I want to open compulsory medical insurance! I heard that this is quite a profitable investment. Gold is a reliable metal. Growing constantly. But I don't know where to start! Where and how to buy? Where to go?

Are there any nuances or pitfalls when investing? What should you pay attention to? Tricks and other finhacks when buying and selling compulsory medical insurance. And the main question is: is it worth buying metals for compulsory medical insurance?

Answers to all questions in the article.

I tried to cover the topic in as much detail as possible, based on my own experience and a little information received from outside from experienced people.

What is compulsory medical insurance?

Compulsory medical insurance or impersonal metal accounts are a kind of symbiosis of bank deposits and investments in precious metals.

There are usually four types of metal available for purchase:

- gold;

- silver;

- platinum;

- palladium.

How it works?

You deposit money into your account and buy a certain number of grams of metal for the required amount at the rate set by the bank. You don’t receive anything in your hands (you won’t get a gold bar). Just a note in the bank that you have so many grams of gold, silver in your account...

But there won’t be any gold on the account either. And its monetary equivalent. Tied to the value of the metal. The gold rate will increase - the money in your account will increase.

What are the features of impersonal metal accounts?

From a price point of view, opening a metal deposit (OMC) is similar to purchasing physical precious metals in bullion. The mechanism of operation of compulsory medical insurance is reminiscent of purchasing bullion in installments. In this case, it is not rubles, dollars or euros that are credited to the account, but grams of silver, gold, palladium or platinum. At any time they can be sold for money, but in the same bank where the deposit was opened. There is an option to receive bullion in your hands. But at the same time, according to the laws in force in Russia, you will have to pay VAT of 20%, calculated on the basis of accounting quotations of the Russian Central Bank on the date of acquisition. If you do not take the precious metal from storage, then you do not have to pay tax. It turns out that by opening a metal deposit, an individual can legally avoid the costs associated with paying value added tax.

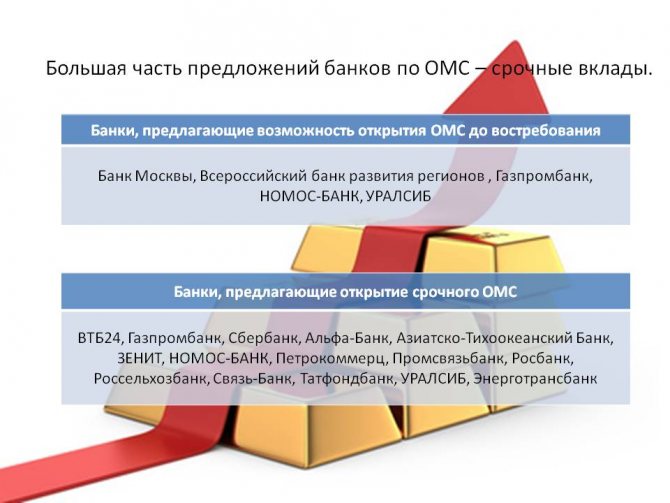

Metal accounts are similar to regular bank deposits in that they can be of two types - “term” or “on demand”. The unit of measurement for the amount of metal is 1 gram. In Russian banks, gold, silver, platinum and palladium OMS are available for opening.

What's the benefit?

Buying gold on compulsory medical insurance is the same as if you bought meat, with the hope that the price tag will soon increase. And you can sell it at a profit. Making money on the difference.

The advantage over meat is that gold “will not go rotten” over time. And you can keep it for many years or decades.

You can just as successfully invest in oil, grain, cocoa and other commodity assets (bricks, diamonds, sugar). )))

But seriously, investing in gold pursues one of the following goals:

- anti-crisis plan - during a crisis, there is a possibility of a sharp rise in gold;

- protection against inflation;

- a way to preserve savings during the devaluation of the national currency;

- insurance against wars and other global shocks;

- short-term speculation;

- long-term investments;

- as part of the investment portfolio.

When investing in gold (as in other metals) with the hope of future growth, you need to understand that the rate does not always rise. There are also periods of falling or at least simply marking time. And very long-lasting ones. Not even a year or two, but decades!!!

Therefore, it is not a fact that you will be able to earn money. There is also a possibility of losses. Even the usual “non-growth” of gold leads to a constant loss of purchasing power due to the inflation rate.

More details about growth and decline over different periods can be found in the article “Investing in gold“.

Strategies for maintaining compulsory health insurance

There are at least two approaches to maintaining compulsory medical insurance: the conservative approach of the investor and the modern approach of the speculator.

The investment strategy is the simplest: a fixed-term compulsory medical insurance is opened and the investor calmly waits for the end of the period specified in the contract, after which he receives or does not receive income based on the exchange rate difference and, in any case, receives interest income. The agreed term of the deposit partially relieves the investor of worries associated with the natural desire to take advantage of the current favorable situation in the precious metals market and make a profitable transaction. But it may turn out that at the expiration date of the contract for fixed-term compulsory medical insurance, prices on the market change in an unfavorable direction, which can bring serious losses to the investor, and interest income may not even cover it.

