One of the most expensive metals in the world is platinum. Now on leading exchanges the price of one troy ounce (31.10 grams) of platinum is about 830 US dollars.

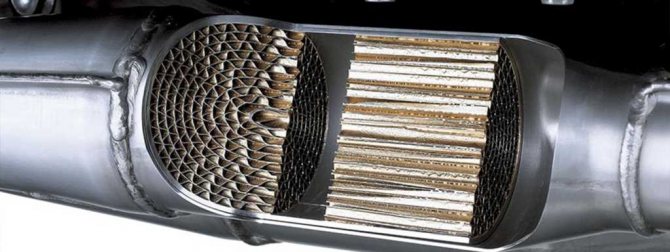

Platinum is used not only for making jewelry. It is used to produce dentures and other medical products, laser mirrors, liquid crystal displays, car catalytic converters, fertilizers and many other items that people really need.

Although just a few hundred years ago (by historical standards - yesterday), this noble metal, on the contrary, had no value - it was simply thrown away!

Now the five leading platinum-mining countries in the world have already firmly taken their positions in this ranking. Although from year to year some of them may change places.

About platinum mining

In the XVIII-XIX centuries. In Europe, platinum, taking into account its special properties, was used only in the creation of chemical equipment and as catalysts. The white metal mined in America at that time was more than enough for such needs.

Platinum mining by "ploughman" in the early 19th century.

On the territory of Russia in 1819, the future precious metal was first discovered in the Urals. Development of the deposit began, and in 1824 platinum mines were discovered in the Nizhny Tagil mining district and in the valley of the Is River (Isovskaya placer). Platinum mining in the Urals has made Russia the world leader in production of this white metal.

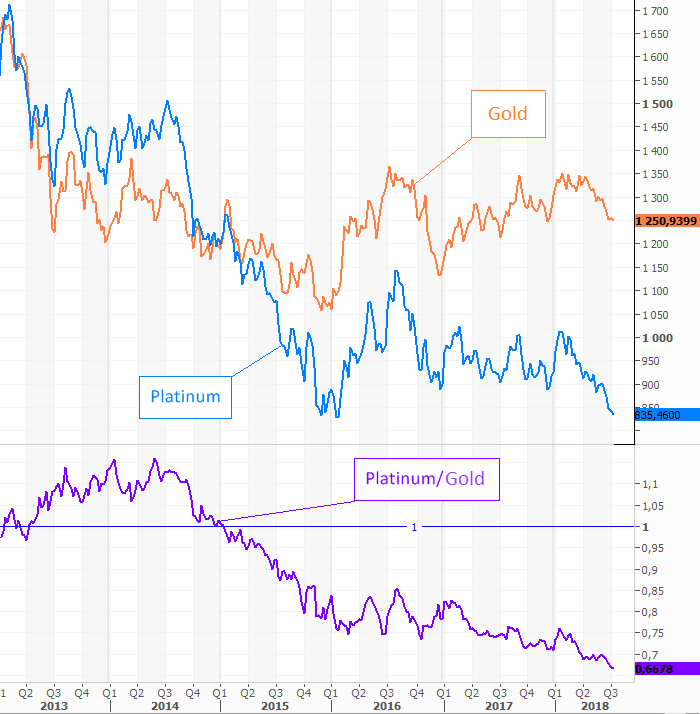

Platinum is not in trend. It's never been so cheap before

Platinum is trading at historical lows relative to gold, showing the worst performance among the precious metals. Let's figure out why the precious metal is losing its value so rapidly?

Description of metal

Platinum is a silvery-white precious metal first discovered by Spanish conquistadors in the mid-16th century. In Russia, platinum placers were discovered in 1819 in the Urals, which were so large that the country very quickly became a leader in the extraction of this metal. Initially in Russia the metal was called “white gold”.

Today, South Africa has a leading position in platinum production, producing about half of all annual metal production and on whose territory about 80% of all economically viable platinum deposits in the world are concentrated. Other major producing countries are Zimbabwe, USA, Russia, and China.

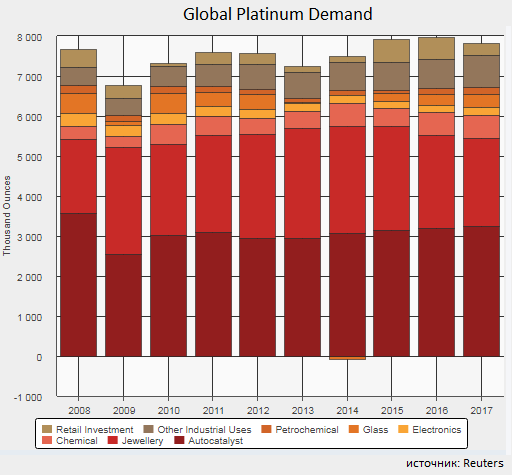

Initially, the precious metal gained its popularity in the jewelry industry, but the physical and catalytic properties of the metal became the basis for its widespread use in industry. The metal is used in the automotive industry, chemical industry, electronics, oil and gas industry, jewelry and other segments of the economy. Jewelry production creates only 30% of the total metal demand.

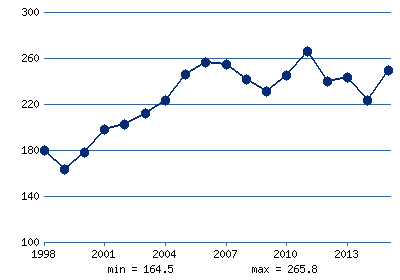

Just a few years ago, platinum was the most expensive on the precious metals market, but in recent years the situation has changed dramatically. Metal futures are trading at multi-year lows today, showing consistent negative dynamics since 2011.

Since the beginning of 2015, platinum has steadily held a lower position compared to gold. If the trend continues, at this rate platinum could soon be removed from the list of precious metals.

What's happening

The decline between 2011 and 2014 was associated with a decline in the market as a whole, when the decline in gold prices pulled down the prices of all other precious metals. But since 2015, an independent negative case has appeared in the history of the platinum market.

Due to its catalytic properties, platinum, along with another precious metal palladium, is used to produce catalysts for cars. Almost 40% of the total demand for metal comes from automakers.

The automotive industry's focus in 2015 was the Volkswagen scandal. An independent study conducted by specialists from the International Council on Clean Transport (ICCT) and designed to prove the environmental friendliness of diesel vehicles revealed exactly the opposite results. The amount of harmful substances in the exhaust of the tested cars was tens of times higher than the permissible standards.

The results were shocking, since previously, similar models passed all the necessary laboratory tests. After several more tests, Volkswagen management was forced to admit that the company installed special software on its cars that changed the operating mode of the engine in laboratory conditions in order to hide the real content of harmful substances.

The scandal led to a change in the position of politicians in Europe, which is the second largest market for platinum. The auto industry's priority has shifted to gasoline vehicles, and there are serious concerns about a significant decline in the share of diesel vehicles in the coming years. According to the Society of Motor Manufacturers and Traders, sales of diesel cars in 2017 fell by 17% and accounted for 42% of the market, against 47.7% a year earlier.

What is the relationship between diesel vehicles and platinum prices?

Platinum and palladium are used in both diesel and gasoline cars in the production of catalysts - special devices that reduce the amount of harmful substances in car exhaust. But the ratio of metals in catalytic elements is different.

On cars with a diesel engine, 70-80% is platinum, 18-28% is palladium, and the rest is rhodium. In gasoline vehicles, the volume of metals in the catalytic elements is approximately two times less, and the ratio of platinum, palladium and rhodium is 1:8:2, respectively.

The scandal surrounding diesel engines put significant pressure on platinum quotes and set a positive trend for palladium prices in the following years. The spread between metals has narrowed rapidly since the beginning of 2021. The Platinum/Palladium ratio, which was around 1.8x at the start of 2021, is now 0.9x.

Since the fourth quarter of 2021, palladium has been steadily trading at a premium to platinum, the rarest metal on earth and previously valued more than gold.

Another factor putting pressure on platinum prices since 2014 has been the decline in demand for the metal from the jewelry industry. According to Reuters, the level of demand in 2021 compared to 2013 was 20% lower. A similar trend is typical for other metals. The drop in demand was mainly observed from China.

