Gold is one of the very first assets to appear on the stock exchange. Compared to the rest - silver, platinum, palladium - gold is still in greatest demand among traders and investors.

This metal has low volatility and high profitability when trading in the long term. Therefore, it is not surprising that it has long been called the best tool for preserving your own savings.

- How to buy gold

- How to trade gold on the stock exchange

- Gold Historical Data

- Features of gold trading

How do exchange trading in precious metals differ from buying bars, coins and opening compulsory medical insurance?

For what reason is it better to trade precious metals through an exchange rather than buying and selling at a bank in the form of investment coins and bars? Here are some undeniable advantages of the spot market:

- Convenience of making transactions using an online trading platform. There is no need to personally go somewhere, travel, sign papers, etc.

- Much smaller difference between the purchase price and the sale price than in banks, due to competition between participants in exchange trading.

- A single brokerage account allows you to combine transactions with precious metals and investments in other assets traded on the Moscow Exchange, and use the same collateral for all contracts. The precious metal itself can be such collateral.

- Access to the use of leverage when making transactions.

- Conducting trading operations without coverage.

Purpose of spot trading in precious metals

Precious metals are bought and sold on the Moscow Exchange in rubles. Purchased precious metals allow you to protect existing cash savings from depreciation and devaluation. With the help of these protective assets, you can also diversify your investment portfolio, compensating for risks and possible losses during a crisis.

The inclusion of precious metals in the investment portfolio provides the following advantages:

- Long-term compensation for inflation risks.

- Reliable diversification of the investment portfolio.

- Reducing losses during market instability.

- Providing liquidity without lending.

- Increasing the overall return on investment.

Experts advise forming an investment portfolio that includes from 5% to 15% of precious metals in the total composition of assets.

What are the benefits of purchasing gold and silver through the Moscow Exchange?

Purchasing gold and silver through an exchange is always more profitable than through a bank. Exchange commissions when selling gold are about 0.015%, when buying - 1 ruble for any amount of the precious metal purchased. Commission payments to a brokerage firm can amount to thousandths of a percent of the contract value, taking into account the tariffs specified in the agreement with the broker. The costs of paying value added tax, capital management and holding assets when purchasing precious metals on an exchange are usually zero.

In addition, gold and silver are sold on the stock exchange in any volume and on almost any day due to the participation in trading of a large number of manufacturing companies and credit organizations.

Basic tips for trading gold

Trading gold on Forex can bring significant income if you choose the right strategy. To make money on precious metal price fluctuations, use the following expert tips:

- Be aware of volatility. Buy XAUUSD on a downtrend: subsequently the value of the metal will rise.

- Be patient: if after purchasing the metal continues to fall in price, do not rush to sell it at a loss. Statistics show that after prolonged declines, the price of gold returns to its previous or higher level.

- Monitor price movements within one trading session. Gold has a wide daily range, the average price change is 160 points, with a maximum of up to 500 points.

- Don't neglect technical analysis. Practice shows that support and resistance levels and Fibonacci sequences help in trading XAUUSD.

- Track exchange rates. Gold has a negative correlation with them. In practice, this means that in a situation where the dollar and euro become more expensive, XAUUSD becomes cheaper, and vice versa. Bearish sentiment in the European and American currency markets is triggering a bullish trend in precious metal trading.

- Stay up to date with the latest news. The price of the precious metal is affected by changes in interest rates, unemployment and inflation levels in Europe and the USA, military conflicts, and economic crises. When the geopolitical or macroeconomic situation worsens, the price of gold rises: this is how investors save their capital in a “safe haven”.

- Choose the right time to trade. You can place orders around the clock, but market quotes are recorded twice a day: at 10:30 and 15:00 London time. The specified interval will be the most productive for an investor aimed at making a profit.

Use rational judgment: Trading based on guesswork or a subjective desire to “win back” leads to losses in the Forex market. Use technical analysis, read the news and do not make rash, emotional decisions.

Procedure for purchasing precious metals

Transactions with precious metals on the Moscow Exchange are concluded in the currency section. The contract deadline is the next day. For direct trading, a personal account is used on the website of the brokerage firm with which the investor works, or special software.

The purchase and sale of gold and silver lasts from 10.00 am to 23.50 at night. Contracts must be completed by 20:00 pm.

A long trading session allows you to cover the period of operation of Asian and European exchanges, which is extremely important, as it makes it possible to take into account the price dynamics of foreign precious metals exchanges when making large transactions.

How do spot trading in gold and silver differ from futures trading?

