18.02.2021

Michael Oliver, well known for his accurate forecasts on stocks, bonds and major markets, said that the price of gold will turn around and head higher at incredible speed. The expert also noted that gold bears are doomed and provided the latest information on the situation in the silver market.

Silver wants to go higher

According to my observations, in the last few weeks, especially in the last days, silver has been trying to break free from its leash, wanting to fly higher. This can be easily seen by looking at the hourly price movement.

But as I said, gold is the master holding the leash tight, and until it completes its labor-intensive correction/stagnation process, which has been going on for six and a half months, silver will likely not be able to rush to new historical highs around $50 dollars.

Misconceptions About Gold Confiscation in America

Source: 24HGOLD.COM

Author: Roland Watson

Gold confiscation is a topic that divides gold investors. Some say it won't happen again, while others say the opposite. But both parties agree that they don't want this to happen again.

The fact that only a minority of American citizens turned in their gold after Executive Order 6102 was issued in 1933 is often used as evidence that there is little likelihood of another government seizure of gold. If this is the case, then the government's actions can be safely ignored, since a nationwide search of suspected households is not possible. Therefore, the government will not take the trouble to apply such measures.

This article is written to show that the following government statement was not idle talk:

“White House Statement regarding the return of gold to the Federal Reserve Banks dated 04/05/1933.

The country has shown remarkable confidence over the past weeks. As most of the country's banks reopened, more than $1.2 billion in foreign currency, of which more than $600 million was in the form of gold and gold certificates, was returned to the Federal Reserve Banks.

Many people across America rushed to donate the gold they owned as an expression of faith in the government and a desire to help in the emergency. But there are, however, others who were awaiting a formal decree for the return of gold to their property. This decree is being issued today.”

The anti-confiscation argument is that people, waiting for a formal government order to be issued, were against surrendering their gold. But as can be seen from the excerpt, $600 million, equivalent to 30 million ounces of gold in coins and certificates, was deposited in banks before the decree was issued.

We can, of course, say that the people who were waiting for the decree still did not hand over their gold, but a careful reading of the decree tells us that there should not have been so much illegal gold. Here's what the relevant section of the decree said:

“All persons undertake to deliver, on or before May 1, 1933, to the Federal Reserve Bank or any branch or affiliate thereof, or to any member bank of the Federal Reserve System, all gold coins, bullion, and gold certificates now in their possession or such as may come into their possession before 04/28/1933 inclusive, with the exception of the following:

(b) Gold coins and certificates valued at $100.00 or less and owned by one person, and gold coins of recognized numismatic value for collectors of rare and unusual coins.

Section (b) is of great interest. Many have focused on the numismatic part of it, but I have rarely seen anyone talk about the $100 exception. At that time, gold cost $20 an ounce. The twenty dollar double eagle contained just under one ounce of gold, and the price of five of these coins was $100.

What does the exclusion clause in Order 6102 say? He says that each person can keep up to five ounces (31.1x5=155.5 g - Ed.) of gold coins and not fear persecution. At that time, the number of adults in America was 90 million. In theory, they could keep 450 million ounces of gold if they had the means and desire to do so (in reality, this amount of gold was never used for coinage).

The reason I decided to write this article is because of a piece by respected gold analyst James Turk . It alleges that American citizens routinely hid gold from authorities in violation of the law. As evidence, he cites Milton Friedman and Anna Schwartz 's A Monetary History of the United States, 1867-1960.

According to the data given in it, in January 1934 there were still 13.9 million ounces of gold in circulation and only about 21.9% of the gold in circulation was handed over to the state.

The problem with this statement is that it does not take into account the five-ounce exclusion clause. While we don't believe that 90 million people owned five ounces each, it would only take every American adult legally owning 0.15 ounces of gold to figure out where the 13.9 million "missing" ounces are. In fact, even if one were to try to account for the “five ounce exception,” I would find it nearly impossible to distinguish between coins owned legally and illegally.

Of those 13.9 million ounces, how much of it was legally owned? Of course, it is impossible to say for sure, but it seems clear to me that even during the Great Depression, owning five ounces of gold was not such a burden for very many people. What was the average wage in America in 1933? I found several answers to this question on the Internet - on average about $1400 per year. Accordingly, $100 is less than the average monthly salary, and although the savings rate in 1933 was one of the lowest in recent American history, we suspect that many households had more than $100 under their mattress.

