Post updated: Jul 19, 2020

At the moment, gold is considered a modern investment instrument, which has always been and continues to be in high demand. Today, the economic market is facing a rather difficult situation and many are looking for the most suitable investment option. According to experts, the best option is gold. Therefore, many depositors are considering various offers from banks for investments in precious metals, such as the deposits offered by Gazprombank with its mutual investment fund (UIF) for gold.

Today, gold is also the so-called world “reserve currency”. In the Russian Federation, many people prefer to invest their own money in the Gazprombank Gold fund. This is due to the bank’s great popularity and fairly wide offers related to precious metals.

Gazprombank is now actively involving its many clients in investing - already about 30% of the population of the Russian Federation have begun investing in gold.

This is an 18% increase compared to the beginning of 2014. Gold prices, both globally and at Gazprombank, are actively growing. The gold rate directly depends on the dollar rate. The dollar is now growing very actively against the ruble, and accordingly the gold rate is growing.

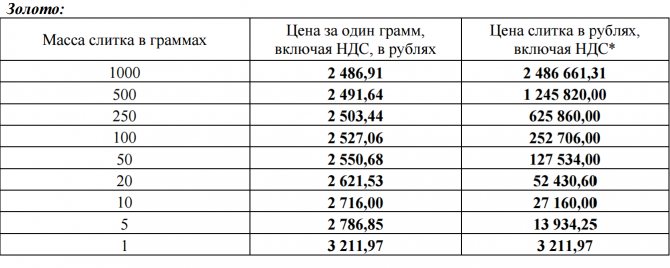

Current price of gold at Gazprombank.

Mutual funds of Gazprombank - conditions

- The minimum threshold for financial investments in Gazprombank mutual fund is 50,000 rubles. The amount is not small. Not every citizen of the Russian Federation will be able to afford such investments. When purchasing through lk.gpb-am.ru it will cost less - 1000 ₽.

- There are no regulated periods for the use of purchased shares. Experts recommend investing money for at least 2 years.

- It is possible to top up your account, but in an amount of at least 1000 ₽.

- There are no additional costs when purchasing shares.

- For the sale of a share, the owner is charged a commission, the amount of which depends on the investment period: 2% - if 182 days have not passed since the date of deposit of funds, 1% - from 182 to 730 days.

There is no interest charged for cashing out after two years of use.

- The Management Company's remuneration is 2% of the average annual net asset value.

- The premium for purchasing shares is only possible when purchasing through an agent and is 1%. In other cases, it is completely absent.

Types of mutual funds in Gazprombank

As of the end of 2021, the Manager offers Russian citizens to invest their savings in 9 mutual funds.

For those citizens who have decided to invest their finances in mutual funds for the first time, experts recommend purchasing bonds. This type of securities is characterized by reduced risk, but the profitability is usually low. Purchasing shares, on the contrary, is characterized by obtaining maximum profit, but the risk of losing everything increases significantly.

"Gazprombank - Bonds Plus"

Today, this mutual fund is one of the largest bond investment funds in Russia. Investments occur primarily in high-yield bonds of Russian enterprises that have an exceptionally high credit rating. Moreover, the assets belong to both private and public organizations.

This fund was created for conservative clients who are not ready to take big risks, but at the same time want to invest their savings and get tangible profits. The yield of the Bonds Plus fund has increased by 28.5% over the past few years.

Financial analysts, based on an analysis of the growth chart, make the most favorable forecasts for the further development of the mutual fund. At the end of December 2021, the price of one share was 1840 rubles, the net asset value (NAV) exceeded 26 million rubles.

"Gazprombank - Balanced"

Almost every management company has in its portfolio an investment fund with mixed assets. Clients' money is used to purchase both bonds and shares of the largest Russian enterprises. As a result, the investor receives a balanced level between large risks with high returns and small risks with low returns.

The price of the share is growing regularly. Investing in the mutual fund "Gazprombank - Balanced" can be an excellent replacement for investing in a classic banking product - a deposit. The fund's return has increased by 31.4% over the past few years. At the end of 2019, the price per share was 2865 rubles, the NAV exceeded the mark of 2.5 billion rubles.

