About gold mining in 2021 - World Gold Council

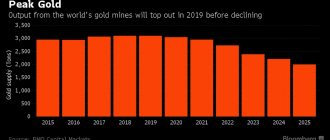

Lower refining volumes saw total gold supply fall 4% to 4,398 tonnes, but production reached a new high in 2021. Production rose to 3,268.7 tonnes in 2017, the highest annual total in the history of the World Gold Council (WGC). In 2021, net dehedge was 30.4 tonnes, marking the first year of net dehedge since 2013. Unusually high refining levels were the main reason for the 10% drop in gold supply in 2021 compared to last year, but refining volumes have normalized in 2021.

Production

Production fell 2% in 2021 compared to last year, reaching 833.11 tons in the fourth quarter. This brought total annual production to 3,268.7 tonnes – significantly higher than in 2021 – and the highest annual output in the history of VZS statistics. New mines that have come online in recent years have largely offset earlier production declines, resulting in a relative stabilization of global production.

China - the world's largest gold producer - recorded a decline during the fourth quarter as domestic production fell by 10%. Production in 2021 is expected to be 9% lower than in 2021, which would be the second annual decline in production since 1980. Stricter environmental regulations on the use of cyanide in gold mining introduced last year have led to the closure of some small mines, negatively impacting overall production. One of the key provisions of President Xi's speech at the 19th Congress of the Communist Party of China was the provision of strict environmental control. Tanzania's fourth-quarter production fell 15% year-on-year. A ban on concentrate exports introduced in March continues to impact production at the Buzwagi project, while the company is also reducing production at its main Bulyankhulu project to reduce losses.

A number of other countries also saw declines. The year-on-year decline in fourth-quarter manufacturing in the US, Brazil and Mali becomes apparent when compared to the high base period in 2021.

Production in Russia increased in the fourth quarter compared with last year. This quarter saw the start of the large Natalka project, located in the Magadan region. The project began commissioning in September and announced in December that it had produced its first dore alloy. Although the project is still in its early stages, it is projected to significantly increase Russian production in the coming years.

In Indonesia, high-grade ore production at Grasberg, the country's largest mine, helped boost ore production in the fourth quarter by 11%. Mining of higher grade ore is likely to continue into 2021. In Canada, the Hope Bay (early first quarter) and Brucejack (early second quarter) projects, as well as new fourth-quarter operations at Rainy River and Moose River, helped increase production by 5% in the fourth quarter. Several West African (Mali) and Houndé (Burkina Faso) have also started production by the end of 2021.

Production is growing, reserves are getting poorer

In 2021, Russia increased its total gold production by 280.7 thousand tons, that is, by more than 7%. Production of ore and alluvial deposits increased by 6%, and concentrates by 13%.

The production of associated gold during the development of complex deposits became 12% higher.

Over the past three years, gold ore reserves of animal mining enterprises have increased by 14.5%, of which the reserves of gold deposits themselves have increased by 17.9%. In alluvial deposits their share decreased by 6%. In total, there are now about 14.5 thousand tons of reserves.

The dynamics of changes in the amount of reserves from 2005 to 2021 showed that the growth occurred mainly due to reserves of category C2.

The economic performance of enterprises is increasing.

Over 5 years, the average stripping ratio in open-pit mining increased from 3 to 9.9 t/m3, and well drilling processes increased 4 times.

According to Rosgeologia, in 2021, an increase of 2,197 tons of resources was planned at government procurement facilities.

The increase in category P1 resources amounted to 833 tons, of which 545 tons were qualified. Thus, the increase obtained due to the increase in mined ores obtained as a result of operational exploration has become one of the main sources of replenishment of reserves at mining enterprises. They remain on the balance sheet and increase over the course of one year, so it is not yet known how much of them will be transferred to reserves.

Deputy Chairman of the Union of Gold Miners Vladimir Surenkov recalled that basically all objects were discovered and explored back in Soviet times, while the share of difficult-to-process and less reliable ore reserves is growing, including reserves of the P3 category.

Accordingly, the number of transitions to underground mining is increasing. However, the average inventory content is declining.

