Good afternoon, dear readers! The market for precious metals has existed since ancient times, although not in its current form. One of the most famous participants in this market, Judas Iscariot, valued the life of Jesus Christ at thirty pieces of silver (about 400 g of silver). Converting this silver at the average rate of 2018, we get about 13,000 rubles - it turns out that Judas received one month’s salary of an auto mechanic from the Kemerovo region for his historical kiss.

Today we’ll see what modern silver pieces look like.

What it is

A market in a general sense is a system of interactions that arise during the exchange of material goods. The concept of a market is relatively new, but its essence has not changed over the past millennia, although a manager watching numbers on a computer screen does not look much like a caveman carrying skins to sell to a neighboring tribe.

The global precious metals market is understood as a set of economic relations that arise in the process of trading metals and securities quoted in gold.

The precious metals market has a peculiarity. The fact is that metals never performed a single function, but were used in two capacities:

- monetary - they measured the cost of goods;

- actual commodity.

And now, in addition to jewelry and investment gold, platinum, silver and palladium, a huge amount of production and technical metal is consumed. It is needed by many industries.

Brief history of formation

For a long time, gold and silver (platinum and palladium were not mined until the 20th century) were a measure of the value of a commodity - money was minted from them in prehistoric times. When people appreciated the convenience of using gold as a reference currency, a real technological breakthrough occurred: the mining and metallurgical industries developed.

Over time, precious metals were withdrawn from direct participation in trade as money (such coins were too expensive, difficult to transport, heavy and prone to deformation). In their place came paper money—essentially, gold certificates that could be exchanged for a certain amount of gold.

Precious metals have long remained the most stable currency, which people especially counted on in times of wars and crises. In the 19th century, many countries officially introduced the gold standard.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

The global precious metals market has undergone significant changes over the past century before it took on its modern form. This was influenced by the abolition of the gold standard (refusal of the free exchange of money for a specific gold unit). In 1971, the US finally abolished the gold backing of the dollar, and gold was demonetized - it ceased to serve as money.

There is a point of view among economists that demonetization has not yet been completed and gold continues to serve as the world’s “reserve fund.” However, now precious metals are sold and bought in commodity form for national currency.

Proponents of partial demonetization are right that gold is used as a reserve asset, but we can confidently say that it has lost most of its monetary functions.

Precious metals in economics

Definition 1

Precious metals are metals that are resistant to oxidation and corrosion and are rare.

The main precious metals are silver, gold, platinum, ruthenium, osmium, iridium, palladium and rhodium. Some metals are ductile and refractory. Gold and silver have been used by mankind since ancient times. Platinum was discovered in the Middle Ages, when colonialists in South America turned their attention to the heavy white metal. Platinum was often substituted for silver, so in some countries it was decided to throw it into the sea. It was only in the eighteenth century that Watson described the properties of platinum. At the same time, its production began on an industrial scale.

Finished works on a similar topic

- Course work International market of precious metals: current state and development prospects 430 rub.

- Abstract International market of precious metals: current state and development prospects 260 rub.

- Test work International market of precious metals: current state and development prospects 250 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Russia is one of the richest countries in the world in terms of reserves of natural resources and precious metals. Mining began in the seventeenth century in Transbaikalia, where a silver ore deposit was being developed. Gold was mined in Karelia, and somewhat later in the Urals. Platinum was also discovered here.

Precious metals were used in the following areas:

- Currency. Metals retain their properties and shape, so they were actively used as money. Some countries now hold gold and silver as foreign exchange reserves. Silver can be used as savings by individuals.

- Technique. Precious metals are widely used in the electrical industry.

- Chemical engineering and laboratory technology. Precious metals are able to withstand the influence of aggressive environments. The creation of laboratory equipment can be carried out entirely from precious metals, or using them as a coating.

- Medicine. Here, precious metals are used to create tools, prosthetics, instrument parts, and so on. Some medications contain silver. Radioactive gold is used in radiation therapy.

Looking for ideas for study work on this subject? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Functions

A metal trading system is necessary so that market participants can carry out the operations they need:

- Purchase of precious metals for industrial and household consumption, investment, and risk insurance.

