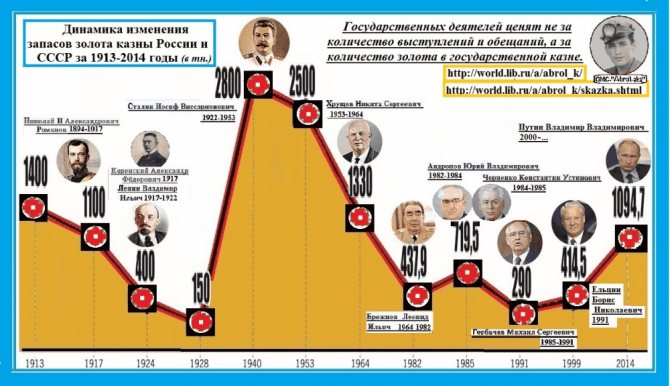

The head of the Russian Ministry of Natural Resources, Sergei Donskoy , speaking on October 26 at the opening of the VIII All-Russian Congress of Geologists, said that the increase in Russia's gold reserves in 2012–2015 amounted to 1,300 tons. I couldn't believe my eyes. I looked at the official data. Strange! As of January 1, 2012, the official gold reserve was 883.2 tons, and as of January 1, 2016, it was 1,415.21 tons. As you can see, the increase for 2012–2015 is only 532, not 1,300 tons.

Was the minister mistaken? Or, on the contrary, did he announce information that corresponds to reality, but is not reflected in official statistics?

Gold of Russia. Who gets the most

Address for questions and suggestions about the site: [email protected]

Copyright © 2008–2021. LLC "Company BKS" Moscow, Prospekt Mira, 69, building 1 All rights reserved. Any use of site materials without permission is prohibited. License for brokerage activities No. 154-04434-100000, issued by the Federal Commission for the Securities Market of the Russian Federation on January 10, 2001.

The data is exchange information, the owner (owner) of which is PJSC Moscow Exchange. Distribution, broadcast or other provision of exchange information to third parties is possible only in the manner and under the conditions provided for by the procedure for using exchange information provided by Moscow Exchange OJSC. Brokercreditservice Company LLC, license No. 154-04434-100000 dated January 10, 2001 for brokerage activities. Issued by the Federal Financial Markets Service. No expiration date.

* The materials presented in this section do not constitute individual investment recommendations. The financial instruments or transactions mentioned in this section may not be suitable for you and may not correspond to your investment profile, financial situation, investment experience, knowledge, investment objectives, risk appetite and return. Determining the suitability of a financial instrument or transaction for investment objectives, investment horizon and risk tolerance is the responsibility of the investor. BKS Company LLC is not responsible for possible losses of the investor in the event of transactions or investing in financial instruments mentioned in this section.

The information cannot be considered a public offer, an offer or an invitation to purchase or sell any securities or other financial instruments, or to make transactions with them. The information cannot be considered as guarantees or promises of future investment returns, risk levels, costs, or break-even of investments. Past investment performance does not determine future returns. This is not an advertisement of securities. Before making an investment decision, the Investor must independently assess the economic risks and benefits, tax, legal, and accounting consequences of entering into a transaction, his readiness and ability to accept such risks. The client also bears the costs of paying for brokerage and depositary services, submitting orders by telephone, and other expenses payable by the client. The full list of tariffs of BCS Company LLC is given in Appendix No. 11 to the Regulations for the provision of services on the securities market of BCS Company LLC. Before making transactions, you also need to familiarize yourself with: notice of risks associated with transactions on the securities market; information about the client’s risks associated with making transactions with incomplete coverage, the occurrence of uncovered positions, temporarily uncovered positions; a statement disclosing the risks associated with conducting transactions in the market for futures contracts, forward contracts and options; declaration of risks associated with the acquisition of foreign securities.

