Post updated: Apr 17, 2016

The largest and one of the oldest trading platforms in the world is the London Metal Exchange. There are transactions with various precious metals. The well-known London fixing sets gold prices and this can be monitored online from anywhere in the world. The price of gold set by the London Stock Exchange, that is, its fixing, shows the activity of various companies that control the gold market in the world.

The London Stock Exchange determines the price of gold based on the results of two trading sessions, which are held from 11:40 to 14:45 and from 14:55 to 17:00. The gold rate is set by companies whose composition on the London Metal Exchange remains unchanged for a long time.

Their representatives shout out the price of a certain metal, and after the trading is over, the concluded contracts are registered in the clearing center.

The price of gold on the London Stock Exchange is formed daily except weekends, and today it is about $1,200 per ounce. What is the cost of 1 troy ounce of gold on the London Stock Exchange right now you can see on our chart:

What is the purpose of stock trading?

The main task of world exchanges is to provide each participant with the necessary indicators. Resource owners receive demand in the form of buyers. Buyers themselves have the opportunity to find materials in any quantity from their manufacturers and owners.

Many large corporations need to purchase large quantities of raw materials to meet their production needs. In addition to individual contracts, there is a way to conclude a deal through trading operations on exchange systems. This type of action allows you to profitably obtain the necessary material while reducing its overall rate.

The main global goal of such operations is to establish average prices for specific raw materials around the world. Stock marks are used so that they can be declared in tax documents. All indicators at the time of the transaction are registered by a special chamber.

With their help, companies indicate fixed amounts for rates and expenses in accounting reports for a specific date. Therefore, the use of such a calculation system is mandatory. When concluding a multi-million dollar contract to purchase, for example, several tons of platinum, it is worth having an accurate calculation in several currencies. To do this, you have to convert the price to the total cost. If gold was purchased from a company on a Russian exchange in dollars, then it will be necessary to convert the transaction amount into rubles according to the time valid at the time the trading transaction was concluded.

Please note that all transaction terms for specific types of raw materials must be presented to brokers before the opening of the trading session. This is necessary so that they can quickly close the purchase or sale operation, in accordance with all established rules.

Fixing history

Against the backdrop of the devaluation of the pound sterling in 1919, the Bank of England decided to grant the Rothschild Bank the right to sell South African gold. The bank had to determine the “best price” that would suit the London market and bullion sellers. The first London fixing took place on September 12, 1919 and fixed the price of gold at 4 pounds 18 shillings and 9 pence (in New York the price per troy ounce was $20.67).

The five largest gold producers and traders were participants in the fixing:

NM Rothschild & Sons (“Rothschild and Sons”);

Pixley & Abell (“Pixley and Abell”);

Mocatta & Goldsmid (“Mocatta & Goldsmith”);

Sharps Wilkins (Sharps Wilkins);

Samuel Montagu & Co (Samuel Montagu & Co.).

In the period from 1939 to 1954, gold fixing was not carried out. This is due to the suspension of the gold market during World War II. Until 1968, gold was fixed once a day at 15:00 GMT. The timing coincided with the opening of markets in the United States.

In the entire history of gold fixing in London, the maximum was recorded on January 21, 1980 at $850 per troy ounce. Gold jumped amid a significant rise in oil prices and inflation during the unfolding crisis in the Middle East. In recent years, the maximum price for gold was recorded on August 23, 2011 at $1911.46 per troy ounce. Bringing prices into line with the inflation of past years, the peak in gold prices in the 1980s remains an all-time high.

What resources are traded?

Lots of energy raw materials and precious metals are actively traded. This is due to the high demand for these types of goods. This is also explained by the wide scope of application of these resources in various industries.

Energy resources are constantly being mined in different countries. They also apply to non-returnable materials. This means that when this type of object is used, it is completely used up and cannot be recycled.

Precious metals have an advantage in this regard. They can be reused many times. There are even separate trading points dedicated to transactions for scrap precious raw materials. After purchase, the materials are subject to recycling and the necessary levels of processing and, after examination, the raw materials can acquire their original quality.

How do trades take place?

