If you urgently need money, then it is not necessary to get it from the bank, since there is a pawnshop for this. Interest is charged to clients for using funds. You can donate movable valuable property. The amount is assigned after the assessment is completed. If the parties agree to conclude a deal, then an agreement is drawn up.

The period for redemption and the interest rate are established between the pawnshop and the client. Within the approved time, the borrower can return the funds by taking back his property. If this does not happen, then the pawnshop becomes the owner of the valuables. He can dispose of things as he wishes. Many people believe that only jewelry is taken as collateral, but in fact the list of accepted items is longer. What can be taken to a pawnshop depends on the type of organization.

Purpose of the agreement

A pawnshop is considered an official organization that operates on the basis of a license. An agreement is drawn up between the borrower and the pawnshop, which specifies the rights and obligations of the parties. The document will be useful for going to court in case of disputes.

The agreement includes information about the borrower and lender. It is necessary to comply with the rules for the redemption of property. What can be taken to a pawnshop should be found out in a specific organization. The list of items may vary.

How does it work?

Let's consider the functioning of a pawnshop and the nuances of the transaction, as well as the payment of borrowed money.

Getting a loan

The main requirement when granting a loan is the age of majority

.

The sequence of actions when visiting a pawnshop is as follows:

- the visitor presents a passport;

- a specialist evaluates the item being handed over.

The borrower must receive two documents:

- bail ticket;

- an agreement with detailed terms and conditions.

In this case, the pawnshop employee must advise the visitor on his rights and obligations.

To return the given item, the borrower must pay the loan amount and interest.

, which will have time to accumulate during the lending period.

What is eligible for collateral?

The pawnshop sells almost everything that you can bring and what you can drive.

Important! Real estate cannot serve as collateral against which money is issued.

What things are accepted as collateral? Here is a sample list:

- precious metals and stones;

- devices of various types (phones, electronics, etc.);

- examples of art (for example, paintings, figurines);

- household appliances;

- vehicles (cars, motorcycles);

- interior elements.

On site at the establishment, you can check before bringing the item there to see if they accept this kind of thing there. But all pawnshops operate according to the same principles, so there shouldn’t be any major differences.

How much does it cost to surrender gold and silver?

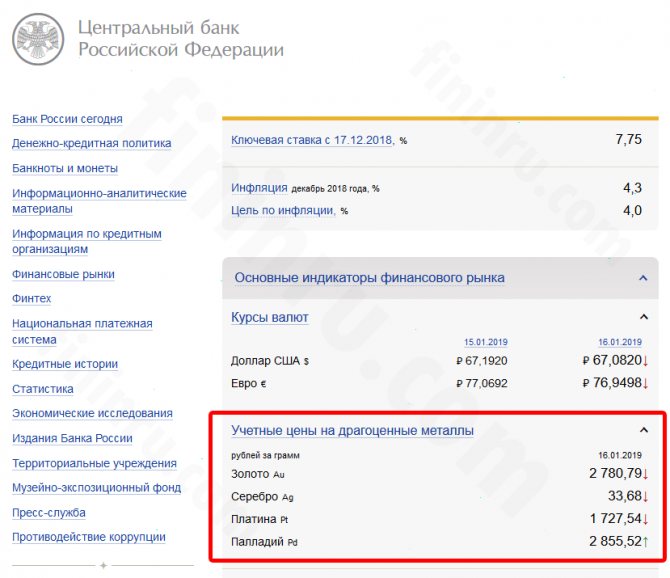

There is no universal value for gold and silver in pawnshop transactions. It depends on the current quote. This is verified using information from the Central Bank of Russia

.

Note 2.

On the Central Bank website you can see the accounting price for precious metals.

On the main page there is a block of information where the name of the metal and rubles per gram

. The date at which this information is current is also noted.

Much when pledging depends on the condition of the item. This directly affects its assessment by a specialist who does not seek to exaggerate its value.

For example, for gold above 750 purity you can earn 1000 rubles/g. For a gram of silver, the client will receive from 20 to 30 rubles. The sample and condition of the item are also important here.

