Cashless metal accounts: concept

Investing in precious metals is simple. Non-cash metal accounts (CMA) are opened in the weight of jewelry, reflecting the relevant information. Metal is not purchased physically; money is deposited into an account and converted into grams, taking into account today's bank rate.

This type of investment is not a deposit. The object of value will not be a monetary unit.

A bank user intending to open an account does not provide metal bullion. A certain amount of money is converted into grams.

Compulsory medical insurance is not subject to insurance.

Such an account can be opened by investing funds in a bank or by writing off money.

How compulsory medical insurance works: making a profit on adjustments

Under the influence of the global economy, the metal is subject to price changes. Fluctuations are used as an option to make money. We should not forget about the reverse processes (fall), which happen today, but are not significant.

Precious metals

A reliable way to preserve personal capital is precious metals. This type of investment is not passive, unlike deposits. The information displayed on the official website of Alfa-Bank allows the investing person to track quote changes. This facilitates the correct execution of transactions related to the purchase and sale of an object, predicting income growth.

The most commonly used metal is gold, which is characterized by high liquidity. Its part constitutes approximately 85% of compulsory medical insurance in a banking institution. The popularity of the alloy is dictated by the ability to predict cost. You can view gold quotes online using banking services or a mobile application.

The bank's policy regarding precious metals is characterized by loyalty. The minimum rates for opening such an account provide the opportunity for most owners of funds to act as investors.

The noble metal of a bank is expressed in the form:

- ingots with definition of measure;

- coins;

- ordinary ingots;

- impersonal metal accounts (OMS).

Ingots, which are investments, are produced by organizations in accordance with government and industry standards. They consist without 0.01% of noble metal.

Compulsory medical insurance is opened by the bank in the following types of precious metals:

- platinum;

- gold;

- silver;

- palladium.

Creation and maintenance by the institution does not entail costs for the client, but closure does entail certain costs. The difference in the purchase and sale price indicators includes the bank’s profit associated with the procedure for opening and closing an account.

Deposits and withdrawals of funds are carried out in precious items or in cash equivalents in accordance with the current exchange rate.

The purchase of a noble alloy promotes long-term investment of funds, taking into account the dynamics of gold in relation to the exchange rate.

Cashless metal account

An impersonal metal account is a type of bank deposit that is opened in the mass of several precious metals: gold, silver, platinum and palladium.

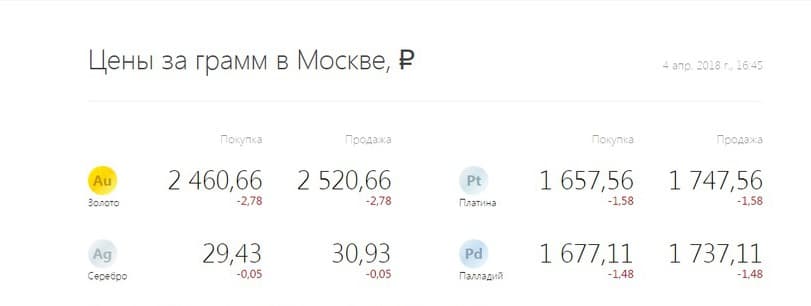

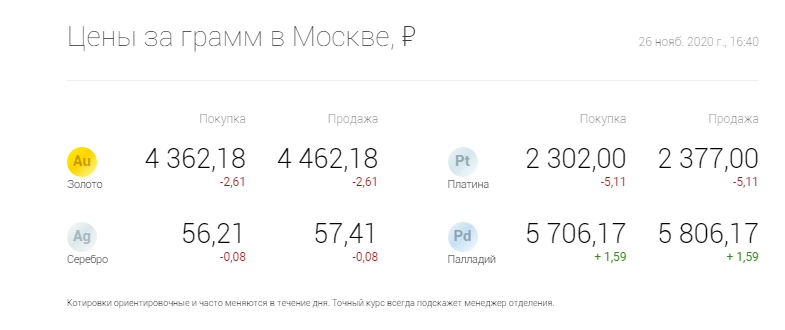

Precious metals rate at Alfa-Bank

Approximate prices per gram of gold, platinum, silver or palladium today can be found on the official website of Alfa-Bank.

It is necessary to indicate the city of location, otherwise the information provided will be incorrect. Alfa-Bank compulsory medical insurance quotes change depending on the market situation throughout the day. Customers can obtain the exact cost at the nearest bank branch.

Benefits of compulsory medical insurance

Compulsory medical insurance does not imply the acquisition of metal as a separate stage in the overall system. There is also no separate transfer to the custody of a financial institution. The preferences are as follows:

- Opening an account with Alfa-Bank does not require the client to have unexpected transportation costs. Safety is the main difference from the use of coins, pieces of precious metal and bars.

- There is no risk of damage or loss during delivery to Alfa-Bank. “Experienced” users are aware of price changes when bars are damaged.

- The quotation figures for unallocated metal are lower, in contrast to coins or bars: Finnish institutions offer a pricing policy close to world standards. Alfa-Bank's exchange rate depends on currency exchanges.

- There is no obligation to pay value added tax when registering a relationship with a bank. The purchase of alloys entails this type of taxation.