The information and opinions provided are based on public sources that are recognized as reliable, however, BKS Company LLC is not responsible for the accuracy of the information provided. The information and opinions provided are formed by various experts, including independent ones, and opinions on the same situation can differ radically even among BCS experts. Given the foregoing, you should not rely solely on the materials presented at the expense of conducting independent analysis. BKS Company LLC and its affiliates and employees are not responsible for the use of this information, for direct or indirect damage resulting from the use of this information, as well as for its accuracy.

We have everything calculated

Maybe we are talking about the fact that, in addition to the Central Bank of the Russian Federation, which is the holder of the national gold reserve, there are other depositories of this metal? For example, the Ministry of Finance, large banks with state participation (Sberbank, VTB, etc.), as well as corporations in the real sector, for the normal operation of which it is necessary to have reserves of physical gold used in technological and settlement processes? All these volumes may be in the Central Bank’s vaults, but not taken into account on its balance sheet.

In addition, the Central Bank’s gold reserve traditionally does not take into account “non-monetary gold” (jewelry, etc.), the volume of which, however, has remained practically unchanged for many years - at the level of 80–85 tons.

Consequently, the Russian state may actually have at its disposal today not 1,542.73 tons of “royal metal,” as follows from the report as of October 1, 2021, but much more. If you believe Mr. Donskoy - at least 800 tons, and taking into account the fact that such a practice, apparently, could have begun much earlier than 2012 - and much more.

But in this case, “where does the firewood come from,” that is, the little gold?

Peak gold: global gold supply unchanged in 2021, China cuts production by 9%

Peak Gold: Global gold mine production will peak in 2021, then begin to decline

Financial markets are freaking out about how much money the global economy lost earlier in the week as the Dow Jones Industrial Average experienced a minor crash—sorry, “correction.” Fortunately, it has (at least temporarily) recovered, but there are many other threats to financial markets in 2021 that indicate the “everything bubble” is about to burst.

There is also an underappreciated threat to the gold market, in particular to gold supply, and therefore the likelihood of rising gold prices - that is, the threat of “peak gold.”

Gold production growth last year was the slowest since 2008. We and other market experts familiar with the data have been saying for months that we are on the cusp of “peak gold.”

The phenomenon of “peak gold” or “plateau gold” was recognized and covered by the FT this week: “Global gold mine supplyp lateaued in 2021 as China output fell 9 %).

China is the world's largest supplier of gold. In 2021, the country produced 453 tons, or 56% more than the second largest gold supplier, Australia. In 2021, Chinese production fell by 9% to just 420.5 tons.

China is also the leader in global gold demand. The source of demand is not only citizens, but also the central bank, which intends to abandon dependence on the US dollar.

Trade driven by love

China's love for gold is well known. And over the years it does not weaken. According to the China Gold Association, demand for gold jewelry has increased by 10% in 2021. According to the World Gold Council, demand grew 9% in the second half of the year compared to the previous 6 months.

The increase in demand for gold is associated with the desire to invest income in something valuable. The real estate boom and high stock market prices have boosted the wealth of the middle class and wealthy Chinese, who now want to secure those gains over the long term - by purchasing physical gold.

We have seen similar behavior in recent months during the cryptocurrency boom. Some investors in Bitcoin, Ethereum and Ripple have taken care to protect their newfound wealth and have diversified it into gold bullion from GoldCore and other dealers.

Strong buying activity is expected to continue this year as the "wealth effect" encourages the Chinese to buy gold. Gold buying should be very active ahead of the Lunar New Year, celebrated in mid-February.

Money control

China is careful not to export gold mined in the country. He continues to remain somewhat secretive about the amount of gold in the central bank's reserves, and every few years he announces a big jump in gold reserves.

The decline in gold production in the country, one of the world's largest gold producers, indicates that the gold market faces more supply problems as China seeks gold on the international market. After all, gold is clearly part of a larger Chinese plan to reduce dollar hegemony and position the yuan as a potential reserve currency.

