A bank deposit is the most reliable, and most importantly, understandable way for the majority of the population to save their savings and even increase them. Gambling on various exchanges, transactions with real estate, and securities is the lot of professionals, which, moreover, involves quite significant risks.

By the way, the beautiful and not entirely clear word “deposit” actually means a bank deposit, money that the bank borrows from the client, obliging to return it with interest. Today, deposits in banks in Moscow, St. Petersburg and other Russian cities are so diverse that the choice can become difficult for an unprepared investor, but meanwhile, knowing how to invest in gold, dollars, euros or virtual grams of precious metals can be very useful.

Sberbank deposit in gold for individuals

When considering various options, you should choose the most acceptable one and the one that will actually bring profit and not cause losses. Sberbank offers several opportunities to make a gold deposit, and each has its own characteristics, pros and cons.

Gold bars

Buying gold bars is the most obvious and affordable way to invest in the precious metal. But today few people do this, because such a decision can cause serious losses, especially with not very long-term investments.

Gold bars require storage in special conditions - where no one can find or steal them, and also to protect them from any influence. Even minimal scratches reduce the value of a gold bar. To ensure optimal storage conditions, you will have to reserve a safe deposit box at the bank and pay for it.

If the bullion is sold, the owner will have to pay value added tax, which is 18% of the profit. It is also important that the cost of selling/purchasing gold bars by weight at Sberbank (and any other) is very different. So, if you invest in gold today and decide to sell it tomorrow, the owner will generally lose about 30%.

Thus, when considering whether to invest in gold bullion, it is advisable to choose this option only for a very long-term investment. Over the course of decades, gold can provide good income, provided that its price continues to rise. But it is unknown whether the profit will offset inflation and whether it is worth it.

How to buy an ingot:

- The client comes to the bank with a passport and is present during the purchase.

- The ingot is weighed with an error of less than 0.01 grams and inspected externally.

- A certificate is issued for the product indicating all the data indicated on the surface of the ingot.

- At the time of transfer of the bullion, an act is drawn up and a cash receipt is issued.

Golden coins

This type of investment also raises many questions. Before buying gold coins, you need to carefully study the assortment and choose the most suitable ones. Gold coins are ideal as a chic gift - they are not only valuable, but also a piece of art. But they hardly see it as a profitable investment item.

Coins can be investment or collectible, differing in the degree of uniqueness, aesthetics, mintage, and age. Experts recommend purchasing domestic coins (“Chervonets”, “St. George the Victorious”, etc.). It is important to pay attention to the quality of the embossing and the condition of the surface. Coins must be stored extremely carefully.

Usually, gold coins are bought by those who, in principle, like to collect such things and are well versed in them. But a businessman should not choose to buy gold coins as a means of accumulating earnings.

Compulsory medical insurance golden contribution

When considering investments in gold, the pros and cons, it is worth highlighting impersonal metal accounts, which have all the advantages of investing in gold and exclude the disadvantages.

An unallocated metal account is a special type of account that displays precious metal owned by an individual, indicating grams, but without information about the fineness, manufacturer, bullion numbers, etc.

By opening an impersonal metal account with Sberbank, the owner can immediately buy/sell metal without the need to check the bullion (there is no physical option for the availability of gold). That is, compulsory medical insurance is the same account, but its unit of measurement is not rubles or dollars, but grams of metal (in this case, gold).

In fact, an impersonal metal account is simply a record that the investor has a certain amount of grams of gold. The metal is not delivered to the buyer; it simply serves as a unit of calculation for deposits. But here it is worth noting that gold is provided by bank reserves, so if desired, the client can order an ingot (by paying the difference in price).

Sberbank allows any client to open such deposits in precious metals; it can be opened for a child. In the future, it is possible to draw up a power of attorney or a will for the deposit.

Metals for impersonal metal accounts:

- Gold – from 1 gram

- Silver – from 1 gram

- Platinum – from 0.1 grams

- Palladium – from 0.1 grams

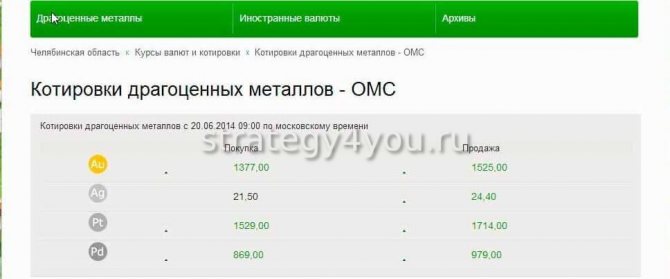

The bank sets the metal purchase/sale rate independently; it usually correlates with current prices for raw materials on international markets. Each client can check the current exchange rate for gold under compulsory medical insurance at Sberbank in the online account on the website or in the mobile application.