Comfort service package from Alfa Bank

How to open?

The process of opening a compulsory medical insurance will not be particularly difficult. You can get the service by contacting a bank branch, taking your passport and TIN. The procedure takes approximately 10 minutes. The client purchases metal at the current Alfa Bank exchange rate.

Receipt transactions take place exclusively at the bank's office. Internet banking does not contain such an option. The monetary mechanism provides for crediting to the account an amount of metal corresponding to the amount of money paid at the Alfa-Bank exchange rate.

The debit transaction is carried out taking into account the bank purchase rate. Funds from such a transaction are credited to an existing investor account opened with the bank.

Compulsory medical insurance is not included in the state insurance program. It is allowed not only to receive income in rubles, but also to lose capital.

How does investing in compulsory medical insurance work?

The abbreviation OSM stands for “impersonal metal account.” An Alfa Bank client can open it in one of four metals of his choice: gold or silver, platinum or palladium.

Next, funds are deposited into the account, which are converted into grams of the metal chosen by the depositor at the rate valid at the time of exchange. If you look at the balance of such an account, the client will see not 100 rubles deposited by him, but 3 grams of silver (for example). Over time, the price of the metal will increase, which will constitute the client’s income. For example, 8 years ago you could buy 2 grams of gold for compulsory medical insurance for about 800 rubles. Today their cost is 5.5 thousand rubles.

If necessary, the account owner can sell the precious metals on his balance sheet and receive money for them at the current rate. In this case, he will not even need to pay a visit to the bank, as when selling bullion. All operations with the account can be performed online through the Alfa-Click system account.

Operation times, telephone service

At Alfa-Bank there is a certain time allocated for the process of opening compulsory medical insurance, buying and selling:

- Monday – Thursday: from 9:00 to 17:15.

- Friday from 9:00 to 16:00.

- Saturday, Sunday – days off.

In order to ensure customer comfort, there are different types of communication with the bank. All kinds of questions are resolved by calling the Alfa Bank hotline. There is no fee for establishing a remote connection. Numbers for different groups of persons are different (individuals and legal entities). They can be found on the official Alfa-Bank portal.

The support service is available 24 hours a day. The call center is equipped with an answering machine, which allows you to quickly help the subscriber and point you in the right direction.

Taxation and bonus system

According to the tax legislation of the Russian Federation, the presence of compulsory medical insurance obliges the owner to independently pay tax payments in the amount of 13% of the profit. Regular clients of the bank (at least 3 years) can count on a bonus system that provides for the absence of tax costs (personal income tax is not charged) and free servicing of a personal account.

Estimated yield

An impersonal metal account is a long-term investment instrument. You won’t be able to make a significant profit on it in a short time; you need to remember this right away. But for those who expect to preserve their existing capital and increase it for the future, compulsory medical insurance is quite suitable.

Minimum investment required to get benefits

To predict income for this type of investment, you need to understand how impersonal metal accounts work. Alfa-Bank, like other banking organizations offering this product, publishes two quotes for each metal:

- purchase – the amount that the client will receive from the bank upon sale of the asset;

- sale – the amount that the client must pay to purchase 1 gram of metal from the bank.

It’s easy to notice that the numbers here differ by 100-300 rubles. That is, if a client buys 1 gram of gold from the bank today and then immediately sells it, he will receive less money than he initially deposited into the bank. The principle here is the same as when buying currency. Only for such a transaction the client will also have to pay income tax.

All banking organizations set the cost of metals for compulsory health insurance, based on data from the Central Bank. If you compare quotes for precious metals (the same as gold) on the website of the Central Bank of the Russian Federation, you will notice that the purchase price per gram catches up with the sale price in about a year. That is, if a depositor buys 1 gram of gold today for, for example, 2,690 rubles, he will be able to sell it for the same price no earlier than in a year. But after three years, the cost of this gram can increase 3-4 times. The real benefit from investments will be visible no earlier than in 10 years, and provided that the citizen regularly replenishes the compulsory medical insurance.

Quotes for April 7 2021

Nuances of calculating income tax

According to the tax legislation of the Russian Federation, income received by a citizen in the form of interest on a bank deposit is not taxed. But the situation with compulsory medical insurance is different. Here, a citizen, in fact, acquires property (precious metals), and then sells it, receiving a certain income. The Tax Code of the Russian Federation considers such a transaction as a transaction with property and believes that a citizen must pay income tax on the amount received from the sale of metal from an impersonal account. The rules here are:

- if the metal was owned for up to 3 years 13% must be paid on the amount received

- when selling metal that has been owned for more than 3 years, taxes are levied at a higher profit;

- it does not matter at what price the citizen purchased the assets (even if in the end he sold them cheaper than he bought them, tax will have to be paid on the entire amount received).

The responsibility for paying income tax rests entirely with the investor. This means that at the beginning of the year following the purchase and sale transaction, he will have to fill out a declaration in form 3NDFL, submit it to the tax authority, and pay the required amount. Alfa Bank does not act as a tax agent. But information about the transaction can be submitted to the Federal Tax Service, however, only at their request.