When a difficult life situation arises, turning to a pawnshop for many people seems like a quick solution to a financial problem.

If a person has jewelry, he prefers to pledge gold in order to immediately receive a certain amount of money without much work and time.

Some unscrupulous gold pawnshops take advantage of gullible customers, deliberately deceiving them. This most often applies to purchases and small pawn shops that want to get maximum profit and do not think about reputation. More and more consumers of their services are faced with deception.

According to the Law on the Activities of Pawnshops (as amended in 2016), pawnshops themselves do not have the right to sell gold. To sell, an appropriate license must be obtained, and a company that sells jewelry (and products with precious metals) must be connected to a program for recording trade transactions with gold products.

What does the law say?

As a rule, the laws of any country have their own documents that describe where, where and how the sale of unredeemed pledges in a pawnshop should be made.

Thus, the Russian Federation must hold special auctions, and they must be public. And in Ukraine, if bargaining occurs, then only to the state or the Bank of the country. But all pawnshops are faced with the question: “What is the most profitable way to sell a pledge whose payment period has expired by its previous owner?”

Before you begin to understand what a pawnshop does with unredeemed property, you need to understand what the initial cost of the product is, since selling it at the same price that it was accepted is unprofitable for the organization.

What characteristics of gold make it a good investment or risk hedge?

Gold is a good investment.

Gold metal, unlike other assets, represents the highest achievement of material well-being and financial success. Physical gold also protects the wealth of those who own it and acts as a universal currency like no other.

The following characteristics make gold an ideal component of any investment portfolio.

Gold is rare.

All the gold ever mined would fit into a 21 meter high cube that could easily fit on center court at Wimbledon. For comparison, the entire gold volume is equivalent to one hour of global steel production. No new gold is created, and aboveground gold reserves only increase at the rate at which you can find, mine, and refine it!

Gold is real money.

For thousands of years, gold has been valued as the most valuable form of money. Today, the world's central banks are the largest buyers and holders of gold reserves.

Gold is a proven value.

Although the price of the metal may fluctuate, the value of gold has never decreased. In fact, gold has maintained its purchasing power for the last 1000 years. As a real and tangible commodity whose supply is limited, the value of gold is inherent and does not diminish over time.

Gold is a proven safe-haven asset.

Time and time again, in times of economic, geopolitical or systemic uncertainty, gold has proven its ability to act as a safe-haven asset, increasing its value. This has been seen throughout history, and most recently during the global financial crisis, where gold prices rose every year before the crisis and in the years during the crisis.

Gold is not dependent on anyone's performance.

Stocks, bonds, real estate and currencies depend on the performance of management, employees, politicians and central bankers to maintain or increase their value. No gold!

In fact, gold tends to perform well even when these groups of people do not perform their duties properly.

Gold is highly liquid.

This means that there is always a secondary market of gold buyers and sellers available. It is as liquid as the international bond market, meaning you won't have a hard time finding a buyer for your gold when you want to sell, unlike other assets such as real estate. Indeed, during a crisis, gold often becomes more liquid.

Gold is useful:

very plastic and excellent conductor of electricity. This makes gold extremely popular in electronic products from computers to light switches.

Demand for gold is growing.

The demand for gold metal in industry and jewelry production has increased significantly with increasing prosperity in India, China and other emerging economies. Moreover, as confidence in the dollar continues to decline, China, India, Russia, South Korea and other newly rich countries are actively accumulating gold as a hedge against a weak dollar.

So why not buy gold coins and gold bars to protect your wealth?

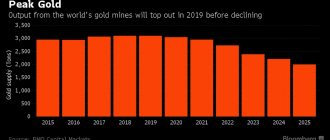

The supply of gold is limited.

Despite periodic increases in gold production, gold supply is stabilizing as mines age and gold deposits become deeper. At the same time, we haven't had any significant gold discoveries in the last few decades. As mining costs steadily rise, the price of gold will only rise in the coming years.

Example of unredeemed collateral

Let’s say a pawnshop client pledged a valuable item and received 2,500 rubles for it. The contract specifies the time frame within which the borrower must meet, and this is 25 days. From the entire loan, the pawnshop earns 250 rubles for itself. Further, let’s assume that the client cannot pay the pawnshop to buy back his product, and as a result, the person refuses to pay in the future.

