Today, the economy of any state is supported by gold and foreign exchange reserves, in the form of gold bars of the highest standard. Whatever economists say, the planet’s main precious metal remains a measure of the economic and financial strength of any country. Therefore, any government strives to replenish this precious fund by constantly purchasing physical bullion on the London Stock Exchange, from gold mining companies and international “gold” markets.

The main holders of the strategic currency in our country is the Central Bank, which stores about 60% of the bullion in a special safe room located on Pravdy Street in Moscow. The total number of accredited branches distributed throughout the country exceeds 600 payment centers. Russia's gold reserves today (mid-2021) are about 2,150 tons of refined gold. For comparison, in 2011 the country had at its disposal only 793 tons of “metal guarantor”. It will be interesting to see how this figure has changed over the past hundred years.

Back to the past!

Gold has been accumulated in Russia since time immemorial. However, as a strategic state reserve, this currency began to be purposefully acquired only with the advent of the capitalist era - in the mid-19th century. In 1865, the amount of precious metal stored in state banks was 57 tons. By 1914, the empire's gold reserves were the largest in the world and amounted to 1,311 tons, which at the current exchange rate is equivalent to $60 billion. The First World War pretty much devastated Russian storage facilities. But at the time of the October coup, the precious reserve amounted to about 850 tons of gold, silver and platinum bars.

The Bolsheviks did not possess the state wealth that had fallen on their heads for long - on August 7, 1918, a dashing attack by the infantry detachments of General Kappel allowed them to capture Kazan, and with it hundreds of boxes with precious bars. But already at the end of autumn 1918, the gold of the Russian Empire temporarily disappeared from the sight of historians. At that historical moment, neither the Bolsheviks nor Denikin’s army really knew where Russia’s gold reserves were currently located. Only later did it become clear that most of the ingots were transferred to Admiral Kolchak, who declared himself the Supreme Ruler of the rebellious country.

However, when the Bolsheviks drove the White Guard troops beyond Irkutsk in 1920, and Kolchak himself was shot, about 180 tons of gold were never found. This mysterious story still has more questions than answers. However, the new Bolshevik government received at its disposal most of the gold reserves of Imperial Russia - about 650 tons.

The subsequent confusion with the financing of the world revolution and chaotic purchases abroad quickly exhausted strategic reserves. Moreover, equipment and machines were sold to the Soviet Republic at prices that were several times inflated. The stock also suffered greatly from the indemnities paid to the Germans under the Brest-Litovsk Treaty and after the failure of the Polish Company in 1921. Therefore, already in 1928 the country’s gold and foreign exchange reserves amounted to only 150 tons. Stalin, who had come to absolute power at this time, perfectly understood the importance of this metal for the economy and prestige of the young workers' and peasants' state. Through the efforts of a number of ministries and the labor of hundreds of thousands of prisoners, the gold reserves were quickly replenished. And already in 1941, 2800 tons of gold bars were stored in the Goskhran safes.

The Second World War and Lend-Lease, for obvious reasons, led to large expenditures of gold and foreign exchange government savings. But even after all the difficulties, by 1953 Russia's gold reserves amounted to 2,500 tons. But after perestroika and the collapse of the USSR in 1991, the main guarantor of economic stability was represented by only 290 tons.

Why does the state acquire and store monetary gold?

Storing a certain amount of yellow metal by the state makes it possible to ensure purchasing power. Among state assets there are technical insurance reserves, debt obligations, precious metals, securities and national currency. At the same time, monetary physical gold in its volume must balance the paper money supply in circulation. Financial government reserves directly depend on its quantity and value on the world market.

To increase the reserve of monetary gold, ODKR purchase it from private gold mining companies and commercial banking institutions. Purchases can be made both on the domestic and international markets. At the same time, acquisition transactions from foreign partners are not considered foreign trade commercial operations.

Features of Russia's gold reserves

★ The main format of the gold and foreign exchange reserve is 999 gold bars weighing 10 kg. However, existing standards provide for the storage of ingots weighing from 100 grams to one kilogram.

