The world's gold reserves are in constant flux. Gold, as an eternal universal asset, is bought and sold in different forms, including electronic lots. However, even in the case of buying or selling gold on an exchange, which will be presented only in the form of numbers, it is understood that the owner will always be able to obtain at his disposal a specific volume of this precious metal. It is on this principle that international trade in gold and foreign exchange assets is built.

The planetary gold market today is a global financial and exchange conglomerate with international powers, consisting of the world's leading banks, large gold mining and production enterprises, and top holders of gold and foreign exchange reserves. It is in this transnational informal corporation that the value of gold is formed every second, from which stock exchanges, exchange rates and international contracts are based.

The most common form of physical gold on the international market is 12.5 kg standard 995 or 999 fineness bars with the hallmarks of reputable refiners. Domestic markets can use bars weighing from 5 grams, gold coins and even gold sand.

Main functions of the gold market

- determination and regulation of the cost of precious metals;

- ensuring international purchase and sale transactions;

- regulating supply and demand;

- creating conditions for analytical research and forecasts

Despite the fact that the American currency has long abandoned the gold standard, the dollar continues to remain the main instrument for international financial transactions. Therefore, mutual settlements in the gold market are currently carried out using the US dollar, which is used to calculate the cost of a troy ounce (31.1034768 grams).

The key features of the gold market lie in the unique characteristics of the item itself. Unlike stocks, currencies and raw materials, this precious metal will always be in demand. Therefore, the market mechanisms operating in this industry do not have the usual direct dependence on external factors for such instruments. Even the largest countries and international corporations cannot deliberately and significantly influence the current price of gold. Therefore, insider information in this market niche has extremely low value.

Another feature of the gold market, when it comes to trading physical gold bars, is that in this case wholesale transactions take place. This means that all risks of influence associated with the presence of small investors are practically zero. For example, on the London Gold Exchange the minimum lot is 1000 troy ounces, the purchase of which in 2021 will require $1 million 314 thousand.

Sberbank is giving away prizes for paying for housing and communal services

The Povolzhsky Bank of PJSC Sberbank continues the “Time is Gold” campaign, within the framework of which clients who have paid for housing and communal services at the bank can receive cash prizes.

The action is held in the Astrakhan, Volgograd, Orenburg, Penza, Samara, Saratov and Ulyanovsk regions.

To become a participant in the promotion, you must pay for housing and communal services in Sberbank in the amount of at least 100 rubles in the period from October 5 to December 31, 2021 inclusive, in any convenient way, and then register the transaction number via SMS or on the Sberbank website in the “Beneficial for you” section " The winner of the promotion will receive the main cash prize in the amount of 500 thousand rubles.*

Sberbank offers clients many convenient ways to pay for housing and communal services. Internet banking “Sberbank Online” allows you to pay receipts without leaving your home, at any time. With the application of the same name, payment for housing and communal services becomes even more mobile, because in order to pay utility bills, it is enough to have a smartphone with Internet access and a few minutes of free time at hand. And for housing and communal services it makes paying for housing and communal services as easy and fast as possible: you only need to set all the necessary parameters once and the bank will take over the routine matters of paying receipts.

Now the bank’s clients have an excellent opportunity to evaluate all services for paying for housing and communal services and become the owner of one of the prizes as part of the “Time is Gold” campaign.

More information about the terms of the promotion, the nature, procedure and method of receiving prizes -.

PJSC Sberbank. General license of the Bank of Russia for banking operations No. 1481 dated August 11, 2015.