Important! Antiques - especially rare ones - are more expensive because... Not only the metal itself is taken into account, but also the aesthetic qualities of the product, as well as the complexity of the work.

You can first visit several pawn shops to compare the difference in estimates given by specialists from different establishments.

For what period is the loan issued and in what volume?

The maximum time limit for storing a pledged item is one year. Moreover, the sooner you can buy it back, the better: interest rates in a pawnshop are higher than bank interest rates.

.

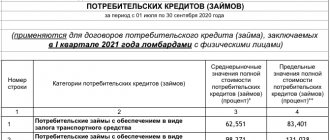

Important! The lower the value of the item pledged, the higher the interest rate on it.

In view of these circumstances, sometimes turning to a bank for a loan is the best way, more profitable.

Rights and obligations of the borrower

What does the pawnshop client undertake in terms of obligations

? In particular, we are talking about the following points:

- timely payment of the loan, interest (fulfillment of other conditions, if any);

- providing up-to-date, correct information about your person.

Note 3.

If it is discovered that the item surrendered was previously stolen, the responsibility for this comes

to the borrower

, and not to the pawnshop.

What rights

registered for the borrower? The client has the right:

- Pay off the debt in advance, before the end of the loan period.

- Receive the most detailed information about loan interest, terms of full payment and other nuances of the transaction before its conclusion

. - Receive your item back safe and sound

after fulfilling the terms of the contract on your part. - Take a pawn ticket

. Without this document, a pawnshop cannot be considered as such. This will already be a regular consignment store. - Through the court, obtain recognition of the transaction as invalid if, after signing the agreement, the borrowed money was not issued.

- File a lawsuit if the given item was not returned or was damaged.

Note 4.

The pawnshop must insure the pledged item independently at its own expense.

Important! The establishment does not have the right to charge the client interest for insurance. It is illegal!

Knowing his rights and obligations, a citizen will be able to build correct interaction with the pawnshop, and if problems arise, quickly resolve them.

List of accepted items

What can you take to a pawnshop? Although the list of things may be different everywhere, some of them are accepted everywhere:

- jewelry: gold, silver, platinum;

- jewelry;

- antiques;

- ancient coins;

- high value watches;

- branded items;

- Appliances;

- cars.

Now there is a network of car pawnshops and watches. Each organization may accept a certain type of thing. To get funds, you need to find out what you can take to a pawnshop. Then the item is appraised, usually the price is slightly lower than the real one. This is associated with risks if the collateral is not redeemed. The item must be in good working order if phones, watches and other equipment are surrendered.

Rules for accepting items at a pawnshop

The client is not required to provide information about his activities or income level. To pawn goods at a pawnshop, you must:

- Present your passport and the item that will be used as collateral.

- Bring documents confirming ownership of the product. These conditions apply when the client wants to hand over antiques, art objects, smartphones or tablets.

- Offer an item without visible defects. It is easy to deposit clean, functional products as collateral.

Loan agreement

This is a document according to which the pawnshop transfers money into the full ownership of the borrower for a specified period. The transaction is completed by filling out a pledge ticket, which contains:

- name, address of the institution;

- borrower's passport number;

- description of the collateral;

- the amount issued;

- date of issue and return of funds;

- interest rate;

- conditions for early repayment;

- signatures of the recipient, an employee of the institution.

Pawnshops additionally draw up a loan agreement, which states:

- loan amount;

- information about the creditor and recipient;

- conditions for termination of the contract;

- description of the pledged item.

Documentation

The pawnshop accepts items at a price that is less than the market value. Subsequent resale takes place under general conditions, and the difference from the transaction becomes the profit of the institution. If all the documentation is available, the borrower is given a larger loan. It can be 60–70% of the cost of the product.

The composition of the package of documents depends on the type of collateral:

- Vehicle . The client presents a registration certificate, PTS, insurance policy, driver's license.

- Appliances, power tools, computers . The citizen will be required to have a charger, a box with components (USB cable, headphones, drills, etc.), documents received when purchasing the product.

