Hurry up to register!

Just before the New Year, get a “100 days without%” card from Alfa Bank and take up to 500 thousand rubles at 0% interest on any expenses.

Find out about the promotion now!

Natural ways to attract investments are investment funds, shares, banks, real estate, portfolio investments. Few people thought that investment coins could act as a publicly accessible financial instrument that would ensure the reliability and security of the deposit. What are investment coins, and how do they attract investors, as well as what is the value of precious metals in the investment market? Let’s find out right now.

Features of investing in coins

The most expensive coin in the world is the Double Eagle, USA.

In 2002, it was sold for $7,590,020. Only one copy of it is known. Article navigation

- What are commemorative and investment coins?

- What types of investment coins are there?

- Gold

- Silver

- How much can you earn

- Examples of coin profitability

- How to buy and sell investment coins

- Rules for storing valuable coins

- Investment coin prices

- Which banks sell investment coins in Russia

- Sberbank

- Rosselkhozbank

- Alfa Bank

- VTB

- Gazprombank

- Bank opening

- Conclusion

Investment coins made of precious metals are a popular and fairly reliable asset, by purchasing which you can secure and increase your personal capital in the long term. Below we will look at whether it is profitable to buy numismatics, how quickly their prices change and how much you can earn on such transactions.

Made from base metals

Coins made of base metals are issued by the Bank of Russia in large circulations of 5-10 million and are designed for the mass consumer, they are in free circulation, there is no need to specially purchase them or pay extra for them - this is ordinary cash.

Such coins differ from ordinary ones only in their limited circulation and reverses (back side), on which images dedicated to memorable or anniversary events are placed. For example, the coin “200th anniversary of the birth of A.S. Pushkin": metal - nickel silver, circulation - 10 million pieces.

What are commemorative and investment coins?

Special samples are used as investment and commemorative coins, which are intended for collectors and those who wish to invest money in precious metals. Naturally, they are not allowed into mainstream circulation. When you get change in a store, you will never accidentally stumble upon a treasure.

Precious coins are divided into two key groups:

- investment - contain a certain weight of metal, are produced in large quantities, and, as a result, are not rare;

- commemorative - usually minted in honor of an important holiday or event (historical date) and are distinguished by their collectible value.

The first group is investment gold and silver in the form of coins. The advantage of this form of purchasing metal is that it is not subject to 20% VAT, compared to bullion. The second type of coin samples are considered collectibles, and their value depends, first of all, on the uniqueness and volume of circulation.

Watch a video that clearly explains this:

About the concept

The concept of numismatics is much broader than collecting coins. This is a science whose subject of study is the history of coinage and monetary circulation.

But in everyday life, the term numismatics also refers to collecting collections. In addition to rare and commemorative coins, numismatists buy:

- paper bills;

- various types of payment documents;

- cash bullion;

- tokens, badges, orders, etc.

Commemorative coins with collector's value are usually minted to mark important historical events in limited editions with intricate artistic designs.

What types of investment coins are there?

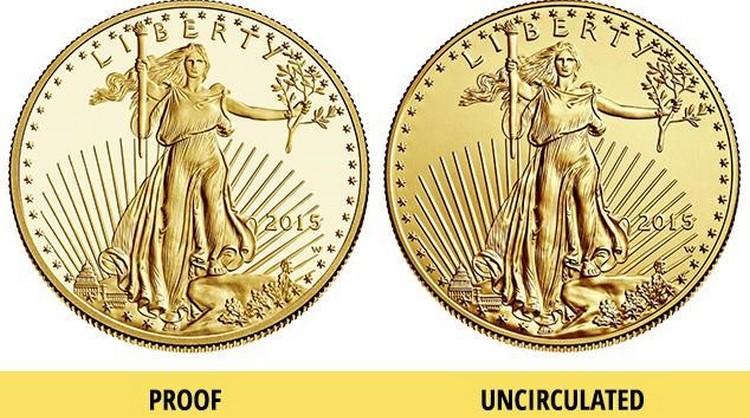

In addition to dividing coins into commemorative and investment coins, there are classifications based on their production technology and quality of minting:

- excellent condition (from English Uncirculated, abbreviated as UNC or AC) - implies a matte finish on the sample;

- improved (from English Proof) – distinguished by a spectacular mirror surface.

