It is generally accepted that the quality of gold is confirmed by its breakdown. However, the Ministry of Finance of the Russian Federation is convinced that the lack of standards for jewelry violates consumer rights, and the established assay system is insufficient to confirm the characteristics of the precious metal.

Gold certification is carried out in order to confirm the composition of the alloy, and can be voluntary or mandatory. Thus, for watch parts or precious metal raw materials, a quality certificate is a necessary document. In other cases, the seller undergoes the procedure at will, and can choose the certification scheme himself.

A certificate of conformity helps to avoid fraud when buying and selling gold and confirms the good reputation of the seller. In addition, often the seller himself is interested in making a certificate, because without it, the price of a gold bar or jewelry may be lower than the market price, and, in fact, it will not be possible to sell the product at the required price.

Compulsory medical insurance or impersonal metal account

Investing in gold is always a profitable decision. Before purchasing, you need to think in advance about how the gold will be stored and transported if necessary. The most optimal and reliable option would be to open an impersonal account for precious metals with VTB.

You can open a compulsory medical insurance at any Russian bank that has a license to provide this banking service.

The only significant difference between compulsory medical insurance and a regular VTB foreign currency account is that the account stores not money, but gold in grams or other precious metal. At the same time, the banking service will not have information about the gold manufacturer, serial numbers, samples, and quantity. Clients who are active users of online banking can carry out popular operations around the clock: carry out procedures for buying or selling precious metals in state currency and transfer metals between active accounts of the owner-client.

Central bank agreements on gold

With reserves of over 30,000 tons, central banks own one-fifth of all gold ever mined (197,576 tons). To prevent one bank from influencing the price of the precious metal through a massive sell-off, the Central Bank Gold Agreements were drawn up.

The pact, which was signed in 1999 between the main European central banks, limits the amount of gold any bank can sell in a year. The first gold agreement lasted five years and has since been confirmed three times in 2004, 2009 and 2014.

What are the advantages of compulsory health insurance at VTB?

When opening compulsory medical insurance at VTB Bank for storing gold, clients are presented with a list of advantages, including:

- Solving the dilemma of safe gold storage, its actual transportation and certification.

- No value added tax when purchasing gold.

- Simplified buying and selling procedure.

- The ability to carry out purchase and sale procedures around the clock, from anywhere in the world.

- Ability to make changes to the metal portfolio.

Also, a significant advantage of a bank account for metals is the ability to increase personal profits due to rising gold prices.

Which banks hold the most gold?

The US Federal Reserve tops the list of buyers of the precious metal. The United States holds 8,134 tons of the yellow metal, almost double that of second-place Germany (3,364 tons).

Italy, France and Russia rank third, fourth and fifth with reserves of 2,452, 2,436 and 2,300 tonnes respectively. China and Switzerland are in sixth and seventh place with 1,948 and 1,040 tons.

At the bottom of the list with volumes under 1,000 tons are Japan (765), India (658) and the Netherlands (613).

Other countries have also increased their purchases. In 2021, more than a dozen banks made net purchases of a ton or more. The largest purchasing country this year was Turkey, which purchased 159 tons.

Investment

For many years now, investing in gold has remained relevant and profitable for clients. Metal deposits are highly reliable due to their pricing policy. However, this type of investment has one significant drawback. Such deposits are not covered by the state insurance program.

If you have compulsory medical insurance, gold is stored in a special bank vault.

It should also be taken into account that servicing metal deposits is a more labor-intensive and expensive procedure than servicing foreign currency deposits. Therefore, it is very important to be especially scrupulous in choosing a bank with a high level of reliability and an excellent reputation. At the moment, one of such banks is VTB, which, moreover, offers the most favorable rate in comparison with its competitors.