The shortcomings of the mineral resource base are evidenced by the minimal number of auctions. In addition to Sukhoi Log, only one auction was held for the biological study of gold mining in Bashkortostan. The resource shortage of gold reserves is obvious: the scope for development of work is limited, and today there is nothing to present at the auction.

To increase production volumes, improved technologies for processing stocks are now being used. They became possible thanks to a noticeable increase in the price of gold. This saves us,” said Mr. Surenkov.

However, there are still deposits with a large share of inactive reserves, for example, the Konstantinovskoye and Olkhovskoye fields.

This year, the Vasilievskoye field was added to them, whose license for the right to use has already been revoked.

It was difficult to work at the Vasilievsky mine - from category C2 reserves, the deposit turned out to have 17 tons of vein-type reserves, and it was considered inappropriate to spend billions of rubles without understanding what was actually there.

The mechanism for testing resource runs has not yet been worked out.

“I recently tried to clarify how TsNIGRI is currently testing. It turned out that they are still using the regulatory framework of 2002,” said the deputy chairman of the Union of Gold Miners.

In his opinion, this problem needs to be solved. In particular, some deposits should be removed from the list of areas of federal significance. It requires revision because it is outdated and does not meet modern requirements.

“All deposits must be checked for the presence of infrastructure, accessibility, level of technological base, etc.

Let’s take, for example, the Darasunskoye field, an object of federal significance. It is now on the verge of extinction.

Subsoil users with licenses want to work, but black diggers interfere with them. Some of them die when entering closed mines.

The enterprises are trying to revoke the license from the field due to failure to comply with the terms of the license agreement of the former subsoil users - the YuGK enterprise. I visited there many times during the times when it belonged to . Then the deposit functioned normally, gold was mined steadily,” said Vladimir Surenkov.

He noted that this problem needs to be solved at the highest level, right up to the introduction of the Russian Guard, which will “smoke out” the black diggers from there.

The process of reserve reproduction at the early stage of subsoil exploration will be carried out by private investors and junior companies.

In 2021, 457 licenses were issued on an application basis; now this figure has decreased to 277.

“Rosnedra presented the cost structure for geological exploration in 2021. The main ones go to precious metals. The cost plan is about 50 billion rubles, although in reality it is much more.

The problem is that next year Rosnedra predicts a decrease in budget funds to 2.2 billion rubles. It is completely unclear what is happening with the draft resolution on juniors, which was developed and submitted to the government last year.

Junior companies still do not have a regulatory framework. I think that for the stable operation of the industry, it is necessary to combine the efforts of both the state and business structures,” said Mr. Surenkov.

Rating leaders

Global gold production volumes are growing every year. More than 50 countries participate in the ranking. China occupies the first place in the production of precious metals in the world. In 2021, gold production volumes amounted to about 450 tons. The Chinese government plans to modernize the gold mining industry and produce five hundred tons by 2021.

Gold production statistics show that China is significantly ahead of Australia. The production volumes of the main competitor of China are 300 tons per year. The country has well-developed industrial gold mining technologies. Artisanal mining of the precious metal is also permitted. Everyone can try their luck. The only condition is to be legally in the country and have a gold mining license.

Some states have prohibitions on visiting protected areas or using mini dredges for gold mining. Different types of mining are used - open pit and underground.

Other countries

Gold mining in Japan takes place in the south of the island of Kyushu. The richest deposit is located here. The metal content per ton of ore is 40 grams, and reserves reach 150 tons.

In South America, Peru ranks first in gold mining. The volume of industrial gold production is 175 tons per year. Illegal gold mining is thriving due to high unemployment.

Uzbekistan is one of the top ten countries in terms of reserves of the precious metal. The country ranks ninth in terms of production volumes. Gold statistics annually record about 90 tons of metal mined. The volume of reserves in the subsoil amounts to more than 2 thousand tons.

In terms of gold production, Kazakhstan ranks 14th in the world. From 2007 to 2021, 540 tons were mined. In 2021, production of the precious metal reached 85 tons. The main deposits are located in the north of the country. Recently, the country's government legalized mining activities. How to obtain a gold mining license? The procedure for issuing permits is described in the Code “On Subsoil and Subsoil Use” dated December 27, 2017 No. 125-VI ZRK.

