Why invest in precious metals? Why and what to buy? History of the precious metals market: gold, silver, platinum, palladium. Pricing of the precious metals market.

The role of precious metals in an investor's portfolio is underestimated today. Classical methods of portfolio formation rarely include a share of precious metals. And most of the portfolios offered by companies, formed within the framework of the portfolio theory of asset allocation, as a rule, do not contain precious metals at all. And if it does, then 5-10% maximum.

Precious metals in an investor’s portfolio can play several roles at once: protective, insurance against negative events both on the stock market in general and in the global economy. There is a possibility that in the next 5-10 years the role of precious metals may change significantly, and interest in them will increase.

Before investing in precious metals, consider the following points:

- Precious metals are not the best investment. But having them in an investor's portfolio can be useful.

- There is no general formula for the correct share of precious metals; it is determined individually.

- There are many different ways to invest in metals.

What it is

A market in a general sense is a system of interactions that arise during the exchange of material goods. The concept of a market is relatively new, but its essence has not changed over the past millennia, although a manager watching numbers on a computer screen does not look much like a caveman carrying skins to sell to a neighboring tribe.

The global precious metals market is understood as a set of economic relations that arise in the process of trading metals and securities quoted in gold.

The precious metals market has a peculiarity. The fact is that metals never performed a single function, but were used in two capacities:

- monetary - they measured the cost of goods;

- actual commodity.

And now, in addition to jewelry and investment gold, platinum, silver and palladium, a huge amount of production and technical metal is consumed. It is needed by many industries.

Question 11. Precious metals market.

The precious metals market is the sphere of economic relations between participants in transactions with physical metals. Economic relations arise at the stage of exploration, extraction and processing (the sphere of mining and production), as well as in the sphere of circulation - the production of jewelry, the use of precious metals in industry, medicine and trade and financial activities.

As a systemic phenomenon, the precious metals market can be viewed from two points of view: institutional and functional.

From an institutional point of view, the precious metals market is a collection of specially authorized banks, precious metals exchanges, financial companies and other exchanges that carry out transactions in securities quoted in gold.

From a functional point of view, the precious metals market is a trade and financial center in which trade and other commercial and property transactions with these assets are concentrated.

The structure of the precious metals market is currently presented in Fig. 7.8. The division of the precious metals market into primary and secondary is due, first of all, to the specifics of its functioning, which is determined by the composition of participants and the object of transactions .

Participants in the primary market of precious metals and stones are subjects of metal mining (production) (with the exception of processing enterprises, which are not independent market participants), institutional investors and industrial consumers. Subjects of mining and production of precious metals are represented on the market by enterprises of the gold-platinum industry.

Rice. 7.8. Structure of the precious metals market in Russia

Government bodies represented by the Gokhran of Russia, authorized executive bodies of the constituent entities of the Russian Federation and the Bank of Russia, and specially authorized banks act as institutional investors. Industrial consumers – Russian and foreign legal entities. The object of operations and transactions in the primary market is, as a rule, metal in physical form (ingots, powders, granules, rolled products) - primary metal extracted from the subsoil, as well as obtained during the processing of secondary raw materials (scrap and waste).

The primary market can currently be represented by three sectors: direct domestic, intermediary domestic and direct export. This division is due to the ability of market participants to purchase precious metals directly from mining and metal production entities.

Entities of the direct internal segment

government bodies, with the exception of the Bank of Russia, specially authorized banks and industrial enterprises act, since, in accordance with current legislation, they can directly purchase metals from manufacturers in order to create strategic and industrial reserves. In addition, they can use precious metals to conduct transactions in foreign and domestic markets (for example, to obtain a loan). These banks purchase metals to form their own assets and sell them on the secondary market, and also carry out client orders.

The subject of the intermediary internal segment is the Bank of Russia, which is explained by the following circumstance: by law, it does not have the right to conduct transactions directly with metal producers and can exercise its purchase rights only through the intermediary of specially authorized banks. The Bank of Russia uses the purchased precious metals to form the country's gold reserves, mint coins with their subsequent sale to commercial banks, as well as for operations carried out on the foreign and domestic markets.

