The pioneers in the knowledge and use of the interesting properties of the precious metal in the form of platinum were mysteriously disappeared civilizations, such as the Chibcha, as well as the Incas. It was their craftsmen who were the first to create unique jewelry from this metal, and they created jewelry not only from pure platinum, but also from its alloys with gold. Which suggests that these South American civilizations had the appropriate technologies in the field of metallurgy, along with a high level of processing and jewelry design.

As for the appearance and study of platinum on the European continent, it was first brought to Europe by a navigator and part-time scientist Spaniard named de Loulom. It was he who first described platinum as a metal that cannot be melted in a traditional forge, it cannot be forged, and it is also not affected by acids. At the same time, his study indicated that the weight parameters of platinum almost coincide with similar characteristics of gold.

Due to this similarity, it happened that at one time platinum was banned in Spain. The fact is that counterfeiters began to use this property of the metal, replacing part of the gold in coins with it. And when the fraud became known to the Spaniards, both a financial and economic crisis occurred in the country due to the depreciation of coins. Therefore, starting in 1735, platinum was outlawed by order of the king, it was confiscated, after which this metal was even sunk in the Atlantic.

Then, when more than 40 years had passed, this precious metal was rehabilitated, and this happened in 1778. And the whole point is that in 1751, a certain chemist Schaeffer, a Swede by nationality, conducted studies of platinum, which showed that this metal is not an alloy and that it belongs to a variety of precious metals.

Dynamics of the exchange rate value of PTV

And therefore, from that time, when the value of this now real precious metal was determined, the search for its deposits began and, moreover, they searched for it all over the world. While its only known deposit was located in a country such as Colombia.

The first Russian deposits were discovered in the 19th century and where do you think this happened? Right! In the Urals!

The date of discovery of the Ural platinum deposit is considered to be 1819, and a little later platinum placers were found in such a district as Nizhny Tagil. Subsequently, having explored the reserves of this precious metal, it was first suggested that Russian deposits were incomparably larger than American ones. And then, this was confirmed in practice, because in the first ten years of platinum mining in the Urals, the same amount of this precious metal was obtained as in a whole hundred years in America.

Literally, platinum is translated as “small silver” and of course this meant a disdainful attitude towards it, as a metal less valuable than silver. Nevertheless, the Russian Empire decided to still use platinum as a material for the production of coins of various ruble denominations. However, minting did not last long: it began in 1828 and ended in 1845.

What else Russia has distinguished itself with regard to platinum mining is that it holds the records for nuggets of this precious metal. Moreover, the first nugget weighs 9 kg. 635 gr. did not live up to our time. It was found back in 1848 and then melted down. And here is the second nugget, weighing 7 kg. 850 gr. mined in 1904, it quietly serves as an exhibition, being in the Russian Diamond Fund.

As for the current volumes of platinum production, Russia is in second place in the world in terms of this indicator.

Analysis of historical PTV quotes

Platinum, unlike palladium, is almost independent of the price of gold, although in some market situations synchronicity of behavior with these precious metals appears. As for historical quotes, the market prices of platinum for a long time were higher than palladium and, moreover, several times. This is confirmed by the graph we provide below:

Platinum price chart for 20 years

Although this chart does not contain information about the competing precious metal platinum, this visualization of comparative quotes quite clearly shows that the object of our attention, for example, at the beginning of 2008 had quotes within 2 thousand 150 US dollars, while at that time there was a minimum the palladium rate is within three hundred USD for the same troy ounce. And we find confirmation of this statement in the graph below:

Comparative chart of platinoids

Platinum prices are influenced not by jewelry, unlike gold, or by the production of electric vehicles, unlike palladium, but by the availability of its global reserves. And its course is also influenced by demand in the chemical and electronic fields and medicine, in particular in dentistry and in the treatment of oncological diseases.

In addition, platinum quotes can be influenced by both economic and political news from the countries where this precious metal is mined, and these are only five countries, such as Russia, Colombia, the USA, as well as Canada and South Africa.

Also, a source of influence on the rate of this precious metal can be the artificial creation of conditions for lowering and increasing quotations through the manipulation of speculators, for example, using futures trading and transactions. For example, the sharp drop in the value of this precious metal several times during the third decade of 2008 was most likely artificial in nature, and not an economic crisis, as some financial experts claim.

For example, the decline in quotations began in mid-2008, when nothing foreshadowed a crisis at $2025, and this fall ended in October at $803.53. And confirmation that this phenomenon was caused artificially is the further behavior of quotes, which is ideal for a situation that is not comfortable for anyone, namely speculators.

