Post updated: May 27, 2020

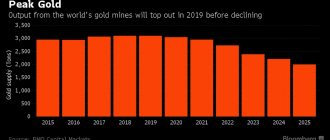

The Earth's gold reserves continue to be mined. This can only mean that the gold reserves of different countries are periodically replenished. Precious metals are bought and sold. Often, the intermediary in this turnover is the bank. Many commercial banks in Russia have a license that allows the bank to purchase or sell jewelry. Such banks themselves set the gold rate based on the discount price of the Central Bank of the Russian Federation. VTB 24 has some of the most affordable prices today.

What are the advantages of compulsory health insurance at VTB 24

Compulsory medical insurance is an alternative to a traditional bank deposit, when the depositor is assigned a certain amount of precious metal in an impersonal (virtual) form, that is, without indicating any special features, such as the sample, number, or origin of the bullion. Only weight is indicated in grams.

When opening a compulsory medical insurance at VTB 24, the client receives the following benefits:

- no VAT is charged when purchasing unallocated gold;

- no account opening fee;

- the minimum initial deposit is 0.1 grams of gold, the possibility of replenishing the account is provided;

- one VTB 24 client can open several compulsory medical insurances in the same name and in the same metal and carry out transactions between their accounts;

- there are no restrictions on the declining balance;

- It takes a short amount of time to conclude an agreement, and you can sell the metal that is fixed on the client’s account without a long wait.

A distinctive feature of compulsory medical insurance is that the depositor does not receive interest, and profit on the deposit can only be obtained through an increase in the market value of the precious metal.

Compulsory medical insurance quotes VTB 24 for various metals

Opening an impersonal metal account at VTB 24 means that the investor buys precious metal in a simplified form, but does not tie his money to a specific bullion with a serial number. This operation allows you to earn a good income when metal prices jump on the world market. But you shouldn't expect quick income. There are situations when, after opening an impersonal metal account, there is a sharp collapse in prices for precious metals on the world market. Such examples are rare and they end with the fact that after some time, prices for gold, silver, palladium or platinum return to their previous level and begin to show steady growth, bringing good profits to the owner of an impersonal metal account.

One of the most profitable and safest instruments for investment today is VTB 24 impersonal metal accounts.

Compared to a regular bank deposit, which provides an average of 8 to 10% annual income, an impersonal metal account is a more attractive investment option.

The VTB 24 website has an online calculator with which, based on quote data, you can calculate the approximate profit from opening an impersonal metal account.

VTB 24 offers account opening in the following types of precious metals:

- gold (Au);

- silver (Ag);

- platinum (Pt);

- palladium (Pd).

To regularly monitor prices for precious metals, you can use the convenient VTB 24 website. Just follow the link www.vtb24.ru/personal/savings/metals/ and get all the necessary information. To calculate the approximate level of return on your investments, you can use an online calculator.

VTB 24 Bank gives its clients the opportunity to invest money in such popular precious metals as silver, gold, platinum and palladium.

The prices shown on the website are valid for all customer groups. For those who plan to buy from 3 kg of gold, palladium or platinum or from 30 kg of silver, the bank provides special favorable conditions.

Methods for opening compulsory medical insurance at VTB

Opening a metal deposit is similar to an operation with a regular deposit.

At a bank branch

When visiting a branch, you need to:

- present your passport and write a statement of intent to open an impersonal deposit;

- open a current account in rubles;

- draw up an agreement.

After completing the documents, you can purchase impersonal gold for cash or by paying with funds from your personal account.

Online on the bank's website

On the Internet banking page, you need to go to the “Investments” section and find the “Unallocated metal account” menu. You can also manage your account here.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

From January 17, 2017, VTB cannot open new metal deposits, but previously created accounts continue to be serviced.

Taxation

There is no need to pay 20% VAT when buying/selling compulsory medical insurance. However, from the profit received on the metal account, you will need to pay NFDL. For example, you bought gold for 600 thousand rubles and sold it for 700 thousand. From 100 thousand you pay 13% - 13,000 rubles.

And here’s another interesting article: Polymetal Dividends in 2021: We need more gold, my lord!

Most banks are tax agents - they themselves calculate personal income tax and transfer it where necessary. But some are not, and then you will need to fill out the declaration yourself, calculate the tax and transfer it to the Federal Tax Service.

The obligation to pay income tax does not arise in two cases:

- if the compulsory medical insurance has been active for more than 3 years, regardless of the type of metal and its amount;

- if during the year you sold metal worth less than 250 thousand rubles.

At the same time, you still need to fill out a declaration and submit it to the Federal Tax Service. The deadline is April 31 of the following year. For example, you sold silver from an unallocated metal account on November 21, 2018 in the amount of 300 thousand rubles, of which 50 thousand rubles are net profit. This means that by April 31, 2021, you need to submit a 2-NDFL declaration to the Federal Tax Service and pay 6,500 rubles in tax.

Conditions for opening a deposit in gold

You can open an impersonal metal deposit at VTB in any precious metal; you should buy it using the currency of the Russian Federation - rubles (all transactions are carried out in this currency). The term of an agreement with a financial organization is not limited by time; you can terminate cooperation at any time.

