Gold buying/selling rates.

Gold prices in banks. News, comments and forecasts for the price of gold in 2021.

Gold purchase rate at Rosselkhozbank today and dynamics for 5 days:

| 18.10.2018 | 17.10.2018 | 16.10.2018 | 15.10.2018 | 14.10.2018 | |||||

| purchase 2665.00 | sale 2505.00 | purchase 2665.00 | sale 2505.00 | purchase 2664.00 | sale 2504.00 | purchase 2628.00 | sale 2568.00 | purchase 2665.00 | sale 2505.00 |

For the entire period from 02/06/2014 to 10/18/2018, the profitability of the deposit in the gold metal account (OMA) of Rosselkhozbank was: 92.98 %

or

a profit of 185,952 rubles

from 200 thousand rubles (about 145 grams) of gold.

Over the past month

(from 01.01 to 02.10) the yield on gold deposits in Rosselkhozbank was:

0%

or

a loss of 0 rubles

from 200 thousand rubles (approximately 0 grams) of gold.

Over the past 3 months

(from 02.07 to 02.10) the yield on gold at Rosselkhozbank was:

0%

or

a loss of 0 rubles

from 200 thousand rubles (approximately 0 grams) of gold.

The profitability of compulsory health insurance in Rosselkhozbank is calculated using the formula:

D = ((K2-K1) / K1) * 100%)

K1 – selling

(for calculation, the gold sales rate established by Rosselkhozbank on the date of sale is used), K2 –

purchase

(for calculation, the gold purchase rate of Rosselkhozbank, established on the date of purchase, is used)

An unallocated metal account (UMA) is an account that reflects the client’s precious metal in grams without indicating its individual characteristics (number of bars, fineness, manufacturer, serial number, etc.).

Gold rate at Rosselkhozbank - current information for those wishing to purchase precious metal bars. This process is not carried out in all bank branches and requires preliminary theoretical preparation. The client can purchase either a full-fledged bullion or use an impersonal metal account. Each method has its own advantages and disadvantages.

Let's pay attention to:

- current exchange rate for buying and selling gold at the Russian Agricultural Bank;

- procedure for purchasing precious metals;

- list of requirements and list of required documents.

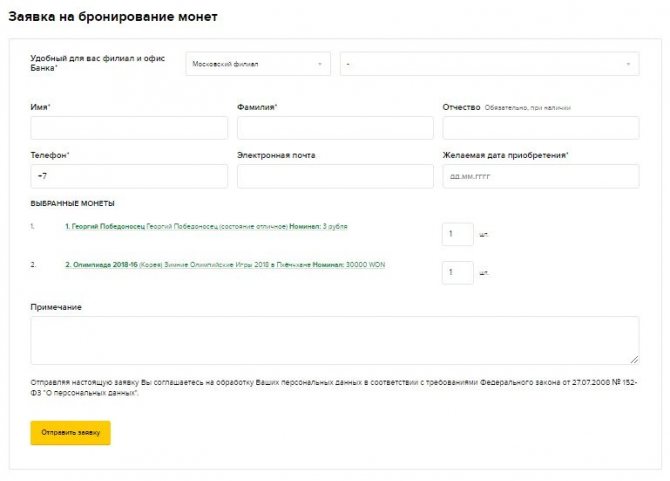

Coins made of precious metals at Rosselkhozbank

Today there are coins on sale in a wide range, as well as those sold without restrictions and other conditions in the branches of Rosselkhozbank. For each of them, a unique passport is issued, which carries legal force and informs about all the characteristics of the coin.

Looking through bullion coins, you will notice that they do not have specific images, which is why their use mainly lies in the metal from which they are made. Such investment opportunities lie in the constant value of the precious material, since it does not depreciate, but rather, on the contrary, will probably increase in price.

They are divided into categories, and the evaluation criteria are their weight, the alloy from which they are composed, as well as the category determined during the production of the precious product.

The most common coins are gold, which can be purchased at any branch of Rosselkhozbank.

Video on the topic:

Investment coins of Rosselkhozbank

This type does not represent high artistic value and differs from traditional coins in the following features :

- Very convenient for investment purposes.

- With long-term storage they can generate income.

- Their cost is as close as possible to the cost of the metal from which they are made.