The speculative strategy of maintaining an impersonal metal account involves opening a demand account and making transactions for the purchase and sale of impersonal metal at suitable short-term moments when the price of metal decreases or increases. This strategy makes sense if the investor manages to receive income higher than on a regular deposit in the same bank. This approach may be the most profitable, but its use requires some skill in estimation and forecasting.

How to open a metal account

There are two options.

Classical. Let's go to the bank with our feet. We conclude an agreement to open compulsory medical insurance. Then we deposit money into the account and buy the required amount of metal. The purchase procedure can be carried out through the bank's cash desk. Or through online banking.

Tip 1 . It is better to purchase and sell metal through your personal account. There the rate is a little more profitable for the client.

Online opening. Through your personal account. If you are already a bank client. But not all banks have this opportunity. Usually, you will still have to come in person to the credit institution and sign an agreement for the opening and maintenance of compulsory medical insurance.

A separate discovery agreement is concluded for each type of metal.

Tip 2 . If you are only focused on buying gold, and you are not interested in other metals, it is still better to open 4 accounts at once. You may want to invest in silver, platinum and palladium in the future. Accounts are opened free of charge. And there is no service charge.

InvestmentRussia rating: the best impersonal metal accounts

With the advent of the global economic crisis, the popularity of impersonal metal accounts (UMA) has grown, which is associated with currency instability and inflation. In recent years, the price of gold has been growing steadily, and this confirms the effectiveness of investing in precious metals. At the moment, compulsory medical insurance remains the most popular type of investment.

Features of compulsory medical insurance

Compulsory medical insurance is an analogue of an individual’s ruble account in which precious metals are stored without indicating the individual characteristics of the bullion (number of bullion, fineness, serial number, manufacturer). The counting unit is grams. Most often, banks work with metals such as gold, silver, platinum and palladium. The most popular compulsory medical insurances are in gold and silver.

The purchase of metal is made according to current bank quotes; the metal is not issued to the buyer in physical form, but is transferred to an impersonal account. Banks offer the opening of urgent compulsory health insurance and a “on demand” account. The latter do not charge interest on the balance. The account term is not limited, and income can be obtained by changing the value of the metal on world markets. A time deposit is opened for a certain period, before which funds cannot be withdrawn. This account accrues interest, which is measured in grams of metal.

Each bank independently determines the conditions for working with compulsory medical insurance and prices for precious metals. Quotes most often change twice a day, but for some clients individual conditions for buying and selling metal are possible. This allows you to choose the optimal moment for carrying out operations, which increases the efficiency of investments. Typically, individual terms apply to transactions whose volume exceeds 1,000 grams in gold, platinum and palladium, and 60,000 grams in silver.

Metal is deposited into an account by purchasing from a bank or physically transferring bullion to be credited to an account, as well as by transferring from one compulsory medical insurance to another. When bullion is deposited into the account in physical form, the client must provide documents confirming his right to the metal, original certificates of origin and bullion quality passports, copies of permits from government bodies for the right to conduct transactions with precious metals in physical form.

Profitability

Compulsory medical insurance in gold is the most popular, with silver a little behind. There are four times more silver reserves than gold, so the market for the white metal is much smaller. Silver is characterized by rapid rises and falls, while gold shows greater stability.

By investing in silver, you can make large profits in a short period of time due to jumps in value. At the same time, it is a risky investment. It is recommended to invest in gold for the long term; over short periods of time it shows minimal profitability.

The demand for platinum is the opposite of the demand for gold. Gold rises in price during periods of crisis, and platinum, on the contrary, during economically favorable moments. Platinum prices have now reached their minimum and have nowhere to go, so long-term investments have additional benefits.

The demand for palladium is constantly growing. It is technically difficult to extract it, and the volume available to the producing countries is unknown to anyone. Experts believe that a decrease in the production of this metal even by 5% will immediately cause a shortage and an increase in price. Most likely, in the next 3-4 years, demand for palladium will exceed supply.

Experts recommend investing in several precious metals at the same time. This allows you to reduce risks to a minimum. According to the Central Bank of the Russian Federation, over the past 5 years the profitability of gold was 25%, silver - 26%, platinum - 6%, palladium - 31%.

Review of compulsory medical insurance of different banks

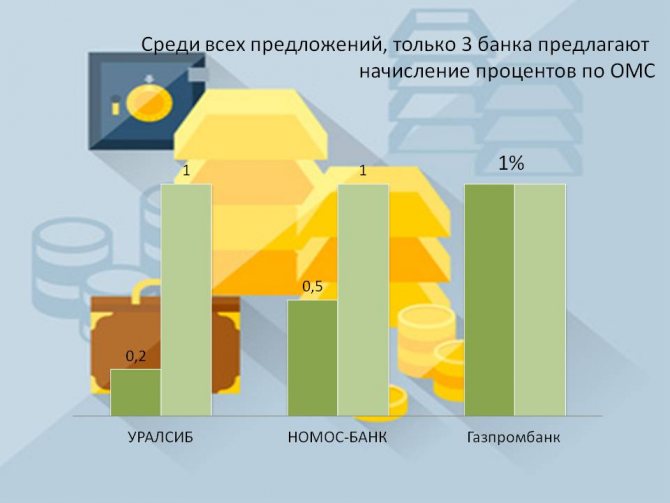

Gazprombank

The bank offers compulsory medical insurance in gold, silver, platinum and palladium. The minimum amount of metal to open a fixed-term account is 50 grams for gold and platinum, 3,000 grams for silver and 200 grams for palladium. The deposit period is 367 days, the interest rate is 1% per annum. In case of early termination of the contract, 0.01% per annum is charged. Additional contributions are accepted, the amount of which is not limited. Urgent compulsory medical insurance is opened subject to the client having a current account in rubles and compulsory medical insurance “On demand”.