"Gazprombank - Foreign Currency Bonds"

This mutual fund is very similar to the Bonds Plus fund, which was mentioned above. The difference between them is that funds are spent on purchasing bonds of foreign enterprises, as well as Eurobonds.

By the way, for those who don’t know, Eurobonds are bonds that can be issued in any world currency, but it must be different from the national currencies of both the issuer and the borrower. Eurobonds are placed simultaneously on the financial markets of several countries, with the only exception being the state in which the bonds were issued.

The fund's main currency is the dollar, which will be extremely beneficial if the state of the national currency is not stable, such as in Russia. A depositor, by investing his savings in the Gazprombank - Currency Operations Mutual Fund, can make a profit not only from the sale of shares, but also from the difference in exchange rates.

The price per share directly depends on the value of $ and over the past three years it has increased by 9.15%. As of December 30, 2019, the cost of one share of the fund was 3,303 rubles, and the value of net assets was more than 500 million rubles.

"Gazprombank - Shares"

The fund is engaged in acquiring shares of Russian and foreign enterprises. The main goal of the mutual fund is to increase capital growth in the main sectors of the economy and increase the securities index on the MSE (Moscow Stock Exchange).

Investing in stocks, although they bring good profits, is also an extremely risky business. That is why, before investing your money in the Gazprombank Shares Mutual Fund, you should think very carefully and be sure to weigh all the pros and cons.

Financial analysts note a good increase in the level of profitability of this mutual fund, which increased by 32.6% over three years. The cost of one investment share as of December 30, 2021 was 2582 rubles, NAV exceeded 428 million rubles.

"Gazprombank - Gold"

Investing financial resources in precious metals, especially gold, has always been profitable. After all, it is in it that most financial institutions around the world store their reserves. In addition, the cost of gold is constantly growing. And the currency for purchasing shares is the US dollar, which can bring good additional income due to fluctuations in exchange rates, just like when investing in the “Currency Bonds” fund.

Experts recommend purchasing fund shares for at least a year to get a good profit. The cost of one share in the last days of 2021 was 1,391 rubles, the value of net assets was 275,975,716 rubles. Unfortunately, the fund has negative dynamics and over the past three years the loss was -0.27%.

"Gazprombank - World Food Basket"

In September 2021, it was renamed the International Dividend Fund.

This fund has no analogues on the Russian market. Its funds are spent on purchasing shares of international funds that specialize primarily in investments in the agricultural sector of different countries.

Today, these are the most profitable assets, since agricultural products are less subject to sudden price fluctuations and are stable in comparison with financial markets. And there was, is and will always be a demand in food markets. After all, every person simply needs food to live.

The risks of investing in this fund are minimal. Investment currency is US $. The cost of one share as of December 30, 2019 was 1,244 rubles, the NAV was approaching 63 million rubles.

"Gazprombank - India"

From the name it becomes clear that all investments are made directly in the development of the Indian economy. Experts agree that in the next five years this country will demonstrate high economic growth to the world.

Today, the investment portfolio of the Gazprombank - India fund already includes more than 75 shares of large Indian enterprises belonging to different sectors of the economy. Increasing the investor's profit lies not only in the regular increase in the value of assets, but also in dividends that are paid to the investor on an annual basis.

As of the end of December 2021, the price of one unit of the mutual fund was 2,415 rubles, and the value of net assets exceeded the mark of 85 million rubles.

"Gazprombank - Oil"

Most of the depositors' funds are directed to the development of the oil industry. Experts note that the price of oil will rise, therefore, such investments are very profitable in the future.

World analysts believe that the “price bottom” of this natural oily fuel passed several years ago and in the future, there will only be an increase in the cost of each barrel. This means that the value of assets acquired now will increase significantly. As of 12/30/19, the price of one share was 851 rubles, and the NAV was about 112 million rubles.

"Gazprombank - Electric Power Industry"

The investment portfolio of this fund includes securities of enterprises specializing in the production and sale of electricity, as well as thermal energy. Recently, there has been a decrease in the growth rate, but despite this, the industry remains stable in both the Russian and global economies.