- Sales of mined precious metals.

- Speculation - obtaining benefits as a result of successfully predicting exchange rate fluctuations (“playing on the stock exchange”).

The precious metals market satisfies all these needs. Technologies for the development of ore deposits are developing, and gold and silver (to a lesser extent platinum and palladium) remain stable enough in value that it is not scary to invest in them. At the same time, exchange rate fluctuations allow the metal to be used for speculation.

Areas of application of precious metals

If gold is used as a store of value and storage of investments and as jewelry, then the story is the opposite for other metals.

Gold

- Jewelry.

- Saving.

- State reserves - funds in the assets of Central Banks - bullion in storage.

- Industrial use: electrical engineering, medicine, chemical catalysts. reactions.

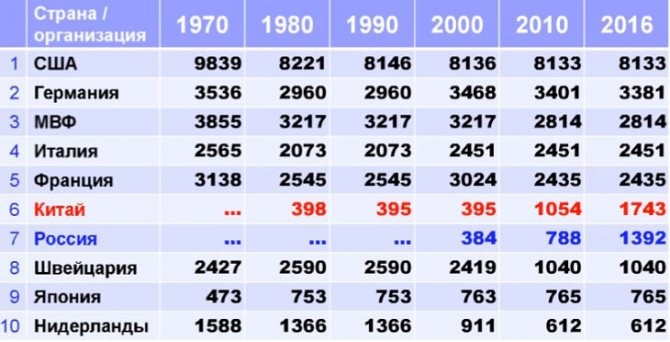

Data on gold reserves:

What is curious is that in China and Russia the gold reserves are growing every year, while in other countries the gold reserves are not growing. In Russia, an increase in reserves has been observed since 2000. with rising oil prices.

Silver

As a means of storage, silver is very inconvenient because it is cheap and takes up large volumes. Therefore, the main use of metal is not storage, not jewelry, but industrial use:

- film and photo industry,

- medicine,

- electronics and electrical engineering,

- automotive industry (batteries).

Today a lot of silver is mined. Unlike gold, it cannot be recovered; it is a non-renewable resource.

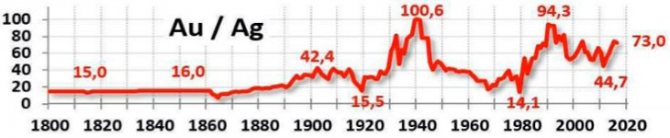

If the “historical” ratio of gold and silver prices is about 15-16, then today it has increased significantly and is at the level of 40-80. And there is high volatility, higher than gold.

Gold to silver ratio:

The higher the ratio, the more preferable it is to buy silver. The lower the ratio, we buy gold.

Platinum

If gold and silver have been known since ancient times, then platinum and palladium were not known in Europe until the 18th century, and were mined only in South America (Colombia, Honduras) in the form of alloys.

Platinum and palladium were isolated in their pure form in 1803. Wollaston. And in Europe until that time it had not been discovered at all. But she was found in 1819. in Russia, in the Urals. The first platinum coins began to be minted by the Russian Empire in 1828-1845.

More than 90% of all proven platinum reserves are concentrated in Russia, the USA, South Africa, Zimbabwe and China. 99% of all proven reserves in Russia are in Norilsk.

Palladium

It was also mined in the form of ore only in South America at first. Focuses only on a small number of deposits.

The largest deposit is located in Russia in the vicinity of Norilsk, followed by South Africa, the USA, Canada, Australia, and Colombia. The production of platinum and palladium is much less than that of gold and silver.

95% of reserves and 90% of production are concentrated in two fields: South Africa and Norilsk. MMC Norilsk Nickel -15% of world platinum production and 55% of world palladium production.

Platinum and palladium are rarely used as stores of value and are largely used in industry:

- electrical engineering - electroplating, production of printed circuit boards, contacts, parts operating in aggressive environments;

- chem. production - coating of boilers and bowls for chemical reactions, catalysts for the production of acids and fats, hydrogen purification;

- automotive - catalysts;

- medicine - additives in medicines;

- jewelry, commemorative coins.