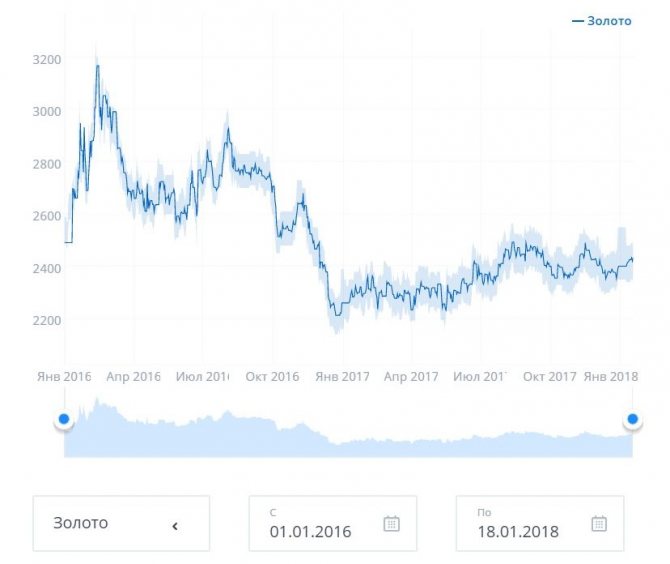

VTB clients can control metal deposits thanks to a profitability calculator. To use the service, just follow the active link and indicate the following data in the boxes: name of the metal; deposit amount; period. The system will make the calculation automatically and display the received data on the screen in the form of an active and detailed diagram.

How much can you earn

It is impossible to determine even approximate figures for the return on investment in compulsory medical insurance. Given the limited global reserves of precious metals, their value will increase every year.

Such investments are a fairly reliable means for long-term profit, but subject to a stable position in relation to national currencies. For example, we can consider the experience of past years: in December 2007, the maximum cost of 1 gram of gold was ~665 rubles, compared to today, the figure has increased 7 times in 13 years.

It is important to consider that you will not be able to make a profit every month. Fluctuations in quotes are quite difficult to predict. That is why an investor can lose everything earned in the first quarter in 1 month.

Let's look at the example of buying palladium. Even taking into account the volatility of our economy, sharp jumps in its value are not expected, but even growth, with some fluctuations, is predicted by experts. It is more profitable to invest for a long period during a short economic downturn. Short-term deposits can bring up to 20% losses, while long-term deposits (from 5 years) – income from 50% per annum.

Even an experienced broker cannot answer how much money you can earn, because the economic situation in Russia and the world is constantly changing.

Anonymized account at VTB: features

To carry out the procedure for opening a compulsory medical insurance account with VTB, you must contact the nearest branch of the bank. Before visiting a branch, it is recommended to use a convenient online map to select the nearest VTB office and clarify the work schedule. To obtain detailed information about the work of the branches, you can contact:

| VTB hotline for clients | 8-800-100-24-24 (calls within Russia are free) |

To open compulsory medical insurance, a VTB employee will only need a document proving the client’s identity. Also, a prerequisite for opening such an account is the presence of a foreign currency account in Russian rubles. If there is no cash account, a VTB employee will open a ruble account along with compulsory medical insurance.

It is noteworthy that there is no commission fee for opening a compulsory medical insurance. This service is free for bank clients.

Managing jewelry, thanks to compulsory health insurance, is much more practical and efficient than physically managing precious bullion. When purchasing gold, you have the opportunity to immediately top up your active account with it. When completing a transaction for the purchase of precious metal, VTB Bank does not take into account the amount of VAT; in addition, there are no costs for work and processing of the metal.

When buying gold, you should definitely take into account that the cost per gram of gold will automatically be set for the entire deposit that is stored in the compulsory medical insurance. This feature distinguishes the online procedure for purchasing gold from the physical purchase of bullion, in which the price per gram of metal is floating and can change based on the total weight of the bullion.

Owners of several accounts with metal deposits can carry out transfer operations from one account to another at any time. However, the material on the two accounts must be identical. For example, you cannot transfer palladium to a silver account. If the account is closed, the bank will rely on current gold prices. Data will be taken into account at the time of compulsory medical insurance closure, according to the internal VTB exchange rate.

Alfa Bank compulsory health insurance quotes for today

You can find out the exact rate of silver, platinum, palladium or gold quotes for today by contacting a bank branch, through an online application or by calling the hotline number 8 (495) 78-888-78.