And here is the link (from the video above) to the Gold Coins, you can purchase them online - buy coins HERE >>

Best interest rates and favorable conditions

Bank ratings based on key, basic indicators of their activities are easy to find on the Internet.

Although the TOP lists provided by different resources may differ slightly, they clearly demonstrate which banks enjoy the greatest trust of the population, as well as their objective financial indicators and credit ratings.

The rating of Moscow banks by deposits is as follows: Sberbank of Russia, Credit Europe Bank, Home Credit Bank, Bank of Moscow, VTB 24, Alfa Bank and others.

The most profitable deposits in banks in St. Petersburg are deposits in Sberbank of Russia, VTB 24, Raiffeisenbank and others.

In fact, in both Moscow and St. Petersburg, the top ten includes (sometimes in different positions) the same banks, and Sberbank tops the list.

As for unallocated metal accounts, not all banks provide the opportunity to open them, and only a few offer time deposits in gold.

Advantages and disadvantages

Before opening a gold deposit in Sberbank, you need to carefully study all the features. All the advantages and disadvantages will be discussed in more detail a little further, but now it is worth noting the main aspects.

The main advantages of a deposit into compulsory medical insurance at Sberbank: no restrictions on withdrawals/replenishments, high potential profitability, no need to pay VAT and physically own the metal, high level of liquidity, the ability to open an account for a child (for the purpose of long-term investment).

Disadvantages: lack of insurance for a deposit in the DIA, risk of losses in the event of a fall in the price of gold, lack of guaranteed profit (as is the case with interest on a deposit), you need to pay personal income tax yourself, if you want to receive coins and bars in your hands, you will still have to pay VAT in the amount 18%.

When investing in impersonal metal accounts, you need to understand that no one can give any guarantees.

On the other hand, the investor can independently monitor prices, respond in a timely manner to changes in the market, change deposits for money and vice versa.

Types of bank deposits

Bank deposits can be divided into two main types:

- Time deposits. Money is deposited in the bank for a certain period of time (from a month to several years). Of course, the bank will return the money before the deadline established by the Agreement, but the client will not receive the expected interest;

- Demand accounts. This type of deposit provides the client with maximum freedom of action: money can be withdrawn at any time. However, interest rates on such deposits in Moscow banks are minimal.

Deposits can be either ruble or foreign currency (US dollars or Euros). Profitable multicurrency deposits in Moscow banks have become widespread.

If it is possible to replenish/withdraw funds from an account , deposits in Moscow banks are:

- Without the possibility of depositing funds during the deposit period – non-replenishable accounts;

- With the ability to deposit funds into the account – replenishable accounts;

- With the possibility of partial withdrawal of funds, with a minimum account balance.

The most pressing issue for every depositor, which often determines the choice of bank and type of deposit, is bank interest.

And here everything is not so simple, interest on deposits in banks in St. Petersburg and Moscow can be accrued in the following ways :

- Monthly addition of interest to the main deposit;

- Interest is added to the principal amount of the term deposit at the end of the term;

- Quarterly and semi-annual interest accrual.

Different banks offer a wide variety of ways to calculate interest, they can even be calculated weekly. Interest can be transferred to a special account or bank card. Another important point for most investors: the minimum deposit amount. Popular banks in Moscow offer deposits at good interest rates, however, the minimum amount for these deposits can be very significant (from 1,000,000).

Requirements for depositors

To be able to invest in gold, you need to find out who has access to this opportunity. To make a purchase, the client goes to the branch that deals with precious metals and presents his passport there.

Who can become a depositor:

- Any individual over 18 years of age, as confirmed by a passport.

- Parents, as well as legal representatives of children under 14 years of age (confirmed by passport, birth certificate).

- Teenagers 14-18 years old, subject to written permission from an official representative.

Management of a metal account can be carried out by the client personally or by another person under a notarized power of attorney. If the account is opened/registered in the name of a minor, then another person can manage it only with a power of attorney and notarized consent of the representative. All expense transactions on accounts registered for a child under 14 years of age require permission from the guardianship authorities.

And a little more about gold

Thus, investing in gold is profitable and makes sense under several conditions:

- Long-term deposit - it is not profitable to invest money in gold, for example, for a period of up to a year, in order to really make money on gold, you need to wait for the dynamics of the gold rate for up to several years, so more often such a deposit is opened by wealthy people who have free funds.

- Adequacy of funds - the larger the amount invested in gold, the more profitable it is for the investor.

- Reliability of a bank - a prerequisite when choosing a bank is its reputation, since in the event of bankruptcy, funds stored in gold are not returned.

- The terms of the deposit - the interest rate and the choice of deposit method are also important; here the most optimal way is to choose an impersonal metal deposit - gold.

