Hello, fellow Forex traders!

On the market, in addition to currency pairs, there is the asset XAUUSD or, more simply, gold. If you have ever tried to trade it, you noticed how sharply your stop loss was knocked out)) Why does gold move so sharply? How can we use this to our advantage? A little history, important nuances of XAUUSD trading that are worth knowing, and... an interesting strategy specially selected for this instrument - in today’s material.

Secrets of trading Gold XAUUSD

Those who watch gold are well aware that in the second decade of the 21st century, the precious metal has ceased to be a safe haven, protecting investors' assets from inflation with an ever-increasing price. The long-term trend of increasing gold prices has led to four-digit price values, the widespread use of robots and strategies that were presented as a grail, in fact using averaging in the form of “stretching” the grids of buy orders or Martingale - increasing the position with increasing losses.

Since 2011, there has been a radical change in the market’s “trading regime” in terms of volatility, which was preceded by a global trend reversal and a subsequent wide flat. These movements turned gold into a speculative instrument and invalidated previous strategies.

Gold – from time immemorial to the present day

Gold as an asset has long been valuable to humanity, as evidenced by archaeological excavations during which gold jewelry and coins were found. 4-5 thousand years BC, of the seven first metals discovered by people, it was gold that received the status of precious, becoming the basis of the economy and monetary system.

From ancient times until the 19th century, the value of the coins of any state was determined not by the denomination, but by the content of gold, which in the era of “paper money” also served as the “gold standard”, abolished in 1971 in the USA. This was followed by global reform of the foreign exchange market, which led to the emergence of the Forex market after the Jamaican meeting of G7 leaders.

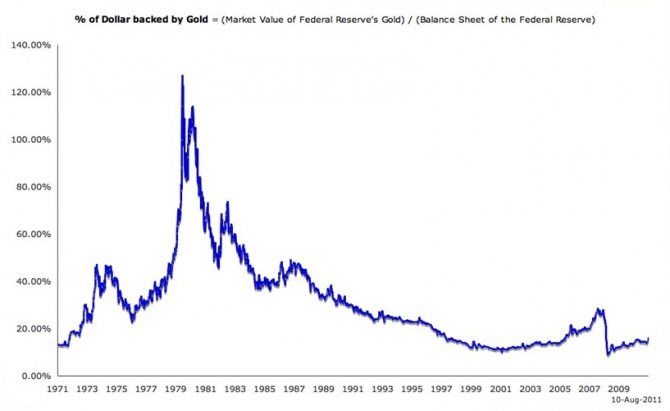

The consequences of the decision to value all currencies through the US dollar, made by the heads of the world's leading states in the town of Kingston, can be seen in the picture below. After the official ratification of the decoupling of currencies from the “gold standard” by the International Monetary Fund in 1978, the US Federal Reserve sharply reduced the share of gold backing of issued dollars. Since then, the number of unsecured printed bills has only grown.

It is also clear from the graph that the low share of “gold backing” in the national currency issue that existed in 1971 served as the main motive for the American government’s refusal to be tied to gold. At that time, in Europe there was a huge amount of cash dollars received by states during the Marshall Plan in the form of loans for the post-war reconstruction that took place by the middle of the 20th century.

European countries were ready to return not only loans, but also American paper money, demanding real precious metal in return.

These days there are calls for reform of the Forex market in the form of a return to the gold standard or the transfer of a sovereign currency to the blockchain.

Both plans are not feasible in the next few years, so it is worth looking for ways to trade gold today. Before listing the strategies, let’s look at the factors influencing the price of the precious metal.

A little history

Since the seventeenth century, Great Britain has played a key role in determining the price of gold, and there is an explanation for this. The capital of Great Britain - London - already in the seventeenth century became the world center for the purchase of gold, because on the territory of Foggy Albion there was a law on the free import of precious metals. Also in the seventeenth century, all silver coins in circulation were backed by gold money, which increased the global demand for gold. In Great Britain, there were a large number of brokerage houses that served as intermediaries in the implementation of gold purchase and sale transactions, and also played a special role in shaping the gold market. As for the price of gold at that time, it was 4.24 pounds per ounce.

London gold fixing

In order to maintain its position as a leader in the world gold market, Great Britain in 1919 decided to sign an agreement between seven gold mining companies in South Africa and the largest banks in the state. After that, all the gold mined in the African leading country in the field of precious metal mining was delivered to London. This period in the economic history of England is called the “age of the golden five,” and all because five British banks took control of the entire situation on the world gold market, and they also dictated prices for the precious metal. At that time, the price of gold was equal to the British pound sterling, but only until a new leader, the United States, emerged on the world market. For this reason, the price of gold began to be tied to the US dollar.

After World War II, Zurich became the “golden” center, because Swiss bankers managed to skillfully take advantage of the closure of the London market. Since then, almost all gold reserves mined in South Africa have been transferred to large banks in Switzerland. Nowadays, Paris, Milan, and Frankfurt am Main are considered the largest gold markets in Europe. In Asia, the trading centers for the precious metal are Tokyo, Bombay and Doha.

The price of gold today is set under the influence of many factors, not only economic ones. So what determines the price of gold?

Gold mining

The earth's crust has a low content of precious metal, but gold mining is quite simple and cost-effective due to the metal's ability to concentrate in certain geographic locations and form clusters in the form of nuggets. It is carried out in an open way, in zones of geothermal post-magmatic release; the main reserves of gold ore are located closer to the center of the Earth due to the peculiarities of the origin of this metal.

In the 21st century, the first place in gold production is occupied by China, which in 2006 seized the palm from South Africa, which dropped to sixth place due to the depletion of deposits. Second place belongs to Australia; the continent has the largest proven reserves of this precious metal and can become a leader.

Russia closes this trio. An interesting fact is that the history of gold mining in our country dates back to the end of the 18th century. The first nuggets were found in the Urals after the death of Emperor Peter I, who laid the foundation for the development of mining in this region.

The yuan correlates with gold prices due to China's dominance in the volume of its production, and the exchange rate is influenced by the central banks of the countries with the largest reserves of this metal.