The “Demand” deposit can be opened for any period, and the amount of precious metal is not limited. No interest is charged on the balance. Compulsory medical insurance “On demand” in NOMOS-BANK is issued subject to the client having a current account in rubles.

NOMOS-BANK

Clients can open compulsory medical insurance in this bank in gold, silver, platinum and palladium. Interest is not accrued on the “Demand” account, and the deposit period and purchase and sale transactions are not limited. The minimum amount of metal to open an account is 1 gram for gold and silver, 300 grams for platinum and palladium.

A time deposit in gold and silver allows you to receive interest, which is calculated in grams and amounts to 0.1-0.5 percent per annum. The minimum amount of metal to open a time deposit is 3,000 grams of gold and 300,000 grams of silver.

The bank allows you to withdraw funds in the form of bullion, but you will have to pay a bank commission and VAT in the amount of 18% of the amount. Opening and maintaining an account with NOMOS-BANK is free. To open compulsory medical insurance, you only need a passport of a citizen of the Russian Federation and funds to purchase the required amount of metal.

To carry out compulsory medical insurance transactions via Internet banking, a special agreement is concluded. Opening and maintaining an account is free. To carry out purchase and sale transactions of impersonal metal on the Internet, open a card in rubles and connect to NOMOS-Link.

Sberbank

Traditionally, customer trust in Sberbank is high, and given that compulsory medical insurance is not included in the deposit insurance system, many investors prefer to open such accounts here.

The investor can open compulsory medical insurance in gold, silver, platinum and palladium. The minimum metal size for opening an account and conducting purchase and sale transactions is 0.1 grams of gold, palladium, platinum and 1 gram of silver. The deposit is made “on demand” with an unlimited period. There is no interest rate on metal. There is no minimum or maximum account balance, which allows you to withdraw metal without closing the account.

It is possible to have several compulsory medical insurances in Sberbank, but funds cannot be transferred from one account to another. It is possible to deposit and withdraw funds in bullion, but in this case the investor must pay a bank commission and a tax in the amount of 18% of the deposit amount. To open a deposit, you must have a passport of a citizen of the Russian Federation with you. Metal can be purchased from a bank for cash, by transfer from another account, or deposited into an account in bullion.

During the transaction, an agreement for opening and maintaining compulsory medical insurance is signed. Money or bars are exchanged for unallocated metal at the Sberbank rate at the time of the transaction and are credited to an account, the opening and closing of which is free. The client is given a second copy of the contract and a savings book, which indicates the amount of metal.

Compulsory medical insurance quotes at Sberbank are set at 9:30 and 19:30. Each bank branch has its own quotes and spreads; this feature must be taken into account before signing an agreement. You can monitor quotes on the official website of Sberbank.

Investors with trades in excess of 1,000 grams of gold, platinum, palladium and 60,000 grams of silver can count on personalized quotes available at any time.

URALSIB

The bank offers to open a time deposit or “on demand” in gold and silver. A passport of a citizen of the Russian Federation is required for registration. It is possible to withdraw metal from the account in the form of bullion.

The interest rate on a time deposit depends on the period the metal is in the account: 0.20% per annum is charged on 181 days, 0.30% per annum on 271 days, and 1% per annum on 367 days. The minimum deposit weight is 10 grams of gold, 1,000 grams of silver. Account replenishment and contract extension are not provided. No interest will accrue upon early termination.

The Demand Deposit does not accrue interest. The minimum metal weight is 10 grams of gold and 1,000 grams of silver. It is possible to top up your account in an amount that is a multiple of 0.1 grams of gold and 1 gram of silver. The deposit period is not limited.

VTB 24

The bank offers compulsory medical insurance in gold, silver, platinum and palladium. The minimum established size of metal for a purchase and sale transaction is 0.1 grams of gold, platinum, palladium and 1 gram of silver. No interest is charged on the account balance. There is no minimum minimum balance, which allows you to sell metal without closing the account.

It is possible to open several accounts in the bank in one name. The client has the right to transfer precious metal from one account to another, provided that they are opened in the same metal. Purchase and sale is carried out at the rate set by VTB24.

Opening and servicing compulsory medical insurance is free, and the deposit period is not limited. To open an impersonal account, you will need a passport of a citizen of the Russian Federation and another identification document. You can top up your compulsory medical insurance by transferring metal from another impersonal account or by purchasing it from a bank. All operations are carried out without the participation of physical metal: there is no provision for receiving and issuing bullion when opening or closing an account.

