Post updated: May 27, 2020

The Earth's gold reserves continue to be mined. This can only mean that the gold reserves of different countries are periodically replenished. Precious metals are bought and sold. Often, the intermediary in this turnover is the bank. Many commercial banks in Russia have a license that allows the bank to purchase or sell jewelry. Such banks themselves set the gold rate based on the discount price of the Central Bank of the Russian Federation. VTB 24 has some of the most affordable prices today.

Gold price

The pricing policy for the precious metal is set in London, twice a day. This is an international or international course. It is used all over the world. As for the national exchange rate, it is set by the Central Bank. It takes as a basis the prices set on the London Stock Exchange, but also takes into account the dollar-ruble ratio and various other factors that influence the cost of jewelry. Commercial banks take the price set by the Central Bank as the basis for setting the rate in their branches. In addition, the price may be affected by the bank's reserve stock of precious metals.

The price of precious metals set by the bank may be influenced by its reserve stock.

Among the largest (commercial) banks in the Russian state, VTB 24 Bank is one of the most reliable. This bank offers people a variety of financial services, from loans and mortgages to deposits and gold bars. The gold rate set by VTB 24 is considered by many analysts to be the most democratic in the Russian Federation.

| Metal | We buy | We sell |

| Gold | 3 794,30 | 4 114,40 |

| Palladium | 4 310,50 | 4 896,50 |

| Platinum | 1 798,50 | 2 050,30 |

| Silver | 38,02 | 41,33 |

Should you trust it?

The VTB company has been operating in the insurance market for quite a long time and effectively; the monetary security of its policy is about 500,000 rubles, which is 5 times higher than the mandatory value in Russia. Regardless of whether the client signs up for compulsory medical insurance or a voluntary medical insurance policy, he gets the opportunity to use modern medical care, consultations with specialists and referrals for tests.

VTB medical insurance guarantees the provision of timely assistance, comprehensive treatment, and effective rehabilitation for its clients, regardless of their age, place of work and citizenship.

Compulsory medical insurance is a service that is provided to Russian citizens and non-citizens permanently residing in the country according to state legislation. VHI can be purchased voluntarily, but sometimes it is mandatory (for migrants and tourists).

An employer who insures its employees under VHI, in addition to the loyalty of its staff, receives the right to take into account VHI contributions, which reduces taxation. Treatment in comfortable rooms with helpful staff reduces the stress of a hospital stay and allows you to recover faster from illness.

Investments in precious metals

Gold deposits are one of the most popular investment instruments.

Unlike the exchange rate or stock price, the gold rate is much more stable and resilient.

That is, while securities or currencies can depreciate, precious metals cannot completely depreciate. They will always be valuable.

Minor fluctuations may affect their prices. But in general, the gold rate is very stable today. At VTB 24 you can purchase gold bars or coins weighing from one gram to several kilograms.

With the help of gold deposits you can increase your capital. In times of crisis, they act as a protective contribution. Most often, the crisis bypasses the precious metals market. Prices could rise as investors shift their capital to the precious metals exchange. The demand for gold will increase, but the supply will remain the same. According to the laws of market relations, prices will begin to rise.

Compulsory medical insurance quotes VTB

The rate of silver, gold, platinum or palladium is unstable, it changes every day, and can change several times a day. You can always view the rate valid at a certain moment on the bank’s Internet resource at the link https://www.vtb.ru/personal/investicii/obezlichennyj-metallicheskij-schet/. Here the table shows the name of the metal, the cost when buying and selling.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

Please note that the sale of the asset is carried out at a higher rate.

By the way, a feature of VTB Bank’s compulsory medical insurance is that the client can replenish the account at any convenient time, as well as make debit transactions on it. The cost of cash withdrawal will be expressed in the equivalent of 0.1 g of precious metal. In a similar way, you can top up with cash, that is, purchase a certain amount of precious metal.

Benefits of investing

When purchasing unallocated gold from a bank, consumers receive a “metal” account. It is practically no different from the usual ruble currency. But instead of currency there are precious metals, according to the gold rate at VTB.

The bank offers gold bars of various denominations.

Gold deposits are very reliable in terms of price, but there is one drawback - the lack of government insurance. Servicing metal deposits is more difficult and more expensive than regular foreign currency deposits. In view of these features, to open a metal deposit you need to choose a reliable bank.

VTB 24 has one of the most favorable gold rates set by banks.

Opening a metal impersonal account at VTB 24 is not difficult.

Opening an impersonal metal account is easy and quick.