Official websites of the Bank - (Sberbank Group website),

* The main cash prize in the amount of 767,076 rubles 92 kopecks is subject to a personal income tax of 35% on amounts over 4,000 rubles. The tax amount is withheld by the organizer of the event, who is a tax agent, and transferred to the budget. The actual amount of the Main cash prize to be awarded is 500,000 rubles. The general period of the promotion: from 10/5/2018 to 01/31/2019 inclusive. Territory of the event: Astrakhan region, Volgograd region, Orenburg region, Penza region, Samara region, Saratov region, Ulyanovsk region. Participants in the promotion can be legally capable individuals who have reached the age of 18 and are citizens of the Russian Federation. Determination of the winner of the promotion - the owner of the Main cash prize: from 01/01/2019 to 01/10/2019 inclusive. Determination of winners - holders of secondary prizes: from 11/01/2018 to 01/20/2019 inclusive. The main cash prize is issued from 01/21/2019 to 01/31/2019 inclusive. Issue of secondary prizes of the promotion: from 11/10/2018 to 01/31/2019 inclusive. The number of prizes is limited. Detailed information about the organizer of the promotion, the rules and terms of its holding, the number of prizes, terms, place and procedure for receiving them can be found on the website www.sberbank.ru or by calling 8-800-555-55-50.

Precious metal exchanges

This sector of the global gold market is represented by specialized platforms and segments of large exchanges. This is where gold acts as a regular asset that is constantly bought and sold through exchange transactions. Electronic purchase and sale of the main currency of our civilization allows you to quickly make a profit even on a slight difference in price when working with large lots. And during periods of economic crises, gold on the stock exchange instantly takes a “long position”, acquiring the status of the most reliable long-term asset.

Users from different countries can conclude contracts for precious metals remotely. Therefore, this market is rightfully considered the most active segment of the international trade in gold, platinum and silver.

Procedure for purchasing precious metals

Transactions with precious metals on the Moscow Exchange are concluded in the currency section. The contract deadline is the next day. For direct trading, a personal account is used on the website of the brokerage firm with which the investor works, or special software.

The purchase and sale of gold and silver lasts from 10.00 am to 23.50 at night. Contracts must be completed by 20:00 pm.

A long trading session allows you to cover the period of operation of Asian and European exchanges, which is extremely important, as it makes it possible to take into account the price dynamics of foreign precious metals exchanges when making large transactions.

Gold as a means of paying debts

Almost all countries pay each other with physical gold bars. The same goods are used to pay indemnities imposed on states that lost in military conflicts. Part of the gold reserves of a country with an unstable political situation or under threat of invasion may be deposited in foreign banks, for example, in Switzerland.

Central banks of developed countries are trying to constantly replenish gold and foreign exchange reserves precisely in case of such mutual settlements and critical situations. While the value of any currency can be questioned, gold can always be considered as a universal means of payment.

Today, the United States has a gold reserve of more than 8,000 tons, the leading countries of the European Union - about 9,000 tons, Russia - almost 2,000 tons. The total volume of gold and foreign exchange reserves on the world market in 2021 amounted to approximately 33,000 tons.

Jewelry gold market

Trade in gold jewelry, accessories and souvenirs has always been considered a profitable business. Currently, the jewelry industry using this precious metal accounts for about 58% of the total consumption of mined and processed gold. Particular activity is observed in the acceptance of scrap gold, which can bring up to 500% profit to professional jewelers.

Where is gold traded?

Mainly in London and Zurich, which traditionally offer the best conditions for concluding international contracts for precious metals. The British capital has been considered the main "golden city" of Europe since the 18th century. And Zurich acquired this status relatively recently - in the 60s of the last century, when the owners of gold deposits in South Africa began to supply their goods directly to Switzerland, ignoring the well-known greed of English bankers.

However, it is on the London market that, since 1919, the value of this metal has been fixed twice a day. Every day, approximately 600 tons of gold are bought and sold here.

As for small bars of 5-10 grams, such products can be purchased at branches of many large banks. Here, the population is offered commemorative gold coins, which can also be considered as long-term investments.

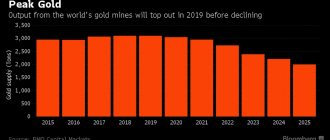

Gold market analysis – realities and prospects

The state of the gold market at the moment is characterized by moderate pressure from the central banks of leading countries on the value of this asset. The most significant factor in the fluctuation will remain the financial policy of the United States, as the largest holder of gold and foreign exchange reserves.

