From the article you will learn:

Hi all! Today we will talk about trading gold on Forex on my trading blog WebMasterMaksim.ru, we will analyze the strategy and I will give you an advisor that is currently showing very good results, I am currently testing it on demo. As you probably know, gold is a metal that will never depreciate in value, the price may TEMPORARILY fall, but in the end it is always in value. And therefore, Forex gold is more stable than various currencies and it is not subject to a very rapid loss of price, no matter what global financial crises occur, or no matter what currencies depreciate, gold has always been on top! For example, a country may become bankrupt, its currency will turn into paper, and gold will only decline in price for a while!

Trading gold on Forex (XAU/USD) – strategy, forex gold advisor

Is this why many experienced traders choose gold for Forex trading? Alpari even has gold PAMM accounts.

Gold is considered the best way to preserve your capital; for many centuries, people have invested in this precious metal. By the way, read the article - Where is it profitable to invest money in Russia?

But, Forex gold does not offer us to invest in the metal, but offers us to trade.

Watch the video:

Content

- General conditions for trading gold

- Gold trading strategy based on news

- Fundamental Gold Trading

- Intraday gold trading: EMA+MACD+MFI strategy

- Gold Trading Strategies DrakeDelayStochastic

- Some features of gold trading

- Instead of a conclusion

Today, this valuable metal, the most “emotional” and reliable financial instrument, is traded on Forex as a regular spot asset. In addition to direct gold trading, its active dynamics are used as a leading indicator for ordinary assets.

How to determine gold forex symbol

The Forex gold symbol also appears in another combination – XAU/EUR. True, the pair with the European banknote is not so popular.

The asset is measured in troy ounces (31.103 g). One lot contains 100 ounces, which is approximately $160,000. Not everyone has such amounts, which is why investors have to resort to leverage. So, using its value of 1 to 100, you can reduce the cost of the contract to 1.5 thousand.

The movement of the asset is not subject to strong fluctuations; it is mainly carried out in a narrow range.

Trends live for a long time, and global trends change once a decade. A unidirectional change in value often lasts for several days, which makes long-term investing profitable and scalping ineffective. Although intraday trading can generate income, it is true that it is not so significant.

On Forex, the designation of gold, which makes up two strong pairs with the most popular monetary units of the market, indicates that operations with it can be carried out using the usual methods of technical and fundamental analysis. All known indicators, tools and oscillators are suitable for it, for example, Fibonacci levels and moving averages.

General conditions for trading gold

Gold is a historical safe-haven asset and its price is constantly rising. Even with the slightest hint of any problems, investors, saving their capital, withdraw funds from dangerous transactions and invest them in non-ferrous metals.

Exchange trading in gold involves fixing quotes at 10:30 and 15:00 London time; it is during this period that most players either close transactions or already decide on positions for the next day. It is this period of time that is recommended for trading gold on Forex.

With high (and potentially profitable) volatility, all Forex assets involving gold have a fairly high spread, and therefore at least medium-term transactions will be the most profitable.

In addition to the high spread, most brokers set a high collateral value for the lot for gold, and therefore for stable gold trading you need a decent deposit (from $10,000). This deprives many novice traders of the opportunity to work with this asset, which, in principle, is correct - trading gold without sufficient experience is very dangerous.

Where else can you trade gold?

In addition to Forex, there are several other trading platforms. Here is a list of the most popular:

- Chicago Mercantile Exchange (CME). Exchange indicators show up-to-date information on quotes around the clock. Disadvantages: expensive maintenance and high contract prices.

- Russian MICEX. The service is cheaper here. Disadvantages: low liquidity, work not around the clock.

- New York Mercantile Exchange (COMEX). Futures and options transactions predominate here, i.e. contract trading. Exchange participants are large global companies.

- London Stock Exchange (LSE). Trades are carried out through brokers. Conducts trading with standardized gold bars. Prices in this market are used as the basis for many long-term contracts.

For small traders, Forex is the most accessible.

Gold trading strategy based on news

This type of trading may seem effective, since the rate of this asset, in addition to the usual statistics, is influenced by all political and economic factors, reports of global disasters, terrorist attacks, crises, etc. The problem is that gold has complex connections with adjacent markets (stocks , raw materials and other derivatives), as well as with politics, so it is very difficult to predict his reaction to news information.

The dynamics of gold do not follow standard logic and, as a rule, do not correspond to economic data. A reaction to US or Eurozone statistics may not cause a movement in the gold rate at all, while at the same time, for example, a fall in Asian stocks in the morning stock market can cause a sharp drop in spot gold assets or those dependent on currency pairs in the European Forex trading session.