The cost of one share on December 30, 2021 was 613 rubles, the NAV exceeded 127 million rubles.

About the broker

| Name | "Gazprombank" (Joint Stock Company) |

| Year of foundation | 1990 |

| Regulator and license | License to carry out brokerage activities number 177-04229-100000 dated December 27, 2000, issued by the Central Bank of the Russian Federation License to carry out depositary activities number 177-04464-000100 dated 01/10/2001, issued by the Central Bank of the Russian Federation License to carry out dealer activities number 177-04280-010000 dated 12/27/2000, issued by the Central Bank of the Russian Federation License FCSM prof. participant of the Securities Market for the implementation of securities management activities dated December 27, 2000, number 177-04329-001000. |

| requisites | INN: 7744000912 KPP 997950001 BIC 044525823 OKPO 09807684 OGRN 1027700167110 dated 08.28.2002 |

| Reliability rating | Expert RA: ruAA+ “stable” (according to Russian gradation) ACRA: AA “positive” (according to Russian gradation) S&P: BB- “stable” Moody's: Ba1 “stable” FITCH: BB+ “stable” |

| Trading platforms | Stock, derivatives and currency sections of the Moscow Exchange London stock exchange Over-the-counter Eurobond market Foreign stock and ETF markets |

| Trading platform | QUIK / PocketQUIK / iQUIK X / |

| Minimum deposit | No limits |

| Authorized capital | 194,996,182 thousand rubles. |

| Head office address | 117420, Moscow, st. Nametkina, 16, building 1 |

| Official site | https://www.gazprombank.ru/personal/brokerage_service |

| Hotline number | 8 |

| Free demo account | No |

| Minimum commission | 0.008% – stock market, subject to a turnover of 60 million rubles. per day 0.5 rub./per contract – derivatives market 0.05% – London Stock Exchange |

| Rating | 3.69 out of 5 |

Advantages of Gazprombank mutual funds

- Income. People invest their money in financial products in order to receive additional profit. Today, investing in mutual funds brings higher income in contrast to a classic bank deposit.

- High level of reliability. The largest rating agency in Russia, Expert RA, assigned the highest level of reliability class A++ to Gazprombank Asset Management Management Company.

- Online purchase. An investor can purchase shares of any GPB mutual fund online. All you need to do is log into your personal account and confirm the purchase.

- Currency. While many similar management companies can boast a wide range of mutual funds, not every Management Company can provide the opportunity to invest funds in both rubles and dollars. While investing in US currency provides additional profit from exchange rate fluctuations.

On the topic: VTB mutual investment funds in 2021 - Profitability, conditions and feedback from investors.

Profitability of Gazprombank mutual funds

The profitability of any Management company, including Gazprombank Asset Management Management Company, depends on many factors. It is simply impossible to calculate it many months in advance. In 2018, its indicator was one, in 2021 – another, no one can say for sure what it will be in 2020.

Investment analysts can only express their assumptions and make preliminary forecasts. This approach is considered completely normal, since not one financial product can guarantee a 100% result in obtaining maximum profit, especially without any risks.

Beginners and experienced citizens in matters of investing are advised, before investing their money in a particular fund, to thoroughly study all the information about the profitability of the mutual fund over the past several years.

It is also necessary to have at least the slightest idea about those industries and companies in whose securities the fund’s funds are invested. If possible, conduct a detailed analysis of the market situation, read and listen to reviews and expert opinions. Such a rational approach will minimize the level of risk in the future. And this, in turn, will help the investor not only preserve his savings, but also increase them.

Another recommendation from experts is the proper distribution of funds. In simple terms, you should not invest all your money in one fund. It is better to divide the funds into several parts and purchase shares of several different mutual funds.

Today, investing in Gazprombank mutual funds is considered one of the best offers on the Russian investment market. Over 15 years of operation, Gazprombank Asset Management has established itself as a stable and reliable company that annually shows a high level of profitability for almost each of its funds.

