 150-200 rubles, depending on what package of Sberbank services the buyer uses.

The cost of physical metal per gram in Sberbank of Russia today is already a thousand or more rubles more expensive, depending on the mass of the ingot. The larger the bar, the lower the price per gram. This difference in rates is due to the fact that it includes VAT and the expenses of Sberbank of Russia for the transportation and storage of metal.

| Price 999 standard according to the Central Bank | Bank price today | Scrap price | Price in jewelry |

Price per gram in investment coins

If you prefer to invest in bullion metal coins, then I have to disappoint you: they are not minted from palladium. However, Sberbank of Russia today offers a wide selection of commemorative and anniversary banknotes in denominations of 5, 10 and 25 rubles. Today, the price of 1 gram of metal of the highest, 999th purity, in coins will be 10% higher than the discount price.

Price of the Central Bank of the Russian Federation

The Central Bank sets daily rates for all convertible currencies and precious metals. Sberbank of Russia and other commercial structures rely on this data when setting their own prices. I suggest you familiarize yourself with the Central Bank rates that are relevant today.

Palladium | RUB | 1 Gram

Central Bank of the Russian Federation – Precious metals rates

Official discount prices for precious metals are established by the Central Bank of the Russian Federation every working day. Prices are calculated based on the fixing of gold, silver, platinum and palladium on the London spot metal market, and are converted into rubles at the official US dollar/Russian ruble exchange rate effective on the day following the day the discount prices are set. Accounting prices are used for accounting purposes in credit institutions.

| date | Gold rub./gram | Silver rub./gram | Platinum rub./gram | Palladium rub./gram |

