What is gold reserve and what is it for?

Quite rarely there is a decrease in price of this precious metal. This is not paper money, which is subject to the devastating consequences of the elements. Metal does not burn, is not afraid of water, and does not deteriorate over time.

Therefore, having such currency in sufficient quantities, you do not have to fear inflation and various financial shocks.

The President of the Russian Federation personally instructed the Central Bank to increase purchases of precious metal from mining enterprises. This, on the one hand, is support for local industrialists, and on the other, an increase in state reserves of the precious metal.

Learn how to determine the authenticity of gold yourself

Mining and production of yellow metal in Russia

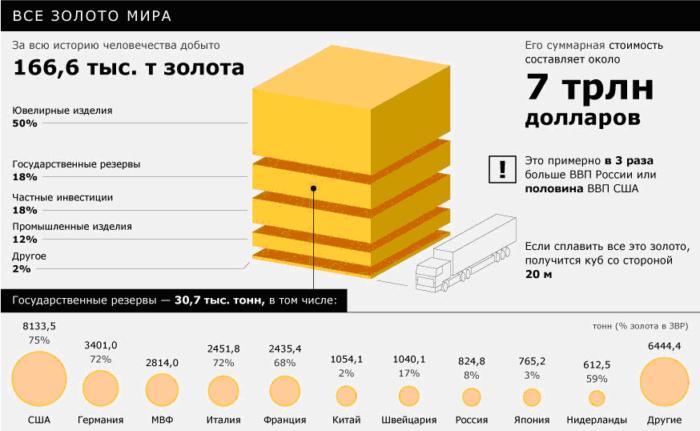

First, about gold mining in the Russian Federation. The US Geological Survey has published global production data for 2021. The Russian Federation closes the top three, behind only China and Australia. In Russia, more than 300 tons of this metal are mined per year.

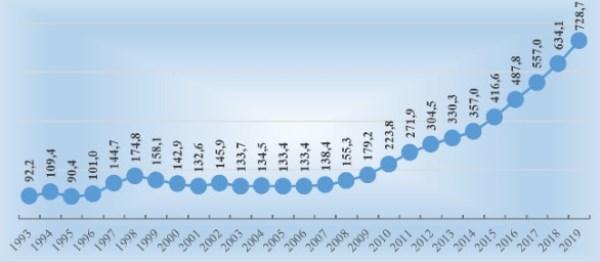

Table 1. Dynamics of gold mining and production in the Russian Federation

| Years | Tons |

| 2010 | 202,5 |

| 2011 | 210,5 |

| 2012 | 224,7 |

| 2013 | 254,8 |

| 2014 | 288,5 |

| 2015 | 293,8 |

| 2016 | 297,4 |

| 2017 | 318,1 |

| 2018 | 331,8 |

Source: Union of Gold Miners

Among the largest domestic mining companies:

- PJSC "Polyus"

- OJSC "GK Yuzhuralzoloto"

- GC "Petropavlovsk"

- Assets in the Russian Federation of JSC Polymetal and Kinross Gold.

Rice. 1. Smelting of precious metal ingots

But in order to increase the share of the yellow metal in its gold and foreign exchange reserves, Russia not only replenishes it with newly mined raw materials, but has been considered the largest buyer of gold for seven years in a row. The country accepts metal to pay off old debts when paying off some projects. In addition, the size of exports of the yellow metal has also been reduced. At the end of 2021, 17.05 tons were supplied to foreign markets, against 56.6 tons in 2021 and 75.66 in 2014.

gold reserve

People have been accumulating gold in Russia since time immemorial. Only the supply of this metal was not a constant value. It could increase, or it could practically disappear, then be reborn again. His ups and downs were directly influenced by the events that shook the country. As of April 1, 2021, 2,168.35 tons are stored in the reserves of the Russian Federation, in monetary terms 487.803 billion dollars.

“For the first time in history, Russia’s gold and foreign exchange reserves fully cover the external debt of both the state and the commercial sector” (V. Putin)

How much gold does Russia have and why does it need it?

The Central Bank of Russia reported on the continued growth of gold and foreign exchange reserves and, in particular, gold, the share of which in these reserves is gradually growing

In February alone, reserves of monetary gold in Russia increased by 2.4%. This is a very high pace. It should be noted that “monetary” does not mean “stored in coins” - our gold of the highest standard is cast into standard bars.

Touch the reserves

With the current price of gold at $1,293 per troy ounce (31.1 g), this equates to 2,204 tons of the yellow metal in our reserves.

By the way, visually this amount does not look very impressive: gold is 19.32 times heavier than water, so a ton of gold is only 51.75 liters, a little more than two and a half office 19-liter bottles of water.