- Paintings and art objects . They must have a certificate of authenticity or appraisal report.

- Branded items, accessories . They are accepted in original packaging, confirming the authenticity of the product.

Metal cost

What valuables can you take to a pawnshop? Usually they accept earrings, rings, chains, crosses, pendants, pendants, bracelets. Each sample may have its own price, which is determined after evaluation. You can donate new and used jewelry.

The cost of yellow metal in pawn shops is less compared to the rate of the Central Bank of the Russian Federation. Each reception point has its own courses. To find out the price of gold, you should determine the Central Bank’s quotes, taking into account an adjustment of up to 50%. If the indicator rises, then the price of metal also rises in pawn shops.

What the pawnshop does not accept

- Orders, medals, except anniversary or commemorative ones.

- Firearms, cold steel. According to Federal Law No. 150-FZ of November 13, 1996, only institutions with special licenses can sell and purchase it.

- Ingots of precious metals, nuggets, blanks for jewelry or loose stones.

- Gold leaf, assembled gilding.

- Elements of industrial equipment, machine tools, laboratory equipment.

- Spare parts for military equipment.

- Zucchini and chicken casserole in the oven - how to cook according to step-by-step recipes with photos

- How dangerous is coronavirus for humans?

- Transport tax may be canceled on Russian cars

Reception of equipment

What equipment can you take to a pawnshop? Computers, laptops, mobile phones, tablets, and household appliances are accepted as collateral. Only the equipment must be in working order. More benefits are given to new or recently purchased devices. For example, an item purchased 10 years ago will not be accepted.

The equipment must not be damaged. The employee inspects the devices for chips, cracks, and abrasions. If there are major flaws, then such a thing will not be accepted. Although in some cities there are points for buying old equipment.

Advantages and disadvantages

Borrowing money from a pawnshop on the security of some property is today a specific way to improve your financial situation, given the level of development of the banking services sector. But there are both pros and cons.

Taking out a loan from a pawnshop has the following positive aspects:

- there is no need to present a document confirming income;

- the terms of the agreement can be extended;

- The loan issuance procedure takes 15 minutes, no more;

- the origin of the thing does not matter (if it was stolen, the borrower

); - a large list of things accepted as collateral;

- if it is impossible to repay the debt, your credit history will not be damaged and you will not have to face extortion.

Negative nuances include the following circumstances:

- the item being handed over is valued as low as possible - the cheaper it is, the more the client will have to pay in interest;

- the interest rate is higher than in banks.

If you need to get a more or less large amount, it is better to turn to a banking service. It may be more profitable to take a gold item to a jewelry store, but then it will actually be sold.

Ransom

Each pawnshop sets its own rules for the delivery and redemption of items. Usually the product is pledged for a month, so interest is paid for this period. When the time has come, the client can return the money and pick up his item. He also has the right to extend the contract if he pays interest.

You can buy an item not only after a month, but even earlier. Then the interest is recalculated and the overpayment will be less. You can return funds immediately or in installments. Money is given upon receipt of the item.

Pawnshop services are convenient because loans are processed very quickly. In this case, you do not need to collect documents, as is required to obtain a loan. And if you pay for the item on time, you can get it back.

Anti-fraud

A few rules that will help protect both the pledged item and your money:

- At the pawnshop, ask to show you documents confirming institution status

. Some consignment stores only imitate the activities of a pawnshop: such establishments can sell a “pledged” item at any time, because

from a legal point of view this is not collateral

.

- Carefully check the list of pledged items in the contract. Sometimes an employee may simply not indicate an item - either through inattention or with dishonest intent.

- information about the item left as collateral meticulously

. The fact is that sometimes the wrong item may be returned to the client, but only one that matches the description. You can even take a witness with you who will be an independent party in case something happens. - Hand in the item either in an envelope or in a box.

It is advisable to fill both of them. Moreover, you can also take a photograph of the item outside the packaging and the seal on the packaging when the item is already inside. Otherwise, there is no guarantee that your property will not be used, and because of this it may become unusable.