Although, in theory, the decisive factor for the movement of quotes in one direction or another should be the relationship between consumers and producers, or vice versa, as some may seem more correct.

Precious metals price forecasts for 2021. Part One: Gold, Silver and Platinum – Heraeus

Gold

Investment demand will support the rate of the yellow metal at a high level

In 2021, the global economy will be in an unenviable position. Some political risks have disappeared from the agenda (Biden has become US President, the Brexit agreement has been signed), but problems with the economy have not gone away due to the second wave of the pandemic and the re-introduction of lockdowns in most countries.

Fiscal and monetary policy is a condition for further growth in gold prices. The Fed and European Central Bank are expanding their balance sheets by about $120 billion a month. The US Congress agreed on another economic stimulus package in December. Democrats control the legislation, so larger fiscal stimulus is a possibility. This will lead to higher inflation if vaccinations are successful and economic growth recovers.

The situation with inflation and bond markets is favorable for the yellow metal. Inflation expectations have exceeded the level at the beginning of 2021. In the short term, the pandemic could raise inflation expectations as vaccinations progress slowly and case numbers rise. However, supply chain disruption has caused prices for food and other commodities to increase. The collapse in oil prices last year caused a spike in inflation due to the unenviable situation of energy resources. The Treasury yield curve is steepening and real yields in Europe and the US are still negative. These circumstances also support the rally of the yellow metal.

Total supply is expected to increase in 2021. Global production was hit last year by the suspension of mine operations due to quarantine restrictions. Similar events may happen again, but not on such a serious scale, so the initial supply indicator will approach the 2021 level. Refining volumes were not bad in 2021, given high prices and economic challenges. The volume of secondary supply will be at the same level as in 2021 due to the expected increase in precious metal quotations this year and the continuation of the coronavirus crisis.

Central banks will increase gold reserves in 2021, but without the participation of China and Russia, the total figure will not exceed last year's result. Let us recall that China stopped buying precious metals in 2021, and Russia – in 2021. Consequently, at the moment Turkey is the only major buyer of the precious metal, but last year the volume of acquisitions on its part decreased significantly.

Consumer demand will recover slightly this year. It was extremely low in 2020 due to the record gold price and the economic fallout from the pandemic. Demand for jewelry fell by more than 40%. In 2021, the gold rate will be elevated, but the economic situation will improve, especially in the second half of the year, if vaccination is widespread and successful. In such conditions, the volume of jewelry purchases will increase slightly. China has been less affected by the pandemic than India, so the aggregate figure will increase slightly from last year's result. The fate of the demand for jewelry depends on these two countries.

Investment demand should support the gold rate. The decline in economic growth due to the pandemic will lead to authorities and central banks providing more generous fiscal and monetary support to the economy. Therefore, investors will not lose interest in gold, which is a protective asset. Inflation expectations have risen, the yield curve is steepening, and interest rates are in negative territory - all of these factors predetermine the continuation of the precious metal's rally. In 2021, the rate will be in the range of $1760-2120.

Silver

The recovery of industrial demand and the increasing popularity of the gray metal among investors will support its course

Inflation expectations have risen, and silver typically outperforms gold when inflation rises. The Fed and European Central Bank will keep interest rates low/negative through 2023, even if economic growth rebounds thanks to universal vaccinations in the second half of 2021. Inflation rates will rise, further damaging real interest rates. The Fed is currently targeting an average inflation rate and may allow inflation to rise before raising interest rates, which is positive news for silver.

In 2021, a lot of silver will be needed for the photovoltaic industry. Photovoltaic installations are expected to grow by 25% (total capacity of 150 GW) as a result of the completion of previously deferred projects and government support. China is the largest market for photovoltaic installations, but many countries are also trying to keep up and contribute to the total. Therefore, demand in this industry will increase by more than 20% compared to 2021.

Silver is also in demand in the context of creating electronic devices. The demand in this industry will increase due to the production of 5G smartphones. Smartphone sales will increase this year. Smartphones with 5G technology are forecast to sell well and capture a larger market share as prices fall, closing the gap with 4G smartphones.

Global silver supply is expected to increase in 2021. The primary supply of this metal suffered more seriously than gold mining last year. Mines were temporarily closed in the leading gray metal producing countries Mexico and Peru, which account for about 40% of global production. Most silver is produced as a by-product of the mining of other metals: gold, copper, lead/zinc. The extraction of these metals also suffered due to quarantine restrictions. The situation will improve in 2021. However, if there are many cases of coronavirus again, then a suspension of production is quite possible.

