21.12.2020

Financial markets love nice round numbers. In early August, COMEX gold futures topped $2,000 for the first time, with COMEX 100-ounce contracts for August delivery trading at $2,001.

On August 6, contracts for December 2021 delivery reached $2,069 before the price began to fall again, ending November below $1,800 for the first time since July. Gold's price movement has caught the attention of many traders this year. Let's see how events developed on the yellow precious metal market.

Record growth in demand for gold

Recently, the World Gold Council published the results of analytical studies of the demand for the yellow metal on the part of foreign exchange-traded investment funds. From the information provided, it is clear that in 2021 investors bought 33.3% or 876 tons more compared to 2021. The total amount of yellow metal purchased during the past year was a record 3,750 tons, which is 230 tons higher than the previous maximum recorded in the crisis year of 2009. Then people all over the world bought about 3,300 tons of gold.

In US dollar terms, investments in gold through ETFs amounted to $47.8 billion.

In 2021, people actively sought to purchase gold, despite the economic crisis associated with the coronavirus pandemic and unprecedented measures of monetary stimulation of markets by the world's leading regulators.

According to Bank of America, the total amount of government support for the economy over the past year was more than $23 trillion. In addition to these measures, throughout 2021, central banks pursued a policy of lowering key interest rates, which increased inflation expectations and the desire of the population to buy precious metals as a reliable anti-crisis tool. All this, together with the rising price, forced investors to actively purchase gold further.

The growth in demand for the precious metal did not continue all the time. People were most eager to buy gold between April and June. At this time, the reserve storage of ETF funds was replenished by 583 tons of yellow metal. In the third quarter, the increase was 273 tons. But from October to December, the total reduction in stock reserves amounted to 131 tons.

Here is information from EPFR on investments of international investment structures in precious metals for 2021:

- from January to March, investors bought the yellow metal for $6.4 billion;

- from April to June - by $30 billion;

- from July to September - by $21 billion.

After Biden was elected President of the United States of America in November and the emergence of new vaccines against COVID-19, the population stopped buying en masse and began selling the precious metal. Within 45 days, capital outflow from this market sector amounted to about $10 billion. Investments began to dwindle as the price rose to new highs, over $2,000 per ounce.

Dollar Weakness and Inflation Trends

Gold's strength often means the dollar's weakness, and vice versa. Due to the Federal Reserve's unprecedented fiscal and monetary policies in response to the COVID-19 crisis, the US dollar's popularity has declined as the risk of inflation weighed on some investors. This weakened the dollar's status as the world's reserve currency. Gold rose against the dollar, but the euro, yen and Swiss franc also strengthened. Even without taking into account factors related to gold, the precious metal tends to rise in price as the main opponents of the US currency strengthen.

Factors specific to gold may come into play in a low yield environment for dollar assets. Bond buying by the Federal Reserve and others has effectively capped nominal yields. With higher inflation expectations, this is leading to record low real yields. The negative correlation between inflation-adjusted returns and gold prices is well documented in history.

How to buy gold in Russia

Investors from Russia also actively bought gold against the backdrop of a global trend of increasing demand for the precious metal. In 2021, private investments in shares of investment exchange-traded funds amounted to more than 10 billion rubles. 75% of funds invested in gold occurred between August and December. The main driver of demand growth was not only the rise in the price of gold, but also the collapse of the ruble and the demand for protective assets that could compensate for losses from the devaluation of the national currency.

The past 2021 has shown a 20% increase in the dollar exchange rate in Russia.

Before buying gold, you need to decide on your goals, take into account the existing risks and understand how to properly form an investment portfolio. It is important to know that gold, compared to other financial instruments, does not create additional income in the form of dividends, and storing the precious metal in a bank may be associated with certain costs.

Today, many investors seek to buy gold through investments in mutual funds that operate with the precious metal. It should be understood that such investments are associated with taxation nuances. Owning ETF shares for more than 3 years entitles you to tax deductions. Moreover, this period of time will not decrease or increase if you exchange the assets of one fund for the assets of another. If you buy gold in the form of bars, you will have to pay value added tax. When you buy gold in the form of bullion coins, there is no such need.