★ Gold is stored in special wooden boxes located in rooms with a stable microclimate. Here, in plastic boxes, banknotes of currencies of different countries are stored, which, according to the regulations, are periodically exchanged for new banknotes.

★ The storage security system is based on innovative tracking and control technologies. Periodically, surprise checks are carried out in the form of unauthorized entry attempts. The ultra-reliable protection of the premises in which Russia's gold reserves are stored is the reason for the openness of information about the location of these storage facilities.

★ Refined gold bullion is purchased primarily from domestic producers for rubles (about 76% of total purchases), which allows saving foreign currency and supporting Russian gold mining enterprises.

★ Foreign currency reserves have shifted significantly since 2014 from the US dollar (minus $101 billion) to the Japanese yen (from 0 to $20.6 billion) and the Chinese yuan (from $23 billion to $67 billion).

Monetary gold and requirements for it

A monetary precious metal can be gold in the form of bars, coins or plates, which has undergone refining to remove impurities and has a purity of 995 to 1000. The bullion metal must meet the requirements of the world standard “Good Delivery”.

Reserve gold reserves may also include OMS (unallocated metal accounts), which allow you to claim yellow metal with the appropriate quality characteristics if necessary. The Central Bank of the country is responsible for storing all such assets.

The future of Russian gold and foreign exchange reserves

For seven years now, our country has been the leading buyer of this precious metal. The answer to the question of how much gold reserves Russia will have at its disposal by the end of 2021 can be found in the following figures. In 2021, the Central Bank of the Russian Federation purchased a record number of gold bars - 273 tons. This allowed the country's main financial institution to accumulate 18.8% of all international gold and foreign exchange reserves. In 2021, the Central Bank purchased 201 tons of gold, and in 2021 – 223 tons.

If the dynamics of precious metal purchases continue, then we can expect that by the end of 2021, Russia’s gold reserves will be at least 2,400 tons. Such an impressive volume will allow our country to reach fourth place in the ranking of gold and foreign exchange leaders, surpassing France.

In conditions of instability of the world's leading currencies and fluctuations in oil prices, gold is becoming the main tool for Russia to diversify foreign exchange reserves. However, there is an important nuance here. Unlike “paper” or electronic currency, gold is quite difficult to sell. Currently, it is used mainly as a guarantee for international lending. Nevertheless, the main precious metal of our civilization will continue to replenish Russian storage facilities, strengthening the position of the ruble and the economy as a whole. Finally, it is worth noting that all the figures presented are public information. In fact, real statistics regarding gold and foreign exchange reserves continue to be a state secret.

American reserves

America's gold was originally collected during the Great Depression, when, according to the decree on the nationalization of the precious metal, the population and all organizations were required to hand over the gold at their disposal at a price of just over $20 per troy ounce. During the Second World War, reserves of the precious metal grew to astronomical figures by today's standards of 20.2 thousand tons. This gold was actively spent in subsequent years to stabilize the American currency.

One of the most famous facts in the history of the Bretton Woods financial system, which presupposes gold backing of every dollar, was the actions of de Gaulle, who led France in the 60s of the last century. De Gaulle sent a military cruiser loaded with paper dollars to the shores of the United States with the intention of exchanging them for gold. Such behavior not only did not suit the Americans, but also created a dangerous situation where other countries could put forward the same demands. De Gaulle did not succumb to US intimidation and issued an ultimatum to the American authorities, saying that if the dollars were not exchanged for metal, France would expel US and NATO bases from the country.

De Gaulle's behavior cost him in the following years in upheavals within the state and ultimately in the loss of power, but French gold was returned to the country, becoming the basis of a stable and independent economy.