Silver is likely to outperform its yellow counterpart again this year. The rate of gray metal will be in the range of 21-36 dollars per ounce. Silver's rally over the past year has pushed its gold-to-gold ratio down to 71, despite a sharp drop in prices in March when the ratio jumped to 123. The gold-to-silver ratio is still above the long-term average of 66, so there is still room for its reduction. Industrial demand should be stronger in 2021, especially from photovoltaics. Exchange-traded fund holdings grew more than 40% last year, surpassing 1 billion ounces for the first time. Rising inflation expectations and negative interest rates should stabilize investment demand this year.

Platinum

To achieve balance, an increase in investment demand is necessary

This year, the platinum market surplus should increase to more than 1.5 million ounces (excluding investments) as supply outperforms demand. If production is not severely affected and crude platinum reserves are refined, global production will be 1.6 million ounces. In addition, it is expected that the restoration of the situation with the secondary supply of platinum will also occur this year. Global demand will reach only 1 million ounces, even if the economy improves and major consumer countries begin to buy more of this precious metal. However, given the introduction of new lockdowns, industrial demand and processing volumes will be at a low level. Global primary supply is expected to exceed 6 million ounces. Production will increase because lockdowns will not lead to the suspension of related activities.

In 2021, global demand for platinum from the automotive industry is expected to grow by 19%. This is more than 100 thousand ounces less than in 2021. This year, expensive palladium is expected to be partially replaced by cheap platinum in gasoline autocatalysts. However, the introduction of new catalysts is just beginning. The new catalysts will be used in small quantities, which will increase total platinum demand from the auto industry by 100 thousand ounces.

To be continued…

Where is platinum traded?

As for trading platforms that offer contracts for platinum, there are only four of them, and these are exchanges such as:

- Moscow , which has such a ticket as MICEX ;

- Chicago University , whose official abbreviation is CME ;

- London , which traders recognize by the LPPM ;

- Tokyo- based marketplace officially named Topix .

Moreover, the most authoritative is, predictably, the London Stock Exchange, firstly, because it was one of the first (Mercy, for a tautology) to open trading in contracts, and, secondly, Small-, thu, Great Britain, has the impudence ( crossed out) the traditional right to set standards for the circulation of precious metals in accordance with four levels of a particular certification.

Among other things, the London trading platform, or rather the information coming from its trading, is both calculated and reference. She also does fixing twice a day, as a result of which quotes are fixed and this happens at the beginning of the trading day at 9:45 and in the middle of the day at 14:00 London time.

As for trading activity on all these exchanges, there is a clear disproportion when comparing the number of transactions with platinum and, for example, with the number of transactions with gold, and even with silver. However, about 2 thousand daily futures transactions in general across all trading platforms again plays into the hands of speculators, as it provides an opportunity for medium- and even long-term rates. Moreover, they can’t really bother with either liquidity, or a shortage of demand, or an oversupply of platinum contracts, as speculation gurus say, in the trading book.

Somehow we are too carried away by the influence of speculators on platinum quotes, although they are decisive, this is more of a flawed policy than a correct one. As we said a little earlier, in theory, the development of industrial production, which is now observed in the so-called developing countries, should determine the behavior of precious metals quotations.

It has now become clear to everyone that since the beginning of the 2000s, China has become the hegemon in the production of literally all goods; in addition, having the largest population, it is also the largest consumer. Therefore, when making forecasts regarding the prices of precious metals, so to speak, dual-use ones, including platinum, it is quite logical to take into account an analysis of the state of the Chinese economy.

Platinum and palladium market in 2021. Part One - GFMS

general review

After a relatively weak 2021, last year was even worse for platinum. With supply increasing as volumes of recovered autocatalyst scrap increased and demand decreasing, largely driven by the autocatalyst and jewelry sectors, supply exceeded demand in the platinum market for the second year in a row. Meanwhile, a strong rally in global stock markets, along with investors' appetite for risky assets - driven by rising optimism about the US economy and the Federal Reserve's tightening of monetary policy - have all weighed on precious metals. Given these circumstances, as well as weak indicators of platinum supply and demand, investors began to become disillusioned with the white metal, and this led to a decline in prices to ten-year lows by the third quarter.

At the same time, palladium posted another year of encouraging growth, albeit rather volatile, nevertheless reaching a new record by the end of 2021.

In terms of supply and demand, palladium fared better than its cousin, as the palladium market was surprisingly tight following another physical shortage last year. Strong demand from the autocatalyst industry as well as the chemical industry has greatly outstripped supply of the metal, despite higher autocatalyst recycling volumes. However, hefty liquidations of exchange-traded fund shares have helped ease the tightening of this market's balance sheet.