The dynamics of prices on stock exchanges is colossal. Their movement is influenced by general world news. As a result, positive or negative forecasts are made. They put serious pressure on the cost of various positions when trading opens. Then, towards noon, the movement begins to slow down. Prices are leveling out and declines are decreasing.

There are two main indicators that control prices:

- Demotion.

- Promotion.

Some brokers play on lower prices and try to reduce the cost of the lot in order to close the deal profitably in the future by acquiring the necessary positions. The other part is trying to raise the rate by selling the volumes they have at inflated prices.

This confrontation affects the price of precious metals. The result of such actions is the total number of transactions completed during one session.

Price dynamics for precious metals

On the precious metals exchange, the price constantly moves to new levels. This is due to constant jumps in both demand and supply. Representatives of many countries are trying to introduce their own trading conditions. Everyone participates with their own raw materials, as a result of which advantageous positions at a certain moment cover weaker ones.

| date | Precious metals price chart in rubles | |||

| Silver | Gold | Platinum | Palladium | |

| 01.05.16 | 36 | 2723 | 2246 | 1282 |

| 01.05.16 | 34 | 2568 | 2073 | 1115 |

| 01.07.16 | 37 | 2717 | 2071 | 1211 |

| 01.08.16 | 43 | 2860 | 2438 | 1511 |

| 01.09.16 | 39 | 2757 | 2223 | 1432 |

| 01.10.16 | 39 | 2706 | 2101 | 1465 |

| 01.11.16 | 35 | 2589 | 1989 | 1249 |

| 01.12.16 | 34 | 2490 | 1925 | 1602 |

| 01.01.17 | 31 | 2264 | 1869 | 1455 |

| 01.02.17 | 33 | 2315 | 1906 | 1448 |

| 01.03.17 | 34 | 2332 | 1911 | 1459 |

| 01.04.17 | 32 | 2234 | 1700 | 1433 |

| 01.05.17 | 31 | 2318 | 1733 | 1494 |

An interesting feature of such activities is that increased demand does not always prevail for a specific position for a long time. Once the market becomes oversaturated with one product, the price begins to decline significantly. As a result, his trading position begins to fall.

Rothschilds emerge from the shadows on the centenary of the London Gold Fixing - ARTICLE OF THE YEAR

“The story of the London gold fix is a story of intervention and manipulation of the price of gold.”

This month marks the centenary of the first London Gold Fixing - the notorious daily meetings of a secret cartel of bullion banks starting in 1919 to determine the benchmark price of gold used in the international gold market, continuing to this day through its thinly veiled successor, the LBMA Gold Price auction.

The London Gold Benchmark Price is critical to the international gold market as it is used as the source for everything from International Swaps and Derivatives Association gold interest rate swaps to gold-backed ETFs and from over-the-counter gold contracts to the underlying transaction prices used by physical bullion dealers when purchasing gold bars and coins from refiners and suppliers.

Since 2015, the London Gold Fixing has been known as the LBMA Gold Price as a result of an attempt by bullion banks – members of the London Bullion Market Association (LBMA) – to correct the reputation of the then disgraced “fixing” and relaunch it under a new name. The first secretive gold fixing formally came into being on September 12, 1919, when the Bank of England appointed its favorite bankers N.M. Rothschild & Sons as permanent chairmen of the daily fixing. The Rothschilds and the Bank of England have been inseparable since the beginning of the 19th century. and throughout the existence of the gold fixing over the next century.

The launch of the gold fixing by the Bank of England and the Rothschilds in 1919 followed a more informal version that existed before the outbreak of the First World War in 1914 and consisted of meetings of four London gold brokers: Mocatta & Goldsmid, Samuel Montagu, Sharps Wilkins and Pixley & Abell, – who set the daily price of gold at the SharpsWilkins office.

Beginning in September 1919 and for the next 85 years, gold fixing meetings took place daily at the Rothschild headquarters in New Court, St. Swithin's Lane, across the road from the Bank of England. Every morning at 10:30 a.m., five people representing the five bullion banks invariably met. Following the collapse of the London Gold Pool in 1968, gold fixing moved to twice daily pricing, with an additional 3:00 pm meeting to "track" the US morning gold market.