Strategic gold reserves of sovereign states

Despite the abolition of the gold standard, various countries still accumulate gold as a strategic reserve to support and stabilize the state's economy. The first place in terms of its savings belongs to the United States, followed by Germany by a wide margin, and the third and fourth places are shared by France and Italy, Russia closes the top five, which is already almost catching up with China.

The Central Bank is responsible for the monetary policy of the state, so gold is a tool for it, when using which the Regulator does not take into account the current exchange rate, fulfilling its own goals and objectives.

Transactions to replenish the gold fund are usually made on the over-the-counter market, but still affect the exchange rate of the metal and the value of the national currency, which falls due to increased emissions, due to which the state reserve increases. In the event of an economic crisis, these reserves are released onto international exchanges in order to increase the supply of foreign currency in the country, usually US dollars and euros.

Factors influencing the price of gold

What determines the price of gold:

- Dollar exchange rate: the value of gold is determined by the dollar exchange rate, and all because the dollar, like gold, is also an investment object. Therefore, if the dollar falls, investors who have invested in this currency will try to get rid of assets that have fallen in price and will purchase gold instead of the currency. Due to the increase in demand for gold, its price will increase. When the dollar rises in price, the opposite situation will be observed.

- Natural disasters and political crises in gold exporting countries: natural disasters, mass strikes, civil wars have the most negative impact on the pace of gold mining. This causes a reduction in the supply of precious metal on the world market, which, in turn, affects the price of gold.

- The behavior of the central banks of the leading countries of the world: if institutions decide to increase their gold and foreign exchange reserves, then they begin to buy precious metals, which leads to an increase in the price of gold.

Today, the world price of an ounce of gold is set by the London Metal Exchange. Price determination occurs 2 times a day, and the central banks of the gold pool countries participate in this. The price per ounce of gold is expressed in pounds sterling, US dollars and euros.

Today, every adult can become an investor who invests their capital in gold. There are several ways to invest in gold:

- Buying bullion from a commercial bank: This is a common method of investing in gold. This operation is regulated at the legislative level, and only those banks that have received a license to operate with precious metals can engage in the purchase and sale of gold.

- Opening an impersonal metal account: such an account is opened in exactly the same way as a deposit, but the only difference is that it is expressed in a certain amount of precious metal. After opening such an account, the investor does not become the real owner of the gold, because the purchased metal is in the bank’s precious metals vault.

- Gold trading through a broker: This transaction is carried out on an online stock exchange.

- Buying gold coins: investment and collectible gold coins are offered to the public by banks. Investing in coins is considered the least risky, but at the same time the least profitable investment in gold.

If a person wants to keep his finger on the pulse of the gold market situation, then he is recommended to regularly study analyst reports and follow economic and political news from the world. It is also recommended to monitor what prices are set in the gold market and what influences them.

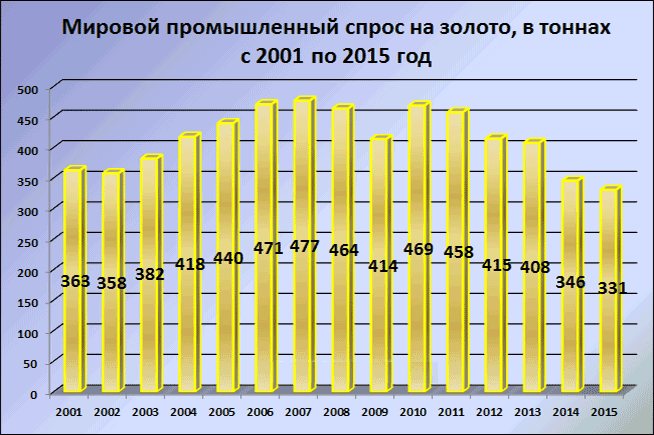

Industrial uses of gold

In addition to the actions of Central Banks, the XAUUSD rate is influenced by the demand for non-ferrous metals from industry. Gold is used in the consumer sector for jewelry, gold plating for premium products, and dental crowns in dentistry. Metal consumption volumes are growing along with the development of microelectronics associated with the production of computers and mobile gadgets, as well as the traditional use of gold in the chemical industry.

Traders can often observe a clear, strong correlation between the rise in prices of non-ferrous metals and gold during an economic boom and the fall due to a sharp collapse in demand during a crisis.

The role of gold in crises

During economic and geopolitical crises, gold is likely to rise because confidence in currencies declines. Gold is, in fact, the oldest universal currency that is not tied to any national currency. Gold is the most important indicator of global economic and political development. The onset of a crisis usually entails a decline in the stock market.

Typically, this pushed gold prices up. Investors, getting rid of falling stock assets, buy gold to reduce the risks of their investment portfolio and gain protection from falling exchange rates.

A sharp decline can have the opposite effect in the short term: to cover their losses, investors sell gold from their reserves, increasing the supply in the market, reducing its price and thus pushing the dollar higher. However, gold's rise resumes soon after. In general, stock market declines direct cash flows into safe haven assets: gold, Japanese yen, Swiss franc, bonds, etc. Most currencies fall along with gold until the world economy stabilizes.

Crisis and gold prices

Global gold trend

Like any asset, the XAUUSD pair is subject to the influence of seasonality, recessions and increases in activity during the day, reacts to the release of macroeconomic statistics, etc. As for the global trend, on the scale of weekly candles over a period of thirty years it still looks growing and is in a temporary correction.

This is a topic of constant speculation by analysts, with growth forecasts “tens of times” becoming more frequent after 2021, associated with a sharp rise in gold at the time the Fed abandoned its zero-rate policy.

If we evaluate locally the period from the beginning of 2011, the naked eye can see a change in the range of fluctuations. The subsequent movement can be roughly divided into two approximately equal periods: the fall (until 2014) and the subsequent wide flat. Such long-term behavior of quotes allows us to deny with sufficient confidence the presence of any directional movement in the XAUUSD pair, which significantly downplays the role of a “safe haven”.

Many traders have stopped seeing opportunities to make money on gold amid nine years of growth in stock markets in developed countries. The same applies to the common man who chose digital currency in moments of crisis.

According to reports from the Finnish exchange of direct international exchanges LocalBitcoins, sharp surges in demand for cryptocurrency coincided with crises in Venezuela, Zimbabwe, India (currency reform), Turkey (US sanctions), South Korea (DPRK missile launches). An interesting fact: according to the latest October data from the service, Russia unexpectedly took first place in Bitcoin purchases.

