There is a persistently difficult economic situation in Russia. Places where you can quickly get money appear and disappear - microfinance organizations and pawn shops open almost in your yard. MFOs have become famous for their extortionate interest rates and the prospect of meeting debt collectors. Pawnshops take the deposit, but do not turn to collectors and bailiffs. How does a pawnshop work in 2021, and what rights does the debtor have?

What is the point and benefit of going to a pawnshop?

The basic principle of operation is the issuance of money exclusively on bail. The amount issued is always lower than the actual cost of the item. Therefore, the deal is beneficial for the credit institution.

Two important advantages for a potential borrower.

- Efficiency. Even microfinance organizations are not able to compete with pawnshops in this indicator - they don’t count the scoring score and don’t ask for “any income certificate.”

- Minimum formalities. In fact, they are limited to the execution of two standard documents - a pledge ticket and a loan agreement. Filling out the prepared forms takes 2-3 minutes.

How profitable would it be to sell the ring to a pawnshop? Product price. What does it consist of?

First of all, the price of the jewelry will, in total, consist of:

- product mass;

- quality and cost of metal (alloy);

- artistic value;

- presentable appearance;

- cost of the stone.

Also, the amount may vary depending on the terms of the contract and its duration. What is this in practice? For example, when a ring is left as collateral for a long time, the loan amount received by the client will be slightly less than that issued under a short-term agreement, with the product being redeemed in a few days.

What does it mean to pawn a thing?

Pledge is a type of guarantee, a way to secure the financial obligations of the borrower. Its concept is defined in Article 334 of the Civil Code of the Russian Federation.

Civil Code of the Russian Federation Article 334. The concept of pledge

By virtue of the pledge, the creditor

under an obligation secured by a pledge (the pledgee)

has the right, in the event of non-fulfillment

or improper fulfillment by the debtor of this

obligation, to receive satisfaction from the value of the pledged property (the subject of the pledge)

preferentially before other creditors of the person who owns the pledged property (the pledgor).

In cases and in the manner provided by law, the pledgee's demand may be satisfied by transferring the pledged item to the pledgee (retaining it with the pledgee).

The pledgee has the right, in preference to other creditors of the pledgor, to obtain satisfaction of the claim secured by the pledge also at the expense of:

- insurance compensation for loss or damage to the pledged property, regardless of whose benefit it is insured, unless the loss or damage did not occur for reasons for which the pledgee is responsible;

- compensation due to the pledgor provided in exchange for the pledged property, in particular if the pledgor's ownership of the property that is the subject of the pledge is terminated on the grounds and in the manner established by law, due to seizure (redemption) for state or municipal needs, requisition or nationalization, as well as in other cases provided by law;

Read completely

Source

The procedure for the practical application of collateral is regulated by §3 of Chapter 23 of the Civil Code of the Russian Federation.

Simply put, if a person takes out a loan from a pawnshop and does not repay it on time, the right to dispose of the pledged property passes to the creditor - the pawnshop can sell the item or, for example, rent it out.

A typical example of collateral is a mortgage. But here the debtor’s obligations are secured not by valuables, but by real estate - an apartment, a garage. Registration of such a pledge requires mandatory registration with Rosreestr, and therefore a mortgage is a complex and lengthy process. Working with a pawnshop is easier and faster.

The pawnshop has the right to accept only movable property from the client. Only banks and microfinance organizations are engaged in registering real estate as collateral.

How safe is it to go to a pawn shop?

The procedure for how a pawnshop operates is regulated by Law No. 196-FZ.

Pawnshops belong to the microfinance services market. Therefore, their activities are controlled by the Central Bank of Russia. The official website of the Central Bank contains a register of pawnshops legally operating in the country. Presence on this list is a guarantee of safety.

Mandatory requirements:

- The presence of the word “pawnshop” in the name and any advertising of its offices and services. Only companies included in the register of the Central Bank can use the term

;

- Opening hours: opening no earlier than 8 am, closing no later than 8 pm. A pawnshop CANNOT operate around the clock - this is a violation of the regulator’s requirements;

- A limited list of activities: issuing loans, storing pledged items, providing information and consulting services. Everything else is prohibited;

- Prohibition on any use of things that are registered as collateral before the expiration of the payment period. It's simple: the ring cannot be worn, the TV cannot be turned on, the car cannot be driven and it must have insurance, buy VSK insurance ;

- Submission of reports to the Central Bank of Russia. Forms and a list of documents were developed by the regulator specifically for persons conducting pawnshop activities.

- Protection and security of the property provided as collateral from damage and illegal actions of third parties.

- Mandatory insurance of property accepted as collateral. Moreover, the insurance is paid by the lender himself.

Our services

Sale of property or bankruptcy on a turnkey basis - from 7,900 ₽/month.