The Rothschilds remained permanent chairman of the gold fixing until May 2004, when the notorious investment bank mysteriously left the gold fixing and went into obscurity after 200 years in the London gold market. That is, until recently, as this week saw the LBMA's seminar and gala celebrating the centenary of the gold fix, held at, you guessed it, NM Rothschild's headquarters on St. Swithin's Lane. According to the LBMA, the "signature event" of the centenary celebration "took place on the hundredth anniversary of the first determination of the price of gold in the present Rothschild building, built on the site of the (second) New Court, St. Swithin'sLane, where the first price of gold was determined. We are grateful to the Rothschilds for their support in hosting this event in conjunction with the LBMA.”

Is the centenary of the gold fix really the “momentous occasion” that the LBMA is making it out to be, or is a more realistic perspective needed to counterbalance the cheers from the LBMA camp?

Let's figure it out, based on the many articles from our and other sites that examine various aspects of the notorious gold fixing during different periods of its existence, including articles about the current LBMA Gold Price. After all, the LBMA Gold Price is just a new name for the gold fix, as the LBMA press office acknowledged this month, dropping the pretense by declaring: “September 12, 2021 marks the centenary of the first London Gold Price, or what is now known as LBMA Gold Price".

The very definition of the century as covering the period 1919-2019. highlights the continuity of the “ London Gold Fixing - LBMA Gold Price ”, where the LBMA Gold Price is just a veiled and more digestible version of the gold fixing, a classic case of the same old wine in a new bottle, with the pricing process still controlled by the Bank of England and the bullion banks.

Unchangeable order - the Rothschilds and the Bank of England

How did the five old members of the gold fixing - Mocatta & Goldsmid, Samuel Montagu, Sharps Wilkins, Pixley & Abell and, of course, NM Rothschild - turn into the modern five - HSBC, DeutscheBank, Barclays, Scotia and SocGen - who ruled the fixing until 2014- 15? In short, the situation was as follows.

In 1957, Sharps Wilkins merged with Pixley & Abell to form Sharps Pixley. In 1966, on the instructions of the Bank of England, the investment bank Kleinwort Benson bought out SharpsPixley. In 1993, Deutsche Bank acquired Kleinwort Benson, and with it one of the positions in gold fixing.

Five former participants in the gold fixing in the London office of the Rothschilds, where the fixing took place until 2004.

In 1957, Mocatta & Goldsmid was acquired by Hambros Bank, which then sold Mocatta in 1973 to Standard Chartered Bank. In 1973, Scotia bank acquired Mocatta Bullion from Standard Chartered, forming ScotiaMocatta . This explains the second place in gold fixing.

In 1967, Midland Bank gained control of Samuel Montagu, making it a 100% subsidiary in 1974. In 1992, Hong Kong and Shanghai Banking Corporation ( HSBC ) completely acquired Midland Bank, and with it the third of five gold fixing positions.

As a major gold refiner, Johnson Matthey (JM) had been involved in gold fixing since the 1920s, but in the early 1960s JM formed Johnson Matthey Bankers Ltd (JMB) to become one of the gold fixers. In 1984, JMB collapsed in one of London's most memorable financial and gold market scandals and was bought by the Bank of England, which then sold it to Mase Westpac, the gold trading arm of the Australian bank Westpac. In 1993, Republic National Bank of New York bought Mase Westpac's place in the fixing position.

In 2000, HSBC also acquired Republic National Bank of New York. Since HSBC already had one of the five gold fixing seats, as did Republic (through its acquisition of Mase Westpac), HSBC sold one of the two fixing seats to Credit Suisse. In 2002, Credit Suisse sold its position in the fixer to Societe Generale ( SocGen ). This explains the fourth place in fixing.

And NM Rothschild? From all this it can be seen that the one constant in the gold fix for most of its history has been the most powerful of all investment banks, NM Rothschild, and its old friend the Bank of England operating behind the scenes. However, in 2004, the Rothschilds mysteriously exited the gold fixing. Was this the Bank of England's revenge for being forced to "look into the abyss" and sell Britain's gold reserves to help a market that was short of physical gold, or was it a typical Rothschild retreat into the shadows? Whatever the reason, in 2004 the Bank of England arranged for the Rothschilds' place in the gold fix to be purchased by the more pliable Barclays Bank .