It would only take 2.8 million adults, or 3% of the adult population, owning 5 ounces of gold to absorb all of the missing 13.9 million ounces. When we also consider that many probably gave away their excess gold to wives, children, parents, etc. to avoid confiscation, the conclusion suggests itself - illegal possession of gold was not widespread.

It can, of course, be said that if Roosevelt had not included the five-ounce clause in his order, illegal possession would have been an omnipresent phenomenon. Perhaps so, but this threshold shows us Roosevelt the socialist in action. As we know, progressive taxation and confiscation are weaknesses of democratic socialism. A person doesn't start paying income taxes until he reaches a certain "level," and the same thing happened with the five-ounce gold clause. How do you get a majority of middle-income voters on your side on this issue? You simply allow them to keep some of the gold and then give them a bonus of a 75% increase in the price of gold when it revalues to $35 an ounce!

How would this form of confiscation work if it were introduced today? Today (in 2006 - Ed.) five ounces of gold cost about $2800. If the average income in America today is $40,000, then five ounces would equal 7% of that amount. In 1933, this amount would also have been 7% ($100 of $1,400). Who says that gold is a bad store of savings?

When (not if) confiscation occurs again to prop up the falling paper currency reserves of Western nations, will we see the five ounce clause again? I would say yes, but the government may decide that there is so little gold owned by citizens today that there is no point in owning it.

This is something to think about that I recommend to all gold investors as the paper based economy continues to march towards disaster in the not too distant future.

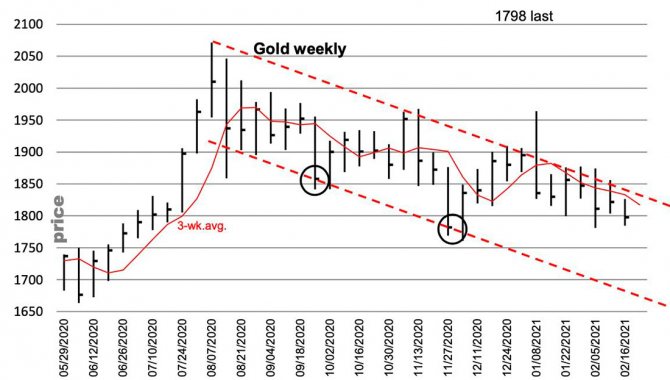

Golden bears are doomed

My second observation is that gold bears are doomed no matter which way the gold price goes. It doesn't matter whether it hits the November low (just above $1,760) or simply reverses above it. Currently, gold is making another attempt to overcome this minimum, but so far it has not been particularly successful. Please note that the precious metal has remained closer to the upper border of the channel over the past seven weeks.

But whatever the result of the current correction, it will be followed by a sharp reversal.

Either the price of gold will very soon update its low below the November low and then rise sharply, or the precious metal is simply teasing a sell-off similar to the one on February 16, after which it will simply reverse without reaching the November low and head towards the weekly channel breakout price of $1.856. $30, which, as you can see on the chart, will be significantly above the top of the channel.

Gold online

Gold is one of the most important components of the global financial system. This precious metal has a large number of applications and is not subject to corrosion than its cheaper counterparts.

Gold price today

In many ways, gold is quite interesting from the point of view of savings, because even in times of serious disasters it only accumulates. The Gold online chart updated in real time, and in order to know what the price of Gold online is, simply save the page to your favorites and, if necessary, you will always be aware of the current prices for XAU/USD.

Gold quotes for today

Recently, we can observe a serious drop in quotations for Gold, however, we cannot talk about the continuation of the current trend and, most likely, in the near future we will see an increase in the cost of gold. Moreover, during times of serious financial crises, Gold can greatly increase in price. To find out Gold quotes for today, just look at the chart presented above; if you see a price of 1150, this means that for one troy ounce they give 1150 dollars on world markets.