As a rule, other types of quality (from bad to good: VF, F, XF and VG) are not applied to investment coins, but are characteristic only of collectible items.

Investment samples are made of gold or silver, since their price is tied to metal quotations on the world market. Commemorative numismatics can be made of a precious material or alloy, such as copper-nickel. Let's take a closer look at the gold and silver versions of investment coins.

Gold

An excellent opportunity to increase and preserve your savings is investing in Russian gold coins. You can obtain up-to-date information on the weight and composition of samples on the official website of the Central Bank of the Russian Federation. Today, only two types of investment coins are made from gold:

- Chervonets (10 rubles) – contains at least 7.742 grams of gold, fineness 900/1000.

- St. George the Victorious (50 rubles) - it contains more than 7.78 grams of gold, fineness 999/1000.

Above - St. George the Victorious, below - Chervonets.

The denomination of coins has no relation to their actual price. The cost is determined by the precious metal content in it and its current exchange rate on international markets. All other samples are already commemorative, not investment.

Silver

Mints, commissioned by the Central Bank of the Russian Federation, mint silver samples in two variations:

- “Sable”, denomination (3 rubles) – contains at least 31.1 grams of silver, fineness 925/1000;

- “George the Victorious” (3 rubles) – similar, but with a purity of 999/1000.

Above – St. George the Victorious (3 rubles), below – Sable (3 rubles).

From precious

Collectible (commemorative) coins are made of the highest quality of minting - the proof method (English proof) and have a complex multi-faceted design.

With this technology, the field of the coin is smooth and mirror-like, and the relief is matte, contrasting with the field; the letters are connected to the field at an angle of 90 degrees. Coins, immediately after they are made, are sealed into transparent capsules or sheets.

Some coins are made as proof-like - this means that the coins are made similar to proof, but fall a little short of it, some condition of the technology is violated.

Collectible coins are valuable not only because they are made of gold, silver or platinum, they have great artistic value and a small, limited mintage. The smaller the circulation, the greater the value it is for numismatists.

Coins are often purchased as an unusual souvenir or gift, for example, at the birth of a child.

Silver

The first silver coins “srebreniks” began to be minted under Prince Vladimir the Great around the 990s. The period of independent Russian coinage did not last long, and already in the second half of the 11th century, the “Coinless Period” began, when silver bars were used as a means of payment. The issue of coins was resumed during the reign of Dmitry Donskoy; from that time on, there were coins of only two denominations - denga and polushka, all of them were silver. Under Ivan the Terrible, the first kopecks appeared, which became the basis of monetary circulation. In 1654-1655, the first ruble coins were issued, which were also made of silver, but the full circulation of the silver ruble had to wait another half century. Peter's monetary reform significantly transformed the appearance of coins, added many new denominations, but silver coins in denominations from a kopeck to a ruble (later from 5 kopecks to a ruble) were still the main ones. It was possible to completely abandon the use of precious metal in monetary circulation only under Soviet rule. The last silver coins date back to 1931 (10, 15 and 20 kopecks), fifty kopecks disappeared in 1927, and rubles even earlier - in 1924. In 1977, for the upcoming Olympics, collectible silver coins of improved minting quality were issued, in subsequent years the production of silver commemorative and commemorative coins continued. Currently, several dozen types of collectible and investment coins are issued annually; they can be purchased in banks at a special price. The weight of such coins ranges from 15 grams to 5 kg.