The three-year flat extends within fairly wide boundaries, so by abandoning a unidirectional strategy (buying), you can confidently build speculative medium-term and short-term tactics. As can be seen from the daily candlestick chart, the gold market demonstrates fairly long periods of directional movement; for example, from the spring of 2021 to the end of summer there was a clear downtrend.

Useful and interesting facts about oil, gold and silver that will help a trader

Oil, gold and silver are the main assets of a trader in the commodity market. To trade each instrument more profitably, you need to understand its features. Therefore, we have collected useful and simply interesting facts about assets that a trader should know.

Oil: features of fundamental analysis and other advantages of trading

The oil market is one of the most favorable for trading. Let's remember the main advantages that prove this.

The asset is amenable to technical and fundamental analysis. Commodity quotes are especially sensitive to various news. To stay updated on the oil market, we recommend following:

- macroeconomic indicators, such as US crude oil inventories, which are released every Wednesday;

- Trump's Twitter, which with one message can push oil up or down several dollars;

- events in the Middle East;

- monthly OPEC reports and cartel meetings.

These are important, but far from the only sources.

High volatility. The advantage of high volatility is greater freedom of action for speculators, since they can constantly find moments to enter. But with increased volatility comes increased risks that need to be taken into account.

Hedging factor during market uncertainty . Oil does not depend on currency prices, so it is often used as a protective asset during times of instability.

Factors of supply and demand

Oil prices, like any commodity, depend on the level of supply and demand. Demand factors:

- Seasonality. In cold winters, more oil has to be used for heating.

- Volume of consumption. Developed countries are gradually abandoning coal and oil. Russian oil producing companies confirm this and are confident that demand will decline.

Supply factors:

- Interruptions in the work of the largest oil companies.

- Restrictions on production of oil-producing countries.

- Military operations in the regions where raw materials are being extracted and the geopolitical situation of the regions as a whole.

Fundamental analysis is important in oil trading, but decisions need to be made quickly as some news has a short-term impact.

Gold: 4 uses

The main feature of gold is that the asset is used as a safe haven in the market. When the foreign exchange market shakes, central banks make life-changing decisions, and one country's government squeezes another's currency, gold remains on the sidelines. Therefore, when the situation in the foreign exchange and stock markets is complex and unclear, investors transfer money into gold.

Protecting assets from global instability is just one use case for the metal. There are 3 more:

- a hedge against inflation because gold retains its purchasing power when a currency depreciates;

- speculation on price changes, since gold is one of the most volatile instruments on the market;

- diversification to balance the investment portfolio.

Factors of negative impact on gold

State of the American dollar. As a rule, gold is traded against the dollar, so the state of the American currency can affect the metal’s quotes. So, if the dollar rises, gold may fall in price.

Decisions by central banks on gold purchases can affect the price of the precious metal in different ways. Strong sales of gold reserves will push metal prices down.

Data from the largest importers and exporters. India is among the top countries in terms of gold purchases. If the country reduces purchases, the demand for gold will fall, followed by the price of the asset.

Silver: similarities and differences with gold

Silver, like gold, is used for hedging and protecting capital. The instrument is traded with high liquidity, so traders usually open transactions with a small spread.

Factors influencing the price of silver

- Level of supply and demand. Silver is used in many industrial applications. There is a demand for metal, but thanks to new materials, it may decrease in the coming years.

- Demand for other metals because silver is often mined from other metals. For example, 26% of all silver production comes from copper ore. If demand for copper increases sharply, silver may be produced in excess, causing the metal to become cheaper.

- The price of gold, which correlates with silver.

- Dollar quotes. The price of the metal is pegged to the US dollar. If the US currency begins to weaken, silver could rise.

- Economic situation in the world. Silver is not pressured by global economic performance

Which is safer for hedging: gold or silver?

Both assets serve as a safe haven during market turbulence. But gold is considered a more reliable instrument for two reasons.

More than 50% of silver demand comes from industrial production. The asset becomes more dependent on the economy: if producers don't have money to work with, demand for silver will fall. Industrial demand for gold is 10–15%.

The second reason is that silver has higher volatility, making it riskier to buy the asset as a hedge.

Oil, gold and silver have many nuances that need to be taken into account when trading. This is difficult without experience, so we advise you to check the RADDAR platform data for each asset to make an informed decision.

Features and Specifications of XAUUSD

In the Forex market, two types of gold designations are common in broker terminals - Gold or a more correct name - XAUUSD. This designation complies with the ISO 4217 standard, which regulates the three-letter code. According to this standard, the letter “X” is added in front of the designation of the metal Au, taken from the periodic table of chemical elements.

The gold rate currently stands at four digits, with two decimal places, reflecting the current value of a troy ounce expressed in US dollars.

The pip counting system in XAUUSD quotes is often controversial. To avoid confusion, take the value of the numbers after the decimal point as a two-digit number of points, i.e. a price change from 1270 to 1270.50 should be perceived as +50 points, and an increase to 1271 will mean an increase of 100 points.

A table of transactions of any system involving the desired instrument (in this case XAUUSD) on the myfxbook service can help you verify that the points for gold or any other non-standard instrument are counted correctly. By selecting the history of any monitoring transactions in this Forex account analysis service, a trader can see how points are actually calculated and the financial final result of closed XAUUSD positions.