The emergence of a direct export segment is due to the ability of mining companies to independently export precious metals, so the subjects of the direct export market are foreign legal entities (for example, JSC Polymetal directly, without the mediation of banks, exported gold to companies in the industrial sector of the United Arab Emirates, implementing the principle “from the deposit” to the consumer").

In the secondary market, the interbank, wholesale and export markets have received the greatest development. The retail sector is in the development stage, and the stock exchange sector is just being formed.

The main task of the secondary market is to create domestic demand for precious metals. Currently, the domestic supply of all types of metals significantly exceeds demand, which is the main problem in the development of the market itself and requires an early solution. The structure of the secondary market for precious metals can be divided into the following segments: interbank, wholesale, retail, exchange and export markets.

The most active development in the structure of the secondary market is the interbank segment , the subjects of which are commercial banks and the Bank of Russia, and the object is precious metals in the form of bars and coins.

The allocation of the wholesale segment in the structure of the secondary market is due to the composition of the participants - industrial consumers, who are represented by medium and small businesses, as well as entrepreneurs without a legal entity who use precious metals to manufacture their products. Institutional investors are also subjects of the wholesale market. To expand their composition, it is possible to attract investment and insurance companies, pension funds, etc., which, by mobilizing significant funds from legal entities and individuals for a sufficiently long period, could play a significant role in the development of this market.

The subjects of the retail segment of the precious metals market include private investors, hoarders and speculators whose purposes for carrying out transactions with metals are different: hoarding, investing, making a profit, hedging, using as a souvenir, an original gift, etc.

The subjects of the export segment of the secondary market are mainly commercial banks and industrial enterprises, and in some cases, government agencies, including the Bank of Russia. The objects of trade are metals in physical form (ingots, coins), as well as products of industrial enterprises.

Commercial banks have the right to carry out export transactions only with refined gold and silver in the form of standard and measured bars of Russian and foreign origin. Currently, several specially authorized banks have export licenses. These credit institutions can export:

· bullion purchased by them as their property;

· bullion sold by credit institutions in accordance with commission agreements.

Export of bullion is carried out through specialized customs posts in compliance with the rules of customs clearance and control.

The main segment of the precious metals market is the gold market.

The gold market is the center of gold trading, where supply and demand for this metal is formed and its regular purchase and sale takes place. The global gold market in a broad sense covers the entire system of circulation of the precious metal on a global scale - production, distribution, consumption. Sometimes this concept is considered in a narrower aspect - as a market mechanism that serves the purchase and sale of gold as a commodity at the national and international levels.

Gold market participants are:

· gold mining companies, mines, mines and mines, refineries, associations of gold producers;

· professional dealers and intermediaries;

· central (national) banks;

· precious metals exchanges;

· investors;

· industrial consumers.

The bulk of primary gold is supplied to the market by gold mining companies, which operate both in free supply and through professional dealers.

Companies that trade in gold bullion act both as brokers for buyers and as primary dealers for sellers, making their profits based on price movements. The London Billion Market Association (LBMA), which represents the interests of wholesale market participants, divides them into two categories:

a) participants forming the market - market makers

), which are present on the market constantly and continuously, providing price quotes for buyers and sellers at the same time, which ensures the formation of market prices;

b) ordinary participants who are constantly present on the market, but set prices only for their agents and do not participate in the formation of market prices.

Most market makers are recognized by international banks as entities that influence the dynamics of gold prices within the monetary system.

There are no specialized precious metal exchanges in the world. In a number of countries, for example in the United States, there are exchanges where gold futures are traded, and the main purpose of such trading is to hedge gold prices.

The basis of modern legal regulation

relations arising in the field of geological study and exploration of deposits of precious metals and precious stones, their extraction, production, use and circulation are the Federal Law “On Precious Metals and Precious Stones” (hereinafter referred to as the Law on Precious Metals), as well as regulatory and legal acts adopted in its implementation, the Law of the Russian Federation “On Subsoil”.

In accordance with the legislation, precious metals acquired in the manner established by the legislation of the Russian Federation may be in federal ownership, the property of constituent entities of the Russian Federation, municipal property, as well as in the property of legal entities and individuals. Refined precious metals enter civil circulation in accordance with the rights of the owners established by the relevant licenses and agreements.