Market prospects

At the beginning of 2021, prices for the metal were under pressure along with other commodities due to the risks of trade wars, causing platinum prices to return to lows again after the rebound in late 2021. However, if you look at the figures representing the ratio supply and demand in the real physical platinum market, the existing discount to gold appears excessive.

According to Reuters, the platinum market has experienced a deficit for the third year in a row. In 2021 it amounted to 50 million ounces. Agency analysts predict the continuation of a commensurate deficit at the end of 2018 due to a moderate decline in production in South Africa and growth in industrial demand.

The situation is stressful for platinum producers. Current price levels are very close to the cost of metal mining. According to Metal Focus analysts, the average production cost in South Africa in 2021 was $834 per ounce, so if the current price level is maintained, a compensating reaction from the supply side will inevitably follow.

However, South Africa is not the only country where a decline in production is predicted. A significant drop is expected in Canada (by 8%) and Russia (by 3%). Other regions are expected to see more modest declines.

However, the decline in production will be partially offset by an increase in platinum production from autocatalyst scrap, which is expected to grow in the coming years. However, the overall trend is negative.

In North America and Europe, analysts predict an increase in demand in the jewelry industry, but declines in China and Japan will offset the entire effect. Overall, a moderate decline is expected, the rate of which will be slightly lower than in 2021.

Increased demand from the automotive industry is expected in all regions except Europe and Japan. What is noteworthy is that, despite the scandal with diesel cars, during 2015-2017. Demand from the auto industry also showed positive dynamics, adding an average of 1.8%.

This may indicate that the negative effect on quotes on this side was more of a psychological nature and is associated more with expectations than with the actual dynamics of demand in this segment.

In addition, given the discount of platinum to palladium, a number of automakers may be thinking about expanding the use of platinum due to its low cost, which will provide additional support to demand.

The rest of industrial demand already showed good growth of 7% in 2021. This year it is expected to add another 9% due to the significant contribution of glass production.

All of these factors indicate that platinum's discount to gold will narrow over the next 12 months. Analysts are of the opinion that this will be a gradual process, since the risks from trade wars are now quite strong and against their background, market participants will be quite cautious in making decisions. In addition, moderate pressure on the metals market is exerted by the strengthening of the US dollar against the backdrop of expectations of an increase in Fed rates.

Galaktionov Igor BKS Broker

Platinum mining methods

The method of mining platinum largely depends on the type of deposit. If the platinum-bearing layers do not lie too deep or on the surface, then the “open” method of its extraction is used, but if the horizon (layer) is located very deep, the “closed” method is used. The technological cycle of platinum mining begins with geological exploration of the proposed deposit.

- With the open method, a small layer of soil is removed, which lies directly on the platinum-containing placer.

- The closed method involves drilling, laying explosives and building deep shafts.

To mine platinum in one way or another, modern technologies are used, and many types of quarry equipment are also used.

How is platinum mined in nature?

Extraction of precious metals using artisanal methods is typical for ordinary people eager to find treasure/treasures. Residents of mountainous regions often search for rich rocks on their own and, using improvised means, try to extract fragments of precious metals (platinum).

One such method is to extract platinum from stone using regular iodine :

First, those on which white veins or inclusions are clearly visible are selected from a pile of stones. Then iodine is drawn into a regular pipette. The reaction of iodine with gold or platinum produces the green color of this substance. If, when the iodine dries, a green coating remains on the surface of the stone, there is the presence of a precious metal.

Platinum is also mined from metal ores. For example, from sulfide copper-nickel or nickel. But during their processing, part of the platinum is lost along with production waste through the enrichment of copper or nickel, so they try not to use this process due to its labor intensity.

How to extract platinum from a catalyst?

You can extract platinum from a car catalyst with your own hands using the “leaching” technology. It is recommended to use an imported device, since gold is often used in the production of domestic cars. “Leaching” involves wetting the catalyst with a solution of high concentration hydrochloric and nitric acids. The process must be carried out at 100 degrees Celsius. After wetting, the device is washed several times, resulting in a mixture containing white metal.

The disadvantage of such an operation is the loss of a certain amount of platinum. It is necessary to take into account the fact that with a long service life of the catalyst, less and less precious deposits remain in it.

Extraction of platinum from radio components

The process of extracting platinum from recycled materials (radio components, electrical installation elements, etc.) at home consists of several stages:

- Dissolution - Selected contacts are brought to a boil in dilute hydrochloric acid to dissolve non-ferrous metals.

- Precipitation - after dissolution, the filtered raw material is immersed in pure hydrochloric acid so that the non-ferrous metal is completely dissolved. Concentrated nitric acid is added dropwise to complete the dissolution cycle. A solution of ammonium chloride is carefully introduced into the resulting mixture of platinum chloride to obtain ammonium hexachloroptatinate.

- Preparation of spongy platinum - the solution is filtered, the resulting yellow salt is again filled with ammonium chloride under vacuum. After such filtration, a precipitate remains; it is dried for several days in the sun or by low heat. The dried sediment is calcined at 800 degrees. The resulting spongy platinum is smelted, poured into a mold and allowed to cool until it becomes an ingot (find out at what temperature platinum melts).

We must not forget that such a process is very dangerous due to the high content of toxic substances in radioelements. Therefore, it is necessary to follow the same safety rules as when working in a laboratory.

How platinum is mined, video

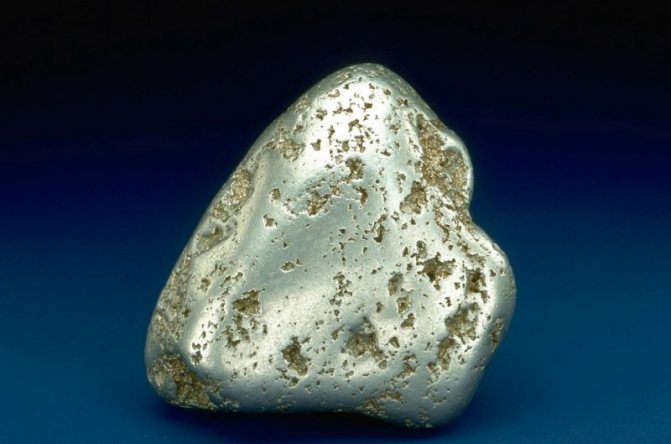

What does platinum look like in nature?

In deposits, this metal is found in the form of granular formations of steel, silver with a white or yellowish tint, depending on the composition of the substance.

There are large platinum nuggets weighing up to 9 kilograms. Small cubic crystals are found much less frequently.

Pure substances are practically never found in nature; more often they are present in rocks in the form of various alloys.

Chemical and physical properties

This element belongs to the noble metals, since it is inert towards most known acids and alkalis:

- At room temperature it reacts with aqua regia.

- It is dissolved by liquid bromine and heated sulfuric acid of high concentration, but the reaction proceeds slowly.

Platinum is capable of creating hundreds of complex compounds, which makes it one of the most active catalysts for chemical reactions, while its composition remains unchanged.

This metal has a high density - a cube with sides measuring 1 cm will weigh 21-21.5 grams.

This is a refractory substance, its melting point is 1768 ° C, while it is very plastic, malleable and can be easily forged.

The process of formation in nature

The main theory is that the platinum group elements were formed during a colossal cosmic explosion and were in a molten state in the substance that later turned into the core of our planet.

How is platinum mined in Russia?

Platinum mining using the example of the richest deposit in Russia - the Konder mine, located in the Khabarovsk Territory in the Far East (the Amur prospecting team):

- The development of the field began in 1984.

- Production area is classified.

- Number of personnel – 1400 people.

- Extraction – platinum group metals.

- Volumes – over 150 tons of precious metals for the entire period of operation of the mine.

- Area of application: automotive industry in Russia, medicine and jewelry production.

A complex technological process is the extraction and production of pure platinum. To get to the platinum sand deposits, workers remove 18-20 meters of waste rock. First they blow it up, then they take it out of the site in dump trucks. The sand containing the precious metal is then washed with a powerful stream of water.

There is only 1 gram of platinum per 1 m3 of sand.

Before mining the rock, miners wash the sand by hand - if grains of white metal are found in the washing tray, then only then do they call in the equipment.

The semi-finished product from the washing machines goes to the processing plant, where pure precious sand is obtained.

Platinum production at this deposit per day is up to 30 kg, and per year - more than 3.5 tons. In order not to reduce such productivity, the management of the enterprise puts into operation high-performance machines and equipment, as well as advanced technologies developed on the basis of leading domestic and foreign centers of the mining industry.