Gold mining in Ukraine is possible at the only deposit in Transcarpathia. Its reserves are 55 tons. The Americans plan to invest in gold mining. A corresponding agreement was signed in 2021. A project has also been prepared to organize production using modern equipment.

Gold mining in Belarus is still questionable. Signs of the precious metal are found at great depths and require significant investment.

Who needs statistics and why?

First of all, the state needs data on the precious metal. Gold has long been considered a means of payment and it can always be used to buy food, weapons, resources and people in any conditions. Governments of all countries are concerned about increasing gold reserves. Statistics on gold reserves make it possible to predict the development of many sectors of the economy.

The industry assesses its own needs for gold, but not only as a precious metal - the basis for the production of jewelry. For production, inertness, electrical conductivity, and its use in technology, producing ultra-thin foil and wire are also important.

South Africa

Artisanal gold mining is prohibited in many countries around the world. In South Africa alone, its volume is at least 1 million ounces. Moreover, the diggers sell it for next to nothing. As a result, the precious metal does not generate income either for the state or for the diggers.

In the 1980s, the ranking of countries in terms of gold reserves and production was headed by the Republic of South Africa. The country's production of the precious metal accounted for more than half of the world's total. Later, gold production in South Africa fell to 30%. However, the country ranks second in the world in terms of total deposit reserves.

Gold production increased in Russia

07.08.2020

Referring to data from the Ministry of Finance of the Russian Federation, the TASS agency reported that from January to May of this year, gold mining volumes in the country increased.

In just the first half of 2021, Russian gold production increased by 2.8% when compared with last year’s data for the same period of time, and reached 104,310 kilograms (in the first half of last year, gold production amounted to 101,440 kg).

In his interview with NSN at the end of June, economist Denis Raksha assessed the policy of domestic credit institutions regarding gold. He noted that after six months of sales, banks again began to replenish their gold reserves, hoping for the continued rise in price of the yellow metal, as well as that it would be able to compensate for losses from the fall of the dollar.

At the end of July, the Russian Central Bank provided information on government gold reserves. Over the last seven days of the month, their volume increased by $8.7 billion in monetary terms. From a statement by Elvira Nabiullina, the head of the Central Bank of the Russian Federation, made back in April, it became known that the country’s reserve gold reserves will be preserved and there is no need to sell it.

According to the head of the Central Bank, the state's gold and foreign exchange reserves are sufficient to implement short-term plans and maintain export supplies. She also noted the unique properties of gold as a reserve instrument in great demand on the international market, which, in comparison with currency, does not experience any dependence on state policies.

Additionally, it became known that VTB Bank is actively financing gold mining in Yakutia. The credit institution allocated about 2.1 billion rubles to expand gold production in the Republic of Sakha. This is 7% more than the funds allocated in the previous year 2021. In total, over the past year, VTB bought about 14.5 tons of the yellow metal from republican gold production enterprises. The bank also almost doubled its purchases of silver, amounting to 10.1 tons.

According to Denis Leontyev, head of the VTB branch in Yakutia, along with the growing dealing, gold mining in the republic is also increasing. In 2021, this credit institution has already purchased 40% of the gold and 8% of silver mined in the region. According to available data for 2021, gold mining in Yakutia increased by 23.5% and amounted to 36.49 tons. Including, 26,165 tons of precious metal were extracted from ore and 10,325 tons from placers.

Other price forecasts and market analytics:

- Silver price forecast: up again

- Gold rate forecast: passions are heating up

- What to expect from the ruble by the end of August

to news list

What's happening in the gold market?