This increases global monetary and geopolitical uncertainty. For the last 40 years or so we have lived in a world dominated by the American dollar. Now we see countries such as Russia and China not only increasing their official gold reserves, but also creating monetary “systems” so that they can trade with each other and with other economic partners using gold as a means of payment.

Peak gold

The first information about the decline in Chinese production appeared last year. In reporting this, we explained why this is a long-term problem for gold supply:

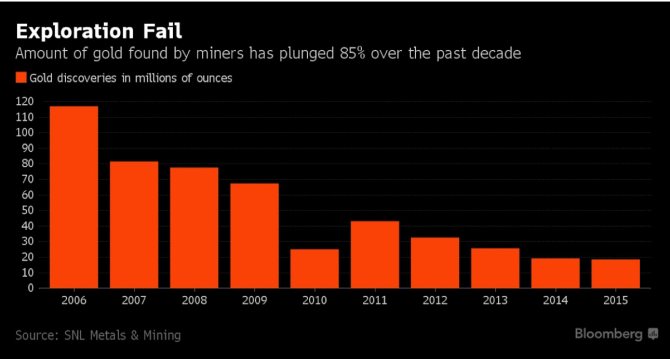

“In the short term, China may well be able to meet domestic demand through increased imports. He may try to increase his own production. But in the long run this is not a sustainable solution. Gold mines are not bottomless, and supply depends on the discovery of more and more new deposits. And, as Pierre Lassonde explained , we can no longer count on it:

“If you look back at the 1970s, 1980s and 1990s, in each of those decades the industry discovered at least one 50+ million ounce gold deposit, at least 10 30+ million ounce deposits, and multiple 5-10 million ounce deposits. million ounces But if you look at the last 15 years, we haven't found a single 50 million or 30 million ounce deposit and we've only found a few 15 million ounce deposits."

One of the main reasons for the decline in gold discovery and mining is clearly that there is not much gold left that has not yet been discovered and mined.

Today, the average mine worldwide has a gold grade of less than 1 gram per tonne. Mining at lower grades is not economically feasible for mining companies. The emergence of technologies that help mine ore with lower gold content is unlikely, since the problem is more geological than technological.

In mid-2021, World Gold Council Chairman Randall Oliphant , demand and falling supply of gold, expressed concern that the world may already have reached its maximum annual gold production .

“There won't be a sharp decline anytime soon, but at the same time, it's hard to see where we'll get enough gold to meet all this demand...”

Exploration collapse: the amount of gold discovered by geologists has collapsed by 85% over the last decade, the amount of gold in newly discovered deposits, in million ounces

Markets are increasingly volatile and the outlook is unclear. More and more retail and large investors and institutions are diversifying into gold.

In the long term, this and the peak of gold is a good sign. The world's central banks have been engaged in an unprecedented monetary experiment for the last ten years. We are yet to see its real consequences.

Gold has reacted positively to economic downturns in the past, but there were no supply concerns back then. When the global financial bubble bursts, we will likely see demand for physical gold far outstripping supply.

Support GOLDENFRONT.RU, subscribe to our YOUTUBE channel HERE .

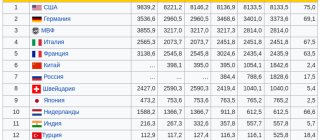

World gold production

If world gold production remains at 3,150 tons in the coming years, then the existing gold reserves of 54,000 tons will be exhausted in 17 years. ... The USGS is aware of only 15,000 tons of proven and verified reserves. The rest of the gold reserves in the ground are only an assumption based on research (Report from the United States Geological Survey (USGS), website https://gold.ru).

World leadership, according to the USGS, as in previous years, remains China. In 2021, its gold mining companies produced 440 tons of the yellow precious metal. Australia takes second place (300 tons), Russia takes third place with a production volume of 255 tons.

The current state of the gold market in Russia

The Russian Federation occupies sixth position in the modern world ranking of gold reserves in the ground.