Remember that by investing in gold rather than keeping it under your pillow, you are protecting your future for the long term. And a gold deposit is considered among financial experts to be one of the most profitable and safe forms of investment.

The reliability of this form of investment is also evidenced by numerous reviews from investors who, in this way, not only saved their invested funds, but also received income, since every year the cost of precious metals only grows, as does the demand for gold.

Features of compulsory medical insurance

When thinking about whether it is worth investing in gold at Sberbank and whether it is profitable, you can start with an impersonal metal account, which gives maximum advantages and compensates for the disadvantages of the usual option of owning gold in bars and coins.

Advantages

Compulsory medical insurance has significantly more advantages compared to traditional options for investing in precious metals.

The main advantages of compulsory medical insurance:

- Free service – including opening an account, buying/selling metal without commissions.

- Convenient management – sales/purchases on the account are made from home at any time of the day.

- Possibility to open a deposit online through a mobile application or Internet banking.

- Gold cannot be damaged or stolen in any way.

- Prices for compulsory medical insurance change in real time and correlate with the exchange rate of precious metals.

- Deposits are considered perpetual and do not require regular renewal.

- The deposit can be opened in the name of the child and these investments will be protected by the law.

- Protection against inflation - if you look at changes in prices for precious metals, you can see the lack of correlation with global crises and a rapid recovery if they did have an impact.

Flaws

A gold deposit in Sberbank also has its drawbacks, which should be studied before opening an account and expecting surprises.

Important disadvantages of compulsory medical insurance:

- No interest accrual on deposits.

- High spreads.

- Liquidity is limited by the bank itself - gold can only be sold to Sberbank, and not to any buyer.

- Lack of insurance in the DIA and, hypothetically, if the bank’s license is revoked, all funds will be burned.

- The condition of additional payment for the delivery of gold in physical form.

When selling metal with compulsory medical insurance, the client pays income tax on profits in the amount of 13%, with self-filing of a declaration, since Sberbank does not act as a tax agent, so it is clear that the client’s profit is not calculated.

How to make money on metal deposits

When thinking about how to make money by investing in a metal impersonal account, it is worth remembering that there is no interest, and profit is created by the difference in the cost of buying/selling gold. The exchange rate is regulated by the bank itself, focusing on world prices. The bank sells at a much higher price than it buys - the spread can be 3-10%.

The only method of making money on such a deposit is to increase the value of the asset (gold). And the growth must be significant in order to overtake the spread and generate profit. For example, if the purchase/sale difference is 7%, then the client’s profit will be accrued only after the price increases by 7% and goes further.

In the short term, the price of gold can rise and fall, but in a few years, decades, it will most likely rise. Metal deposits go well with dollar deposits - when gold rises, the dollar falls (this relationship also works in the opposite direction). Therefore, both assets can neutralize each other’s risks.

Gold rate today

You can monitor changes in the value of gold in Sberbank’s impersonal metal accounts on the official website online. There are charts for different periods that can be printed.

In the process of analyzing and studying charts, you can find out many useful features: for example, the highest spread for gold is usually recorded at night and on weekends, the best quotes are during business hours on weekdays.

What type of deposit is better to choose?

All three listed methods of investing in gold can be conditionally considered financially equivalent according to the following criteria:

- the investor cannot count on current dividends;

- all hope for profit is connected with the future rise in price of the precious metal;

- The acquisition of gold, physical or “paper”, takes a long time.

The options demonstrate approximately the same profitability, but when choosing between bullion, coins and compulsory medical insurance, their specifics should be taken into account.

If an investor is a numismatist, then he can, with a certain probability, predict an increase in the value of some coins, taking into account not only the weight characteristics, but also the collection value.

Storing bullion at home is only possible if you are confident that your home is reliably protected from the risks of theft.

The conditions for placing a gold deposit in Sberbank PJSC may change in favor of the client if quotes on world markets show steady growth. In this case, there is a chance that dividends will be paid, albeit small. True, the gold account will have to be reissued.

As for the entry threshold, it will be the highest for coins. The minimum weight of an ingot is only one gram, and even a person of modest means can purchase such an amount.

The smallest step of a gold transaction at Sberbank is only 0.1 grams. The minimum deposit for opening a compulsory medical insurance is one gram. It is difficult to imagine a coin with such weight.

It should be borne in mind that investing in precious metals is advisable only when investing a significant amount, measured in tens, hundreds of thousands and millions of rubles.

How to open compulsory medical insurance in Sberbank

You can open a metal account at Sberbank using several available methods, and each client chooses the one that is most suitable for him.

In the office

Not all offices have the necessary equipment - while most Moscow branches provide the service, this is not always the case in the regions. Typically, compulsory medical insurance is opened where trade in gold bars and coins takes place.