Therefore, news trading tactics can give reliable results only in the event of any force majeure situations with a clear outcome - positive or negative, for example, a natural disaster or a sharp drop in the stock market. In such cases, gold grows as usual and you can have time to “jump in” to quick purchases.

In general, it is not recommended to trade gold using conventional news methods - its speculative volatility with a high spread and large collateral value can be very dangerous.

Fundamental Gold Trading on Forex: Correlation Strategy

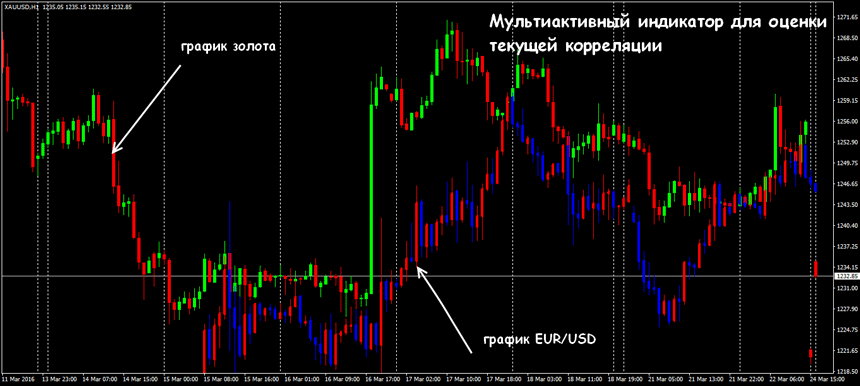

It is believed that the gold sports asset - the XAU/USD pair is quite reliably correlated with the main assets (EUR/USD, AUD/USD, USD/CHF), as well as the dollar index and the price of oil (on WTI - stronger, on Brent - weaker ). You need to understand that before using cross-correlation in a trading strategy, you need to check its current state. Classic recommendations may no longer be relevant. Below is the calculation of the correlation of XAU/USD with major pairs:

From a fundamental perspective, XAU/USD consistently maintains a strong positive correlation only with the Australian dollar (AUD/USD), so the RBA constantly has to balance its gold and foreign exchange reserves, and other Central Banks need to buy Aussie for mutual settlements. Gold reacts actively to all fundamental data from Australia; a weaker, but still active positive correlation is observed with the NZD/USD pair.

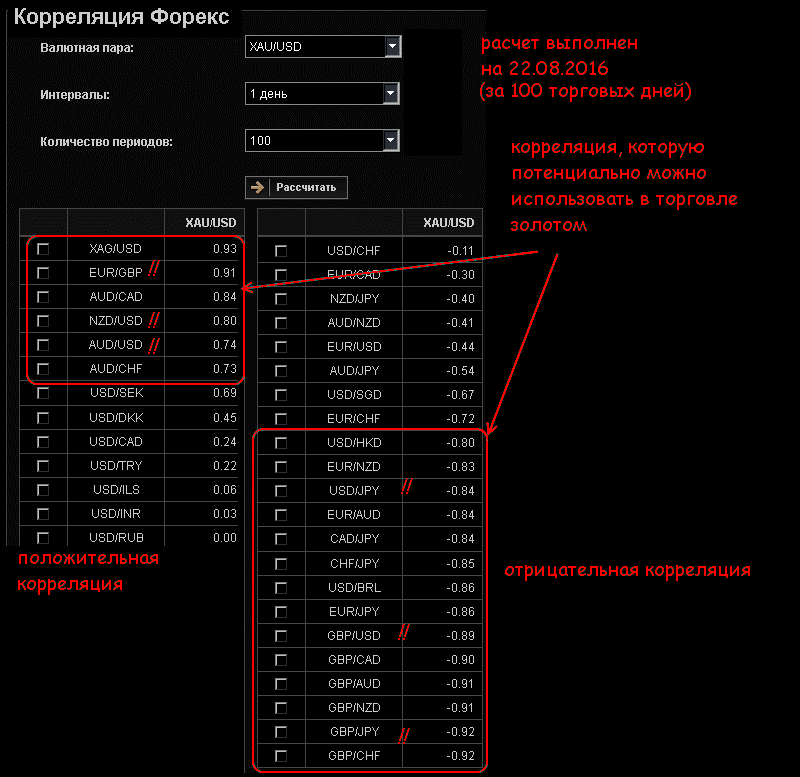

Intraday gold trading: EMA+MACD+MFI strategy

Central banks, commercial banks, industrial groups and other major players are actively involved in gold transactions. Due to the high requirements for deposits in tick volume for gold, there are practically no small transactions (insignificant ticks), and therefore the price movement is quite accurately modeled by the volume movement. You can build a successful indicator strategy on this.

