I am glad to welcome readers of our resource again, and we are talking about gold again. The purpose of writing this article is to consider how the gold rate has changed over 10 years. Let's talk about what factors and to what extent influence its value and how to conduct a preliminary analysis of changes in its course for the future.

The role of this metal can hardly be overestimated: it is a unique reserve currency, which is also a commodity. An increase in its production does not lead to inflation and depreciation, as happens with any other monetary unit.

Gold cannot turn into a useless piece of metal - in almost all cultures, jewelry made from it is a favorite among women and men, and its physical properties make this substance indispensable in the production of electronics, high-precision optical instruments, medicine and many other industries.

Gold rate for today

The main benefit of investing in gold is that this method of investment makes it possible to preserve your finances even during a period of serious economic crisis and high inflation in the country. You can find out the cost of one gram of bank gold on a specific day on the official website of the Central Bank of the Russian Federation. On average, at the moment the rate fluctuates and is about 1320 rubles per 1 gram (information as of the beginning of July 2021). Price dynamics largely depend on what the situation will be on the global gold market. The course is quite “sensitive” to various kinds of economic and political changes in events taking place on the world stage.

What is the gold market

The gold market is a comprehensive and multifaceted concept that includes all aspects of the circulation of the yellow metal and its circulation in the system of a particular state entity or the global economy as a whole.

This term may include:

- production;

- world settlements;

- hoarding;

- investing and hedging;

- trading, etc.

Gold rate: forecast

Over the past 10 years, the dynamics of gold prices have demonstrated themselves quite clearly. Back in the early 2000s, you could buy an ounce of gold for 270-290 US dollars. By 2011, this amount had increased to $1,600. In 2021, prices “rose” again. A slight drop in gold prices was observed after the global financial crisis of 2008. However, the development of the situation in the Middle East, the war in Ukraine, and the destabilization of the Eurozone due to the default in Greece caused a new rise in gold prices. Another “leap” is expected in the near future.

The gold rate is quite “sensitive” to various kinds of economic and political changes and events taking place on the world stage.

Gold in a rising dollar atmosphere - World Gold Council

Market analysts seem to agree on two things: first, that a strong dollar is bad for gold, and second, that the dollar is likely to continue to rise in value. We can agree that a strong dollar can put pressure on gold, but analysts at the World Gold Council (hereinafter - WGC) believe that the dollar/gold relationship is asymmetric: the price of gold rises more in a weak dollar than it falls in price in a strong dollar . Additionally, history shows that the benefits of owning gold for investment portfolios outweigh the challenges created by a strong dollar. Gold is stable, given good supply and demand indicators, increased geopolitical risk and decreasing returns on risky assets. In addition, pressure on the dollar will also increase as we move towards a multi-currency world.

The US dollar is an important - but not the only - factor influencing gold

It is always easy to analyze any phenomenon in terms of “good and bad”. The saying “what's good for the dollar is bad for gold” is no exception. However, the actual situation on the gold market has many more nuances and sides. We can agree that as long as the dollar continues to rise, the gold rate will be constrained. However, the relationship between the dollar and gold is more complex today than in the past. The current situation is different from what it was during the 1970s-1990s. and will likely continue to change. The current macroeconomic environment is characterized by unprecedented monetary policy, low rates, high equity prices and the prospect of deflation in many parts of the developed world. In addition, the influence of emerging markets has increased and we are slowly but surely moving towards a multi-currency financial system. While the dollar remains an important factor for gold, its influence is likely to diminish. The World Gold Council analyzed the dollar/gold ratio to better understand what to expect in the short term. We present the conclusions of this analysis:

— The dollar may rise in the short term, but growth will soon slow down. It is known that the dollar has reached multi-year highs over the past 12 months. This is partly due to US economic growth and differences between US monetary policy and other parts of the world. However, the pace of dollar appreciation will be constrained by the low growth potential of the US economy and the consequences of a prolonged period of low real interest rates;

— Despite the strengthening of the dollar, prospects for gold remain stable. According to the VZS, gold production will remain limited, which will put less pressure on demand and support the rate. Moreover, the benefits of lower oil prices for consumers may be outweighed by geopolitical instability and credit risk - an atmosphere in which gold takes to the waters. Moreover, stock and bond prices continue to show an imbalance between risk and return, prompting investors to seek alternative assets;

— owning gold has great benefits, even despite the consequences of a stronger dollar. VZS research shows that investors still prefer to make strategic holdings of gold, even with the most modest forecasts for its growth, even when the dollar is rising and US stocks and bonds are predicted to surge in prices;

— the dollar/gold ratio continues to develop. Changes in global markets and gold market structure should reduce the dollar's influence on gold in the long term. And while the fact that gold is denominated in US dollars attracts a lot of attention, the significance of this fact is exaggerated.