| 27.02.2021 | 4224.26 | 66.83 | 2893.39 | 5693.45 |

| 26.02.2021 | 4233.41 | 65.54 | 2959.92 | 5733.22 |

| 25.02.2021 | 4285.38 | 66.31 | 2994.85 | 5612.67 |

| 21.02.2021 | 4248.68 | 64.10 | 3077.93 | 5620.67 |

| 20.02.2021 | 4218.41 | 64.60 | 3022.75 | 5591.25 |

| 19.02.2021 | 4228.69 | 64.32 | 3005.24 | 5633.35 |

| 18.02.2021 | 4242.54 | 65.40 | 2912.40 | 5620.83 |

| 17.02.2021 | 4296.61 | 64.96 | 3077.34 | 5638.65 |

| 16.02.2021 | 4283.63 | 63.80 | 3026.32 | 5663.74 |

| 13.02.2021 | 4321.67 | 64.48 | 2916.77 | 5591.07 |

| 12.02.2021 | 4367.35 | 64.57 | 2971.33 | 5617.78 |

| 11.02.2021 | 4377.11 | 65.62 | 2884.91 | 5579.87 |

| 10.02.2021 | 4400.30 | 64.77 | 2816.69 | 5602.40 |

| 09.02.2021 | 4325.35 | 63.34 | 2743.26 | 5605.89 |

| 06.02.2021 | 4367.40 | 63.75 | 2687.74 | 5597.65 |

| 05.02.2021 | 4410.67 | 65.25 | 2639.27 | 5495.23 |

| 04.02.2021 | 4487.73 | 66.84 | 2675.96 | 5488.89 |

| 03.02.2021 | 4507.67 | 72.20 | 2689.33 | 5532.40 |

| 02.02.2021 | 4509.90 | 66.55 | 2709.15 | 5529.96 |

| 30.01.2021 | 4542.04 | 61.79 | 2664.87 | 5712.18 |

| 29.01.2021 | 4506.07 | 61.69 | 2589.03 | 5636.11 |

| 28.01.2021 | 4454.61 | 61.28 | 2622.49 | 5592.38 |

| 27.01.2021 | 4506.49 | 62.34 | 2643.29 | 5653.78 |

| 26.01.2021 | 4465.88 | 60.94 | 2661.81 | 5699.07 |

| 23.01.2021 | 4431.54 | 61.84 | 2632.24 | 5649.40 |

| 22.01.2021 | 4405.56 | 59.67 | 2644.30 | 5630.64 |

| 21.01.2021 | 4373.92 | 59.66 | 2584.82 | 5589.45 |

| 20.01.2021 | 4368.68 | 58.94 | 2607.32 | 5650.77 |

| 19.01.2021 | 4361.69 | 60.04 | 2566.19 | 5650.84 |

| 16.01.2021 | 4383.49 | 59.70 | 2589.17 | 5655.97 |

| 15.01.2021 | 4366.17 | 60.11 | 2631.21 | 5658.65 |

| 14.01.2021 | 4378.94 | 60.34 | 2541.22 | 5652.15 |

| 13.01.2021 | 4445.57 | 59.74 | 2540.53 | 5687.54 |

| 12.01.2021 | 4426.84 | 63.83 | 2498.75 | 5653.93 |

| 01.01.2021 | 4491.66 | 62.48 | 2553.29 | 5629.12 |

| 31.12.2020 | 4459.48 | 62.11 | 2522.42 | 5562.62 |

| 30.12.2020 | 4437.61 | 61.05 | 2465.21 | 5612.44 |

| 29.12.2020 | 4438.08 | 61.10 | 2419.84 | 5517.53 |

| 26.12.2020 | 4436.55 | 61.08 | 2419.01 | 5515.62 |

| 25.12.2020 | 4505.61 | 60.91 | 2456.66 | 5601.48 |

| 24.12.2020 | 4529.59 | 62.52 | 2459.96 | 5667.14 |

| 23.12.2020 | 4538.16 | 63.36 | 2432.24 | 5603.36 |

| 22.12.2020 | 4487.62 | 61.98 | 2439.17 | 5567.37 |

| 19.12.2020 | 4428.96 | 60.67 | 2446.72 | 5503.94 |

| 18.12.2020 | 4392.15 | 58.96 | 2463.61 | 5527.88 |

| 17.12.2020 | 4393.73 | 57.16 | 2473.81 | 5507.07 |

| 16.12.2020 | 4354.98 | 56.33 | 2413.27 | 5490.07 |

| 15.12.2020 | 4267.87 | 55.84 | 2382.18 | 5448.99 |

| 12.12.2020 | 4310.63 | 56.15 | 2402.56 | 5470.42 |

| 11.12.2020 | 4346.88 | 57.08 | 2393.61 | 5422.35 |

| 10.12.2020 | 4383.23 | 57.68 | 2418.11 | 5439.57 |

| 09.12.2020 | 4415.66 | 56.25 | 2420.38 | 5480.20 |

| 08.12.2020 | 4375.28 | 57.83 | 2454.05 | 5557.43 |

| 05.12.2020 | 4390.93 | 57.70 | 2501.87 | 5591.02 |

| 04.12.2020 | 4436.04 | 57.98 | 2470.91 | 5821.87 |

| 03.12.2020 | 4456.05 | 57.22 | 2440.80 | 5878.35 |

| 02.12.2020 | 4407.43 | 54.35 | 2409.59 | 5889.01 |

| 01.12.2020 | 4341.07 | 56.68 | 2359.24 | 5889.52 |

| 28.11.2020 | 4409.74 | 56.97 | 2336.51 | 5829.09 |

| 27.11.2020 | 4402.52 | 56.79 | 2336.07 | 5732.24 |

| 26.11.2020 | 4388.45 | 56.19 | 2339.15 | 5670.73 |