This text was written today, March 8, so another illustration is appropriate. If all our treasury gold of the highest standard is cast into elegant gold necklaces of the 585th standard, 20 grams each (in stores, these cost from 80 thousand rubles, without diamonds), we will get 188 million jewelry - enough for all the women of the former USSR and a little would remain.

Another valuable feature of our gold reserves, which distinguishes them favorably from, for example, the American 8200 tons of gold, is that our reserves... exist. The Central Bank of Russia sometimes conducts excursions to gold vaults and allows journalists there, but even the US President himself cannot get to the American storerooms located in the town of Fort Knox. There is no audit of reserves, and one of the shipments of American gold exported to China turned out to be dyed tungsten (the density of tungsten is 19.25 g/cm3 - almost equal to the density of gold).

However, the United States is not ready to admit problems with its gold - the consequences will be too serious. The gold standard has long been abolished, but the psychological role of the yellow metal remains extremely high. It is easier for Americans to throw away trillions on some kind of carpet-blanket humanitarian aid than to let inspectors into the basements of Fort Knox.

Why gold?

By the way, have you ever wondered why gold was the basis of the economy of human civilization from the time of the Sumerians until the 1970s? What makes it unique?

Firstly, gold is a so-called noble metal, that is, it does not easily enter into chemical reactions, including with such a strong reagent as oxygen. Have you seen how bronze statues turn green, how iron and other metals rust? This is oxidation, interaction with oxygen. Antioxidants, moderators of this interaction, are an essential part of our modern life. But gold doesn’t care, it doesn’t deteriorate. And besides, it has antibacterial properties.

Secondly, gold is an extremely malleable, plastic material. It can be pulled into incredibly thin threads and rolled into transparent (!) plates. Gold holds up where other metals break and tear.

There is little gold on earth and it is difficult to get. At a mine in the Magadan region. Photo: www.globallookpress.com

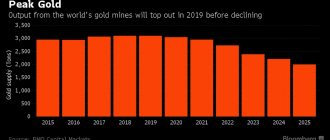

Thirdly, there is little gold on earth and it is difficult to get. It is not subject to inflation, because the growth rate of gold production (when there is such growth at all) is inferior to the rate of economic development. In this way, it is possible to reduce the price of gold, but it is a very expensive pleasure.

All this (plus the highest electrical conductivity and some other properties discovered in modern times) makes gold indispensable in industry, and scientific and technological revolutions only increase the need for this metal. It’s not for nothing that Russia and China are actively increasing their reserves: gold will come to the global forefront more than once.

By the way, to support Russian manufacturers, the Ministry of Finance proposes to abolish VAT on gold bars - this will stimulate the development of the domestic electronics industry.

Military spending

A wonderful series of articles by Valentin Katasonov is devoted to the economic role of gold in the modern world, and we will tell you about the history of the Russian gold reserve. This is by no means idle reading - the power of gold is such that many facts from the past directly affect the future. This also applies to some of Russia’s “golden demands”, which are rooted in events a century ago.

105 years ago, before the outbreak of the First World War, our gold reserves were the largest in the world - 1311 tons. Such prosperity, by the way, became one of the factors that prompted us to get involved in this ill-fated European cabal: the government decided that the country was more than provided with the resources for a small, victorious war. Several hundred tons of gold went to Great Britain as a guarantee for the repayment of loans that were issued to us for the purchase of military equipment.

Yes, yes, for the British, Russia’s involvement in the war was, among other things, the opening of an excellent market for stale weapons. Selling excess reserves that will be used against your main competitor for full gold is an excellent move, unfortunately underestimated by the Russian command.

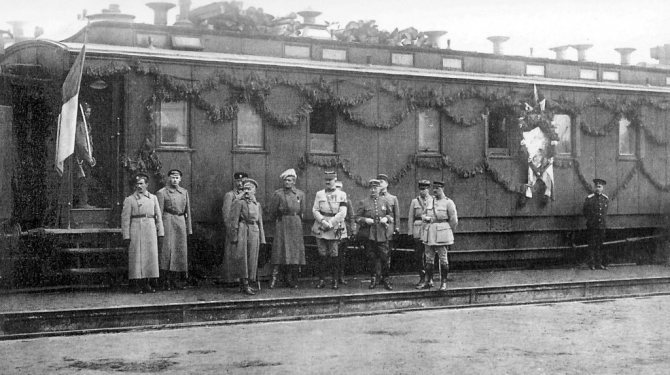

After the revolution, the empire's gold reserves became the object of hunting by a variety of forces. The Bolsheviks, having taken possession of the treasury, sent it from Petrograd to the Volga region - there was a real danger of the capital being captured by troops loyal to the oath. But the Whites also found gold in Kazan - in August 1918, almost the entire reserve was captured by the troops of Colonel Vladimir Kappel.

