Purposes of acquisition and storage

To ensure purchasing power, the state holds a certain amount of monetary gold in reserves. All financial assets of the state consist of national currency, shares, monetary gold, loans, and insurance technical reserves. The greater the mass of paper money in circulation, the greater the reserves of monetary gold should be. Changes in gold prices and their volume are reflected in the financial accounts of the state.

Monetary authorities, in order to increase the monetary gold reserve, purchase precious metal from commercial banks, commercial companies, and private gold miners. Such transactions can be carried out within the country, as well as with foreign partners. International transactions for the sale and purchase of monetary gold do not relate to commercial foreign trade activities.

For what purpose does the Central Bank hold reserves in the form of gold?

Previously, gold was the equivalent of the national currency and provided its value. Now gold reserves are included in the gold and foreign exchange reserves of countries, the purpose of which is to be able to withstand crises and stabilize the exchange rate.

Reserves of the yellow metal can be used as finance for payment, because the more gold in the reserve, the greater the economic independence of the country.

Countries of the world and their gold reserves

European Union

This political union is in first place in terms of gold reserves in Central Banks, because includes a large number of developed countries. In 2015, the reserve totaled 10,800 tons of valuable metal. The largest reserves in the European Union countries (which are not part of the Eurozone) are:

- Great Britain (more than 310 tons),

- Sweden (126 tons),

- Romania (104 tons),

- Poland (103 tons).

USA

Since the Great Depression of the 1930s, the United States has created the bulk of its gold and foreign exchange reserves. The maximum reserves were recorded during the Second World War - more than 20 thousand tons (that's about 500 wagons fully loaded with gold). At the end of the war, the country stabilized its dollar, spending more than half of its reserves and reducing them to 8 thousand tons. And today this volume fluctuates around 8000 tons.

Most of the US gold reserves are stored underground in New York City vaults.

Germany

In the post-war period, the country began to create and increase gold reserves to stabilize the exchange rate. At the end of the 60s of the last century, volumes reached 4,000,000 kg. By 2013, the volume of gold amounted to 3.4 million kg, which is equivalent to 140 billion euros.

Germany mainly buys gold on the exchanges of the USA, France and England. In the US, Germans keep 45% of their reserves, in the UK 13%, in a French bank in Paris - 10%. The rest of the gold is stored in Germany (32%).

However, in recent years, the country has been actively returning gold to its homeland from the banks of these countries. In 2021, Germany already held almost 45% of all their gold. Official stock figures for 2021 are 3,370,000 kg.

France

The country also did not ignore projects to stabilize its currency after the war. At this time, the economy was growing throughout Europe, there was even an “economic boom” in France, Germany, and Great Britain.

However, the US dollar still played a major role in economic calculations and international trade, so an imbalance in gold reserves began to appear in France. But in the 60s, France began to increase the share of gold in its reserves. In the mid-60s of the last century, the country exchanged a record $870 million for bullions of the valuable metal.

France is the first European country that was the fastest to accumulate a gold reserve of more than 4,000 tons. Unlike Germany, the country did not store gold in New York vaults, but chose to take it out of the United States. Now the country ranks 5th in reserves of the valuable metal, having 2,440 tons in the vaults of Paris banks.

China

Only in 2015 did the Chinese Ministry of Finance publish its data on precious metal reserves. Then the reserve amounted to 1660 tons.

The country is actively replenishing its reserves and buying gold. In 2013 alone, 600,000 kg were purchased.

Since 2007, China has also held the record for mining the valuable metal:

- 2007 – 280 tons,

- 2008 – 290,

- 2009 – 435.

Today China ranks 7th in terms of reserves, with almost 1890 tons.

Russia

The gold reserve is in the possession of the Central Bank of the Russian Federation, which pursues a policy of actively purchasing the valuable metal and increasing the volume of reserves to stabilize the ruble exchange rate. The reserve also serves as a source of funds in case of possible emergency situations.

In 2014, Russia took second place in resource extraction (after China). For 4 years (from 2014 to 2018), the Russian Federation purchased more than 1,000,000 kg of valuable metal. If Russia maintains the same pace of purchases, it will be able to reach 3rd place in reserves (up from 7th) in the coming years.

