Online course schedule

The essence of making money on investments in platinum is speculative operations in which income is the difference between the buying and selling rates of an asset. When choosing this method, it is necessary to constantly monitor price fluctuations in the precious metals market. A tool such as an online rate chart allows you to monitor price changes in real time. It also makes it possible to predict the general trend for today and make a decision to buy or sell an asset.

Price of 1 gram of platinum in Sberbank of Russia

Today, Sberbank of Russia is actively promoting investments in precious metals, being one of the key participants in the process. It provides its clients with affordable ways to invest in platinum, palladium, gold and silver. At the same time, he sets current rates that are as close as possible to the quotes on the world market, displayed in this chart.

Platinum price per gram in unallocated metal account and physical metal in bullion

| Price 999 standard according to the Central Bank | Bank price today | Scrap price | Price in jewelry |

The closest value to world prices today are quotations from the Central Bank, which publishes precious metals rates in terms of dollars to rubles. The price of Sberbank of Russia differs from the market price because it includes the bank’s commission premium.

Today, a non-cash purchase will cost the owner of compulsory medical insurance approximately 3.5% more than the Central Bank discount price per gram.

A physical bullion will cost 27-37% more per gram. The greater its mass, the more favorable the price. The exchange rate difference is due to the addition of the value added tax, which is currently levied on transactions with precious metals, to the cost of refined (chemically pure) metal. The price also includes bank commission. Sberbank of Russia encourages large purchases by reducing the price of platinum per gram.

Platinum price per gram in bullion coins

Platinum products do not appear on the list of investment coins today. And the cost of a gram of metal of the highest standard in commemorative and anniversary copies offered by Sberbank of Russia starts from 2,570 rubles. Transactions with coins made of precious metals are not subject to tax, but their cost includes the work of the artist and production costs.

Lyudmila PesterevaOur most experienced investor in goldAsk a questionAnother important point is that the revaluation of anniversary and commemorative coins, as a rule, does not correlate with an increase in the market rate of precious metals. Therefore, with a sharp increase in quotes, buying a coin can be quite a profitable acquisition.

Price of the Central Bank of the Russian Federation

The Central Bank sets current rates for platinum, converted from dollar prices to rubles. Thus, the profitability of such operations is influenced not only by stock exchange quotes, but also by the exchange rate of the national currency today. I always use this chart when analyzing the market.

Platinum | RUB | 1 Gram

Gold today: rates, forecasts, how to buy

Dynamics of compulsory medical insurance for goldin 2021 at Bank of Moscow online.

Profitability calculator for deposits in gold Gold purchase rate at the Bank of Moscow today and dynamics for 5 days: 01/18/2018

| 17.01.2018 | 16.01.2018 | 15.01.2018 | 14.01.2018 | ||||||

| purchase 2502.66 ↓ -20.28 | sale 2333.39 ↓ -18.91 | purchase 2522.94 ↑ 19.05 | sale 2352.30 ↑ 17.76 | purchase 2503.89 ↓ -12.06 | sale 2334.54 ↓ -11.25 | purchase 2515.95 ↑ 10.31 | sale 2345.79 ↑ 9.61 | purchase 2505.64 | sale 2336.18 |

Archive of gold rates Bank of Moscow

For the entire period from 02/11/2014 to 01/18/2018, the profitability of the deposit in the gold metal account (OMA) of the Bank of Moscow was:

77.11%

or

a profit of 154,213 rubles

from 200 thousand rubles (approximately 142 grams) of gold.

Over the past month

(from 01.01 to 28.02) the yield on gold deposits in the Bank of Moscow was:

0%

or

a loss of 0 rubles

from 200 thousand rubles (approximately 0 grams) of gold.

Over the past 3 months

(from November 28 to February 28) the yield on gold at the Bank of Moscow was:

0%

or

a loss of 0 rubles

from 200 thousand rubles (approximately 0 grams) of gold.

The profitability of compulsory medical insurance at the Bank of Moscow is calculated using the formula: D = ((K2-K1) / K1) * 100%)

K1 –

sale (for calculation, the gold sale rate established by the Bank of Moscow on the date of sale is used), K2 –

purchase

(for calculation the Bank of Moscow gold purchase rate established on the date of purchase is used)

An unallocated metal account (UMA) is an account that reflects the client’s precious metal in grams without indicating its individual characteristics (number of bars, fineness, manufacturer, serial number, etc.).

- By playing on precious metals quotes, the owner of the OMS Bank of Moscow can earn income in the same way as when playing on the stock market.

Bank of Moscow offers the following services related to precious metals:

- opening current (on demand) impersonal metal accounts in gold, silver, platinum and palladium;

- sale and purchase of measured gold bars weighing 1, 5, 10, 20, 50, 100, 250, 500, 1000 grams, metal purity 99.99%.

Anonymized metal account (UMA)

Compulsory medical insurance is intended for transactions with non-cash precious metals without indicating the individual characteristics characteristic of bullion (sample, bullion number, year of issue, etc.).

Compulsory medical insurance can be opened at any branch and regional branch of the Bank of Moscow.

