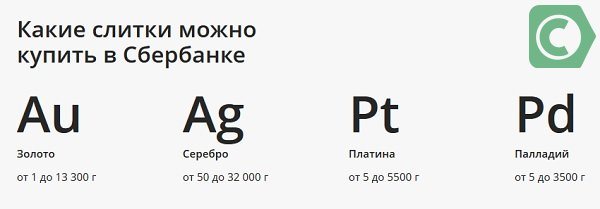

With economic instability and fluctuations in exchange rates, many investors resort to this type of profit making, such as investing in precious metals. Such methods are available to the population thanks to banks. The leader in the field is Sberbank, which offers various deposits in gold, silver, palladium and platinum.

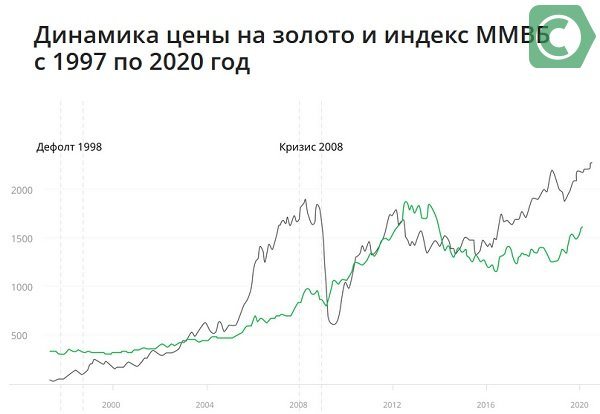

The steady rise in gold prices over the years has made investing in the metal very popular. The yield on such deposits significantly exceeded the deposit rate. At the same time, in the short term the situation was not always favorable.

How to invest money in gold at Sberbank at interest

There are two ways to open a gold deposit at Sberbank - buy gold bars or open an impersonal metal account.

The first method differs from the other in that the acquisition of precious metal is accompanied by a paid procedure for examination and further storage. Upon completion of the contract, the bullion is handed over to the owner with payment of tax. The opening of compulsory medical insurance occurs without the issuance of real gold, and the monthly income is calculated based on the difference in quotations for the precious metal with subsequent conversion into money.

Options for how clients can invest their funds in gold

If in a regular deposit the profit is determined by accruing interest, then under compulsory medical insurance no interest is accrued, and the income from the deposit depends only on the rise in metal prices on the international market. This deposit is suitable for those clients who are accustomed to dealing with real money and making profits in the usual “paper” equivalent. Another advantage of an impersonal metal account is the absence of VAT and storage costs.

You might be interested in:

Mutual Fund Sberbank: Global Internet

Before you invest money in gold at Sberbank at interest, buying real metal rather than virtual, you should consider options for storing it. It is best to do this in one institution: taxes and expenses will be lower. Experienced investors advise purchasing bars of 50 g and 100 g: they are more profitable than specimens of smaller volume. The greater the weight of the purchased bullion, the lower the price of metal per 1 g. To avoid taxation, you can transfer the metal to a metal safekeeping account.

Gold bars will not only help you save and increase money, but are also an excellent gift.

Advantages of a gold deposit

Is it worth investing in gold at Sberbank, is it profitable? Let's consider the advantages of such an investment:

- unlike ruble and foreign currency accounts, gold deposits are safe - they are less susceptible to inflation;

- over a long period of time, you can not only save your own funds from inflation, but also achieve a certain profit;

- the steady rise in prices on the world market guarantees a small but stable and predictable profit;

- the product has high liquidity;

- an excellent tool for diversifying an investment portfolio;

- high-quality gold bars can be used for any purpose;

- The registration procedure takes a minimum of time, opening and maintaining an account is free;

- a metal account can be opened for a child.

The risks of such investments are minimal; the most important risk is the choice of bank and its reliability: gold deposits are not subject to insurance in the event of bankruptcy of the institution, and the client will not be able to return his funds.

Conditions for opening a gold deposit

The procedure for opening a gold deposit has been simplified to the minimum. The investor will need to provide the following documents:

- passport,

- TIN,

- statement,

- a signed agreement, which specifies all the conditions for maintaining and maintaining the deposit, the procedure for accepting and issuing precious metals;

- an order to transfer bullion to a bank vault.

If an individual does not open compulsory medical insurance, but purchases real precious metal, then he will first have to make a payment for receiving the goods into storage and pay for an examination, which will determine the final price of the metal.

To buy such a product, you need to find a branch where bullion is available and take your passport with you.

There are features of the procedure:

- You can purchase precious metal in the range from 1 g to 1000 g;

- no need to open a bank account;

- Storage in a safe deposit box is allowed.

After the end of the contract, the investor can receive his bullion by pre-paying VAT.

Where and how to buy gold

The instability of the economic situation forces even those who previously trusted only banknotes to look at gold with new eyes. It is now irrelevant and incorrect to perceive precious metals exclusively as jewelry. It is not they that will help you get out of a difficult financial situation, but gold in its physical form - best of all in gold investment coins.

Gold prices tend to rise in the medium to long term.

You can buy gold either from a bank or from a company engaged in the purchase and sale of gold investment coins. Any individual can make a purchase.