Fed monetary policy boosts demand for precious metals

Platinum quotes hit a six-year high. The price of the metal was approaching $1,270 per troy ounce, having increased by almost 16% in five days. Interest in platinum is growing against the backdrop of a depreciating dollar and its undervaluation compared to other precious metals. Taking into account the structural shortage of the metal and the restoration of demand for it from the automotive industry, analysts believe that prices could reach $1,500 per ounce.

Platinum quotes on the world market on February 11 updated their maximum since January 27, 2015. According to Reuters, on Thursday quotes rose by 2.2% to $1,268.9 per ounce. Since the beginning of the year, platinum has risen in price by more than 19%; in the last five days alone it has risen in price by almost 16%. Prices for other precious metals rose at a lower rate. Over five days, gold rose in price by 3%, to $1,847 per ounce, silver by 3.7%, to $27.3 per ounce, palladium by 4%, to $2,378 per ounce.

The rise in prices for precious metals occurs against the backdrop of a weakening US currency. On Thursday, the DXY index (the dollar exchange rate against six leading world currencies) dropped to 90.26 points, having lost almost 1.5% in five days. According to Ilya Sushkov, managing partner of Amber Lion Partners, the rise in prices for platinum, like other precious metals, is supported by demand from investors trying to protect themselves from a weak dollar, low rates caused by unprecedented support measures from the Federal Reserve.

The high impact of investment demand on the platinum market is evidenced by preliminary research from Johnson Matthey (JM). While in 2021 investors accounted for less than 1% of total global demand, or 67 tons, in the last two years the figure has risen above 13%. At the end of 2021, investors purchased more than 900 tons of metal. “ETF holdings rose by almost half a million ounces to a record high of 3.8 million ounces. Some of these were likely to be a safe haven for gold buying, but platinum also benefited from improved sentiment based on the potential for wider use in gasoline autocatalysts and fuel cells,” JM said in its review.

Analysts attribute the rapid growth rates of platinum prices this year to the low liquidity of the metal and its lack of value.

In 2021, prices for platinum group metals - palladium and rhodium - reached historical highs amid shortages. At the end of last year, palladium increased in price by almost 26%, rhodium by almost 170%. At the same time, the growth in platinum prices was more restrained - about 11%. “When the trend towards green energy and electric vehicles again became relevant on the economic and political agenda, platinum became the cheapest asset for investment, capable of showing high returns,” notes Daniil Karimov, managing director of the metallurgy sector at Otkrytie Research.

How investors and industry are driving up the price of platinum

The structural shortage of the metal on the world market adds to the attractiveness of investing in platinum. According to Johnson Matthey estimates, in 2020 the total consumption of platinum was 6.92 thousand tons, which is 18.2% lower than the result of 2021. At the same time, production fell by 19.5%, to 4.89 thousand tons, processing decreased by 21%, to 1.64 thousand tons. As a result, the metal deficit at the end of the year amounted to 390 tons, which is a third higher than the deficit in 2021. “The recovery in industrial demand for platinum may be hit by supply shortages. In particular, platinum production in South Africa in 2021 is projected to be 7% below the 2021 level, while demand for the metal may already fully recover this year,” notes Daniil Karimov.

In the medium term, the growth of platinum quotes may continue due to fundamental factors.

“Given that, with the exception of the production of green hydrogen, platinum and palladium often act as substitutes, the current price ratio (0.5 - the minimum since 2001) will be adjusted towards a ratio of 0.7–1,” notes Daniil Karimov. According to his assessment, without a noticeable negative correction in palladium prices, platinum quotes could soon reach $1,500 per ounce. However, due to the high role of investment demand, market volatility may increase. “The platinum market is relatively small, so investment demand for the metal can either compensate for surpluses in production and maintain high prices, or lead to a decrease in metal prices, and the commodity market to equilibrium or even excess supply,” says Ilya Sushkov.

Vitaly Gaidaev

Where is platinum mined in Russia?

Russia ranks second in the world after South Africa in deposits where platinum is mined in large quantities. Not only in the Khabarovsk Territory, but also at large mines in Taimyr, the Primorsky Territory and the Kola Peninsula, deposits of platinum-containing ores are being developed.

Development of platinum deposits in the Urals

About 250 tons of precious metal were mined in the Urals from 1824 to 1922. The Ural deposits are rightfully considered unique to this day, since it was here that nuggets of incredible size were mined. At the Isovskoye deposit, prospectors found the largest (7.86 kg) known nugget of pure platinum, the “Ural Giant,” which is stored in the Diamond Fund of Russia.

At the beginning of the 20th century, the Isovsky and Nizhny Tagil deposits produced about 80% of the total world volume of platinum. But by the middle of the last century, platinum deposits in the Urals were almost completely depleted, and production was reduced to a minimum. Today, only placer residual deposits continue to be developed here.

Platinum deposits on the Kola Peninsula

The primary platinum deposit near Monchegorsk on the Kola Peninsula was discovered by geologists relatively recently. Research into the rock for the presence of platinum has been ongoing here since 2021. If development, which will begin this year (2020), confirms the presence of platinum deposits, this deposit will be considered the richest in Russia.

According to geologists, the 3 km area contains several platinum-bearing strata, on which great hopes are pinned.

The richest deposits

South Africa has the richest reserves of platinum on the planet, and the largest deposit of all currently existing is also located there.

In the world

The most famous and promising mines today:

- Merensky Reef, South Africa;

- Great Dike, Zimbabwe;

- Stillwater, USA;

- Lac Deux Iles, Canada;

- Sudbury, Canada.

In Russia

The world's largest alluvial platinum deposit (Conder) is located in Russia.

Metal mining is carried out mainly in the Khabarovsk Territory, Kamchatka and the Sverdlovsk Region. The following deposits are especially noteworthy:

- Norilsk group, Krasnoyarsk region;

- Fedorova Tundra, Murmansk region;

- Conder, Khabarovsk Territory;

- Lobva, Sverdlovsk region;

- Levtyrinyvayam, Kamchatka;

- Vyysko-Isovsky, Sverdlovsk region.

Experts also highly appreciate the proven reserves that are located in Karelia, the Kola Peninsula and the Voronezh region.

All platinum mined on the territory of the Russian Federation falls on the share of MMC Norilsk Nickel. It is also one of the largest PGM producers in the world.

What other countries produce platinum?

On an industrial scale, platinum group metals are mined in only four countries. The world's largest platinum deposits are located in South Africa.

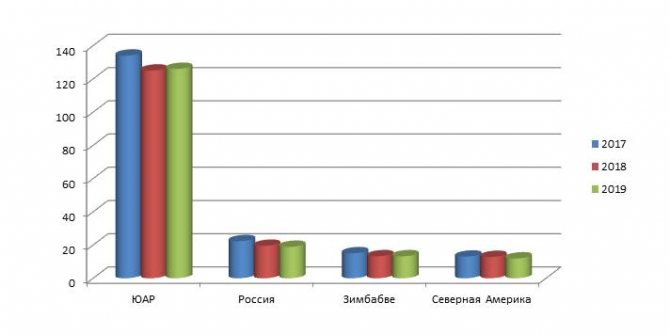

Platinum production in the world by country looks like this (see figure):

Platinum mining in China

In the early 2000s, China began to develop platinum deposits. The Jinchuan nickel deposit and Jinbaoshan were considered the largest in China. The content of pure precious metal was only 1.5 grams per ton of developed rock - very little compared to the indicators of the leading countries.

In terms of platinum production, China accounts for 3% of world volumes, sharing them with Colombia and Finland (see figure above), so it can rather be called not a miner, but a consumer of this metal. Today, almost 45% of global consumption of platinum jewelry occurs in China.