More than 65% of the total gold and foreign exchange reserves are located in the vaults of the Central Bank in Moscow. By the spring of 2021, according to updated data, the gold reserves in Russia amounted to 70 million ounces (2180 tons). The total value of this volume is $90 billion. The total volume of valuable metal in the gold and foreign exchange reserves is almost 20%.

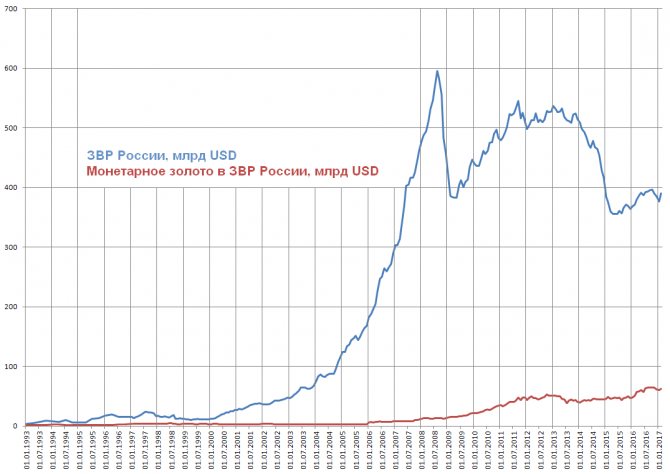

Dynamics of Russian gold reserves

Judging by the graph, in 2015 the volume of the yellow metal increased almost 3 times compared to 2005. The country purchases gold to provide risk insurance when the price per ounce of gold declines. For example, in 2011 the price was $1900, and in 2015 it was already $1100, which led to losses for many investors in the precious metal. Therefore, as the volume of gold reserves increases, the risk of a fall in the value of this volume decreases.

Gold reserves of the Russian Federation

Unlike many other countries, the Russian Central Bank keeps almost all its gold reserves in its vaults, and not abroad, and is constantly increasing their volumes. The Russian Federation is in fifth place in the world in terms of monetary gold reserves (the first place is occupied by the United States).

Replenishment of gold reserves is carried out by purchasing gold bars within the country by the Central Bank of Russia. Monetary gold of the Russian Federation is stored in coins and bars with a purity of at least 995 purity, in modern storage facilities with a multi-level security system. The gold is located in the main vault in Moscow, as well as in the vaults of branches of the Central Bank of Russia. Other assets of the country's financial reserve are securities, deposits and cash.

Bank of France and gold: past and future

Translation of an article by Sylvie Goulard, deputy director of the Bank of France, published in the September issue of the London Bullion Market Association magazine “Alchemist”.

The Bank of France has always been a major player in the gold market. Since its creation in 1800, this institution has held one of the largest reserves of the yellow metal and its gray cousin in the world. The Bank of France issued a 20-franc gold coin with the image of Napoleon Bonaparte, which was one of the iconic coins of the 19th and 20th centuries, along with the British Sovereign and American Eagle.

In the 19th century, Paris was a major center for the gold trade (which came from Australia, South Africa, the USA, Russia, etc.). Therefore, the Bank of France worked closely with other financial institutions, such as the Bank of England and the London Market.

" La

Souterraine ": construction of the vault

During the period of the gold standard, trade balances in gold were mainly settled in Paris, London and New York.

The Bank of France kept its gold in vaults located below its head office in Paris. Before the First World War, gold reserves were stored in the former wine cellar of the Hotel Toulouse. However, after the war and the bombing of the French capital, the authorities realized that this was not a very safe place and decided to build a larger and deeper storage facility.

In 1924-1927 1,200 workers worked day and night to build the famous "Souterraine" (lit., French, "underground"). This huge underground vault, built at a depth of 29 meters below the Seine, covers an area of 10 thousand square meters (100 x 100 meters), and is supported by 720 columns. By the way, the Austrian writer and playwright Stefan Zweig was so inspired by this news that he even asked the director of the Bank of France to give him the opportunity to visit the Souterraine. After his visit, he published a short story in the Neue Frei Presse magazine. The built storage facility became the deepest and largest in the world.