Largest gold deposits

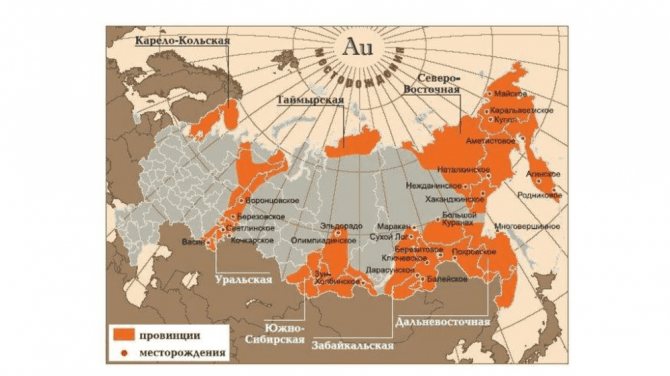

The largest gold mining areas remain Siberia and the Far East. This is where the gold deposits of Russia are located:

- Eastern Siberia - regions: Bodaibo, East Transbaikal, Yenisei and Prilensky;

- Yakutia - Aldan and Verkhoyansk regions;

- North-East of the Russian Federation;

- Amur region;

- Primorsky Krai.

Rice. 4. Distribution of gold deposits on the territory of the Russian Federation Source: website ppt-online.org

Reference. Gold reserves in the Russian Federation are in 372 primary and 5000 placer deposits. Indigenous - primary, formed in the earth's crust through magmatic processes. Almost always found in the mountains. Gold in its pure form is rare, often with admixtures of other metals (silver, copper, platinum, etc.), so it has to be extracted from ore. Placer - considered secondary, formed from primary under the continuous influence of winds, temperatures, precipitation, groundwater and other phenomena that destroy rocks. Gold in placers is much more accessible.

Natalkinskoye (Magadan region) and Olimpiadinskoye (Krasnoyarsk Territory) are two Russian deposits that are among the five largest in the world and are on a par with Pebble Deposit (USA, Alaska) and Grasberg (Indonesia).

The most famous Russian deposits are of the indigenous type, and have been developed since Soviet times:

- Sukhoi Log - belongs to the Bodaibinsky gold-bearing area in Eastern Siberia, discovered in 1961;

- Berezovskoye - discovered in the 18th century and is still being developed;

- Vorontsovskoye - in the Sverdlovsk region, work has been going on since the 1980s.

But far from all the riches of the Russian subsoil have been developed.

“On the territory of Buryatia, in subsoil areas not transferred for development, there are four large gold deposits: Barun-Kholbinskoye, Vodorazdelnoye, Dynamitnoye and Tainskoye... the total reserves of gold ore in these areas are over 6021 kg” (Yuri Safyanov, Minister of Natural Resources of Buryatia).

Rice. 5. The Elginskoye deposit, discovered in 2021 in the Amur region, with 72 tons of gold Source: website rjs.ru

And according to the forecasts of Rosgeology, in the near future we will see the discovery of a large gold deposit in the Komsomolsky district of the Khabarovsk Territory.

Gold mining companies of the Russian Federation

Almost fifty gold mining companies operate from the Republic of Karelia to Chukotka in 28 regions of Russia.

The ten largest enterprises account for more than half of the gold volume.

The leadership among them has been maintained by JSC Polyus Gold for many years by Said Kerimov (son of Suleiman Kerimov, a statesman and professional investor). It is this company that produces every fifth kilogram of gold. Tab. 2. TOP 10 leading gold producers