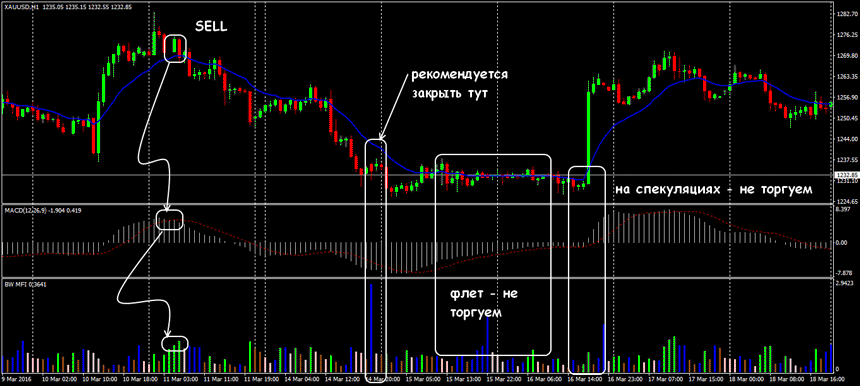

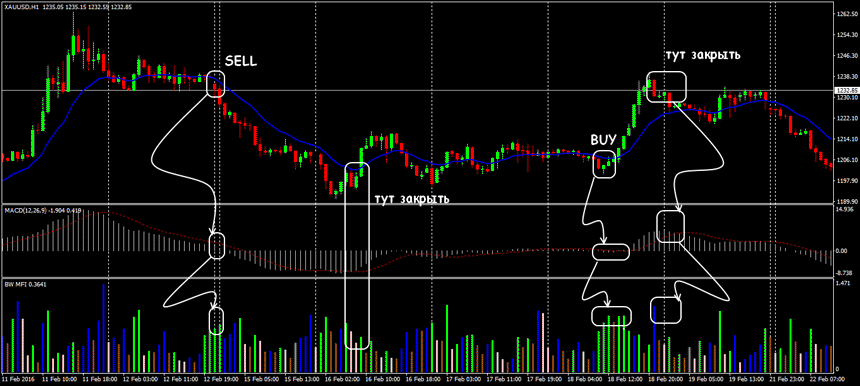

Indicators: EMA(14), MFI(14) and MACD with standard settings.

Timeframe: not lower than H1.

We look for trading signals on technical indicators using the usual methods, as shown in the diagram below. In addition to the correct “behavior” of the moving average and the MACD histogram, we pay attention to the volume histogram.

In a flat, there is a tendency for volumes to decrease, which means you should prepare for a change in direction. The first signal to exit the flat should be given by the MACD indicator, then when the price crosses the moving average in the desired direction, we look for an entry point on a shorter period.

Groups of green (or red) lines should form on the volume indicator, signaling a possible change in direction. We open orders from the market when the price crosses the moving average, but you can also use pending orders. We place our stops behind the average line based on the last reverse max/min. Money management follows the usual rules, but more stringent.

Gold Trading Strategies DrakeDelayStochastic

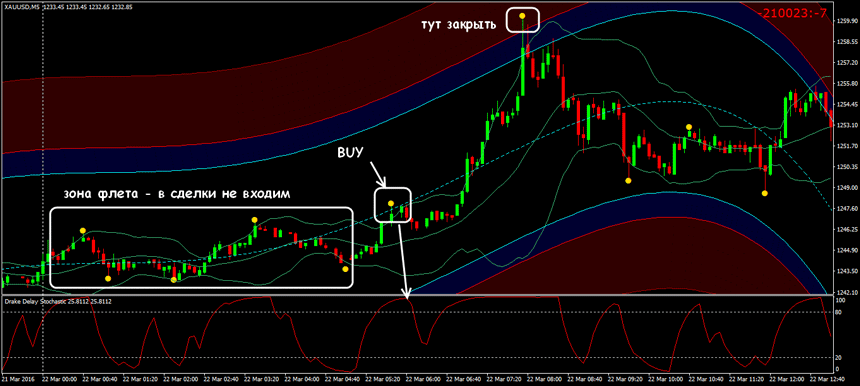

Of the many technical strategies for trading gold, reliable results are obtained by the method based on a set of indicators collected in the Drake strategy. The indicators were developed specifically for trading binary options, and therefore can also be used on Forex.

Indicator:

- HolyCandleTime and HolyChannel - build a wave-like channel and work as a trend indicator;

- HolySignal - shows the signal point and sounds a sound signal;

- DrakeDelayStochastic - used like a regular oscillator, but only for additional confirmation of the entry point;

- BollingerBands - in principle, you don’t have to use it, but it refines the Drake Delay Stochastic signal.