Legal support for bankruptcy - from 88,000 ₽

Preparation for the extrajudicial bankruptcy procedure - 15,000 ₽

Before handing over an item to a pawnshop, check the company in the Central Bank register. It’s easy to do this today, even from a mobile device with Internet access. This simple protective measure guarantees the safety of the client’s property and the confidentiality of his data.

The danger of underground pawnshops and microfinance organizations is that fraudsters can use a copy of your passport to apply for loans and microloans.

What types of pawn shops are there?

Pawnshops can be universal or specialized

. The first accept an extensive list of things that have value, without restrictions. The latter are focused on a specific type of asset. Specialization provides more favorable conditions, so let’s take a closer look.

Pawnshops are classified according to the type of things that are accepted as collateral:

- Jewelry.

The most common type of legal entities conducting pawnshop activities. These organizations are registered with the Federal Assay Chamber, maintain special records of precious metals, and report according to 115-FZ. Detailed information is provided on the official website of the department.

- Household and computer equipment.

We are talking about mobile phones, televisions, microwaves and other similar items.

- Fur

, including hats, fur coats, vests.

- Antiques

, art objects, luxury items. Includes selected items of increased value, such as antique furniture, Swiss watches, paintings and old books. Typically there is an appraiser, art expert or antique dealer on staff.

- Cars.

Car pawn shops have become widespread in recent years. Not all of them work legally. A mandatory condition for granting a loan is the seizure of the car and subsequent storage of the vehicle in a parking lot owned by the pawnshop. Such requirements are contained in Article 7 (clause 1) of Law No. 196-FZ.

When choosing a pawnshop to receive, take into account additional requirements for the type of specialization. Otherwise, there is a high probability of running into an ordinary microfinance organization or even scammers.

What affects the price of a stone or product?

We accept cut and polished diamonds from 0.50 carats and above, as well as jewelry with a large scattering of precious stones. You can purchase the product in any traditional store, but selling a diamond ring can be difficult.

Private buyers are offering too little for it. Transactions with resellers will be extremely unsafe. By contacting us, you are guaranteed to receive a decent amount.

When assessing, we pay attention to the following factors:

- appearance and absence of defects;

- fineness and weight of gold;

- carat, clarity, color, cut of the gemstone;

- method of fastening the stone;

- availability of certificates;

- product design;

- brand, manufacturer.

Buying a diamond ring in Moscow is possible if you provide a passport of a citizen of the Russian Federation. The presence of documents and branded packaging can significantly increase the price. With us you can donate diamonds as part of rings and other jewelry or separately.

| Types of cuts | Cost, rub.) | ||

| 0,3 carat | 0,5 carat | 1 carat | |

| Round | up to 45,000 | up to 60,000 | up to 500,000 |

| Fantasy | up to 30,000 | up to 45,000 | up to 350,000 |

Rate this product

The difference between a pawnshop and a consignment store

Do not confuse a pawnshop with a consignment store. The first one issues loans secured by things. Its activities are controlled by the Central Bank and a special Federal Law.

The commission does not issue loans. The store helps the client sell the item and takes a commission for it, or buys the item itself and sells it on its own behalf.

The basic difference is that a pawnshop allows you to return the collateral, for which it is enough to repay the loan with interest. He does not have the right to sell the pledged property before the expiration of the time specified in the agreement with the borrower.

How to sell gold to a pawnshop without redemption

There are 2 options for pawning gold jewelry at a pawnshop:

- the institution issuing a loan secured by your jewelry;

- sale of gold without return.

There are different rates for pledging and selling.

If you want to hand over the ring to a pawnshop with subsequent redemption, then pay attention to the history of the pawnshop. After all, if it turns out that the organization was recently created and has no experience or reputation, then by the time the product is redeemed, it may not be there, just like the pawnshop itself.

You can hand over a gold item to a pawnshop without redemption, even if the institution is not engaged in purchasing, because the pledge agreement is valid for no more than a month. If the debt with interest is not repaid in a timely manner, then after another month the pledged product will become the property of the organization and will subsequently be sold, because the pawnshop needs to reimburse the amount previously issued to the borrower.

How is the cost of pawnshop services determined?

The key selection criterion is financial. People are interested in how much the services of a bank, microfinance organization or pawnshop will cost.

What is the cost of a loan from a pawnshop?

No. 1. Loan amount

This is part of the real value of the item being pledged. Usually we are talking about 50-80% of the market price. The appraisal is carried out by a pawnshop employee; in some places the price is higher, in others it is very cheap.

To return the collateral, the borrower needs to repay the loan amount + interest.