Platinum mining in Africa

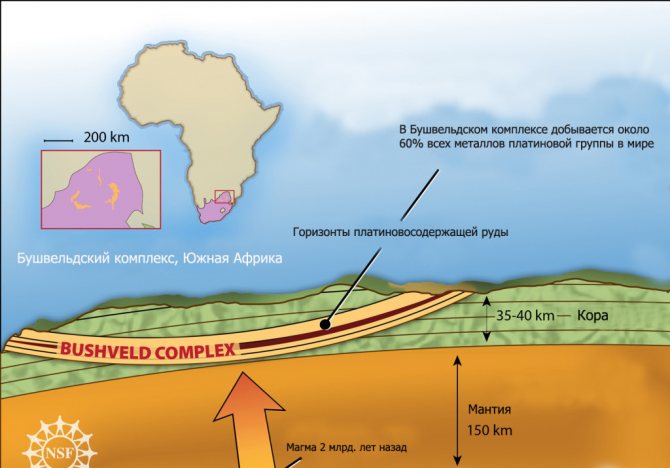

The world's largest and inexhaustible deposit of platinum group metals is located in the Republic of South Africa (RSA). The gigantic Bushveld complex deposit is estimated to be about 2 billion years old. A third of all platinum in the world is mined here - 140-150 tons annually. The complex consists of three layers of platinum deposits with a length of 1500 km: Merenski, UG2 and Platrif. The deposits of platinum-containing ore in this complex will be enough for more than 10 years of extraction of the purest platinum.

The Bushveld complex was discovered by Hans Merensky (a South African, geologist by training) in 1924.

Another southern African country, Zimbabwe, produces 11 tons per year, which is a good indicator, and puts it among the world leaders in platinum mining. A joint venture between Zimbabwe and Russia, Ruschrome Mining, is developing the Darwendale deposit, where, according to geologists, platinum deposits will allow the extraction of about 30 tons per year.

Platinum mining in Mongolia

The small but resource-rich country of Mongolia, a former republic of the USSR, has large reserves of coal, gold, various metal ores, as well as good deposits of alluvial platinum.

At the moment, negotiations are underway with companies of world leaders in the extraction of minerals, including the discovery and development of deposits of platinum group metals.

Peter Reus (Russian geologist) in 2014, traveling through Mongolia, discovered an accumulation of ore particles in the water of Lake Bayan Nuur, in which, according to the analysis, pure platinum was identified. “In the annals of world platinum mining, there has never been such a rich and such accessible placer,” according to the geologist, the layers of placer platinum lie almost under the entire lake valley and are of great value for the economic development of the country.

Platinum deposits in Kazakhstan

The extraction of platinum group metals in the Republic of Kazakhstan is carried out by isolating precious metal fragments from complex ores during the development of gold deposits.

Platinum deposits in the USA and Canada

At this mark, the team will drill into the rock. Canada. Up to 5 tons of platinum are mined in Canada per year. The development of deposits of platinum group metals began already in 1908 and still allows Canada to maintain a leading position. Platinum deposits are located in the northwest in the town of Ontario.

USA. Stillwater Mining Co has owned mines in the US state of Montana since 1987. Every year, platinum deposits produce about 6-7 tons of pure precious metal. The ore here is rich in platinum group metals and amounts to 20 grams per ton of rock. Alaska also had fairly rich mines, but they dried up in almost 60 years.

Stages of obtaining platinum

Mining and obtaining platinum is a complex technological process that consists of three main stages, characteristic of almost all mined metals:

— Ore mining

— Ore beneficiation

— Obtaining pure metal

Stage 1: Platinum Ore Mining

The method of extracting ore largely depends on the nature of the deposit. There are “open” and “closed” mining methods.

The open-pit method usually extracts platinum from secondary placer deposits, where platinum accumulated as a result of the destruction of primary rock. First, “stripping” is carried out - a layer of soil is removed in order to get to the platinum-containing placer. Then, special quarry equipment is used to directly extract the rock with platinum included in it.

However, most of the platinum is found in primary deposits, being part of copper-nickel ores. Platinum is extracted from such deposits using a “closed” method, which involves the construction of mines. To mine ore using a closed method, traditional methods for such conditions are used: miners manually drill holes in the rock, lay explosives and carry out an explosion. The broken pieces of rock are transported to the mine shaft and raised to the surface. Mining conditions require a lot of manual labor, although recent improvements have been made in the form of low-profile drilling machines and conveyors that can work in low shafts.

Stage 2: platinum ore beneficiation

Mined ore typically contains 1 to 6 grams of platinum group metals per ton, depending on the deposit. The main goal of beneficiation is to significantly increase the content of valuable metal in the ore. In this case, the ore will be more accessible for more subtle chemical refining operations, as a result of which the metal is released in its pure form.

Ore beneficiation is based on the physical properties of the metal and is a chain of operations that results in a concentrate with a platinum content of approximately 1400 grams per ton of rock. In alluvial deposits, as a result of enrichment, so-called schlich platinum appears, containing 70-90% of platinum group metals.

For example, we can consider the process of beneficiation of ores from the Bushveld complex in South Africa. Taking into account the varying metal content of different ores of the Bushveld complex and losses during processing, from 0.5 to 1.5 tons of ore are required to obtain 1 gram of pure platinum.

The extracted rock is crushed and crushed. The resulting mass is mixed with water and special reagents, and then air is pumped through it. As a result, bubbles are formed to which rock particles containing PGM adhere. Bubbles with adherent particles float to the surface, forming foam, which is collected and dried. As a result of this operation, a concentrate is obtained that contains from 100 to 1000 grams of pure metal per ton.

The concentrate is then smelted in electric furnaces at temperatures up to 1500 °C, as a result of which unwanted minerals are converted into slag and removed. Then the resulting mass is fed into converters, where it is blown with air to remove sulfur and iron. As a result, a concentrate is obtained with a pure metal content of 1400 grams per ton.

Stage 3: obtaining pure metal (platinum refining)

The concentrate obtained as a result of ore enrichment is supplied to refineries. These enterprises have special equipment and technologies that allow them to isolate the metal in its pure form. At the same time, refineries can be located at a considerable distance from the place of ore mining and enrichment. For example, enriched ore from deposits in Canada is transported to refineries located in Europe.

Refining uses a chain of complex thermochemical purification reactions that release the six platinum group metals, as well as some gold and silver, which are usually present in platinum-containing ores.

Refined metals are over 99.95% pure and are produced in the form of ingots, granules or fine powder. The time from mining the ore to obtaining the pure metal typically ranges from 6 weeks for palladium and up to 20 weeks for rhodium (excluding transportation time).

Back to Top

ALL JEWELRY METALS: CATALOG | JEWELERY METALS - GUIDE

All about platinum | All about gold | All about silver | Palladium

Main platinum deposits | Physico-chemical properties of platinum metal | Samples of platinum alloys | Where is platinum used? | Why are platinum products more expensive than gold ones?

Share this article with your friends

Works by designers from the JEWELIRUM catalog

- Co.Cos Jewelry

- Co.Cos Jewelry

- Taiga Jewelry, Tomsk

- Taiga Jewelry, Tomsk

- Ilya Maksimov, Crimea

- Ilya Maksimov, Crimea

- UBIRING

- UBIRING

- Diamonds are Forever

- Diamonds are Forever

- Rings in natural style, Sergacheva Jewelery

- Earrings with pearls, Sergacheva Jewelery

- Cabochon ring, Minty Sky

- Fly earrings, Minty Sky

- Ring, Precious Park

- Ring, Precious Park

- Snake skin ring, Stoyanova Jewelery

- Chain earrings, Stoyanova Jewelery

- Children's pendant - stick, Matthew&Daniel

- Pendant for a child, Matthew&Daniel

- Bracelet, Svetlana Subbotina

- Ring with Slavic symbols, Svetlana Subbotina

- Indian style ring, Anna Goffman

- Indian style ring, Anna Goffman

- Earrings, ISTA

- Geometric ring, ISTA

- Earrings with enamel, PNJewelry

- Ring with enamel, PNJewelry

- Ring, Khramtsova Jewelry

- Ring, Khramtsova Jewelry

- Wedding rings to order, obruchalki.com

- Wedding rings to order, obruchalki.com

- Earrings, Yuri Bylkov

- Earrings, Yuri Bylkov

- Titanium bracelets, LanaMuransky

- Titanium pendant, LanaMuransky

- Brooch Elephant (after Salvador Dali), THING

- Ring Veil, THING

- Mace earrings, VLADIMIR MARKIN

- Cufflinks, jewelry mechanics, VLADIMIR MARKIN

- Drop-shaped ring, EKATERINA TOLSTAYA

- Drop-shaped earrings, EKATERINA TOLSTAYA

- Necklace with amber, LETA

- Earrings with amber, LETA

- Children's earrings, combinable, FASHBY

- Children's earrings, combinable, FASHBY

- Ring of architectural form, Elizaveta Malafeevskaya MANU_L

- Architectural bracelet, Elizaveta Malafeevskaya MANU_L

- Set Ginkgo Leaf, SHABUT JEWELLERY

- Brooch Wearable porcelain, SHABUT JEWELLERY

- Architectural ring, GEOMETRY

- Brooch, porcelain, GEOMETRY

- Necklace made of polymer clay, LICORNE ART

- Brooch made of polymer clay, LICORNE ART

- Ring, avant-garde, VALERY SEREDIN

- Bracelet, avant-garde. VALERY SEREDIN

- Wooden set, Scandinavian/Japanese minimalism, VLADIMIR SHESTAKOV

- Ring, Scandinavian/Japanese minimalism, VLADIMIR SHESTAKOV

- Earrings, TON ANT

- Ring, TON ANT

- Architectural ring, ANCHOR

- Architectural necklace, ANCHOR

- Earrings, GOHFELD JEWELLERY

- Necklace, GOHFELD JEWELLERY

- Massive ring, YAKISCHIK

- Designer jewelry, YAKISCHIK

- Architectural ring, ONE DAY ART

- Architectural ring, ONE DAY ART

- Brooch, bionics, VALERIYA MARKOVA (TESSA)

