One of the stable currencies on the market are precious metals. Therefore, investing in precious metals is the most profitable investment. Such contributions must be made only through verified organizations. Alfa-Bank clients have the opportunity to open a non-physical precious metals account and work with it, making a profit. What is compulsory medical insurance? What are its advantages? How to open compulsory medical insurance Alfa-Bank? You will find answers to these and other questions below.

Advantages and disadvantages of an impersonal metal account

When considering this banking service, clients are interested in the positive and negative aspects of this type of business. You can see the pros and cons of this service in the table.

| Pros of compulsory medical insurance | Cons of compulsory medical insurance |

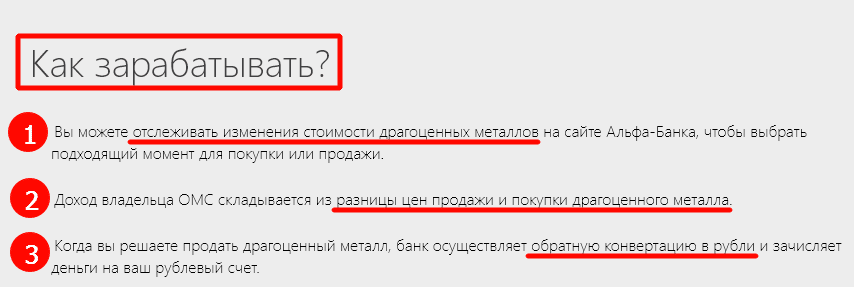

| The client can earn income due to the difference in exchange rates for precious metals. | Without the skills to work with the non-physical precious metals market, the client may make purchases and sales at the wrong time, thereby incurring financial losses. |

| The cost of impersonal metal is as close as possible to world market prices, and not to the cost of physical bullion. | An unallocated metal account is not subject to deposit insurance. |

| When purchasing unallocated metal, you do not have to pay VAT. | |

| As the owner of an OMC, you do not have to pay for the storage of bullion. | |

| The absence of a physical ingot allows you not to worry about damage to the material, which reduces its price. |

Taxation and bonus system

According to the tax legislation of the Russian Federation, the presence of compulsory medical insurance obliges the owner to independently pay tax payments in the amount of 13% of the profit. Regular clients of the bank (at least 3 years) can count on a bonus system that provides for the absence of tax costs (personal income tax is not charged) and free servicing of a personal account.

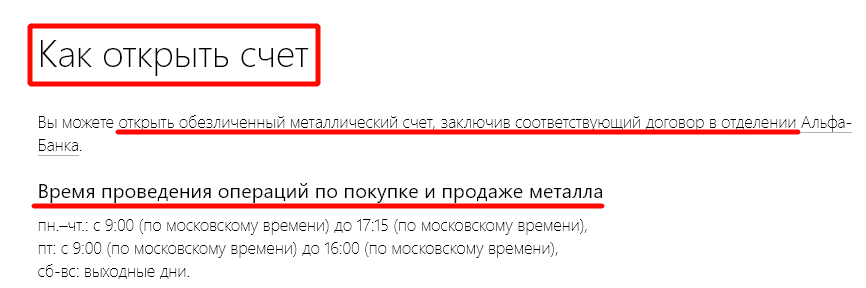

Open compulsory medical insurance at Alfa-Bank

Any individual can become the owner of an impersonal metal account. To open a compulsory medical insurance, you should visit any convenient bank office. The employee will need to present a passport and tax number. A TIN is required to register tax in the event of the sale of an impersonal resource, provided that it has been owned for less than three years. Opening compulsory medical insurance takes a little time, and after completing the paperwork, the client can purchase impersonal metals at the current rate.

Important! Operations for depositing funds can only be carried out at bank branches; this option is not available in the online account.

Investment conditions

The client can deposit any amount into the account, starting from the minimum investment threshold:

- gold, platinum, palladium - 1 g;

- silver - 100 gr.

Are investments in precious metals profitable?

There is no doubt that such an investment can save money from economic shocks, but how long will it take to pay off? When purchasing any gold bar you will have to pay VAT. Moreover, when selling purchased gold, no one will return the money spent for VAT.

It turns out that in order not to go into the red from purchasing gold, you need to wait until the difference between the purchase price and the market price at the time of sale is more than 20 percent. Not a very happy prospect.