Review of Tinkoff mutual funds - How does Tinkoff Investments work?

Features of receiving cashback

Gazprombank provides some of the best conditions for cashback. You can get up to 10% back on purchases in the category where you spend the most. In addition, the bank returns up to 1% for other purchases directly to the account. As a result, you can hope for a partial refund, but costs may not be reduced.

When does the Gazprombank Gold Card cashback arrive? The product owner does not have to independently choose the category according to which the cashback increase occurs. It is determined independently without unnecessary actions on the part of the client. The switching takes place taking into account what more funds are spent on in a particular month. Gazprombank cashback under the terms of the Gold Card is credited on the 10th working day of the next month.

It is possible to connect to the bonus system depending on the tariff plan and the chosen platform. In addition, you can join an insurance program, the payments for which are minimal. If an insured event occurs, you can receive serious compensation from a reliable insurer.

How to buy Gazprombank mutual fund?

It is not at all difficult to purchase shares of any of the GPB mutual funds you like and you can do this in several ways.

- Method 1. Directly at the branch of the bank or Management Company “Gazprombank - Asset Management”. You must have a passport of a citizen of the Russian Federation and an amount of money in the amount of the down payment, which in 2021 amounted to 50,000 rubles.

- Method 2. Online via the Internet. To do this, you need to register in your personal account at the Management Company GPB UA. Top up your account with 50,000 ₽, select a mutual fund and purchase shares.

- Method 3. Just like the previous option, this is done online, without leaving your home. All that may be required is to log into your personal account on the State Services website. Next, you will need to complete all the necessary steps and tips and in 10-15 minutes become a shareholder of one of Gazprombank’s funds.

How to get a card?

A Gazprombank debit or credit card provides great benefits to its owner due to favorable offer conditions. You don't have to spend a lot of time before getting a finished product with your data.

To obtain a Golden Visa Card from Gazprombank, you need to follow simple steps:

- Fill out the application. To do this, you need to fill out the basic fields in a special section on the website or go to the nearest bank office. The procedure will take no more than a few minutes.

- Wait for a ready solution. After completing the application, a decision is received in the form of an SMS message after some time.

- Get a card. To do this, you can contact the same office where the application was submitted. It is also possible to receive the card by courier delivery through a bank representative.

The client can transfer wages to a Gazprom card. To do this, you need to download a special application form on the website. It contains account details and employer details. Then you need to submit an application through the accounting department. Starting next month, you can use a gold card as your main financial instrument.

Business strategy and investment idea

The investment idea of Gazprombank funds is to provide private investors with the opportunity to receive additional profit from their savings, as well as at any time, if the need arises, to withdraw personal funds.

The strategy of the mutual fund depends on the economic situation in the country. The choice of companies in whose securities the fund’s main investments are made also has an influence in the formation of the strategic approach.

Brief history of the broker and awards

The history of the credit institution begins in 1990. Gazprombank has been actively developing, now it is one of the largest credit institutions in Russia. However, the brokerage department of this bank is not very popular among private investors, and it itself positions its brokerage services with a focus on institutional and corporate clients.

Gazprombank does not have any special awards related to brokerage services.

Net asset value and investment share

The table below provides information on the value of net assets and one investment unit.

Name of mutual fund | NAV, in rubles | Price per share, in rubles |

| Bonds plus | 27 742 451 890,68 | 1837,80 |

| Balanced | 2 698 281 575,44 | 2865,07 |

| Currency operations | 518 450 092,28 | 3303,15 |

| Stock | 428 484 337,74 | 2582,64 |

| Gold | 275 975 716,39 | 1391,42 |

| International Dividend Fund | 62 960 401,16 | 1244,47 |

| India | 85 065 885,77 | 2415,28 |

| Oil | 111 958 474,09 | 851,07 |

| Electric power industry | 127 340 316,44 | 613,18 |

Note. All figures shown are current as of December 30, 2021. More accurate information for the current day can be found on the official Gazprombank Asset Management portal.