Gold price

Today, the price of Gold on the exchange has reached the level of 2009, but at that time the cost of xau usd was in a serious upward trend during the financial crisis of 2008. It is quite possible that this price of Gold on the stock exchange today will not last long and in the near future there will be a new round of growth for GOLD.

GOLD chart online

Above is an online GOLD chart that shows the value of xau/usd expressed in US dollars at a given time on the global financial markets of London and New York. The chart is updated automatically, so you just need to look at the current quotes to see the GOLD chart online .

Gold to Dollar rate

Historically, the dollar exchange rate was pegged to Gold, and world currencies to the dollar. However, such a system could not exist for long and countries switched to a floating exchange rate, and the United States, in turn, abandoned the pegging of the Gold rate to the Dollar, which led to a serious increase in prices for the precious metal GOLD in the next few years. Today, prices on world markets for Gold are expressed in dollars per ounce; on the presented chart, Gold Chart (XAU/USD) online, you can track the Gold to Dollar exchange rate for today in real time.

Gold price per ounce today

A troy ounce is a unit of mass, it is equal to 31.1034768 grams, so when we see a quote of 1200 on the chart of Gold (XAU/USD) online , it means that for 31.1034768 grams GOLD gives 1200 US dollars. The price of gold at 19.3 dollars per 1 ounce was established back in 1792 in the United States of America. During the gold standard, the price was already at $35 per ounce. At the time of the collapse of the Bretton Woods system, the cost of gold began to rise, and was already worth about $200 by 1978.

How much does Gold cost on the market?

The price of XAU/USD is constantly changing, so it is impossible to say how much Gold is worth on the market; in order to see the current prices of the precious metal, use the charts above. Where you can find out how much Gold costs on the market now or how much it cost yesterday.

Gold price dynamics, Gold price chart

The dynamics of gold prices is a unique economic indicator that can tell us whether the markets are now in crisis; if the value of gold rises rapidly, then we can talk about the development of a serious financial crisis, as investors flee to gold, and gold an asset that will always be in value.

How much gold is in a dollar?

Money management is carried out by three categories of citizens: some decide how much money to spend; others decide how much money to give; and only a select few decide how much money to print.

As you know, the dollar was declared equivalent to gold at the Bretton Woods International Conference in 1944.

The reason is simple: during the Second World War, the United States was ahead of the rest in the economy and, moreover, concentrated 2/3 of the world's gold reserves in the basements of Fort Knox. This is neither more nor less than 701 million ounces (for reference: 1 ounce = 31.1 g). At this historical conference, the cost of 1 ounce of gold was equal to $35, in other words, $1 = 0.9g of gold. And this ratio lasted until August 15, 1971, when the United States refused to pay gold for dollars.

Until this point, any foreign citizen or US government had to exchange dollars for gold on first presentation. And some states managed to do this, in particular, France (albeit with a big scandal) and, quietly, West Germany. But thanks to de Gaulle, the French received their ship with gold delivered to their home, but the Germans still cannot return their gold reserves from “secure storage” in Fort Knox to their homeland; the Americans are clearly in no hurry.

When there were too many takers , President Nixon announced a temporary ban on the convertibility of the dollar into gold, which was never resumed. Before 1972, more than 60% of the gold reserves were exported from the United States in exchange for paper dollars. The dollar, “untied” from its gold content, turned out to be a very convenient tool for a well-fed life at someone else’s expense. It's simple: you print paper money and export everything you need from third world countries.

Official world gold reserves in tons and their share in the total volume of national gold and foreign exchange reserves in percentage (according to the World Gold Council for June 2013) look like this:

Gold at $70,000 per ounce

Other fiat or new digital currencies may not become good money; it must be a currency backed by gold. There are many ways to calculate the right price for gold, depending on which money supply measure is used. But if we take M3 in the US, which is a broad measure of the money supply, and are 100% backed by gold, the price of gold is over $70,000 dollars. This is not a forecast, but only a theoretical calculation. As we know, gold is an international currency, so China and Russia will have the final say in this matter.

I doubt that there are 8,000 tons of officially declared US gold reserves. There hasn't been a full audit since the 1950s, when Eisenhower was president. China and Russia claim that their countries have reserves of about $2,000 tons, but China's actual reserves may well exceed 20,000 tons, and Russia's - 2,300.