Price per gram in Moscow at the time the article was updated:

| Metal | Purchase (RUB per gram) | Sales (RUB per gram) |

| Au – gold | 4654, 32 | 4754, 32 |

| Ag – silver | 59,38 | 60,58 |

| Pt – platinum | 2 138,46 | 2 213,46 |

| Pd – palladium | 5 772,01 | 5 872,01 |

Current data can be obtained on the company's official website.

VTB: investing in gold accounts

Investment in gold is one of the most effective investment tools. The financial market has not been stable in recent years: there have been constant fluctuations in exchange rates. Over the past decades, investing in gold has been less risky than investing in stocks. In addition, there is always the possibility that the currency will completely depreciate and the securities will burn.

VTB clients can purchase not only bars, but also gold coins. The weight of purchased gold ranges from one gram to several kilograms.

Regarding gold, we can safely say that it always remains in price. Of course, financial fluctuations affect pricing. However, the rate often remains stable at VTB. In an era of financial crises, investing in metals can help significantly increase capital, providing a protective foothold.

VTB is buying tons of gold

While most Russian banks are rapidly selling gold abroad, recording profits from rising prices to 7-year highs, one large state bank continues to purchase bullion for storage, the size of which already exceeds the gold reserves of most countries in the world. At the end of April, VTB Bank purchased another 4.4 tons of gold, increasing the total amount of precious metal owned to 51 tons, Interfax reports, citing reports posted on the Central Bank website.

As of May 1, the second-largest bank by assets had twice as much gold on its balance sheet as all other banks combined (23.4 tons). VTB’s gold reserves are already comparable to the reserves of the central banks of not the smallest economies: for example, Finland’s gold reserves have 49.1 tons of gold, Qatar’s have 42.2 tons, and Malaysia’s gold reserves have 38.9 tons.

In 54 out of 100 countries of the world, statistics for which are maintained by the IMF, gold reserves in gold and foreign currency reserves are inferior to the volume that VTB managed to accumulate.

The bank was the only major bank that continued to replenish its vaults in March and April, when the Russian Central Bank stopped purchasing precious metal for reserves, encouraging bankers to sell the metal abroad to compensate for the lack of petrodollar revenues.

In two months, banks sold 8.6 tons of gold, and since the beginning of the year - more than 24 tons, or a quarter of all reserves accumulated by the beginning of the year.

The volume of gold at Otkritie Bank, owned by the Central Bank, has decreased almost 6 times: last year it was one of the three largest holders, having more than 10 tons. On March 1, the bank had 5.8 tons left, and by May 1 - only 2.2 tons.

At the end of April, Gazprombank sold 0.4 tons (its reserves fell to 5.9 tons), 3.1 tons - Sovcombank (it had 1 ton left).

The largest seller at the end of April was Sberbank, whose storage facilities sold 5.5 tons. The total gold reserves of the largest state bank of the Russian Federation fell by 37.7%.

Sberbank has been actively selling gold since last fall. On November 1, the bank had 22.5 tons, by February 1, 17 tons remained, on April 1 - 14.5 tons, on May 1 - 9 tons. Thus, in six months, almost two-thirds of the bank’s gold reserves left the bank.

The ban on international air travel has cut off the traditional export channel - in the luggage compartments of passenger airliners. The bankers got out of the situation by chartering charters, a source in a bank participating in the precious metals market told Interfax.

Liners with ingots fly to London. “Since April, a special air service has been organized for the prompt delivery (at least once a week) of precious metal bars (gold, silver) from the Russian Federation to the UK. Export is carried out by both banks and subsoil users,” the banker said.

Until last year, almost all the gold mined in the country was bought up by the Bank of Russia for reserves, but from April 1 it completely suspended the replenishment of gold reserves in order to export the precious metal to cover the shortage of petrodollars and plug the “holes” in the balance of payments.

The Russian government has decided to issue general export licenses to mining companies, de facto opening the door to the export of all gold mined in the country.

