Sberbank gold deposit for individuals

We will not find out the reasons why you wanted to save in gold - this is a worthy choice, which, in combination with other financial distribution options, can perfectly complement your investment portfolio.

There are several ways to invest money in gold; let’s find out what options are offered at Sberbank.

Gold bars

The simplest and most obvious way is to simply buy a gold bar.

But this method has several noticeable disadvantages. Firstly, it must be stored in special conditions, since the slightest scratch reduces the selling price of the product - and this is an additional cost for at least a safe deposit box in Sberbank.

Secondly, when selling an ingot you must pay value added tax - 18% of income.

Thirdly, the price of selling and purchasing gold bars by Sberbank will greatly upset you. Let's look at the table “Purchase and sale prices of bullion bars of precious metals” for gold, for September 2018:

If you bought gold, and after a couple of days you decide to sell it to the bank, you will lose up to 30% of your investment. Not the most attractive option, but in the long run it is possible to make a profit.

Golden coins

Making a profitable gold deposit in coins is a decision that will require your time. There are a lot of gold coins in Sberbank, which ones should you choose?

It's one thing when you just want to give someone both a precious gift and, in fact, an object of art. It's another matter if you decide to consider coins from an investment point of view.

But you should not discard this deposit option - study the specifics of the issue and the possible benefits, they are there, but not everyone can succeed. This option is also suitable, only for long-term investments.

Compulsory medical insurance golden contribution

Therefore, it is easier for bank clients to open an Impersonal Metal Account (UMA). This is the same golden deposit of Sberbank. Its basic unit of measurement is the gram of substance.

In fact, compulsory medical insurance is a record that the investor has a certain amount of gold.

The gold itself is not transferred to you, but is provided by bank reserves. If you wish, you can order delivery of the bullion directly - but you will have to pay the difference in cost.

Any adult client can open deposits in precious metals at Sberbank for himself or for his child. You can issue a power of attorney for the deposit or draw up a testamentary disposition.

In addition to gold, deposits in the following metals are available for opening:

- in silver – the minimum purchase amount is 1 gram;

- in platinum and palladium – purchase step is 0.1 grams.

The bank independently sets the rate of purchase and sale of metal; in general, it correlates with prices for raw materials on international commodity exchanges.

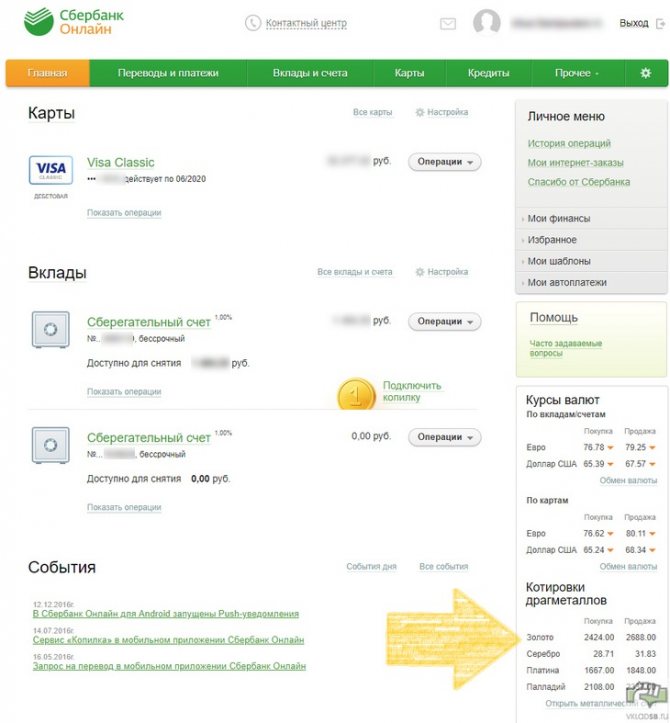

You can view the current gold rate for today on metal deposits in Sberbank in the online account on the bank’s website or in the mobile application. There is also information on the value of the main currencies - the dollar and the euro.

Gold rate for today - view through Sberbank Online

Gold price in mobile application

Purposes of buying gold

Many people are interested in the question: is it profitable to invest money in gold? You can almost always say that yes, it is profitable. But everyone is different and has different ideas about profitability. For example, a seasoned speculator will say that 3% per month is pennies, but for lovers of foreign currency deposits such a return will seem exorbitant. Therefore, it is important to determine what goals we are pursuing. To do this, consider the main options that cover 99% of the entire investor audience:

- Long-term investing . This may seem strange, but this includes billionaires and some of us. The first want to keep capital in a serious asset that will always be in demand as a physical means of payment. The latter simply want not to lose. In principle, this is understandable - according to the logic of many people, the dollar is there today and gone tomorrow, while gold is always the same. True, we are talking about storing your funds in physical gold or in metal accounts. We'll talk about the differences and nuances further.

