Scientists believe that people have been mining “solar” metal for about 6 thousand years. The first gold coins appeared in 550 BC in Lydia (Mediterranean), where the legendary Croesus ruled. Since then, they have spread quite quickly and entered the circulation of business transactions. If you fight, pay the mercenaries in gold; if you trade with overseas countries, again pay in precious metal. But is there enough for everyone? That’s the question.

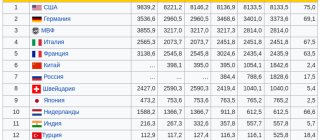

They say that if all the gold mined throughout the history of mankind is collected in one place and melted down, the result will be a rather modest figure - a cube with a side height of about 20 meters. And how much of this metal is in the world now and where exactly it is concentrated - there are different opinions on this matter. Let's try to figure it out: the leading countries in terms of gold reserves - who they are, and what place Russia occupies in the ranking.

Mining history

In the entire history of mankind, not much precious metal has been mined. The fact is that a person’s abilities and technical equipment did not always help to find and extract Au. To see this, just look at the statistics:

- before 500, about 10.5 thousand tons were mined;

- from 500 to 1500 about 2.5 thousand tons were mined;

- Today, about three thousand tons are mined annually in the world;

- Over the years of its existence, humanity has managed to extract about 160 thousand tons.

That is, over the years of development of civilization, the production of precious metal has increased many times. But the presented data is difficult to consider 100% reliable, since some information relating to Au is shrouded in secrecy.

There is information that concerns gold mining; it still raises doubts and bewilderment not only among skeptics, but also among very authoritative scientists. The fact is that people have not always thought about how much metal they spend and when its reserves will run out.

How much gold is left in the world and how long will it last? According to some reports, the metal on Earth will run out in a few centuries, there is not much of it left, and it is also necessary to take into account the fact that production volumes are constantly growing.

Africa produces the most precious metals; the gold mining industry is thriving in this country. But it is worth keeping in mind that illegal gold mining is also thriving in South Africa, and the exact size of the precious metal extracted from the bowels of the earth is difficult to determine.

In addition to Africa, the following countries have been on the list of leaders for many years:

- Australia.

- America.

- Russia.

- China.

Since the 19th century, mining of the precious metal has increased in Australia. Au is found in mines and mines, but the country’s subsoil is not only famous for this element. Fancy diamonds and rare semi-precious and precious stones are mined on its territory.

If we talk about America, then this country was “fevered” with gold several times. But most of all Au was found in the 60–70s of the 20th century.

The precious metal began to be mined on the territory of our country relatively recently, under Peter I. But, despite this, reserves have become significantly depleted, and today Russia is not among the top 5 leaders in Au mining.

World gold reserves

China has significantly succeeded in gold mining; in this country, the precious metal is mined using the mining method. The largest amount of Au in Asian countries was mined in the 16th century

–

XVII century

. Later, production volumes began to decline and gradually the palm passed to America.

It makes no difference exactly where and how much precious metal is mined today; all the same, reserves are gradually depleted and sooner or later humanity will inevitably face a shortage of gold on the planet. What to do then?

Ordinary people

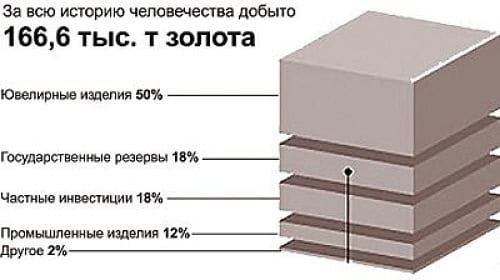

When determining the amount of gold in a country, it is worth taking into account not only the official reserves in vaults, but also the amount that is in private possession, especially since in some countries this figure is tens of times greater than state reserves. Only 18% of the total is owned by states, the rest is concentrated in private hands.

For example, in India, back in 2011, citizens owned 18 tons of this precious metal, and it was concentrated in the hands of a tiny percentage of the population. This is what explains such a large difference in the standard of living in this country between poor and rich people.

As for the indicator per capita, Switzerland is the undisputed leader here. According to data at the beginning of 2018, every Swiss person accounts for 136.5 grams of this pure precious metal.