Thus, so that the entire loan does not go to a loss to the pawnshop, he decides to sell this property for 2,500 rubles. Thus, the organization returns the loan back into its hands, as well as all the interest that was accrued, having previously paid tax to the state treasury.

As a rule, this is how many pawnshops profit from this; it is more profitable for them (and this is logical!) to earn money rather than distribute it left and right. After all, you still want to keep something for yourself. Also, a pawnshop may not sell the client’s property, storing it in its premises for up to two months. But here you need to keep in mind the fact that in this case a penalty will be charged, which the person will need to urgently pay if he nevertheless decides to return the item back into his own hands.

If the pledged property spends enough time in a pawnshop, but no one buys it, then such an item will be sold by the pawnshop much more difficult and longer, since there are large losses on the loan, large penalties and interest imposed.

Selling gold to a pawnshop

To get cash urgently, you should take your gold to a pawnshop that buys precious scrap. In addition, in this financial institution you can get a loan, the security of which will be your jewelry. A good pawnshop must have a registration certificate and a license to operate from the Central Bank of the Russian Federation, otherwise it is not recommended to contact such an organization.

The option of selling gold to a pawnshop has a number of advantages:

- Cash can be received in the shortest possible time.

- You only need a passport; no certificates, applications or additional documents are needed.

- If you return your money early, you can avoid paying fees.

- The goods that will be given as deposit will later be returned to you if desired.

In addition, there are significant disadvantages, for example, very high interest rates compared to banks. Also, the purchase of a product by a pawnshop is made at a price lower than the cost of scrap. It is for this reason that it is better to leave your valuables as collateral, but you should not sell them to a pawnshop.

How is the sale of unredeemed collateral carried out?

Firstly, competition in the pawnshop market is quite high; people buy from those where it is more profitable and cheaper to purchase property. Therefore, every organization must have its own clever tricks that their customers will fall for. For example, if you are a representative of a pawnshop, then the sale of unredeemed pledges includes:

- A guarantee that gold products are absolutely NOT fake (and in general, it is advisable to be as honest as possible with your clients, since many pawnshops deceive people by passing off property as gold!). Your merchandise experts must be professionals in their field, carefully evaluating and checking each product down to the smallest detail.

- Each pawnshop should have its own discounts and promotions so that people begin to think: “in this place you can buy an item cheaper than across the street!” For example, every tenth visitor gets a 10% discount, elderly people get a 15% discount, and the sale of property worth 50,000 rubles includes a 7% discount. Think about how else you can attract and interest the client so that the once unredeemed item finds its new owner.

- Offer your customers the opportunity to purchase a product not only face to face, but also via the Internet - nowadays this is very convenient. Note that it is becoming much easier for people to sit at home and make purchases while lying on the couch, rather than get up and go to the other end of the city for property that is not yet guaranteed to be purchased.

Why is it still worth trying and buying property from a pawnshop?

Firstly, in most situations, interest for 1-2 months of storage is actually quite low and achievable for any working person (of course, in this case not only interest is paid, but also the amount received for the pledged item).

Secondly, you get your item back, and this is very important if it could be very dear to you. At the same time, a good pawnshop always responsibly stores the pawned items, observing all safety precautions.

Thirdly, truly valuable things made of gold or precious metals cannot be compared with the liquidity of ordinary money. Yes, you give back the money and somewhere you encounter new difficulties. But believe me, the gold you get back will only increase your wealth. And money comes and goes.

In general, the most correct attitude towards a pawnshop is rather as a temporary assistant on a long journey in case of some passing difficulties. It is in this case that you receive some money to overcome temporary troubles, but are not left without the main values in your life, since you return them back to your property in a timely manner.

Unpurchased pledges in a pawnshop - what can you buy?

- Coins from different countries for numismatists.

- Phones, tablet devices, e-books, laptops, computers.

- Watches (pawnshops accept certain brands, i.e. not all watches).

- Photographic equipment, video equipment.

- Products made of gold and silver.

Of course, if a valuable item remains in the pawnshop, this does not mean that the price for it will be the same as in stores, or what the pawnshop assigned to its client who was overdue and did not meet the time frame. The price, naturally, will be a little higher, but the uniqueness of the property still prevails over the final amount.