| 25.11.2020 | 4431.61 | 58.27 | 2283.93 | 5689.11 |

| 24.11.2020 | 4539.73 | 58.86 | 2313.95 | 5687.45 |

| 21.11.2020 | 4562.65 | 58.60 | 2324.09 | 5706.37 |

| 20.11.2020 | 4554.16 | 59.62 | 2304.79 | 5678.60 |

| 19.11.2020 | 4582.44 | 60.12 | 2279.99 | 5712.18 |

| 18.11.2020 | 4622.23 | 59.49 | 2270.17 | 5712.20 |

| 17.11.2020 | 4680.45 | 59.96 | 2243.03 | 5799.24 |

| 14.11.2020 | 4669.38 | 60.20 | 2212.62 | 5842.32 |

| 13.11.2020 | 4631.33 | 60.02 | 2164.43 | 5838.74 |

| 12.11.2020 | 4596.93 | 59.28 | 2173.26 | 6039.56 |

| 11.11.2020 | 4605.21 | 61.66 | 2149.21 | 6098.86 |

| 10.11.2020 | 4842.82 | 63.78 | 2236.54 | 6044.10 |

| 07.11.2020 | 4834.10 | 60.97 | 2235.95 | 5933.59 |

| 06.11.2020 | 4834.96 | 60.47 | 2239.90 | 5902.45 |

| 04.11.2020 | 4886.56 | 61.67 | 2242.85 | 5789.75 |

| 03.11.2020 | 4887.70 | 61.20 | 2222.68 | 5787.27 |

| 31.10.2020 | 4784.40 | 58.70 | 2183.31 | 5677.62 |

| 30.10.2020 | 4759.17 | 60.67 | 2195.94 | 5662.27 |

| 29.10.2020 | 4729.52 | 60.93 | 2179.19 | 5812.01 |

| 28.10.2020 | 4667.69 | 59.68 | 2145.92 | 5813.41 |

| 27.10.2020 | 4673.64 | 60.85 | 2189.85 | 5807.64 |

| 24.10.2020 | 4697.13 | 60.87 | 2192.95 | 5853.59 |

| 23.10.2020 | 4750.35 | 61.74 | 2210.56 | 5957.61 |

| 22.10.2020 | 4752.55 | 61.97 | 2169.54 | 5943.94 |

| 21.10.2020 | 4767.05 | 61.59 | 2138.03 | 5876.45 |

| 20.10.2020 | 4785.15 | 62.23 | 2184.64 | 5874.97 |

| 17.10.2020 | 4783.12 | 61.06 | 2163.21 | 5883.02 |

| 16.10.2020 | 4740.64 | 59.98 | 2142.65 | 5881.64 |

| 15.10.2020 | 4711.68 | 60.06 | 2176.40 | 5875.79 |

| 14.10.2020 | 4772.77 | 61.96 | 2164.25 | 6003.24 |

| 13.10.2020 | 4754.14 | 62.06 | 2199.02 | 6067.12 |

| 10.10.2020 | 4736.09 | 60.22 | 2176.86 | 5968.41 |

| 09.10.2020 | 4737.92 | 60.02 | 2169.37 | 5931.95 |

| 08.10.2020 | 4740.23 | 59.08 | 2169.26 | 5925.29 |

| 07.10.2020 | 4827.56 | 61.34 | 2244.03 | 5926.86 |

| 06.10.2020 | 4771.68 | 60.07 | 2212.96 | 5814.99 |

| 03.10.2020 | 4786.39 | 59.92 | 2244.56 | 5802.22 |

| 02.10.2020 | 4709.54 | 58.68 | 2233.59 | 5769.07 |

| 01.10.2020 | 4770.62 | 60.10 | 2208.76 | 5848.66 |

| 30.09.2020 | 4822.55 | 61.06 | 2239.11 | 5802.74 |

| 29.09.2020 | 4681.68 | 57.90 | 2157.53 | 5632.84 |

| 26.09.2020 | 4618.65 | 55.89 | 2116.62 | 5522.48 |

| 25.09.2020 | 4592.32 | 55.14 | 2081.83 | 5520.96 |

| 24.09.2020 | 4635.01 | 57.92 | 2096.44 | 5479.23 |

| 23.09.2020 | 4666.73 | 59.59 | 2172.62 | 5559.07 |

| 22.09.2020 | 4720.43 | 64.44 | 2261.33 | 5737.66 |

| 19.09.2020 | 4715.50 | 65.28 | 2274.83 | 5659.33 |

| 18.09.2020 | 4680.61 | 64.66 | 2299.08 | 5717.49 |

| 17.09.2020 | 4733.17 | 65.96 | 2363.21 | 5721.33 |

| 16.09.2020 | 4746.61 | 66.59 | 2332.75 | 5630.03 |

| 15.09.2020 | 4665.67 | 64.58 | 2258.01 | 5582.56 |

| 12.09.2020 | 4681.88 | 64.71 | 2239.21 | 5547.47 |

| 11.09.2020 | 4722.48 | 65.82 | 2241.28 | 5563.14 |

| 10.09.2020 | 4716.38 | 64.90 | 2228.08 | 5517.61 |

| 09.09.2020 | 4690.71 | 65.15 | 2220.06 | 5646.63 |

| 08.09.2020 | 4686.60 | 65.21 | 2201.86 | 5589.70 |

| 05.09.2020 | 4683.50 | 64.82 | 2187.53 | 5518.39 |

| 04.09.2020 | 4692.80 | 65.27 | 2215.26 | 5566.05 |

| 03.09.2020 | 4675.61 | 65.79 | 2222.64 | 5350.00 |

| 02.09.2020 | 4703.11 | 68.34 | 2247.52 | 5377.48 |

| 01.09.2020 | 4644.50 | 64.90 | 2206.75 | 5163.32 |

| 29.08.2020 | 4693.40 | 65.63 | 2231.70 | 5231.29 |