ParameterValue

| Color | Silver white |

| Chemical designation | Ag |

| Melting temperature | 960°C |

| Density | 10.5 g/cm3 |

| Mohs hardness scale | 2,7 |

Gold

The first Russian gold coins appeared at about the same time as silver ones - at the end of the 10th century, but their production had a very small volume, and under subsequent rulers it stopped altogether. Under Ivan III, the minting of gold grant coins began, which were awarded to outstanding architects, builders, and also for various merits. These coins were not a full-fledged currency, although they came into circulation from time to time. Since the era of Peter I, the gold coin has occupied a special niche in monetary circulation; 2-ruble coins and chervonets coins without indicating the denomination are made from gold. Under Elizaveta Petrovna, 5 and 10 rubles appear. The gold coin remained a hard currency, an alternative to constantly depreciating banknotes. During the Civil War, they (especially the Nikolaev 10 rubles) had a high exchange rate among the population and were in great demand. In 1923, a large edition of Soviet gold chervonets was issued, the size and weight of which coincided with the Tsar's 10 rubles. Their goal was to reinforce the paper chervonets, which had a gold backing. The population did not receive such coins, and they were not accepted abroad because of Soviet symbols, so the issue was not continued, and the bulk of the circulation was melted down. In 1975-1982, new-made chervonets were issued with exactly the same images, but different dates; currently they serve as investment coins. Since 1977, in addition to collectible silver coins, gold coins have been minted. The production reached its greatest volume in 2010-2013, after which it began to decline. However, several types of gold coins are currently produced annually and can be purchased from banks at special prices. In addition to this, investment gold coins of UNC quality are issued, the cost of which is slightly lower than collectible ones.

ParameterValue

| Color | Golden |

| Chemical designation | Au |

| Melting temperature | 1064.43°C |

| Density | 19.621 g/cm3 |

| Mohs hardness scale | 2,5 |

Special value

The most expensive are the exclusive gold editions. Particularly valuable ones can cost up to 2-3 million rubles. They are distinguished by high quality of coinage and artistic execution. Expensive coins are associated with special periods and events in Russian history - the coronation of emperors, the reign of Catherine II, Peter the Great. The gold “History of Monetary Circulation in Russia”, 2009, costs more than 1.8 million rubles. The gold “Sedov” and “Kruzenshtern” are worth more than 1 million.

Expert opinion Alexander Ivanovich Private collector with 4500+ coins and bonds in his personal collection. Knows the value of each of them today. Out-of-circulation banknotes minted in limited editions are of particular collectible value. The price is high for copies that have a manufacturing defect, if they have passed the control system and are put on sale.

The most popular Russian investment coins are the gold “George the Victorious” 999 fine and the “Sower” (chervonets) 900 fine. They are not as liquid outside of Russia. Selling them in another country will be difficult. In this case, I advise you to invest in such popular examples in the world as the Austrian Philharmoniker, the Canadian Maple Leaf, the American Buffalo and Eagle, and the South African Krugerrand.

Philharmoniker Krugerrand Maple Leaf Buffalo

Platinum

Unlike other metals from which money was minted for centuries, platinum was discovered only during the reign of Alexander I. Its deposits were discovered in the Ural Mountains, and they were very significant. The minting of platinum coins began only under Nicholas I; these were in denominations of 3, 6, 12 rubles. Due to the much higher estimated cost of the metal and the use of the same equipment as for minting silver, the changes affected the denominations. With the same mass and size of the coin discs, they (the denominations) were increased 12 times (the silver ruble coin began to correspond to the 12-ruble platinum coin, etc.).

Mass production of money from the precious metal took place in 1828-45, until counterfeiters again stood in the way of the state monetary machine, who this time used much cheaper silver to mint “platinum” money. In low light conditions it was very easy to confuse them. As a result, the entire platinum coin stock stored in the state treasury, and everything that was returned to it from circulation, was sold for melting down in England. In new history, the issue of platinum coins returned during the period of Soviet power, but these were no longer popular, but collectible commemorative and investment issues, which ended in 1995.

Copper

The first copper coins, called pools, were produced in the 15th century in the Novgorod and Tver territories, but were not widespread. They were small in size and did not have a perfectly round shape. The relationship between their nominal value and silver coins has not yet been precisely clarified; more precisely, numismatists have not been able to come to a consensus. Pools were in circulation, albeit very limited, until the unification of Rus', after which copper money appeared again only under Alexei Mikhailovich. This was an attempt to equate silver and copper based on their size and weight.

The result was a crushing exchange rate crash and the subsequent infamous “copper riot.” The idea was considered unsuccessful and was quickly abandoned. Full-fledged copper coins began to be minted from the beginning of the 18th century, and they already had a modern round shape and were on par with silver “scales”, far ahead of their time in this sense. The excellent quality of these copper coins made it possible to partially replace the amount of coinage silver that the country was already short of.