Article on the topic: Bond yield in Rosselkhozbank for [y] year

Each buyer has a choice over which precious works can be purchased.

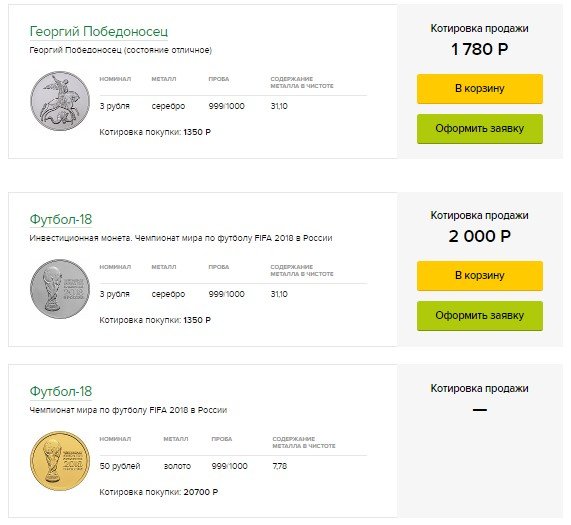

Quotations for investment coins are presented below:

| Name | Denomination, rubles | Metal | Purchase quote, rubles | Sales quote, rubles |

| Russian | ||||

| St. George the Victorious | 3 | Silver | 1350 | 1780 |

| Football-18 | 3 | Silver | 1350 | 2000 |

| Football-18 | 50 | Gold | 20700 | — |

| George the Victorious (MMD) | 50 | Gold | 20600 | 22500 |

| St. George the Victorious (SPMD) | 50 | Gold | 20000 | 21450 |

| Zodiac signs (Leo-02, Aries-03, Cancer-03, Cancer-05, Gemini-05, Libra-05, Taurus-03, Capricorn-05) | 25 | Gold | 8000 | 9500 |

| Zodiac signs (Virgo-03) | 50 | Gold | 19500 | 21500 |

| Foreign | ||||

| Slavyanka (Belarus) | 50 belorus. rub. | Gold | 20 000 | 21450 |

Commemorative coins

From time to time, as part of emission activities, rare commemorative values are issued in limited editions from the Bank of Russia. Such precious specimens have documented distribution and are mostly sold within banks. Points of sale are bank credit organizations, a significant share of which falls on Rosselkhozbank.

It offers commemorative gold and silver items that are not only beautiful pieces, but also collectible items. They can act as both a gift and a souvenir. When purchasing a gold coin, you should carefully inspect it for serious damage, on which its value greatly depends.

Such valuables are produced in small editions , which greatly increases their cost for numismatists.

Rosselkhozbank offers for purchase new minted products with the symbols of the 2021 Olympic Games in Pyeongchang.

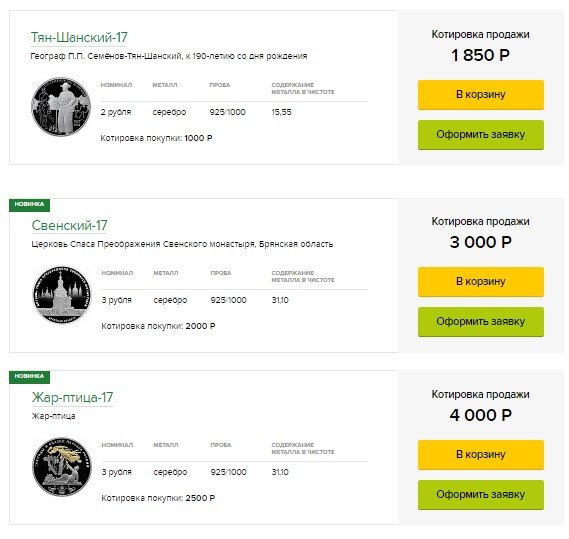

Quotes for commemorative coins are presented below:

Article on the topic: What do you need to know about “RSHB Asset Management”?