Under the pressure of the Reds, gold moved further to the east - Ufa, then Omsk. It is clear that in the midst of that confusion, the treasury was “drying up” before our eyes: an audit carried out by the government of Alexander Kolchak showed that of the approximately 850 tons that the tsarist government had at the time of its fall, only 505 tons remained. Kolchak also spent a fair amount, and the Czech troops who ensured the safety of the “golden echelon” did not fail to profit: in general, at the time the gold was returned to the Soviet authorities (this was one of the conditions of the compromise with the Czechs, who really wanted to leave inhospitable Russia), the treasury had shrunk to 323 tons

Golden echelon. Photo: www.globallookpress.com

Bottom and recovery

Thus, it took less than six years to spend almost a thousand tons of gold. The beneficiaries of this Stakhanovite movement were Great Britain, Czechoslovakia, and Japan, where the White Guards hid several tens of tons of gold from the Bolsheviks. Moreover, if losses from military trade and robberies have long been written off, then no one gave the Japanese gold - in theory, it should lie in bank vaults awaiting the heirs of its owners. And this heir, as we see from history, is, of course, the Russian Federation.

But the “drying out” did not stop at 323 tons. In the first years of their power, the Bolsheviks were anything but zealous masters; moreover, the country had to be restored after the bloody mess of the Civil War. As a result - 150 tons of gold by 1928. This became the lowest point in the entire modern history of Russian gold.

After this, at the cost of incredible efforts of the people, the gold reserves grew at an incredible pace - up to 2800 tons by 1940, a record that has not been broken to this day. Here Russia was again needed by the “civilized world” to redirect Hitler’s armies from the Western Front to the Eastern Front - and gold again flowed from the country, which then needed literally everything.

As we see, Nicholas II and Joseph Stalin actively accumulated gold in order to use it in difficult times. Yuri Andropov, who came to power after the great spenders Nikita Khrushchev and Leonid Brezhnev (they spent more than 2,000 tons in 19 years), tried to follow the same path.

Euro up, gold down: Central Bank lost $3 billion of reserves in 3 days

However, after Andropov’s death, the gold reserves began to melt at an increased rate: from 720 to 290 tons in just six years (1985-1991), when we did not seem to be at war with anyone. In the 1990s, under Boris Yeltsin, the reserve grew somewhat: the country survived on oil, not gold. And Vladimir Putin followed the path of Nicholas II and Joseph Stalin: since 1999, the volume of gold in the Central Bank’s vaults has increased almost fivefold. And, apparently, achieving Soviet records is not far off.

* * *

An analogy suggests itself: an increase in reserves leads to war. This is indeed so, and the war has already begun, an economic war, long, hypocritical, with friendly visits and shaking hands, a war of attrition. And in this war you can only rely on your own resources, and one of the most reliable is gold, without which a successful industry is unthinkable.

The value of the ruble will change, the dollar will change, the value of gold will not.

Back to the past!

In 1865, 57 tons of precious metal were stored in state banks. By 1914, the gold reserves of the Russian Empire were estimated as the largest in the world and amounted to 1,311 tons. At current exchange rates, this is about 60 billion dollars.

Russian storage facilities were pretty much devastated by the First World War. But by 1917, there were about 850 tons of gold, silver and platinum bars in the bins.

In 1928, there were only 150 tons of the country's gold and foreign exchange reserves. But by the beginning of the Great Patriotic War, in 1941, there were 2,800 tons of ingots in the Goskhran safes. Half a century later, the reserve had decreased by 10 times and amounted to only 290 tons. Until 2007, it was still being replenished unevenly. But from that time on, steady growth began.

Table 2. Russia's gold reserves (at the beginning of the year)

| Years | Billion dollars | Tons |

| 1993 | 4,532 | 267,28 |

| 1994 | 8,894 | 317,15 |

| 1995 | 6,506 | 262,2 |

| 1996 | 17,207 | 292,79 |

| 1997 | 15,324 | 419,59 |

| 1998 | 17,784 | 506,88 |

| 1999 | 12,223 | 458,47 |

| 2000 | 12,456 | 414,51 |

| 2001 | 27,972 | 384,4 |

| 2002 | 36,622 | 422,97 |

| 2003 | 47,793 | 387,67 |

| 2004 | 76,938 | 390,19 |

| 2005 | 124,541 | 386,96 |

| 2006 | 182,240 | 386,86 |

| 2007 | 303,732 | 401,48 |

| 2008 | 478,762 | 450,34 |

| 2009 | 426,281 | 519,58 |

| 2010 | 439,450 | 649,03 |

| 2011 | 479,379 | 788,62 |

| 2012 | 498,649 | 882,96 |

| 2013 | 537,618 | 957,76 |

| 2014 | 509,595 | 1035,21 |

| 2015 | 385,460 | 1208,19 |

| 2016 | 368,399 | 1414,54 |

| 2017 | 377,741 | 1615,19 |

| 2018 | 432,742 | 1838,78 |

| 2019 | 468,495 | 2113,36 |

Source: World Gold Council

Since the collapse of the Soviet Union, reserves of the yellow precious metal have increased by 7.3 times, over the past ten years - by 3.3 times.