Benefits of compulsory medical insurance

The advantages of compulsory medical insurance over the physical purchase of metal are that when conducting transactions with an impersonal account, VAT in the amount of 18% of the cost of the metal is not paid. At the same time, its price is as close as possible to the level of the world market, because the price does not include the production, transportation and insurance of bullion. In addition, the investor does not need to rent a cell for storing bullion.

The indisputable advantage of compulsory medical insurance is the free opening and maintenance of an account. Many banks do not limit the minimum amount of initial and additional contributions. And the sale of metal from an impersonal account is carried out on the day of application. Some banks allow the withdrawal of metal in the form of ingots, but in this case you will have to pay VAT (18%) and a bank commission. Sometimes a non-cash transfer of metal from one compulsory medical insurance to another, opened in the same bank, is provided.

Disadvantages of metal accounts

Compulsory medical insurance is not included in the deposit insurance system. Against the backdrop of recent events in Russia, this is a significant drawback of this type of investment. If a bank's license is revoked, the account holder joins the general queue of bank creditors and awaits the sale of its assets.

Banks set their own quotes for the purchase and sale of metal. In this case, the spread (the difference in price between the purchase and sale of precious metal) is 3-5 percent. But in case of unforeseen circumstances, for example, a sharp increase or decrease in demand, the spread can increase significantly, because there are no restrictions, and the decision is made by the bank.

Compulsory medical insurance does not make the investor the actual owner of the gold. Some banks provide the possibility of physically withdrawing metal from the account, but in this case the owner pays VAT in the amount of 18% of the amount and a bank commission, which is not regulated by anyone and is set by the financial institution independently. This means that in a situation that could provoke a massive withdrawal of physical metal from an account, the bank has the right to set a commission of even 50% of the cost of the bullion.

Recently, there has been a tendency for the amount of paper gold to exceed physical gold. This could theoretically lead to the fact that owners of physical gold will not want to sell it on deliverable futures and paper contracts markets will stop. As a result, the owners of such contracts will simultaneously want to cash them out, and there will not be enough physical metal to cover the obligations. In addition, banks will be able to set arbitrary spreads and commissions for withdrawing metal into physical form. Therefore, despite the advantages of compulsory medical insurance, we should not forget about possible investment risks.

After the opening of compulsory medical insurance, the cost of investments immediately decreases by the amount of the spread, and in order to reach at least zero when selling metal, you must wait until its value increases by the amount of the spread. Based on this, it is recommended to open compulsory medical insurance for the long term.

Interest on urgent compulsory medical insurance, as well as income received from changes in metal quotations, are subject to income tax at the rate of 13%. In the first case, the bank holds it, and in the second, the responsibility falls on the account owner.

27.01.2014

Costs when purchasing compulsory medical insurance

What costs do CHI account holders bear?

The account is opened for free. Service costs zero rubles zero-zero kopecks. Purchase and sale transactions are carried out at the bank's exchange rate.

In fact, there are no additional costs. But there are so-called hidden fees.

Banks allow you to open accounts for no reason. From each operation they charge us a small penny (although in some banks it is a large one).

When setting purchase and sale prices, the bank is guided by the Central Bank exchange rate or stock quotes on the foreign exchange market. Throwing in “your interest” in the form of a slightly higher price.

It is precisely these costs that are borne by the owners of compulsory medical insurance.

Conventionally, the official gold rate is 1,000 rubles. The bank will sell it to you for 1,050. And buy it back for 950.

We get the difference between buying and selling of 100 rubles. This is called a spread. It is on the spread that banks earn their margin.

Additionally, the bank can earn money by using customer money attracted to metal accounts. Therefore, this is doubly beneficial for him.

Very reminiscent of a currency exchanger selling dollars and euros. The meaning of business is similar. Sell to customers at a higher price, buy at a lower price. Put the difference in your pocket.

The good news is that these are one-time costs and you will only have to pay them twice. When buying and selling.

Naturally, it is advisable to choose a bank with a minimum spread level.

How prices for compulsory medical insurance are set

Each bank sets its own quotes for impersonal metal accounts, based on the greed factor of the dynamics of supply and demand. When setting prices, they are based on data from the Central Bank - just as in foreign exchange transactions.

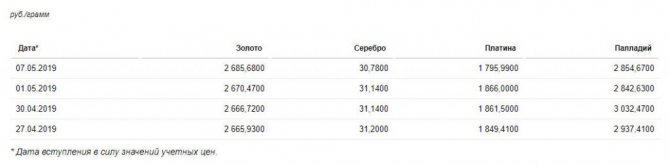

The Central Bank itself also does not take prices out of the blue. The price of the precious metal is determined by the London Stock Exchange every morning based on the results of trading. It is measured in dollars per troy ounce. One troy ounce is 31.1 grams. Historically, ounces have been used by jewelers to measure the weight of precious metals.

The Central Bank takes the price of gold in dollars, determined by the London Stock Exchange, then divides it by 31.1 and converts it into rubles at the current exchange rate. This is how the ruble price for 1 gram of metal is formed.

You can view the current rate here: https://www.cbr.ru/hd_base/metall/metall_base_new.