The dollar may increase in value, but this trend will not last forever

The general consensus is that the dollar will continue to rise in the near future based on the following factors: the expansion of the US economy, the prospect of tightening US monetary policy, weakening economic conditions in Europe and China and some countries dependent on the export of raw materials, loose monetary policy in Japan, Europe and other countries. At the same time, the rise in the dollar will not lead to a serious collapse in the gold rate. And that's why:

— as you know, the dollar reached a 12-year high this year. However, historically, the correlation between the dollar's growth over 12 months and the next year is such that the dollar tends to lose ground. Only in the early 1980s. The dollar increased in value over a long period of time. But this was a period in history with dynamics that are very different from modern ones;

- A flat yield curve suggests that the rate of economic growth is unsustainable. US short-term rates are moving higher, while the long end of the curve is steadily declining. The current yield curve is even lower compared to previous dollar rally years. The data reflects widespread uncertainty in the market about long-term growth and the prospect of high inflation in the future - ideal conditions for raising rates and holding down the currency - as both authorities and market analysts say. Weak growth in Europe and China, among other regions, is partly to blame for the dollar's strength and will likely weigh on U.S. economic growth.

— The Fed will move cautiously, while increasing debt will remain an acute problem. The Fed has made it clear that its policy depends on economic data. Such a policy, by definition, involves a time lag. In this case, real rates will remain low - which, in turn, should stop the dollar from rising. In addition, Fed officials expressed concern that weak growth in other key countries and a stronger dollar could slow the US economy. In addition, and not just in the US, high levels of government debt keep interest rates from rising, preventing borrowers from being able to repay their debts. Containing interest rates should also slow the dollar's appreciation.

Further increases in dollar strength could lead to corrections, but not shocks

Steady dollar growth will not necessarily lead to further weakening of gold. There are other factors that support gold even with a strong dollar. GZS research shows that, as is often the case with gold, the factors are complex and it is easy to fall prey to misconceptions. While a strong US dollar may continue to weigh on gold, there are many factors limiting its impact. But first, let's talk about the myths associated with the dollar/gold ratio.

Myths and misconceptions regarding the dollar/gold ratio

You can often hear from market participants that the basis for the dollar/gold ratio is that the gold rate is expressed in dollars. There are two main problems with this statement. While it is true that the gold rate is often “expressed” in dollars, the rate is not dictated by the dollar. The dollar/gold ratio corresponds to the dollar's position as - as some say - a reserve currency. Additionally, it is necessary to consider the supply and demand implications of gold, which are expressed in dollar terms. From a demand perspective, the exchange price of any homogeneous commodity (gold, oil, etc.) is less important to investors and consumers than the price paid for it in local currency. On the supply side, the relative strength of the local currency can have an impact on production. Professor Martin Feldstein from Harvard University showed how this works using oil as an example. In his opinion, the local oil price moves against the dollar, which reflects its movement against the local currency. Thus, a decrease in the dollar price of gold (for example) only affects the change in the exchange rate of the dollar relative to the price of the local currency.

A strong dollar is a relative term, especially when it comes to gold

It is common to talk about the appreciation or depreciation of a currency in such a way as to give the impression that the exchange rate is almost a completely independent variable. In fact, currencies can strengthen against some currencies and move in the opposite direction against others. In order to properly measure the strength of a particular currency, investors rely on indices, which record the relative strength of a given currency relative to various other currencies at the same time. In the case of the dollar, a popular benchmark is the trade-weighted dollar index created by the Fed. However, the index's performance is heavily weighted by the dollar versus the euro or Canadian dollar (large trading partners) but has little regard for the Indian rupee or Turkish lira (smaller trading partners). But to truly understand the relationship between the dollar and gold, it is more relevant to measure the strength (or weakness) of the dollar relative to the currencies of countries with higher levels of gold demand. For example, measuring the value of the dollar against the Indian rupee will be more appropriate than measuring the value of the US dollar against the Canadian currency.

The market always predicts a strong dollar

In our opinion, the current gold price reflects market expectations for a stronger dollar, but the dollar's upside potential may be limited. Most analysts do not expect the euro to fall below parity against the dollar. However, certain events may occur that could cause the dollar to spike, such as the breakup of the eurozone or the default of dollar-denominated loans. However, these types of events usually increase the demand for gold, since it is a store of value. There are also other currencies that are important to the gold market, such as the Indian rupee, which has the potential to appreciate, or the Chinese yuan, which is increasingly moving away from the dollar.