Investment recommendations

Many newcomers to investing make mistakes due to ignorance and misunderstanding of the process itself. Most citizens think that purchasing shares of any mutual fund will definitely bring a guaranteed profit, which will be higher than the income from a regular bank deposit. At the same time, possible risks are completely ignored.

Of course, the return on investment in a mutual fund exceeds the return on the deposit. But do not forget about price jumps in the exchange rate of any securities. While on a deposit, at the end of the contract, not only all invested money is paid, but also pre-defined interest. Of course, subject to all agreements.

To get the most positive result from investing in a mutual fund, you should first set a specific financial goal for yourself, and also decide which factors are most appropriate in your specific situation:

- The period for which you are ready to purchase shares;

- Profitability indicator;

- Risk level.

Successful experienced investors and investment analysts advise beginners to follow a number of simple recommendations. This will allow you to minimize possible risks and make a profit.

- Recommendation 1. Do not start investing with large amounts. To get started, it’s enough to invest a minimum.

- Recommendation 2. Do not invest all available funds in one mutual fund. It is better to divide it into several parts and invest in several funds or even in different management companies.

- Recommendation 3. It is always necessary to work for the future. Only with this approach can you become a successful investor.

- Recommendation 4. To obtain maximum profit, it is recommended to purchase shares in ownership for a period of at least 1 year.

Benefits of a gold card

Gold card holders receive bonuses and discounts. Among them, there is a reduction in payment when receiving a rental car or in case of booking through the CARSHARING service. There are promotions when renting a hotel room, purchasing plane or train tickets. There are separate promotions for those who use online platforms to make monthly purchases.

Golden Smart Card from Gazprombank pros and cons :

- Smart cashback. The user receives up to 10% for the category that has large expenses in the current month. At the same time, 1% is returned on other purchases. As a result, the holder of a gold card receives favorable conditions for its use not only when accumulating funds, but also for monthly expenses.

- Miles. The bank returns 4 miles for 100 rubles. shopping. This is an opportunity for travelers to realize their own plans. If you wish, you can save up for expensive tickets within Russia and when traveling abroad.

- Possibility of free cash withdrawal. This opportunity is provided not only at Gazprombank ATMs. It is possible to receive funds from other ATMs if there are no own or partner branches nearby. This establishes the conditions under which such an operation is possible.

- Possibility of transfers without additional commission. This is a good solution for those who often transfer money to relatives. While most banks set minimum limits, at Gazprombank they are optimal within 100,000 rubles.

- Free shipping. The client can not only pick up the finished card himself, but also choose delivery through a representative of Gazprombank. This is a great opportunity for those who lack free time.

The only negative point is the cost of maintenance. But for regular purchases it will not be available, since the bank does not impose additional fees for active clients.

Internet banking is also provided. To do this, you need to contact a Gazprombank branch to generate a login and password. Here you can carry out most of the operations yourself, including replenishing and transferring funds from your account, making an online deposit, and controlling expenses. If you use your smartphone more often, you can download an app to access mobile banking. This solves the problem of mobility and makes it possible to perform operations on the go.

Which mutual fund should you choose?

In which mutual fund of the Gazprombank - Asset Management Management Company to invest your personal funds depends only on the investment strategy of the investor himself. And it, in turn, is determined on an individual basis. Experts highlight some options that, in their opinion, can bring very good results in the future.

- Currency bonds. Funds that purchase foreign currency bonds have as their main goal protection from currency risks should they arise. This approach is a good safety net, especially in conditions of the unstable position of the ruble.

- Investing in shares of Russian companies that have recently shown the most consistently growing level of development.

- Oil. The cost of this fuel has the ability to both go down and go up in a fairly short period of time. The moment of decline in the price indicator is considered the most favorable period for purchasing shares of companies specializing in oil production and refining.

- Electric power industry. Not a bad industry, well worthy of investment. Just as in the case of oil, after the price falls, it always rises. Consequently, the possibility of getting a good return on investment increases.

Another excellent solution would be to invest in such mutual funds of the Management Company “Gazprombank - Asset Management”, such as “Bonds Plus” and “Balanced”. These mutual funds offer their investors to receive significant profits with a low level of risk.