Then each bank, based on the price of the Central Bank of the Russian Federation, sets its own quotes. Here, for example, is the compulsory medical insurance rate at Sberbank on the same date (May 6, 2021).

And here’s another interesting article: Where to invest a million rubles: a review of options

Also keep in mind that the bank sets a spread - the difference between the purchase and sale prices. The larger the spread, the less profitable the deal and the longer you will have to wait until the price rises. Therefore, it is better to compare offers from several banking organizations and open compulsory medical insurance where the spread is the smallest.

Bank spreads

The spread level may vary from bank to bank. Literally exponentially.

Compiled current offers from several banks. So that you can evaluate the spread of quotes. Using gold as an example.

Red and green are the worst and best offers, respectively.

The Central Bank exchange rate for gold at the time of compiling the table was 2,604 rubles per gram.

All markups in the table are indicated relative to the official Central Bank exchange rate.

The most important bank in the country, Sberbank, turned out to be the most greedy unprofitable for opening metal accounts. Who would doubt that.)))

Do you want to open a compulsory medical insurance? Keep a checklist:

- Check the reliability of the bank where you are opening compulsory medical insurance. Remember, a metal account is not insured by the DIA.

- Think about whether you are ready to invest for several years in advance. Otherwise it's not worth it. Metals last a long time.

- Ask the operator if the bank pays personal income tax for you. Banks usually pay, but it’s best to check in advance.

- Think again, are you ready to invest in an asset whose price can jump like that? Take another look at the graphs above.

- #Beginners

Was the article helpful?

Thanks for the answer!

Which bank is better to open an account with?

It would seem as simple as shelling pears. Choose a bank with the most favorable rate or spread. In fact, this is only the second point when choosing the “right compulsory medical insurance”.

The bank's reliability comes first. We need credit institutions with the highest reliability rating. And only then look at the quotes.

Food for thought.

Banks with the maximum reliability rating AAA, AA, A have a hundredth of a percent probability of bankruptcy within a year. On the horizon of 10 years, this figure increases to a maximum of 0.5 - 1.5%.

The rating BB+, BB, BB- gives the risk of bank default within a year of 1-3%. Over a 5-year period up to 6-10%. For a decade - 10-20%.

That is, within ten years, every fifth bank will not be able to pay off its obligations.

How does this threaten owners of impersonal metal accounts? Information-answer in the next paragraph.

Advantages and disadvantages

Each depositor, before concluding an agreement with a bank, should analyze the advantages and disadvantages of impersonal metal accounts, which will allow them to make the right decision.

The advantages of compulsory medical insurance include:

- A small package of documents for registration.

- Reliability, since fluctuations in precious metals rates are not as significant as the value of the currency.

- The benefit of purchasing unallocated metal is that there is no need to pay VAT.

Among the disadvantages are:

- Lack of an insurance system for deposits in unallocated metal.

- In order to earn income, you need to regularly monitor exchange rate changes.

- By investing money for a short period of time, the investor risks incurring losses.

Are compulsory medical insurance insured?

The quick answer is no.

If problems arise at the bank, be it bankruptcy or revocation of a license, the owner of the compulsory medical insurance is left alone with his problems. And whether he will get his money back is a big question.

Even ordinary deposit owners who have the protection of deposit insurance face certain difficulties in returning their invested funds.

What can we say about some compulsory medical insurance? In most cases, you can say goodbye to them. Especially when it comes to small amounts. The game is not worth the candle. Lost time and nerves upon return. Moreover, a positive result is not guaranteed.

To store money for compulsory medical insurance, it is better to choose only the largest reliable banks.

Although recently this also does not guarantee the occurrence of negative consequences for the bank in the future.

But at least their probability of a “black streak” is much lower than that of any small banks of the “horns and hooves” type.

What about insurance and taxes?

- Metal accounts are not insured by DIA

- Owned metal for less than 3 years - you must pay personal income tax

- Sold for more than 250,000 ₽ - you have to pay personal income tax

In the end, everything leads to the fact that it makes sense to open compulsory medical insurance for several years.

Watch your hands. On the one hand, metal accounts are not insured by the DIA. Therefore, in order not to lose money due to bankruptcy, it is worth opening a compulsory medical insurance in a large bank. But if you open an account with a large bank, you will have to buy metal at a less favorable rate. And to make up for this price difference, you will have to maintain compulsory health insurance for several years.

When is the best time to buy or sell metals?

The timing of the purchase matters. Here we are not talking about the situation on the market - the price will rise, you need to buy it urgently. Or the exchange rate falls - we throw everything away.

You decided to simply buy yourself 100 grams of gold for the long term. You are not following the course. You don’t know the situation on world markets.

The bank where you will take gold has been selected. All that remains is to make the deal.

Try to buy and sell metals only during business hours. Avoiding transactions on weekends and holidays. We exclude night and late evening hours

Why?

The gold rate is constantly changing. Walks within a certain range. Plus or minus 1-3%. Sometimes sudden changes can occur in a short time.

During business hours, the bank can monitor the situation on the market. And adjust your internal courses in time.

When you go on holidays, control is almost lost. And in order to protect itself (and its own money), the bank sets the rate “with a reserve” for this period (widening the spread). In case unpleasant situations arise.