It is noteworthy that even with the participation of Barclays in the gold fixing, the influence of the Rothschilds remained, since in 2006-2012. The chairman of Barclays was one Marcus Agius , the - in-law of the former chairman of NM Rothschild , Edmond de Rothschild .

For those familiar with the five houses of the Rothschilds and the symbolism of the five arrows, the fact that there have only ever been five places in the gold fixing is a symbolic coincidence.

However, the question has always remained who is the real puppeteer of the London gold market: the Rothschilds or the Bank of England. Guys, the fixing is ready - one of the daily gold fixing meetings at the Rothschilds on St.

Swithin's The Not-So-Invisible Hand of the Bank of England

Apart from NM Rothschild, the constant component of the gold fix since its inception is, of course, the Bank of England, the central bank that controls and has always controlled the London gold market. A version of the 1919 fixing, then still in sterling, was even launched by the Bank of England, mainly to sell the gold of seven South African gold miners in London, using the Rothschilds as trading agents. Essentially, the Rothschilds began to intervene in the market by presiding over the new fixing and distributing South African gold through other bullion brokers.

The first six years of the gold fix, 1919-25, coincided with the era of floating exchange rates, when almost all gold passing through London was sold by the Rothschilds through the gold fix, and the price of gold fluctuated slightly based on a fixed dollar price of $20.67 per ounce and fluctuations in the pound sterling. relative to the US dollar. Then, when Britain returned to the gold standard in 1925, the fixed price of gold remained within a very narrow trading range until 1931, with the official price of gold paid by the Bank of England to gold miners effectively serving as the cap on the price of gold.

When Britain left the gold standard in 1931 and the US raised the official gold price to $35 an ounce in 1934, the London price of gold began to rise slightly, but still under the interventionist supervision of the Bank of England. Due to the outbreak of World War II, the London gold market and gold fixing closed in 1939 and remained closed until 1954. When they reopened, it was the world of the Bretton Woods monetary system with a fixed official gold price of $35 per ounce.

In 1954-68. There were countless audacious attempts by the Bank of England and other central banks to keep the market price of gold at $35 an ounce, culminating in the notorious London Gold Pool, an experiment in gold price intervention from 1961-68 that collapsed in March 1968 when the US Treasury ran out of good delivery gold bullion, despite the Bank of England as pool agent in 1967-68. sold thousands of tons of gold as part of the gold fixing.

However, the Bank of England regularly intervened in gold fixings even before the London Gold Pool in order to exert what it haughtily called a “mitigating influence” on the price of gold. The following passage from the Bank of England's quarterly bulletin for 1964 is a clear illustration:

“The Bank of England is not physically represented in the fixing. But he can, like any other operator, actually participate in the fixing by placing orders by telephone through his bullion broker, and in fixing he uses exclusively the services of the Rothschild market chairmen .

...The Bank strives , as in the case of the foreign exchange market and the gold-cut securities market, to the best of its ability to exert a softening influence on the market in order to avoid sharp and unnecessary price movements and thereby help the market fulfill its functions.”

Following the collapse of the London Gold Pool in March 1968, the gold market reopened two weeks later using a two-tier approach: an official gold price of $35 an ounce for central banks and a “free market” price for everyone else. Notably, upon re-opening, the Rothschild and associates gold fixing moved to pricing in US dollars and an afternoon fixing meeting was added at 3:00 pm to give the Bank of England and the five fixing members more control over the morning trading hours in New York.

If you think that the Bank of England gave up on finding ways to manipulate the price of gold in 1968, you are wrong. Instead, he continued to scheme behind closed doors down to the present day, including discussions with managers of others at the Bank for International Settlements in Switzerland in 1979 and 1980. creating a new interventionist gold pool to “break the market psychology” and contain the price of gold “in a targeted area during a critical period” (“New Gold Pool at the Bank for International Settlements in Basel, Switzerland: Part One – The Big Investigation” (New Gold Pool at the BIS Basle, Switzerland: Part 1) and “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil)

The Bank of England was also behind the creation of the London gold lending market, a highly secretive and opaque market that emerged in the 1980s where central banks lend their gold through LBMA bullion banks, after which the loaned gold positions are sold on the market, overwhelming the price. If you ask the LBMA and the Bank of England for data on outstanding gold loans or the size of the lending market, you will not get an answer. The Bank of England also promoted the trade in London of unallocated gold positions - a huge pyramid of paper gold positions (the usual credit in the form of bullion bank promises) with virtually no real gold backing, but which had a huge impact on discovering the price of gold and, importantly, proving that the Bank England continued to exert a softening influence through the gold fixing.