However, in the near future, the rapidly developing economies of countries such as India and China will have a significant impact on the state of the global gold market. Today, active research is underway related to the possibility of mining this precious metal in the World Ocean. If the experiments carried out are crowned with success, then the reserves explored on land can significantly increase with richer deposits in the ocean depths. Accordingly, the price of gold will begin to decline, which will lead to increased activity by private investors focused on long-term investments. However, positive results from such research may not appear until 2021.

According to analysts, the gold market in 2021 will continue the upward trend in the value of the international currency asset. If the US dollar weakens, attention to the main “yellow metal” will inevitably increase. So in the near future, the main currency of our civilization will retain and increase its absolute value.

Gold today: rates, forecasts, how to buy

Dynamics of compulsory medical insurance for goldin 2021 at Sberbank of Russia OJSC online.

Profitability calculator for deposits in gold in Sberbank Price of gold today in Sberbank

Cost of populas and sales in Sberbank today

(rub/g)

28.02.2021

| 27.02.2021 | 26.02.2021 | 25.02.2021 | 24.02.2021 | ||||||

| purchase: 3915.00 | sale: 4382.00 | purchase: 3915.00 ↓ -130 | sale: 4382.00 ↓ -56 | purchase: 4045.00 ↓ -19 | sale: 4438.00 ↓ -24 | purchase: 4064.00 ↓ -52 | sale: 4462.00 ↓ -54 | purchase: 4116.00 ↓ -52 | sale: 4516.00 ↓ -54 |

Archive of Sberbank gold rates

For the entire period from September 27, 2013 to February 28, 2021, the profitability of the deposit in the gold metal account (OMA) of Sberbank was:

179.24%

or

a profit of 358,488 rubles

from 200 thousand rubles (approximately 143 grams) of gold.

Over the past month

(from 28.01 to 28.02) the yield on gold deposits in Sberbank was:

-17.27%

or

a loss of -34,531 rubles

from 200 thousand rubles (approximately 42 grams) of gold.

Over the past 3 months

(from November 28 to February 28) the yield on gold in Sberbank was:

-14.35%

or

a loss of -28,703 rubles

from 200 thousand rubles (approximately 44 grams) of gold.

The profitability of compulsory medical insurance is calculated using the formula: D = ((K2-K1) / K1) * 100%)

K1 –

sale (for calculation, the gold sales rate established by Sberbank on the date of sale is used), K2 –

purchase

(for calculation, the gold purchase rate is used set by Sberbank on the date of purchase)

“If all that glitters were gold, it would cost a lot less.” Miguel Cervantes

An unallocated metal account (UMA) is an account that reflects the client’s precious metal in grams without indicating its individual characteristics (number of bars, fineness, manufacturer, serial number, etc.).

- By playing on precious metals quotes, the owner of a compulsory medical insurance bank can earn income in the same way as when playing on the stock market.

- With compulsory medical insurance from Sberbank you can receive metal in kind, although you will have to pay VAT

OJSC Sberbank of Russia offers its clients - individuals services for opening and maintaining impersonal metal accounts in gold, silver, platinum and palladium.

An unallocated metal account (UMA) is an account that reflects the client’s precious metal in grams without indicating its individual characteristics (number of bars, fineness, manufacturer, serial number, etc.).

Advantages of impersonal metal accounts:

- the opportunity to generate income due to the increase in the cost of precious metals

- fast - instant purchase/sale of metal at the time of circulation

- no VAT on the purchase and sale of precious metals in impersonal form

- good alternative to the stock market

- free account opening and maintenance

- the possibility of obtaining precious metal in bullion (18% VAT is charged)

- the possibility of obtaining compulsory medical insurance from Sberbank for a minor