It was the most modern at that time, having an autonomous source of electricity, and was subsequently regularly updated in accordance with the latest technologies. In the 1930s. The storage facility was equipped with an air filtration and oxygen supply system. Ten years later it received an international prize for underground architecture.

The "Golden Era" of Paris between the two world wars

In the 1930s, as Britain abandoned the gold standard and the dollar suffered from the Great Depression, the French franc remained the only major currency in the world still backed by and convertible into gold. This led to the movement of large quantities of the yellow metal to France.

At the same time, the gold reserves of the Bank of France reached their highest level - 5 thousand tons.

After World War II and the creation of the Bretton Woods system, the gold market's center of gravity shifted to Fort Knox and the dollar, which was considered "as good as precious metal."

As the French franc gradually regained some of its lost luster, Banque de France gold reserves began to rise again, returning in the 1960s. almost to the level of 1932. The Bank of France is currently the fifth largest holder of gold in the world, holding 2,436 tons.

After US President Richard Nixon decided to end dollar convertibility in 1971, gold lost its monetary role. The yellow metal market then suffered a slow decline, so before the global financial crisis of 2008, gold was considered an unremarkable commodity. The financial crisis saved the yellow metal as investors lost confidence in financial assets, seeking salvation in real physical assets. This circumstance helped gold and the Bank of France.

Active gold storage policy

Beginning in 2009, the Bank of France began an ambitious program to improve the quality of its gold reserves. The goal was to ensure that all of its bullion met London Bullion Market Association standards, as this would allow them to be traded internationally.

To effectively implement this program, the Bank of France began to control all stages of the process: from transportation to smelting and/or refining, as well as inspection at the refinery.

This close monitoring was critical to understanding all stages of the quality increase and analyzing any weight issues that might cause accounting adjustments. The Bank of France has gained good experience in this process. Initially, he carried out only the remelting process, but since 2014, his program has also affected the “refining” of all ingots up to 999.9 purity.

In addition to improving the quality of its reserves, the Bank of France is taking other steps to meet the criteria of the London Association. All large bars are weighed on electronic scales, allowing the Bank to monitor their condition according to London Association standards for efficient accounting.

In addition, the renovation of the ancient vaults that house gold reserves is almost complete: a new floor will be able to support heavy forklifts, and intermediate shelves will be inserted between the shelves so that the gold is stacked in five bars, making it easier to handle. Other vaults will soon be available, either reinforced areas for storing single bars or large vaults for storing sealed pallets for easier handling, transport and auditing. By the end of the year, a new IT system will be put into operation to improve the quality of storage services.

Gold Services for Reserve Managers

Since the 2008 financial crisis, interest in gold has increased among reserve managers. Gold has confirmed its status as a safe haven and has also become a very good asset for diversification purposes given its low correlation relative to other asset classes.

Building on its many years of experience managing its gold reserves, in 2012 the Banque de France began expanding its range of gold services for reserve managers. In addition to providing storage services for physical gold in Paris, the Banque de France can now sell and buy gold on spot markets for its institutional clients. It also offers swaps to use gold as collateral in deposit contexts, which is increasingly required since Basel III rules recognized the yellow metal as an acceptable form of collateral. Swaps are also used to attract cash in foreign currency thanks to the yellow metal. Finally, to increase the return on their gold holdings without increasing counterparty risk, foreign central banks may engage in gold lease transactions with the Banque de France as the principal. Demand for gold deposits with maturities ranging from one week to one year increased when interest rates fell below zero for a number of reserve currencies, thereby encouraging central banks to seek alternative sources of income.

These gold investment services have so far been offered from London. However, recently it has become possible to carry them out from Paris, thanks to cooperation with large commercial banks that are active in the gold market. As a result, thanks to improvements to the Bank of France's vaults, as well as innovations in service delivery, Paris could soon once again become a center for gold trading.

The Bank of France strives to continue its traditions of being a key player in the Eurosystem.

History of demonetization of gold

The status of world money was assigned to gold in 1867 (before that, silver and gold were world money). Since that time, the actual and legal demonetization of gold (loss of monetary functions) has gradually occurred.