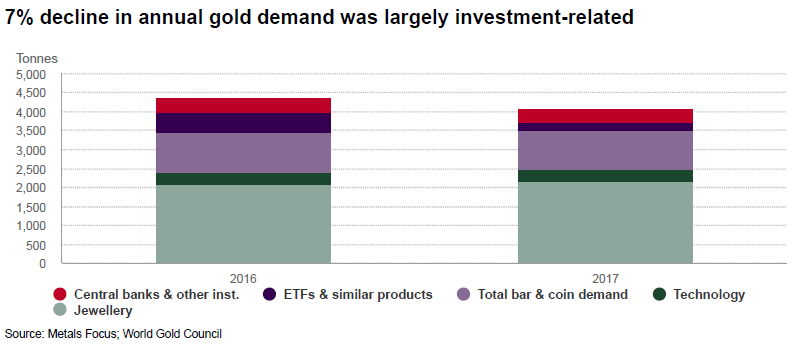

According to a report from the World Gold Council, global gold demand fell 7% year-on-year to 4,071.7 tonnes in 2021, driven primarily by lower investment demand. We understand the main trends in the gold market.

INVESTMENT DEMAND

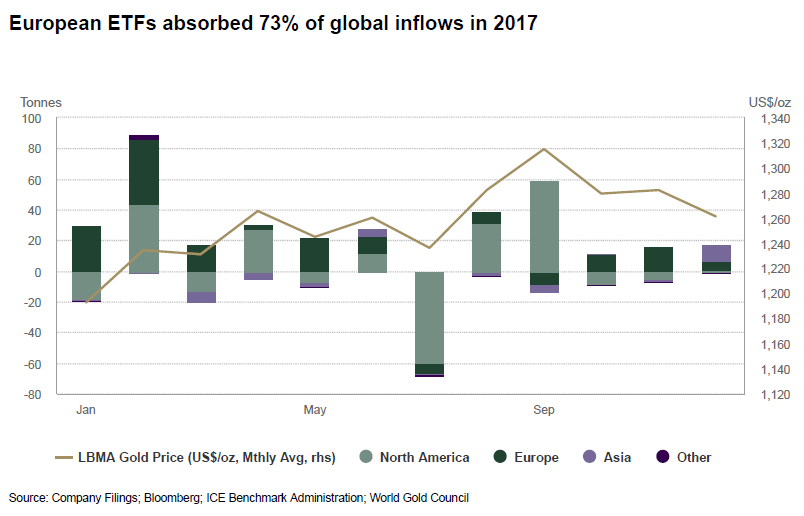

The inflow into gold ETFs (exchange traded funds) in 2021 amounted to 202.8 tons, having decreased by 63% over the year.

At the same time, 148.9 tons were provided by European funds, 63.0 tons by American funds, while inflows into ETFs from Asia and other regions decreased by a total of 9.2 tons. In value terms, assets under management (AUM) increased by 24% and amounted to $98.7 billion.

Growth rates in the sector slowed sharply in the second half of the year. The influx of 42.1 tons in the second half of the year was only a quarter of the figure for the first half of the year. In some ways, this was not unexpected: the price of gold had already increased by 14% by the end of August, encouraging investors to take profits rather than new purchases. Meanwhile, stock markets continued to rise to new highs and the opportunity cost of investing in gold increased as ultra-loose monetary policy came to an end in some markets, especially in the US, where the Federal Reserve raised rates three times in a year.

Continued geopolitical tensions continued to undermine investment flows, especially to Europe. Persistent uncertainty over the economic and political fallout from Brexit, fragile relations between the US and North Korea, and ongoing tensions in the Middle East have combined to create a positive backdrop for inflows into gold ETFs.

Major stock indexes reached new highs. With prices at historic highs, investors are adding gold to their portfolios to manage risk.

Investment in bullion was generally stable, while investment in coins was down 10%. The weakness in the sector is largely due to a sharp fall in demand in the US, which fell to a 10-year low of 39.4 tonnes. This was outpaced by strong demand growth in China and Turkey.

DEMAND Central Bank

Central banks continued to increase gold reserves in 2017. Total gold and foreign exchange reserves increased by 73.1 tons in the 4th quarter, bringing the world's official net gold purchases to 371.4 tons, down 5% from last year. The 38% year-on-year decline in demand in the fourth quarter was entirely due to the fact that in October Venezuela closed a gold swap deal with Germany's Deutsche Bank, resulting in the country losing about 45 tons of the precious metal worth $1.7 billion. The gold is now owned by to a German bank.