If you are a complete cosmopolitan and at least theoretically imagine that all the gold in the world is divided equally among all the people inhabiting the planet, it turns out that everyone would receive a little less than 25 grams without impurities and alloys.

When will there be a shortage?

Experts give different estimates on the size of precious metal deposits that exist on the planet today. The fact is that only those deposits that are currently operating are considered; their reserves are estimated approximately. When predicting a particular outcome, experts often disagree. Some say that gold will last for 20 years, while others claim that for II

–

In the 3rd century

, humanity will not know what a deficiency of the yellow metal is.

Our planet is rich in various elements and most of them are not found on the surface of the earth, but in its depths. Au was no exception; the 79th element of D.I. Mendeleev’s table is hidden from human eyes under tons of rock.

Geologists unanimously claim that deposits of the precious metal are located deep in the earth, they are in close proximity to the core of the planet. From an economic point of view, developing such deposits is unprofitable. But the situation may change radically.

All skeptics should cite the example of the Soviet Union, on whose territory they searched for and developed only alluvial deposits, and did not develop indigenous ones at all. The reason for this was the reluctance of the authorities to develop the industry and spend money on equipment and specialists.

But sooner or later there will be a shortage, and then what? Today, scientists have three options for the development of events:

- Mining precious metals from space.

- Recycle recyclable materials.

- Filter the water of the seas and oceans.

How much gold is mined and how much remains in the bowels of the earth does not matter, since it all came to us from space. Au came to Earth from the space of the Universe. And there is a chance to mine the precious metal on the territory of not only our planet, but also other celestial bodies. For example, quartz deposits were recently discovered on Mars, and quartz is the main satellite of gold.

Already today, the recycling industry is thriving, with citizens taking broken jewelry to pawn shops. They are melted down and new, very beautiful products are made from the resulting material.

Au is present in sea water; this discovery did not strike the world only because experts have not yet found a single method that would allow extracting the element from the depths of the seas and oceans. Today, experts are working on the problem of extracting Au from water and are ready to offer a new, alternative extraction method using bacteria that combine precious metal ions.

And about 10-11% of gold is destroyed during storage, subject to mechanical damage and one way or another ends up in nature again.

Trump or Biden?

For investors, the outcome of the US presidential election does not matter at all. A four-year Trump or Biden presidency is insignificant for the economy and markets.

The candidates have no choice - one of them will have to govern a bankrupt country that has recorded budget deficits since 1930, with the exception of four years in the 1940s and 1950s. The surplus under Clinton was fake, and the US trade deficit is almost 50 years old. The consequence was an exponentially growing debt, which under Reagan in 1981 did not exceed $1 trillion, and now stands at $27 trillion.

According to my calculations, over the next four years the debt will rise to 40 trillion, and as the financial system collapses it could easily reach 100 trillion - or quadrillion when the derivatives bubble bursts.

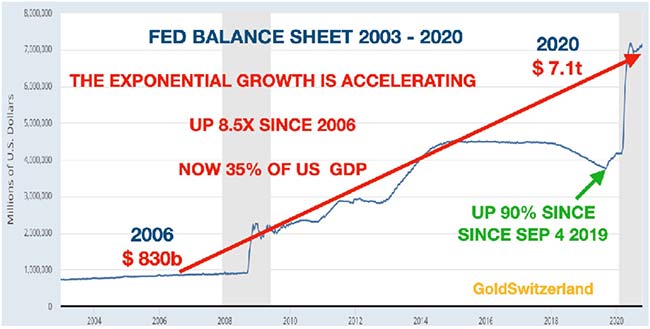

The global financial system was supposed to collapse back in 2006-2009, but central banks managed to delay the inevitable collapse for more than a decade.

Interest rates

Today, interest rates are the most controversial phenomenon. The entire investment world, including the Fed and the ECB, believes that rates will remain at zero or lower in the coming years. Usually, when the majority comes to an agreement, the opposite happens.

A weaker dollar will increase inflation, putting upward pressure on rates. As investors begin to sell off long-term government bonds, short-term rates will rise as well.