This is illustrated by the striking intervention in the gold fixing in the 1980s by the head of the Bank of England's gold and foreign exchange department, Terry Smeeton : "Terry's gold activities, often partly aimed at facilitating the daily gold fixing of the London market, were generally beneficial." Read more: “The Bank of England and the London Gold Fixings in the 1980s.”

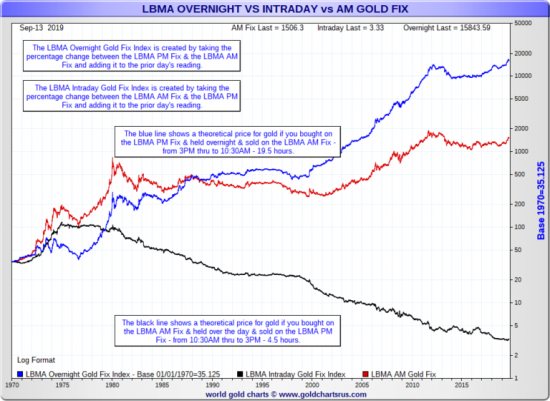

If anyone doubts that the London Gold Fixing has suppressed the price of gold, take a look at the following chart from Nick Laird's goldchartsrus.com , which shows three gold price lines from 1970, when the price was $35 an ounce, until 2021 d. The red line is the actual dollar price of gold. Blue is the theoretical price of gold if you buy at the afternoon London Gold Fixing price and sell the next day at the morning Gold Fixing price. Black is the theoretical price of gold if you buy at the morning gold fixing price and sell on the same day at the afternoon gold fixing price.

Fixing is ready! – the overwhelming influence of gold fixing on the price of gold for almost 50 years. Source: goldchartsrus.com

Overnight, intraday change and morning gold fixing LBMA

13 Sep. 2021; Last morning fixing = 1506.3; Last intraday value = 3.33; Last overnight = 15843.59

1970 base = 35.125

The LBMA Overnight Gold Fixing Index is created by adding the percentage change between the afternoon and morning LBMA fixing to the previous day's value

The LBMA intraday gold fixing index is created by adding the percentage change between the morning and afternoon LBMA fixing to the previous day's value

The blue line shows the theoretical price of gold if you buy at the LBMA afternoon fixing price at 15:00 and sell 19.5 hours later at 10:30 at the morning fixing price

The black line shows the theoretical price of gold if you buy at the LBMA morning fixing price at 10:30 and sell 4.5 hours later at 15:00 at the afternoon fixing price

Logarithmic format

LBMA Overnight Gold Fixing Index, base 01/01/1970 = 33.125; LBMA Intraday Gold Fixing Index; Morning gold fixing LBMA

If, starting in 1970, when the price of gold was $35 an ounce, you bought gold every day at the afternoon gold fix and sold it 19.5 hours later at the morning gold fix, then your $35 would be worth $15,843 today. This is the total cost of the overnight strategy. On the other hand, if you had bought gold at the morning gold fixing price every trading day since 1970 and sold it 4.5 hours later at the afternoon gold fixing price, then your $35 would be worth only $3.33 today. This is the total cost of the intraday strategy. The bottom line is that the London Gold Fixing is suppressing the intraday gold price and the current gold price of around $1,500 is well below what it should be. But the LBMA made no mention of this in its comments on the centenary of the London gold fixing this month.