Timeframe: for entering and holding a position - M15.

In the classic version of the strategy, trades are opened when signal points appear in the corresponding zones of the HolyChannel indicator and DrakeDelayStochastic is beyond the overbought/oversold border. But this gives too few signals and their accuracy is not great. Therefore, including the BollingerBands indicator in the strategy provides more probable entry points.

To open a trade:

- the candle must be outside the extreme Bollinger bands (if inside, then we do not enter the market);

- It is desirable (but not necessary) for DrakeDelayStochastic to be in the overbought/oversold zone.

Stops and profits are placed outside the red channel.

What strategies should you use?

In principle, all standard strategies work on this asset; gold is volatile and therefore suitable for both intraday trading and medium- and long-term trading. That is, you can use candlestick and technical analysis, conventional indicator strategies, etc. We will analyze several specific vehicles based on the pricing features of this asset.

Basic Strategies

There are basic and behavioral gold trading strategies. You can add any TS to the basic ones, based on news, technical analysis, indicator analysis of a chart, etc. Behavioral - you need to analyze the behavior of the main players influencing the price of the precious metal.

The simplest basic strategies are news and based on chart correlation with some currency pairs.

As an example of the influence of news, we can cite the period April 12-15, 2013. Then, amid reports that economic growth in China was slowing down, gold fell in price by more than 10%.

The logic of investors is as follows: if economic growth in the 2nd economy in the world decreases, then the demand for gold will fall. Massive sales followed, hence this result. In addition, the yellow metal is used as an insurance against inflation; if the economy does not grow, then deflation is likely, so holding gold in your hands becomes unprofitable.

Another profitable gold trading strategy is to work based on correlation with certain currency pairs. Any online service is suitable for determining correlation.

For example, over the last 100 days for the D1 time frame, the direct correlation is maximum with silver and the AUD/USD pair, the reverse correlation is maximum for the USD/JPY pair.

Correlation data should be used rather as a tool for a general determination of the direction of movement of the chart. The correlation is not constant and changes over time.

It can be added to a gold trading strategy, but only as an additional signal to enter the market. Trading solely on the basis of correlation with other assets is strictly prohibited.

Behavioral Strategies

The trader must, based on the behavior of the main players influencing the price of the asset, predict the development of the situation with the price of the yellow metal. You need to take into account the following data:

- for gold mining companies. If there is a sharp drop in production levels and demand is high, then the price may rise;

- about the demand for gold from central banks. Only part of the country’s gold reserves are stored in bullion; if the Central Bank decides to increase the amount of precious metal, then its price may rise depending on the volume of purchases;

- Don’t forget to take into account all other news, including force majeure.

Gold has risen steadily in price in the past and this trend is likely to continue in the future. But the “buy and hold” tactic is not suitable for everyone; due to the high volatility of the asset, it makes sense to work with it more intensively. So you can’t do without taking into account the specified data.

Some features of gold trading

If gold goes up in price (the XAU/USD pair goes up), then it goes up against all major currencies paired with the dollar (euro, pound, Aussie, franc, dollar). If the dollar strengthens against major currencies, the XAU/USD pair declines.

When the main dollar pairs are in a flat, then most often gold paired with the dollar goes up in price.

When the dollar becomes cheaper against its opponents, gold paired with the dollar strengthens faster than in other pairs.

The influence of oil prices on gold manifests itself in the form of trading signals only if there are no other strong fundamental factors during the day.

The previously popular idea of using the EUR/USD rate as a leading indicator for the gold rate in today's market does not work. To study current correlations, you can use special indicators that show several assets on one price chart, for example - due to the strong connection between gold and Aussie, fans of extreme trading can try trading EUR/AUD or GBP/AUD crosses on a strong movement, but, of course, on periods not lower than H1 and with fairly reliable feet.

Impact of Monetary Policy

Gold is affected by the “value of money”, i.e. interest rates of the Central Banks of each advanced economy. This is not the only relationship - GDP, unemployment and other macroeconomic factors cause a sharp change in the XAU/USD rate as follows: any deterioration in the economy in a developed country raises quotes, and success in resolving negative trends lowers the gold rate.

The global upward trend in gold was stopped after peaking during the 2008 crisis. The subsequent factor stopping growth was a set of measures to reduce interest rates and the introduction by developed economies (following the US Federal Reserve) of quantitative easing programs (QE3). Investors now have access to “cheap” money and an appetite for risk.

The fall was stopped amid tightening of US monetary policy and promises of its further continuation.