During non-working hours, the exchange rate is almost always less favorable for transactions compared to normal business hours on weekdays.

Metal or currency?

The dynamics of gold prices acts as an important economic indicator, which to a certain extent allows us to assess investors’ risk appetite. During periods of economic instability, investors resort to investment instruments that primarily allow them to protect assets from depreciation. If economic growth is brewing, the situation changes in the opposite direction: investors switch to the issue of increasing profitability, and the price of gold begins to fall.

In September 2011, amid investor fears of a default in the United States and debt problems in the Eurozone, the price of gold broke records of previous years, setting a new world gold price record exceeding $1,900 per troy ounce.

Statistics on transactions with compulsory medical insurance confirm the surge in demand for this instrument, with emphasis during periods of unstable financial situations. When considering impersonal accounts as an investment instrument in the precious metals market, it should be understood that this type of investment is designed for at least the medium term. Over a short period of time (up to one year), fluctuations in precious metals rates may not bring a decent income under compulsory medical insurance, and sometimes even bring a loss to the investor. But over a long period of time and taking into account more favorable tax conditions, the profitability of an impersonal metal account definitely outperforms the deposit.

The table below presents data on the profitability of investments in precious metals and currencies over the past 5 years (from 2008 to 2013) according to the Central Bank of Russia.

| Investment object | Unit measurements | January 2008 | January 2013 | Yield per annum, % |

| Gold | rub. for 1 gram | 723,3 | 1609,67 | 25% |

| Silver | rub. for 1 gram | 12,92 | 29,92 | 26% |

| Platinum | rub. for 1 gram | 1227,26 | 1620,21 | 6% |

| Palladium | rub. for 1 gram | 282,43 | 717,35 | 31% |

| U.S. dollar | rub. for 1$ | 24,47 | 30,15 | 5% |

| Euro | rub. for 1 € | 36,13 | 40,54 | 2% |

Taxation of compulsory medical insurance

Why do they mainly buy compulsory medical insurance?

There are two reasons: to earn or protect your savings from inflation, currency fluctuations or ruble deflation.

And when the time comes to sell assets, a profit is generated (if the rate has increased).

And the state imposes personal income tax on all citizens. At a rate of 13%.

But there is a slight difference here from the taxation of securities.

If, for example, you buy shares for 1,000,000 rubles. And then sell for 1.5 million, the difference between the purchase and sale will be taxed. That is, your net profit is 500 thousand.

If you pull off this trick with compulsory medical insurance, then in theory, tax should be paid on the full amount of the sale. From 1.5 million rubles.

Why is this happening?

In the tax code, according to classification, impersonal metal accounts are equated to property.

For several years now there has been talk about plans to equate compulsory medical insurance to securities, but for now this is the scheme.

There are a number of tax benefits for owners of compulsory medical insurance.

Amnesty. If the period of ownership of the metal (the report starts from the moment of purchase, and not the opening of an account) is more than 3 years, there is an exemption from paying tax.

Tax deduction. Account holders have the right to a property deduction in the amount of 250 thousand rubles. Simply put, this means that if the sales amount is less than 250 thousand per year, you can congratulate yourself - you saved on taxes. If it is more than a quarter of a million, you must pay 13% on the excess amount.

Income tax. In order not to pay 13% in taxes on the sale amount, you can provide the tax office with supporting documents on the amount of expenses incurred for the purchase of metal. Conventionally, we bought gold for 300 thousand, a year later we sold it for 400. Net profit is 100,000 rubles. The tax will be 13 thousand. Instead of 52,000 (13% of 400 thousand).

A taxpayer who has owned metal for less than 3 years has the right to take advantage of only one benefit at his discretion.

Let's look at it with an example.

The investor sold gold for compulsory medical insurance in the amount of 350 thousand rubles. Ownership period is less than 3 years.

He needs to pay personal income tax. Which of the two options should I use?

- Property deduction. You can get a benefit for 250 thousand. And on the balance of 100 thousand, pay 13% tax. In money it will be 13 rubles.

- Net profit tax. Here you need to know the costs incurred for the purchase of metal. Let there be 300 thousand. In this case, the net profit or tax base is 50 thousand. The tax will be 6.5 thousand rubles.

Result: It will be more profitable for an investor to take advantage of the second type of deduction - net profit tax.

If the cost of purchasing gold were not 300 thousand, but for example 200,000, then the net profit would increase to 150 thousand (the tax would be 19.5 thousand).

In this case, it is more profitable to choose a property deduction. And pay taxes on 100,000 rubles (sale amount 350 thousand - minus property deduction 250 thousand). Or 13,000 rubles.

Even with a tax benefit of 250 thousand, this does not mean that you can sell metal for an equivalent or lesser amount, get money and sleep peacefully.

By law, an individual is obliged to declare his income at the end of the year (if taxes were not automatically withheld from him, as for example in hired work, when the employer himself withholds and transfers the entire quitrent to the budget). And confirm your right to receive a deduction.

Many write that they did not submit any declarations. And everything went well. But there are cases (and every year there are more and more of them) when a “chain letter” arrives from the tax office. Provide an explanation of the undeclared income received.