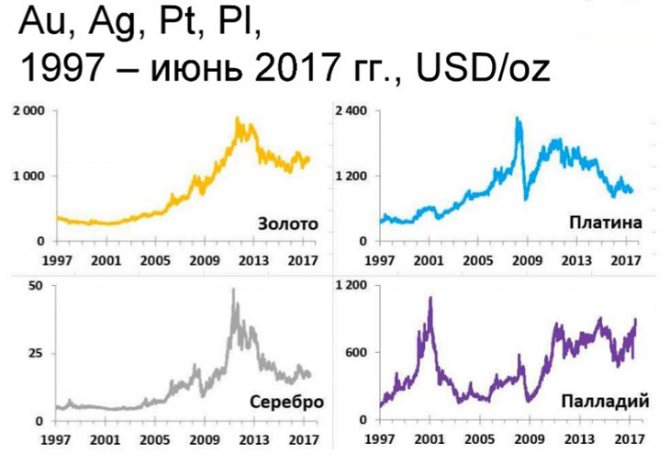

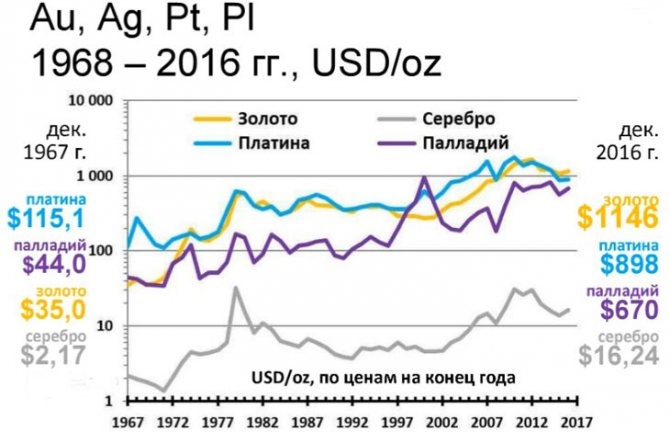

As we can see in the graphs, if gold and silver somehow depend on events in the global economy, the price of platinum and palladium is affected only by the supply-demand ratio in industrial production.

In the chart below we see the returns on precious metals since the end of the gold standard.

Gold showed the highest profitability, but volatility was higher for platinum, palladium and silver.

In Russia, gold and silver made it possible to save money from inflation:

Kinds

Precious metals markets differ in the level of government regulation of transactions performed, the residence of participants and the amounts of transactions. Let's look at one of the main classifications.

International

These are the largest markets in the world, where trade is carried out between corporations from different countries. They are characterized by high volumes, a variety of available transactions, and wholesale supplies.

A distinctive feature of such a market is customs and tax benefits.

Domestic

Domestic markets mainly serve investors. Their scope of activity extends to one or more neighboring countries (for example, the Turkish market operating in the Middle East). Traded gold is taxed according to the laws of the country where the market is based.

Based on the level of government intervention in the operation of domestic markets, they are divided into:

- free (almost no control);

- regulated (there are quotas, licenses, restrictions on export and import);

- closed (strict restrictions, full control).

Closed markets operate in Greece, Egypt, and Pakistan. Participation in trading on them is greatly complicated by state bans, which leads to the emergence of another type of market - black markets.

Black

Shadow markets are a consequence of excessive government rigidity in establishing trade frameworks that make it unprofitable and difficult to access. The largest center of illegal gold trading is Mumbai (until 1995 - Bombay) in India.

After the India-China War in 1962, the Indian government banned private ownership of investment gold, which led to the establishment of an underground trading network.

Participants

The companies participating in the tenders and thus influencing the situation on the market differ in both scale and type of activity.

Gold mining companies

Owners of mines, mines and mines are the main suppliers of metals to interstate markets. Small businesses most often cannot work with brokers directly and are forced to use the services of intermediaries.

There are also large gold miners: the Canadian company Barrick Gold, which occupies a leading position in the ranking, the Australian Newcrest Mining, and the British Goldcorp. These are corporations that work with the largest volumes and therefore have a huge impact on the situation in the system.