Exchange trades in precious metals are more suitable for long-term investing than futures due to the lack of expiration dates. After purchasing a precious metal through an exchange, it can be stored indefinitely.

Spot contracts are not tied to a global benchmark. They show the state of the developing domestic market for gold and silver in Russia, characterizing domestic supply and demand. However, pricing takes place here taking into account the international cost of precious metals, established in London. If prices on different exchange platforms differ greatly from London prices, then appropriate arbitration is carried out to restore balance.

Other differences with futures are that exchange trades in gold and silver do not come with a forward interest rate, guarantee or expiration date. Tariffs for brokerage firm services also vary.

By successfully combining exchange transactions with futures for precious metals, you can achieve a greater level of hedging and use various strategic investment schemes.

The value of gold in stock trading

In the Forex market, gold is a form of currency. The international code is XAU, the symbol used in accordance with the ISO 4217 currency standard to represent one troy ounce (31.1 g). A key feature of a safe-haven asset is its ability to appreciate in times of instability and economic uncertainty. Investors describe gold by three main criteria - safety, liquidity and profitability.

“It is not just a metal, but one of the oldest and most effective measures of capital and wealth. An independent resource that is not owned by a particular country or trading market, is not associated with a specific company or any government, so investing in gold helps protect investors' capital from the consequences of various political and economic crises,” NSBroker representatives explain.

One of the most reliable determinants of the price of gold over the past 50 years has been the level of real interest rates, specifically the interest rate minus inflation. When real interest rates decline, alternative investment options, cash and bonds, tend to provide low or negative returns. This forces investors to look for more profitable ways to protect their capital. But if real interest rates rise, so do cash and bond yields. In this case, the attractiveness of gold for industrial purposes may decrease. As analysts at NSBroker suggest, a simple way to track a proxy for real interest rates in the world's largest economy, the United States, is to look at the yield on Treasury inflation-protected securities.

Clearing operations

The currency exchange and the precious metals exchange use a common clearing mechanism and joint risk management. Failure to perform under contracts is governed by general rules.

When entering into any partially collateralized contracts and using updated or existing settlement codes, the client has the right to use the general ruble collateral provided by the brokerage firm and the exchange.

In the domestic domestic market of gold and silver, the role of the main counterparty and clearing operations was assumed by the organization NPO NCC, part of the association. At the same time, the taken into account risk coefficient for exchange and over-the-counter transactions reaches 5%, and not 20%.

Rating of brokers with gold trading on Forex

| Broker | Open an account | Based | Adjustable | Broker type | Min. deposit | Max. credit leverage | Bonus |

| AlpariReviews: 25 | Open account Demo | 1998 | IFSC, NAFD, FSA, AFD | ECN | 0$ | 1:1000 | +100% |

| FinmaxFXReviews: 21 | Open an account Demo | 2017 | TsROFR, VFSC | MM | 250 $ | 1:200 | +100% |

| RoboForexReviews: 13 | Open an account Demo | 2009 | IFSC | NDD, ECN | 0$ | 1:2000 | +120 |

| InstaForexReviews: 6 | Open an account Demo | 2007 | RAUFR | NDD, ECN | 1$ | 1:1000 | +100% |

| AmarketsReviews: 5 | Open an account Demo | 2007 | FSA | NDD, ECN, STP | 100$ | 1:1000 | +20% |

| BCS ForexReviews: 2 | Open an account Demo | 2004 | FSA | NDD, ECN | 1$ | 1:200 | |

| Forex4you Reviews: 9 | Open an account Demo | 2007 | BVIFSC | NDD, STP | 20$ | 1:1000 | +100% |

| XM.COM Reviews: 1 | Open an account Demo | 2009 | ASIC, FCA | MM | 5$ | 1:300 | +100% |

Receiving precious metals purchased on the exchange

Spot precious metal trading on the exchange allows you to deposit and receive physical gold and silver. Based on the results of trading sessions, the metal asset located in the exchange storage facility in the required quantity is entered into the trader’s TBS (trading bank account), which is opened at NCC.

The deposit or receipt of precious metals by the trading participant is carried out using a correspondent account, through an authorized Moscow storage facility. For brokerage clients, this procedure is determined by contractual agreements.

Withdrawing gold and silver from the exchange involves what are called storage costs. At the same time, the quality and liquidity indicators of the gold precious metal may be lower than stated. The standardized bars issued by the vault usually weigh from 11 to 13 kilograms or 1 kilogram.

What affects the gold rate?