When choosing a seller, you need to focus on two factors:

- optimal price;

- physical presence.

Do not hesitate to call the contacts you have found and ask whether the gold prices presented on the site are current, and whether the required amount of the precious metal is available. With persistence and patience, the buyer has a chance to purchase cheap gold not from his own hands, but from a specialized institution.

Parameters affecting the price

As mentioned above, due to VAT, a gold bar in Russia is a priori more expensive than a gold investment coin of the same weight (provided that you want to pick up your purchase and store it yourself).

But there are a number of other pricing features for gold bars and coins that need to be taken into account:

1) Whether the seller deals in gold coins or gold bars professionally. If this activity is just one of a wide range of services, you will most likely expect higher prices, low inventory, and less than professional employees.

2) If we talk about coins, it is most profitable to buy gold investment coins specifically intended for investing and saving funds, which are traded with a very small premium to the price of gold and can easily be sold back with minimal losses.

Such coins include domestic coins St. George the Victorious and Chervonets Sower, as well as foreign Kangaroo, Philharmonic, Maple Leaf, Krugerrand, Panda, American Eagle and Buffalo (Buffalo), Britain.

3) Safety of gold coins and bars. When purchasing, pay attention to the absence of scratches, dents and other defects on the purchased product. Gold is a very soft and ductile metal, so you need to store gold coins and bars very carefully. It is highly recommended not to handle coins and bars with bare hands; use special gloves. Remember that a scratched coin or bar immediately loses significant value.

4) The mass of the purchased bar or gold coin. As a rule, the following rule applies in the market - the higher the weight, the lower the price per gram. But there is also a downside to the coin - the higher the weight, the more difficult it is to sell a gold coin or gold bar.

Ingot vs Coin

When planning to invest in gold, a potential capital investor expects benefits. The quality of the investment and future income directly depend on the form of investment, so it is worth considering what is preferable for the safety of funds: bars or coins.

Investing in bullion is convenient for very large investors, but they also experience some problems when selling the yellow metal. The need to sell the entire bullion when you need to sell a small part of it is one of the disadvantages of such an investment. Thousands of market participants are trying to buy gold cheaply. And they will have such a chance if the seller is forced to give away a massive ingot at a low price.

Buying gold investment coins will help you insure yourself against an unenviable situation. In essence, a coin is the same ingot, only cylindrical in shape and of minimal weight. Its value lies in the metal from which it is minted.

Coins, just like bars, have a certain purity of gold, their price varies from several to hundreds of dollars, they are ideal as a product in a familiar situation when money is urgently needed.

Coins are necessary for the convenience of buying gold - small packaging is more profitable and much better protected from counterfeiting, so the demand for coins is an order of magnitude higher than for bars.

It is impossible not to note the tangible material difference when choosing between two methods of investing in gold:

- coins are not subject to VAT, and this is not such a small amount - 18% of income;

- If the sale of the bullion is successful (or not) you will have to pay tax.

How is the price of 999 fine bars determined?

To calculate the real cost of 999 gold per 1 gram on a specific date, you need to know that the exchange rate for precious metals is set by Sberbank daily and depends on prices on the world precious metals market. Among the factors influencing the price of bullion are the following:

- investor demand;

- high level of quality of bullion, since Sberbank works only with reliable manufacturers;

- decrease in production volume on the international market;

- Sberbank has a gold and foreign exchange reserve.

These are the factors that the bank takes into account when calculating the cost of gold bars. You can independently calculate the price for 1 gram of gold. To do this, compare the cost of 1 troy ounce of the precious metal to the dollar exchange rate on a specific day. Add VAT to this number (13-16%).

Opening conditions

Investment in gold occurs under the following conditions:

- gold deposits can be opened by individuals and legal entities;

- the metal account is opened in grams;

- opening and maintaining an account is free;

- the minimum weight of gold in bullion and on accounts is 1 gram;

- maximum weight of a gold bar – 1 kg;

- transactions with precious metals are carried out throughout Russia, but in a limited number of branches;

- There is no interest on metal accounts; income is generated solely from changes in quotes;

- with compulsory medical insurance you can receive physical metal, and also hand it over by depositing it into an impersonal account;

- There are no restrictions on the number of transactions, accounts can be replenished and reduced many times;

- gold bars can be left in the bank for free storage;

- the metal account agreement is concluded for a year with automatic renewal;

- ingot quality 999.9;

- Gold deposits are not insured by the Deposit Insurance Agency.

- Gold compulsory medical insurance transactions can be carried out in minimum increments of 0.1 grams;

- purchased coins can be sold back to the bank.

How to store money in gold in Sberbank

When purchasing bullion , you need to think about their proper storage. There are several arguments against keeping them at home. This is unsafe, and in addition, the client is unlikely to be able to provide good conditions for preserving the presentation of the ingot.

Options of bars that can be purchased

The slightest scratch automatically reduces the value of the product; more serious damage may cause the bank to refuse the purchase. Sometimes damage to the packaging itself can significantly affect the price, and some institutions only accept products in original packaging. Therefore, most banks are reluctant to cooperate when purchasing bullion that has not been left in their custody. This is how banks seek to protect themselves from problems in selling goods. Therefore, the desire to keep gold at home may result in the fact that if you want to sell it in a bank, the price of the bullion will be equal to the price of scrap.