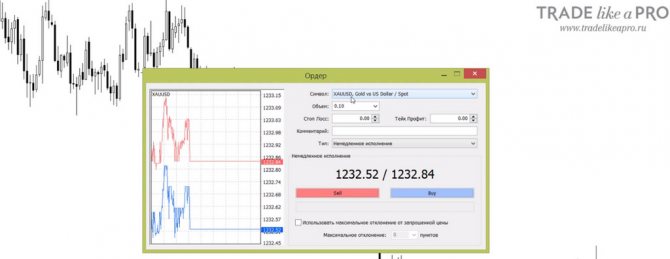

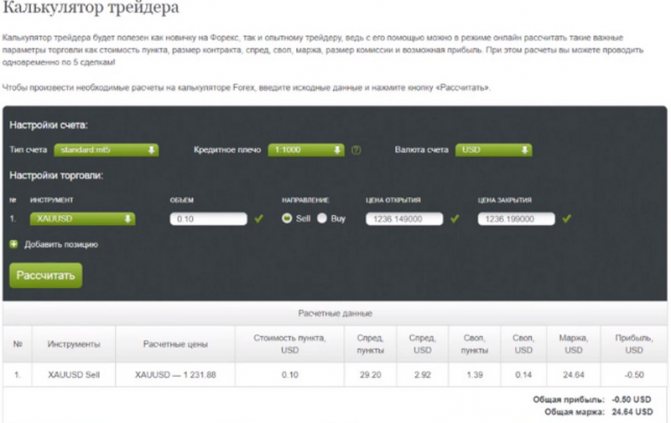

The cost of a pip, depending on the lot size chosen by the trader, can be found in the “Trader Calculator” service from your broker, for example, from Alpari. When entering the market with a 0.1 Lot order, the trader will earn or lose $0.1 on each pip.

Pay attention to your broker's gold trading hours!

Some brokers close trading an hour before midnight. Traders often find out about this one Friday, holding the trade to close it at the end of the day, avoiding rolling the position over the weekend, suddenly discovering no price movement on the chart.

Before trading any instrument, including the XAUUSD pair, pay attention to the contract specification. This will provide information not only about the trading time, but also about the amount of the swap, which is added or subtracted when moving the transaction overnight, depending on the direction of the position.

What should you pay attention to when buying and selling gold?

Since precious metals have always attracted and continue to attract the attention of scammers, it is worth following several rules when buying and selling them. So, for example, you should not agree to the first price named by the buyer, but you should definitely study the market and consult with at least two jewelers. In addition, be sure to ask the buyer for documents confirming the value of gold today and allowing him to conduct activities to purchase precious metals from the population. At the same time, you should also not follow the lead of a person who does not want to take into account the hallmark of your gold product when determining the price.

It would be best to contact official pawn shops, but in the same case, when you want to buy or sell investment gold, you will need to go to any bank. Remember that the sale of gold in Russia by private individuals is prohibited, and serious criminal liability has been established for this.

As for working on the Forex exchange, there are no obstacles here, since in this case trading does not take place in real gold, but only dollar-gold pairs are bought and sold. Moreover, all trading takes place through specialized brokerage agencies or brokers.

0

Medium-term and short-term periods of XAUUSD trading activity

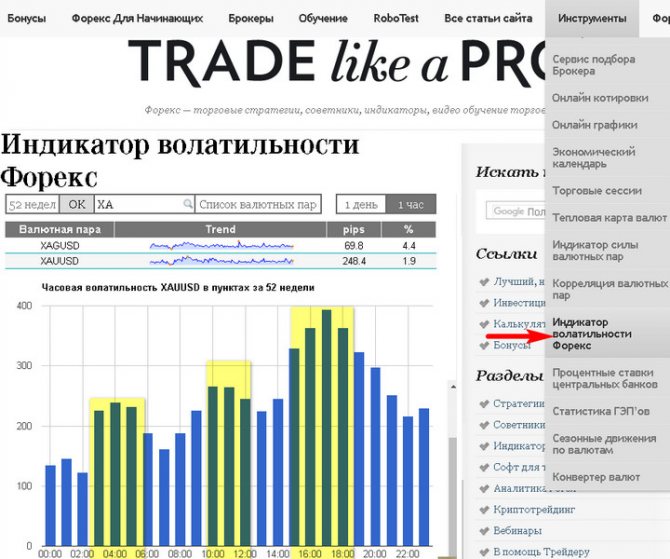

To determine the days of the week and hours of active trading in the gold market, let’s turn to the “Forex Volatility Indicator”, which is located on our website in the drop-down menu of the “Tools” tab.

During the year, the highest average intraday volatility occurred in the morning hours of the Asian session, the opening of the London LSE, which traditionally trades large volumes of metals, and the beginning of the American session. The bars of the intraday volatility histogram clearly show that the most active trading period falls between 15:00 and 20:00 Moscow time. We will return to this point later.

The discovered trends make night trading strategies unsuitable for gold speculation and “shorten” the time to 20-00 Moscow time.

By setting the switch to 1 day mode, we find out the average value of intraday fluctuations. As can be seen from the chart, on average it is equal to the value of 1,300-1,500, which in terms of points, according to the principles described in the section of gold characteristics, is comparable to 130-150 points. This volatility is comparable to many major currency pairs.

The most volatile days are Tuesday and Wednesday, with the least activity observed on Monday.

On a historical scale, the peak of volatility occurred in 2011, where a global break in the growing trend occurred. This was followed by a peak after the announcement of the quantitative easing program QE, combined with a drop in interest rates of the Central Banks of developed countries to zero.

The last jump in this parameter occurred in 2021, coinciding with the first increase in the Fed rate above zero. The current flat corresponds to the minimum volatility values of 2017-2018, which once again confirms the hypothesis of the absence of a trend in gold put forward in the article.

Gold Price Forecast 2021 – World Gold Council

The coronavirus pandemic has increased geo-economic instability, exacerbating existing risks and creating new ones. However, by the end of last year, investors began to believe that the worst was over.

In a low interest rate environment, investors will buy risky assets in the hope that the economy will recover in the near future. At the same time, they most likely need to prepare for possible risks, namely:

– growing budget deficit;

– inflationary pressure;

– corrections in stock markets due to inflated stock prices.

Gold has risen due to new risks, low rates and increased demand

The yellow metal turned out to be one of the most profitable assets of 2020, which was caused by:

– high level of risks;

– low interest rates;

– positive price dynamics, especially in late spring and summer.

Gold also had fewer declines during the year, helping investors reduce losses and cope with the risks of volatility in other markets.

In early August, the price of the precious metal reached a historical high of $2,067 per ounce. Records were set in all leading currencies. Subsequently, quotes fell below the year's high, consolidating above $1,850 per ounce for 3-4 quarters. An ounce of the yellow metal cost $1,887 at the end of the year.

