Post updated: May 27, 2020

Finding out data on the current price of precious metals is not difficult. To find out the price of gold as of today, just refer to the information posted by the Central Bank of the Russian Federation. It is almost pointless to use this figure to make an investment decision; you also need to study quotes in a particular commercial bank, where the purchase and sale price of gold is formed under the influence of several factors. What does the precious metal exchange rate depend on, how is it formed, and what information does the gold exchange rate chart carry for an investor when making a transaction at Sberbank?

Gold rate in Sberbank for today - real-time chart

Every day, Sberbank on its official website introduces visitors to the price of the yellow metal. How is the gold rate formed? What can quotes depend on and why do leading media outlets use the prices of this particular financial institution in their daily reports? Let's try to figure it all out.

You can view the gold rate for today (in real time) on the page of the bank’s official website.

Gold became the main measure of the intangible and material value of things many years ago. Since ancient times, it has been used to pay for labor and buy food. And the possession of this precious metal allowed a person to gain confidence in his own material well-being. Gold could always be exchanged for money, using it to obtain the desired benefits or realize a cherished desire.

Why choose Sberbank of Russia for storing capital

In terms of the amount of gold that Russian residents bought, and this is a total of about 15 tons of precious metal stored in customer accounts, the Russian Sberbank is considered the leader.

The huge demand for the services of this particular domestic bank can be explained by the favorable conditions provided for clients, as well as the extensive network of bank branches. Sberbank branches are everywhere - in any locality in our country. The leader of the domestic precious metals market began its work in 1841. Thanks to the huge banking capital and stable operation of Sberbank, it is chosen by many Russians who are willing to overpay for the services of a leading bank. The exchange rate and price of gold at Sberbank is determined not only by the current situation on the precious metals market, but also by the situation that is developing in the global market as a whole. It is worth recalling that gold is an international currency. This means that its value is not tied to the economy of any country. How can you find out the current rate of the precious metal if you want to buy gold bars or investment coins?

To get acquainted with the current quotes, you need to type the corresponding query in the search engine window, for example, “the cost of gold in Sberbank of Russia” and use one of the proposed results. In most cases, data presented on analytical resources with an economic focus is updated in real time. In addition, you can obtain the necessary information at one of the bank’s branches.

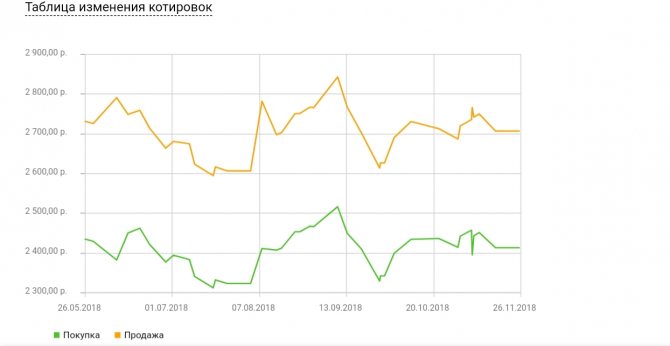

The current price of the precious metal is also presented on the official website of Sberbank. In addition to gold quotes, the rate of silver, platinum and palladium is also indicated here. Users of the resource will also appreciate information related to the dynamics of exchange rate changes, as well as the archive of quotes. Just a couple of mouse clicks will allow bank clients to find out the possible profitability of one of their deposits in precious metals. Thanks to the profitability calculator, in which you can specify the desired time period and the amount of the deposit, information important for making the right decision will be received by a potential investor in a matter of seconds.

Dynamics of rates

The dynamics of the gold rate in Sberbank is available to anyone online. To do this, you just need to go to the official Sberbank portal, select the “Sberbank Compulsory Medical Insurance” tab there and get access to the latest charts and quotes.

There you can also see how much 1 gram of gold costs in different regions of Russia, because prices differ.

There is also information about how much gold was sold during the year, which makes it possible to assess the demand for the metal.

The gold quotation at Sberbank depends not only on the internal economic situation, but also on the global current position. Therefore, increases and decreases in quotes must be carefully monitored.

How is the price of gold set?

Having earned a reputation as the largest player in the domestic financial market, Sberbank promptly responds to any changes regarding the economic and political situation, both in Russia and in the world.

Since the Russian Federation does not have the status of a global trading platform for precious metals, it is forced to take into account the prices set by the London Metal Exchange. It is in the capital of Great Britain that the London fixing is established twice a day (exactly at 10.30 and 15.00), on the basis of which Central Banks of different countries form their prices. The Russian Central Bank sets current gold prices in domestic currency, taking into account the dollar exchange rate, as well as the fixing value, taking into account transportation, customs and other costs associated with the delivery of the precious metal to Russia. Next, commercial banks add their percentage to the Central Bank’s price, as a result of which one of the most popular products in the financial market receives a considerable markup.

Sberbank of Russia uses the Central Bank gold rate as a starting point. Bank specialists also take into account prices presented on other trading platforms and internal fluctuations in demand, which are seasonal. It is for this reason that the rate of the precious metal in Sberbank often differs from the rate of the Central Bank. In some cases, the price of one gram of gold may be different even within several Sberbank branches.

Bank clients planning to open a deposit must remember that the purchase and sale rates for precious metals at Sberbank differ from each other. The difference in different departments can be up to 15%. That is why, before investing money in gold, it is necessary to study the size of the spread and current prices for the precious metal at the nearest bank branches.

How much is 1 ton of gold worth today?