Precious metals (types of precious metals) in the Federal Law on Precious Metals mean the following metals: gold, silver, platinum and platinum group metals (palladium, iridium, rhodium, ruthenium and osmium). It should be noted that the possibility of changing the above list is provided only by introducing amendments to the Law on Precious Metals.

Precious metals can be in any state, including in native and refined form, as well as in raw materials (concentrate), alloys, semi-finished products, industrial products, chemical compounds, jewelry and other products, coins, scrap and scrap (production and consumption waste ).

The Precious Metals Law defines the mining, production, use and circulation of precious metals.

Production

— extraction of precious metals from primary (ore), placer and technogenic deposits with the production of concentrates and other intermediate products containing precious metals.

Production

— extraction of precious metals from mined complex ores, concentrates and other intermediate products containing precious metals, as well as from scrap and waste (secondary raw materials). This also includes refining.

Under use

precious metals refers to their use for production, scientific and socio-cultural purposes.

Appeal

precious metals, i.e. actions expressed in the transfer of ownership and other property rights to precious metals, refers to transactions with precious metals.

Brief history of formation

For a long time, gold and silver (platinum and palladium were not mined until the 20th century) were a measure of the value of a commodity - money was minted from them in prehistoric times. When people appreciated the convenience of using gold as a reference currency, a real technological breakthrough occurred: the mining and metallurgical industries developed.

Over time, precious metals were withdrawn from direct participation in trade as money (such coins were too expensive, difficult to transport, heavy and prone to deformation). In their place came paper money—essentially, gold certificates that could be exchanged for a certain amount of gold.

Precious metals have long remained the most stable currency, which people especially counted on in times of wars and crises. In the 19th century, many countries officially introduced the gold standard.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

The global precious metals market has undergone significant changes over the past century before it took on its modern form. This was influenced by the abolition of the gold standard (refusal of the free exchange of money for a specific gold unit). In 1971, the US finally abolished the gold backing of the dollar, and gold was demonetized - it ceased to serve as money.

There is a point of view among economists that demonetization has not yet been completed and gold continues to serve as the world’s “reserve fund.” However, now precious metals are sold and bought in commodity form for national currency.

Proponents of partial demonetization are right that gold is used as a reserve asset, but we can confidently say that it has lost most of its monetary functions.

Precious metals in economics

Definition 1

Precious metals are metals that are resistant to oxidation and corrosion and are rare.

The main precious metals are silver, gold, platinum, ruthenium, osmium, iridium, palladium and rhodium. Some metals are ductile and refractory. Gold and silver have been used by mankind since ancient times. Platinum was discovered in the Middle Ages, when colonialists in South America turned their attention to the heavy white metal. Platinum was often substituted for silver, so in some countries it was decided to throw it into the sea. It was only in the eighteenth century that Watson described the properties of platinum. At the same time, its production began on an industrial scale.

Finished works on a similar topic

- Course work International market of precious metals: current state and development prospects 410 rub.

- Abstract International market of precious metals: current state and development prospects 220 rub.

- Test work International market of precious metals: current state and development prospects 220 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Russia is one of the richest countries in the world in terms of reserves of natural resources and precious metals. Mining began in the seventeenth century in Transbaikalia, where a silver ore deposit was being developed. Gold was mined in Karelia, and somewhat later in the Urals. Platinum was also discovered here.

Precious metals were used in the following areas:

- Currency. Metals retain their properties and shape, so they were actively used as money. Some countries now hold gold and silver as foreign exchange reserves. Silver can be used as savings by individuals.

- Technique. Precious metals are widely used in the electrical industry.

- Chemical engineering and laboratory technology. Precious metals are able to withstand the influence of aggressive environments. The creation of laboratory equipment can be carried out entirely from precious metals, or using them as a coating.

- Medicine. Here, precious metals are used to create tools, prosthetics, instrument parts, and so on. Some medications contain silver. Radioactive gold is used in radiation therapy.

Looking for ideas for study work on this subject? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Functions

A metal trading system is necessary so that market participants can carry out the operations they need:

- Purchase of precious metals for industrial and household consumption, investment, and risk insurance.

- Sales of mined precious metals.

- Speculation - obtaining benefits as a result of successfully predicting exchange rate fluctuations (“playing on the stock exchange”).