Compulsory medical insurance: pricing policy

Today, VTB provides the opportunity to create an account for the following types of metals: gold, palladium, platinum, silver. Precious metals are actively mined to this day, which leads to regular replenishment of gold and foreign exchange reserves.

The pricing policy for metals is dictated by London, which announces the international exchange rate twice during the day. The rate, which is taken as a basis by Russian banks, is set by the Central Bank; it takes into account the international exchange rate of metals, as well as the currency ratio. VTB forms the internal rate based on the bank’s reserve stock and data from the Central Bank. You can get acquainted with the VTB exchange rate for today by clicking on the active link.

Thanks to the convenient service from VTB, clients can monitor metal quotes online, carry out operational procedures for the purchase and sale and transfer of gold between their own accounts, and also monitor deposit analytics. At the same time, the client independently controls the payment of taxes for transactions with metals, which makes the compulsory health insurance service as transparent as possible.

Compulsory medical insurance of Alfa-Bank

When investing in compulsory medical insurance, the investor must understand that this asset will bring tangible profits only in the long term.

Article navigation

- Investments in precious metals through Alfa-Bank

- Alfa Bank compulsory health insurance quotes for today

- How much can you earn

- How to open an account and what to do next with it

- Opening rules

- Working with compulsory medical insurance

Alfa-Bank's unallocated metal accounts are the most convenient option for investing in precious metals without directly purchasing them. This is an investment analogue of a deposit, but with high returns in the long term, subject to positive changes in precious metals quotes.

Compulsory medical insurance, like any financial product, has its own risks. These include losses associated with a sharp decline in the exchange rate, which will entail the loss of the investor’s entire income.

Purchase

The procedure for purchasing a gold bar from a bank consists of the following steps:

- Choose an ingot, taking into account its cost and weight.

- Before visiting the bank, find out which branch you can make a transaction at. Not all branches of banking organizations carry out the purchase and sale of gold.

- Agree on the transaction with a bank employee and visit the office with your passport.

- Make a deal. When making a transaction, the client must be present in person; online purchases are not allowed.

Usually the transaction takes no more than 10 minutes. First, the ingot is inspected and weighed. The client must observe the inspection and weighing and see the scale readings. After this, payment is made and the bullion is transferred to the client.

The transfer is accompanied by the execution of an acceptance and transfer certificate, which must indicate:

- name of the precious metal;

- try;

- weight;

- number;

- sum;

- date of;

- Full name of the buyer and bank employee.

Upon transfer, a certificate is attached, which is produced by the manufacturer. The data indicated in the certificate and on the front side of the ingot must match. The certificate must be kept. If it is lost, the bank will not take the bullion for storage and will not buy it back. In addition, the buyer receives a receipt (cash order), which confirms the purchase. It also needs to be preserved.

Gold bars

Investing your savings in gold bars is the most tangible and practical way to preserve and increase your funds. You can buy gold at almost any bank in the country. Alfa Bank also sells and buys gold.

This type of investment is designed for a long time, that is, several decades. You should buy gold at the moment when its price drops to its lowest point in the last 6-10 years. Or when there is a real threat of devaluation of the domestic currency.

Sale

In order to sell a gold bar, you need to find out in which bank branch such transactions are made. Then come to a banking institution with your passport. Banks buy measured gold bars that are in excellent or satisfactory condition:

- Excellent condition is a clean surface (no scratches, burrs, abrasions, etc.). The certificate must also be undamaged and in clean condition.

- Satisfactory condition is considered to be the presence of stains of dirt, scratches and abrasions on the surface that do not affect the mass. An ingot without damage, but with a damaged certificate (dirty, torn, with a torn part, etc.) is considered satisfactory.

When a bank suspects that a bullion is counterfeit, it has the right to seize it from the owner and send it for examination. The client will be notified of its results.

If the bank refuses to buy the bullion and recognizes its condition as unsatisfactory, it can be:

- take it to a pawnshop;

- sell at the price of scrap to jewelry workshops or buyers.