15.11.2019

A pawnshop is a commercial organization specializing in issuing cash loans secured by valuable property. When visiting a pawnshop, not every client will think about how the interest on a loan is calculated. The average client simply brings an item as collateral, hears the loan amount with interest and, if he is satisfied with it, agrees to the processing. However, it would not hurt to find out how the interest rate for a loan is formed, what the indicators are based on and how it is all calculated.

Possession of this information will protect clients from irretrievable loss of pledged property associated with late repayment of the secured loan amount. It is advisable to study the issue before you contact the pawnshop.

What is a pawnshop?

First of all, pawnshops are participants in the microcredit market.

They issue money against valuable property, and the loan must be repaid with interest. Pawnshops are primarily aimed at earning interest. After all, they need money that can be spent on issuing new loans, and not the debtor’s belongings. Therefore, unclaimed property is quickly sold to replenish the balance.

This is the main difference between pawnshops and consignment stores, which simply sell donated items and receive a reward for this - a commission.

At the same time, unscrupulous second-hand shops can disguise themselves as pawnshops, buying things from people supposedly “with the right of repurchase,” the Central Bank reminds in the draft. In fact, they can sell such a “collateral” at any time, because in fact it is not a collateral. Pawnshops cannot do this - they have restrictions.

What types of pawn shops are there?

Pawnshops can be universal or specialized

. The first accept an extensive list of things that have value, without restrictions. The latter are focused on a specific type of asset. Specialization provides more favorable conditions, so let’s take a closer look.

Pawnshops are classified according to the type of things that are accepted as collateral:

- Jewelry.

The most common type of legal entities conducting pawnshop activities. These organizations are registered with the Federal Assay Chamber, maintain special records of precious metals, and report according to 115-FZ. Detailed information is provided on the official website of the department.

- Household and computer equipment.

We are talking about mobile phones, televisions, microwaves and other similar items.

- Fur

, including hats, fur coats, vests.

- Antiques

, art objects, luxury items. Includes selected items of increased value, such as antique furniture, Swiss watches, paintings and old books. Typically there is an appraiser, art expert or antique dealer on staff.

- Cars.

Car pawn shops have become widespread in recent years. Not all of them work legally. A mandatory condition for granting a loan is the seizure of the car and subsequent storage of the vehicle in a parking lot owned by the pawnshop. Such requirements are contained in Article 7 (clause 1) of Law No. 196-FZ.

When choosing a pawnshop to receive, take into account additional requirements for the type of specialization. Otherwise, there is a high probability of running into an ordinary microfinance organization or even scammers.

And what? How do pawn shops work?

Pawnshops provide two types of services. In addition to issuing loans secured by property, they also take things for storage.

The scheme of working with loans is quite simple.

You bring valuables to a pawnshop.

They are assessed there for free.

You are given two documents: a security ticket and a consumer loan agreement with the conditions specified in it. This is a required set of documents. If you are offered to register for something else, then this is a reason to suspect fraud. Acceptance and transfer acts can also be drawn up, helping to avoid later disputes about whether this scratch was there or not. Consultant-methodologist for the Ministry of Finance project to improve financial literacy Ekaterina Kachalina recalled that the pledge ticket should describe the subject of pledge in as much detail as possible: not just a “bracelet”, but, for example, “with a round blue stone, 585 standard, net weight 40 grams” .

To return your items, you must repay the loan amount and interest for each day of use within the period agreed upon with the pawnshop.

If you hand over an item for storage, you do not receive money for it, but, on the contrary, you pay for the fact that the pawnshop provides the appropriate conditions for its maintenance. For example, pawn shops offer summer storage of fur items that require low temperatures and a certain level of humidity.

In this case, the person receives a safe receipt, which, among other things, specifies the storage period and conditions. If the deadline has expired and the owner has not come to pick up the item, then the pawnshop has the right to sell it - after two months.

How safe is it to go to a pawn shop?

The procedure for how a pawnshop operates is regulated by Law No. 196-FZ.

Pawnshops belong to the microfinance services market. Therefore, their activities are controlled by the Central Bank of Russia. The official website of the Central Bank contains a register of pawnshops legally operating in the country. Presence on this list is a guarantee of safety.