The first coins of Russia were made from this metal, in particular - lower denominations up to 5 kopecks inclusive of 1924, however, the production of copper coins was considered unprofitable and already in 1026 they were replaced by other metals - in particular, more durable and less expensive bronze.

In the modern history of Russia, a copper coin with cupronickel plating was also issued; these were 5 rubles in 1997. They were no longer minted, replacing the base with steel, but they are still found in circulation to this day.

How much can you earn

The approximate income from investments in coins varies from 10 to 50% per annum. Much depends on the duration of the investment, as well as the situation on global financial markets. In some years, coins may fall in value.

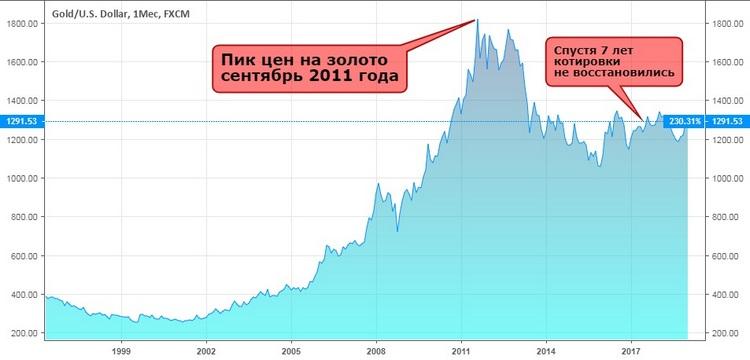

Dynamics of gold prices over the past 20 years.

The situation is little better with silver, which fell almost 4 times over the same period.

The myth of gold's unwavering rise was perpetuated due to the strong bull run (2002–2011) in which investments generated huge returns in a short period. Today, the further dynamics of the exchange rate is questionable. There was a similar crisis for this metal from 1980 to 2000 (as much as 20 years). Of course, it is difficult to dispute the value and reliability of gold as an asset, but this is only true over a horizon of 30 years or more.

It is important to understand:

- coins are not completely dependent on metal quotations, since they are also affected by inflation, as a result, they grow in price more steadily;

- Gold price movements have less of an impact on commemorative pieces, which can rise or fall depending on uniqueness and demand among collectors.

Buying investment coins is a means of saving and increasing capital, but it will only be justified for a long period, ideally 5–10 years. This is due to the dynamics of prices for precious metals. It’s up to you to decide whether to buy an asset at such a time.

Examples of coin profitability

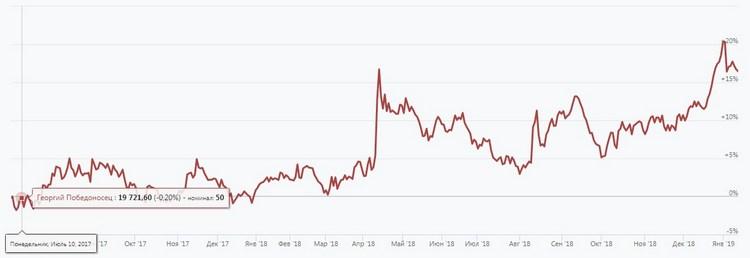

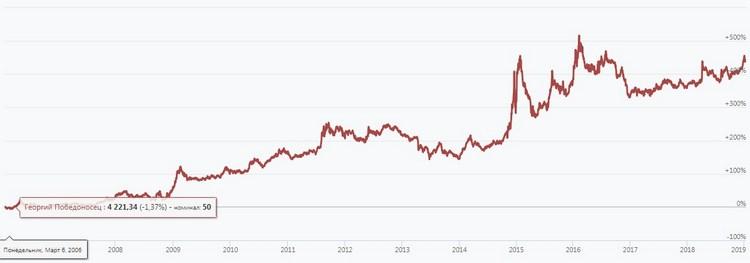

Let's pay attention to the dynamics of the cost of several coins to clearly see the size of earnings. Let's start with the investment samples of St. George the Victorious. Having bought it in 2021 with a par value of 50 for 19,721 rubles, already at the end of 2021 it would be possible to sell it at 20% more expensive - for 23,780 rubles.