By opening compulsory medical insurance at the Bank of Moscow, the Client has the opportunity to:

- buy non-cash precious metals from the Bank for Russian rubles;

- sell non-cash precious metals to the Bank for Russian rubles;

- carry out non-cash transfer of precious metals to another compulsory medical insurance opened at the Bank of Moscow;

- withdraw gold and silver bullion from compulsory medical insurance in Bank of Moscow branches equipped with weighing instruments.

How the price is formed, why it changes and is different in different banks

The cost of precious metals in commercial banks includes several components: stock exchange quotes in dollars, the exchange rate of the ruble against the currency of trading operations for today and commissions of the financial institution itself.

To determine what markup Sberbank of Russia has set for platinum, it is enough to compare its rates with the Central Bank rate.

What affects the price of platinum

Fluctuations in the market value of any product are influenced by an independent economic law: the relationship between supply and demand. The mechanical engineering, chemical and jewelry industries absorb up to 70% of the mined platinum. Therefore, the price of this element rises when economic indicators are stable and investors do not need to save their resources with gold.

Today, the exchange rate is also significantly influenced by annual production volumes, which, by the way, have decreased somewhat in recent years.

Deposits in gold at Promsvyazbank

This precious metal is the most famous of investment instruments. It is bought and sold in the same way as shares on the stock exchange. However, the price of this metal is not as volatile as that of securities and is characterized by stable growth. That is why it is considered as a reliable source of income. The simplest ways to invest are to buy bullion or open a so-called metal account at an institution that provides for the exchange of rubles into gold grams. A little more complicated is buying coins and trading through a brokerage company on the stock exchange. Buying them requires specialized knowledge and, in general, a love for numismatics as such. To make money on the stock exchange, you will need a large starting capital. Therefore, the last two options are suitable for a very limited circle of people. Investments in gold at Promsvyazbank are a reliable option for those who decide to use money in this way.

Peculiarities

The choice of method depends entirely on the client and can be changed in the future. Today, several types of cooperation are practiced throughout the country. The most practical and common are gold bars. In case of sale, the owner will have to pay value added tax, which is 18% of the profit. It is also important that the cost of selling/purchasing by weight in financial institutions varies greatly. Coins are also popular. Today they are less actively purchased and in demand among numismatists and collectors. In addition, you can use compulsory medical insurance (an impersonal metal account - a special type that displays precious metal belonging to an individual indicating the weight, but without information about the sample, manufacturer, numbers, etc.). Conditions for opening a gold deposit at Promsvyazbank:

- it can be opened by an individual or legal entity;

- accounts are opened in grams (bars from 1 g to 1 kg);

- residents of the country who have reached the age of 18;

- the number of transactions is not limited;

- the deal is concluded with the right to extend.

In other words, such agreements are drawn up on the basis of the documents presented and do not have any special restrictions. Each owner of a certain amount or jewelry can take advantage of the offer and become a client of the bank. To do this, you only need a passport, TIN, and additional documents that the organization may require. An agreement is concluded between the parties, and the person automatically becomes the owner of an investment reserve in precious metals.

Advantages

Each precious metal deposit has its own distinctive characteristics. To cooperate, you should know and use its features. Gold is the most popular resource for opening a deposit, and to get real profits, transactions must be long-term. If a person intends to make money, a mixed portfolio of precious metals will be most effective. In recent years, there has been a steady increase in prices, and accordingly, the profitability of such contracts is high. Compared to other investments in currencies, the fluctuations of which cannot be predicted, this precious metal is cost-effective.

Types of investments in platinum

Today, there are several simple and publicly available ways for individuals to make a contribution to this metal.

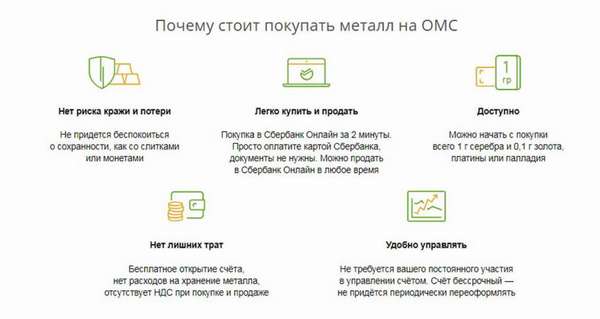

Compulsory medical insurance

An unallocated metal account makes it possible to make money on exchange rate fluctuations, since the bank’s commission for transactions with non-cash precious metals is minimal. Profits from operations are subject to income tax. The tax agent is the account owner. However, after 3 years of owning the platinum, profits from its sale are not subject to taxation.

Ingots

Sberbank of Russia currently sells refined platinum ingots weighing from 5 to 100 grams. However, this method has its drawbacks. The VAT levied on purchases and the costs of storing bullion make purchasing bullion less attractive in terms of earning money.

Investment coins

Hoarded platinum coins are not issued today. But Sberbank of Russia offers an assortment of commemorative banknotes made from this metal. The advantage of this type of deposit: no VAT is charged, small circulations of coins and how old they were made. The most recent release took place in 1995, which plays into the hands of the owner of the item.