Industrial users

The main clientele of the market are enterprises that process precious metals and turn them into consumer products: jewelry, luxury goods, and high-tech devices. These are jewelry and electrical production, refineries that prepare metal for subsequent remelting.

A distinctive feature of industrial buyers is that they need a product of a certain quality depending on the purpose: for example, only pure metal is suitable for the production of microcircuits, while a jeweler can process gold dust.

Precious metals exchanges

Participants trading on exchanges do not operate with “live” metal, but mainly with futures contracts - agreements for the sale of an asset on special terms. The main purpose of such operations is hedging, that is, price insurance by opening forward transactions to compensate for risks in another market.

The world's largest exchanges are located in London, Shanghai, New York and Tokyo.

Central banks

The most influential ones are in the USA, Great Britain and Germany, but banks in other countries also play an important role - in particular, the Bank of Russia, in whose vaults most of the gold reserves of the Russian Federation are located.

Other countries participating in international trade also store a significant portion of their reserves in the form of physical gold - bullion. The central banks that store these treasures (hundreds and thousands of tons of gold!) are the largest sellers in the metal market.

Professional dealers and intermediaries

This market segment is represented by:

- dealers;

- brokers.

The difference between a dealer and a broker is that the first carries out trade intermediation on his own behalf and at his own expense, while the second (broker) is an intermediary acting at the expense and on behalf of the client. The broker does not become the owner of the assets, cannot dispose of them on his own behalf and works for a commission.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

The dealer's income is generated by the difference between buy and sell quotes (spread). The dealer (unlike the broker) has the right to set a quote for the client independently.

Investors

Investors are companies (for example, pension funds) or individuals who use gold to build savings. Special bars and investment coins are issued for them. There are investors who buy metal without delivery - with the aim of further use for speculative purposes.

Some publications note that investors from Asia are more inclined to purchase precious metals to preserve resources, while European and American investors are increasingly choosing to play on the stock exchange.

How the jewelry market will change in 2021

Like other sectors of the economy, the jewelry industry around the world has been severely affected by the pandemic. The demand for jewelry naturally decreased with the fall in real incomes of the population, according to a joint review by the Expert RA agency and the Higher School of Economics. In February-April 2021, the drop in sales was 82%, including due to the postponement of a large number of weddings and engagements, which traditionally create a significant share of the demand for jewelry with stones.

In the third quarter of 2021, according to the review, a recovery trend has emerged in the world. In addition, new unusual trends have emerged during the pandemic. For example, sales of earrings and necklaces that look good on camera have increased, for example during a Zoom video conference. They even received the name “Zoom-worthy jewelry” for this (jewelry worth going to Zoom).

Sales of jewelry online have increased. The leader of American jewelry retail, Signet Jewelers Ltd, saw online sales jump by 71.4% in August-October 2021 compared to last year. The leader in sales of diamond jewelry, Tiffany & Co, reported a doubling of online sales back in May.

However, a significant increase in all sales occurred in the South Asian region (mainly China and South Korea), which by the third quarter had largely recovered from the pandemic. In North and South America, on the contrary, there was a noticeable drop in sales, the review says. And the USA, after China, is the main driver of jewelry sales.

In the Russian jewelry industry, most likely, there will also be slight growth at the end of 2020, the head of the Jewelers Guild, Eduard Utkin, told RG. However, he drew attention to several factors that indicate that not everything is so simple.

Firstly, expensive items have increased in price as prices for precious metals and stones have increased in 2021. Thus, in the past year, exchange prices for gold updated the record since 2011. According to Utkin, the cost of gold for jewelry has increased by 55-60%. Silver also increased in price (+75%). But physically, at the same time, there are fewer products, and this means a decrease in the salaries of employees of jewelry companies: their earnings are based on the number of products produced.

The second trend is the transition to a cheaper segment. Jewelers are reducing the weight of metals and stones, more often using cheap alloys or silver, and some are relying on costume jewelry. For many years, jewelers used only 585-carat gold, Utkin said, but now advertising for products made from 375-carat gold has appeared again. This test means that the pure gold content in the product is only 375 grams per 1 kg. The remaining 625 grams are alloys of other, less valuable metals (for example, silver, copper or palladium).