The precious metals market satisfies all these needs. Technologies for the development of ore deposits are developing, and gold and silver (to a lesser extent platinum and palladium) remain stable enough in value that it is not scary to invest in them. At the same time, exchange rate fluctuations allow the metal to be used for speculation.

Features of investing in precious metals

- Gold is always in price, especially physical gold. Demand for it remains at all times, so it can be confidently called a liquid asset. Bullions made of precious metals can always be sold quickly and profitably. Moreover, during times of crisis, governments and large investment funds look for salvation in gold and begin to actively buy it - quotations of precious metals are rising. Over the past 10 years, gold has risen in price more than 4 times. Considering that it is traded on world markets in dollars, when the ruble weakens, the investor’s profitability increases even more.

Gold price growth chart from 2000 to 2021 - Silver is more volatile due to its lower price and wider use compared to gold. It reacts quite sharply to news, and is more susceptible to outside influences and “storms” in the markets. Therefore, prices for silver rise faster, but also fall faster than for gold.

- If you buy bullion silver, you will have to pay attention to the costs of its maintenance - the metal darkens over the years.

- Platinum and palladium prices mainly depend on industrial demand. Both of these precious metals are used in the automotive industry, computers and gadgets. For example, in 2021, due to the active growth of the Tesla company, which produces electric cars, the engines of which use a large amount of palladium, quotes for this metal increased by 50%.

All these points should be taken into account when planning your investments in precious metals.

Kinds

Precious metals markets differ in the level of government regulation of transactions performed, the residence of participants and the amounts of transactions. Let's look at one of the main classifications.

International

These are the largest markets in the world, where trade is carried out between corporations from different countries. They are characterized by high volumes, a variety of available transactions, and wholesale supplies.

A distinctive feature of such a market is customs and tax benefits.

Domestic

Domestic markets mainly serve investors. Their scope of activity extends to one or more neighboring countries (for example, the Turkish market operating in the Middle East). Traded gold is taxed according to the laws of the country where the market is based.

Based on the level of government intervention in the operation of domestic markets, they are divided into:

- free (almost no control);

- regulated (there are quotas, licenses, restrictions on export and import);

- closed (strict restrictions, full control).

Closed markets operate in Greece, Egypt, and Pakistan. Participation in trading on them is greatly complicated by state bans, which leads to the emergence of another type of market - black markets.

Black

Shadow markets are a consequence of excessive government rigidity in establishing trade frameworks that make it unprofitable and difficult to access. The largest center of illegal gold trading is Mumbai (until 1995 - Bombay) in India.

After the India-China War in 1962, the Indian government banned private ownership of investment gold, which led to the establishment of an underground trading network.

Participants

The companies participating in the tenders and thus influencing the situation on the market differ in both scale and type of activity.

Gold mining companies

Owners of mines, mines and mines are the main suppliers of metals to interstate markets. Small businesses most often cannot work with brokers directly and are forced to use the services of intermediaries.

There are also large gold miners: the Canadian company Barrick Gold, which occupies a leading position in the ranking, the Australian Newcrest Mining, and the British Goldcorp. These are corporations that work with the largest volumes and therefore have a huge impact on the situation in the system.

Industrial users

The main clientele of the market are enterprises that process precious metals and turn them into consumer products: jewelry, luxury goods, and high-tech devices. These are jewelry and electrical production, refineries that prepare metal for subsequent remelting.

A distinctive feature of industrial buyers is that they need a product of a certain quality depending on the purpose: for example, only pure metal is suitable for the production of microcircuits, while a jeweler can process gold dust.

Precious metals exchanges

Participants trading on exchanges do not operate with “live” metal, but mainly with futures contracts - agreements for the sale of an asset on special terms. The main purpose of such operations is hedging, that is, price insurance by opening forward transactions to compensate for risks in another market.

The world's largest exchanges are located in London, Shanghai, New York and Tokyo.

Central banks

The most influential ones are in the USA, Great Britain and Germany, but banks in other countries also play an important role - in particular, the Bank of Russia, in whose vaults most of the gold reserves of the Russian Federation are located.

Other countries participating in international trade also store a significant portion of their reserves in the form of physical gold - bullion. The central banks that store these treasures (hundreds and thousands of tons of gold!) are the largest sellers in the metal market.