| Name | Denomination, rubles | Metal | Purchase quote, rubles | Sales quote, rubles |

| Russian | ||||

| Tien-Shansky-17 | 2 | Silver | 1000 | 1850 |

| Svensky-17 | 3 | Silver | 2000 | 3000 |

| Firebird-17 | 3 | Silver | 2500 | 4000 |

| Surb-Khach-17 | 3 | Silver | 2000 | 2950 |

| Frog Princess-17 | 3 | Silver | 2500 | 4000 |

| Juma-Jami-16 | 3 | Silver | 2000 | 3300 |

| Forum-16 | 3 | Silver | 2000 | 3500 |

| Bank of Russia-15 | 3 | Silver | 2000 | 3300 |

| Armory-16 | 25 | Silver | 10500 | 13000 |

| G. Pobedonosets-12 | 50 | Gold | 21000 | 25500 |

| Bank of Russia-15 | 1000 | Gold | 420000 | 630000 |

| Foreign | ||||

| LEV-18 Austria | 5 euros | Silver | 1000 | 2500 |

| Dog family-18 | 5 New Zealand dollars | Silver | 2000 | 4000 |

| archangel Michael | 10 euros | Silver | 2300 | 4500 |

| Mozart | 20 euros | Silver | 2500 | 4900 |

Eternal bonds 08T1

Classic bonds issued by legal entities imply a full return of the face value on a predetermined date. Banks have the right to issue bonds that will never go out of circulation. That is why such papers are called eternal. The terms junior or subordinated also apply to such bonds. This is due to the fact that the issuer’s obligations under such bonds are significantly less than for standard debt securities.

You can return the money invested in such assets by selling them to another investor. In addition, the terms of the issue most often involve an offer. This term refers to the date on which the issuer can buy back the securities.

Perpetual bonds 08T1 can be purchased at an affordable price.

Subordinated bonds can be written off from the bank’s balance sheet at any time if required by capital adequacy standards. This is standard practice based on international agreements. Therefore, the investment risks when investing in such assets increase.

Despite this, they are in great demand among investors. For example, subordinated bonds of Rosselkhozbank can only be purchased at a higher price than their face value. Quotes start from 107%.

The issue price of RSHB-08T1 in mid-June 2021 reached 132% of the face value. These bonds have the following parameters:

- coupon 14.25% per year;

- interest payments every 6 months;

- the nearest offer is 09/23/20206;

- issue volume 5 billion rubles;

- denomination of 1 paper 1000 rub.

Purchasing such a security allows you to fix a yield of 7.79% for 6 years before the offer date. It is important to understand that the issue includes a call option. This means that the issuer himself will decide whether to repurchase the bond on the appointed day. In addition, he has the right to change the coupon rate after this procedure.

In 2021, subordinated bonds were considered too risky an investment vehicle. Therefore, junior bonds issued in 2021 and beyond will be available only to qualified investors. People who do not have this status retain the right to acquire similar assets placed before the change in legislation. As a result, RHSB 08T1 bonds are still suitable for purchase.

Table: comparison of profitability

Table comparing coupon yields of several subordinated bonds of Rosselkhozbank.

| Issue name | Coupon rate,% of face value |

| RSHB-08T1 | 14,25 |

| RSHB-01T1 | 9 |

| RSHB-06T1 | 14,5 |

| RSHB-07T1 | 14,5 |

| RSHB-09T1 | 9 |

How to buy coins from the RHSB catalog?

To profitably purchase rare collectible coins, you should carefully study the offers from the catalog.

The set of memorable valuables may differ depending on the region, which is caused by geolocation.

To make a profitable purchase of gold coins, you need to do the following:

- Make sure that the commemorative coin is available at the selected branch of Rosselkhozbank. To be completely sure, you can call the bank’s hotline and ask relevant questions. If the required copy is not available, it can always be purchased not only in Moscow, but also in other cities of Russia. The availability of coins for regions can be found at the link.

Please note that it is possible to submit an application online

- Appear at a branch of Rosselkhozbank with documents confirming your identity and make a purchase if its availability is confirmed. It is worth noting that payment at the bank is carried out either in cash or by debiting the required amount from any of the client’s available accounts.

- Receive the jewelry and sign for its receipt.

Article on the topic: How is the sale of collateral property of Rosselkhozbank carried out?

Experts advise carefully inspecting the item for mechanical damage and abrasions. The commemorative jewelry should not have traces of any intervention, because it requires special conditions in which its appearance is preserved, and also, if sold, it will be as close as possible to its value. These recommendations are relevant not only for the “St. George the Victorious” coin, but also for other copies.