The IMF charter does not contain the obligation to refer to gold when determining exchange rates and ratios, and the official price of gold has also been abolished. Despite economists' disagreement about the reality of demonetization, gold continues to play an important role in monetary relations between countries. Therefore, states store a certain amount of gold reserves in case of various force majeure situations in the economy or other areas.

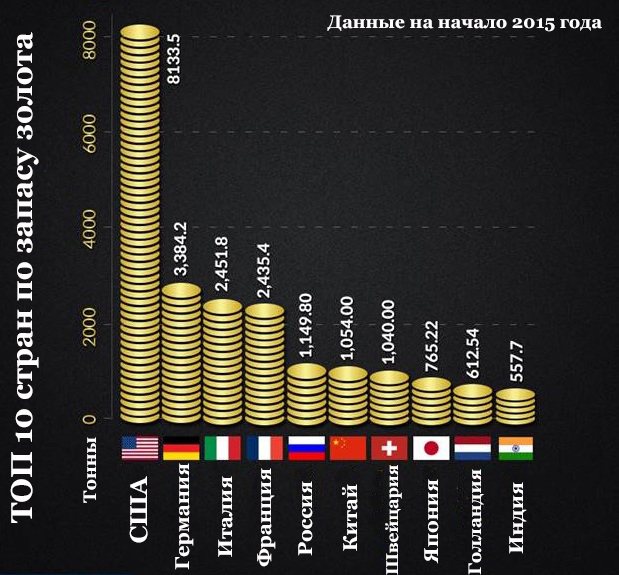

Rating of countries with the largest reserves

The United States of America is the world leader in gold reserves today. As of July 2015, official statistics provided data on 8,133.46 tons of precious metal, the share of which in the US foreign exchange reserve exceeds 70%. The indicator is quite impressive both in absolute and relative terms.

The closest neighbor of the United States in this ranking is Germany, which has a gold reserve of 3,384.2 tons of the metal. The figure differs from American reserves by a factor of two, although the share of these 3.3 thousand tons of precious metal in the entire foreign exchange reserve of the country approaches the same 70% in Germany.

It was German gold that caused discussions in the press that US storage facilities were empty. The story began a couple of years ago, when the German authorities, during a period of crisis, decided that gold stored in New York, Paris and London should be returned to the country - to where it might be needed at a time when the problems of the European Union worsened. A whole plan was developed to return a significant part of the stock to Germany, designed for the period until 2021.

As a result, in the year after this decision, only 5 tons of metal were returned from the United States, and then the plan was abandoned altogether. Journalists and many experts agreed that the Americans could not return the gold, since it was no longer there, so at the highest level they persuaded Germany to abandon plans to return the reserve. Rumors about the disappearance of German gold were also fueled by the news that German representatives were not allowed into the gold storage facility to inspect the bullion located in the United States.

Following Germany, the world leaders in terms of gold reserves are Italy and France, with 2,451.84 tons and 2,435.38 tons of the precious metal, respectively. The fifth and sixth places in terms of reserves of the yellow metal are occupied by China and Russia. China is far ahead of other Asian countries in this indicator. As of July 2015, China's reserves stood at 1,658.1 tons of the precious metal, which is only 1.6% of the country's huge foreign exchange reserves.

Until mid-2015, Russia was ahead of China in terms of the volume of gold reserves as part of the foreign exchange reserve, since during 2014 it seriously increased its reserves by almost 170 tons of the yellow metal. Countries changed places in the ranking only after the publication of official Chinese statistics. The increase in Russian gold reserves continues to this day. During the period from January to July 2015, the reserve increased from 1,208.2 tons to 1,275 tons of metal.

Rounding out the top ten countries with the largest gold reserves are Switzerland, Japan, the Netherlands and India, whose reserves have increased sharply since 2009.

Statistics by year

The state replenishes reserve savings both by purchasing metal from mining companies and by purchasing volumes of metal on the international market. This yellow metal is practically not subject to depreciation and allows you to compensate for the devolution of your own currency. It is also a good tool for diversifying the country’s reserve portfolio and an excellent means of payment, as it acts as a means of ensuring the government issues various types of securities (bonds, etc.).