If a pawnshop employee refuses to provide documents from the establishment under various pretexts, this is already extremely suspicious

.

Important! It is best to use the services of pawnshops that are part of a network of such institutions.

Remember that you cannot invest money at a pawnshop at interest.

, as in a banking organization.

If you are offered such a service, it is illegal

.

What is accepted as collateral?

The collateral must be liquid, i.e. there should be good demand for it. Thanks to liquidity, in case of problems, the collateral can be quickly sold, which will cover expenses and even bring a small profit to the pawnshop.

The collateral must have objective value. Therefore, no one gives a loan against a document: this paper has value only for its owner, but not for several hundred thousand people. So what do pawn shops accept? Anything that falls under the above two conditions:

- Jewelry, precious metals and bullion;

- Expensive accessories - watches, cufflinks, sometimes even branded glasses;

- Equipment - from smartphone to video camera;

- Expensive items made of leather and fur;

- Vehicles from bicycle to yacht, etc.

Tip 1. Choose a pawnshop

Despite the fact that over the past 2-3 years the pawnshop market of the Russian Federation has become more civilized and cleared of openly fraudulent schemes, not all financial companies are equally reliable. We recommend working with network companies that have more than one branch to serve clients - they care about their reputation, constantly improve the quality of service, and ensure the maximum level of security for operations, property and personal data of clients. It is also better to avoid the services of pawnshops with a short history and carefully study the information on the corporate website - the presence of permits and licenses is a guarantee of the legality of all operations.

What does it mean to pawn a thing?

Pledge is a type of guarantee, a way to secure the financial obligations of the borrower. Its concept is defined in Article 334 of the Civil Code of the Russian Federation.

Civil Code of the Russian Federation Article 334. The concept of pledge

By virtue of the pledge, the creditor

under an obligation secured by a pledge (the pledgee)

has the right, in the event of non-fulfillment

or improper fulfillment by the debtor of this

obligation, to receive satisfaction from the value of the pledged property (the subject of the pledge)

preferentially before other creditors of the person who owns the pledged property (the pledgor).

In cases and in the manner provided by law, the pledgee's demand may be satisfied by transferring the pledged item to the pledgee (retaining it with the pledgee).

The pledgee has the right, in preference to other creditors of the pledgor, to obtain satisfaction of the claim secured by the pledge also at the expense of:

- insurance compensation for loss or damage to the pledged property, regardless of whose benefit it is insured, unless the loss or damage did not occur for reasons for which the pledgee is responsible;

- compensation due to the pledgor provided in exchange for the pledged property, in particular if the pledgor's ownership of the property that is the subject of the pledge is terminated on the grounds and in the manner established by law, due to seizure (redemption) for state or municipal needs, requisition or nationalization, as well as in other cases provided by law;

Read completely

Source

The procedure for the practical application of collateral is regulated by §3 of Chapter 23 of the Civil Code of the Russian Federation.

Simply put, if a person takes out a loan from a pawnshop and does not repay it on time, the right to dispose of the pledged property passes to the creditor - the pawnshop can sell the item or, for example, rent it out.

A typical example of collateral is a mortgage. But here the debtor’s obligations are secured not by valuables, but by real estate - an apartment, a garage. Registration of such a pledge requires mandatory registration with Rosreestr, and therefore a mortgage is a complex and lengthy process. Working with a pawnshop is easier and faster.

The pawnshop has the right to accept only movable property from the client. Only banks and microfinance organizations are engaged in registering real estate as collateral.

Dispelling the Myth of Pawn Shops

I'm sure that as soon as you read the phrase "pawn shop", something like the following picture comes to mind: an old fat guy in a T-shirt with a wife beater, sitting behind the counter watching TV, with a cigarette dangling from his mouth. Maybe even a gun and a dog next to him, and random things piled up in the aisles everywhere.

Well, believe it or not, there are a few pawn shops that don't fit into this stereotype. In fact, some of them are very clean and professional - such as the National Pawnshop in Kharkov. So don't let preconceived notions stop you from saving money.