| 28.08.2020 | 4689.71 | 65.90 | 2256.81 | 5282.82 |

How the price is formed, why it changes and is different in different banks

Buying and selling rates for palladium change continuously during daily trading. They are regulated by independent laws of market relations: price is proportional to demand and inversely proportional to supply.

Twice daily trading results, called fixings, are consolidated and published by the London Mercantile Exchange. The Central Bank of Russia calculates and sets the price in rubles, taking into account the current exchange rate of the ruble to the dollar. The next stage is the setting of rates by private financial institutions, taking into account the rates of the country's main financial institution.

Sberbank of Russia sets its own palladium purchase and sale rate based on world prices and its own policy.

Much depends on how important this segment is for a financial organization in terms of making a profit today, as well as how exactly the bank intends to generate income: through purchase and sale volumes or through a significant margin difference.

What affects the price of palladium

We have already found out that the exchange rate is affected by supply and demand. But they are influenced by the state of the world economy today. In times of crisis, traders' interest in gold increases, while the activity of the industrial sector, on the contrary, decreases. Accordingly, the demand for palladium is decreasing. This rule also works in reverse.

Economic stability leads to the development of industry, increased demand for platinum group metals and a decrease in the exchange rate of gold.

Large producers also influence the price of the precious metal, increasing or decreasing its annual sales volumes. Thus, they are able to regulate its rate by changing the size of supply on the market.

Reasons for changes

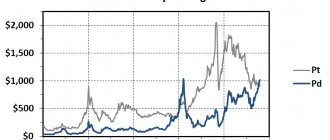

Periods of decline and growth in quotations of a precious element are caused by certain factors, therefore, the analysis of moments of sudden changes must be carried out together with an analysis of the factors accompanying this situation. The sharp rise in the palladium chart in 2000 is also explained by the sharply increased demand for the metal as a raw material for the production of automotive catalysts. The change in quotations in those years was facilitated by the adoption of decisions in the EU on restrictions on emissions. To ensure that vehicles meet accepted requirements, there is a need for high-quality automotive catalysts. Since previously quite expensive platinum was a component of such chemical compositions, representatives of the automotive industry turned their attention to cheaper palladium, which has better properties.

The new stage of growth in palladium rates, which began in 2010, is due to the global economic situation. Economic growth, which began after two years of crisis, led to increased consumption of precious metals in various industries. The palladium price began to rise for three reasons:

- There has been a positive trend in demand for palladium jewelry;

- The metal again replaced platinum in the production of autocatalysts due to the rise in price of the latter;

- The demand of other industries for metal has increased.