Professional dealers and intermediaries

This market segment is represented by:

- dealers;

- brokers.

The difference between a dealer and a broker is that the first carries out trade intermediation on his own behalf and at his own expense, while the second (broker) is an intermediary acting at the expense and on behalf of the client. The broker does not become the owner of the assets, cannot dispose of them on his own behalf and works for a commission.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

The dealer's income is generated by the difference between buy and sell quotes (spread). The dealer (unlike the broker) has the right to set a quote for the client independently.

Investors

Investors are companies (for example, pension funds) or individuals who use gold to build savings. Special bars and investment coins are issued for them. There are investors who buy metal without delivery - with the aim of further use for speculative purposes.

Some publications note that investors from Asia are more inclined to purchase precious metals to preserve resources, while European and American investors are increasingly choosing to play on the stock exchange.

History of gold and silver

Approximately 4000 BC gold and silver were used as jewelry, symbols of power and objects of religious worship.

500 BC The first coinage began. At the same time, in different countries they were minted from gold, silver, copper and its alloys, depending on what was mined more. In Rus', silver was traditionally in use - the silver hryvnia, the silver ruble. Silver for coinage was popular in the Czech Republic and Germany, and gold was popular in the Mediterranean countries.

In the 17th century, the first paper banknotes appeared (1661 in Sweden), but they were then strictly tied to gold or silver. The bills indicated how much gold and silver they could be exchanged for. The ratio of gold to silver in the 15th-19th centuries ranged from 12/1 to 6/1.

The first gold coins began to be minted under Peter the Great, but then they were not widespread. And towards the end of the 19th century, the gold Imperial of 1897 was minted. 900th standard.

State tickets contained a direct inscription that they could be exchanged for gold without restrictions. And the corresponding royal banknotes were equated to a certain gold content.

Gold standard era

Over time, the role of gold and silver changed - a bimetallic standard appeared. This continued until 1860, when more silver began to be mined, and gradually silver ceased to be a means of payment, but became a commodity. And gold remained as the only means of payment.

In the 1870s In the USA, the free minting of silver coins ceases, silver production increases, and its value falls. In the chart above we see how gold continues its peg to the dollar, and silver goes into “free float”.

The beginning of the end of the Gold Standard era began in 1910, when America was emerging from yet another crisis. A handful of the richest people of that time (Rothschilds, Rockefellers, Morgans) held a secret meeting on the island. Jekyll. The result of the meeting was the creation of the private US Federal Reserve Bank (1913), which received the right to issue US dollars without actual reference to gold.

This led to a boom in the stock market in the 1920s. As a result, by 1929 a huge financial bubble inflated, which burst and developed into the Great Depression for 3 years. Essentially, this was a consequence of too many dollars being issued that were not backed by gold.

After the First World War, some European countries abandoned tying their currencies to gold, but already in 1925. The gold standard was restored by Great Britain and France (1928). Banknotes were then exchanged for large weight bars. And only very rich people could afford to exchange for gold.

Then the Great Depression occurs in the United States in 1929. Following them, the economies of European countries begin to fall. In 1931. Germany, Austria and 25 other countries default.

And in 1931, the Bank of England first abandoned the gold standard.

In 1933 Roosevelt comes to power in the USA. His first decree No. 1602 on the suspension of the circulation of gold coins in the country leads to confiscation reform : until May 1, 1933. everyone must exchange gold for paper money at $20.67/oz. Violation is punishable by up to 10 years in prison or a fine of $10,000.

Gold exchange standard

During World War II, the United States actively helped its allies through lend-lease, and received payment in gold. As a result, gold reserves in the United States are growing sharply. And towards the end of the war, when all of Europe lay in ruins, in June 1944. The Bretton Woods conference took place. As a result of the meeting, the United States pledged to exchange dollars for gold at a fixed rate ($35/ounce), and other countries were obliged to keep fluctuations of their currencies against the dollar within 1% (so that the dollar did not fall sharply in price).

In essence, this policy led to the dollar replacing gold in international payments. Moreover, it was possible to exchange dollars for gold in only one place - Fort Knox in the USA.

The United States could issue dollars without control under the promise of exchanging them for gold.