'Fixing is Rigging'

London Gold Market Fixing Limited

Also silent on the LBMA's centenary celebrations this month was that the improbably named London Gold Market Fixing Limited (LGMFL), a private company formed by five banks participating in the gold fixing ( Barclays BankPlc, HSBC Bank USA, The Bank of Nova Scotia, Deutsche Bank and Societe Generale) are still listed as active companies on the UK Companies Register. The company, founded in 1994, is still reporting on an ongoing basis and cannot be shut down as class action lawsuits alleging LGMFL's involvement in gold price manipulation are pending in New York courts.

register dated 4 September 2019 shows the appointment of Francois Combes of SocGen as a director of LGMFL on 30 August 2021, the dismissal of Vincent Domien a date and Termination of Steven Lowe from Scotia in August 2018

addition , LGMFL's current directors include Scotia's Simon Weeks , SocGen 's Xavier Lannegrace , HSBC's Paul Voller and Barclays ' Jerzy Burmicz . Deutsche Bank by this time had successfully exited LGMFL. The register also contains the latest LGMFL annual reports up to December 2021 with critical commentary:

“Four LGMFL member banks are named as defendants in class action lawsuits pending in the U.S. District Court for the Southern District of New York, the first of which was filed on March 3, 2014, in connection with their role in establishing the London Gold Benchmark Price. Plaintiffs allege, among other things, that LGMFL and its member banks violated the Sherman Act , the Commodity Exchange Act, Commodity Futures Trading Commission Rule 180.1(a) and various state laws by manipulating the London Benchmark Gold Price ."

The above-mentioned US class action lawsuits against LGMFL were discussed in publications on the BullionStar website, such as “Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks.” , and in a detailed and unprecedented analysis of class action court documents on Allen Flynn's .

And it's not just New York that investors believe they've been scammed in the gold market. Investors also filed class action lawsuits against LGMFL and five banks participating in the gold fixing in the Ontario Superior Court of Justice in Canada. The aforementioned LGMFL reports state that, according to the Canadian class action lawsuits:

“LGMFL and the member banks conspired, agreed and/or agreed to manipulate the London Gold Benchmark Price and are required to pay damages in the amount of C$1 billion under the Competition Act, as well as for civil conspiracy, dishonest enrichment and repudiation of liability.” .

There is no mention in the LBMA's September 12 centennial update that LGMFL is still an active company and that four of the five banks participating in the fixing are currently defendants in class action lawsuits in New York and Canada.

It is also interesting that the majority of LGMFL participants have now exited the London bullion markets altogether. These include Deutsche Bank, Barclays and, more recently, SocGen. Another cartel member, ScotiaMocatta, reorganized its precious metals business. Thus, only HSBC remains fully active in the London gold market, as explained in the article “Curse of the London Gold Fix strikes again as SocGen abandons ship”:

“The battle losses of the still active LGMFL company appear so severe that the entire former gold fixing brood seems cursed. Is it really only a matter of time before the fifth member of the notorious syndicate, HSBC, runs into trouble?”

Hasty cover-up GoldFixing site

LGMFL is the same company that Bloomberg highlights in its November 2013 article “London Gold Fix Calls Draw Scrutiny Amid Heavy Trading”:

“LGMFL, a company controlled by the five banks that set the benchmark price, has no permanent employees. call was forwarded to Douglas Beadle, 68, a former Rothschild banker who serves as a consultant to the company ... Beadle declined to comment on the benchmark price determination process."

The LBMA also made no mention in its speeches this week of the real reasons why the gold fixing was wound down in March 2015. Let us remind you that the last gold fixing took place on Thursday, March 19, 2015, at 15:00. Then on March 23, 2015, the LGMFL website at www.goldfixing.com was closed and its server was disabled, which was confirmed by the same former employee of the Rothschild bank, Douglas Beadle. For details and links to all the original documents that were on the website www.goldfixing.com before its hasty closure, see the article “London Gold Fixing website goldfixing.com taken offline.”

“The best thing that could be done was to close everything down.”

But what led to the demise of the gold fix in 2015 (and its replacement with essentially the same thing, just under a different name)? It can be assumed that the collapse of the London gold fixing began in late 2013 after the LIBOR scandal, when financial regulators such as the British Financial Conduct Authority (FCA) and the German Financial Supervisory Authority (BaFin) began investigating the gold fixing and its five banks. BaFin was particularly effective in investigating DeutscheBank's gold fixing activities. At the end of 2013, BaFin demanded certain documents from Deutsche, after which in January 2014 DeutscheBank withdrew from the London gold and silver market and then abandoned its place in the gold and silver fixing.