Note that the dynamics of prices for the precious metal in the second half of the year was due to increased investment demand for gold exchange-traded funds, bars and coins, and not to speculative trading on the futures market. For example, the volume of net long positions on the COMEX exchange reached an all-time high in the first quarter - 1,209 tons. However, by the end of the year the figure dropped by almost 30%. This could be due to the wide spread between futures quotes and the spot rate, which widened in March, making futures more expensive than others.

Investors preferred physical gold and products backed by real precious metals last year. This points to the use of the yellow metal as a strategic asset rather than just a profitable tactical acquisition.

Investment demand for gold has increased due to the interest rate and inflation situation

Global stock market indices performed particularly well in November and December. However, the rising number of coronavirus cases and the emergence of a new, more dangerous strain have caused concern in the markets. However, these circumstances, as well as political events in the United States during the first week of 2021, did not prevent investors from buying risky assets.

The price-to-sales ratio of companies listed in the S&P 500 index was high. The 15 factors that make up the S&P 500 valuation model are near record levels, according to Crescat Capital. Low interest rates around the world will support stock prices at high levels. Investors should prepare for sharp market swings and significant corrections. Such events could occur, for example, if vaccination takes longer than expected or is not very effective in the fight against coronavirus, given, in the first case, logistical problems, and in the second, the many mutations of the virus.

In addition, many investors are concerned about the potential risks associated with widening fiscal deficits, which, combined with low interest rates and money supply growth, could lead to higher inflation pressures. It should be noted that central banks, including the US Federal Reserve and the European Central Bank, have indicated they are prepared for a temporary increase in inflation that may exceed their traditional targets.

Gold generally performs well against the backdrop of stock market volatility and high inflation. The value of gold increases by an average of 15% when the inflation rate exceeds 3%. It is noteworthy that, according to Oxford Economics, the yellow metal also rises in price during periods of deflation. Typically, these environments involve low interest rates and high financial risk, which drives demand for gold.

In addition, over the past decade, the precious metal has responded very sensitively to the state of the global money supply, even better than US Treasuries, thereby effectively helping investors preserve their capital.

Economic recovery in developing countries will lead to increased consumer demand for gold

According to surveys, most experts predict a global economic recovery in 2021 after a dismal 2021 picture. In an environment where global economic growth is likely to be quite sluggish, the stable dynamics of the gold rate since mid-August will contribute to an increase in consumer demand for it.

Economic recovery could come faster, for example, in China, where the situation was dire early last year until the spread of the virus in the country was stopped more effectively than in many Western countries. We should expect an improvement in the situation with the precious metal market in this country, given the positive correlation between economic growth and increased demand for gold.

A similar situation will be observed in the gold market in India. According to statistics after November's Dhanteras festival, jewelery demand was still below average, but compared to the lows of the second quarter, the situation was much better.

At the same time, consumer demand in other regions may be weak, given that the global economy will not function at its maximum capacity, and the gold rate is still at historically high levels.

Demand for gold from central banks is here to stay

During the first six months of last year, central banks were eager to increase gold reserves, but the situation changed in the second half of the year as net buying months gave way to net selling months. Let us remind you that during 2018-2019. Central banks were net buyers of the precious metal, partly thanks to the activity of the Central Bank of the Russian Federation, which ceased in April last year. Despite this, central banks still remained net buyers of the precious metal in 2021, although the aggregate acquisition rate lags significantly from the previous two years. In 2021, nothing will fundamentally change in this sector. There are good reasons why central banks continue to favor gold for reserves, and with low interest rates, the yellow metal won't lose its appeal in the long term.

Production will increase

During this year, production will recover after a decline in its volumes last year. A large scale production shutdown was observed in the second half of the year, but the situation subsequently returned to normal.

While it is difficult to predict what will happen to the sector in 2020, there is evidence to suggest fewer production stoppages due to the successful management of the pandemic. Consequently, the situation of gold mining companies will improve. Even if a potential second wave hits manufacturing countries, major companies have already put in place protocols and procedures that should reduce the negative impact of production shutdowns seen in the early months of the pandemic.

conclusions

The dynamics of the gold rate depend on the interaction of various sectors of supply and demand, which, in turn, are influenced by four main factors (economic growth; risks and uncertainty; opportunity costs; market dynamics, investments). In this context, the outlook is that the need for effective hedging instruments in a low interest rate environment will keep investment demand strong, but may be heavily impacted by risk perceptions related to the pace and sustainability of the economic recovery.

At the same time, economic recovery in developing countries (China and India) may reduce the negative impact on the gold market that was observed in 2021 due to extremely low levels of consumer demand.

Oxford Economics proposed five macroeconomic scenarios for 2021:

— sustainable economic recovery (company’s baseline scenario);

— delay in recovery;

— deep financial crisis;

- rapid economic growth;

- global second wave of the pandemic.

In general, the gold rate will feel normal in 2021 under any scenario, but you should not expect such jumps as last year. The restoration of consumer demand will greatly help the precious metal, if, of course, the economy improves. In addition, gold yields may increase due to the extension of the low interest rate regime, which will almost eliminate the precious metal's opportunity costs.

The number of risks will increase as the global economic recession worsens and consumer demand declines, causing the precious metal to suffer. However, under the “deep financial crisis” and “global second wave of the pandemic” scenarios, investment demand for gold should increase, which could compensate for the low level of consumer interest, as happened in 2021. Investors buy the yellow metal when they need risk-free, high-quality and liquid assets.

XAUUSD Trading Strategies

One of the features of XAUUSD quote fluctuations, which can be taken as a basis when creating a strategy, is the rapid change of quotes within the range on any timeframe. The reason for this is the low liquidity of gold trading on the Forex market.

The fact is that the spot market is only available to professional investors due to the high margin requirements of the exchange. The main volumes are tied to it, while XAUUSD has a frankly weak order book, so almost any large transaction collects pending orders from a large number of levels.

.

Candles that leave large tails in the direction of the local trend after closing are a reason to open a trade in the opposite direction.

The signal should be strengthened by a false breakout, in which the tail of the candle breaks the existing flat range. Working timeframe – H1.

The tail of the signal candle will determine the size of the stop loss, and the maximum range of the local trend (usually two or three candles) will determine the take profit level.