In terms of diamond products, people will increasingly choose synthetic diamonds, Utkin believes. Such stones, grown in a laboratory, are no different from natural ones - the same crystal lattice, the same chemical composition, the same shine, but the price is several times lower. This will play a decisive role in consumer choice.

The third trend in 2021 is that along with an increase in sales in the economy segment, sales of expensive jewelry were also observed. This may be due, according to Utkin, to the cancellation of travel. Instead of planned expensive trips, people purchased expensive jewelry.

It is difficult to predict whether the latest trend will continue in the new year, but the trend for cheaper jewelry has been observed for a long time, so it will continue in 2021.

The diamond industry believes that the industry is now passing the price bottom, and sales may begin to recover in 2021. The opening of offline stores and the restoration of tourist flows (a significant share of jewelry purchases is correlated with tourism) will trigger pent-up demand. But no one undertakes to make clear forecasts in connection with the pandemic.

In Russia, the jewelry industry will also be affected by the introduction of mandatory labeling for precious metals and stones. Some companies, according to the head of the Jewelers Guild, may be thinking about moving into the costume jewelry segment, since the purchase of marking equipment may not be affordable for them. “The cost of a test sample of Russian-made equipment reaches 80 thousand rubles, and foreign - 240 thousand rubles. In addition, it is technically difficult to apply markings to the products themselves. This will require additional resources - financial, time and human. If large players can provide them, then for small companies this is a serious burden,” he argues.

At the end of 2021, the Guild sent a letter to First Deputy Prime Minister of the Russian Federation Andrei Belousov with a request to postpone the introduction of mandatory labeling of jewelry until 2022. So far the solution is unknown.

In general, jewelers are not against the introduction of markings - it should whiten the jewelry market as much as possible and ensure traceability of precious metals and stones from mining to the finished product. Deputy Head of the Ministry of Finance Alexei Moiseev previously reported that unaccounted for gold could amount to up to 50-60% of the legal market per year.

Testing of the marking system (GIS DMDK) began in early December 2021; from January 2021, personal accounts should appear on the Assay Office website - they can be checked in test mode. From July 1, 2021, the circulation of jewelry without means of identification will be prohibited.

Largest gold trading centers in the world

The first on the list of leading platforms is, of course, the legendary London Interbank Market. London has been setting gold prices for almost a hundred years - since 1919, when the London fixing was established. Until 2015, the price of gold was formed using the fixing method (the exception was the war and post-war years, when people had no time for exchanges). Fixing gave way to an electronic auction in 2015, but London remains the world's gold trading center.

The London market sets strict requirements for traded gold: all of it must be marked Good Delivery - “good delivery” - and meet the quality standard.

Another market leader is Zurich. Switzerland imports up to 40% of the world's gold supply. The peculiarity of Swiss banks is that they have representative offices in most countries that actively trade in precious metals: in the USA (New York), Australia (Melbourne), and in the Far East (Singapore, Hong Kong, Japan).

In the Middle East, the main free domestic markets are in the UAE (Dubai) and Turkey. In Europe you can also note Paris, Milan and Frankfurt am Main, in Asia - Karachi and Dhaka, in Africa - Alexandria and Cairo, and in South America - Rio de Janeiro and Buenos Aires.

Expert opinion

Lyudmila Pestereva

Our most experienced gold investor

Ask a Question

Russia's mineral resources are among the richest on the planet, and we make an important contribution as a supplier of gold to the global economic market. However, the domestic gold market in the Russian Federation is poorly developed - this is due to the strictness of tax legislation, which imposes a high VAT on the purchase of bullion (currently 18%), making such investments not very profitable.

Precious metals market

The financial market includes such components as the money market and the capital market, which is due to the presence in these markets of financial resources of different nature, which serve both fixed and working capital. Funds in circulation on the money market ensure the movement of so-called short-term savings; those that make up the capital market stimulate the movement of long-term loans. The stock market is just a segment that is inherent in both the money and capital markets.