Rice. 2. Change in Russia’s gold reserves, as a percentage of the 1991 level.

The current dynamics of the increase in gold and foreign exchange reserves will allow the Russian government to fight rising inflation, compensate for devaluation and guarantee the preservation of the ruble exchange rate for 2019.

For reference! Why is the global demand for gold falling?

Features of gold mining in the country

In Russian practice, there are different methods for extracting gold from earth rocks. There are both underground mines and open deposits. Some methods involve metal production using complex chemicals. Mining can seriously harm the environment. At the state level, problems of regulating the activities of companies of this type are being developed. Places where gold is mined in Russia often require serious measures to restore flora and fauna after work has been carried out and the deposits have been devastated.

Mines are divided into different types depending on how much gold is contained in a ton of rock. Those that have up to 10 grams of valuable metal in their soil are considered rich.

Resource extraction technologies have been improved over the years, but among them we can list several of the most common:

- The use of dredges - special mechanisms for washing sand extracted from the bottom of rivers or from the banks.

- Manual washing of sand using mini-dredges or nets.

- Chemical extraction of metal from rock, which involves the use of mercury or sodium cyanide.

The first two methods are considered the most environmentally friendly in the region; they are fundamental for this industry. Since there are still many rich deposits in the country, the question of how gold is mined in Russia does not imply much damage to the area surrounding the deposit. Generally, the use of harmful chemicals is required on already depleted rocks. When a mine has almost exhausted its resources, the remaining gold is extracted from it using environmentally unfriendly methods.

Gold mining technology is poorly improved for many reasons. Despite the availability of progressive methods from the field of chemistry and mechanization of work, the process requires a large involvement of unqualified personnel. Much work is done manually. And the labor productivity of each employee in domestic mines is 7-8 times less than in similar industries in the USA and Canada. Russia is ahead of many countries in this industry not so much due to innovation, but due to the round-the-clock work of a huge number of low-skilled workers. With this approach, one cannot expect serious progress in the industry. And yet scientific progress is not alien to this area of economic activity. It concerns exploration methods, extraction technologies, and development of tools.

Demand for precious metal

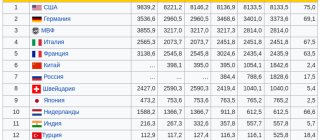

In 2021, central banks of different countries increased their gold and foreign exchange reserves. Main buyers (tons):

- Russia – 223.

- Türkiye – 86.

- Kazakhstan – 42.9.

- Colombia - 4.6.

- Venezuela – 4.4.

- Indonesia – 2.5.

- Jordan, 2.2.

- Kyrgyzstan – 1.8.

- Thailand - 1.6.

- Mongolia – 1.3.

Demand in industry and jewelry production has also increased. The main consumers of jewelry are India and China. They account for 57% of the world's volume.

Gold price statistics for the year show negative dynamics. The cost of an ounce fell from 1327.05 to 1210.15 dollars. However, analysts predict an increase in quotations. Against the backdrop of a possible US trade war against China and the EU, by the end of 2021 they will reach $1.5 thousand per ounce.

Reflecting investor demand, the gold rate at Sberbank of the Russian Federation is steadily growing. As of September 4, 2018, its price is RUB 2,617.34. for 1 g.

United States

Large-scale gold mining in the United States began in the mid-19th century. Ingots of the precious metal were discovered in California. Many films are about the California fever. Global gold production statistics show that the United States held the lead until the early 20th century. After which gold production in America began to decline:

- 2000 - 353 tons;

- 2005 – 256 tons;

- 2010 – 231 tons.

Gold statistics place the United States in fourth place in the world rankings. The average production is about 230 tons. The main volumes of the precious metal are mined in Alaska and Nevada. Mining is carried out by large and small companies, as well as private prospectors.

Exchange rate fluctuations

The price maximum was reached in 2011. For a year and a half, quotes fluctuated in the range of $1,500–$1,800. In the spring of 2013, prices dropped sharply to $1,180. In 2015, the price reached its minimum of 1,045.4. In 2021, the cost of an ounce reached $1,250.

There is no consensus among investors regarding further changes in prices for the precious metal. However, gold growth statistics show positive dynamics.

Main factors:

- economic instability in the world;

- rising political tensions;

- threat of terrorism;

- local wars.

Statistics on rising gold prices show that at the end of 2021, demand for the precious metal increased by 6%. However, overall the figure fell by 7%. At the beginning of 2021, quotes rose to $1,350 per ounce.