Of course, such profitability does not happen every year. If we take a period of 10 years, the total profit will be about 250% (on average, this is only 10% per year, taking into account capitalization and compound interest).

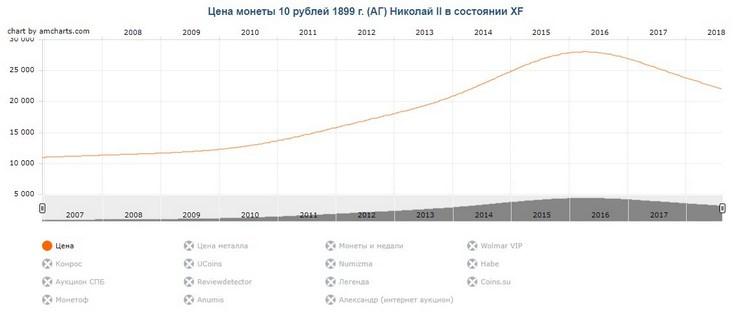

The graph shows that during the period of falling gold prices from 2011 to 2014, the coin also lost in price, being in the range from 14,800 to 10,800 rubles, but then sharply increased to 25,000 rubles. This precisely reflects the impact of inflation on the value, because over the same period, deposits in gold, although they showed positive dynamics, were clearly not on such a scale.

For rarer commemorative coins, the situation is different, since their purchase and sale is carried out at auctions. For example, gold 10 rubles from 1899 of Nicholas II in good condition have increased in price over the past 10 years, but for a particular investor they could show a return of both 200% and 400%.

Dynamics of the value of 10 rubles of Nicholas II 1899 over the past 10 years, taking into account various auctions.

As a result, buying gold investment coins in the long term can bring on average about 10% per annum. This is a good indicator for such a reliable asset, since you will simultaneously protect your capital from currency fluctuations, which, for example, a deposit in rubles or dollars does not have. In addition, you relieve yourself of the risks of revoking the bank’s license.

General information

Let's focus on the topic of investing in precious coins. This method is not so common, since it is more conservative, but it also has its significant advantages .

Let me remind you of the important rules of investing:

- We invest only our own funds , no loans from friends, credits, and even less applications to microfinance organizations. Only your own free funds.

- The money you invest should not be your last , set aside for an important matter or purchase, or vitally necessary. You must understand that if you lose them now, you will be able to live in peace without compromising your quality of life.

- There is no guarantee that your investment will be profitable . Even if you invest in stable and reliable government bonds or bank deposits, there is no guarantee that this will actually be the case.

- Before investing your own money in a particular instrument, you should carefully study and evaluate the possible risks and potential profitability. As a rule, risks are proportional to projected income. The higher the profitability, the greater the risks. But there are exceptions to this rule.

- In order to make a decision on investing money in a particular financial instrument, it is important to evaluate it according to the following key characteristics - possible risks, projected profitability, payback periods, minimum investment amount, advantages and disadvantages of investing for yourself.

- The available amount for investment must be distributed over several different instruments, that is, risks must be diversified . Investing your entire capital in one instrument is a rather risky step, which can lead to the loss of everything at once, especially if you have chosen a rather risky instrument with a high return.

Differences from numismatic

Unlike investment coins, the value of numismatic coins is determined by their collectible, artistic or commemorative value, and does not directly depend on the current market prices of precious metals. The price of numismatic items can be many times higher than their face value, as well as the value of the precious metal they contain. They are produced in limited quantities, with improved proof quality, and are often used as gifts or collectibles.

The opinion that numismatic coins are not suitable for profitable investments and are intended only for speculation in a narrow circle of professional collectors is erroneous. They just require a qualified approach with a deeper immersion into the topic. To work with numismatic money, you will have to learn how to select and search for the necessary specimens, analyze the prospects and ensure their safety. The profitability of such investments will largely depend on your intuition and luck. It will not be possible to make a profit quickly or urgently convert such assets back into cash. You'll have to be patient and wait.