Unable to sell its position in the gold or silver fixing because other banks were unwilling to deal with the fixing due to regulatory investigations, Deutsche Bank gave two weeks' notice and withdrew on May 13, 2014, leaving four banks in the gold fixing (Barclays , Scotia, HSBC and SocGen), and in silver there are only two (Scotia and HSBC).

Then the rest of the fixing participants also wanted to jump ship, but on May 15, 2014, ZeroHedge managed to publish an excellent article “From Rothschild To Koch Industries: Meet The People Who “Fix” "The Price Of Gold) with dossiers on all 10 directors of LGMFL at that time. These directors are: Matthew Keen and James Vorley for DeutscheBank, Simon Weeks and Stephen Lowe for Scotia, Jonathan Spall and Martyn Whitehead for Barclays, Peter Drabwell ) and David Rose from HSBC and Vincent Domien and Xavier Lannegras from SocGen.

Less than a week later, on May 20, 2014, Barclays announced that its head of gold trading, Marc Booker , was . Three days later, the British financial regulator FCA announced that Daniel Plunkett , director accused of manipulating the price of the afternoon gold fix and would be fined and suspended from participating in the auction. Daniel Plunkett became famous for saying that he hoped the price of gold would fall.

At the same time, the FCA fined Barclays Bank Plc £26,033,500 for "failing to adequately manage conflicts of interest with its clients and systemic and management failures relating to the gold fixing during 2004-13."

That's right. Barclays was fined for manipulating the price of gold during the decade from 2004 to 2013, i.e. the entire period of the bank's participation in fixing. 2004 is also interesting because, from that time on, the five fixing participants stopped meeting daily in person, switching to using electronic applications. See the article “The pre-2015 London Gold Fixings – More technologically advanced than reported.” The use of online applications made the conspiracy easier, but also left clues behind.

Same thing, just a different name.

Considering how the LBMA controlled the transition from the London Gold Fixing to the LBMA Gold Price and continues to prevent real representative participation in the global gold price discovery process is beyond the scope of this article. Let's leave this for future analysis. For those interested in the background and methods for choosing a “new” version of the gold fixing, here is a selection of current articles: “Chinese banks as direct participants in the new LBMA gold and silver auctions? Not so fast!" (Chinese Banks as direct participants in the new LBMA Gold and Silver Price auctions? Not so fast!), “Six months on ICE – The LBMA Gold Price” and “LBMA Alchemy and the London Market gold and silver: 2 steps back" (LBMA Alchemy and the London Gold and Silver Markets: 2 Steps Back).

Suffice it to say here that two-thirds of the fifteen participants in the LBMA Gold Price auction are bullion banks such as Goldman Sachs, HSBC, JPMorgan Chase, Morgan Stanley and Bank of Nova Scotia.

Bank of England softening the price of gold

Conclusion

If anyone is in London on 27 September and wants to see the LBMA and the Bank of England commemorate the centenary of the gold fixing, there will be a 'gold talk' co-hosted at the Bank of England on the day by LBMA CEO Ruth Crowell and LBMA Chairman Paul Fisher . The LBMA's 'independent' chairman Paul Fisher will be right at home there, having spent much of his career in senior positions at the Bank of England, including as head of the foreign exchange department (also covering gold). For more information, see the article “Blood Brothers: The Bank of England and the London Bullion Market Association (LBMA)”. As Jim Rickards when Fisher was appointed LBMA Chairman in 2021:

“The banks chose the central banker to be in charge of the gold market. It’s like putting an oil executive in charge of Tesla.”

As those in charge of the London gold market this month raise a glass to a century of gold fixing to the praises of the “new” LBMA Gold Price auction, the old saying may be remembered: “No matter how you paint a pig, it will remain a pig.”

The LBMA recently stated that “it took 89 years for the price of gold to break through the $1,000 barrier and reach a new all-time high of $1,023.50 on March 17, 2008,” which leaves us wondering what the price of gold would be today without the London Gold Fixing and LBMA Gold Price?

Manly, Ronan Commentator for Bullionstar. https://goldenfront.ru

(Visited 165 times, 1 visits today)