The depositor must be a client of VTB 24 and have an active ruble account or create one at the same time as a metal one.

Required documents

To open compulsory medical insurance, the client must present a passport of a citizen of the Russian Federation or an identity document, as well as a tax identification number. If you do not have a passport, you can present a duly issued temporary certificate. Foreigners present a passport of a foreign state and a document confirming the legality of their stay in Russia.

Requirements for depositors

Any capable citizen of the Russian Federation who has reached the age of majority and has confirmed his identity, as well as a foreigner legally residing in Russia, can become a bank depositor.

How much can you earn on compulsory medical insurance?

Depends on your luck and a cool head. No expert can accurately predict what the dynamics will be in the future. But you can look at the exchange rate charts for the past year and look at the peaks (jumps): each of them is someone’s earnings.

Banks publish profitability calculators for impersonal metal deposits. They help you understand how you can earn money and decide whether it will be profitable to invest in metal or not. Here is a calculator from Sberbank:

Precious metals yield calculator

And here is the calculator on the VTB website:

Compulsory medical insurance profitability

In the graphs below you can see the dynamics of all metals over the last decade:

Gold, Silver and Platinum Quotes from TradingView

Profitability calculation

To calculate the profitability of a deposit in VTB 24, you need to use the formula:

D = (K2-K1) / K1 x 100%, where K1 is the gold sales rate. It is set by VTB on the date of sale, K2 is the purchase rate at the moment when the precious metal was purchased.

By tracking changes in the value of gold on the world market, the owner of an impersonal deposit can receive income in the same way as when playing on the stock market.

There is a profitability calculator on the website of a commercial organization, using which you can make approximate calculations.

Gold price

The pricing policy for the precious metal is set in London, twice a day. This is an international or international course. It is used all over the world. As for the national exchange rate, it is set by the Central Bank. It takes as a basis the prices set on the London Stock Exchange, but also takes into account the dollar-ruble ratio and various other factors that influence the cost of jewelry. Commercial banks take the price set by the Central Bank as the basis for setting the rate in their branches. In addition, the price may be affected by the bank's reserve stock of precious metals.

The price of precious metals set by the bank may be influenced by its reserve stock.

Among the largest (commercial) banks in the Russian state, VTB 24 Bank is one of the most reliable. This bank offers people a variety of financial services, from loans and mortgages to deposits and gold bars. The gold rate set by VTB 24 is considered by many analysts to be the most democratic in the Russian Federation.

| Metal | We buy | We sell |

| Gold | 3 794,30 | 4 114,40 |

| Palladium | 4 310,50 | 4 896,50 |

| Platinum | 1 798,50 | 2 050,30 |

| Silver | 38,02 | 41,33 |

How to close a deposit

To close an impersonal account, the deposit holder must sell “virtual” gold to the bank and transfer the funds to any of their own accounts. This can be done both in the branch and online.

According to the Tax Code of the Russian Federation, when closing a deposit that has been owned for less than 3 years, residents of the Russian Federation are required to pay tax at a rate of 13%; if the deposit is 3 or more years old, then personal income tax is not charged.

Non-residents of the Russian Federation are required to pay a tax on transactions with unallocated gold in the amount of 30%.

What is an impersonal metal account

If the bullion is “live”, real gold, then the compulsory medical insurance can be called “virtual”. This is an open bank account, but not in currency, but in metal. The unit of measurement is grams (interest is also calculated in grams).

The account is called impersonal because when registering the movement of funds on it, only the amount of receipt or write-off without physical characteristics (weight, manufacturer, sample, serial numbers and others) is indicated. When carrying out operations on an impersonal metal account, transportation is not required, and the storage conditions for bullion do not change.

Futures contracts for gold: features, pros, cons.

The best way to make money on gold without purchasing real metal and without waiting a long time for the price to rise is to use exchange instruments such as futures and options.

A futures contract is

a standard exchange operation that has two sides. The seller gives an obligation to sell gold at a certain price within a specified period, and the seller has an obligation to buy it. Depending on the current exchange rate of the precious metal, the contract price also changes. In most cases, investors do not plan to purchase natural gold (although this option also exists), but make money on the difference in prices.

Gold futures are sold on the world's largest trading platforms, including:

• on the London Metal Exchange; • at the Tokyo Commodity Exchange; • on the Moscow International Currency Exchange.

Futures trading is a risky exchange transaction that allows for increased profits, but in case of failure, the investor will incur increased costs.

The features of the gold futures contract are as follows:

• the initial contract price is set taking into account the London Gold Fixing data (the price of gold is set by a special group of experts twice a day);

• underlying asset – refined gold bars;

• minimum lot – one troy ounce;

• currency – US dollar;

• settlement of futures is carried out on the day of its execution, for the Moscow Exchange this is the 15th day of March, June, September and December;

• collateral – 6% of the contract value (that is, the investor’s account must contain at least 6% of the futures price).

You should also take into account the commission for opening and “holding” the futures. For the Moscow Exchange, this is 1 ruble for buying or selling a contract and 0.5 rubles for each day of holding the futures.

