More and more countries around the world are taking their gold from the USA

More and more countries around the world that kept their own gold reserves in what until recently seemed the most reliable on the planet, the “bins” of the United States of America, are lining up to take the precious metal from there. And it would be nice if we were talking only about those states that have had serious friction with Washington. Even the most seemingly reliable US allies from Europe are striving to return home their little gold.

Just a dozen years ago, the list of states that entrusted their main assets to the supposedly impenetrable granite-concrete walls of Fort Knox and the basements of the Central Reserve Bank of New York (these two places are the main storage facilities for precious metals in the United States) exceeded well over fifty. According to the leaders of various countries, piles of gold, which form the basis of their financial stability, were in these places reliably protected from any threats posed by wars, revolutions and other disasters.

Again, why keep the “yellow metal,” long ago transformed from a monetary standard into a common commodity, away from the New York Mercantile Exchange, where the main transactions with it are carried out? Transporting (especially across the ocean) is both troublesome and expensive – the insurance alone is worth it!

Everything began to change after the global crisis of 2008-2009, when many countries began to think seriously about how “indestructible” the US economy and financial system really were. Venezuela and Germany became “pioneers” in the issue of “golden repatriation”.

Hugo Chavez, quite rightly believing that sooner or later his country would face open pressure and aggression from the United States, extremely wisely withdrew 176 tons of Venezuelan gold worth $9 billion. Today's events show that the late leader may rest in peace! As soon as the well-known events in Venezuela began, the Bank of England (no doubt on orders from Washington) “punished” Caracas with $1.2 billion, “freezing” the gold deposited there.

Based on this, it is not surprising that Turkey hastily “evacuated” its own gold reserves from the United States. Relations between the countries are about to finally reach a boiling point, threats from the White House and the State Department against Ankara are heard, in fact, continuously, and the Turks have already tasted their fill of the “delights” of American sanctions aimed at the collapse of their economy.

For the purchase of Russian S-400s, which Ankara does not intend to refuse under any circumstances, Washington threatens it with all “heavenly punishments.” It is obvious that it was precisely based on the reality of such a prospect that the Turkish authorities exported more than 28 tons of government gold from the United States. Following this, Turkish commercial banks did the same, returning the gold stored overseas to their homeland.

As for Europe, for example, more than 20% of its own gold reserves (120 tons), stored in the United States, were withdrawn from there by Holland. Today, according to available information, similar decisions have been made by the governments of Belgium and Italy.

For Germany, which, as mentioned above, was one of the first to be concerned about the return of its wealth from American storage facilities, this process resulted in a lengthy and rather unpleasant procedure. The Bundesbank turned to its overseas “allies” with a corresponding appeal back in 2012, however, the matter unexpectedly stalled. The reason for the delay turned out to be simply shocking - the ingots handed over to “the most reliable storage facilities in the world” by the zealous Germans simply were not there!

This was irrefutably proven when the return process finally began.

The United States gave Germany completely different gold than what it received from it. The markings on the pleasantly shining heavy bars did not match at all! As you understand, there was quite a scandal - after all, Berlin entrusted the Americans with more than one and a half thousand tons of its own gold reserves!

This unfortunate incident is far from the only incident that casts a very deep shadow on the reputation of the United States as a country that can be trusted with its own national treasure.

There are still persistent rumors circulating about gold bars received from the United States by China, which turned out to be, let's say... not quite gold. It seems that it has not been officially confirmed, but it is unlikely that there is smoke without fire. And what can we talk about if the most fertile ground for the spread of such sensations is provided by the fact that no audit has been carried out in the US gold vaults for more than half a century!

According to official data, more than 260 million ounces of real gold from all over the world, so beloved by Americans, continue to remain safe and sound there. The problem is that no one can actually confirm this figure. Any attempt to schedule an audit is defeated by the categorical objection of the US Congress. Why would that be so?

The reasons why the “trickle” of gold outflow from the United States is increasingly turning into a full-flowing “river” can be reduced to three main ones: firstly, the reluctance of states to become hostages of the foreign policy twists of Washington, which has a habit of terminating previously reached agreements at any moment, starting trade “war”, impose sanctions, or even declare someone a sponsor of terrorism.

Well, these “allies” who can lay their paws on someone else’s gold at any moment and even come up with a “legal” justification for this!

Secondly, all of the above things, the further, the more they reduce confidence in the American dollar as the main world reserve currency. Who knows at what confrontation the American economy might finally break down? Too many analysts and experts in the world do not see positive prospects for it in the near future.

For the US financial system in particular.

So gold - your own, your own, and even stored, as they say, nearby, will definitely be more reliable.

Thirdly, as already mentioned, more and more countries are beginning to fear that the Americans will not return their gold because... they won’t! The sad example of Germany made many people think. So, after all, Washington is still forced to at least somehow reckon with Berlin...

What can the current processes mean for the United States itself?

Definitely not good. It is unlikely (at least for now) that we can talk about the financial cataclysm that French President Charles de Gaulle caused the United States in 1965, forcing Washington to exchange green cut paper brought from Paris for full-weight gold at the stated rate of 35 dollars per ounce.

The process that began then, to which the central banks of other countries of the world became involved, ultimately led to the collapse of the Bretton Woods system. That is, to the complete refusal of the dollar from gold backing. This, however, did not kill the “green” one, alas. Rather, on the contrary, it gave him new strength.