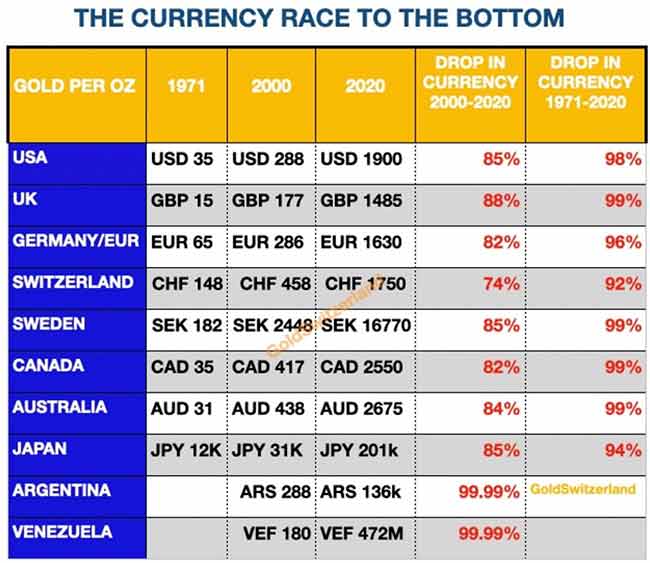

Precious metals typically benefit from negative real rates when inflation exceeds interest rates. As long as inflation is higher, gold will rise even with high nominal rates. This is what happened in the 1970s and early 1980s, when values reached 20% and gold jumped from $35 to $850 an ounce. All this time, inflation remained above normal.

I remember this period well because I took out my first mortgage while living in the UK and the rate was 21%.

Super cycles of bull markets will end in euphoria

It is worth remembering that the end of an economic supercycle does not go unnoticed. It will come in conditions of the highest euphoria and the most optimistic sentiment regarding the economy and stocks. This means that 9-18 months before the end of the era, markets will take off, with growth possibly doubling.

This is evidenced by many factors. First, both presidential candidates will need not just pockets full of currency, but quantum computers capable of printing trillions and quadrillions of dollars. There is also a convenient excuse for this: COVID. Unemployed citizens, companies, municipalities, states and the federal government all need money.

Remember how the end of the final phase of the current economic era began. In August-September 2021, the Fed and the ECB announced that they would do everything possible to save the system. They did not say what the problem was, but those who understood the fragility of the financial system knew that its position was unenviable.

At the time of the last crisis in 2006, the Fed's balance sheet was $830 billion. At the end of the Great Financial Crisis in 2009, the balance increased to $2 trillion.

But in 2009 the problem was not solved - the sentence was only postponed. Why else has the Fed's balance sheet increased by another 5 trillion since then? Just looking at the projected budget deficits over the next 4 years, as well as the worsening problems in the financial system, the Fed's balance sheet is going to explode over the next few years.

Dollar

Continuous printing of money always has consequences. Since 1971, the dollar has lost 98% in real terms, i.e. against gold, since gold is known as the only currency that has survived millennia.

Now the dollar is on its final path to zero, and even such a weak and artificial currency as the euro will surpass it. A falling dollar will accelerate inflation in the US until hyperinflation occurs.

The Rise of Commodities

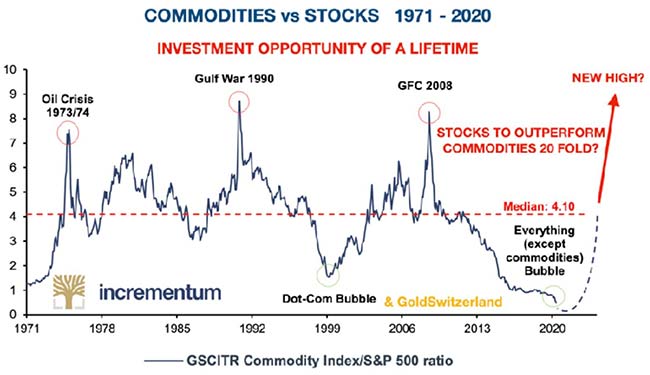

The biggest winners will be commodities markets, which are currently at 50-year lows relative to equities. The forecast is for commodities to rise by at least a 4:1 ratio, eventually reaching a new high, with commodities outperforming equities by 20 times. The first phase will come as stock markets rise, but the final phase will come when major equity markets crash and commodities continue to strengthen. Goldman Sachs estimates commodity markets will grow 28% in 2021 as inflation and commodity shortages drive prices higher.