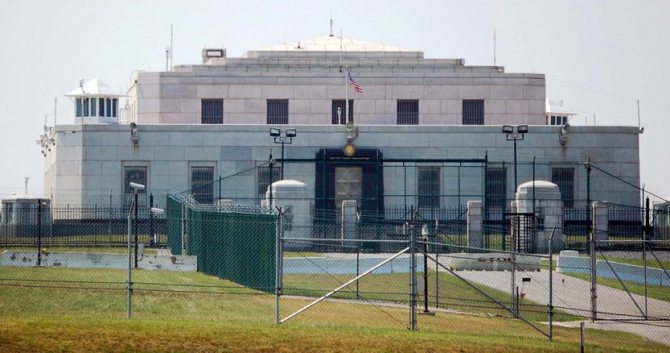

Whose gold is currently stored in the USA? American vaults contain not only bullion owned by the United States, but also gold from 60 other allied countries. The most famous vaults in America are Fort Knox, West Point and the Federal Reserve vault. Some states store their precious metal reserves partially in the United States, others completely. No one can say what the volume of these reserves is, since official data is not published anywhere. An audit that could confirm the real volumes of gold was carried out more than 60 years ago. Today, Americans do their best to avoid the possibility of carrying out a similar check.

Stages of demonetization

The yellow metal received the status of the world's main money in 1867. Previously, both gold and silver acted in this capacity. Legally and actually, the precious metal began to lose its monetary properties immediately. This process is called "demonetization".

The International Monetary Fund's bylaws do not include any obligation to refer to gold in determining currency rates and ratios. There is also virtually no official price for the yellow metal. However, demonetization and the controversy surrounding it did not in any way affect the very essence of the precious metal, which continues to remain a key instrument of financial and economic international policy. Almost every country has its own reserves of monetary physical gold, which help mitigate the consequences of risks and shocks.

to the list

So how much gold does China really have?

Posted by Matt Insley

It's surprising that no one talks about this.

“Demand from China is strong,” they say. “China will soon overtake India as the world's largest gold consumer,” they add. “Import volumes are growing year after year,” and so on.

But no one in the major media even hints at what the situation really is. China is accumulating gold at a rate never before seen - like modern-day conquistadors. Only today, unlike the era of geographical discoveries, it is more difficult to find traces of ships filled with gold.

But this is a very large purchase. And despite the fact that the major media refuses to cover this story, we will try to establish how much gold China has.

The essence is in Chinese mathematics.

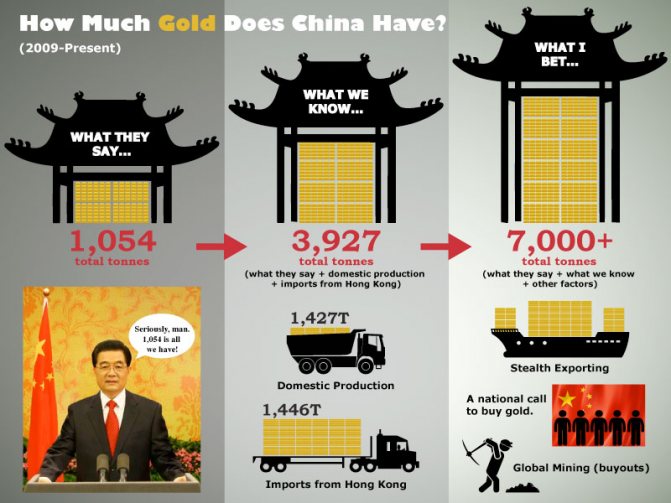

Let's remember that the last "official" statement regarding Chinese gold reserves was made in 2009 and it mentioned 1,054 tons. Compared to the previous statement on the same topic made in 2003, the new results showed an increase of as much as 75%.

Much time has passed since the last official statement and Chinese reserves have undoubtedly increased significantly. When we wrote about this a year ago, we estimated that China's gold reserves totaled 3,300 tons of gold, which is about three times the current "official" reserves.

And today the Middle State has definitely accumulated much more metal. Just look at the dynamics of gold imports into China over the past 12 months...

Buying on declines: import of gold to China from Hong Kong in tons

As you can see from the chart, and if you read Agora Financial you already know this, the volume of gold imports from Hong Kong has risen sharply recently. Last year an absolute record was set.

But that's only part of the story. This morning I decided to add up all imports to production to get a clearer picture of how much gold China actually has.

Since the last official announcement, we should add another 2,873 tons to China's official gold reserves just to account for imports and domestic production. This would bring current “known” reserves to 3,927 tonnes , far greater than those of Germany, the world's second largest owner of gold.