The Central Bank began actively purchasing gold back in 2008. As a percentage of world reserves, domestic reserves have grown over ten years from 2.5 to 17%.

| As of | Cost, billion $ | Monetary equivalent, million troy ounces | Total weight, in tons |

| 1 Jan 2010 | 22,798 | 20,9 | 649,1 |

| 1 Jan 2011 | 35,788 | 25,4 | 788,6 |

| 1 Jan 2012 | 44,697 | 28,4 | 883,0 |

| 1 Jan 2013 | 51,039 | 30,8 | 957,8 |

| 1 Jan 2014 | 39,990 | 33,3 | 1035,2 |

| 1 Jan 2015 | 46,089 | 38,8 | 1208,2 |

| 1 Jan 2016 | 48,5626 | 45,5 | 1414,6 |

| 1 Jan 2017 | 60,1936 | 51,9 | 1615,2 |

| 1 Jan 2018 | 76,647 | 59,1 | 1838,8 |

Note! When calculating the total volume of gold, the following values must be taken into account: 1 troy ounce = 31.1034768 g 1 ton = 1000000 g

The main reason for such a rapid increase in Russia's gold reserves is the sanctions imposed by the United States and its allies. At the same time, the number of sanctions restrictions on the part of Western countries begins to grow like an avalanche, therefore, in order to ensure its solvency in the event of a ban on our country paying in dollars, this universal means of payment is being increased.

One day it may happen that countries that bought American government bonds will present them to the United States, and the dollar will depreciate. It is from this kind of risks. But it is worth noting that the yellow metal is less liquid than bonds. But in the event of a depreciation of the US dollar, gold will definitely retain its value for international payments as a universal means of payment.

Return to content

Gold reserves in Russia and in leading countries of the world for 2021

At the beginning of 2021, the largest reserves of gold are owned by 12 leading countries of the world and the European Union from 71 banks in the world, which are systematically analyzed by the Bank of Russia:

| №№ | Countries with the largest gold reserves in international reserves. | Gold reserves (tons) As of 01/01/2018 | Gold reserves (tons) For reference: as of 01/01/2017 | International reserves as of 01/01/2018 (millions of US dollars) | Share of gold in total international reserves as a percentage |

| 1. | USA * | 8 133,5 | 8 133,5 | 450 170 | 75,3 |

| 2. | Germany | 3 373,7 | 3 378,0 | 208 691 | 67,4 |

| 3. | Italy | 2 451,9 | 2 451,9 | 152 169 | 67,2 |

| 4. | France | 2 436,0 | 2 435,9 | 176 076 | |

| 5. | China* | 1 842,6 | 1 842,6 | 3 421 899 | 2,2 |

| 6. | Taiwan (China) | 423,6 | 423,6 | 469 158 | 3,8 |

| 7. | Russian Federation | 1 838,8 | 1 615,2 | 432 742 | 17,7 |

| 8. | Switzerland | 1 040,0 | 1 040,0 | 811 941 | 5,4 |

| 9. | Japan | 765,2 | 765,2 | 1 322 405 | 2,4 |

| 10. | Netherlands | 612,5 | 612,5 | 40 582 | 62,9 |

| 11. | Türkiye | 564,8 | 377,1 | 107 635 | 21,9 |

| 12. | India* | 558,0 | 556,8 | 414 110 | 5,6 |

| 13. | European Central Bank | 504,8 | 504,8 | 78 872 | 26,7 |

| 14. | Total for the EU and 12 countries: | 24 545,4 | 24 138,1 | 8 086 450 | — |

| 15. | The volume of international reserves of 71 countries of the world analyzed by the Bank of Russia, incl. EU | 28 759,6 | 28 296,1 | 12 533 255 | 9,6 |

| 16. | Percentage of line 12 to line 13 | 85,35 | 85,31 | 64,52 | — |

(*) The assessment of gold reserves of countries (India, China, the United States, Taiwan (China)) is presented at market value, which differs significantly from the national one.