You might be interested in:

What to do if you lost your Sberbank card

How to properly store money in gold in Sberbank? If the client prefers not virtual gold in the form of compulsory medical insurance, but real gold, then it is better to open a metal account for safekeeping. It can only be opened in those departments where there is special equipment for assessing and measuring metal. When deposited, all bars have their own characteristics: fineness, weight, serial number, stamp, issue date. This information is recorded in a special document and a report is drawn up during the transfer of the bullion to the warehouse. The institution does not have the right to use the bullion placed in safekeeping as credit funds, and is obliged to give the client his property upon first request. A commission is charged for such services - for depositing into a warehouse, monthly for maintaining a deposit, for issuing or transferring to another financial institution.

Today, in addition to bullion, this type of investment in gold, such as impersonal metal accounts, is gaining more and more popularity.

During the quarantine and after it, most banking services became available online. Banks went to meet customers, taking into account the modern challenges facing humanity, and transferred their sphere to the online plane as much as possible.

Where should I put the gold?

Gold in any form (coins or bars) should not be kept at home unless you are sure of its complete safety. Home safes are not as reliable as we would like. Mechanical damage cannot be excluded, which automatically transfers gold to the status of satisfactory, that is, cheap.

In order not to develop the Kashcheev habit of languishing over gold, it is advisable to store the precious metal in a safe deposit box. Then the owner will only have to monitor the prices of gold bars and wait for the moment for the most profitable sale.

Requirements for depositors

To purchase gold bars and coins, you must go to the department dealing with precious metals with your passport. Investors in metal accounts can be:

- persons over 18 years of age with a passport;

- parents or legal representatives of a child under 14 years of age upon presentation of a passport or birth certificate, if the child is not included in the passport;

- teenagers from 14 to 18 years old with written permission from a legal representative.

You can issue a notarized power of attorney to another person to manage a metal account. If the account is opened for a minor, then not only a power of attorney is required, but also the notarial consent of the legal representative. Expense transactions on accounts for a child under 14 years of age require permission from the guardianship authorities.

What is compulsory medical insurance - an impersonal metal account

Unallocated metal accounts were conceived as a real alternative to cash deposits . The instability of the world market and frequent economic crises contribute to the fact that businessmen prefer gold, silver or platinum to standard foreign exchange investments.

Sberbank provides all the necessary services for this - the client does not have to worry about storing the asset, and the procedure for purchasing precious metals under the conditions of opening a compulsory medical insurance is simple. You need to choose one of four types of assets - silver, gold, platinum, palladium.

Please note that the asset is not issued in person. The client has the right to invest, redistribute assets and receive the corresponding profit, transfer by agreement to another person, buy or sell, but they will be located on the territory of the bank. In the event that you decide to withdraw your asset from the bank's territory, you will need to pay all VAT requirements (18 percent of the value of the bullion).

How to profitably make money on compulsory medical insurance

Unallocated metal accounts are opened under special conditions when compared with other credit services. You can either earn or lose money on this due to the difference in exchange rate.

First, you need to fill out an application via the Internet, or contact a specialized credit institution of Sberbank. Keep in mind that not every Sberbank branch can provide a client with this kind of service. Out of more than 8 thousand branches, only 500 can provide you with the opportunity to open such an account.

Sberbank undertakes to establish a minimum threshold for the asset being sold. It corresponds to 0.1 g for gold, platinum and palladium, and 1 g for silver. You only pay for the purchase of the asset itself; additional funds are not required for the service.

There is no minimum threshold for the amount of profit, that is, the client can withdraw all the cash after the transaction, and the compulsory medical insurance will not close. There is also no maximum threshold; you decide how much metal you will store in the bank, but assets of one type of metal cannot be transferred to another.

Opening a compulsory medical insurance is associated with a certain amount of risk , since these deposits cannot be insured, which we will discuss in detail later.

Pros and cons of investing in gold

pros

Keeping money, as they say, “under the pillow” is completely unprofitable, and besides, it’s also dangerous. Money should always bring income - that’s why more and more people in our country are abandoning this practice and keeping money on deposits. But even so, the danger of exchange rate fluctuations remains - and to minimize it, a metal deposit, especially a deposit in gold, is useful. Let's highlight a few more advantages of deposits in gold at Sberbank:

- The ability to manipulate funds in the account at your discretion: withdraw or replenish, transfer them from gold to a deposit of another type.

- If an impersonal account is opened, then you need to take into account that real metal will not be stored on it. Your virtual account will store the same virtual gold - and the advantage here is that you will not need to pay taxes, while when purchasing real gold, you will need to pay VAT.

- Not only the purchase of virtual gold is not taxed, but also the profit received from an impersonal account after its sale - but having sold real gold and making a profit, again, you will have to give part of it to the state.

Minuses:

- Since the deposit does not carry a high risk, the interest rate will be low, as already mentioned.

- The deposit will not be insured.

- A fee applies.