The impulsive nature of quote movement can be used in breakout and range breakout strategies. Basically, this tactic of work is designed for professionals who know how to determine the boundaries of a flat and place pending orders higher and lower. Momentum traders love gold for a reason)

In this case, the take level will be determined by the size of the flat range, and the stop will be located beyond one of its boundaries, opposite to the entry direction.

The best time for intraday trading is from 15-00 to 20-00 Moscow time. Once again, it is worth recalling that the concept of “night trading” in the form of flat strategies does not exist for gold.

Classic strategies for working with the trend are not available on small time frames; directional movements in gold are formed on daily candles. Before using them, you need to take into account the peculiarity of the high range of fluctuations; the tails of the candles require the use of a large stop size.

The same feature affects trading at levels that represent price zones; in the case of XAUUSD, a wider size is sufficient, unlike currency pairs.

To avoid “unnecessary” knocking out stop orders, you can use the “true volatility” ATR indicator to determine its size. This algorithm and various other rules for setting loss limits are described in detail in the topic “What you need to know about Stop Loss”.

How does the size of gold reserves affect the country's economy?

At first glance, one might think that all states are in a hurry to acquire gold, at any cost; however, in reality the opposite is true. Gold used to be a unique reserve asset for states and citizens due to its unique chemical characteristics that made it incapable of reacting with other elements, including acids, making it a reliable store of value.

However, this situation changed in the twentieth century. All countries and their central banks or treasuries now hold significant amounts of reserves in the form of a diversified portfolio of currencies, foreign government bonds and precious metals.

Most published studies and articles focus primarily on the volume of gold held by governments, without addressing the ratio of the amount of gold to total reserves. The volume of gold reserves in comparison to the total reserves of countries reflects the political and economic interests of the authorities and the position of the state in the international arena. Below we present a study of two groups of countries. The first group consists of those countries that continue to increase their gold reserves; the second group is countries that are reducing their gold reserves.

Gold standard era

Without going too far into history, let's look back to 1694, when the Bank of England established a gold standard system in which banknotes were exchanged for gold on demand. This system was adopted throughout the world and remained the basis for an effective economic system for more than two centuries.

Under the gold standard, the value of any currency was fixed in gold, which meant a fixed exchange rate between currencies. The gold standard system put great pressure on large and small countries alike. On the larger countries' side, absolute rising inflation for more than two centuries has caused people to doubt the ability of central banks to back their banknotes in gold; this led to speculators selling currencies in order to exchange them for gold. As a result of such speculative actions, the volumes of gold in central banks began to be depleted, most notably in the Bank of England. On the other hand, smaller countries have been forced to raise their interest rates when foreign rates rise; otherwise they suffered serious losses. The massive sell-off of domestic currency prompted a turn to gold reserves or to the sale of domestic currency and the purchase of foreign currency in an environment of high interest rates.

During World War I, the gold standard system was suspended in all countries except the United States. After the end of the war, many countries found themselves saddled with debt and hyperinflation. At the same time, the banking sector was the most affected, as many banks faced insolvency. By the end of World War I, central banks made significant efforts to restore the gold standard system. Despite the fact that during the war large sums of money were printed that were not backed by gold reserves, states could restore the gold standard system. However, the post-war period did not prove stable in the monetary sphere, and many countries, including Great Britain, refused to restore this system.

In the absence of political and ideological support for the gold standard system, central banks began to reevaluate their policies, especially after the global Great Depression era in the 1930s. Significant changes to the monetary system were carried out by US President Franklin Roosevelt.

Countries with increasing gold reserves

USA

Once the markets crashed in 1929, Britain abandoned the gold standard as the pound began to float and be determined by market forces due to frequent attacks by speculators. States stopped believing in the gold standard system, and one after another abandoned it.

The United States has taken new measures to save itself from the global crisis. One measure was to raise interest rates, which had been below 20%, in order to quell speculation on the dollar. As the government began to put pressure on the Fed, the Open Market Committee was created, which was responsible for increasing the supply of money by reducing interest rates on government and corporate bonds. Ultimately, the Fed and the government realized they were not on the right track and had to change it. They realized that gold was the basis of their previous fiscal policy and nothing could be changed without a complete revision of this system, and therefore the end of the gold standard.

By the beginning of Roosevelt's presidency, shifting the gold standard was a priority. It didn't take too long to recognize that abandoning the gold standard would be key to recovery from the Great Depression. In short, Roosevelt decided to let the dollar float against gold, driving its value to a low level.

The hardships of World War II were unbearable, so all countries eventually decided to abandon the gold standard system as it became unprofitable. In 1944, before the end of the war, major nations signed the Bretton Woods Agreement, which pegged currency prices to the dollar rather than gold.

However, the US dollar had to be exchanged for gold on demand, and gold was valued at $38 per ounce. In 1971, President Richard Nixon decided to end the gold standard system and replace it with a petrodollar system. From this date onwards, interest rates replaced gold and became the mainstay of fiscal policy.

By that time, gold was outside the Fed's fiscal policy; although its importance as a reserve asset has not diminished for the Secretary of the Treasury. According to the World Gold Council, the United States tops the list of countries with the largest gold reserves. It turns out that the United States owns 8133.5 tons of gold (about 12 billion dollars), which is 74% of the total reserves held in the treasury. The Treasury has been responsible for storing gold in secure vaults since January 31, 1934, in three locations: Denver, Fort Knox and West Point. The United States ranks fourth on the list of largest gold producers with 209 tons per year.

If we look at the issue of percentage of gold reserves to total reserves, then no other country has such a high percentage of gold reserves as Tajikistan and even the US is in second place in this list. Here the question may arise: what does this mean? a) The United States, as the producer of the dominant currency in the world, does not need a large number of foreign currencies, b) gold has an inverse relationship to the dollar, which means that as the demand for gold from the Treasury increases, the price of gold will rise, and the US dollar will depreciate. In other words, a weaker dollar will improve the economy and increase the value of stored gold.