Rhodium was by far the best-performing platinum group metal in 2021, rising to an eight-year high by the end of the year, posting an intra-year gain of 43%. As a niche market with limited onshore inventory, there is potential for significant price hikes if there is an imbalance between supply and demand. The rise in prices last year was largely driven by growing concerns over supply cuts following South Africa's announcement of production cuts, and robust demand from the auto industry, which is the main source of demand for rhodium.

Platinum in 2021

The platinum market maintained physical surplus in 2021 for the second year in a row, with higher supplies of platinum scrap from autocatalysts and jewelry offsetting a slight decline in production, resulting in a 2% increase in total supply. Meanwhile, demand also grew last year, rising 2%, as strong growth in industrial demand offset a decline in jewelry production.

Platinum production decreased by 0.1 million ounces (2 tonnes) to 6 million ounces (185 tonnes) in 2021, representing a slight decrease compared to 2021. Metal production in South Africa increased by 1%, to 4.3 million ounces (134 tons), and in the United States - by 2%, to 0.1 million ounces (4 tons), while production decreased in Canada and Russia. Total cash costs plus capital expenditures increased 1% to $938 per ounce, excluding Russia. South Africa, where 72% of the world's platinum is mined, has seen some energy and labor issues, pushing costs up 1% to $985 an ounce. Although miners around the world have been cutting costs over the past few years, largely due to the closure of high-cost mines, GFMS estimates that 38% of all platinum mines are unprofitable at current prices for the precious metal. Total costs increased by 9% in Zimbabwe and by 6% in the North American region.

At the same time, Russia managed to reduce costs by 9%, which was facilitated by the depreciation of the ruble and increased operational efficiency.

Global jewelry scrap volume rose 13% in 2021 to 0.7 million ounces (23 tonnes), a five-year high. This result may seem surprising given that the average platinum price fell 7% last year. However, the increase was almost exclusively driven by a 20% increase in recycling in China, as weak consumer demand for platinum jewelry stimulated recycling throughout the supply chain. Scrap supply was also constrained by lower prices, with volumes down 4% and 2% in Japan and Europe, respectively.

The volume of autocatalyst scrap recovered increased 5% year over year in 2021, the third year in a row, to approximately 1.3 million ounces (41 tonnes). Growth was recorded across the board, particularly in all key markets. China was the leader with 10% growth in refining volumes, while other countries saw the figure rise by 9% year on year. Stronger markets also performed well, with scrap volumes in Europe, North America and Japan up 4%, 5% and 3% respectively.

On the demand side, platinum consumption for autocatalysts fell 1% last year to 3.2 million ounces (98 tonnes). Unsurprisingly, the biggest decline was recorded in Europe, where demand for platinum fell by more than 8%. These figures were somewhat offset by strong growth in North America, up 4%, while demand from Japan and China remained unchanged. In other regions, growth was 10% last year.

Platinum jewelry production fell 5% year-on-year to an estimated 2.1 million ounces (66 tons), declining for the fifth year in a row and the lowest level since 2008. China accounted for the lion's share of these losses, at 11% year on year, as economic woes dampened consumer spending on luxury goods and competition from the karat gold jewelry market took its toll. Jewelry production in Japan began to pick up again as a decline in the value of platinum and more tourists helped boost consumption, while in the United States a stable economy boosted consumer demand for luxury goods.

In terms of industrial demand, growth was recorded across all sectors in 2021, with aggregate growth (excluding autocatalysts) of 14% year-on-year for a total of 2.3 million ounces (71 tonnes). The most notable gains were seen in glass, chemicals and electronics, which grew by 37%, 17% and 18% respectively, with the former seeing growth in the glass fiber sector, while platinum demand in the chemicals sector was boosted by new paraxylene plants in China and other regions.

Retail investment volumes rose again in 2021, rising 5% to 0.3 million ounces (10 tonnes). The slight gain after two years of declines was the result of increased investment in Japan, where demand rose 27% year-on-year, but retail demand was weaker than in previous years despite the yen price of platinum falling to a ten-year low. At the same time, demand in North America was broadly stable, although Europe showed a sharp decline as investor interest shifted to other asset classes.

Palladium in 2021

The physical deficit in the palladium market increased by 1.7 million ounces (53 tons) in 2021. A 1% increase in total supply due to higher refining volumes, which partially offset production declines, was partly offset by a 2% increase on the demand side. Taking into account statistics on metal reserves (from the redemption of shares of exchange-traded funds and shares of palladium miners), the net balance dropped to a deficit of 1.3 million ounces (41 tons).