Coins that might have been considered investment coins in the past, for example, the Tsar’s gold chervonets or the Soviet “Sowers,” acquire numismatic and even historical value over time. The latter becomes an obstacle to international trade in them.

A reverse metamorphosis can also occur, when numismatic specimens, due to improper storage and damage, lose their original appearance and collectible value and automatically become classified as investment coins. The only exception is metal money from pre-Petrine times, which are historically valuable regardless of condition.

How to buy and sell investment coins

There are several ways to purchase investment and collectible coins:

- In banks - the recommended and safest method.

- Through specialized online stores, for example, the Golden Mint (ZMD), Monetnik, Numizmatik - this option is less reliable. Before purchasing, you should check the seller’s license and carefully study the reviews.

- Through online auctions with delivery (Wolmar, Rcoins) - as a rule, such events have their own experts and commissions that guarantee the authenticity of the coins.

- From hand, through ad services, for example, on Avito, there is already a risk of fraud when purchasing, so you may need the services of an expert with a diploma (if there is no personal experience).

It is impossible to say for sure which coins and where it is better to buy. For example, investment samples should be purchased from a bank with the appropriate certificate and in a case. As for collectible items, you cannot get them this way; they are usually sold at auctions. Often people offer coins on message boards to avoid intermediaries.

If you are ready to risk an independent transaction, then study in detail the features of the selected coin: does it need a certificate, what each side looks like, etc. Below will be a short video with general recommendations for identifying counterfeits.

The sale of investment coins occurs in a similar way. First of all, this is a bank purchase regardless of the presence of scratches or stains. For memorable and collectible items, this option is only possible if it is in perfect condition and all storage conditions are met. Poor quality samples must be sold differently:

- using bulletin boards - the most profitable option without intermediaries with a wide audience reach, but quite dangerous, since they can also deceive you with money;

- through online auctions is the best way, only such services always charge a commission for intermediation of about 10% of the transaction;

- Selling to an antiques store is a very quick option, but not profitable, since they will buy a collection there for only 50–60% of its real value, and will take a very expensive one for sale.

Frequently asked question: is it possible to transport investment coins by plane? The answer is yes, this can be done even without filing a customs declaration, if the value of the collection does not exceed the equivalent of 25,000 US dollars. For safety, it is better to take samples with you in your hand luggage or take care of a durable case and cases.

Rules for storing valuable coins

Investing in Bank of Russia coins takes a long time, so it is very important to follow basic rules when storing samples:

- do not touch without gloves - a fingerprint on the surface can greatly reduce the value of the coin; you should always pick it up by the edge;

- do not store next to household chemicals and medications - for example, if a closed bottle of iodine is placed nearby, stains will appear on the surface of the metal;

- use capsules for separate storage - as a rule, valuable samples are immediately sold in them, which protects them from scratches.

There is no need to be afraid if the coin begins to fade over time, otherwise known as “the appearance of patina.” This process is natural and does not affect the cost.

It is better not to clean or touch samples of improved quality (Proof) unless necessary. For UNC and lower conditions, you can use special metal polishing cloths.

How to store

To sell a coin profitably, you need to preserve it well. Since the shelf life sometimes reaches several years, it is worth taking care of the storage location. This can be a closet or safe, dry, without direct sunlight, without sudden temperature fluctuations, without the presence of chemicals. All this can ruin the coin, for example, the metal can enter into a chemical reaction. Of course, the coin should not have mechanical damage, chips, or dents. Typically, coins are sold in specially prepared capsules that protect them from external influences, so they should not be removed from them.

Investment coin prices

In the following table you can compare prices for several popular Russian coins for clarity. All of them are indicative and depend on the safety and current prices of precious metals.

| Name | Approximate cost (RUB) |

| 55 years of Victory, Moscow (2 rubles) | 70 |

| Sable 1995 (3 rub.) | 1,398 (Bank of Russia price – 838) |

| 10 kopecks 1933 USSR | 2 750 |

| FIFA World Cup 2021 (RUB 50) | 23 400 |

| St. George the Victorious (50 rub.) | 24,300 (selling price of the Central Bank of the Russian Federation – 23,011) |

| Gold coins 50 rubles for the FIFA Confederations Cup 2017 | 29 302 |

| Olympics 80 (torch, proof, 100 rub.) | 49 278 |

| 1999 (5 RUR, magnetic) | 250 000 |

| 2006 (5 RUR, magnetic) | 300 000 |

| Gold coins of Catherine II (10 rubles) | 2 100 000 |

As you can see, the list includes samples of completely different price categories in ascending order. Two million is not the limit. The most expensive Russian coin is considered to be the proof gold 20 rubles (1755), the only copy of which was sold in London in 2008 for more than 1.5 million pounds sterling, which amounted to about 80 million rubles at the exchange rate of that time.