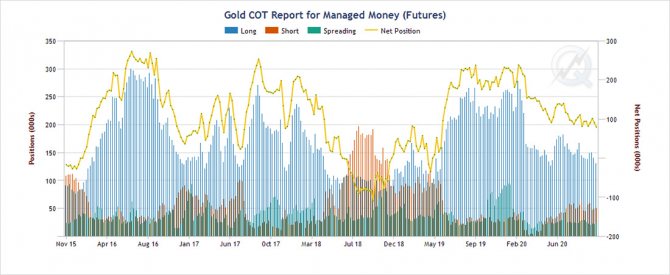

Market positioning

The net positioning of the managed money category (hedge funds, commodity trading advisors, etc.) is currently showing a bullish bias. Currently, net long positions are around 100,000 contracts. By historical standards, this is a high level, but, of course, not prohibitive. In fact, the figure is below the January level, when gold was trading around $1,600.

At the same time, open interest in the COMEX GC futures market (100 oz futures contracts) is growing. They started the year at a record high of 800,000 open contracts and fell below 500,000 in early June. As of mid-November, the number of contracts had returned to 550,000 - below this year's high, but in line with the past few years.

Investments in gold mining - features of the organization of modern mines

Investing in the development of gold deposits in Russia is mainly carried out by such large enterprises as Kinross Gold, OJSC Yuzhuralzoloto, OJSC Severstal. The fact is that this industry is characterized by high costs at the start-up stage and the need for huge investments in the direct production process. Difficulties in obtaining licenses provided on an auction basis significantly limit the opportunities for private capital. And individuals can engage in the development and use of gold deposits only if they have the status of an official employee of an enterprise that has received a license.

In 2021, another legislative relief for private miners came out. Today it is possible to mine gold on an area of 0.15 square meters. m, subject to surface treatment of layers without the use of explosives at a depth of up to 5 meters.

Expand the diversification of your assets

For the reasons stated above, gold has the ability to rise in price during a crisis, when all other assets fall in price. This behavior of investment instruments, in which prices move in opposite directions, is called negative correlation. This negative correlation has a very good effect on the investment portfolio, significantly reducing risks and slightly increasing its profitability. How does this happen? This issue was thoroughly studied by Harry Markowitz, for which he became a Nobel Prize laureate in 1990, as a result of which the Markowitz portfolio theory appeared. Unfortunately, a detailed explanation of this theory is beyond the scope of this article; we recommend that you familiarize yourself with this theory. Within the framework of this theory, it is necessary to buy and sell assets in a portfolio when their percentage ratio changes significantly in order to bring this ratio to the original one. Different books and authors give different percentages of gold that should be in every well-diversified portfolio. Usually this is 5-10%, but there are sites selling gold whose articles talk about a 20-30% share of precious metals in the portfolio. It is likely that this position is related to the commercial benefits of these sites, so you should not rate their advice highly. We agree with most opinions about a 5-10% share; this share will be enough for the Markowitz portfolio theory to work.

Fair valuation of gold

As you probably noticed, in all three answers there is no connection between the time of purchase of the precious metal and the value of its price. Everywhere the circumstances are primary, not the price tag. Why is this happening? Because gold is not an investment instrument, it has no added value and, therefore, there is no way to evaluate the profitability and tie a fair valuation of gold through the percentage of profitability. As a result, it is difficult (and some argue impossible) to assess the fairness of the current price. We cannot determine a fair value for gold, and therefore have nothing to go by.

Will gold continue to rise in price?

Answering this question, experts are clearly and openly divided into two camps. Each of them has its own reasons and arguments for asserting that one or another point of view will be more appropriate and correct in a particular case. Experts make their bets and assumptions: gold will rise in price by an order of magnitude or will still become cheaper.