How to avoid running into a fake pawn shop

You can get profitable, fast and comfortable loans for any amount secured by jewelry, equipment, cars and other property and not worry about all the above difficulties by using the services of Lombard 52 in Nizhny Novgorod.

All our transactions are legally clear, and the terms of the contracts guarantee the transparency of transactions. In addition, if you find yourself in a difficult life situation, special transaction conditions are provided for you.

Working with a large number of clients, we benefit from honesty because we value our reputation.

The nuances of working with unredeemed items

A pawnshop has its own nuances if the client has not purchased his property. So, there are certain costs, i.e. expenses incurred by the organization when selling unredeemed items. For example, this includes giving the product a marketable appearance so that it does not look old and shabby, that is, in the form in which the former owner handed it over, but it needs to look fresh, beautiful and new.

Or, for example, good advertising of property is typical here, so that a person wants to buy and acquire a product, being sure that he needs this particular thing more than anything else. Or, also, the final assessment of the item, its final price, agreement on the total amount and quality, appearance and design, style and price tag, so that the buying client is sure that the price is equal to the quality. Unredeemed pledges at a pawnshop will find use in any case. Things will not remain unnecessary.

In general, it is better to avoid such situations when the realization comes that it is not possible to buy back your valuable property. Plan your finances so that the pawned item is back in your hands, since it is not particularly pleasant to realize that your once favorite “trinket” now belongs to someone else. So always know that the pawnshop will sooner or later sell your item without blinking an eye, taking twice as much money for it as you received a loan for it. Be careful.

Ways to defraud jewelry pawn shops

Arriving at a pawnshop, you need to take your time, carefully familiarize yourself with the terms of the proposed transaction, and be especially vigilant when signing a loan agreement and storing the collateral.

What should you pay attention to, and what methods of deception do pawn shops use?

Frauds with jewelry samples

There is currently a large amount of gold that has not been redeemed from collateral. To return money to circulation, pawnshops sell it, although, by law, they do not have the right to do this without an appropriate license.

If a client purchases 585-carat jewelry at a pawnshop, and after some time, for various reasons, wants to pawn it in another gold purchase, it can be valued, for example, as 500-carat. The man is confused, but when he urgently needs money and has no time, he hands over the jewelry at 500 standard.

A pawnshop employee who has underestimated the standard remains in double benefit - he accepts a ring of 585 standard at the price of 500 standard, and then sells it as 585 standard.

How to avoid: if you purchase gold at one pawnshop and then sell it to another, be sure to ask for a cash receipt and check for a sealed tag on the purchased product with the name of the organization, its address and gold purity.

Fraud with product weight

When delivering gold to a pawnshop, pawnshop employees may manipulate the scales to underestimate the weight of the item, as well as report weight loss due to melting.

When returning jewelry that has not been cleaned of dirt, a deduction may be made for losses due to contamination (1-5%).

In jewelry with stones, the weight is reduced by 5-10 times the actual size (depending on the weight of the stone).

How to avoid: to avoid such actions on the part of the loan office employees, you need to clean the products from contamination in advance before handing over, and remove the stones from the jewelry. To check the correctness of the scales, a 5-ruble coin is suitable - its weight is 6 grams (with an error of 0.2 grams).

Fraud with price per gram

Employees can often misinform customers over the phone or on the website. Some conditions and prices are stated, but in reality they are different.

If the fineness is not indicated on the jewelry, the price for each gram is reduced by several hundred rubles.

How to avoid: Before visiting a pawnshop, study all the details of the transaction in detail.

Fraud under the guise of a pawnshop

The name of an organization that engages in pawnshop activities must include the word “pawnshop.”

When concluding a loan agreement, the client must be given a security ticket, and when drawing up a storage agreement - a receipt and an act of acceptance of the transfer of the pledged item. All these forms are subject to strict reporting.

The pledged item must be insured at the expense of the pawnshop for the entire period of storage.

The law establishes a period of 30 days for which the loan is provided. Within a month, the client can redeem the pawned item from the pawnshop. Unscrupulous employees can indicate a period of 1 day in the contract without notifying the client about it.

How to avoid: if the name of the selected organization does not contain the word “pawnshop”, but contains the words “purchase”, “thrift store”, then the services of such an institution should be refused. The validity period of the contract must be checked on the pledge ticket.