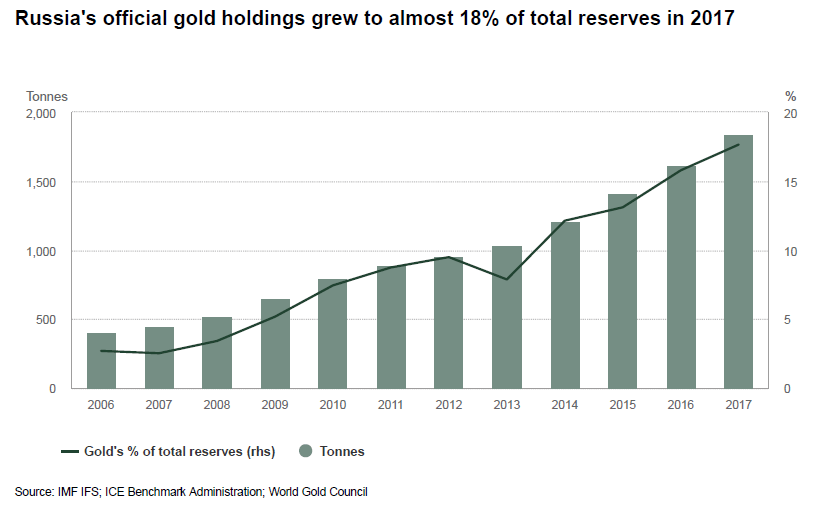

The growth of world gold and foreign exchange reserves continued to be dominated by a small number of large buyers. Net purchases of gold by the Bank of Russia in 2021 reached 223.5 tons, increasing gold reserves to 1838.8 tons (+14% y/y). This year marks the 11th consecutive year of growth, with net purchases exceeding 200 tonnes for three years now. Gold now accounts for almost 18% of the country's total reserves. First Deputy Chairman of the Central Bank of Russia Sergei Shvetsov previously said the Central Bank is increasing gold purchases in accordance with instructions from Russian authorities, who consider it a key asset in the face of geopolitical uncertainty.

The most notable buyer of the year was the Turkish Central Bank. The central bank began buying with great appetite: since May, reserves have increased by an average of 11 tons per month. By the end of 2021, gold reserves increased by 86 tons to more than 200 tons. The decision to regularly purchase gold was strategic and confirms the view of the country's Central Bank that gold is a key reserve asset.

Kazakhstan remains committed to increasing its gold and foreign exchange reserves, with total net purchases for the year amounting to 42.9 tons. This brought Kazakhstan's gold reserves to over 300 tons. Other noteworthy buyers were: Colombia (4.6 t), Venezuela (4.4 t), Indonesia (2.5 t), Jordan (2.2 t), Kyrgyz Republic (1.8 t), Thailand (1.6 t) and Mongolia (1.3 t) .

INDUSTRIAL DEMAND

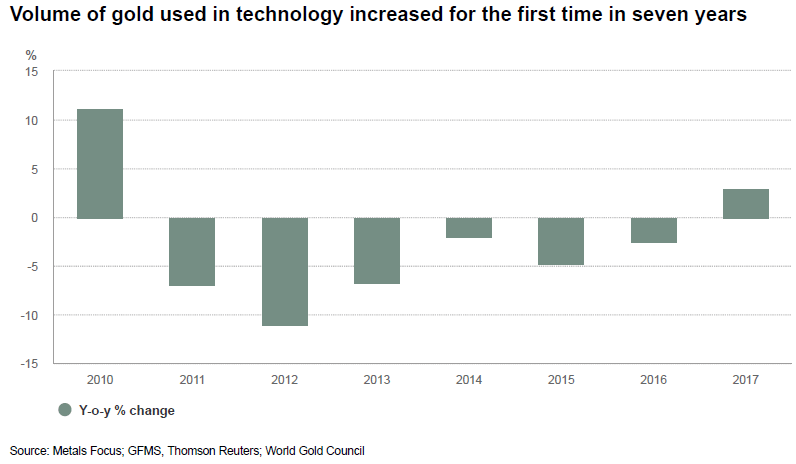

Industrial demand for gold recovered to 332.8 tons, ending a 6-year downward trend. Q4 was particularly strong, with demand at 88.2 tonnes, the highest level since Q4 2014. This trend has been driven primarily by the increased adoption of next-generation features such as 3D video, virtual reality (VR), augmented reality (AR) and gesture recognition in smartphones and vehicle modernization.