Mandatory requirements:

- The presence of the word “pawnshop” in the name and any advertising of its offices and services. Only companies included in the register of the Central Bank can use the term

;

- Opening hours: opening no earlier than 8 am, closing no later than 8 pm. A pawnshop CANNOT operate around the clock - this is a violation of the regulator’s requirements;

- A limited list of activities: issuing loans, storing pledged items, providing information and consulting services. Everything else is prohibited;

- Prohibition on any use of things that are registered as collateral before the expiration of the payment period. It's simple: you can't wear a ring, you can't turn on the TV, you can't drive a car;

- Submission of reports to the Central Bank of Russia. Forms and a list of documents were developed by the regulator specifically for persons conducting pawnshop activities.

- Protection and security of the property provided as collateral from damage and illegal actions of third parties.

- Mandatory insurance of property accepted as collateral. Moreover, the insurance is paid by the lender himself.

Our services

Sale of property or bankruptcy on a turnkey basis - from 7,900 ₽/month.

Legal support for bankruptcy - from 88,000 ₽

Preparation for the extrajudicial bankruptcy procedure - 15,000 ₽

Before handing over an item to a pawnshop, check the company in the Central Bank register. It’s easy to do this today, even from a mobile device with Internet access. This simple protective measure guarantees the safety of the client’s property and the confidentiality of his data.

The danger of underground pawnshops and microfinance organizations is that fraudsters can use a copy of your passport to apply for loans and microloans.

What if the sale amount does not cover the amount of debt?

This is the task of the pawnshop - to successfully sell the item. The borrower is liable to the organization only for the pledged property.

So in the worst case, he risks simply losing it.

Even if you owe more than the pawnshop managed to get for your things, it does not have the right to demand additional payment.

At the same time, the former owner, in turn, has the right to find out how much the pawnshop sold his property for. If, on the contrary, he very successfully sold things and the income from the sale exceeds the amount of debt, then the borrower has the right to demand that the difference be paid to him. This can be done within three years from the date of sale.

And how much interest will you have to pay for the loan?

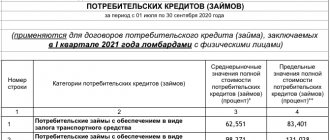

It all depends on the interest rate of the pawnshop. It cannot exceed the maximum value that the Central Bank sets every quarter. Thus, in the fourth quarter of 2021, pawnshops can lend to Russians at a maximum of 88.91% (if the collateral is transport) and 140.542% (if the collateral is any other property) per annum.

Less is possible, more is not.

And the specific rate in a particular pawnshop depends on its conditions and the collateral. For example, if a client pawns a camera for 20 thousand rubles for a month at 85% per annum (approximately 0.23% per day), then after a month, in order to return the equipment, he will have to pay 21.4 thousand rubles.

But if you don’t repay the loan, it will ruin your credit history, right?

By law, credit, microfinance organizations, credit cooperatives, as well as investment platform operators are required to transmit information about loans to the Credit History Bureau (BKI).

All other participants in the credit market should do this only for those loans, information about which is already available in some financial institution.

That is, no, pawnshops are not required to report loans issued to the BKI, but they can do this at their own discretion. And if the pawnshop you choose does do this, then the non-repayment of the debt will appear in your credit history and will remain there until the lender sells the collateral and closes the debt. And any information about delays, naturally, spoils the credit history and rating.

So, when contacting a pawnshop, find out if it cooperates with BKI. And regularly check your credit history - we told you why and how to do this.

Terms of pawn loans

You should not expect favorable conditions from pawnshops. They are somewhere in the middle between the offers of microfinance organizations and banks. That is, pawnshop loans are more profitable than in microfinance organizations, but worse than in banking institutions.

First of all, you need to talk about the loan amount. It depends entirely on the price of the pledged item. Therefore, the borrower cannot claim the amount that he exactly wants. In this case, the pawnshop will not issue a loan corresponding to the real value of the item. During the assessment, the specialist will determine the real price of the pledged item, and will offer the client an amount that is almost half that.

The pawnshop will charge interest throughout the duration of the loan. Their size is approximately 1-2%. Accruals are made daily, and not once a month as in banks. The loan term is essentially unlimited. The debt must be repaid one month after the loan is issued. If it is not possible to do this, then you can extend it by paying only interest. You are allowed to renew an unlimited number of times.

The debt was closed, and the item that was obviously used was returned. Can I demand some kind of compensation?

The pawnshop has no right to use the item left to him - he must only store it and provide suitable conditions.