The United States received the right to endlessly issue money, which caused a new round of growth in the country's stock market. It ended very sadly. By this time, the United States had already gotten involved in the Vietnam War.

Kennedy, upon coming to power, tried to limit the Federal Reserve's right to issue dollars and adopted a decree in 1963. about “silver certificates”, which were supposed to replace paper dollars in circulation. After Kennedy's assassination and during the Vietnam War, inflation increased in the United States. And in 1965 France demanded that the purchased dollars be exchanged for gold in accordance with the rules of the Bretton Woods agreement. Looking at this, other countries also demanded to exchange their dollars for gold. The US gold reserve began to rapidly dwindle and in 1968 exchange within the US was limited.

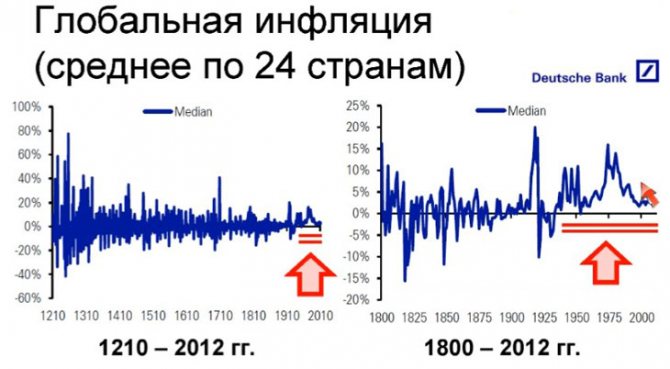

In 1971 "Nixon Shock" - President Nixon stops the exchange of dollars for gold at central banks. In essence, this was the end of the gold standard. And from this moment on, gold ceases to play the role of money. And paper money begins to be printed on its own without any connection to gold. This causes inflation to skyrocket around the world.

Those. The world doesn't have any real hard currency to rely on.

The world got rid of gold and came to a point where inflation became constant.

Debt standard

In 1971 tried to increase the gold rate to $38/ounce without the possibility of exchange for gold, then in 1973. to $42.2/oz. Nothing ever came of it. And in 1976 The Jamaican Conference takes place, at which it is finally agreed that gold ceases to be a means of payment, exchange rates are set in relation to each other on a market basis, and the FOREX market is born - the market for exchanging currencies against each other.

After the ban on gold ownership was lifted in the United States in the 70s and 80s. There is a sharp increase in precious metals: gold rises to $800/ounce, silver to $49/ounce.

In essence, a huge bubble was inflated in the precious metals markets, which collapsed in 1980. Gold for 20 years goes into a downward trend and drops in price to $294/ounce. Silver falls to $4/oz.

Since by 2000 the dollar remained the means of international payments, bankers had the opportunity to inflate the financial bubble for the third time. This led to a rise in the stock market, which collapsed in 2000. Along with the “dot-com bubble,” gold and silver began to rise sharply until 2011.

Largest gold trading centers in the world

The first on the list of leading platforms is, of course, the legendary London Interbank Market. London has been setting gold prices for almost a hundred years - since 1919, when the London fixing was established. Until 2015, the price of gold was formed using the fixing method (the exception was the war and post-war years, when people had no time for exchanges). Fixing gave way to an electronic auction in 2015, but London remains the world's gold trading center.

The London market sets strict requirements for traded gold: all of it must be marked Good Delivery - “good delivery” - and meet the quality standard.

Another market leader is Zurich. Switzerland imports up to 40% of the world's gold supply. The peculiarity of Swiss banks is that they have representative offices in most countries that actively trade in precious metals: in the USA (New York), Australia (Melbourne), and in the Far East (Singapore, Hong Kong, Japan).

In the Middle East, the main free domestic markets are in the UAE (Dubai) and Turkey. In Europe you can also note Paris, Milan and Frankfurt am Main, in Asia - Karachi and Dhaka, in Africa - Alexandria and Cairo, and in South America - Rio de Janeiro and Buenos Aires.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

Russia's mineral resources are among the richest on the planet, and we make an important contribution as a supplier of gold to the global economic market. However, the domestic gold market in the Russian Federation is poorly developed - this is due to the strictness of tax legislation, which imposes a high VAT on the purchase of bullion (currently 18%), making such investments not very profitable.