Precious metals market 2014

The precious metals market, in general, consists of the following sectors:

- "gold" market;

- silver market;

- platinum and palladium markets;

- market for products made of precious metals;

- market for securities whose quotes are calculated in gold.

In general, the precious metals market is defined as a certain sphere of economic relations, the subjects of which are the participants in transactions, and the objects can be precious metals and stones that are quoted in gold. These are, for example, gold certificates or gold bonds, or gold futures.

Reference: regarding the definition of the precious metals market as a systemic phenomenon, in this aspect it is necessary to determine the functional and institutional points of view. Functionally, it is a kind of trade and financial center that serves as a platform for trading precious metals and their assets. From an institutional perspective, the precious metals market can be defined as a collection of individual institutions, such as, for example, banks or stock exchanges.

Today we can state that the changes that occurred in 1968, which relate to the formation of so-called “floating” exchange rates and the elimination of the dependence between such rates and the price of gold, determine the essence of today’s precious metals market. The modern world giants trading centers for precious metals are:

- London Stock Exchange;

- Loco Zurich;

- New York Stock Exchange;

- Loco Tokyo.

We recommend reading: Prices for gold bars in the CIS countries

Against this background, the London Bullion Exchange has a significant advantage, which has not lost its leading position for decades. However, analysts today say that London's leadership in the precious metals market could be rivaled by the newly activated Shanghai Stock Exchange.

Precious metals market forecast

Our readers are undoubtedly aware of the latest dynamic changes that have become characteristic of gold prices recently. And, of course, they cannot but agree with us that gold is gradually losing its power on the world market.

Did you know that investors should not fall into despair, since, as you know, the formation of gold as a unique world currency has come a long way in its formation. And today’s indicators can in no way indicate a further complete depreciation of gold.

Yes, the current market situation does not inspire confidence in investors’ previous words. But you just have to analyze the fact that all prices in the world are tied to one figure - the cost of one ounce of gold . There have been no such drastic changes in the market that could lead to a refutation of this information.

We recommend reading: Exchange quotes for precious metals in June 2015

Precious metals market in Russia

The Russian Federation is one of the few countries that has a powerful raw material base of various precious metals. Its main advantages in this sector are:

- Seriously equipped industry.

- Adaptation and timely modernization of production.

- The presence of a modern jewelry industry.

The listed advantages contribute to the full development of the gold mining industry in Russia, which is reflected in statistical data, which, in turn, indicates the presence of constant developments and work on the extraction of precious metals in Russia. However, the current situation on the Russian market allows us to say that the precious metals market in Russia has significantly greater potential. Undoubtedly, today we have to say that the domestic precious metals market needs emergency measures that will help increase Russia’s gold reserves, which, in the future, will contribute to the full development of the precious metals mining sector.

London Bullion Market

London is one of the world's greatest leaders in the precious metals market. Perhaps every investor has heard about the London fixing more than once in his life. It represents one of the most important trading venues for precious metals on a global scale. The London fixing is often associated with the most realistic and fair quotes for gold, silver, platinum and palladium. At the same time, the price of precious metals at the London fixing directly depends on the purchasing power of clients. Prices are set twice daily. The main principle of pricing for a particular precious metal at the London Fixing is the so-called auction process. In simple terms, fixing is established based on the results of trading for a specific precious metal for a certain period.

We recommend reading: Dynamics of gold quotes: February 2015

Video about the gold market

conclusions

In general, current trends in the precious metals market (taking into account individual national and regional characteristics) can be formulated as follows:

- the investment attractiveness of precious metals is growing due to positive price dynamics;

- precious metals in their future do not have a tendency to completely depreciate, unlike currencies;

- The “top four” of the precious metals market are gold, silver, platinum and palladium;

- gold, the leader of the precious metals market, despite the latest disappointing quotes, still retains its position and does not lose its investment attractiveness;

- silver has high volatility, which causes a significant difference between the upper and lower price limits of its value;

- Platinum and palladium are industrial metals; this sector is characterized by relatively low growth rates and significant prospects for medium- and long-term investment.

