Central Bank of the Russian Federation – Precious metals rates

Official discount prices for precious metals are established by the Central Bank of the Russian Federation every working day. Prices are calculated based on the fixing of gold, silver, platinum and palladium on the London spot metal market, and are converted into rubles at the official US dollar/Russian ruble exchange rate effective on the day following the day the discount prices are set. Accounting prices are used for accounting purposes in credit institutions.

| date | Gold rub./gram | Silver rub./gram | Platinum rub./gram | Palladium rub./gram |

| 27.02.2021 | 4224.26 | 66.83 | 2893.39 | 5693.45 |

| 26.02.2021 | 4233.41 | 65.54 | 2959.92 | 5733.22 |

| 25.02.2021 | 4285.38 | 66.31 | 2994.85 | 5612.67 |

| 21.02.2021 | 4248.68 | 64.10 | 3077.93 | 5620.67 |

| 20.02.2021 | 4218.41 | 64.60 | 3022.75 | 5591.25 |

| 19.02.2021 | 4228.69 | 64.32 | 3005.24 | 5633.35 |

| 18.02.2021 | 4242.54 | 65.40 | 2912.40 | 5620.83 |

| 17.02.2021 | 4296.61 | 64.96 | 3077.34 | 5638.65 |

| 16.02.2021 | 4283.63 | 63.80 | 3026.32 | 5663.74 |

| 13.02.2021 | 4321.67 | 64.48 | 2916.77 | 5591.07 |

| 12.02.2021 | 4367.35 | 64.57 | 2971.33 | 5617.78 |

| 11.02.2021 | 4377.11 | 65.62 | 2884.91 | 5579.87 |

| 10.02.2021 | 4400.30 | 64.77 | 2816.69 | 5602.40 |

| 09.02.2021 | 4325.35 | 63.34 | 2743.26 | 5605.89 |

| 06.02.2021 | 4367.40 | 63.75 | 2687.74 | 5597.65 |

| 05.02.2021 | 4410.67 | 65.25 | 2639.27 | 5495.23 |

| 04.02.2021 | 4487.73 | 66.84 | 2675.96 | 5488.89 |

| 03.02.2021 | 4507.67 | 72.20 | 2689.33 | 5532.40 |

| 02.02.2021 | 4509.90 | 66.55 | 2709.15 | 5529.96 |

| 30.01.2021 | 4542.04 | 61.79 | 2664.87 | 5712.18 |

| 29.01.2021 | 4506.07 | 61.69 | 2589.03 | 5636.11 |

| 28.01.2021 | 4454.61 | 61.28 | 2622.49 | 5592.38 |

| 27.01.2021 | 4506.49 | 62.34 | 2643.29 | 5653.78 |

| 26.01.2021 | 4465.88 | 60.94 | 2661.81 | 5699.07 |

| 23.01.2021 | 4431.54 | 61.84 | 2632.24 | 5649.40 |

| 22.01.2021 | 4405.56 | 59.67 | 2644.30 | 5630.64 |

| 21.01.2021 | 4373.92 | 59.66 | 2584.82 | 5589.45 |

| 20.01.2021 | 4368.68 | 58.94 | 2607.32 | 5650.77 |

| 19.01.2021 | 4361.69 | 60.04 | 2566.19 | 5650.84 |

| 16.01.2021 | 4383.49 | 59.70 | 2589.17 | 5655.97 |

| 15.01.2021 | 4366.17 | 60.11 | 2631.21 | 5658.65 |

| 14.01.2021 | 4378.94 | 60.34 | 2541.22 | 5652.15 |

| 13.01.2021 | 4445.57 | 59.74 | 2540.53 | 5687.54 |

| 12.01.2021 | 4426.84 | 63.83 | 2498.75 | 5653.93 |

| 01.01.2021 | 4491.66 | 62.48 | 2553.29 | 5629.12 |

| 31.12.2020 | 4459.48 | 62.11 | 2522.42 | 5562.62 |

| 30.12.2020 | 4437.61 | 61.05 | 2465.21 | 5612.44 |

| 29.12.2020 | 4438.08 | 61.10 | 2419.84 | 5517.53 |

| 26.12.2020 | 4436.55 | 61.08 | 2419.01 | 5515.62 |

| 25.12.2020 | 4505.61 | 60.91 | 2456.66 | 5601.48 |

| 24.12.2020 | 4529.59 | 62.52 | 2459.96 | 5667.14 |

| 23.12.2020 | 4538.16 | 63.36 | 2432.24 | 5603.36 |

| 22.12.2020 | 4487.62 | 61.98 | 2439.17 | 5567.37 |

| 19.12.2020 | 4428.96 | 60.67 | 2446.72 | 5503.94 |

| 18.12.2020 | 4392.15 | 58.96 | 2463.61 | 5527.88 |

| 17.12.2020 | 4393.73 | 57.16 | 2473.81 | 5507.07 |

| 16.12.2020 | 4354.98 | 56.33 | 2413.27 | 5490.07 |