What does this mean? Fines, penalties, plus proceedings with the tax authorities, even to court.

Profitability of investments in metals

So, which banking instruments are more profitable to invest in: deposit or compulsory medical insurance? This is the main question that interests investors, because profitability is the main indicator characterizing the investment of funds.

Let's compare the profitability of compulsory health insurance and a deposit using the data from the example discussed above.

An investor, having invested 150,000 rubles in compulsory medical insurance (gold) in 2008, received a profit in the amount of 79,847.80 rubles in 2011.

At the same time, having opened not a compulsory medical insurance, but a deposit with an average rate of 7%, he received an amount of 34,903.61 rubles, which is half as much as the compulsory medical insurance.

Accordingly, when choosing an account type, you should carefully analyze the terms of service and focus on the dynamics of prices for precious metals.

How to minimize taxes?

Sell for no more than 250 thousand per year. Moreover, if you have several compulsory medical insurance opened in different banks, the amount of all sales is balanced. As an option, open compulsory medical insurance for family members. One person - 1 benefit per 250 thousand per year.

Keep accounts intact for 3 years. If you plan to constantly purchase precious metals into your account, we open a new compulsory medical insurance in a different bank every year. Accordingly, we sell in the same sequence. So that in the future, if necessary, you can “throw off” metal that has been sitting for 3 years, without tax consequences.

Alternatively, you can keep all compulsory health insurance in one place. But... in this case, you will have to take them into account according to the rules of warehouse or accounting (fifo-lifo) and provide the tax office with supporting documents about the date and amount of purchase for each transaction. To avoid taxation.

How does profitability work out?

Unallocated metal accounts are divided into two types, which determines the calculation of profitability based on the balance of the precious metal in the account:

- Compulsory medical insurance “on demand” - income is based on changes in the price of metal without accruing interest income. The investor may make transactions on the account or close the account at any time at his discretion. If the price of the precious metal you are interested in has increased, you have made a profit; if the price has fallen, you have a loss.

- “urgent” compulsory medical insurance - income from a possible increase in prices for precious metals with the accrual of interest income in grams with placement for a predetermined period. Sometimes the bank charges interest in ruble equivalent to a current ruble account. Naturally, if the contract is terminated (closing the compulsory medical insurance) before the established period, the investor loses interest. The term for a “golden deposit” is usually from 1 month to a year, but sometimes up to two years. The maximum interest rate for compulsory medical insurance in gold is about 5% per annum, but in most cases the bank will offer 1.5-2% for a period of 6 months, and for short periods (30 - 90 days) - 0.5-1.5%. To open a fixed-term metal account in gold, you will need to purchase about 50-100 grams of metal at a time, which is already a decent amount. The larger the deposit and the longer the mandatory storage period, the higher the interest the bank will offer.

We recommend reading: Which bank should I open a compulsory health insurance policy in?

Is it worth opening an urgent compulsory medical insurance?

It is impossible to answer this question unequivocally. On the one hand, the interest on such accounts is not very large and will not cover losses when the value of the precious metal decreases. On the other hand, by choosing urgent compulsory medical insurance, the investor does not lose anything: the account can be closed at any time with the loss of accrued interest, which essentially reduces it to compulsory medical insurance on demand. Some banks pay a symbolic 0.01% when closing an impersonal account ahead of schedule.

Therefore, in certain situations, you can sacrifice interest and get a better result (increase income or reduce losses) by selling the precious metal at the best price in the current situation. If the outcome is favorable (increase in metal prices), the interest will also not be superfluous.

In which bank to open an urgent compulsory medical insurance? Not every bank will offer you to open a fixed-term impersonal account - they are less common, unlike compulsory medical insurance on demand. The minimum “contribution” for opening such accounts is significantly higher than that of current compulsory medical insurance. Some banks are ready to open a fixed-term metal deposit starting from 1 gram of gold, but the interest will accordingly be minimal.

The Sberbank Compulsory Medical Insurance Profitability Calculator service allows you to calculate the compulsory medical insurance profitability in various metals with the result reflected on the chart as if you had opened compulsory medical insurance in the past period of your choice for the specified amount in rubles. VTB-24 has a similar service for calculating the efficiency of an impersonal metal account on its website.

Algorithm for choosing and purchasing compulsory medical insurance

How to choose the right bank to open a compulsory medical insurance?

Algorithm of actions:

Bank rating. Considering that funds for compulsory medical insurance are not insured. We only need stable credit institutions with the highest reliability rating.

Let's look at the spread. Among the selected banks, we compare the spread. And we choose the most optimal bank (or several) for ourselves. It is not necessary to choose the most minimal one. If the rate at the first bank is a little higher and at the same time you are a client of this bank, then there is probably no strong financial benefit to switching to another.

We remember about taxation.

For short investment periods (less than 3 years), we ensure that the sales amount for compulsory medical insurance does not exceed 250 thousand per year. Otherwise, an option is to open several compulsory medical insurance for family members.

For long periods of more than 3 years, we open a new compulsory medical insurance every year (in another bank, or for family members). Or we become an accountant. We collect and save all data on completed transactions (price and date of purchase and sale) in order to subsequently prove to the tax authorities that you do not have the right not to pay taxes.