For other countries, the national gold valuation used for accounting purposes generally corresponds to the market value. Banks of 12 countries and the European Union as of 01/01/2018 have 24,545.4 tons of gold as part of International reserves, which is 85.35% of the total gold reserves of the countries of the world analyzed by the Bank of Russia.

Gold reserves 2018

Of the 71 banks in the world analyzed by the Bank of Russia, 13 countries saw an increase in gold in International reserves in 2021, while 6 countries allowed a decrease in gold reserves. Thus, the largest increase in gold reserves in 2021 occurred in the following countries of the world:

- Russian Federation - by 223.6 tons;

- Türkiye - by 187.7 tons;

- Kazakhstan - by 41.7 tons

- Jordan - by 9.4 tons;

- Colombia - by 4.6 tons.

And the following countries have reduced their gold reserves:

- Austria – by 7.1 tons;

- Germany - by 4.3 tons;

- Argentina - by 2.0 tons;

- And etc.

International reserves of 71 countries as of January 1, 2018 amount to 12,533,255 million US dollars, of which the reserves of the 13 leading countries amount to 8,086,450 million US dollars (64.52%)

.

The total reserves of gold in international reserves as of 01/01/2018 are 28,759.6 tons, of which 24,545.4 tons

or 85.35% are located in the 13 leading countries.

It should also be noted that the two leading countries in the world have 11,507.2 tons of gold, which is 40% of the total gold reserves in the world and 46.88% of the 13 leading countries in the world in terms of gold reserves. These countries include as of 01/01/2018:

- USA with a gold reserve of 8,133.5 tons.

- Germany with a gold reserve of 3,373.7 tons.

The international reserves of the Russian Federation as of January 1, 2018 amounted to 432,742 million US dollars, and the share of gold in them is 17.7%. With these indicators, among the 12 leading countries with the largest gold reserves, Russia took 6th place as of January 1, 2018, behind the leadership of the USA, Germany, Italy, France and China. It should be noted that in February 2021, Russia may have moved to 5th place, overtaking China in gold reserves.

The dynamics of gold reserves (in tons) of the Bank of Russia for the period from 2010 to 2021 look like this:

| date | International reserves as of the reporting date, million US dollars | The value of monetary gold in foreign currency (millions of US dollars) | Monetary gold (millions of fine troy ounces) | Gold reserves (tons)* |

| 01/01/2010 | 439 450 | 22 798 | 20,9 | 649,1 |

| 01/01/2011 | 479 379 | 35 788 | 25,4 | 788,6 |

| 01/01/2012 | 498 649 | 44 697 | 28,4 | 883,0 |

| 01/01/2013 | 537 618 | 51 039 | 30,8 | 957,8 |

| 01/01/2014 | 509 595 | 39 990 | 33,3 | 1 035,2 |

| 01/01/2015 | 385 460 | 46 089,0 | 38,8 | 1 206,8 |

| 01/01/2016 | 368 399 | 48 563,0 | 45,5 | 1 414,6 |

| 01/01/2017 | 377 741 | 60 193,6 | 51,9 | 1 614,27 |

| 01/01/2018 | 432 742 | 76 647,0 | 59,1 | 1 838,22 |

(*) 1 troy ounce = 31.1034768 grams

The increase in gold in International reserves for the period from 2010 to 2018 amounted to 1,189.12 tons (1,838.22 - 649.1), i.e. increased by 2.83 times. And this is with a slight change in the size of International reserves.

Gold reserves of the Russian Federation continued to grow during 2021 and amount to:

| date | Monetary gold reserves (millions of fine troy ounces) | Gold reserves (tons)* |

| 01/01/2018 | 59,1 | 1838,8 |

| 02/01/2018 | 59,7 | 1856,88 |

| 03/01/2018 | 60,5 | 1881,76 |

| 04/01/2018 | 60,8 | 1891,09 |

| 05/01/2018 | 61,4 | 1909,75 |

| 06/01/2018 | 62,0 | 1928,42 |

| 07/01/2018 | 62,5 | 1943,97 |

| 08/01/2018 | 63,3 | 1968,85 |

| 09/01/2018 | 64,3 | 1999,95 |

| 10/01/2018 | 65,5 | 2037,28 |

For information: The material uses data from the Bank of Russia.