Types of markets

Depending on the range of participants, the volume of transactions, types of operations and the degree of openness, it is customary to distinguish the following types of gold markets.

International

These markets are characterized by large transactions and a wide range of operations, as well as the absence of tax and customs barriers. Operations are carried out around the clock and are wholesale in nature. As a rule, such markets have a relatively small number of participants, because The bar for the reputation and financial condition of the participant is quite high. The rules of the market are established by the market participants themselves. International markets include: Zurich, London, New York, Chicago, Hong Kong, Dubai.

Domestic

Domestic markets are aimed at investors and hoarders of one or more states. Coins and small bars predominate as goods; payments are made in local currency. Such markets are subject to government regulation through, as a rule, economic levers of influence: state participation in pricing, taxation, restrictions on the import and export of precious metals, etc.

Depending on the degree of government intervention, domestic markets can be divided into the following types:

- Free - with soft government regulation that does not limit the import and export of gold from the country.

- Regulated - with moderate government intervention through the establishment of import and export quotas, the introduction of duties and taxes, and licensing.

- Closed - strict control and a complete ban on the import and export of gold. The state creates unfavorable economic conditions for trading in precious metals; prices for precious metals become significantly higher than prices on international markets.

Domestic markets include: Paris, Hamburg, Frankfurt am Main, Amsterdam, Vienna, Milan, Istanbul, Rio de Janeiro. Regulated (controlled) markets operate in Athens and Cairo.

Black

“Black” gold markets are a radical form of organization of the domestic market, as a reaction to total restrictions (intervention) of the state on the domestic gold market. Illegal markets, as a rule, operate in parallel with closed ones. There are such markets in India and Pakistan.

We recommend reading: What types of gold are there?

Factors influencing the global financial market

The global economy is influenced by both global trends and paradoxical, seemingly insignificant factors.

For example, the gold rate is highly dependent on seasonality due to India, where it is customary to have weddings at the same time of year.

This significantly increases the demand for gold, without which not a single Indian wedding is complete.

Political situation and international tensions

Unrest is activating investors. History knows many cases of rapid depreciation of money, but gold has always been consistently expensive, therefore it is considered by people as an emergency reserve and does not lose ground in times of crisis.

Supply and Demand Relationship

Like any other asset, precious metal is subject to the economic laws of supply and demand. The value of a unit of gold or silver depends, therefore, on the totality of:

- forecasts and behavior of sellers, buyers and intermediaries;

- changes in prices for transportation of goods;

- welfare of market participants and other factors.

Seasonality

In addition to Indian weddings and other festival periods, the price of precious metals is influenced by agricultural seasonality. This is especially true for Asian countries where the agricultural banking system is not very developed. Farmers massively invest profits from their harvests in gold, thereby significantly increasing demand.

State reserves

An important factor is the gold and foreign exchange reserves of the countries participating in the trade. It, in turn, depends on other circumstances, for example, on the political and economic situation in the state.

Production volumes

The amount of treasures mined is not constant: old mines are depleted, new mining technologies appear - the price of precious metals is sensitive to these phenomena.

Like other factors, this one is closely related to others: a natural disaster or revolution can unexpectedly and permanently block supplies from deposits that ensured the flow of metal to the market.

Bitcoin or Gold: The Great Debate

Market participants began to ignore gold after the sharp rise in Bitcoin and other digital currencies. Bitcoin's parabolic price move on February 22 lifted the leading cryptocurrency to a new record of $57,790 per token.

Gold peaked in early August 2021 and has fallen 12.3% in recent months. At the same moment, Bitcoin rose to a high of $12.635 dollars and has since risen four and a half times. Such a leap provoked a transition from the gold metal to “esoteric” means of exchange. Some market participants believe that Bitcoin and other cryptocurrencies are much more useful than gold. Meanwhile, digital currencies have been around for little more than a decade, and gold has served as a medium of exchange for thousands of years.

Moreover, central banks continue to hold gold as an integral part of their foreign exchange reserves. Central banks and governments are natural enemies of digital currencies because they threaten their control over the money supply.