| 15.12.2020 | 4267.87 | 55.84 | 2382.18 | 5448.99 |

| 12.12.2020 | 4310.63 | 56.15 | 2402.56 | 5470.42 |

| 11.12.2020 | 4346.88 | 57.08 | 2393.61 | 5422.35 |

| 10.12.2020 | 4383.23 | 57.68 | 2418.11 | 5439.57 |

| 09.12.2020 | 4415.66 | 56.25 | 2420.38 | 5480.20 |

| 08.12.2020 | 4375.28 | 57.83 | 2454.05 | 5557.43 |

| 05.12.2020 | 4390.93 | 57.70 | 2501.87 | 5591.02 |

| 04.12.2020 | 4436.04 | 57.98 | 2470.91 | 5821.87 |

| 03.12.2020 | 4456.05 | 57.22 | 2440.80 | 5878.35 |

| 02.12.2020 | 4407.43 | 54.35 | 2409.59 | 5889.01 |

| 01.12.2020 | 4341.07 | 56.68 | 2359.24 | 5889.52 |

| 28.11.2020 | 4409.74 | 56.97 | 2336.51 | 5829.09 |

| 27.11.2020 | 4402.52 | 56.79 | 2336.07 | 5732.24 |

| 26.11.2020 | 4388.45 | 56.19 | 2339.15 | 5670.73 |

| 25.11.2020 | 4431.61 | 58.27 | 2283.93 | 5689.11 |

| 24.11.2020 | 4539.73 | 58.86 | 2313.95 | 5687.45 |

| 21.11.2020 | 4562.65 | 58.60 | 2324.09 | 5706.37 |

| 20.11.2020 | 4554.16 | 59.62 | 2304.79 | 5678.60 |

| 19.11.2020 | 4582.44 | 60.12 | 2279.99 | 5712.18 |

| 18.11.2020 | 4622.23 | 59.49 | 2270.17 | 5712.20 |

| 17.11.2020 | 4680.45 | 59.96 | 2243.03 | 5799.24 |

| 14.11.2020 | 4669.38 | 60.20 | 2212.62 | 5842.32 |

| 13.11.2020 | 4631.33 | 60.02 | 2164.43 | 5838.74 |

| 12.11.2020 | 4596.93 | 59.28 | 2173.26 | 6039.56 |

| 11.11.2020 | 4605.21 | 61.66 | 2149.21 | 6098.86 |

| 10.11.2020 | 4842.82 | 63.78 | 2236.54 | 6044.10 |

| 07.11.2020 | 4834.10 | 60.97 | 2235.95 | 5933.59 |

| 06.11.2020 | 4834.96 | 60.47 | 2239.90 | 5902.45 |

| 04.11.2020 | 4886.56 | 61.67 | 2242.85 | 5789.75 |

| 03.11.2020 | 4887.70 | 61.20 | 2222.68 | 5787.27 |

| 31.10.2020 | 4784.40 | 58.70 | 2183.31 | 5677.62 |

| 30.10.2020 | 4759.17 | 60.67 | 2195.94 | 5662.27 |

| 29.10.2020 | 4729.52 | 60.93 | 2179.19 | 5812.01 |

| 28.10.2020 | 4667.69 | 59.68 | 2145.92 | 5813.41 |

| 27.10.2020 | 4673.64 | 60.85 | 2189.85 | 5807.64 |

| 24.10.2020 | 4697.13 | 60.87 | 2192.95 | 5853.59 |

| 23.10.2020 | 4750.35 | 61.74 | 2210.56 | 5957.61 |

| 22.10.2020 | 4752.55 | 61.97 | 2169.54 | 5943.94 |

| 21.10.2020 | 4767.05 | 61.59 | 2138.03 | 5876.45 |

| 20.10.2020 | 4785.15 | 62.23 | 2184.64 | 5874.97 |

| 17.10.2020 | 4783.12 | 61.06 | 2163.21 | 5883.02 |

| 16.10.2020 | 4740.64 | 59.98 | 2142.65 | 5881.64 |

| 15.10.2020 | 4711.68 | 60.06 | 2176.40 | 5875.79 |

| 14.10.2020 | 4772.77 | 61.96 | 2164.25 | 6003.24 |

| 13.10.2020 | 4754.14 | 62.06 | 2199.02 | 6067.12 |

| 10.10.2020 | 4736.09 | 60.22 | 2176.86 | 5968.41 |

| 09.10.2020 | 4737.92 | 60.02 | 2169.37 | 5931.95 |

| 08.10.2020 | 4740.23 | 59.08 | 2169.26 | 5925.29 |

| 07.10.2020 | 4827.56 | 61.34 | 2244.03 | 5926.86 |

| 06.10.2020 | 4771.68 | 60.07 | 2212.96 | 5814.99 |

| 03.10.2020 | 4786.39 | 59.92 | 2244.56 | 5802.22 |

| 02.10.2020 | 4709.54 | 58.68 | 2233.59 | 5769.07 |

| 01.10.2020 | 4770.62 | 60.10 | 2208.76 | 5848.66 |

| 30.09.2020 | 4822.55 | 61.06 | 2239.11 | 5802.74 |

| 29.09.2020 | 4681.68 | 57.90 | 2157.53 | 5632.84 |

| 26.09.2020 | 4618.65 | 55.89 | 2116.62 | 5522.48 |

| 25.09.2020 | 4592.32 | 55.14 | 2081.83 | 5520.96 |

| 24.09.2020 | 4635.01 | 57.92 | 2096.44 | 5479.23 |

| 23.09.2020 | 4666.73 | 59.59 | 2172.62 | 5559.07 |