The global measure of all values on Earth - gold - in turn is itself a commodity, the value of which is subject to constant fluctuations. That ton, which was worth a lot yesterday, can significantly decrease in price the next day. It all depends on market conditions and a number of other factors.

The dynamics of fluctuations in the price of the precious metal can be clearly seen by looking at the chart and in the tabular data for the recent period.

Price in billions of rubles:

Price in millions of dollars:

Dynamics of changes in the gold rate until 2021

Bank clients who are interested in “gold investments” will need information regarding not only the price of the precious metal, but also dynamics over different time periods, as well as the opinions of experienced experts expressed regarding the rise or fall of quotes. In addition, at Sberbank anyone can purchase:

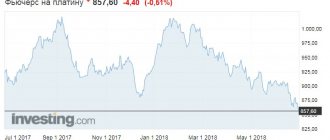

- palladium,

- platinum,

- silver.

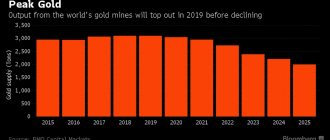

Despite the excellent selection of precious metals, gold is considered to be the most liquid investment product. This statement is confirmed by the huge demand for the precious metal from both small and fairly large investors. Since 1971, when the gold backing of the US national currency was abolished and the “gold standard” was subsequently abolished in most countries, changes in gold prices have occurred cyclically - sharp growth was necessarily followed by protracted recessions. This process can be clearly seen in the graph below.

Over the past 10 years, the dynamics of prices for the precious metal have demonstrated impressive figures:

- $440.6 per ounce in 2005;

- $598.8 per ounce in 2006;

- $696.7 per ounce in 2007;

- $868.4 per ounce in 2008;

- $957.5 per ounce in 2009;

- $1224.7 per ounce in 2010;

- $1558.3 per ounce in 2011

The rapidly growing demand for “gold deposits” is explained by the distrust of investors in the dollar, euro and other currencies. It is associated with the global financial crisis, the possible collapse of the European Union and the instability that has recently been observed in the Middle East. At the same time, some leading experts are confident that prices for the precious metal are unjustifiably “inflated”, so sooner or later there will definitely be a decline.

How much could you earn in a year, 2, 5 and 10 years?

Owning a ton of gold in itself, in addition to satisfying one’s pride, also brings real profit. Gold is a currency. Its simple storage as a reserve “for a rainy day” is used as a safe haven asset, because the metal is liquid in any situation (war, change of political system, economic crisis).

With a starting price at the time of writing of 1 troy ounce of $1,227.10 USD (and one troy ounce contains 31.1035 grams), a ton is estimated at 39,452,151 in US dollars, or 2,641,321,555 in rubles (slightly more than 2.5 billion).

Price dynamics charts show that:

- Over the year (2017-2018), the price of a troy ton decreased from $40,992,171 to $39,448,936 (-$1,543,234).

- Over the course of 2 years, it increased from 36,233,864 to 39,448,936, that is, by $3,215,072.

- In 5 years it has remained virtually unchanged.

- The lucky owners of a ton, who owned it 10 years ago (in December 2008), today, having sold all the available metal, would become 1.4 times richer. That is, their passive income would be $15,779,574.

Expert opinion

World Gold Council Managing Director for Investments Marcus Grubb is confident that the gold price will continue to rise in the near future. The reason for this trend is considered to be the booming economies of developing countries. The same trend is clearly visible today in Forex trading. China's economy, which is considered one of the largest in the world, is also developing by inertia. In 2011 alone, demand for the precious metal in this country increased by 20%. A similar situation is observed in India, as well as in the countries of Central and Latin America.

And the citizens of this country themselves actively buy gold not only in the form of jewelry, but also in the form of bars or coins. The situation is not so simple in the industrial sphere of gold consumption. Due to the economic recession and the rather slow pace of economic recovery, some manufacturers were forced to use cheaper analogues of gold in the field of semiconductor technologies. The precious metal is increasingly being replaced by copper coated with palladium. Only manufacturers of expensive equipment do not use precious metal substitutes. At the same time, industrial demand for gold is driven by the emergence of new technologies, including autocatalysts and photovoltaic cells. Various precious metals are actively used in their production. As a result, technological demand for gold remains at 14% of the total consumption of this metal. Grubb is confident that in the near future the world economy will face a “soft” monetary policy, which will be able to stimulate its development in every possible way. As a result, the demand for gold will begin to increase, which will certainly entail an increase in prices for the precious metal.

Reasons for rising gold prices on the world exchange

Leading experts highlight the following reasons for the rapid growth of gold prices:

- The desire of small and large investors to ensure the safety of their savings by purchasing gold.

- Increasing balance sheets by purchasing gold by Central Banks of developed countries in order to develop the economy.

- Purchasing gold to replenish gold and foreign exchange reserves by developing countries.

- The “zero interest rate” policy pursued by the US Federal Reserve. It is this that has a beneficial effect on the “gold market”. Gradually, the US dollar is losing its reserve currency status, forcing investors to use other more reliable instruments.

Gold is not an innovative investment product. However, this particular precious metal remains in demand for several millennia. Despite all the attractiveness of such investments, it is important to adhere to the “golden rule” of many successful investors when choosing investments - you cannot put all your eggs in one basket. In other words, it is not recommended to keep absolutely all your savings only in gold bars or coins. The best option is to invest a small part of your own savings (no more than 30%) in the precious metal. Thus, you will be able to protect your finances in accordance with all the laws provided for by the science of investing.