- Unclosed ring, bionics, VALERIYA MARKOVA (TESSA)

- Ring, bionics, BEAVERS

- Earrings, bionics, BEAVERS

- Earrings, asymmetry, VAGANOVA JEWELRY

- Airplane ring, VAGANOVA JEWELRY

- Flower ring, ALCHEMIA JEWELLERY

- Set, ALCHEMIA JEWELLERY

- Pendant-cat, ethnic, STUDIO OF ILYA AND VERA PALKIN

- Earrings, STUDIO OF ILYA AND VERA PALKIN

What is the volume of platinum mined in the world annually?

World platinum production is about 170-180 tons annually.

The volumes of platinum mined per year (in tons) for the leading countries can be seen on the graph:

The data is for the last 3 years. The North America indicator includes the United States and Canada. Every year, platinum production decreases. The development of new deposits in Russia and Zimbabwe in 2020 will significantly increase the amount of white precious metal mined.

How are platinum veins found?

Such veins were often found in streams, on the banks of rivers, and also in places where other minerals were mined.

In Russia, platinum was discovered in the Urals and was considered an admixture with gold in placer mines. But due to its refractoriness, this metal did not find use for a long time and was simply thrown away or sent to waste dumps.

Satellites of platinum

As a rule, this metal is never found separately. His constant companions are:

- iron;

- rhodium;

- ruthenium;

- palladium;

- iridium;

- osmium.

Rarer satellites are nickel and copper.

Where is platinum found in nature?

This metal is mined mainly in complex deposits. It looks like a heap of small particles and ingots. The platinum vein, like gold, can be found in typical igneous igneous rocks.

Types of deposits

The deposits in which this element is mined are of two types:

- indigenous (primary);

- loose (secondary).

In primary deposits, platinum, along with other platinum group metals, is obtained as a by-product from the mining of sulfides, copper and nickel. There are vein inclusions in the rock that go deep into the earth's crust.

Placers are the result of the destruction of a bedrock deposit and are often located at a short distance from it. Here ingots and small particles in the form of sand and flakes or plates are mined.

This element is very rarely found in quartz vein formations.

Extraction methods

Placers are developed by washing soil containing precious metal. Heavy particles settle to the bottom, and waste rock is washed away with water. Platinum obtained from alluvial deposits is called raw.

In complex deposits, the main source of platinum is the slurry remaining after the extraction of nickel and copper from ore. The sludge is subjected to additional processing - roasting and repeated electrolysis. After which the content of precious metals in such ore reaches 60% of the total mass.

The method of subsequent purification (refining) is also used for raw platinum. It consists of double treatment of the substance with aqua regia, and then calcination at a temperature of 800 to 1000 °C.

Production volumes

Today, the total world production of platinum is about 184 tons per year. About 60 more tons of precious metal are obtained as a result of processing.

What are the world's platinum reserves?

Mineral commodity summaries' 2021 Mining, Production and Reserves of Metallic and Non-Metallic Raw Materials 2021 and 2021 Report published estimates of global platinum reserves. They amount to almost 69,000,000 tons in all countries that mine the precious metal.

The world's largest reserves of platinum are in Russia - 3,900,000 tons. Further in descending order in the ranking of leading countries:

- Zimbabwe – 1,200,000 tons

- USA – 900,000 tons

- Canada – 310,000 tons

- South Africa - 63,000 tons.

Companies mining platinum in Russia and the world

Russian mining companies specializing in the extraction and production of platinum are Russian Platinum OJSC (the deposits are located in the Khabarovsk and Krasnoyarsk Territories) and the group, which develops deposits and mines the white metal in Taimyr and the Kola Peninsula. Smaller producers who mine platinum in Russia: Renova, Zolotaya Dolina, Farta.

Platinum-copper ore - Northern Siberia, Norilsk Mining District, Krasnoyarsk.

In South Africa, these companies are Anglo-American Platinum, Lonmin and Sibinanye-Stillwater.

Cost of platinum mining

To obtain 25 grams (1 ounce) of pure platinum, an average of 10 tons of ore must be processed. Due to the total costs of deposit development, mining and production of the precious metal, the cost factor was about $1,000 per 1 ounce. This figure changes daily.

For example, on 05/12/2020. the cost of 1 ounce of Pt was $950, and as of May 20, 2020. – 909 dollars.

The high cost of the precious metal is associated with its great practical value (use in many areas), the presence of a small amount in nature and the difficulty of extraction.

EREPORT.RU

The platinum market suffered from negative sentiment and falling prices in 2015, but demand trends were generally positive. Expectations of weakness in the Chinese jewelry market were overstated, while net sales of platinum ETFs by investors in Europe, the US and South Africa outweighed a surge in physical investment demand in Japan. Consumption of platinum in autocatalysts was strong, while industrial demand remained stable, resulting in overall platinum demand increasing by 4%. On the supply side, the recovery in sales by South African manufacturers was partly offset by a sharp fall in secondary metal production from scrap cars and old jewellery, leaving the market in significant shortfall.

Primary platinum supplies rose 19% to 6.08 million ounces in 2015, the highest level in four years. This increase was driven entirely by large supplies from South Africa, where platinum production has recovered from a devastating blow in 2014; sales by manufacturer in other regions were flat or decreased.

Inventory movements once again played an important role in the supply story, with South African producers bringing significant quantities of platinum to market from refined and in-production inventories to maintain cash flow during a period of low prices and unprecedented financial pressure.

In contrast, some producers in other regions modestly added inventory in 2015, either in response to low prices or to provide a buffer against future operational outages.

South African platinum supplies rose by more than 1 million ounces to 4.57 million ounces, the highest level since 2011. It was 274 thousand ounces higher than Johnson Matthew forecast in its November 2015 report; Most of these changes come from stock movements. Analysts had previously suggested that producers were unlikely to supplement their sales with supplies of platinum from inventories, following severe destocking during strikes in 2014. However, the need to generate revenue led all three major manufacturers to undertake additional sales from inventory at the end of 2015. Johnson Matthew estimates that nearly 150,000 ounces of platinum were recovered from refinery reserves (including 130,000 ounces from recovery at the Anglo Platinum refinery), while approximately 70,000 ounces were sent from pre-existing refined reserves.

Platinum production at Norilsk Nickel's Russian operations rose 2% to 610,000 ounces in 2015, following the clearing of some in-process stockpiles in the first half of the year. However, platinum sales fell 3%, and Norilsk added approximately 32 koz of platinum to its refined metal inventories ahead of the reconfiguration of the company's nickel and PGM production capacity that will take place throughout 2021. Johnson Matthew analysts estimate that output from alluvial platinum mines in the Khabarovsk region and the Urals fell to about 90,000 ounces in 2015, half the level a decade ago. In large alluvial operations, the grade of ore has fallen in recent years, and it has become impossible to compensate for this decline by increasing the volume of processed sands.

North American platinum supplies fell 6% in 2015 to 319 thousand ounces, due to lower by-product yields from Canadian nickel producers, coupled with some inventory build-up at Stillwater Mining Company in the United States.