| 22.09.2020 | 4720.43 | 64.44 | 2261.33 | 5737.66 |

| 19.09.2020 | 4715.50 | 65.28 | 2274.83 | 5659.33 |

| 18.09.2020 | 4680.61 | 64.66 | 2299.08 | 5717.49 |

| 17.09.2020 | 4733.17 | 65.96 | 2363.21 | 5721.33 |

| 16.09.2020 | 4746.61 | 66.59 | 2332.75 | 5630.03 |

| 15.09.2020 | 4665.67 | 64.58 | 2258.01 | 5582.56 |

| 12.09.2020 | 4681.88 | 64.71 | 2239.21 | 5547.47 |

| 11.09.2020 | 4722.48 | 65.82 | 2241.28 | 5563.14 |

| 10.09.2020 | 4716.38 | 64.90 | 2228.08 | 5517.61 |

| 09.09.2020 | 4690.71 | 65.15 | 2220.06 | 5646.63 |

| 08.09.2020 | 4686.60 | 65.21 | 2201.86 | 5589.70 |

| 05.09.2020 | 4683.50 | 64.82 | 2187.53 | 5518.39 |

| 04.09.2020 | 4692.80 | 65.27 | 2215.26 | 5566.05 |

| 03.09.2020 | 4675.61 | 65.79 | 2222.64 | 5350.00 |

| 02.09.2020 | 4703.11 | 68.34 | 2247.52 | 5377.48 |

| 01.09.2020 | 4644.50 | 64.90 | 2206.75 | 5163.32 |

| 29.08.2020 | 4693.40 | 65.63 | 2231.70 | 5231.29 |

| 28.08.2020 | 4689.71 | 65.90 | 2256.81 | 5282.82 |

Precious metals: results of 2013

Precious metals market analysis

2013 is ending and it's time to look at what happened to metals during the year. To do this, we will compare the position of their value at the beginning of the year, at the end of last year and the current situation, trying to identify the general dynamics.

Gold will continue to fall

The pre-New Year time for gold in the past year turned out to be quite “hot” - it managed to both increase in price and drop noticeably

. Having started trading at $1,218 per troy ounce in early December, it has grown quite significantly in price, although such growth was not supported by any specific events. As a result, the New Year's “race” actually ended in a “draw”, as gold stopped at $1,212 per troy ounce.

Let's look at the indicators of the previous year and the beginning of this year: gold began trading at $1,669 in January and continued its decline, maintaining the trend of 2012. The reasons are the same - an increase in the value of indices, a certain strengthening of the dollar as a currency. As became apparent back in 2011, gold was in a severely overbought state.

(the same can be said about all the metals under consideration, except palladium), so the continuation of the decline dynamics was quite obvious. As a reserve currency, gold retains its status, but its weight is somewhat lower than before.

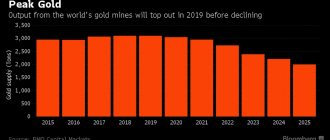

1. Gold price dynamics in December 2013. In annual terms, gold has lost a lot in value

- more than 27%. This fact indicates that this metal is overbought. However, the dynamics of the fall make it possible to make certain forecasts for 2014: gold will probably continue to fall, but not as intensely as it has been in the last 2 years. There are well-defined reasons for such a forecast:

- Any overbought currency (we can consider gold specifically as a currency) still has a real value limit

, below which a fall is almost impossible (otherwise it depreciates and the currency is taken out of circulation). - The slowdown in the fall of gold directly depends on the position of the dollar as a currency. Its strengthening causes the value of gold to fall, and its weakening strengthens the position of gold.