JEWELRY

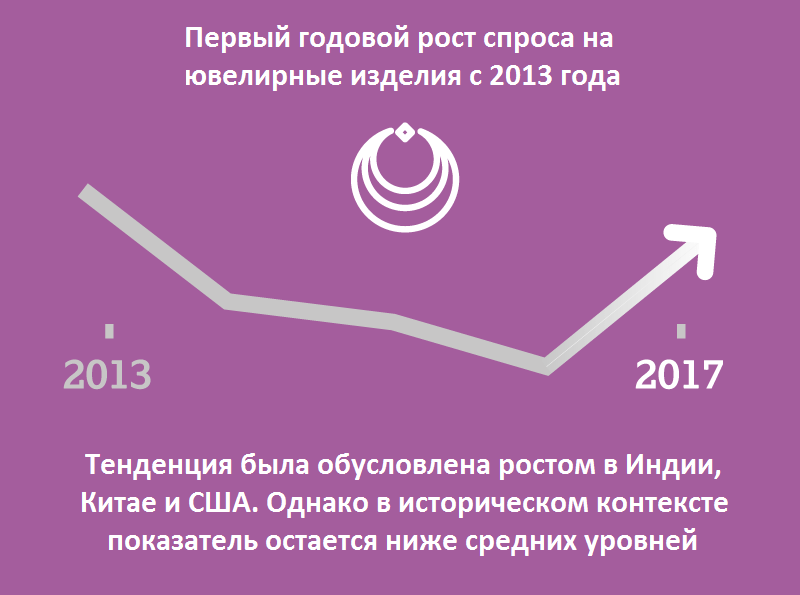

For the first time since 2013, an annual increase in demand for jewelry was recorded to 2,135.5 tons (+4%). Relatively stable prices and improving economic conditions contributed to growth in 2021. The increase in demand was mainly driven by a recovery in India, the US and China. These countries accounted for 95% of the growth in demand. However, the sector still remains weak in historical context.

GOLD OFFER

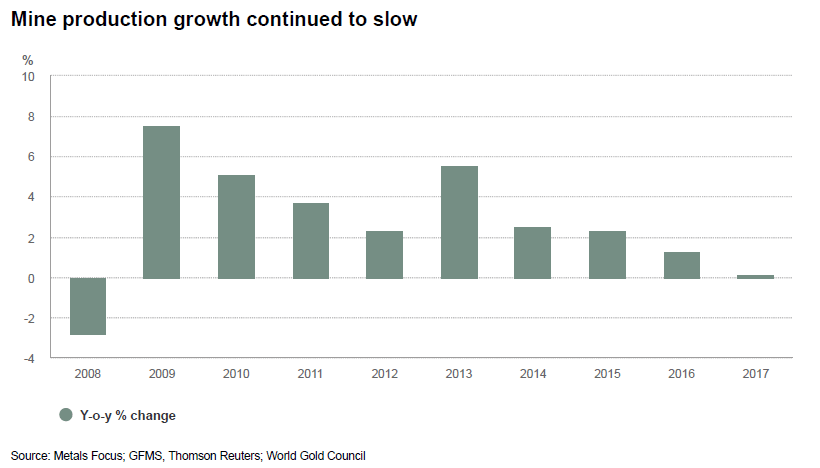

Supply on the gold market in 2021 decreased by 4%, to 4398.4 tons. However, production of the precious metal increased to a record 3268.7 tons (the growth rate slowed down). Recycling in 2021 fell 10% YoY amid unusually high 2021 values.

China, the world's largest gold producer, will cut gold production by 9% year-on-year, the second annual decline since 1980, according to WGC forecasts. Tightening environmental requirements have led to a decrease in the level of gold production in the country. In the 4th quarter, production also decreased in Tanzania, the USA, Brazil and Mali.