According to estimates from the world-famous investment bank JP Morgan, in the next few years gold will be able to reach a fairly high price level, and its quotes will fluctuate around $2,500 per ounce. Whether the price of gold and other precious metals will rise after this, experts are silent. In turn, analysts from the equally authoritative English bank Standard Chartered believe that in the coming years the jump in the price of gold will not be so significant, but already in 2020-2021 the price will become literally fabulous and will be about 5 thousand dollars per ounce.

It is difficult to say whose forecasts are more plausible and which experts will be right, but, one way or another, with regard to earnings for investors, these forecasts are quite comforting.

So how much can you earn in this case? If the bankers’ most insignificant forecasts come true, then we can say that a gold bar weighing 100 grams purchased at the beginning of the year will increase in price by $100 in 12 months, which, you see, is not so bad.

But don’t forget about the pitfalls that every bank tries to hide or veil from its clients as best as possible. We must not forget that the bank’s margin can fluctuate from 7% to 10%; if you decide to sell this same bullion to the bank after purchasing it, then you will not only not recoup the invested money, but will also play at a loss. It is unlikely that any of the investors are striving for this.

In order for such investments to give a positive result in a fairly short period of time, it is necessary that the increase in gold prices be very significant. If JP Morgan’s assumptions come true, at a time when the price of gold rises significantly, you will not only not play at a loss, but also get “clean” from one 100 gram bar about $400, and this is already throwing away the bank’s margin. If you expect that at the same time you will put interest-bearing “paper” currency on the most profitable deposit, the income will still differ significantly in favor of gold, but all this is subject to its significant rise in price.

At the same time, experts at other banks are suggesting that the so-called psychosis point regarding the price of gold in the precious metals market is not only subsiding, but will soon come to naught, as a response to the views of those who claim that gold will rise. Therefore, their forecast is that soon the price per ounce of gold will not exceed $1,800, but will fluctuate between $1,600-1,800 per ounce. It is difficult to affirmatively confirm or deny such forecasts, because the main role will be played by how unstable or stable external economic factors will be. Despite this, a significant part of experts assume that in the near future this “soap bubble” will burst and the price will stabilize again, so whether gold will rise is a matter of debate.

The largest players in the gold market - George Soros and Eric Mindich have already managed to sell a significant part of their gold reserves during a period when the price of gold was almost at its peak.

In this situation, it is pointless to say anything regarding earnings, because with short-term investments, earnings will be essentially “zero”, and if you also want to sell the gold back to the bank, you will definitely go into a loss of about 5-15%, in depending on the bank. If you already have gold assets, then the best option would be to extend the investment period, thereby waiting for the next increase in prices for the yellow metal, because as practice shows, you can periodically observe a surge in prices for the precious metal. Then it will be possible to say goodbye to gold, while earning a significant amount of money.

In fact, almost no one can say with 100% certainty whether the current gold rate will increase.

Preserve capital for centuries

Gold, like no other commodity, is suitable for carrying capital over vast periods of time without losing its value. In what cases does this make sense? Let's list a few.

- You are young and earn good money, but you are afraid to invest in stocks, bonds, real estate and other assets. In this case, a solid stash of gold will be of great help to you in retirement.

- You received some capital in a not entirely legal way, or you fear for its safety due to some conflicts with the authorities, former partners or criminal structures. Capital can be easily converted into gold and hidden in a hard-to-reach place for decades.

- You want to transfer all or part of your capital to your children or even grandchildren, but only after your death (or even a certain time after it). Just as in the previous case, physical gold is stored as a treasure until the right moment.

Surely you can offer some other options that fit the first reason, but we will move directly to the answer to the question “when should you buy gold in this case?” In this case, the moment of buying gold is absolutely unimportant. If you already have a certain amount for a one-time purchase of gold, you can buy it right away. If you decide to save money monthly for gold, this is also a good option; buy when you receive money. For long periods of time, price fluctuations become insignificant.

Investing in gold for the long term

It is long-term investment in the yellow metal that is rational. Current levels are quite low.