Pros and cons of compulsory medical insurance

So, let’s highlight the main pros and cons of impersonal metal accounts. Advantages:

- investments are available from small amounts - you can buy a minimum of 1 gram of gold or 5 grams of silver;

- income is virtually unlimited - only by the increase in the exchange rate of the purchased precious metal;

- there is no 20% VAT, as when purchasing an ingot;

- Compulsory medical insurance does not need to be stored anywhere - it is in the bank;

- There is no fee for servicing a metal account;

- you can buy metal at a low price and sell it (partially or completely) at any time;

- there are tax benefits;

- you can open compulsory medical insurance online;

- If you wish, you can exchange paper gold for real gold (although it is very expensive).

But I will also note the disadvantages of impersonal metal accounts, which also need to be taken into account:

- no interest is accrued on compulsory medical insurance;

- such accounts do not fall under the compulsory medical insurance program;

- limited liquidity - you can sell paper metals only to the bank where you opened the account;

- large spreads - sometimes you have to wait for years for the price to “work out” at least the spread;

- the bank arbitrarily sets spreads, and sometimes they are not fair;

- not all banks with good rates offer online transactions;

- Sometimes you still have to pay taxes.

Well, the main disadvantage is that no one guarantees your income here. The price of the precious metal can either rise or fall. Therefore, you can either earn or lose money by investing in compulsory medical insurance. You need to be prepared for this.

What do you think about impersonal metal accounts as an investment instrument? My review: you can make money, but you need to know how and prepare for long-term investments. Not for a week, but for months and years. Perhaps it is more profitable to invest in gold ETFs or shares of gold mining companies? How do you think? Good luck and may the gold be with you!

Rate this article

[Total votes: 2 Average rating: 5]

Kinds

The difference in impersonal metal accounts is the agreed storage period for savings. For us as investors, the choice depends on the purpose of opening an account.

Urgent or deposit

What it is? An ordinary time deposit, opened until a certain date, on which the investor is accrued interest (the rate is agreed upon in advance), but not in dollars or rubles, but in impersonal grams of the metal in which the account is opened. A rather rare type of compulsory health insurance today.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

The investor's benefit is formed from accrued interest, taking into account the growth of the metal exchange rate in the world. This option is suitable for those who want to save money first and plan to invest it for the long term (statistically, metal accounts opened for a period of 3–5 years or more become profitable).

Current, or on demand

A current impersonal account should be opened for those who plan to win on the difference in rates. Interest is not accrued on an impersonal metal account opened on demand, but the depositor can independently operate the funds - replenish the account and make debits from it at any time.

Expert opinion

Vladimir Silchenko

Private investor and stock market expert

Ask a Question

A current metal account is chosen by people who believe in the long-term growth of the value of precious metals, or who are interested in speculation, “playing on quotes.” It is impossible to predict whether you will be able to get income from it and what kind of income it will be. To manage such an account, you do not need to constantly monitor quotes.

How to cash out compulsory medical insurance

You can only withdraw funds from an impersonal account in cash. In many banks (for example, Sberbank), this requires just a few clicks of the mouse.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

There is a myth circulating on the Internet: supposedly you can withdraw funds in metal form (ingots). In practice, I have never encountered this before.

This is understandable, it is not profitable for the bank, because the cheapness of compulsory health insurance consists of:

- no costs for transportation, storage and maintenance of physical gold;

- no need to pay VAT.

What metals can be bought on compulsory medical insurance?

An impersonal account is opened in one of 4 investment metals. Here are the static returns over a five-year period:

- palladium - 1st place - 31% per annum;

- silver - 2nd place - 26% per annum;

- gold - 3rd place - 25% per annum;

- platinum - 4th place - 6% per annum.

Gold

Gold is popular in Russia. This is due not only to its stable position in the market, but also to traditions, which some call prejudices. Gold seems to be the most valuable, most expensive asset to people, even as platinum prices soar higher.

Gold is a good option for opening a non-personal metal account, but other metals are also worth considering. In addition, gold's growth is stable, so it is not very suitable for speculation.

Silver

Many experts believe that silver as a participant in the precious metals market is undervalued and, in particular, that is why it is so cheap. There are forecasts that in the coming years it will rise significantly in price. Whether they are justified or not, we will only know after these years have passed.

Platinum

Platinum is characterized by an increase in value during periods when the demand for gold falls. Platinum is an expensive metal to produce. The main supplier of platinum to the world precious metals market is South Africa, so the position of platinum depends on the political and economic situation in Africa. For example, in 2014, the level of metal production fell due to miners' strikes, which affected the cost.

Platinum is a significantly rarer metal than gold. Its reserves are limited, which may lead to a crisis for mining companies in the future.

Palladium

The leader of the five-year plan rating is palladium. Unlike gold and silver, which serve primarily jewelry and investment purposes, palladium is widely used in industry, particularly in mechanical engineering. Demand for it is stable and depends on more constant things than trends and the vagaries of the market. Mining palladium is labor-intensive and expensive, although its reserves in the world are greater than those of gold.