Platinum mining by country and region of the world*

| tons | 2012 | 2013 | 2014 | 2015 | 2016 |

| South Africa | 127,8 | 130,9 | 110,0 | 142,1 | 133,4 |

| Russia | 24,9 | 22,9 | 21,8 | 20,8 | 21,1 |

| North America | 9,5 | 9,9 | 10,5 | 9,9 | 11,2 |

| Zimbabwe | 10,5 | 12,8 | 12,5 | 12,5 | 14,2 |

| Others | 3,9 | 4,4 | 4,1 | 3,6 | 3,5 |

| Total production | 176,6 | 180,9 | 158,9 | 188,9 | 183,4 |

*data from Johnson Matthew

Autocatalyst recycling has fallen short of expectations for two years in a row. Growth was unexpectedly weak in 2014, and scrapped platinum supplies fell short of expectations as some scrap processors built up inventories in response to falling PGM prices. In the past, stockpiling was usually a short-lived phenomenon; However, in 2015, hoarding intensified as PGM prices fell to multi-year lows. This trend has been reinforced by a collapse in scrap steel prices, which in some cases has impacted end-of-life vehicle recycling rates. The result has been a significant and prolonged decline in the volumes of catalytic converters collected, recycled and refined.

Platinum supply in the world, tons

(including recycling)

Source - Johnson Matthey

Other platinum market indicators

Gross platinum demand increased by nearly 300 thousand ounces to 8.46 million ounces in 2015, as higher demand from the automotive and investment sectors offset a moderate decline in jewelry demand. While stronger demand in the auto sector came as no surprise due to tightening European emissions regulations, the jewelry and investment sectors ended the year on a surprisingly strong note, with Johnson Matthew's new estimate for combined demand in the two sectors up by 250k in 2015. ounces compared to the November 2015 report. Global platinum demand from the automotive industry reached 3.43 million ounces in 2015, up 6% from the previous year. This was almost entirely driven by increased usage in the light-duty diesel (LDD) sector, where consumption grew by 11%. In contrast, platinum use in motorcycles, gasoline cars and heavy-duty vehicles declined, although there was a slight increase in platinum use in non-road diesel vehicles.

2015 was an exceptionally positive year for LDD production worldwide, with production rising to 16.3 million units, exceeding the previous record set in 2011 by more than half a million vehicles. The vast majority were equipped with some form of catalytic emissions control: Johnson Matthew estimates that more than 98% of diesel vehicles built in 2015 had at least one platinum-containing catalyst. Europe is by far the world's largest LDD market, accounting for two-thirds of global vehicle production in this segment. The share of diesel cars in the total number of cars produced in Europe reached more than 50% in 2011, but has fallen slightly over the past four years to 48% in 2015. Despite this, in the context of a rapidly recovering overall market, LDD vehicle output showed healthy growth, up 6% to 9.4 million units. This was below the 2007 peak by a million units, but represented the highest in four years. Elsewhere, other regional markets also registered healthy production growth in the diesel segment. Production of diesel cars in Japan increased by 11%. As one of the largest manufacturers, the country has introduced a range of diesel compact cars for the domestic market, competing primarily against petrol hybrids. In North America, diesel vehicle production rose 9% as sales of light-duty diesel-powered trucks rose, offsetting a decline in sales of diesel passenger cars following the discontinuation of some Volkswagen models. In the rest of the world region, total LDD production grew by 2%, and underperformance in India (the world's second-largest diesel vehicle market) was offset primarily by growth in exports from Korea and Thailand (the third- and fourth-largest producers, respectively). LDD vehicles worldwide). Industrial demand for platinum remained stable in 2015 as falling demand from oil refiners offset moderate growth in the glass and chemicals industries. Platinum purchases by the chemicals industry remained at historically high levels, with additional investment in propane blending and isobutane dehydrogenation, adding strong demand from traditional consumer sectors such as paraxylene and silicones. There was also a sharp increase in demand from display glass manufacturers, following two years of selling the metal back into the market as a result of plant closures in 2013 and 2014.

Platinum consumption by country and region of the world*

| tons | 2012 | 2013 | 2014 | 2015 | 2016 |

| Europe | 60,8 | 54,5 | 60,6 | 64,7 | 71,5 |

| Japan | 35,4 | 29,9 | 27,7 | 51,2 | 35,4 |

| North America | 36,0 | 30,3 | 29,7 | 30,2 | 35,9 |

| China | 71,4 | 81,5 | 78,7 | 74,6 | 77,5 |

| The rest of the world | 42,2 | 72,1 | 57,4 | 42,4 | 49,5 |

| Total consumption | 245,8 | 268,3 | 254,1 | 263,1 | 269,8 |

*data from Johnson Matthew

Platinum Market Forecast

During 2015, economic conditions and price movements were generally not favorable for platinum investment in Europe and North America. Prices have fallen steadily from $1,200 an ounce in January to a seven-year low below $900 in December, weighing on investor sentiment towards commodities in general and platinum metals in particular. Investors were discouraged by a combination of uncertainty over the outlook for the diesel car and jewelery markets, while the rapid return to full production in South Africa defied any expectations of a short-term supply squeeze. The prospect of rising interest rates in the US has also acted as a drag on investment in precious metals in general. Johnson Matthew's 2021 platinum supply and demand forecast calls for a fourth year of significant market deficits. Analysts see little chance of any increase in newly mined metal supplies, although combined primary and secondary supplies could rise, suggesting some recovery in autocatalyst refining. On the demand side, 2016 should be the peak year for platinum use in Euro 6 diesel vehicles, while there are good prospects for further moderate growth in jewelery demand. Industrial consumption is expected to be unusually strong, while continued Japanese purchasing should keep investment demand in positive territory.

In 2021, platinum prices have rebounded from lows below $820 an ounce in January to over $1,000 an ounce in the second half of April. There was a corresponding increase in the net length of futures positions, and this may indicate that market sentiment has begun to change in a positive direction. However, uncertainty over economic growth prospects in general, and for the platinum jewelery and diesel car markets in particular, may continue to act as a drag on investors. Global platinum reserves are expected to decline 3% in 2021 to 5.90 million ounces. After two years of dwindling inventories, South African producers now have less flexibility in sourcing metal from inventories; Johnson Matthew forecasts shipments from the region will decline 6% in 2021. Russian sales are forecast to change little, although there may be temporary production disruptions due to changes at Norilsk Nickel. In contrast, supplies from Zimbabwe and North America are expected to increase moderately. The volume of platinum recovered from end-of-life vehicle recycling is forecast to rise 9% to 1.22 million ounces in 2021. The significant level of stockpiles in 2015, coupled with expected growth in autocatalyst refining volumes, could lead to a significant increase in supplies in 2021. However, in the first quarter of 2021, there was no evidence of such a recovery, despite an increase in PGM prices since the beginning of the year; this may reflect the fact that steel prices remained close to multi-year lows. Therefore, Johnson Matthew is cautious about the potential for increased recycling volumes in 2016. It is possible that full recovery in the autocatalyst refining market will be delayed until 2021 or beyond. Overall, assuming positive investment demand as discussed above, Johnson Matthew believes the market is likely to remain significantly tight in 2021. Analysts currently forecast that the supply-demand gap will widen to approximately 860,000 ounces. It should be noted that this figure is based on the assumption that there will be some recovery in the collection and recycling of used autocatalysts in the second half of 2021.

Other articles in the “Commodity Markets” section

What are the prospects for platinum mining in the world?

Today, world reserves of platinum are rapidly decreasing, this is due to a reduction in the volume of mined metal. The developed deposits have already spent their potential, while new deposits of platinum-containing ores are still being explored and developed.

According to forecasts, platinum production in South Africa, Zimbabwe and Russia - leading countries in the production of the white metal - will grow due to new, already explored deposits.

In South Africa, the full potential of the Bushveld mines has not yet been fully realized, and in Russia they have high hopes for platinum-bearing strata on the Kola Peninsula.

The decline in global platinum production over the past few years will in the near future be replaced by a huge increase in this mineral.

Platinum deposits in South Africa

On the territory of the Republic of South Africa there is a unique deposit - the Bushveld complex , the world's largest source of platinum group metals.

The complex was formed approximately 2 billion years ago and is of igneous nature. It can be imagined as a huge saucer, 370 kilometers across, with irregular edges, dug deep into the ground. The bottom of the saucer is in the depths, and the edges protrude to the surface. The body of the complex consists of several horizons (reefs), which slope towards the center. Three reefs, Merensky Reef, Upper Group 2 (UG2) Reef and Platreef Reef, contain economically significant concentrations of platinum group metals.