Palladium production fell less than 1% to 6.8 million ounces (211 tonnes) in 2021. Strong results in the North American region were offset by lower production in South Africa, Russia and Zimbabwe. It strengthened its position as the leader in platinum group metals production as palladium output rose 24% to 0.8 million ounces (26 tonnes), while Lonmin fell 13% and 6% respectively. Russia's Nickel also posted year-on-year growth, and maintenance at its Krasnoyarsk refinery forced it to produce only from Russian sources, making all third-party suppliers unnecessary.

It is important to note that the increase in metal prices has led to the advancement of geological exploration, which, according to our estimates, will help replace almost depleted deposits.

Palladium recovery from autocatalysts reached a record high in 2021, increasing 7% year over year to approximately 2.2 million ounces (70 tonnes). Increased recycling of end-of-life vehicles, driven by rising palladium prices, has contributed to increased industrial recycling volumes. The fastest percentage growth was recorded in non-leading regions, at 1.3%, while volumes from China and Europe increased by 8% year-on-year.

Recycling of palladium jewelry scrap grew 4% last year to 0.05 million ounces (2 tonnes), while an 18% jump in the average palladium price encouraged both consumers and supply chain companies to sell off old items, albeit modestly growth was observed in Europe, Japan and North America. Scrap supplies in China fell slightly as the domestic market for palladium products collapsed and access to recycling services remained limited.

Demand for palladium from the autocatalyst industry rose 3% last year to 8.6 million ounces (268 tons), a new high. The annual increase came despite a modest decline in global gasoline vehicle production in 2018, which fell 1% to 74.5 million units. The main driving force behind the decline in production was China, where production fell by 5% in 2018. An increase in demand for palladium was recorded in China. Demand for palladium in North America also picked up slightly as federal emissions regulations continued to be implemented, which had a positive impact on demand. Demand from Europe as a bloc grew just 1%, while demand from Japan fell 3% year-on-year.

Analysis of platinum quotes 2021

Judging by the chart, platinum 2021 has a strong bearish trend. As for possible changes from the negative value of trend friction to positive dynamics, this is an extremely unlikely forecast. And here we should remember two factors, one concerns politics, and the other, which comes from the essence of current politics, but is economic.

So, the first is the sanctions that are mentioned in vain. Although we are not one of the government officials who can refer to sanctions, thereby hiding their miscalculations in their work, we must be objective in the fact that sanctions are by no means drivers of economic growth, as for the one against whom they are directed, and for those who impose these sanctions. This, as they say, is a double-edged economic weapon that is dangerous for everyone.

The second factor causing, to one degree or another, negative dynamics in platinum quotes is the fact that a Russian enterprise such as Norilsk Nickel is on the sanctions list. What does Norilsk Nickel and platinum quotes have to do with it, since there is practically no connection here? If you ask, you will find yourself wrong in this situation.

The fact is that this enterprise is the largest producer of platinum and sanctions directed against it cannot but cause a negative impact on the exchange rate of this precious metal. At the same time, there are cases where even changes in the board of directors of Norilsk Nickel caused shocks in platinum quotes.

Taking into account, as officials express all of the above in phony language, we believe that until the end of 2018, platinum will continue to hang around 900 American dollars with a correction in one direction or another. But what about without correction, it’s born and is the means of existence of the speculator fraternity. In other words, without volatility, speculators will have no luck.

Does platinum have any prospects?

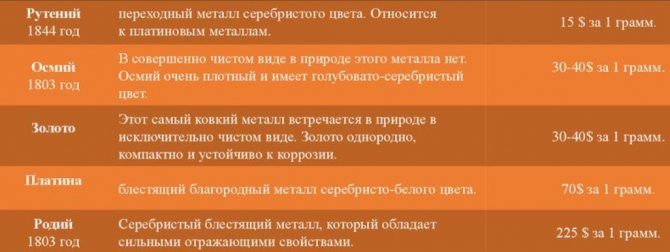

The question is, in general, rhetorical. Well, judge for yourself, can the prospects for platinum, which is among the top five most popular metals in the world, second only to gold, silver, as well as copper and nickel, be lost?! It is also in the TOP 5 for price per gram:

The most expensive metals in the world

The growth of the global economy is inevitable, so interest in commodity assets will only progress. And this is the basis for the confidence of Cryptoprognoz.ru analysts that platinum still remains an undervalued asset, which in the future will become a leader among metals, the so-called platinum group.