Precious metals market: results of January 2015

Precious metals market: results of April 2015

Precious metals market: overview May 12, 2015

Factors influencing the global financial market

The global economy is influenced by both global trends and paradoxical, seemingly insignificant factors.

For example, the gold rate is highly dependent on seasonality due to India, where it is customary to have weddings at the same time of year.

This significantly increases the demand for gold, without which not a single Indian wedding is complete.

Political situation and international tensions

Unrest is activating investors. History knows many cases of rapid depreciation of money, but gold has always been consistently expensive, therefore it is considered by people as an emergency reserve and does not lose ground in times of crisis.

Supply and Demand Relationship

Like any other asset, precious metal is subject to the economic laws of supply and demand. The value of a unit of gold or silver depends, therefore, on the totality of:

- forecasts and behavior of sellers, buyers and intermediaries;

- changes in prices for transportation of goods;

- welfare of market participants and other factors.

Seasonality

In addition to Indian weddings and other festival periods, the price of precious metals is influenced by agricultural seasonality. This is especially true for Asian countries where the agricultural banking system is not very developed. Farmers massively invest profits from their harvests in gold, thereby significantly increasing demand.

State reserves

An important factor is the gold and foreign exchange reserves of the countries participating in the trade. It, in turn, depends on other circumstances, for example, on the political and economic situation in the state.

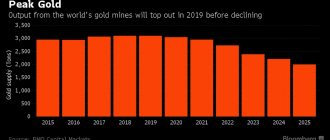

Production volumes

The amount of treasures mined is not constant: old mines are depleted, new mining technologies appear - the price of precious metals is sensitive to these phenomena.

Like other factors, this one is closely related to others: a natural disaster or revolution can unexpectedly and permanently block supplies from deposits that ensured the flow of metal to the market.

How to access the market

The first, “classic” way to become an investor is to purchase metal from a bank. Many Russian banks carry out transactions with precious metals. You can buy bullion, investment coins, or use the OMS - an impersonal metal account.

The second method became available recently - individuals were able to buy and sell precious metals on the Moscow Exchange. The easiest way to do this is through an intermediary - a broker who will represent your interests. The choice of a broker usually depends on two qualities:

- reliability;

- commission amount.

There are sites on the Internet where investors (including beginners) share information about available brokers. If you want to start the journey of an investor, it’s worth exploring thematic forums - live experience can be more useful than articles, even those written by professionals.

Trading gold and silver on the Moscow Exchange - instructions for use

Why is it important to have precious metals in your portfolio?

Gold and silver are precious metals that have always been a symbol of wealth and success. Today, in addition to industry and jewelry production, they are actively used in financial markets as a reliable financial investment instrument when world exchanges are in a fever.

The crisis year 2021 especially clearly emphasized the need to invest part of the capital in gold and silver. Thanks to the protective properties of precious metals, investors were able not only to preserve capital, but also to significantly increase it - the cost of gold and silver in rubles (account prices of the Central Bank of the Russian Federation) since the beginning of this year has increased by an even more impressive 51% and 69%, respectively. Thus, purchasing precious metals for an investment portfolio will reliably protect it from currency devaluation.

Why trade gold and silver on the stock exchange?

This method of purchasing precious metals has several advantages. Gold in particular can improve a portfolio in several key ways:

— generates long-term protection against inflation

— effectively diversifies the portfolio

– reduces losses during market stress

— provides liquidity without credit risk

— increases the overall efficiency of investments

Contracts for gold and silver on the Moscow Exchange are quoted in rubles. This allows you to insure capital both against inflation in Russia and the world. Investments in gold and silver allow any investor to diversify their portfolio and add stability, usually provided by protective assets.

We recommend allocating about 5-15% of the total investment portfolio to precious metals.

How are precious metals traded on the stock exchange?

The precious metals market on the Moscow Exchange involves trading in physical metal, including the possibility of delivering it to the buyer. In our case, this is the physical purchase or sale of gold and silver in grams. The minimum volume traded on the exchange is 10 grams for gold and 100 grams for silver.