And do you think Germany is alarmed? Yes sir! Where do you think the news came from earlier this year about Germany's audit of gold reserves and the repatriation of some of its gold held outside the country? The essence is in Chinese mathematics!

But that's not all.

When you add up the secret, untraceable sources of gold - black market metal from Africa and South America (and possibly Iran), the volumes of gold mined around the world by Chinese parastatals, and China's campaign to buy gold from its citizens - you see the size of the Chinese hoard. — 7,000 tons or even more!

My calculations say China is sitting on a 7,000 tonne cushion of gold today. Much of it is made up of "secret" purchases that the major media don't dare talk about: secret exports, potential nationalization of citizens' gold, and gold transfers from mining mergers and acquisitions. - and these are just a few of them.

This is how all this can be imagined. The United States is currently tightening sanctions against Iranian oil exports.

The US is making a huge effort to limit the flow of money into Iran, so there are experts inside the US who are also looking at this problem. But even with all the press coverage and government measures, you don't think Iran is actually stopping oil exports?

I don't think so. "Official" export volumes are undoubtedly declining, but huge amounts of Iranian oil are pouring into the market through the back door.

Let's return to our Chinese discussion. There are no sanctions against Chinese gold imports, and no government agencies interfere in Chinese gold policy.

And if Iran can export oil to places we don't want, just imagine what China is doing behind the scenes and the US government isn't even looking at it! The amount of gold flowing into China under the radar from Africa and South America is potentially staggering.

Just name any African country with gold in the ground and I'm sure there are Chinese citizens digging in the ground, or at least setting the stage for black trade deals.

After all, to turn the world gold market upside down, all you need is a small boat. But I will say with confidence that the Chinese do not sail to the golden African countries on small boats, they appear there on container ships. Several at once.

And here is a little story from life...

A few years ago I sold my old car. During the process, various “colorful” people came to see me. They tried to lower the price or offer an “exchange” - my God, whoever you see on the Internet today. But in the end I sold my old, beat-up car for the highest price. And the buyer was happy with the purchase.

After completing the paperwork, I asked him who he bought it for - himself or his family - he said no.

“I’ll send it on a container ship to Africa, there’s a huge market for old cars and it’s one of the most popular models,” he said. I thought I sold my car to a high school student and it would go overseas!

How does this relate to China?

Believe it or not, the developing world wants to develop further. Whether we are talking about old cars or cheap Chinese consumer goods, they are willing to pay (good) and even gold money for imports.

And there is plenty of consumer goods in China - go to your local supermarket.

I write this and shake my head. Just imagine a container ship filled with all sorts of cheap stuff - plastic soccer balls, Barbie-like dolls, tool kits and the like. After unloading off the African coast, this ship certainly does not return to China empty. It is increasingly being filled with local resources that China desires, including GOLD.

So China gets a lot more gold than we think - I'm sure they have thousands of unaccounted for tons of metal. China officially states that they have not added an ounce of gold to their reserves in four years! This is ridiculous. And it is beneficial for those who see where we are heading.

Everything is adding up. China is the world's largest gold miner and gold importer. But its official reserves have not grown in nearly four years.

It's like the nasty guy at the poker game hiding his chips in his lap as he prepares to throw. But unlike poker, the stakes on the global foreign exchange market are much higher.

So do some Chinese math. And by the way, how much gold do YOU have?

Unverified data on Chinese gold

According to the most conservative estimates, if we add up production and official imports, at least 10 thousand tons of “yellow devil” are hidden in the storage facilities of this country. Until 2010, the main value of government savings was US dollars and US bonds. Apparently, the 2009 crisis dramatically changed the strategy of the Chinese government, which decided to diversify its foreign exchange reserves by investing in the most reliable asset of our civilization.

All import operations in recent years have been carried out through Hong Kong. In 2015, more than 1,300 tons were imported, and if we sum up all imports since 2010, then more than 5 thousand tons of precious metal were imported into the territory of the PRC.

The Celestial Empire completely lacks gold exports. This means that all gold bars, coins and jewelry entering the country or produced on its territory remain at the disposal of Chinese wealthy citizens and the government. The reluctance of the official leadership to share real figures about China's gold reserves is some kind of powerful strategic move based on far-reaching plans.