The price of these precious items largely depends on their condition, so it will not be possible to simply sell it without a preliminary assessment.

To maintain a marketable appearance, you should make sure there is a place with low humidity and no sunlight. Also do not forget that the cost of precious metals is subject to changes, which are regulated by the official exchange rate of the Bank of the Russian Federation.

VTB: investing in gold accounts

Investment in gold is one of the most effective investment tools. The financial market has not been stable in recent years: there have been constant fluctuations in exchange rates. Over the past decades, investing in gold has been less risky than investing in stocks. In addition, there is always the possibility that the currency will completely depreciate and the securities will burn.

VTB clients can purchase not only bars, but also gold coins. The weight of purchased gold ranges from one gram to several kilograms.

Regarding gold, we can safely say that it always remains in price. Of course, financial fluctuations affect pricing. However, the rate often remains stable at VTB. In an era of financial crises, investing in metals can help significantly increase capital, providing a protective foothold.

Operations with precious metals

RSHB provides the opportunity to open a current impersonal metal account (OMS) in:

- Gold.

- Silver.

- Platinum.

- Palladium.

Compulsory medical insurance is an account on which the client can see a display of the precious metal in grams that belongs to him. It is also important to note that the characteristics that are inherent to it are not indicated, namely the manufacturer, serial number, sample, number of ingots, and so on.

Purchasing precious metals with subsequent enrollment in compulsory medical insurance is one of the convenient and simple options for investing in precious metals.

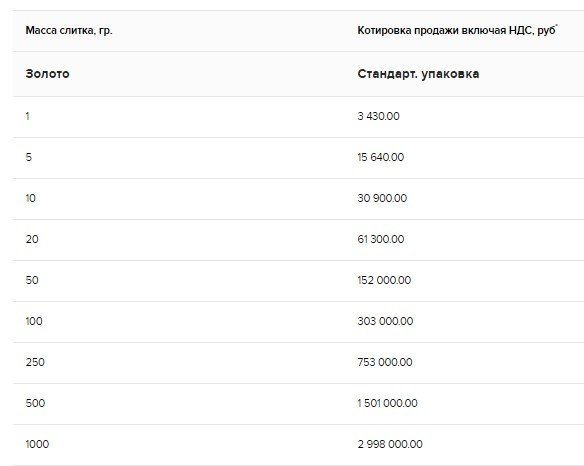

Rosselkhozbank also offers services for the purchase and sale of precious metal bars.

bullion sales quotes are in effect today

Gold

Silver

The rules for purchasing bullion from a bank can be found in the attachment.

Investment

For many years now, investing in gold has remained relevant and profitable for clients. Metal deposits are highly reliable due to their pricing policy. However, this type of investment has one significant drawback. Such deposits are not covered by the state insurance program.

If you have compulsory medical insurance, gold is stored in a special bank vault.

It should also be taken into account that servicing metal deposits is a more labor-intensive and expensive procedure than servicing foreign currency deposits. Therefore, it is very important to be especially scrupulous in choosing a bank with a high level of reliability and an excellent reputation. At the moment, one of such banks is VTB, which, moreover, offers the most favorable rate in comparison with its competitors.

VTB clients can control metal deposits thanks to a profitability calculator. To use the service, just follow the active link and indicate the following data in the boxes: name of the metal; deposit amount; period. The system will make the calculation automatically and display the received data on the screen in the form of an active and detailed diagram.

Features of selling precious coins

Commemorative precious items sold by Rosselkhozbank have their own classifications determined by the central bank. On each coinage, the types of alloys used, denomination, weight and purity are indicated with special signs.

We should not forget that the real value has nothing to do with the denomination of the commemorative coin (which is especially true for investment pieces), and is determined solely by the cost of the metal.

Rosselkhozbank accepts commemorative copies that meet at least one of the criteria :

- Precious coins in original capsules.

- Gold copies from other countries with the original composition of the set and the corresponding certificates.

- Investment coins.

- Commemorative coins from other countries that are in excellent quality and approved for circulation.

With all this, it is worth remembering that some investment bars may have minor scratches or notches that do not greatly affect the value.