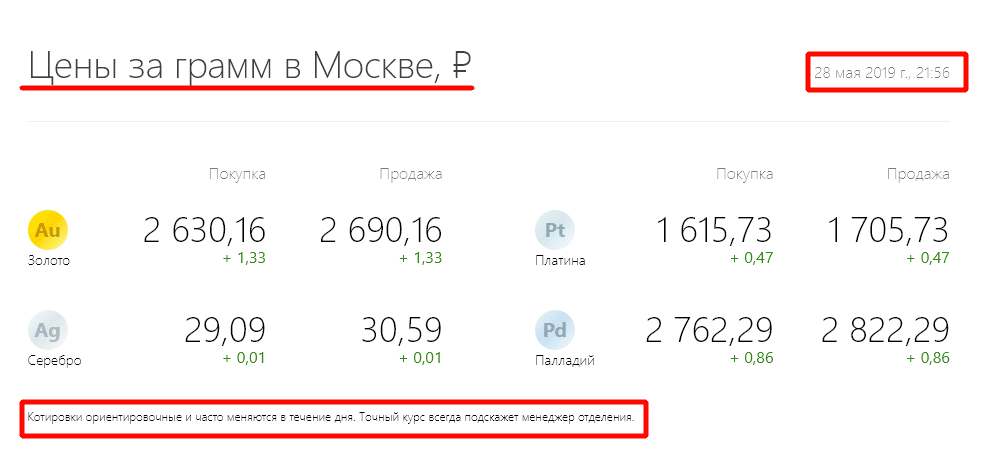

Gold rate in Alfa-Bank

The price of gold is constantly growing, regardless of any factors. Since the market is constantly changing, the price of gold has also ceased to be stable. Current information on the exchange rate for gold and other metals at Alfa-Bank can be found on the official website or at a bank branch.

The gold price is affected by:

- political and economic situation in the world;

- euro and dollar exchange rate;

- state of stock markets;

- supply and demand.

Palladium bars

SuisseGold.ch sells low margin palladium bars including PAMP, Credit Suisse and Johnson Matthey brands for secure storage and delivery worldwide. Ounce palladium bars are the most popular size sold among precious metals investors. Palladium bars are available in a variety of sizes, including 1 gram and 1 ounce. Palladium bars are sourced from major precious metal refineries including PAMP and Valcambi.

Why buy palladium?

Palladium is a member of the platinum group metals (PGMs) and is one of the four major precious metals available for investment. More than 90% of global palladium production comes from South Africa and Russia, making metal prices sensitive to economic changes in these countries.

Palladium is used to make automotive catalysts, so it is also very sensitive to the automotive market. Palladium is much rarer than gold and silver and is therefore more dependent on market conditions. With the recent surge in metal prices, it is becoming increasingly popular among investors as a component of a precious metals bullion portfolio.

Palladium plants

Argor Heraeus

Argor Heraeus is located in Ticino, Switzerland and is one of the world's largest precious metals refineries. Argor-Heraeus produces palladium bars in a variety of sizes, from 1 gram to 1 ounce.

Argor-Heraeus also produces palladium bars for UBS, one of Switzerland's largest banks. UBS palladium bars are available in 2 sizes.

All Argor-Heraeus palladium bars have a purity of 999.5.

PAMP

PAMP palladium bars are also produced in Switzerland. Currently they are only available in the Fortuna series. All PAMP palladium bars come with a serial number and certificate, and can be purchased wholesale or retail.

Valcambi

Valcambi palladium bars are also produced in Switzerland. In addition to the standard range of palladium bars, Valcambi also produces palladium combibars, which are very popular with investors. Valcambi also issues Credit Suisse palladium bars for investors.

LBMA Approved Palladium Bars

For customers looking to purchase competitively priced palladium bars, SuisseGold.ch sells LBMA approved 1 oz palladium bars. These bars are guaranteed to come from an LBMA approved manufacturer and are sold at very competitive prices.

Palladium bars for storage without VAT in Switzerland

For clients wishing to store their palladium bars in Switzerland, SuisseGold.ch offers free accommodation in Zurich (Switzerland). All palladium bars are held outside the banking system, which means they are not reported to government agencies. For this reason, many clients prefer to store gold bars with SuisseGold.ch instead of opening a bank account. Customers can purchase palladium bars using any of 15 currencies.

How much can you earn on compulsory medical insurance?

There is no exact answer about income from unallocated metal accounts. This is primarily due to the fact that the cost of metals changes, sometimes there are significant incomes, sometimes quite noticeable losses of savings. What can be said for sure is that the cost of precious metals will rise as their reserves become less and less. It is very difficult to calculate short-term profit, but longer-term profit can be predicted. For example, in 2007, a gram of gold cost about 700 rubles. Today - more than 2.5 thousand. The economic situation in the world is constantly changing, the national currency does not have sufficient strength, so even experienced brokers cannot provide long-term guaranteed forecasts.

Factors influencing the cost of yellow metal

Dollar exchange rate. When the dollar becomes cheaper, the cost of a gold ounce increases sharply. Everything happens in the inverse relationship when the dollar strengthens against the euro. This is especially true today, when the world currency has risen noticeably in price.