European countries use the euro

Like the dollar, the euro is considered one of the pillars of the world economy. Although the European Central Bank stores 26% of its reserves in gold (504 tons), each country in the EU has its own treasury, storing its gold separately. The formula “sell the euro – buy gold as a reserve” is a common policy in the Eurozone countries. In second place among the countries holding the largest volumes of gold is Germany, owning 3,377 tons of gold, representing 68.7% of the total reserves; Italy follows with 2,451 tons, representing 67.8% of total reserves. Although Cyprus only has 33 tons of gold, it accounts for 64.1% of its total reserves; France - 2435 tons, 63.8% of total reserves, the Netherlands - 612 tons, 63.9% of total reserves, Portugal - 382 tons, 59.1% of total reserves and Austria - 280 tons, 45% of total reserves.

European countries take the position that it is necessary to have large volumes of gold reserves in relation to their total volume (commodities, currencies, etc.). If there were a gold standard system in the world economy today, countries would hold as much gold reserves as needed to control their currency and economy.

The sad lesson of Venezuela

The authorities of Venezuela, one of the leading oil-producing countries, were determined to pursue illiberal, anti-Western policies by abandoning the dollar. As a result, they held 64.8% of their reserves in the form of gold rather than foreign currencies; Only 187.5 tons of gold were stored, which was the lowest level in the last three decades. In December 2009, the Central Bank of Venezuela decided to carry out a “reorganization of gold reserves.” A 10-year plan was drawn up to increase gold reserves, but they did not announce how much the increase would be; Moreover, the financial crisis was still in full swing at that time, confidence in the US dollar had decreased, so in Venezuela that year was called the “year of gold.” In fact, the plan led to some success, as gold reserves increased from 355 to 365 tons by 2011; however, this policy did not last long. The country faces a major crisis in 2021, necessitating the sale of two-thirds of its gold reserves at a lower price than in 2010.

As a result, most of the gold purchased after the “reorganization” in 2009 was sold at a loss, and the economic situation in Venezuela worsened significantly.

Tajikistan

It may seem surprising, but Tajikistan, one of the poorest countries in the world with 30% of the population below the poverty line, stores 81% of its total reserves in gold, which puts the country at the top of the list, even above the United States. This 81% represents only 14.4 tons.

The country's GDP was $7.8 billion in 2021 as the economy is largely dependent on agricultural and metal exports. The country's income mainly depends on the labor force emigrating to Russia and the export of products to neighboring countries such as Russia, Turkey, Kazakhstan and Afghanistan.

Countries with declining gold reserves

Great Britain

However, some developed economies have a different view on gold. Unlike the rest of Europe, the UK has a different policy regarding gold. On 7 May 1999, the UK decided to sell most of its gold reserves at short notice, replacing them with a basket of currencies, including a new currency (the euro). UK gold reserves have fallen from 590 tonnes in 1999 to 310 tonnes currently, representing just 8.6% of the UK's total reserves.

This decision was made following new amendments made by the Bank of England. In the mid-1990s. Policies were introduced to reduce high levels of unemployment and price volatility, which led to a sharp fall in UK exports. Great Britain decided to reduce its gold reserves by 2/3, however, the kingdom still ranks 17th in the list of countries with large amounts of gold reserves.

Commonwealth Kingdom Countries

Canada and New Zealand followed the UK, but more decisively. The gold standard was adopted by Canada on June 14, 1853, and in 1999 the Bank of Canada decided to sell all of its gold reserves. The economic reasons that led Canada and New Zealand to dump all of their gold reserves remain unclear.

Australia is a country with a strong economy, largely focused on mining, representing only 6% of its total reserves. Australian gold reserves have increased slightly from 79.7 tonnes in 1999 to 79.85 tonnes in 2021. Commonwealth countries are among the richest gold mining countries as they account for the majority of gold mined. Australia is the world's second largest gold producer, producing 270 tonnes per year, Canada is fifth with 170 tonnes, and South Africa is seventh with 140 tonnes per year.

Sino-Russian axis

China became the last country to join the gold standard system at the beginning of the 20th century. China ranks fifth in gold production with 1,842 tons of gold; they represent only 2.6% in relation to total gold and foreign exchange reserves, which makes it similar to other countries that are reducing their gold reserves.

Following China is Russia, which stores only 1,645 tons, representing 16% of its total reserves; however, there are doubts about the accuracy of the statistics for both countries.

Gold is a very popular commodity in retail jewelry in China and Russia; these countries are considered the cheapest markets to buy gold. China ranked first among gold sellers with 455 tons, and Russia came in third with 250 tons per year.

Final words

Gold reserves are a popular topic and there are many questions associated with it. For example, is there a connection between gold trading, gold reserves and the gold rate. What is the impact of the gold price on gold held by states? And the most important question: what will be the consequences of depleting the extraction of this metal? In general, we can summarize the main ideas of this topic as follows:

Although gold has never lost its importance as a store of value, its role in the modern economy has now changed. Its history began with a simple coin, then gold evolved into a backing medium for banknotes, and is now an important part of government reserves, being a useful element in traditional fields (jewelry and store of value), including the medical and automobile industries. Moreover, the relationship between banks and gold also changed from one historical period to another.

We can divide countries in relation to the gold reserve system into three types: a) The US and the Eurozone hold the most sought-after currencies and have no choice but to hold their reserves in gold and give very little room to the less desirable currencies. It must be kept in mind that the United States is the second largest producer of gold; b) advanced economies such as the Commonwealth countries are treating gold differently by liquidating their reserves, followed by other developed economies such as Japan and Switzerland; c) developing economies such as Russia, China and India are adopting the same policies as countries from the second group, which was the inevitable result of economic stagnation.

Venezuela is a prime example of a failed policy in which the country defied international monetary systems and funneled all its oil revenues into gold. This was one of the reasons that caused a major crisis in the country in 2015, resulting in most of the gold reserve being sold at a low price in 2021.

American Gold Explosion Strategy

The strategy is very simple and, at the same time, effective.

On the hourly timeframe, the “inactive” segment of the session until 15-00 can be used as a range filter, identifying the flat price zones that had developed before this time and trading a classic breakout.

By placing orders on both sides after 14:00, having previously determined the take profit level equal to the size of the flat range, the trader can hold the deal until closed with a profit or exit it after 20:00, using the opposite border as a stop.