No. 2. Interest on borrowed funds

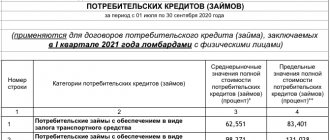

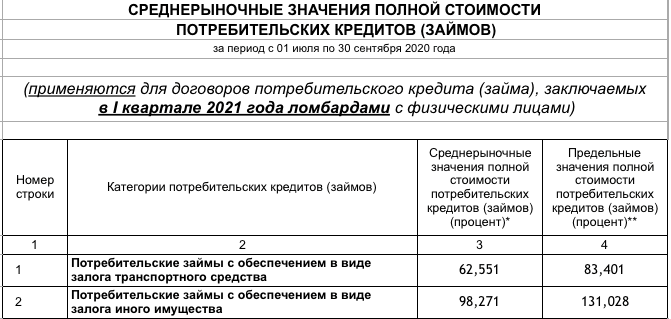

Maximum rates for pawnshops in 2021

The maximum value of this indicator is determined by the Central Bank. The rate is published on the official website in this section.

The average market values of the total cost of the loan given on the page are addressed to different categories of credit institutions, which include pawnshops.

The pawnshop does not have the right to charge its own commissions and payments, or to fine the borrower for delays. The client can appeal such violations to the Central Bank of the Russian Federation.

No. 3. Storing things

This is a separate independent service of pawnshops. The organization has specially equipped storage rooms, which are often empty.

An example of such a service is seasonal storage of fur items or antiques. The owner does not need a fur coat for most of the year. It is easier to give the item for storage to a pawnshop, where optimal conditions are provided - humidity not higher than 65% and temperature below 4 degrees. Plus things will be insured.

Receiving the service is accompanied by a number of mandatory formalities. The first and main one is issuing a personal safe receipt to the client. The document confirms the validity of the storage agreement.

The receipt includes the following details and information:

- the name of the pawnshop and its address;

- Full name and passport details;

- characteristics of the thing being transferred for storage, name, valuation;

- date of transfer of the item to the pawnshop;

- contract time;

- storage conditions;

- cost of providing services;

- payment procedure.

Storage services are not controlled by the Central Bank, but products made of precious metals are kept in safe deposit boxes or special metal boxes. The price list with prices is developed by the pawnshop employees without any restrictions.

The pawnshop receives the right to sell the item transferred for storage after two months from the date of expiration of the contract. Until this time, the client can repay the debt for the service and take back the property.

What rights does a borrower have when collaborating with a pawnshop?

The responsibility of the client of the credit institution is clear - to repay the loan on time and with interest. List of his rights under the law:

- return of the pledged item at any time until it is sold;

- receiving insurance compensation in case of damage or loss of property;

- payment only for the loan amount and interest on it. The remaining services - assessment, insurance, storage - are paid by the credit institution;

- obtaining information about the sale price of the collateral;

- compensation for the difference between the loan and the sale price, if there is revenue;

- confidentiality, compliance with requirements for the circulation and storage of personal data;

- receiving a pledge ticket and, if issued, a loan agreement;

- appealing violations to the Central Bank of the Russian Federation.

How to pawn things in a pawnshop correctly and without risk?

To get a loan quickly and without problems, you need to follow the recommendations.

The first and main thing is to first check the organization in the register of the Central Bank of the Russian Federation.

The second tip on how to use a pawnshop concerns documents. Basic is a security ticket that actually replaces a full-fledged loan agreement. It states:

- personal and contact information of the pawnshop and the borrower;

- description and valuation value of the collateral;

- loan amount and duration;

- interest rate;

- conditions for early repayment of debt;

- possibility of withdrawal of collateral.

The third recommendation is to fulfill your financial obligations. The money must be paid on time and with interest if you intend to return the pledged item.

How do you pay for pawnshop services? Cash on receipt.

If the debt is not repaid, after a month the collateral is put up for sale. It is not always possible to sell an item quickly, and the borrower still has the opportunity to repurchase the property. Mandatory requirements - repayment of debt with interest.

Some pawnshops cooperate with BKI. In such a situation, non-repayment of the loan worsens the credit history - information about the delay will be reflected in the CI and will reduce the credit rating.

When finances are difficult and you have nothing to pay off your loans, you don’t have to pawn your last loan at a pawnshop. This way you will not get rid of debts, but simply postpone the problem for a couple of months. If the loan debt is more than 350 thousand rubles, you can write off the debts through personal bankruptcy. This is absolutely legal, official and correct in a situation where your income is not enough to pay at least 10% of the debt per month.

Call the lawyers. We will tell you what bankruptcy is, whether it is suitable for your situation, and what options there are to deal with banks and debt collectors in your specific situation.

How does the ring buyback deal work?

- Consultation. Please clarify all your questions and terms of service:

- by calling us at +7 (968) 039-66-77;

- by writing to online chats Viber, WhatsApp.

- Jewelry appraisal. Specialists will quickly and efficiently examine the diamond ring, taking into account all the features (size of the stone, its purity and quality). You can also use the service of an appraiser visiting your home.

- Payment of funds. We issue money immediately: cash, transfer to a bank card, bank transfer. We would like to draw your attention to the fact that the history of your gold ring with a diamond will remain within the walls of our organization. We guarantee you 100% confidentiality at every stage of the transaction.

Request a call