Further growth in quotations was facilitated by both the promotion of the metal among jewelry lovers and the energy crisis in South Africa, the leader in the supply of platinum group metals. Due to disruptions in the supply of platinum from South Africa and the rise in its cost, the automotive industry has again returned to palladium, which has also increased in price.

The forecast for 2013 contained data on a decrease in the supply of metal on the market. Among the reasons for this situation, experts cited a reduction in the volume of Russian raw material production, the depletion of reserves of the Russian Gokhran and problems in South Africa. The current market situation has led to palladium rising again. Its price at the end of 2013 approached $720 per ounce, and the quotes chart went up.

Forecast

I expect the value of palladium to increase over the next few years. The demand for this metal today is steadily growing due to the engineering sector. This element is used in the production of catalytic exhaust converters, which are equipped in almost all modern passenger car models.

Experts in the jewelry industry, for their part, note that the popularity of palladium jewelry is growing, and this trend is unlikely to change in the next couple of years, since jewelry fashion changes slowly.

However, there are no forecasts for increasing its production volumes. Recycling is also unlikely to increase in the near future.

Dynamics and analysis of the global palladium market

Palladium , Palladium, [Pd] - element 46 in the periodic table, named after the asteroid Pallas, discovered in 1801 by the German astronomer Heinrich Olbers.

The metal density is 12 g/cm³ - slightly heavier than silver. Palladium belongs to the noble and precious metals and is also part of the platinum subgroup. In its pure form it has a silvery color:

The metal was first discovered by the Englishman William Wollaston in 1803 during experiments with platinum ore.

The scientist did not intend to study a new chemical element, but he did not want to lose the authorship of the discovery, so he resorted to a trick. Representatives of the London Scientific Society began to receive anonymous leaflets entitled “Palladium or the New Silver,” which described the properties of the metal. There was also a mention of a store, which, again anonymously, received a package with a sample. To drum up interest, Wollaston announced a £20 reward for anyone who could produce the metal artificially. Naturally, no one succeeded. While interested scientists tried to uncover the deception, William Wollaston completed his research on platinum and began working on a new metal. In 1805, he announced the discovery and recognized himself as the author of the mysterious leaflets. What lengths will you go to to remain in the history of science!

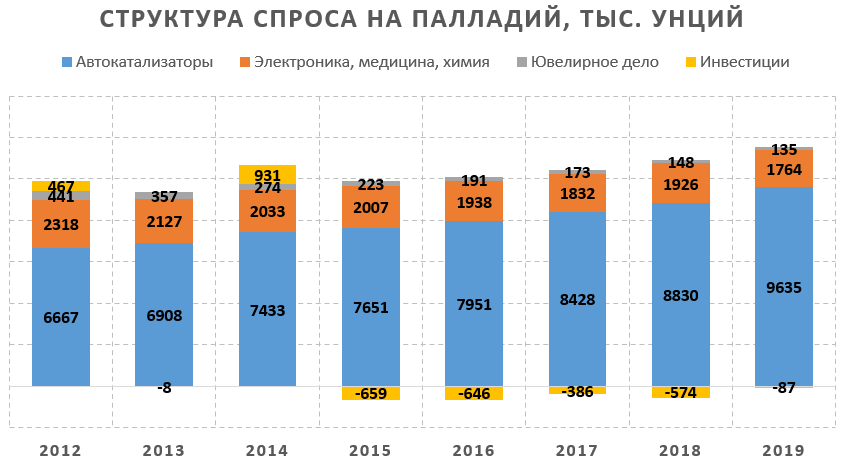

Today, palladium plays a small but important role in the global economy. First of all, it is indispensable in the automotive industry; demand grows every year:

Chart source: platinum.matthey.com

In 2021, 85% of palladium is used in autocatalysts - devices for filtering vehicle exhaust gases. In the 1970s, countries began tightening vehicle emissions standards, most notably nitrogen oxide, one of the main components of smog in big cities. Palladium, unlike platinum, neutralizes N₂O well; it has become more often used in new cars.

