Advantages of a metal account

The banking institution offers its clients to open an impersonal metal account. This should not be confused with buying bullion directly. Unlike the latter, the compulsory medical insurance does not indicate the specific characteristics of the metal purchased by the client.

What are the main benefits for customers?

When a client purchases an ingot, he receives an additional document containing complete information about it: weight, number, manufacturer, fineness. When opening a metal deposit, the client acquires metal in an impersonal form.

Reasons why compulsory medical insurance is the best option for investment

For example, gold for a certain amount. But he is not given any characteristics. This is due to the need to become a participant in the game on stock exchanges for a group of precious metals.

The principle of making a profit is based on quotes of precious metals. Compulsory medical insurance of Sberbank today allows you to receive complete information in this direction.

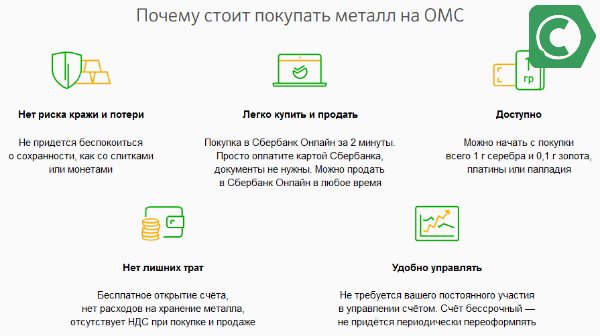

A metal account provides clients with the following opportunities and advantages:

- Obtaining additional profit associated with the growth of the price of the precious metal.

- The purchase of metal occurs instantly. Same as selling.

- When carrying out transactions with unidentified metal, VAT is not charged.

- An alternative option for participating in the stock market.

- Opening is free. There are no fees or charges for the service.

- It is possible to open it to another person.

Online course schedule

Sberbank offers its clients to track the compulsory medical insurance rate effective today online. Here you can not only see the latest quotes, but also analyze the exchange rate dynamics for any selected period for each metal, and, if necessary, print graphs.

Gold

In 1976, the gold standard was abolished at the Jamaica Conference. From that moment on, the world's major currencies were no longer backed by gold, and the metal itself became an object for investment. There is a relationship between the situation in the country's economy and the gold rate. During a crisis period, when the economy is unstable, investors pay attention to gold, and its price rises.

During periods of economic growth, when efficiency is required, currency comes to the fore, and the gold rate, accordingly, falls. Thus, gold today is an indicator of economic stability and at the same time a guarantor of financial security in times of crisis.

Today, gold is in first place in popularity when opening compulsory medical insurance at Sberbank.

Silver

The second popular metal today is silver. Since it is more common than gold, its price is much lower. If we consider it today as an investment object, then in the short term silver is a rather risky option.

Serious investors are reluctant to invest in it, unlike various speculators.

The reason is that the price of silver constantly fluctuates, while other precious metals are more stable. But, on the other hand, due to sharp fluctuations in the exchange rate, you can get a good profit if you sell the investment asset on time. Other metals have lower returns over such short time periods.

American experts are confident that the time is approaching when silver will equal gold in exchange rate, and perhaps even surpass it. This is due to the fact that, according to some data, silver resources on earth today are almost exhausted. But before you buy silver, keep in mind that they have been predicting an increase in quotations for this precious metal for several years now, but growth has not yet been observed.

Palladium

Palladium is the rarest metal of these four. Although, according to some estimates, its reserves in the ground are on par with gold, mining palladium is much more difficult. And the volume that is produced today does not correspond to the growing demand.

Palladium is indispensable in some industries, especially in mechanical engineering. And since this area is developing at a gigantic pace, the demand for it is much higher than the supply. This shortage has existed for the past 8 years, and, according to experts, this situation will continue for at least the next five years.

Today, the price for palladium at Sberbank is already higher than gold. However, experts from Commerzbank (Germany) consider the current situation with the exchange rate to be speculative and predict a downward adjustment in prices already in the first half of 2021.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

Those who decide to open compulsory medical insurance at Sberbank and purchase palladium should take into account that today 80% of this metal is used in mechanical engineering. This means that palladium quotes at Sberbank directly depend on the situation on the global automobile market.

Platinum

If investors choose gold during a period of economic recession, then platinum is chosen during a period of growth. Therefore, it is often advised to invest in both precious metals at once. Thus, financial losses on one exchange rate are compensated by an increase in the cost of another.

However, over the past few years, the price of platinum has remained at its lowest level. According to experts, the metal has become practically unprofitable for mining and with the slightest reduction in price, platinum can already be excluded from the list of precious metals.

Oddly enough, the negative dynamics of platinum are also associated with the automotive industry. In 2015, a scandal erupted regarding the environmental friendliness of diesel car engines.

A number of tests have shown that engines of this type significantly exceed the norms in terms of the amount of harmful emissions, and manufacturers deliberately underestimated the data.

The scandal has caused demand for diesel cars in Europe to plummet. And since the bulk of platinum is used in engines of this type, the drop in their sales immediately affected its quotes.

Methods for opening compulsory medical insurance

The metal deposit demonstrates the price dynamics of metals in an impersonal form. Investors note the attractiveness of this type of investment for obtaining a decent level of profit.

Types of precious metals available for purchase in the form of impersonal metal accounts

This is explained by its advantages compared to the purchase of real precious metal bars:

- purchase and sale transactions are not subject to VAT;

- there are no storage and transportation costs, which affects the cost of unidentified metal;

- there are no risks associated with theft and force majeure;

- ease of cashing out.

You may also find the article about mutual fund risky bonds in Sberbank useful.