However, today there is clearly another trend - albeit a slow, albeit gradual and still timid, but de-dollarization of the world economy. Depriving the United States of access to the gold reserves of sovereign states is one of its most important components.

Germany gold reserve

More recently, Germans were surprised to learn that Germany itself holds only 31 percent of the country's gold reserves. 1,536 tons—45 percent of the reserve—are in the United States. 450 tons of gold are waiting for return in banks in London, and 374 tons are stored in Paris. Moreover, France and the USA do not charge storage fees, while the practical British charge five hundred thousand euros every year.

The gold reserves of Germany (more precisely, the Federal Republic of Germany) began to form only in 1951, when the “German economic miracle” began. The Germans bought 259 kilograms for storage. Every year Germany acquired more and more gold.

So, in 1968 the country purchased more than 4 thousand tons. For a long time, the population and members of the Bundestag did not suspect that the bulk of the gold was located outside the country. When the information became public, a public movement “Bring back our gold!” even began in the country.

Since 2013, Germany has been gradually exporting its reserves from other countries. Only 210 tons of precious metal were returned.

Why the stock is stored outside the country and it is not yet possible to return it in full, the German authorities do not give a clear answer. There is a version that in 1949 the German government signed the so-called Chancellor Act with the USA, England and France, which will be valid for a century and a half.

With its help, the allies - England, France and the USA - will store and use Germany's gold reserves at their discretion until 2099. Every new chancellor who comes to power is required to sign the secret Chancellor Act. This version was first expressed by the former head of German counterintelligence Gerd-Helmut Komossa in the book “The German Map. The secret game of the secret services." Komossu was immediately declared crazy.

The version of the Chancellor Act looks fantastic, because in 1949 Germany did not have any gold reserves. Why the country created a powerful reserve, the second largest in the world, but cannot return it, remains one of the most interesting mysteries in the political arena of the world.

The gold reserves of the countries of the world, at least its first three leaders, raise many questions that remain unclear.

The biggest US deception: gold vaults are empty

There are good reasons to believe that the American gold reserve exists only on paper. Real gold bars stored in Fort Knox or other vaults do not actually exist. And if they exist, then in very modest quantities.

There is no direct evidence of this, but there are more than enough indirect signs. Especially many of them appeared after Donald Trump took office.

Return of German gold

While still a candidate for US President, Donald Trump drew attention to the trade expansion of China and Germany into the American market. The volume of products imported from there to the United States significantly exceeded the volume of American goods supplied to these countries.

The newly-minted American president decided to strike the first blow against the Germans. He imposed a 35 percent duty on the import of BMW cars from Germany to the United States. The German government's response to these unfriendly actions was the withdrawal of German gold reserves stored in America.

In parallel with this story, other events took place that, at first glance, had nothing to do with the Americans increasing the import duty on German cars or with the return of Germany's gold.

The first was the switching of the world community's attention to Trump's aggressive rhetoric towards North Korea, promising to “ruin into dust” the rebellious Pyongyang. The American-Korean skirmish between the leaders of countries possessing atomic weapons was so violent that the world began to prepare for nuclear war and forgot about everything. An excellent distraction!

Another interesting fact was the significant increase in gold prices on the world market. The increase was approximately 11.6%. It strangely coincided with the transfer of gold to Germany. It looked like someone was actively and hastily buying it in large quantities.

From German sources it is known that Germany previously stored 70% of its gold reserves abroad, mainly in the USA. Now this amount has decreased to 50 percent, or to 1,665 tons. It turns out that the return amounted to no more than 600 tons. The question arises: why didn’t the Germans return all their gold? Didn't want to escalate with the USA? Maybe. Or were the Americans simply unable to collect the required amount of gold? It looks like it is.

"Electronic gold"

Gold trading is brisk on world markets. But in the age of development of computer technology, no one is engaged in transporting gold bars from the old owner to the new one. Typically, all transactions take place electronically, and gold does not disappear from the vaults.

And although the United States is officially considered the largest holder of gold, the question arises whether this gold actually exists.

It is known that with the help of speculation with “electronic” gold, the American government and the Federal Reserve System often successfully solve their problems.

For example, during the transfer of German gold, along with the purchase of real bullion, there was an active sale of “electronic” gold. Sometimes, through the purchase or sale of gold, the Fed regulated the amount of dollar supply in circulation.

Where is the gold?

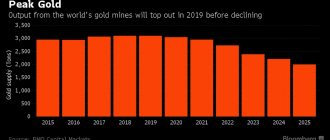

It is known that over the past 13 years, China, India and Turkey have been actively buying gold from the West. The total volume of purchases was about 28 thousand tons, with the Federal Reserve being the main seller. It can be assumed that, along with “electronic gold,” a significant amount of gold bullion was also supplied to these countries from the United States.

From this fact we can conclude that the amount of real yellow metal in US storage facilities has decreased significantly.

Against this background, the US attempt to wage a trade war with China is very surprising. She seems suicidal. Imagine if China responded by demanding that they “cash in” the “electronic” gold that was sold to them. And these are not the unfortunate crumbs requested by the Germans, which the Fed “scraped together” with such difficulty. Here we are talking about a serious volume that is capable of collapsing the global financial system.

Watching this situation, Russia should also “strain”, storing approximately $100 billion in US Treasury securities.