Gold production in Russia showed an increase in the 4th quarter, thanks to the commissioning of the Natalka mining and processing plant in the Magadan region. In December, the first Doré gold was cast at Natalka. Although the project is still in the early stages of production, Polyus expects it to significantly increase gold production at the company and in Russia in the coming years.

Based on materials from the World Gold Council

BKS Express

Gold is a precious metal that has historically played an important role in monetary circulation and the creation of luxury goods. In the modern world, most gold is used for jewelry, investments, and the technology sector (mainly electronics).

Structure of gold use in the world in 2021 Source: author’s calculations based on Metals Focus, World Gold Council

Gold production in Russia

At the beginning of the 20th century, gold mining in Russia was limited to 30-40 tons per year. In the USSR in the 1960-1980s. metal production increased annually and reached a peak of 300 tons (the share of the RSFSR is about 50%).

In Russia in the 1990s. due to the general economic crisis and lower prices in the commodity markets, there was a reduction in gold production to 100 tons. Since 2000, against the backdrop of rising world prices and private investment in the industry (including foreign), as well as increasing incomes of the population, gold mining began to recover and by 2021 reached a record 329 tons (without secondary gold).

Gold

Total gold production in Russia in 2021 amounted to 368 tons , it is divided into gold bullion (93%): mined, associated (from the extraction of other metals), secondary (from processed raw materials), and obtained from marketable concentrates (7%) .

Structure of gold production in Russia in 2021 Source: author’s calculations based on data from the Union of Gold Miners of Russia and the Ministry of Finance

Most of the country's gold is mined from gold deposits (70%), and the rest from placers (20%) and complex deposits with other metals (10%).

Mined gold predominantly remains in the country, and exports range from 5% to 30% of production. The main buyers of Russian gold bullion are Great Britain and Switzerland, and China for marketable gold concentrates.

Gold mining regions in Russia

Gold production is carried out in 26 regions of Russia, but the main reserves and production are concentrated in Eastern Siberia and the Far East. The Krasnoyarsk and Khabarovsk territories, Irkutsk, Magadan and Amur regions, Yakutia and Chukotka account for 85% of production. The largest gold deposits in the country are located in these regions - Olimpiada, Blagodatnoye, Pavlik, Albazinskoye.

In the Krasnoyarsk Territory, in addition to mining at gold deposits, associated gold mined at copper-nickel deposits plays a significant role.

Production of mined gold (excluding associated and secondary gold, as well as in marketable concentrates) in Russian regions in 2021. Source: author’s calculations based on data from the Ministry of Finance.

Who mines gold in Russia?

There are several hundred gold mining companies operating in Russia, but more than half of the market is controlled by the 5 largest enterprises. The main producer is the Polyus company, one of the largest gold miners in the world, its share in production is 25% (in reserves - 40%). The second and third players in terms of production are Polymetal (10%) and Yuzhuralzoloto (5%).

Structure of gold production in Russia by company in 2021 Source: author’s calculations based on data from the Ministry of Natural Resources.

Gold mining and reserves in the world

Russia is one of the world leaders in the gold mining industry. Global gold reserves are 50-63 thousand tons; in terms of their size, Russia ranks 1-3 in the world (5-7.5 thousand tons or 10-12%), depending on the methodology for estimating reserves. Other countries in terms of gold reserves include: Canada, South Africa, USA, Mexico and Australia.

Every year, 3.5 thousand tons of gold are mined in the world; in 2021, Russia took 2nd place after China with a 9% share. The largest gold-mining countries also include: Australia, the USA and Canada.

Gold production by country (excluding secondary gold) in 2021 Source: author’s calculations based on Metals Focus, World Gold Council

Over the past 10 years (2010-2019), the global gold mining market has grown by 25%. Russia demonstrates the highest growth rates among producing countries (+126 tons or +62%). Production is actively increasing in African countries (with the exception of South Africa), Australia, Canada and the post-Soviet republics - Uzbekistan and Kazakhstan.