Gold production has decreased now compared to periods of strong dollar

In the early 1980s. and the mid-1990s, when there was also a large rise in the dollar, the gold rate declined. But in those years, strong production growth became an additional factor of pressure on its rate. Production grew at an annual rate of 8.3% during this period, compared with a rate of 0.9% in other years. At the same time, net sales of gold by central banks increased by 16.3%, while in other years the same figure fell to 1.3%. Currently, while the dollar is strengthening, gold production is unlikely to rise to 1980s levels. In recent years, total gold production (including refining) has decreased. In this case, the gold market receives support:

— the supply of processed gold is constantly decreasing. In 2009-2014 it fell to a seven-year low, falling by more than 600 tons;

- gold production may level off next year as supply increases from gold mining companies that have developed during a period of higher gold prices;

- While gold exchange-traded funds can serve as a source of gold supply, it is unlikely that there will be a large-scale outflow of shares from them in the near future. Most tactical and speculative investors have exited the market, leaving only strategic investors in gold ETFs.

Gold's Position in a Rising Dollar

Historical Perspective on Gold's Conditions During Various Dollar Regimes

The US dollar is by no means the only factor influencing gold, but in the absence of major changes among other factors, investors are focusing their attention on the dollar/gold ratio. It is interesting to look at periods in which a similar situation was observed to analyze the movement of the gold rate in relation to how quickly the dollar rose or fell. Let's take a 40-year period for analysis (from January 1973 to December 2014; see table) and divide the dollar movement based on the following three categories:

— fall: the dollar depreciates by more than 2% over a 12-month period;

- slight dynamics: the dollar moves up or down by 2% over a 12-month period;

- growth: the dollar rises by more than 2% over a 12-month period.

Based on the results of the analysis, we can say that gold shows the best dynamics (+14.9%) during the fall of the dollar. Gold also shows growth, although to a lesser extent, when the dollar has little momentum. On the other hand, the gold rate falls (-6.5%) during periods when the dollar rises. Gold typically rises more than twice as much when the dollar falls than when the yellow metal falls when the dollar rises. Additionally, gold's correlation to equity markets and commodities tends to be below average during periods of rising dollar. This becomes important in the context of a balanced portfolio because the dollar is not as significant from a diversification perspective.

Table 1: The dollar/gold relationship is not symmetrical: exchange rate

gold doubles during dollar weakening

Average annual gold performance statistics from January 1973 to December 2014

| Conditional Analysis | ||||

| All period | Falling dollar | Nebol. dynam. | Dollar growth | |

| Profitability (annual) | 6.2% | 14.9% | 7.8% | -6.5% |

| Volatility (annual) | 19.5% | 18.4% | 20.2% | 19.7% |

| Correlation with fund. markets | -0.06 | 0.07 | -0.16 | -0.11 |

| Correlation with commodities | 0.15 | 0.16 | 0.14 | 0.07 |

Source: Bloomberg, World Gold Council

Gold improves the health of an investment portfolio even in a rising dollar

Should investors hold gold in a rising dollar? In our opinion, they certainly should. In the long term, the optimal investment in gold in a balanced portfolio should be from 2 to 10% (depending on risk tolerance).

Moving towards a multi-currency world

In the long term, there is one important development related to the dollar that needs to be considered along with near-term events. This is a downward trend in its rate. Instead of the “collapse” of the dollar that was wrongly predicted many years ago, there are signs of a future transition to a balanced multi-currency system.

Tests for the dollar

In 1971, the US authorities announced that the dollar would no longer be convertible into gold. This marked the end of the Bretton Woods system. Since then, the dollar has floated freely compared to other currencies. In general, the trend is that the dollar is falling in value due to macroeconomic factors - such as falling interest rates, the rise of the euro and emerging market currencies. Despite strengthening over recent years, the long-term downtrend, or at least pressure relative to the uptrend, will gain momentum. Let's look at the factors that put pressure on the dollar:

- appreciation of the yuan. China is now the world's second-largest economy, and its currency is likely to dominate international reserves in the future. As you know, China has entered into swap agreements with 23 central banks. China's importance on the world stage has not yet been fully reflected in its currency. It is quite possible that we will see an increase in the role of the yuan;

— a decrease in the share of the dollar in world reserves. The dollar's share of world reserves has fallen slowly but steadily - from 61% in 2000 to 55% in 2014 - while the euro's share has risen from 15% to 22%. The share of other currencies is also growing, in particular the Canadian and Australian dollars. However, while these currencies are gaining a larger share of global reserves, their effectiveness in diversifying foreign exchange reserves may decline if their central banks' monetary policy actions become more synchronized. Consequently, gold will become a more valuable tool for central banks to diversify foreign exchange reserves.