Luck at auction and the rarity of the sample have a huge impact on the final price. For some commemorative coins, the state gold reserve is also important. It indirectly affects price increases.

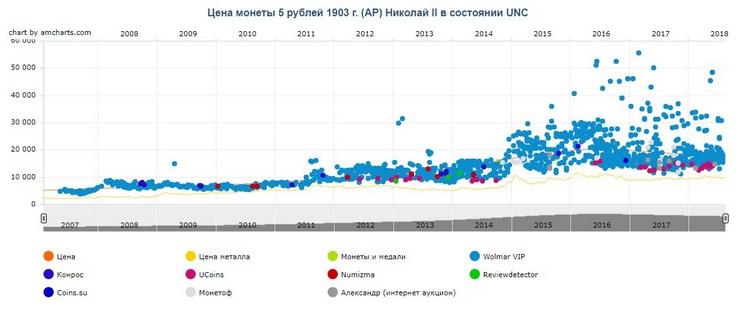

For example, today the price of a gold coin of 5 rubles of Nicholas II averages 14,000, and the image above shows the dynamics of the exchange rate over 10 years. Blue dots are individual prices at specific auctions. As you can see, someone was lucky to sell a sample for four times more expensive, but there are only a few of them. The yellow line on the price chart shows gold prices. The cost of a collector's item does not fall below it and has similar fluctuations. This clearly demonstrates the correlation between them.

It cannot be said that foreign gold coins are more expensive or cheaper than Russian ones. In this case, too, there are completely different price categories. The table below shows several examples with approximate prices.

| Name | Approximate cost (RUB) |

| Richard Nixon 2021 $1 | 165 |

| Lincoln Shield 2012 $0.01 | 3637 |

| 100th Anniversary of Boys Town $1 | 5316 |

| Golden Eagle 2021 $5 | 9323 |

| National Baseball Hall of Fame 2014 $5 | 28773 |

| American Buffalo 2021 $50 | 87 000 |

| American Freedom 2015 $100 | 125 462 |

| Head of Liberty 1882 $20 | 1 720 000 |

| Loose hair 1794 $1 | 151 330 000 |

The US Silver Coin Catalog contains many interesting and inexpensive examples, but all of them are related to the value of the metal on the international market. As a result, their price is often close to the equivalent of silver in the composition, which is also true for Russian specimens.

Costs and taxes

As we said above, the value of a coin initially depends on the weight of the metal in it. This is the standard price, with the seller’s markup added to it, which can sometimes be quite large. But you need to understand that the current exchange price is only a guideline. We don’t see a dollar at 73.5 rubles in exchange offices if it is 73.5 rubles on the exchange. In the best case, they will buy it from us for 73-73.3 rubles.

Also here – there is a difference compared to the exchange, plus a markup. But investment coins are exempt from VAT , so in terms of taxes it is more profitable than working with bullion. Well, it’s worth noting that when selling you will have to make a small discount from the average market price in order to sell the coin faster. Coins are usually sold at special sites - flea markets for collectors, since banks buy them back at a large discount from the average market price.

Which banks sell investment coins in Russia

Most large credit institutions in Russia present their own line of commemorative and investment samples. The procedure for purchasing coins by a client is practically no different from purchasing any product in a store:

- Ideally, you need to familiarize yourself with the catalog and the availability of samples on the organization’s website; otherwise, you will have to “extort” information on the spot.

- Visit the desired office. As a rule, banks that sell coins designate a special branch in the region for this purpose.

- Inspect the copy and pay for it.