Examples of such precious specimens include :

- George the Victorious.

- Sable-95.

- Golden chervonets.

Photos:

Sobol-95

Golden chervonets

St. George the Victorious golden

St. George the Victorious silver

In such cases, they follow a preliminary expert assessment to decide on their value. Accurate information about the situation with prices for certain categories of coins can be found in the catalog of precious coins from Rosselkhozbank.

The sales procedure itself is divided into several stages. First, you need to contact the bank branch and make sure that your intentions can be realized, and also find out about the coinage quotation.

When selling directly, you must provide the RSHB with documents confirming your identity, as well as the necessary certificates for the product.

Experienced numismatists advise storing purchased commemorative coins in Rosselkhozbank safe deposit boxes, as this helps preserve their ideal appearance for a long time, and also allows for the accelerated sale of a precious item without a thorough expert assessment.

Recommended viewing:

Why exactly gold and specifically in Sberbank?

Many people are wondering why more and more users are deciding to purchase this asset. The main reason is that its price is steadily and quite confidently rising, which is typical for the Russian Federation, since such a trend is not observed throughout the world. Gold deposits should be preferred for the following reasons:

- Production in the Russian Federation has long exceeded the main world indicators;

- Its price is constantly increasing. Over the course of a year, the average increase is 170%;

- If, in the process of choosing an investment form, you give preference not to expensive bullion, but to coins or the opening of compulsory medical insurance, you can free yourself from paying VAT.

Based on this, we can conclude that the acquisition of an asset is currently an extremely profitable form of investment.

Let's sum it up

Commemorative coins from Rosselkhozbank are a treasure for numismatists, as well as a truly precious gift for loved ones. Their feature is a limited edition, which is why they acquire additional significance for collectors.

The cost of minting may depend on various factors, among which it is worth highlighting such as the metal of which the coin itself is made and the appearance of the specimen.

An expert assessment allows you to determine the real cost of minting, which is especially important when selling.

Subscribe to our channel on Telegram and be the first to receive interesting news and reviews!

Risk premium

By risk premium, investors understand the difference between 2 values:

- the interest that the asset brings;

- the rate of return on a risk-free investment, which is taken to be the yield on government bonds.

By purchasing RSHB bonds in June 2021, by the end of their circulation period you can receive a profit of 1-2% more than when investing in OFZs. However, this statement does not apply to every release. For the bonds, the investor will receive no more than 5%. The indicator of this level is also demonstrated by the papers of the Ministry of Finance.

Gold rate in Sberbank for today sale and purchase

A client of a financial institution has every right to buy or sell metal in any form chosen at any time. You can always check the course in your personal account. Having a minimal financial education, you can make relatively good money on the difference in such a parameter as the cost of gold per 1 gram in Sberbank today.

The cost of quotes is constantly changing; it is not possible to determine the exact price in advance. Recently the following prices have been set for the metal:

3915

4382

The difference between the indicators is quite significant, because the investment can only bring profit in the long term. Despite this, investments are increasingly preferred, since the bank and its offers are characterized as one of the most reliable and successful.

Taxes and restrictions on purchasing gold

The user who purchases 999 fine coins, registers an account, automatically asks himself whether he needs to pay certain taxes, how to properly report to the regional tax office, and what restrictions exist.

It is necessary to understand that the tax will need to be paid exclusively on profit, VAT, which is initially included in the cost of bars and valuable coins by gram.

If everything is clear with VAT, then personal income tax will need to be paid exclusively on the profit received, strictly at the time of sale of previously acquired assets. If a bank client decides only to buy an asset, but does not sell valuable material, then he, accordingly, does not receive income and will not need to pay taxes.

If the assets have already been sold, you need to calculate how long they were in official possession. If it’s more than three full years, then you can relax, you won’t have to pay anything to the state on the deposit. If the assets are held for less than three full years, you will need to determine the exact amount of the taxable basis and immediately multiply it by the official tax rate.

For residents, taxes will be 13%, but if a person does not have a similar status, he will need to pay 30%. The dynamics of the gold rate at Sberbank does not matter here. A resident is a person who stays in the Russian Federation for more than a full 183 days over the course of one year. If during this time a person traveled for treatment or treatment to another country, this period will not be taken into account.