Once again about the dollar/gold ratio

VZS analysts believe that there are signs of a change in the dollar/gold ratio:

- Demand for gold, not denominated in dollars, is not overly sensitive to dollar movements. Demand for gold outside the United States is not clearly tied to the dynamics of the dollar. China and India account for 50% of total gold demand, with Southeast Asia accounting for another 9%. Demand from China is likely to increase even if the dollar rises or falls in value. Demand from India is more dependent on the volatility of the local currency and cultural factors than on the dynamics of foreign currencies and the global financial situation. The growing influence of East Asia not only in the gold markets, but also in the capital markets as a whole, of course, is unlikely to break, but it will certainly weaken gold's dependence on the dollar;

— Asia is becoming the center of gold trading. The trend of large trade in the yellow metal moving to the East is becoming evident as the global gold market is rapidly developing in Asian countries such as China, Hong Kong and Singapore. Examples of this trend are the creation of the international council of the Shanghai Gold Exchange, the emergence of gold kilobar contracts on the Singapore Gold Exchange, new kilogram gold bar futures in Hong Kong, etc. All of this is likely to lead to more gold trading in other currencies as the gold market becomes less centralized (previously centered on London) and more regional, networked.

The Dollar Matters, But It Doesn't Determine Gold's Value to Investors

While dollar strength may put additional pressure on gold in the short term, as long as the strength is not too great, the benefits of owning gold in an investment portfolio will remain significant. Over the medium term, demand from the East and limited production will provide support for the gold market. And finally, in the long term, VZS analysts believe that the dollar’s influence on the gold rate will decrease as other currencies begin to challenge the dollar’s leading position as the world’s only reserve currency.

Gold buying rate

Please note that the purchase rate for gold will always be influenced by the exchange rate of world currencies and, in particular, by the US dollar. There is a certain correlation between gold prices and the value of the dollar. As a rule, it is inversely proportional. In other words, as the dollar rate rises, the cost of an ounce of gold decreases slightly. When it falls, it grows. World gold prices are fixed in US dollars. Accordingly, if in Russia the value of the national currency decreases against the dollar, prices for purchasing gold in rubles will increase.

Factors that influence the rise or fall of the exchange rate

I highlight one single factor: the ratio of supply to demand. Everything else is the consequences of changing this ratio. Let's take a closer look at how this works.

Lyudmila PesterevaOur most experienced gold investorAsk a questionThe 2008 crisis was the result of gross financial fraud with securities of American bankers. The natural economic reaction to this would have been a collapse in the value of the dollar, which is what happened initially. But by integrating the dollar into the economies of other countries, the United States imported its inflation into other currencies, and the value of the dollar did not fall too much.

However, this did not add confidence to him, and since 2008 there has been a persistent trend: states are increasing the share of 999 precious metal in their gold and foreign exchange reserves. Demand increases and so does the price.

Political aspect: refusal of some states to use the dollar as a reserve currency in settlements. Each country is equally interested in strengthening its currency, and it is not easy to agree on who will pay with what. Why not use metal? As a result, the demand for it will increase, and hence its exchange rate.

There is no permanent growth for anything on the stock exchange. This is due to the colossal influence of major players on the market - they are the ones who make the difference. In order to bring down the quotes of a particular commodity, be it stocks or precious metals, a player, sometimes in tandem with other interested parties, can drain a certain amount of an asset, provoking its fall due to a glut of supply in the market, in order to then buy it cheaper and make money.

This fact is indirectly confirmed by the fact that on the stock exchange transactions in which the object is physical metal occupy barely a tenth, the rest is securities, essentially not backed by precious metals. Dummies, but they really change the value of gold.

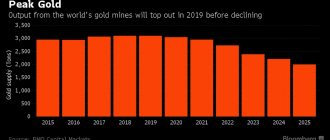

Another indicator of the stability of gold is its finiteness as a resource. Deposits are being depleted, reserves are drying up and, according to expert forecasts, gold mining volumes will steadily decline in the coming decades.

The invention of a cheap method of extracting the precious metal can have a huge impact on the price of gold. So, in 1947, after successful experiments on the transmutation of mercury isotopes into gold, the price of gold collapsed - holders hurried to get rid of the asset, which, in their opinion, was about to depreciate. But parity was just as quickly restored after it was announced that this method of production did not pay off at all.

Gold selling rate

For those planning to invest money in gold, keep in mind that this does not need to be done before Thanksgiving in the US, before the Christmas holidays in Europe and America (from December 25). In addition, in September the demand for jewelry usually intensifies, and accordingly, the gold selling rate also increases slightly. Prices may also increase on Chinese New Year's Eve. These are annual exchange rate fluctuations. They depend little on major changes in the economy and politics.

Advice from Sravni.ru: buy and sell gold only on official exchanges or through banks.