Volume of supplies by major mining companies. Teachers at school also talked about this: the smaller the quantity of a product on the world market, the higher its cost.

Natural disasters and political crises. This factor is also of great importance. It may affect the work of mining companies. In the event of a natural disaster or crisis, various difficulties may arise in the extraction of minerals, and this will lead to a decrease in the amount of gold supplied to the world market and therefore the price per ounce will increase significantly.

Activity of state banks of developed countries. State banks of large countries, consumers of gold, can play a huge role. When deciding to increase gold and foreign exchange reserves, state banks begin sharp purchases of precious metals, and these actions significantly increase the demand for gold. Because of this, the market value of the yellow metal increases significantly.

The situation in developed countries. Demand for the yellow metal can be significantly increased not only by state banks of developed countries, but also by ordinary residents. As income levels increase, citizens begin to buy more and more jewelry, thereby increasing demand.

Investor behavior. This factor should not be ignored either. Every year, experts increasingly talk about the significant role of investors in determining the value of precious metals. When buying gold directly or gold-containing goods, they create a huge demand for the yellow metal.

As you know from an economics textbook, the greater the demand for a certain product, the higher its price will be.

The reason for buying may be not only financial instability and fear of losing all cash, but also an improvement in the quality of life in a certain state.

Gold mining companies influence quotes in one form or another.

Speculation on the world market. Do not forget about such an important indicator as the presence of rumors. They can have a very strong impact on the price of the precious metal. Very often, rumors are spread by companies that mine the yellow metal. Like everyone else, they strive to get as much profit as possible, which is why they resort to such tricks.

Reviews about compulsory medical insurance at Alfa-Bank

There are practically no reviews on websites about impersonal metal accounts at Alfa-Bank. In a few messages, users note the incompetence of employees.

User Nikolay Gruzdev on a review site shared his experience of buying silver on compulsory medical insurance. For several days there was no manager at the bank branch to transfer funds to the impersonal account. Then there was a technical glitch in the program that prevented the purchase of silver. Despite active interaction with the employee, Nikolai saw that the money was still in the account and had not been converted into silver. Thus, the client was unable to purchase metal at a price that suited him due to technical failures and the absence of an operator in the office. A bank representative invited Nikolai to the branch to resolve the issue.

Silver coins or bars: what to choose?

Which is better, silver coins or bars? Why are some better than others? Are they both profitable properties for collectors and investors? Are the benefits of silver coins and bars different?

Here are the pressing questions that a buyer may face. We will try to answer these questions below.

What is the difference between silver bars and coins?

Bars and coins differ in physical form and purpose. State coins have the status of legal tender. Ingots are manufactured purely for storing and trading silver. The authorities do not define them as money.

There are several other differences between silver bars and silver coins:

Size

Silver coins come in different sizes, ranging from a diameter of 1 cm and a weight of several grams. The vast majority of silver bars weigh 1 ounce or more, but most weigh around a kilogram.

Form

Coins are generally shaped like flat circles, while most bars are rectangles. However, silver coins are not always round, and bars are not necessarily rectangular in shape.

Try

American Eagle Silver Bullion Coins are made from .999 fine silver. Other silver coins may be 0.900 or 0.925 fine. Most bars from leading refineries are created from 0.999 pure silver.

Design and lettering

Depending on the issuing country, there may be different inscriptions on the surface of the silver coin. They report the denomination, country of issue, year of issue and other information. Silver bars often contain only the refinery's logo and inscriptions about the weight and fineness of the metal.

So which is better? Silver coins or bars?

There is no clear answer to this question, because bars and coins have special advantages.

Silver coins are in demand among investors and collectors. Silver Eagles are legal tender, but they have a denomination of 1 US dollar, and the price is higher than the price of the precious metal.

Partly because of this, consumers on a budget are choosing to buy silver bullion. The premium for bullion is less than for silver coins.

Silver bars are easier to store than coins. This is due to their rectangular shape and lack of a high relief surface.

Per gram, you can buy more silver at a lower price in bullion form. Thanks to the special geometry, the vault can accommodate more silver in bullion than in coins.

However, in the event of a crisis, silver coins can be used for barter trade without problems.

However, if silver prices ever fall to historical lows (anything is possible), then the value of the coins will be equal to their face value.

If the price of silver falls below a dollar per ounce, the silver Eagle will be worth less than the coin's face value. However, this is an unlikely scenario in the 21st century.

There are at least two types of buyers for silver coins: investors and numismatists. There are not that many collectors in the bullion market.

Since there is no clear answer to the question of which is better, bars or coins, it all depends on the subjective preferences of the buyer. Either way, it's worth buying your silver bars and coins from a reputable dealer like .