Here it is worth mentioning the theory of supercycles. According to it, prices for raw materials rise for 10-15 years, and then decline for 10-15-20 years. If we look at the long-term price chart for copper, oil and gold, we will see such a cycle in the period 1930-1970. (40 years). And also in the period 1970-2000. (30 years) and even in the period 1890-1930. (40 years). The last supercycle began in the 2000s. This means that we are facing 10-15 years of low commodity prices.

This theory is based on extrapolation. But now the economy in the world is different, some things have changed (there is no gold standard) - so there is no guarantee that supercycles will be repeated.

In addition, even in the theory itself there are many nuances: 1. Within large 30-40 year supercycles, short-term bursts of activity are observed in 3-5-10 years (minicycles). 2. In the 70s, the rise in prices was not due to economic growth or increased demand for raw materials, but to the banal devaluation of the dollar - after it was untied from gold. 3. When prices reach peaks and then decline, they do not return to their previous range, but reach a new level. That is, the graph does not look like a sinusoid, but a ladder, a new cycle is the next step.

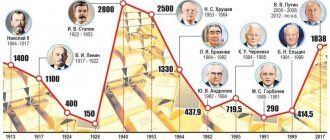

Evidence of the unconditional prospects of gold assets

- Just look at the chart of the gold price behavior from 2000 to 2021. The price of a troy ounce at the beginning of the century was no more than $480. And after a large-scale crisis that began in 2009, by 2012 it surpassed the $1,500 threshold. in 1880, they asked for about $18 per troy ounce, and before the Great Depression the price dropped to $8-9. But as soon as the US economy collapsed in 1929, the price of gold immediately jumped to $33 per ounce.

- Leading states continue to increase gold reserves, making large investments in gold development. However, explored deposits of this precious metal are very limited. So the shortage of the main currency equivalent will inevitably lead to an increase in its value.

- With advances in advanced technology, gold is rapidly expanding its range of applications. Today this metal is used in plastic and microsurgery, luxury cosmetics are made from gold, and gold components are actively used in miniature electronics. Rapidly growing demand will also inevitably become a powerful stimulator of growth in the cost of a gold troy ounce.

No flowers needed, gold!

Demand for gold traditionally increases before holidays in cities with a population of half a million or more. This was shown by the results of surveys conducted by employees on the topic of residents’ attitudes towards valuable gifts and investments in precious metals.

Approximately 6% of respondents purchase or sell gold products and jewelry at least once a year. About 5% of urban residents are thinking about investment options in the precious metal and related instruments. The most active pre-holiday rush is observed in the capital and large cities.

Statistics confirm that more men than women invest in gold. Typically these are Russians aged 30 to 40 with a high level of income and completed higher education. The age category of 40-50 years is characterized by a decrease in demand for gold before the holidays by approximately three times.

This is about active holiday shoppers. If we talk about those who are just showing interest in investing in precious metals, then among them there are more students and young people under the age of thirty.

Who cares about gold?

It's time to reflect on the discussion about gold and savings. Usually groups gather that can be divided into:

- Theorists

- Small investors/savers

- Gold sellers/practitioners

Everyone has their own truth. Is the discussion helpful? Hardly ever. How can a theoretical physicist help a plumber solving a practical problem? Yes, nothing. Even in applied science, theorists cannot themselves create a test bench that should confirm/refute theoretical hypotheses.

What do a millionaire and a conventional Skier have in common? Different volumes of savings lead to different strategies related to ways to achieve the goals. An attempt to provide a theoretical basis for solving specific problems, a lack of knowledge about the real market and an attempt to lecture practitioners is simply annoying.

People have no understanding of the real gold market. There are some illusions. Even most sellers know little about the big gold market (Russian, Eurasian). He is very unique, closed and lives by his own laws. It is far from being regulated by the Central Bank, although they sometimes have an influence. No one is ready to share knowledge about it. Some comments on this market, without detailed explanations, cause dissatisfaction/distrust among most skiers. The only format of communication is a get-together of people who know something about this market and exchange news. Therefore, there is no point in starting a revolution in knowledge about the gold market.