When closing a metal account, the metal can be issued in bullion or cash. The calculation will be made with a recalculation of the cost per gram of gold, depending on the weight of the bar. In addition, if you want to take away gold, you will have to pay 18% VAT on its value.

You can open a precious metal deposit at VTB 24 Bank at any branch, bringing your passport and money. In order to sell precious metal to a bank, you will also need documents for the bullion, a certificate and a certificate from the manufacturer. All these accompanying documents must be provided along with the bullion itself.

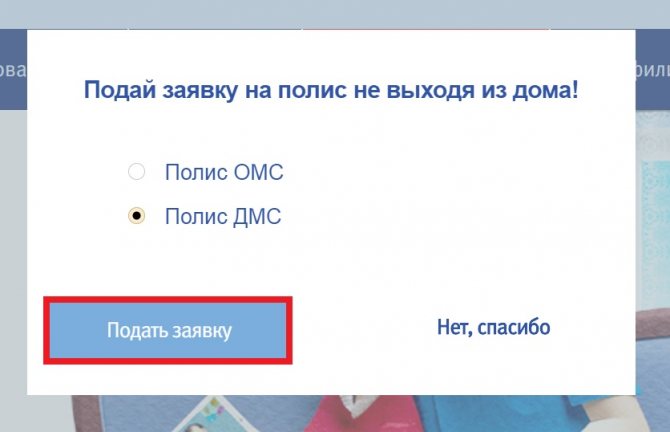

Registration of a voluntary health insurance policy on the official VTB website

The application is submitted in the same way as for the mandatory one. Only in the pop-up window you need to select “VHI”. Then indicate your full name, region and contact information. An employee will contact you to clarify the program and other details.

Step-by-step registration of a voluntary health insurance policy at VTB:

1. When you open the official VTB website (https://vtbms.ru), a window will appear asking you to issue a policy. Select the “VHI” option and click the “Submit Application” button.

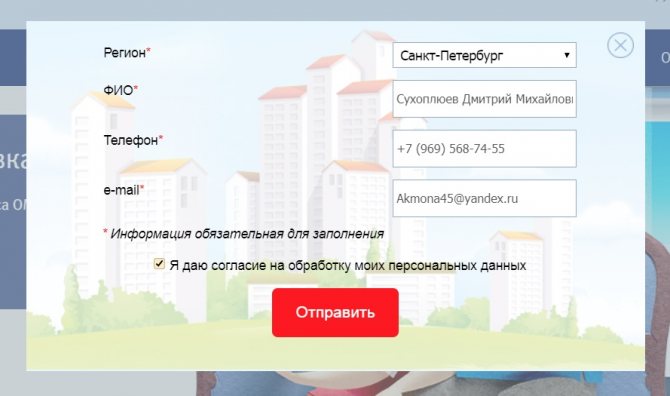

2. In the window that appears, specify:

- required region;

- FULL NAME;

- and contact information - phone number and email address.

Check that the box next to consent to the processing of personal data is ticked. Click "Submit".

3. After sending this information, it goes to a specialist serving clients in this region.

The operator will tell you when it will be possible to get the policy and where the nearest VTB branch is located. When VTB's medical policy is ready, you will be notified by phone and email.

By phone you will be given an appointment at the nearest VTB office. The operator will tell you when it will be possible to get the policy and where the nearest VTB branch is located.

Then you need to fill out an application. This can be done in the office or at home, in advance. Download the form on the website or pick it up at the branch.

Please attach the following documents to your application:

- passport or other identification;

- SNILS (if issued);

- previous VHI policy, if any.

The procedure itself takes no more than 5 minutes. And the ability to choose a convenient time and place is very convenient for a modern busy person.