The thickness of the Merensky and UG2 horizons is only about 1 meter. The Platreef horizon (the Bushveld mining complex in South Africa) is much thicker, from 5 to 90 meters, and is mined by open pit mining. In some places, where possible, the Merensky and UG2 horizons are also developed using the open method.

Bushveld platinum mining complex in South Africa

The complex was discovered by South African geologist Hans Merensky in 1924. The following year, mining began at the Merensky Reef, which was the main source of platinum-bearing ore until the 1970s, when development of the UG2 reef began. Currently, ore from the UG2 horizon accounts for about 63% of all production, from the Merensky horizon 22% and from the Platreef horizon 15% of all production of the Bushveld complex.

The Bushveld Complex supplies approximately 75% of the world's platinum and 40% of its palladium.

Platinum mining and environmental impact

The development of deposits and the extraction of platinum, like other metals, leads to a significant deterioration in the ecology of the work site: disruption of the landscape of vast areas, deterioration in the quality of water and forests, which in turn leads to a reduction in the population of flora and fauna.

The technological process of extracting ores from rock uses a large volume of water, and after washing, tons of wastewater containing large amounts of metal fragments are discharged into water bodies without proper filtration.

And since most of the mines are located in the upper reaches of rivers, they become sources of pollution in areas located downstream. Muddy and often poisonous streams are carried for hundreds of kilometers. At the same time, environmental pollution continues for many years after the cessation of production due to waste dumps, which are also washed away by the river over time. For example, the prospectors of the Conder mine have already worked out the main area and are moving downstream of the river, leaving behind huge “lunar landscapes” of bare earth, clearly visible even from space.

The time to buy platinum has come

Trading idea from 23 Aug. - a lot of letters - but perhaps the question has been answered about - when will analytics tell WHERE? Well, for trolls - you complain about spam analytics - here's a multi-bookoff of analytics - Ability?

____________________________

If someone is going to bet on the growth of commodity markets, then it is better to do this by investing in the platinum market. The price is in the range of 900-1000 dollars per ounce of platinum, very comfortable for purchases. It is worth understanding that this metal is both precious and industrial. And no matter what happens to the economy, raw materials, unlike companies, cannot go bankrupt, especially since these are raw materials, of which there are not so many.

Platinum is one of the rarest elements in the world, much rarer than gold. Even in bank cards, platinum cards are usually ranked higher than gold cards. The entire global platinum market is only 250 tons per year (8.2 million ounces), which is more than 10 times less than the gold market. Over the past 5 years, the physical platinum market has been in a state of shortage. The total deficit from 2012 to 2021 was 2.3 million ounces, equal to more than a quarter of the world's annual platinum consumption. But despite this, platinum prices have been declining since 2011, along with commodity markets. The reason for the price decline was a number of factors, which will be discussed below. But first, it’s worth talking about the general picture of supply and demand on the global platinum market.

Physical platinum market

Offer

In 2021, the total supply of platinum was 8,025 thousand ounces. The main supplier of platinum to the world market is the Republic of South Africa, with production in 2021 of 4,383 thousand ounces, which is equal to 54.5% of the total platinum market in the world. Therefore, the state of affairs in South Africa is very important for the market as a whole. The increase in platinum production in South Africa in 2015 was painfully perceived by the market, which partly justified prices to continue falling. However, it is worth considering that in South Africa they restored production, and did not increase it. The failure of production in 2014 was associated with miners' strikes. It is also worth considering that in fact, platinum production in South Africa, if you look at the long-term picture, has been declining since 2006. At that time, almost 5.3 million ounces were produced in South Africa, instead of today's 4.4 million ounces. Also, Russia, North America and Zimbabwe are considered major suppliers of platinum. Production in Russia is declining; if in 2000 it was 1,1000 thousand ounces, then in 2021 it decreased to 723 thousand ounces. Production in North America is more or less stable, but Zimbabwe has increased its production in recent years. (More detailed information in the table at the bottom of the text)

But, one way or another, the deposits are depleted, and fewer and fewer new ones are found. Global platinum production peaked in 2006 at 6.8 million ounces and has since fallen to 6.1 million ounces. The growth in platinum production is local in nature, not a trend, so, looking ahead, we can say with confidence that production on average will fall over the years. The total world reserves of platinum group metals are estimated at 80 thousand tons, of which platinum reserves are only 22 thousand tons.

The supply situation is saved by obtaining platinum from recycled materials. Old catalysts, jewelry, electronics and other platinum-containing products. In 2011, the supply of recycled platinum exceeded 2 million ounces, nearly tripling since 2004. Accounting for almost a quarter of the total supply of platinum. But recycling of secondary raw materials is very price sensitive. And the fall in the price of platinum stopped the growth in the volume of platinum extraction from secondary raw materials. And without a rise in price, the supply of recycled platinum will either decline or stagnate. Production in South Africa has already recovered and will not grow in the future, remaining at approximately the same level. Likewise in Zimbabwe, production has increased due to the commissioning of new fields, but there are no further plans for new developments. In view of this, the supply of platinum in the world simply cannot grow. According to the estimates of the most reputable companies in the industry, the total supply in 2021 will decrease. Johnson Matthey predicts a reduction in supply by 100 thousand ounces in 2021; according to the World Platinum Investment Council, it will fall by 200 thousand ounces.

Demand

The demand for platinum can be divided into the following main components. This is investment demand. Demand in the automotive industry for the production of catalysts for cleaning vehicle exhaust gases. Demand from the jewelry industry. And demand in other industries (such as electronics, petroleum, chemicals, glass, medicine and biotechnology).

The growth rate of demand for platinum in the last decade has not been high; in fact, current consumption is at the level of the pre-crisis 2007. Consumption of platinum in the automotive industry, despite the fact that the volume of cars produced in the world has increased significantly, has even decreased. The reason for this situation is that the main growth in car sales occurs in developing countries, including China, with low environmental requirements. Therefore, the Chinese auto industry used more, less expensive palladium. It should also be noted that the use of platinum is critical for diesel engines, which use a more complex exhaust gas cleaning system. In gasoline engines, palladium can be used along with platinum. Therefore, manufacturers used palladium as much as possible in the production of catalysts for gasoline engines. Since palladium fights gasoline emissions not much worse than platinum, and its price was lower. Therefore, prices for palladium, unlike prices for other commodities and precious metals, have not fallen since 2011, but have even increased. The entire increase in the automobile industry went into palladium. As a result, today the price of palladium has almost caught up with the price of platinum. In August 2021, the price difference was less than 10%, $970 and $900 per ounce (in 2011, platinum was almost 2.5 times more expensive than palladium). And this state of affairs, in the future, will take away the price advantage from palladium, and the subsequent growth of the automotive industry in the world will lead to an increase in demand for platinum.

In the jewelry industry, compared to the 90s, demand has doubled, for example, in the 90s, the jewelry industry consumed 1.4 million ounces, and in 2013, 3 million ounces. But in recent years, demand has also been weak. Due to falling sales in China, demand levels fell to 2.4 million ounces in 2021. There is and of course will be an increase in demand in the long term, but everything depends on success in the global economy. The 2015 crisis in China, or more precisely, the slowdown in the growth rate of the Chinese economy, and the outflow of capital from the Chinese economy in the amount of more than a trillion dollars, hit all commodity markets very hard, both oil prices and platinum prices. Chinese demand from the jewelry industry fell from 2,100 thousand ounces in 2013 to 1,510 thousand ounces in 2021. Demand from the rest of the world remained at the same level during this period. Further, demand in China will no longer fall due to its low base. But the overall demand for jewelry in the world, according to Johnson Matthey and the World Platinum Investment Council, will decrease by 35-100 thousand ounces in the current year 2021.

Balance for 2021

Excluding the investment component, total demand for platinum in 2021 is estimated to decrease by 200 thousand ounces, more than supply, which will decrease by 100 thousand ounces. In view of this, if we assume that investments remain at the same level as last year, then the metal deficit will fall to 100 thousand ounces based on Johnson Matthey data (given in the table below). Data from the World Platinum Investment Council differ slightly from Johnson Matthey's data; according to them, if investments remain at the same level, the deficit will fall to 300 thousand ounces from the current 360 thousand.