Purchasing precious metals on the Moscow Exchange is highly reliable - you are not buying a paper asset, but a real one, which is located in special storage facilities in Moscow and London.

Differences from banking products such as compulsory medical insurance, investment coins and bullion

The undoubted advantage of this method of investing is minimal costs compared to other instruments. Thus, when buying an ETF or mutual fund, an investor must pay for fund management; opening an unallocated metal account (OMA) or buying bullion in a bank forces the owner to sell it only to the bank where it was purchased, at the rate that will be in the bank at the time of sale, it is also worth taking into account VAT if the client receives the bullion. Futures contracts have a time limit - investors are forced to buy new ones when the old ones expire. Buying precious metals directly on the exchange does not have these disadvantages.

Why is it profitable to purchase precious metals on the stock exchange?

Purchasing precious metals on an exchange is a cheap way to invest in gold and silver. The exchange commission for spot transactions for a gold seller is 0.015%, for a gold buyer – 1 rub. for any transaction volume. The Otkritie Broker commission averages 0.0036% of the transaction amount, but may also differ depending on the tariff you choose. There are no fees for storage, management and VAT when purchasing gold/silver on the exchange for our clients.

Moreover, metal can always be bought on the exchange and in almost any quantity, because A wide range of banks and gold producers take part in exchange trading.

How to get gold and silver purchased on the exchange?

Exchange trading in precious metals makes it possible to receive/deposit metal. Delivery of precious metals based on the results of exchange trading is carried out to special trading bank accounts of trading participants (TBS) opened by the National Clearing Center.

However, it must be taken into account that when withdrawing metal bars from exchange trading, storage costs arise, and the liquidity of the precious metal decreases. Important! The bars that are issued from the storage facility weigh 1 kg or 11-13 kg.

Will there be VAT required?

In addition to the above costs, when receiving an ingot through TBS, there is a need to pay VAT in the amount of 20% of the cost of the ingot. In this regard, at present, obtaining physical possession of the metal is not very attractive. As the new marking system for products made of precious metals (GIIS) is implemented in Russia, starting on January 1, 2021, VAT on investment bullion may be abolished. According to the Ministry of Finance of the Russian Federation, approximately this may happen from January 1, 2022.

What other taxes are there?

When trading precious metals, a private investor incurs an income tax (NDFL) of 13%. Unlike trading on the stock market, the broker does not act as a tax agent for the investor when dealing with precious metals, but provides all the necessary documentation for filing a tax return, Form 3-NDFL. Income received from owning metal for a period of more than three years is subject to property deduction. If the precious metal is in a bank account for more than 3 years, the income is exempt from personal income tax.

Prospects

The precious metals market in Russia is taking shape, which means that positive changes for investors will occur. From January 1, 2021, trading in physical gold and silver will become available from IIS (individual investment account) accounts.

Who can buy gold and silver on the stock exchange?

Clients of brokerage companies are allowed to trade, including. Moreover, the opportunity to carry out transactions with precious metals is provided to both residents and non-residents.

We conveniently implemented the purchase of precious metals on the exchange through your personal account and mobile application - this allows you to quickly perform transactions in a few clicks and effectively invest funds.

The precious metals market is interesting and fascinating. You will get real pleasure from trading metals. Get involved, trade, earn money, and if you have any questions, we are always happy to see you in our comfortable offices at the address: Ulyanovsk, st. Karl Liebknechta, 24/5a, building 1.

We work on weekdays from 09:00 to 18:00, phone: 8 800 500-99-66.

Types of transactions on the global gold market

Here are typical transactions made with non-cash precious metals on trading platforms:

- “Spot” is a transaction with settlement on the second business day after the day of conclusion.

- “Swap” (exchange) is a transaction with a simultaneous reverse transaction (for example, an exchange with an additional payment for gold of a different standard or located in another country).

- Deposit - placement of metal.

- An option is the right to sell (put) or buy (call) a specified amount of metal at a certain price within a specified period.

- A futures contract is an agreement on the future supply of metal.

There are also forward transactions - purchase and sale transactions of real precious metals with a specific delivery date after the second business day from the moment the contract is concluded.