What you need to do to open an account:

- Make a call to Sberbank at number 900 and find out whether the selected branch can complete the procedure or look at the list of required offices on the website: go to the compulsory medical insurance page, go to “How to open compulsory medical insurance”, find the link under the button labeled “Open compulsory medical insurance online” with a list of branches.

- Go to the department with your passport and complete all the necessary steps.

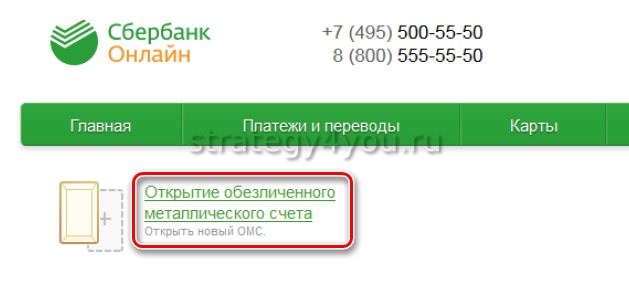

In Sberbank-online

Individuals are allowed to open accounts online using Sberbank Online.

Procedure:

- Log in to Internet banking.

- Find the “Metal Accounts” section and go to it.

- Select the desired metal.

- Determine and indicate the number of grams that you plan to buy.

- Select the card/account from which funds will be debited.

- Read the contract, complete the operation.

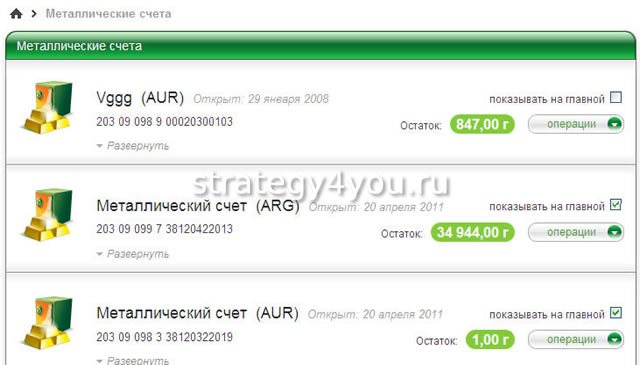

After this, compulsory medical insurance can be found in the list of your accounts. Two values are indicated - the number of grams and their cost at the current bank price. If you want to top up your deposit or sell an asset, you need to select an account and carry out the required operation.

In the mobile application

All of the above operations can be performed using the mobile application. There is only one clarification here: in paragraph 6 the branch is indicated - this is the Sberbank office designated, which is assigned to the deposit.

If you want to receive a paper contract or communicate with an employee, you need to go there. But opening an account does not require personal presence - everything is done in the same way as in online banking from a computer.

Closing a deposit

In Sberbank, you can close a deposit after the expiration date only at the branch, and it is important to have all the necessary documents for the deposit with you.

Important: if you urgently need money, you don’t have to close the deposit, but simply withdraw the required amount down to zero, because there are no restrictions on operations and no minimum funds.

If you decide to close your existing “gold” deposit, this can be done without visiting a bank branch. This uses remote access. In this case, you should proceed according to the following instructions:

- Log in to the portal and go to your personal page “Sberbank-Online”.

- Oh, and then click on Metal Bills.

- The compulsory medical insurance management page will open, where you should see Fr.

- A list of suggested actions will open. You need to find and click on the “Closing” section.

- Carry out all further actions following the instructions of the automated system.

Are deposits in GOLD profitable today?

The question of whether investing in gold and directly in unallocated metal accounts is a profitable option today requires indicating the term of the deposit. In the short term, there is no point in buying and selling gold due to high spreads. But over the course of years, the price of gold is constantly rising, and the one who made such an investment 20 years ago today received a profit that recouped the investment several times over.

Few people can answer whether gold will grow just as rapidly now. But it is a fact that the price of precious metals will rise. Compulsory medical insurance allows you to eliminate all the risks and troubles associated with storing bullion and coins, but it is not insured. A metal account can be opened for a child and the deposit can be protected at the legislative level.

Regardless of the type of investment in gold, you can make money on it only if the price of the metal increases. Gold reserves are limited in the world; after a fall, its price still always rises.

How is the price of 999 fine bars determined?

To calculate the real cost of 999 gold per 1 gram on a specific date, you need to know that the exchange rate for precious metals is set by Sberbank daily and depends on prices on the world precious metals market. Among the factors influencing the price of bullion are the following:

- investor demand;

- high level of quality of bullion, since Sberbank works only with reliable manufacturers;

- decrease in production volume on the international market;

- Sberbank has a gold and foreign exchange reserve.

These are the factors that the bank takes into account when calculating the cost of gold bars. You can independently calculate the price for 1 gram of gold. To do this, compare the cost of 1 troy ounce of the precious metal to the dollar exchange rate on a specific day. Add VAT to this number (13-16%).