To begin with, the thing needs to be described in great detail at the moment when you apply for a loan. This will then allow you to more accurately determine the degree of wear.

And when you come to return the pawned item, carefully check its condition, warned Ekaterina Kachalina. Pawnshops may require you to sign a statement of receipt with the wording “there are no claims to the accepted collateral.” Then it will be very difficult to file a complaint with the pawnshop if you discover a defect later.

However, according to Mikhail Alekseev, an expert of the ONF project “For the Rights of Borrowers,” it is most often very difficult to prove that an item was used in one way or another if there are no visible damages on it.

But if the pawnshop still used the item, damaged it, or even sold it ahead of schedule, complain to the Central Bank. Fines for violation of the law for organizations range from 50 thousand to 100 thousand rubles.

What items can be taken to a pawnshop? And for what amount?

Pawnshops only accept movable property.

That is, you can donate anything - from a ring or bracelet to a car. But real estate - apartments, rooms, etc. - they do not have the right to accept collateral. Moreover, from November 1, 2021, microfinance organizations can no longer issue loans secured by housing. So if a pawnshop redirects you to a microfinance organization as its partner in order to issue a mortgage on real estate, this will already be illegal.

Also, do not try to hand over the medals of your veteran relatives - the acquisition or sale of state awards involves criminal liability.

In addition, now the loan amount should not exceed the estimated value of the pledged item.

Pawnshops can be different - there are specialized ones, for example jewelry, and there are others with a more general profile. Usually on the organization's website you can find a specific list of what they accept as collateral. Most often, according to Nina Kultysheva, an expert at the National Center for Financial Literacy, pawn shops bring jewelry, laptops and cameras.

By the way, there is an additional requirement for jewelry pawnshops - they must be registered with the Assay Office, that is, have the right to work with precious metals.

What costs are included in the interest of a car pawnshop?

As we have already found out, the interest rates of automobile and regular pawnshops are somewhat different. The percentage also includes some of the risks that a pawnshop assumes when accepting a car as collateral:

- Costs of storing movable property during the loan term (parking, 24-hour surveillance, etc.);

- Material costs for the sale of unredeemed collateral.

In any case, before you start applying for a loan, we recommend that you independently calculate the final amount and interest rate. To find out the daily or monthly percentage of a specific pawnshop, you can simply call and ask. This will give you confidence in the integrity of the pawnshop, as well as have an adequate idea of the size of the loan and the amount of overpayment.

How to avoid getting caught by scammers?

Firstly, if you are offered to mortgage any real estate - a house, land, an apartment, then this is a 100% sign of scammers. Consider it an almost guaranteed way to lose property.

Secondly, most often fraud occurs at the stage of assessing collateral and determining the interest rate on the loan, noted Ekaterina Kachalina. Therefore, she advises carefully studying all the terms of the transaction, loan and storage agreement.

She also recommends contacting pawnshops that are registered as limited liability companies (LLC), and not individual entrepreneurs (IP). You can check your company's registration in the Unified State Register of Legal Entities (USRLE). In addition, the Central Bank has a separate register for pawnshops in general.

How do pawn shops value things?

Each appraiser at a pawnshop has an internal price list that he or she is guided by, noted Nina Kultysheva. According to her, you can usually count on up to 50% of the market amount.

For some pawnshops, the approximate price list can be found directly on the website. But the appraiser will still determine the specific value of the item only on the spot after inspection.

In general, it is determined by agreement of the parties. That is, the employee names the maximum amount that the pawnshop is willing to lend to the client. For example, you brought a smartphone and it was valued at 20 thousand rubles. If you need less, the pawnshop will issue a loan without any problems.

How to calculate the pawnshop percentage yourself

If you want to calculate the interest rate at a pawnshop yourself, you need to check the interest rate at a specific institution. After this, you can make calculations.

Let's say the loan amount is 10,000 rubles, and the daily interest is 0.37%. You are going to apply for a loan for 2 weeks - 14 days. Then 10,000 * 0.37 * 14 = 518 rubles. Please note that this is just an example of calculating interest in a pawnshop. Any similarities with actual figures are purely coincidental.

In approximately this context, you can make your own calculations at home and find out which pawnshop has the most favorable interest rate. However, we hasten to remind you: sometimes you should not chase the minimum percentage without making sure that the pawnshop has a good reputation. One-day companies can collect valuables at a negligible percentage, and when the time comes to buy the property back, simply no one will open the door for you.