Digital currencies are here to stay because they are the brainchild of technological advancements. Blockchain is revolutionizing the world of payments and business. However, parabolic movements often lead to serious corrections. After Bitcoin reached its first peak of $20,650 at the end of 2021, the price fell to a low of $3,120 a year later. Buying into a bull market just before the top is dangerous, and those who try often lose everything. As a result, such price movement encounters such a powerful force as gravity.

Bitcoin, Ethereum and the other 8,500 cryptocurrencies may be basking in glory today, but the question is not if a correction will happen, but when. And when that moment comes, gold will become much more attractive to investors and traders in the current inflationary environment.

How to access the market

The first, “classic” way to become an investor is to purchase metal from a bank. Many Russian banks carry out transactions with precious metals. You can buy bullion, investment coins, or use the OMS - an impersonal metal account.

The second method became available recently - individuals were able to buy and sell precious metals on the Moscow Exchange. The easiest way to do this is through an intermediary - a broker who will represent your interests. The choice of a broker usually depends on two qualities:

- reliability;

- commission amount.

There are sites on the Internet where investors (including beginners) share information about available brokers. If you want to start the journey of an investor, it’s worth exploring thematic forums - live experience can be more useful than articles, even those written by professionals.

What kind of profitability should you expect?

As mentioned above, gold has more than quadrupled over the past 10 years. However, its growth is largely due to the fall of the ruble against the dollar, and not just the increase in the value of the asset. If the ruble strengthens, the growth in the value of gold will slow down.

However, in general, it is not possible to calculate how much you can earn from metal. Prices for gold and silver are formed due to various factors independent of each other.

Only one thing can be said for sure: if markets prepare for a global crisis, then the price of protective assets, including precious metals and American Treasuries, will rise.

Over the past decade, gold has grown by an average of 4% per year, silver by 6%, and palladium and platinum by 10%.

Palladium price chart from 2003 to 2021

Precious metals stored by themselves do not generate income. The investor can make money only if the price of the asset increases. This also needs to be taken into account.

Types of transactions on the global gold market

Here are typical transactions made with non-cash precious metals on trading platforms:

- “Spot” is a transaction with settlement on the second business day after the day of conclusion.

- “Swap” (exchange) is a transaction with a simultaneous reverse transaction (for example, an exchange with an additional payment for gold of a different standard or located in another country).

- Deposit - placement of metal.

- An option is the right to sell (put) or buy (call) a specified amount of metal at a certain price within a specified period.

- A futures contract is an agreement on the future supply of metal.

There are also forward transactions - purchase and sale transactions of real precious metals with a specific delivery date after the second business day from the moment the contract is concluded.

Alternative ways to invest in metals

If the options for investing in precious metals described above are not suitable for some reason, then you can use alternative methods:

- Acquisition of shares of gold mining companies . There are few of them in Russia - these are Buryatzoloto, Lenzoloto, Polyus, Seligdar and Polymetal. You can buy them through any broker with access to the Moscow Exchange. In addition to the increase in the value of the shares themselves, you can count on receiving dividends, the size of which will depend on the company’s revenue and, in general, on the prices of precious metals.

- Purchase of bonds of the same companies . At the moment, bonds are not publicly traded, but if they appear, they can be purchased to diversify investments. The main difference between debt securities and shares is that bonds have a guaranteed coupon income, which brings them closer to bank deposits in terms of the method of generating profit.

- Purchasing a gold mutual fund . Many management companies, including Sberbank Asset Management, VTB, Raiffeisen, Gazprombank, offer mutual funds that invest in securities of gold mining enterprises and directly in precious metals. In this case, asset management is carried out by professional market participants, and the investor receives income due to the growth in the value of the share.

- Purchasing ETF Gold . There is no opportunity to buy a “gold” ETF through Russian brokers yet. But you can find access to a foreign broker and buy shares of the desired fund through them.

- Options, futures, forex . Particularly risky ones can try to work in the derivatives market, purchasing options and futures on precious metals, or in Forex, making money on CFDs (contracts for difference), but this already relates more to the area of speculation than investment.

Thus, there are many ways to invest in precious metals. The simplest and most effective is buying bullion or investment coins. For novice investors, the option with paper gold is suitable - opening a compulsory medical insurance in a reliable bank. There are also alternatives - you can invest in “gold” mutual funds and ETFs or directly in shares of gold mining companies. Or even speculate on price differences within a day or between days.