The advantages of trading gold contracts are:

• futures are standardized, they can be sold on any market at any time, 24 hours a day;

• to make a profit, it is enough to hold futures for a minimum time - the price of contracts changes actively, and you can conduct profitable trading even intraday;

• minimal costs - the exchange commission cannot be compared with the costs of storing real metal.

At the same time, one should take into account the big disadvantage of such trade

: the investor bears increased risk because he uses leverage, and if there is insufficient funds in the account, he may simply lose money.

Thus, futures are useful for fairly sophisticated investors who wish to hedge against the risk of rising or falling gold prices. Contacts are successfully used by traders to make money on a rising or falling market.

Gold options: features, pros, cons.

As stated above, futures are one of the derivative exchange instruments and allow you to get fantastic profits by changing their price.

However, it is not without drawbacks, in addition to risk. One of them is the obligation to complete a transaction at a specified time at a set price, even if it is not beneficial to one of the parties. The option is designed to solve this problem. The principle of operation of an option is similar to a futures contract

: the parties agree among themselves on a transaction for the purchase and sale of a financial asset within a specified period at a “fixed” price, but the buyer in this case may refuse to fulfill his obligations. His loss in this case is not the full value of the contract, but only the option premium.

This property made the option an excellent and reliable tool for hedging risks. The losses that one of the parties may suffer are not as significant compared to the possible loss from the loss of the asset.

“Gold” options are actively used by conservative investors, large state banks and gold mining companies. It is important for them to maintain stability in the value of the asset and minimize risks. Gold options are not very popular among private speculators for two reasons.

:

• fairly low volatility, prices for this asset change little;

• high option premiums, which increase losses in the event of loss of the contract.

There are two major types of options:

• American, which can be executed at any time while the contract is in force;

• European, which are executed exclusively on the agreed expiration day.

(!) Traditional options should not be confused with binary options. The latter are sold exclusively on the Chicago Mercantile Exchange and have a completely different execution scheme. Binary options, actively advertised on the Internet, have nothing in common with real options and in most cases are a simple lottery. A real option is a powerful exchange tool for making money.

How else can you invest in gold?

Those investors who do not want to trade on the stock exchange themselves can choose a trust management company - for example, a mutual fund that specializes in the purchase and sale of precious metals.

In this case, professionals will deal with trading complex financial instruments, and the investor will be able to make a profit by selling the share that has “jumped” in value. It is more important for him to pay attention not to gold quotes, but to the financial statements of the management company of interest. In indirect investing

Precious metals have their advantages - at least calm nerves - but there are plenty of disadvantages:

• increased commission; • it is impossible to personally control the work of the company; • there are non-trading risks – for example, bankruptcy of the management company.

Another way to invest in gold indirectly

– investments directly in companies that are engaged in its extraction. The easiest way to do this is by purchasing shares or bonds of the company you are interested in.

Since it is impossible to directly buy securities in accordance with our legislation, it is necessary to resort to the help of brokers. Now there are many organizations providing similar services. It is necessary to choose a fairly reliable broker with minimal commissions and providing access to the Moscow Exchange - it is where domestic securities of such large Russian mining companies as:

• Polyus Gold; • Nordgold; • Yuzhuralzoloto Group of Companies; • Susumanzoloto; • Gold of Kamchatka, etc.

It is worth paying attention to other metals mining companies, for example, Norilsknickel, Uralkali, Alrosa, etc., and purchasing their shares for maximum portfolio diversification.

On the stock exchange you can

not only purchase shares and expect profitability due to rising prices and receiving dividends, but also open short positions - i.e.

make money on the fall of a particular stock

.

Compulsory medical insurance: pricing policy

Today, VTB provides the opportunity to create an account for the following types of metals: gold, palladium, platinum, silver. Precious metals are actively mined to this day, which leads to regular replenishment of gold and foreign exchange reserves.

The pricing policy for metals is dictated by London, which announces the international exchange rate twice during the day. The rate, which is taken as a basis by Russian banks, is set by the Central Bank; it takes into account the international exchange rate of metals, as well as the currency ratio. VTB forms the internal rate based on the bank’s reserve stock and data from the Central Bank. You can get acquainted with the VTB exchange rate for today by clicking on the active link.

Thanks to the convenient service from VTB, clients can monitor metal quotes online, carry out operational procedures for the purchase and sale and transfer of gold between their own accounts, and also monitor deposit analytics. At the same time, the client independently controls the payment of taxes for transactions with metals, which makes the compulsory health insurance service as transparent as possible.

Where is the best place to open a current impersonal account?

The future “gold player” should pay attention to:

- actual quotes;

- spread size.

The wider the spread, the more the metal must rise in price for you to make a profit. Therefore, sometimes this parameter is even more important than the quotes themselves: it can level out your income. Choose the most loyal banks.

Where to open an urgent compulsory medical insurance

When opening a fixed-term impersonal account, first of all you should inquire about the proposed term and interest. Most banks offer 0.5–1.5% per annum for short-term deposits, and up to 2% for deposits over six months. You can find better offers, but free cheese is only in the mousetrap: before agreeing to a tempting 4-5%, it is appropriate to mentally return back to the “reliability” point.