The main consumer of palladium in 2021 and according to forecasts in the future is China, where the air in large cities is heavily polluted. The dynamics of demand are stable; more and more palladium is required for cars every year.

The remaining 15% comes from electronics and the production of medical instruments, as well as jewelry: both in pure form and in alloys such as white gold.

The graph shows that in industries other than the automotive industry, palladium consumption is falling. The metal has become too expensive, manufacturers are looking for alternatives wherever possible, for example, platinum, which is 40% cheaper today.

Palladium is mined in large quantities in 5 countries: Russia, USA, Canada, South Africa and Zimbabwe. The Russian company Norilsk Nickel ranks first in the world in production with a market share of 40%. The following places are occupied by companies from South Africa - Anglo Platinum (24%), Impala Platinum (13%), Sibanye-Stillwater (6%). Russia and South Africa are the main suppliers of palladium, see chart:

Despite constantly growing demand, neither country has been able to significantly increase production. The fact is that palladium is a by-product of the extraction of other metals. Companies from South Africa primarily specialize in platinum (80% of world production), and it has become much cheaper in recent years. Norilsk Nickel also has plenty of problems, although management has plans to increase palladium production.

The situation is partially saved by recycling; the dynamics over 8 years have been positive - an increase of 35%. In general, there has been a shortage of palladium on the market for several years, as can be seen from this graph:

The excess of demand over supply of palladium on the market has been observed since 2012. In 2021, the shortage of metal increased again, which led to a double increase in prices.

In the future, palladium will not lose its position. LMC Automotive predicts that gasoline-powered vehicles (where palladium is most used) will cease to be sold until 2035. The market will be captured by hybrids that still use fuel. For details, follow the link to the study on this topic.

85% of palladium is used in the automotive industry. Demand is growing every year due to stricter requirements for vehicle exhaust gases. The supply of metal is not keeping pace with this growth. As a result, there has been a shortage on the market for many years, which provokes a constant rise in prices.

Now let’s evaluate the current situation on the market and make a forecast for palladium prices.

Types of investments in palladium

There are several ways to invest money in palladium. Each of them has its own advantages. You can choose the most convenient and attractive option.

Compulsory medical insurance

Compulsory medical insurance is a current account, the currency of which is metal. The advantage of this method is the absence of VAT, minimal bank commissions, and maximum liquidity. The cost of entry is also insignificant, because the minimum step is 0.1 g of metal. Of the minuses: when selling an asset, the income from the difference in exchange rates received in this case is subject to taxation.

Ingots

Physical palladium can also be purchased, but this option has its drawbacks: Sberbank of Russia today does not buy it from the population, and when purchasing an ingot, you will pay VAT. The purchase will need to be stored somewhere; a safe place will require additional costs.

Investment coins

To date, I have not found any mention of palladium investment coins anywhere. But anniversary copies are widely represented in Sberbank of Russia.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

When purchasing metal in coins, value added tax is not charged, which adds to the attractiveness of this method of investment.

However, the price of investment and commemorative banknotes includes minting costs, so a gram of palladium in a coin will be more expensive than in a measured bar.

Which investment method is more profitable?

Considering all of the above, I advise you to opt for compulsory medical insurance at Sberbank of Russia as the most reliable, most liquid, simple and least expensive way of investing today.

Palladium price chart today + 45 years of quote history

Palladium is a rare and scarce metal, so its prices have been steadily rising over the past few years. The bullish trend since 2021 has paused due to the coronavirus crisis, when palladium quotes fell to $1,500. However, in just a week prices increased by several hundred dollars, and after a period of profit-taking, growth continued again in the summer of 2020:

At the end of 2021, the price of palladium increased by another 28.5%, and it is difficult to say what should stop the growth in 2021. There have already been situations in history of explosive price increases, but not on such a large scale:

Chart source: macrotrends.net

Below you can download the data and graphs that I used in the article:

The last 10 years have been successful for palladium, prices have skyrocketed many times over. The graph is reminiscent of the Bitcoin cryptocurrency - there, too, the rate flies up/down by tens and even hundreds of percent.