An important factor is the magnitude of investment demand. If it remains at the level of 500-600 thousand ounces, then the platinum shortage will continue. If, as Johnson Matthey believes, demand falls to 220 thousand ounces, then there will be a surplus in the physical metal supply market.

By the way, it is worth noting that current platinum reserves are estimated at 1,800 thousand ounces. As was written above, the market has been living off reserves in recent years and they have decreased by 2.3 million ounces. That is, at the moment, the total amount of reserves in comparison with 2012 has decreased by more than half. The market can no longer live off the consumption of reserves. And if there continues to be a shortage of metal in the world, then the price will rise, there will simply be no way out.

Therefore, an important factor that determines whether the platinum market will be in deficit or in surplus is the amount of investment in platinum. But the price of platinum still depends more on other circumstances, which will be discussed below.

Reasons for the fall

The fall in the price of platinum from 2011 to 2014 was primarily due to the general fall in prices for precious metals and primarily gold (more about gold). Gold prices simply pulled platinum down with them. The price fell from $1,700 to $1,200 per ounce. At the same time, in the panic mood of that time, the market did not even notice a strong drop in metal production in South Africa, which then decreased from 4.2 million ounces to 3.5 million ounces. The real physical platinum market could not resist the fall in exchange prices, since along with the fall in price, the volume of investments in platinum also fell, decreasing from 2012 to 2013 by 600 thousand ounces.

In 2015, platinum prices continued to fall, and this time the recovery in production in South Africa can be identified as the reasons for the price drop. But the main contribution was made by the scandal surrounding the Volkswagen company due to non-compliance with environmental standards in the company's diesel cars, which led to fears of a reduction in sales of cars with a diesel engine. Also, demand from the jewelry industry, mainly in China, has decreased. This, together with falling commodity prices, including a panicky drop in oil prices, pressed the price of platinum down. The price fell from $1,200 to nearly $820 per ounce by early 2021. It is paradoxical that throughout this period there was a shortage of metal on the physical market. The general negative mood of investors in the commodity market and the precious metals market drove platinum prices down. But the main thing that drove prices down was and still remains the scandal surrounding diesel engines. This has led to a downward trend in the price of platinum in recent years. This trend can be clearly seen on the price chart.

Volkswagen diesel scandal

Most of all platinum in industry is used in the automotive industry, more precisely, in the production of diesel engine exhaust cleaning systems. At the end of 2015, Volkswagen was caught deliberately underestimating emissions in its diesel cars (You can read more here). In the world, this scandal actually caused hysteria, with calls to almost ban diesel engines altogether. A huge anti-diesel campaign has risen in the media. Subsequently, it turned out that almost all companies, not only Volkswagen, have problems with exhaust gases. This in turn has raised fears that global diesel engine production could collapse and demand for platinum would collapse accordingly. This is why platinum prices have fallen extremely and are still very low.

Gold and platinum

The fact that platinum is now extremely cheap can be seen in relation to gold. Today, one ounce of gold costs almost 1.4 ounces of platinum, a ratio that has not existed in the foreseeable past. Platinum is very oversold. The graph below shows the dynamics of the ratio. The scandal surrounding diesel engines led to unprecedented sales of platinum and a drop in price.

Prospects

As a result, the current situation with the price of platinum is very, very sad. Negative sentiment and fear of diesel cancellation caused the scarce platinum market to fall in price, defying the laws of supply and demand. But as they say, fear has big eyes. Yes, of course there are risks. But what does the ban on diesel engines mean? This means that due to environmental requirements, and quite stringent ones, like Euro-5 or Euro-6. Western countries, and primarily Europe, will bring almost the entire automotive industry to the brink of bankruptcy. After all, if the worst assumptions come true, then given the fact that millions of diesel engines are produced in the world, and in Europe, half of the cars sold are diesel and automakers have invested hundreds of billions of dollars in their production. And while it will be very difficult and expensive to quickly rebuild, the ban will simply put almost all European automakers on the brink of bankruptcy. Both German and French, and it will also hit the American, Japanese and other auto giants, everyone who produces cars with a diesel engine, very hard.

That is, if platinum prices fall even lower, and this can only happen if diesel engines are abandoned. Then there will be no BMW, the company will simply go bankrupt, because it will not be able to quickly rebuild and, most importantly, there simply won’t be enough money for such a restructuring. Volkswagen and Citroen, Renault, Hyundai and the list goes on will also go bankrupt. Also, from such a blow, the German economy, and in general the entire world economy, will fall first. And what does it all come from – the difference in environmental requirements of Euro-3 and Euro-6? That is, Europe will commit economic suicide for this? - I don't think so.

The problem with diesel engines turned out to be more global than environmental issues. The scale of the problem has grown to such an extent that ecology can already be relegated to the background. And politicians in Europe understand this - you can’t stop an entire industry and throw everything into chaos because of environmental regulations. And therefore no one will stop the production of diesel engines. Of course, politicians now need to somehow reassure environmentalists, but so as not to bring down the industry. Therefore, in the last month there have been statements like that France will ban diesel and gasoline engines, but in 2040. Therefore, it is possible that sales of diesel engines in Europe will fall, but it is simply impossible to stop completely. This means that the “fears” have overdone the pressure on platinum prices.

On the other hand, platinum prices have already almost caught up with palladium prices. Therefore, the use of platinum in gasoline engines is becoming competitive. And if, due to the scandal, the number of diesel engines produced does not increase, it means that the number of gasoline engines will grow with a vengeance. And on the palladium market, there is now also a shortage of the metal. Therefore, platinum will be used in gasoline engines.

- The total consumption of platinum and palladium for the production of catalysts in the world in 2021 was 11,253 thousand ounces. 3,318 thousand ounces of platinum and 7,935 thousand ounces of palladium. In analogy, this is 246.8 tons of palladium + 103.3 tons of platinum, which equals a total of 350.1 tons. In 2021, 84.2 million passenger cars and light commercial vehicles were produced worldwide. A simple calculation suggests that for each car there are 4.15 grams of metal, but this does not take into account other vehicles, trucks, buses and other things. Taking them into account, the figure per 1 car will be significantly less. If diesel engines are abandoned, they will be replaced by gasoline ones. Where platinum will also be in demand, simply because the platinum market will not be able to compensate for the 100 ton volume. Rearranging the terms does not change the sum.

Data for the 1st quarter of 2021

It is also worth paying attention to the numbers. According to the World Platinum Investment Council, in the first quarter of 2021, demand for platinum from automakers even increased from 830 thousand in the first quarter of 2021, then 855 thousand ounces. That is, there is no actual collapse in platinum consumption. Moreover, the diesel scandal may even lead to an increase in metal consumption. Companies will simply be required to make catalysts better than they were, which could, in theory, imply a greater volume of platinum use, due to a banal increase in the size of the catalysts.

Also, according to data for the first quarter of 2021, the platinum deficit has not decreased, but even increased by 20 thousand ounces, and supply has decreased.

Buying Platinum

Therefore, at the moment and in the next 2-3 months, the market provides an excellent opportunity to buy very cheap platinum, taking advantage of fears about the diesel scandal. Once the hysteria passes, and in fact diesel engines continue to be produced and platinum continues to be sold, prices will begin to recover after a long and deep decline.

Technical picture

In trading, investors are often guided by technical analysis of quotes. In its simplest form, shown in the graph below. We can highlight a downward trend since 2011, within which the price moved. But from the beginning of 2021 until today, platinum prices have formed support, shown on the chart with a red line. The price ended up being trapped in a triangle and in the coming months, the price will come out of it. As I believe, in view of the above - up.

Buying platinum at this moment is beneficial for both speculative and investment purposes. Platinum is fairly oversold. The shortage of metal will continue, and reserves are no longer large, so the price will recover in the future. And looking into the future, half a year or a year, the level of 1200 is easily achievable. Moreover, the target of $1,200 per ounce of platinum can be called conservative. Under favorable circumstances, the price may go higher.

The most convenient way to invest in platinum is to purchase futures contracts on the Moscow Exchange. Ability Capital, being a licensed broker, will gladly provide the opportunity to carry out transactions for its clients.

The estimated, conservative estimated return on the investment is 20%, expressed in US dollars.

Mikhail Fedorov

Head of Analytical Department, Ability Capital