| 2014 | 2015 | 2016 | 2017 | |

| JSC Polyus Gold | 52,7 | 54,8 | 61,2 | 67,2 |

| JSC "Polymetal" | 26,3 | 24,7 | 24,8 | 28,7 |

| Kinross Gold Corporation | 21,5 | 23,6 | 21,3 | 17,7 |

| OJSC "Yuzhuralzoloto GC" | 8,5 | 13,7 | 14,6 | 15,0 |

| GC "Petropavlosk" | 19,2 | 15,0 | 13,0 | 13,6 |

| Nordgold Company | 10,6 | 10,6 | 8,3 | 7,4 |

| JSC "Vysochaishy" | 5,5 | 5,6 | 5,1 | 7,0 |

| H.G.M. | 6,7 | 6,6 | 6,9 | 6,8 |

| JSC ZRK "Pavlik"/IK "Arlan" | — | 1,1 | 3,8 | 6,5 |

| OJSC "Gold Kamchatka" | 3,0 | 2,5 | 5,5 | 5,4 |

Source: Company websites, eruda.ru website

Gold mining in Russia - history

For modern Russia, gold mining is a very important industry. She remained without proper attention for quite a long time.

According to the official version, the mining of this precious metal began in the 18th century. A small pebble, found in the area of present-day Yekaterinburg by a schismatic, served as a start. For some unknown reason, the find was reported to the administration of the Yekaterinburg plant, and the search continued. Many more similar stones were discovered. Much later, the “Primary” gold mine appeared, on the very spot where the pebbles were found.

The foundation of the industry in the Russian Empire on a national scale was laid by Peter the Great in 1719. There is a mention in 1732 of a mine in the Arkhangelsk province, which produced 65 kg over the years of its existence.

Rice. 2. Gold mining two centuries ago Source: website aikido-mariel.ru

By the beginning of the 19th century, Russia was already a leader in the development and extraction of valuable metal. After the reform of S. Yu. Witte and the introduction of the “gold standard,” Russia began to mint gold coins, and foreign companies and private individuals were given access to the development of gold mines.

The Revolution and Civil War had a detrimental effect on the mines that developed during tsarist times. Gold mining found itself in a rut for many years.

The creation of the Committee on Precious Metals in 1918 did not help either. It was not possible to establish order, and a record of the mines was not created, but it turned out to be difficult to restore order and register the mines. The Urals and Siberia were the main gold mining areas. The new government did not get there right away. Moreover, the mines and mines changed owners every now and then: sometimes “white”, sometimes “red”. And they were not stingy in their desire to destroy the enemy. The confrontation ended with the almost complete destruction of the industry:

- 1913 – about 64 tons;

- 1918 – 30;

- 1920 – 2,8;

- 1921 – 2,5.

The Soviet period did not bring prosperity to the industry either. The state did not see its task as development. The state focused its attention not on the development of already discovered deposits and the exploration of new ones. It focused on expropriating gold and its products from the population. At the level of production at gold mines in the period 1918 - 1922. The Soviet government received about 15 tons of gold, while at the same time 15.7 tons of gold and products were confiscated from the population.

The monetary reform of 1921 was based on the “gold standard” formula, which meant that the gold reserve should become collateral for funds. But it is already clear that the reserves of the precious metal have been depleted, geological exploration data can no longer be found and there are no plans for new geological exploration.

The young Soviet state is trying to create a system of financing and encouraging private miners and small gold mining enterprises; in 1923, it began the development of Yakut gold in the Aldan River basin. They said that gold was almost collected there by hand.

The first results have also appeared. In 1929, more than 25 tons of pure gold were mined, most of which came from government organizations. During 1936-37, 130 tons were mined, which brought Russia to second place in the world. By the beginning of the Second World War, the treasury received an average of almost 174 tons per year.

Later, the industry had to go through difficult times. Information about its activities turned out to be classified for a long time. Economic recovery required emergency measures. And in the camp system, gold mining was carried out by prisoners serving sentences. Super-cheap labor very soon raised gold mining in the country to a fairly high level, and the price of that gold was human lives.

And during Brezhnev’s rule, the industry traditionally did not receive due attention. And only with perestroika the approach to supplying the industry was revised. And with the reorganization of 1988, the decline in volumes gave way to growth. Although it is difficult to call this period sustainable for gold mining. There were 330 tons from 1990, and 115 from 1998.

Rice. 3. A visual aid to the history of gold mining in Russia Source: website world.lib.ru