The rules of the strategy are extremely simple:

1) We determine the flat area at approximately 14:00 – 14:30 Moscow time;

2) We place pending orders Sell stop and Buy stop below and above the flat boundaries;

3) Stop loss order at the level of the opposite order, take profit equal to the size of the flat range;

4) A candle at 15:00 (sometimes a little earlier, sometimes a little later) activates our order, we wait for TP or SL.

5) At 20:00, if neither the take nor the stop loss were triggered, we close the position, regardless of the presence of profit/loss.

Of course, you can adjust this idea to suit your trading style. Perhaps we will look at this strategy in a separate review later.

Sources of quotes

Along with the era of the “gold standard,” gone are the days when gold consistently had the same value. Today's gold market dynamics are cyclical. A long recession is always followed by a period of growth. World political and economic events inevitably affect the precious metals market. The current rise in prices is a consequence of the global economic crisis, geopolitical tensions and trade conflicts.

Wanting to save their earned funds during the “turmoil” before they become just paper or meaningless numbers in a bank account, many seek to invest their savings in assets that are reliable and liquid. In this sense, humanity simply does not know anything more suitable than gold.

Potential investors will show keen interest not only in today's gold quotes, but also in tomorrow's possible exchange rate, as well as in price dynamics for the long term.

Among the trusted sources displaying the price of the yellow metal are the following:

- Metal Exchange in London;

- New York Commodity Exchange;

- Central Bank of the Russian Federation;

- Russian Sberbank;

- Yandex search engine.

London Metal Exchange (LME)

This is the largest platform in the world where non-ferrous and precious metals are traded. Over the century of the exchange's existence, the trading system has remained unchanged. Only the use of conference calls has been added. There are 6 main items traded here: lead, aluminum, copper, nickel, zinc and tin. Quotes are generated for rare earth metals and elements of strategic importance, such as vanadium, cobalt, selenium, cadmium, silicon and chromium. We also install fixings for precious metals: platinum, gold and silver.

The “London fixing” of the price of gold is formed by five main exchange players. Since 1919, two trading sessions have been held every day - at 10.00 GMT (13.30 Moscow time) and at 15.00 GMT (18.00 Moscow time). In most countries around the world, the price of gold is set on the basis of this fixing.

Commodity Exchange in New York

This futures company merged with the COMEX exchange in 1994. It is also included in the Chicago Board of Trade. Currently, its activities are carried out by two of its divisions - COMEX and NYMEX. The first of them deals with gold. Price is measured in US dollars per ounce.

The average person will only be interested in the quotes generated on these two largest trading platforms as food for thought.

The purchase and sale of precious metals in Russia is carried out at a price determined by the country's leading banking organizations, guided by the discount price of the Central Bank of the Russian Federation.

By the way. A troy ounce corresponds to the weight of metal 31.1034807 in grams. With mathematical rounding, we get 31.103 grams. This measure was used back in Ancient Rome. Then a heavy copper coin weighing 1 pound was divided into 12 parts - ounces. Later, the “ounce of avoir du pois” (from the French avoir du pois) appeared, which was already equal to 1/16 of a pound. But a troy ounce continued to equal 1/12 of a pound. The definition of “Troy” comes from the name of the city of Troyes in France, where fairs were held in the Middle Ages. Traders from all over the world came here in the 13th century, and the standards adopted here enjoyed unquestioned authority.

Central Bank of the Russian Federation

In Russia, it is the Central Bank that sets discount prices for gold and other precious metals. It also provides the latest data on interbank lending conditions, exchange rates and refinancing rates. The unit of measurement for the value of gold here is rubles per 1 gram. The Central Bank sets prices daily based on the dollar rate, London fixing and information from the world's leading trading platforms. The cost of gold per 1 gram also takes into account the costs of transportation, customs clearance, etc. The validity period of each announced price is one day.

What is fixing, refined metals and why are prices called discount prices?

If the cost of materials is variable, then accountants and banks apply so-called accounting prices to them. The discount price of the precious metal is valid for a calendar day from the moment of its announcement until new values are formed.

Refined precious metals This is the name of a precious metal (gold, platinum, palladium and some others) that has gone through all stages of processing from mining, enrichment and smelting of ore or processing of secondary materials and concentrates to the final product. There is a regulatory framework regulating the varieties, labeling and composition of refined metals. Thus, a gold nugget of considerable value is not considered refined. To do this, it must turn into a measured ingot, on which the sample and weight are indicated.

Sberbank of Russia

You can view gold quotes online on the Sberbank Internet resource. It shows the variability of dynamics over the past few years, and also contains an archive of price fluctuations.

Being the largest Russian participant in the gold market, Sberbank maintains branches in almost every locality of the country. At the same time, this financial organization is ready to offer various ways of investing in precious metals:

- Investments in gold and silver coins.

- Ingots of precious metals.

- Opening a compulsory medical insurance (an impersonal metal account).

Since the quotes (discount prices) determined by the Central Bank of the Russian Federation are advisory in nature, the price level in the Russian Sberbank may differ from them. Here, the price of gold is formed taking into account the internal market demand for precious metals in the country, the exchange rate of the ruble against the US dollar, discount prices of the Central Bank and data from international trading platforms that deal with gold.

It is worth remembering that Sberbank of Russia is a branched and structured organization with many branches that independently set their prices. Therefore, one gram of gold somewhere in the Far East can differ significantly in value from the same one gram in Moscow.

The level of spread at bank branches may also vary. This refers to the difference between the optimal acquisition cost and the selling price at the same point in time. In various branches of Sberbank, the spread value fluctuates in the range of 7-15% of the metal price.

What is the spread in private companies that sell investment and commemorative coins? When compared to commercial banking institutions, our company as a coin dealer, and some other similar private companies, tend to offer lower spreads on the purchase and sale of coins.

Yandex

One of the most convenient tools for monitoring the cost of securities and raw materials, stock quotes and exchange rates is offered by the domestic search engine Yandex. Sometimes there is not enough time to visit special Internet resources to get acquainted with current gold prices. The rhythm of modern life simply does not leave us with it. But, since work and entertainment today are, in one way or another, connected to the Internet, accessing Yandex will not be difficult. And here there is a whole section related to quotes, where you can observe the annual, quarterly, monthly or weekly variability of the price of gold. There is also archival data for the time period 1996-2019.