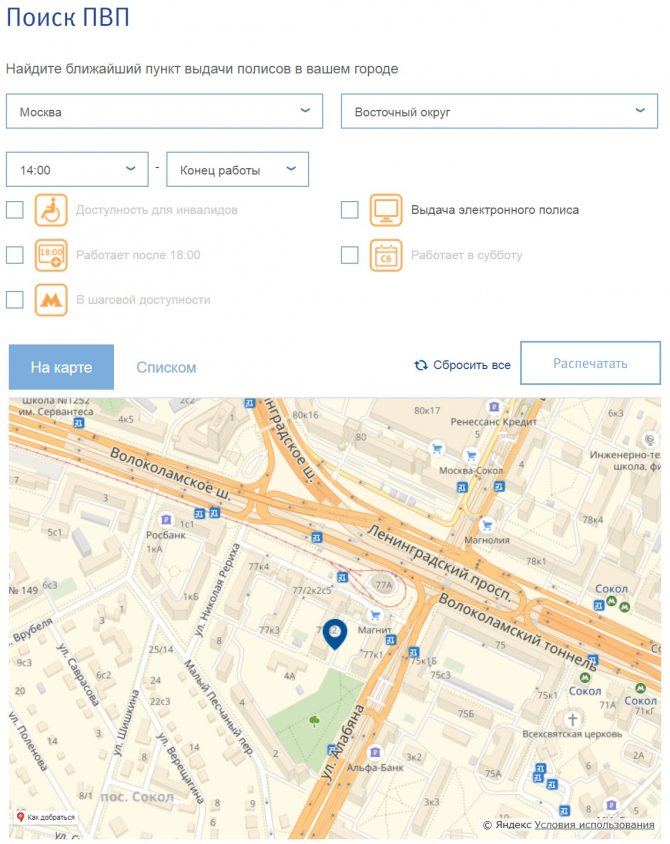

The policy can be obtained at any issuing point, you just need to indicate the point in advance. The list and location can be viewed on the website. To do this, on the main page, select “Addresses of pick-up points”. Then find the desired office on the map. You can use the search for the nearest one by address (at the top of the page).

The registration of a VHI agreement takes place exclusively in the office, since it is necessary to select a program in which additional beneficial options can be included.

Age also affects the cost of the program. In this case, an online application can only speed up and simplify the receiving process, because a convenient day and time will be chosen at which the specialist will expect the client.

Checking the readiness of the VTB Insurance VHI policy

An insurance company employee, having accepted the citizen’s data, sends it to the contract processing department, from where the completed policy will be received in a few days.

You will be notified of the document's readiness by phone or email. But if you wish, you can clarify the terms by calling the VTB Medical Insurance helpline. The hotline number is 8 (800) 100-800-5. It will also answer other questions related to insurance.

More information about the VHI policy at VTB Medical Insurance:

- VHI medical programs from VTB Insurance;

- VTB 24 - the cost of a VHI medical policy;

- "VTB Insurance" - purchase of a voluntary health insurance policy;

- List of VHI policy clinics from VTB Insurance;

- Hotline number for VHI policy.

What assistance is provided under compulsory medical insurance?

Compulsory insurance may include not only free assistance, but also paid assistance. At the expense of the VTB program, insured persons receive services free of charge for the following diseases and conditions:

- Infectious pathologies (except for STDs, HIV infections);

- Metabolic disorders and digestive problems;

- Diseases of the central nervous system;

- Pathologies of hematopoiesis;

- Genetic failures;

- Immune system diseases;

- Injuries;

- Ophthalmological pathologies;

- Skin diseases;

- Respiratory diseases;

- Pathologies of the musculoskeletal system;

- Urogenital problems;

- Diseases of otorhinolaryngology;

- Poisoning;

- The period of gestation, child, childbirth and postpartum;

- Congenital developmental disorders;

- Problems in children during the perinatal period.

Insured persons receive the following services:

- Preventive and diagnostic measures, treatment, rehabilitation;

- The use of reproductive techniques, including IVF;

- Procedures for PRT;

- Medical examinations for permission or restriction of sports and physical education and issuance of certificates.

- Measures for the selection and adjustment of devices for sensorineural hearing loss.

- Necessary diagnostic tests when registering conscripts or for military service.

- Examination and conclusion for persons preparing to adopt a child.

Compared to VHI, the quality of services is somewhat lower: you have to stand in line to see doctors, inpatient treatment takes place in ordinary wards of a government institution, and not in comfortable ones.

Emergency medical care is provided regardless of the availability of insurance policy, citizenship and registration, in accordance with the law.

At the expense of personal funds, citizens have the right to consultations with any specialists, preventive and diagnostic private events, examinations and examinations, even if there are no medical indicators. The list also includes the following services:

- Cosmetology and plastic surgery;

- Dental prosthetics;

- Homeopathic and alternative treatment methods (acupuncture, hirudotherapy, etc.);

- Psychologist assistance, both individual, group, and family;

- Stay in sanatorium-resort institutions (with the exception of a special category of citizens and children undergoing treatment in specialized institutions);

- Anonymous diagnosis and therapy;

- Therapeutic procedures, examination at home at the request of the patient and observation after discharge from the hospital at home.

- Other services.

Additional paid services are carried out solely at the patients’ own voluntary will.

The fact that a person has expressed a desire to be treated for a fee must be recorded in the medical record by the doctor.