Which investment method is more profitable?

The best prospects for today are provided by compulsory medical insurance. Rates of physical precious metals in bars and coins due to taxes, bank markups and related expenses will most likely bring losses. Even in the event of a record price increase, the same metal account will provide a profit unencumbered by additional expenses.

Investments in gold

Investment in gold

The instability of the economic situation leads citizens to the conclusion that it is safest to store their savings in precious metals. Investing in gold is a common way of investing. It is carried out through the purchase of gold bars and coins or by opening an impersonal metal account. Let's consider each option separately.

Should I buy in bullion?

In general, this transaction is regarded as a purchase, so the bank’s profit, VAT and other expenses will be added to the cost of gold. On the one hand, the pricing policy of the procedure is quite favorable. But there are also negative factors:

- There is no deposit insurance system from the state;

- Risk of loss as a result of criminal acts.

Additional expenses for taxation, markup from the lender;

Payment for safe deposit box;

And yet, today, transactions with gold do not lose their popularity for some organizations and individuals.

If you register?

There are no releases for this type of storage of material assets. Therefore, bullion bars are not issued; they are registered on the territory of a specific facility. As for the advantages, they are:

- No VAT payment;

- The minimum size is 0.1 g of gold;

- There will be no cost for conservation.

The disadvantages of this program are presented as follows:

- Like a deposit in foreign currency or domestic money, an impersonal account for metals does not have insurance in the amount of 1.4 million rubles;

- Dependence on a financial institution. If it goes bankrupt, it is almost impossible to get the money back.

Deposit or metal account?

If such a dilemma arises before the owner of capital, then you should pay attention to the list of differences between saving funds in gold equivalent and in monetary terms. The underlying earnings on a precious metal is the change in its value itself. If it is unchanged, then the person does not make a profit, and if the price decreases, he suffers losses. In the event of a bank bankruptcy, all cash accounts fall under the protection of state law and receive insurance in the prescribed amount. Investments in jewelry do not fall under this program, so their owners cannot count on compensation.

Briefly about risks

Despite the stability of the supply, it also has pitfalls.

You can find them on the Banki.ru website by reading reviews about each financial company. If you plan to buy a bullion, there is no guarantee that the bank will accept the gold back. It is not recommended to constantly cash out your income, as investing in gold is a long-term perspective. As for the pricing policy market itself, you need to purchase precious metals when prices are falling, and sell, on the contrary, when prices are rising. Otherwise, the client of the banking structure will suffer large losses.

Purchasing and storing bullion at Sberbank

Purchasing bullion is an operation similar to currency exchange. Platinum can be purchased at the cash desk of a branch of Sberbank of Russia. The bank provides safe deposit boxes for long-term rent for storing valuables. Sberbank of Russia does not currently offer metal deposit accounts to its clients.

Advantages and disadvantages

The advantage of owning platinum is that you have physical metal in your hands. Thus, you are insured against bank bankruptcy and non-payment of the deposit. But this is a way, first of all, to save money, and not to increase it.

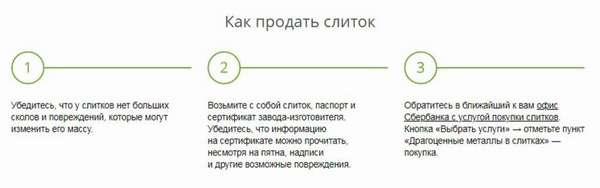

Procedure for selling bullion

Today, to sell bullion, you should contact an authorized branch. In addition to the metal, you should have a certificate for it, a purchase receipt and an identity document of the owner. The operation itself is identical to currency exchange at the established rate.

Selling a bullion purchased from another bank

Banks have no problem accepting metals purchased from competitors if you have a certificate and receipt of purchase in your hands, and the bullion itself is in excellent condition. Today, Sberbank of Russia accepts silver, platinum and gold from the population.

Taxes and restrictions on acquisition

The volume of purchased platinum, or the purchase amount, is not limited either by law or by Sberbank of Russia. Value added tax is already included in the price of the bullion and is not reimbursed upon sale.

Is it profitable to open a deposit in gold?

Thus, a deposit in gold at Sberbank can serve to save money against inflation. The price of precious metals tends to rise, so a timely purchase can turn out to be a good investment.

It is better to purchase gold not in physical form, but in virtual form on an impersonal metal account. This way you will have to pay less taxes and not spend money on maintenance. However, compulsory medical insurance also has disadvantages - it does not accrue interest and accounts are not insured by the DIA. When the price of metal decreases, the profitability of such a deposit falls. You can make money on a gold deposit only if the value of the metal increases in the long term.

How to open compulsory medical insurance in SB

Compulsory medical insurance is opened if you have a current account with Sberbank of Russia. If you are not yet a bank client, you need to visit one of its branches with an identity document and a certificate of assignment of an individual tax payer number. The manager will prepare the documents and open the account.

If you already have a service agreement with Sberbank of Russia, then you can apply for compulsory medical insurance online in your own account and immediately top it up by non-cash purchase of platinum, without leaving your home.