The graph shows how palladium has been steadily rising in price since 2021; the only noticeable drop occurred in 2021 amid the coronavirus crisis. Prices have failed to reach their all-time high, but gradual growth continues.

Key moments in the history of the palladium market:

- 1980 - stock exchange speculators increased the prices of all precious metals several times.

- 1999 - the Euro-3 environmental standard was issued, which greatly increased the demand for palladium in the automotive industry.

- 2001 - the first boom in the 21st century, the rate reached $1000 per ounce. The subsequent collapse to $200 occurred against the backdrop of the dot-com crisis in the stock market.

- 2008 - the global financial crisis once again brought down prices.

- 2014 - the introduction of the Euro 6 standard, which seriously tightened emission standards for diesel engines and increased the need for palladium.

- February, 2021 - historical record price, $2,724 per ounce.

- March, 2021 - prices collapsed almost 2 times amid the coronavirus panic. By the beginning of 2021, the exchange rate had almost recovered.

If we compare prices in 1977 and 2021, we get a yield of 9% per annum - an excellent result! Unfortunately, rate fluctuations do not allow you to simply “invest and forget” about palladium - as the crisis years of 2001, 2008 and 2021 have shown, prices can drop by 50% or more at a moment.

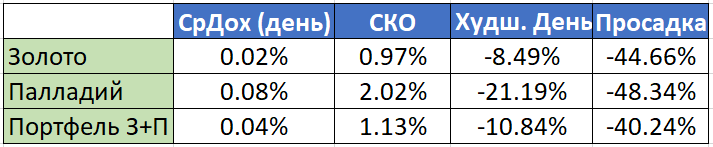

In an investment portfolio, palladium can be safely used together with traditional gold; according to the calculation of the correlation coefficient, there is practically no connection, the value is -0.13 . The connection with stocks is stronger; with the American Dow Jones index the correlation is +0.84 . Palladium is not suitable for diversifying the risks of stocks, but it is very suitable as an alternative to gold during a growing economy.

Article on the topic: How to properly diversify your investment portfolio

The gold+palladium portfolio shows excellent results historically:

Adding palladium to a portfolio only slightly increases the risks, but the profitability increases several times. The indicators for the worst day in history and the maximum drawdown remain within acceptable limits.

Investing in palladium is quite risky and there are often strong price movements. Price quotes strongly depend on the state of the world economy; during crises, the graph does not just fall - it flies down at a steep peak. Volatile palladium in an investment portfolio looks best as a complement to calmer gold.

Purchasing and storing bullion at Sberbank

To purchase palladium bullion, you will need to visit a branch of Sberbank of Russia. The metal can be left in the bank for safekeeping by renting a special safe. Unfortunately, Sberbank of Russia does not offer current or savings accounts for physical palladium.

Advantages and disadvantages

One of the advantages is owning real palladium. This is where the advantages end. Among the negative aspects: the need to pay VAT, storage fees, the lack of repurchase of palladium by Sberbank of Russia today, as well as the investment risk, which is higher compared to investments in gold or silver.

Procedure for selling bullion

I did not find information about any bank accepting palladium bars from the population. This indicates low demand for physical metal from individuals. Perhaps the situation will change in the future, but today only pawn shops and purchases willingly accept palladium.

How to open compulsory medical insurance in Sberbank

It’s very simple: with your passport and tax payer code, you go to the nearest branch of Sberbank of Russia, sign an agreement, and the responsible specialist opens an account. If you are already a bank client, then you can even open compulsory medical insurance online in your personal account without leaving your home, and then buy metal at today’s rate, paying for it non-cash.