Most gold entered the market in the 90s of the last century after the sale of bullion from the vaults of global central banks. By 2008, sales had slowed, with gold production beginning to decline as early as 2000. According to BullionVault, annual gold production fell from 2,573 metric tons in 2000 to 2,444 metric tons in 2007. In 2011, production partially recovered, and within a year the volume reached almost 2,700 tons. On average, it takes 5-10 years to launch new mines, and a reduction in the supply of gold directly affects the increase in the price of this metal. In 2021, its global production amounted to 3463.7 tons, which is 1% less than in 2018.

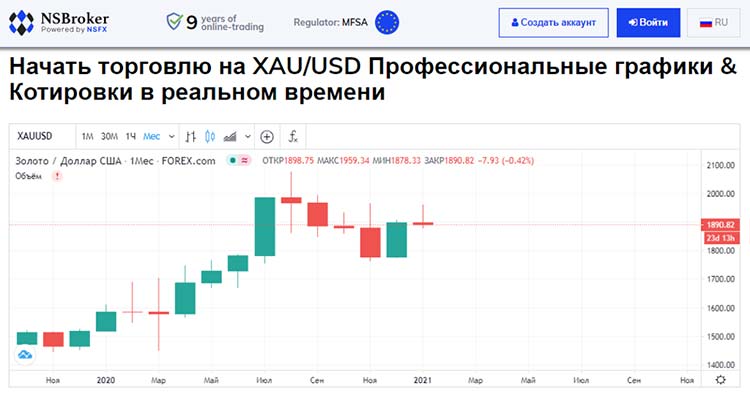

The second factor is global force majeure. The chart presented by NSBroker shows how the asset behaved throughout 2020, during the peak periods of the pandemic and when the situation stabilized.

The first price jump was noted in April last year, when the first cases of the disease were recorded. By July, the asset broke a record of $2 thousand per ounce. Similar jumps were observed during the financial crisis of 2008. Then the price first collapsed by 25%, to $750, and then almost doubled, to $1,400.

The third price determining factor is global gold reserves. Currently, about 244 thousand tons of this precious metal have been discovered in the world. Most of the asset is stored in China (383.2 tons), Russia (329.5 tons), Australia (325.1 tons) and the USA (200.2 tons). Data on the availability of gold savings in the central banks of countries is regularly reported by the IMF. Such dynamics will be useful for a trader when predicting the future vector of demand for a protective asset.

The fourth factor is the demand of large consumers. Gold is used not only in jewelry, but also in medicine, the chemical industry, electronics and astronautics. An analysis of the indicators of major market players will give an idea of in what period the price may increase or sharply decrease. NSBroker experts cite the Indian phenomenon as an example. Every year in October, wedding season takes place in India. Due to increased household demand during this period, exchanges record the highest global demand for metal among jewelry suppliers and manufacturers. During this period, the price of the asset grows steadily.

Other tax features of exchange trading in gold and silver

Trading operations with precious metals are associated with another tax for a private individual - personal income tax. It is 13%. In this case, the brokerage company is not a tax agent, as happens when selling securities, but only prepares the documents required for filing a declaration in accordance with Form 3 of personal income tax.

If you own gold or silver for more than three years, you have the right to a property deduction with an exemption from personal income tax.

The rules for the sale of precious metal from bank accounts, provided for by Russian tax legislation, are identical to those used for the sale of other material assets.

How to trade gold on the stock exchange

There are other alternative ways for traders and investors to purchase gold:

1. Investing money in precious metals funds, namely in the asset gold. The minimum contribution to accrue passive income is 5,000 rubles.

2. Investing money in gold futures from 3 months to a year and a half based on your own forecasts or advice from experienced analysts and traders. This can be done through brokerage platforms.

3.Investing money in shares of gold mining companies, “Vysochaishy” “Polyus”. To do this, you need to create an investment portfolio - a set of securities in which the investor invests money. If you distribute your investments across several assets, the risk of losing your funds will be significantly less. To know which asset to invest money in, it is necessary to analyze the activities of a particular gold mining company.

Brokerage companies for gold trading “Finam”, “Alfa Direct”

What to expect from the gold and silver market in the future?

In Russia, the precious metals market is in its formation stage. Therefore, we should expect favorable innovations in the future. Thus, from the beginning of 2021, access to transactions with gold and silver through IIS has been opened. The change became possible after amendments made to the Federal Legislation.

Currently, discussions are underway on amendments to pension legislation that will allow pension funds to invest available money in precious metals.