Let's pay attention to the offers in several large banks of the Russian Federation.

Sberbank

Sberbank has both expensive and budget models. For example, Catherine II the Great (Niue) costs 2.9 million rubles, and “The Winner Takes All” (Cameroon) costs 4,490 rubles.

Collectible sets are sold separately, for example, “Evolution of the Calendar” of two coins for 13,990 rubles.

To purchase, you need to personally contact the Sberbank office. There is documentation on the official website with a list

branches in the selected region and with the presence of various copies. You can receive similar information orally from a specialist by calling the hotline.

More details

Rosselkhozbank

The Rosselkhozbank catalog contains many budget coins and several options of medium cost, but no super-expensive ones. For example, Solzhenitsyn-18 for 2000 rubles. and an exclusive sample Heart of Chechnya-15 for 58,500 rubles.

You can pre-order the selected sample directly on the website, but to purchase you need to visit an authorized office of Rosselkhozbank from the list provided in your region.

More details

Alfa Bank

Unfortunately, at the time of writing, Alfa-Bank does not sell coins on its official website. He concentrated exclusively on investments in compulsory medical insurance. The latest information in the news is related to commemorative samples in honor of the 2018 FIFA World Cup, which were sold through the offices. It is likely that the bank will resume sales when new memorable events occur.

VTB

The main VTB catalog contains more than 500 different coins, with an equal number of expensive and budget coins. This opens up wide opportunities for investments in gold and silver.

In a separate document with a list of discounted coins (with minor defects), you can find expensive samples at a discount, for example, the “Sistine Madonna” set costs 255,000 instead of 300,000 rubles.

According to the instructions on the website, you can purchase the selected copy at any VTB office in your region. If necessary, the availability of samples should be checked by calling the hotline. The current list of branches selling coins is not publicly available.

More details

Gazprombank

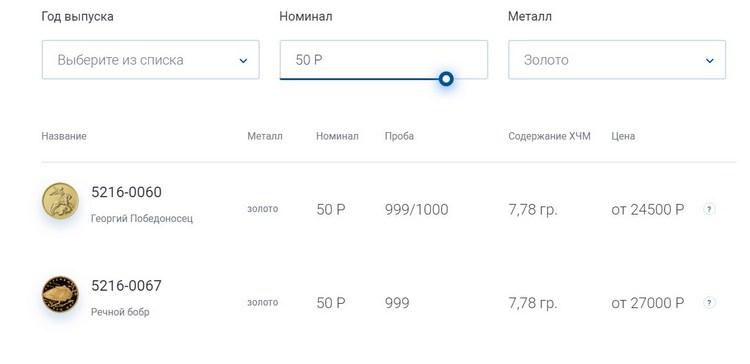

The Gazprombank catalog includes budget and medium-priced samples, but no ultra-expensive ones. The highest price is for coins with a face value of 100 rubles. made of silver - from 65,000 rubles. Only two examples are presented in gold: St. George the Victorious and River Beaver (from RUB 27,000).

To purchase, you must leave a preliminary request by phone, ext. 2-93-76, the day before the expected visit to the bank (until 16:00 Moscow time in general, until 15:00 Moscow time - on weekends and pre-holidays).

More details

Bank opening

Otkritie Financial Group offers a wide range of coins with a cost range from 2,500 to 75,000 rubles. There are a total of 7 gold samples and 229 silver samples available.

Coins are not available in all divisions of the Otkritie group. You can clarify this through the catalog by selecting the desired office. The bank sells copies of interest only upon personal contact at the branch.

More details

How to determine the value of a coin

The nominal value (for example, 3 rubles for the Sobol) indicated on the investment coin does not correspond to the real value. The price will be determined by current metal prices as its basis.

You can track the cost on the website, for example, of Sberbank (sells and buys coins), but I focus on the stock market. When dollar prices fall, the metal rises in price. All that remains is to check the purchase from trusted buyers (Sberbank, Rosselkhoz, TKB, etc.).

Here is a list of sites I checked for buying and selling:

- https://www.golddep.ru/ Gold Department;

- https://mosdragmet.ru/ Mosdragmet;

- https://a-fin.net/ Finance architecture.