- Speculation . The situation described above with a possible US default in 2011 led to gold becoming an object of speculation. Volatility and swings have decreased significantly since then, but the metal is still subject to quite a lot of activity. The same principle works here as with stocks after a fall - the asset remains attractive, but costs much less, driven down by speculators. Such periods are excellent for buying and holding, because a return to growth is inevitable for one simple reason - giants such as central banks are only too happy to buy cheap gold at a profit. By the way, this is quite easy to notice from the activity during the Asian trading session, when gold begins to grow rapidly.

- Investments in enterprises . This cannot be said to be a direct investment in gold, but the metal itself certainly plays its role. Just like in the spot market, there are fluctuations here, since everything is tied to real production. On the other hand, the demand for gold is only growing, so there simply cannot be a shortage of consumers for such industries, including the jewelry industry, global investment, and the creation of reserves.

It is impossible to say for sure which of the listed approaches can be considered the most reasonable, since everyone works differently. In general, speculators and long-term investors are two opposites. But speculation requires certain knowledge, attention, and study of information. Probably, not everyone is ready to do this, while buying gold bars is not very burdensome - just like going to the store. Next, let's move on to methods of investing in gold.

Features of compulsory medical insurance

Let's look at what key features an individual should pay attention to if he wants to open a gold deposit with Sberbank.

Advantages

The significant advantages of compulsory medical insurance are:

- free service – an account is opened for free, no commission is charged for the purchase and sale of metal;

- the ability to open a gold deposit online using Internet banking or a mobile application;

- convenient management – the sale and purchase of gold through compulsory health insurance is carried out around the clock, right from home;

- such gold cannot be stolen or damaged;

- the price of compulsory medical insurance changes in accordance with the real exchange rate of precious metals;

- the deposit is unlimited, there is no need to renew it;

- the deposit can be opened in the name of a minor child. At the same time, investments are reliably protected by law. Any expense transactions on the deposit, if the child is not yet 14 years old, are allowed to be carried out only with the permission of the guardianship and trusteeship authorities, and from 14 - by him personally with the written permission of the legal representative.

Such a deposit protects funds from inflation. If you look at the dynamics of the price of gold, it becomes clear that it is practically not affected by global crises and quickly recovers in value after a fall in price.

Flaws

But among the disadvantages it is worth noting:

- interest is not accrued on gold deposits at Sberbank;

- fairly high spreads;

- limited liquidity - you can sell gold with compulsory medical insurance only to Sberbank itself;

- funds for compulsory medical insurance are not insured by the DIA, and if the bank’s license is revoked, they “burn out” (however, the likelihood of Sberbank’s license being revoked is negligible);

- the need to pay extra for the delivery of physical gold.

As for taxation, when selling gold with compulsory medical insurance, you will need to pay income tax (13%) on profit. The declaration will need to be submitted independently - Sberbank does not act as a tax agent for compulsory medical insurance and does not calculate the client’s profit.

How to make money on metal deposits

Many people wonder whether it is profitable to open a deposit in gold at Sberbank? To answer this, you need to clarify a few points:

- there is no interest accrual on gold deposits;

- profit is generated by the difference between the purchase and sale prices;

- Sberbank regulates the rate of precious metals in accordance with world prices;

- there is a significant difference between the purchase and sale prices - the spread (the bank always sells at a higher price and buys at a lower price);

- the spread can range from 3% to 10% of the price (depending on market volatility).

You can make money on this type of deposit only if the price of the asset increases – i.e. for the gold itself. However, the growth must be significant to overtake the spread. So, if the difference between the purchase and sale prices is 5%, then the price should increase by more than 5%.

The price of gold in the short term may not increase or even fall; you need to be prepared for this. Typically, investments in precious metals are made for several years.

Metal deposits combine especially well with deposits in dollars. From time immemorial, a relationship has been established in stock markets: when the price of gold rises, the dollar falls (and vice versa). Sberbank's foreign currency deposit will help mitigate the risks of loss due to price fluctuations.

Gold rate today

The most convenient way to monitor changes in the gold rate in Sberbank's compulsory medical insurance is on the bank's official website, here is the link: Online precious metals quotes.

Here you can print a chart for the period you select.

Please note that monitoring the issuance of quotes for the purchase of gold from Sberbank showed that the bank fixes the most unfavorable spread (the difference between purchase and sale) on weekends and at night. The most favorable quotes are on weekdays during business hours.

How to open compulsory medical insurance in Sberbank

Gold deposits are opened both in Sberbank branches and online.

In the office

It should be taken into account that not all offices have the necessary equipment to provide the client with the opening of compulsory medical insurance. As a rule, these are the same branches where gold coins and bars are sold.

We recommend:

- call Sberbank at 900