Most likely

It seems that the value of gold has lost another $150 on average. Many experts believe that the most realistic scenario would be for the price of gold to stop at $1000-1050 per troy ounce. And so far, current trends, supported by the results of two years, indicate the same thing.

Silver: there are prerequisites for growth

Silver, as noted earlier, largely repeats the situation with gold

, although not in all aspects.

Silver is often used on the exchange for margin trading, as evidenced by the frequent sharper price changes compared to gold while maintaining the general trend. This month, silver was also quite actively traded in both directions, which, as in the case of gold, brought it to its original value. Having started trading at $19.19 in December, silver experienced both good growth and good decline

, ultimately stopping at $19.8, which is slightly better than in the case of gold, but not fundamentally significant.

Let's look at silver performance for the year.

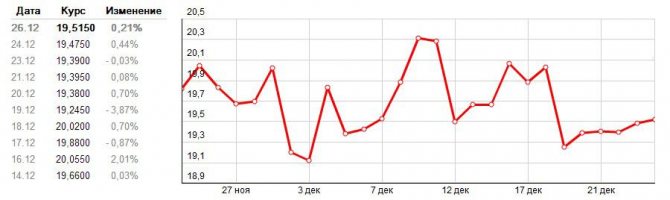

Rice. 2. Silver price dynamics in December 2013.

After trading at $30.4 per troy ounce at the beginning of the year, silver lost almost 35% of its value, settling at $19.8 at the end. The numbers are considerable, however, unlike gold, silver has some hope of changing the direction of the trend

: in the previous article I described that the cost of metals is also influenced by completely objective factors, such as new deposits and depletion of existing ones, an increase or decrease in production volumes.

In the case of silver, everything is somewhat ambiguous: since the reserves of any metal on the planet are limited, news about the depletion of silver reserves on the planet cannot plunge anyone into an unexpected shock. Apparently, in the next 10 years we will see a decline in the level of silver production in general

and, as a result, an increase in its value. And the price of silver will rise, spurred by margin transactions on the exchange, due to the fact that the metal is widely used in manufacturing and the jewelry industry. As long as the metal is used, it will be “valued.”

Most likely

in 2014, the price will continue to fall to a price range of $14-15 per troy ounce. However, if forecasts for a reduction in the amount of metal turn out to be correct, silver will move away from the already established trend, and its value will directly depend on the level of consumption.

Platinum: the forecast is not optimistic

Platinum most often follows the dynamics of gold, although it has its own specifics, being a nominally monetary metal, the cost of which largely depends on the demand in production and the jewelry industry.

In December, platinum more closely followed the dynamics not of gold, but of silver

: having started trading at $1341.5, thanks to the New Year’s “race” it was able to reach the level of $1364, ending the year on a fairly positive note.

However, looking at the indicators at the beginning of the year and comparing them with the current ones, one cannot say with confidence that everything is so “rosy”: platinum started the year at $1,557.5 per troy ounce, and in February it was even able to rise in value to $1,715. But overall, the year ended with a loss of 12.5% of its value. This is much lower than in the case of silver (almost 3 times) and much lower than in the case of gold (almost 2 times). The answer to the question “why is this so” is quite simple:

- less impact on the stock exchange situation due to the scope of application;

- Platinum's overbought level is currently much lower than gold and silver.

Rice. 3. Dynamics of the price of platinum in November 2013.

Palladium has reached its price limit

This precious metal, belonging to the platinum group, has always stood somewhat apart. Quite often, due to its complete dependence on the field of application and less influence on the market, it showed changes in value that were opposite or poorly consistent with other metals. However, the New Year's “race” this year only slightly worsened his situation

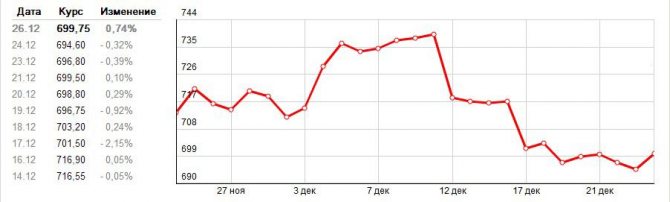

. Having started trading at $712 per troy ounce, palladium quite confidently lost in value during the month, stopping at $702.5.

4. Palladium price dynamics in November 2013. However, if you look at the price of the metal at the beginning of 2013, it not only did not lose its value, but even strengthened slightly: starting at $695 in January, ending at +1% in value by the end of the year, which can also be taken as an error. This only indicates that the cost of palladium depends entirely on the demand in production and the jewelry industry

, and, despite fluctuations throughout the year, its market value corresponds to its real value. But it is precisely this fact that makes it a futile tool for long-term investment; Moreover, when the value falls, it will return to the current level again. This is probably his expected price limit within standard consumption. And this is precisely what allows us to make a forecast for 2014, leaving the metal at the same level.