The most common and sought after metal today is gold. The client also has the opportunity to open an account using silver, palladium and platinum. To open, you can use any of the following methods:

- Bank branch.

- Online service (if you have open accounts and activate the service).

Stages of opening a metro account online

When visiting the branch, you will need to fill out an application. The employee needs a passport to identify the client. Opening a metal account follows the same procedure as any other.

Gold price charts for buying and selling

The client can choose his deposit options, which provide different levels of profitability:

- Profit increases only due to changes in the exchange rate. The amount of impersonal metal remains at the same level, but its value changes based on stock market trends.

- In addition to the above-mentioned principle of changing the amount, interest is calculated (as with a deposit).

Read our article about how to buy silver bars at Sberbank.

When opening in an online service, the instructions are similar to opening any other account. You will need to select: Open an account – compulsory medical insurance. Fill out an application on the form provided: enter your passport details, amount to invest, type of metal. After review, bank employees will inform the client when they can come to the branch and sign documents to open an account.

Three steps on the path to wealth

In addition, you can invest existing metal ingots. Payments are required for the following operations:

For gold

- standard bars - 0%;

- in unsatisfactory condition - 0.1%;

- measured ingots - 15-400 rubles based on weight;

- ingots in unsatisfactory condition are not accepted.

Download file:

Conditions for placement of precious metals

Download file:

Standard form of the Compulsory Medical Insurance Agreement

For silver

- in excellent condition - 0-0.5%;

- not corresponding to good delivery - 1-1.5%;

- in measured ingots - 0%;

- in unsatisfactory condition - not accepted.

- Platinum, palladium - as agreed.

The service also allows you to control your account. The client can view quotes of precious metals under compulsory medical insurance in Sberbank of the Russian Federation from his Account online.

Silver buying and selling charts

Taxes on income under compulsory medical insurance

In accordance with current legislation, all income is taxed. In this case, the key word is “income,” which the owner of the compulsory medical insurance can receive only when closing the account and selling the precious metal. An exception is accounts that were issued more than 3 years ago (Article 217 of the Tax Code of the Russian Federation). Even if the sale of the asset did not generate income, the person is required to provide a tax return and confirm expenses (if any).

The tax office analyzes the data and, based on it, draws conclusions about the presence or absence of income from the sale. If personal income tax (which is 13% of the profit) still has to be paid, then the right to receive a tax deduction remains.

Important: when calculating profits from the sale of assets, do not forget that losses are not carried over to another tax period. That is, if gold was purchased in 2021 and sold in 2021, then these purchase costs in the year of sale are not taken into account.

Opening compulsory medical insurance for another person

You can open a metal deposit in the name of a minor. This can be done by a parent or guardian. You will need to present the certificate issued at his birth and the parent’s passport, which contains a note about the presence of children. The guardian must have a certificate of the appropriate type issued by the guardianship authority.

If a minor is over 14 years old, he can perform the operation on his own with parental permission. It must be certified by a notary.

Guardians, parents and other citizens are allowed to carry out deposit transactions, provided this is stipulated in the agreement and notarized. Upon reaching 14 years of age, he will be able to perform actions himself if the appropriate permission from his parents is transferred to the bank. Alternatively, a parent or guardian can visit the branch and inform staff in person of their consent.

Metal deposits are opened in an impersonal form

This way, parents can save a certain amount in their child's name. The trend in the price of gold in the long term has a pronounced increase; you can always check the history of precious metals quotes for Sberbank OMS. According to approximate estimates of experts, in 12 years you can accumulate about 2 million rubles with a monthly deposit of 3 thousand rubles into a metal account.

Step-by-step instructions on how to open compulsory medical insurance in the SB of the Russian Federation

To open compulsory health insurance (in Sberbank) online today, you need to do the following:

- log into your account on the bank’s website;

- find the subsection “Metal accounts”;

- choose one of four possible precious metals;

- enter your data in the form for opening compulsory medical insurance;

- study the contract and conditions;

- confirm your decision;

- after the payment has been completed, compulsory health insurance in Sberbank is considered valid.

All that is required for this method is a valid Sberbank card and a sufficient balance on it. This is the easiest and fastest way, which will take no more than half an hour.

Those who do not have a Sberbank card or the opportunity to use the online service will have to contact the bank branch in person. Unfortunately, this opportunity is currently only available to residents of Moscow and the Moscow region. To open compulsory medical insurance, a person will need a passport and TIN. To open or close compulsory medical insurance at Sberbank, you do not need to pay any commissions. It will also take a little time; a second visit to Sberbank will not be necessary.

Customer Reviews

It would take quite a long time to list the benefits of compulsory medical insurance.

Before opening, it is worth studying in detail not only the advantages, but also the possible risks. You should also pay attention to the reviews of real clients who have already stored or are storing their funds in a metal account. Anna, 35 years old, St. Petersburg:

“Investing in metals is quite possible - I have been able to earn money this way for the last 5 years. Average yield is 10% per annum and above. But there are nuances. The most important thing for beginners: distribute your risks. Those. store funds in both metals (and more than one) and currency. And try to study the market in advance, choosing a convenient moment to buy.”

Igor, 48 years old, Yaroslavl:

“Gold and other precious metals are not an instrument for those in a hurry. In the future, quotes are really rising, because in principle the price is rising for everything - just remember the notorious Big Mac index. Therefore, you can only enter this market with serious intentions and fairly large sums.”

Yuri, 28 years old, Ekaterinburg:

“I purchased 10 g of gold out of pure curiosity in September 2021 for 25 thousand. As of June 2021, the same piece of metal already costs almost 28 thousand. The increase is 12%. Of course, it’s too early to rejoice, but in principle this investment is made for the long term. Accordingly, you need to wait for an advantageous moment.”