Lazy Investor Blog > News

There is a lot of speculation in the media that the main cause of financial crises is the abandonment of the gold standard. The topic of returning to the previous system is also actively discussed. Let's see what is hidden behind this sonorous phrase, and how true are the postulates about its universality.

Finding the equivalent of money before the gold standard

The entire history of money is an attempt to find a universal equivalent to the value of the national currency of each country . In ancient times, such equivalents were animal skins, iron, salt, furs, etc., i.e. essential goods to ensure the life of primitive tribes.

With the formation of the first states, the role of money began to be played by rare earth metals - gold, silver, copper . For example,

- The Novgorod hryvnia was an oblong ingot (“stick”) weighing 204 grams

- Lithuanian hryvnia - a similar “stick” 100-105 gr. silver;

- Polish skoec - the same “silver stick” at 204 g. (as in Novgorod);

- Kiev hryvnia - a hexagon in the shape of a rhombus, weighing 163-165 grams of silver, etc.

It is not difficult to guess that the money changers of Europe had no problems exchanging this money for its silver content , as later from the 16th century, when silver and rarer gold money took on the more familiar form of coins for us.

No inflation, devaluation or revaluation of currencies in the world has occurred for centuries , unless the state itself reduced the “silver (gold) standard” of its fiat money (no, the “mints” did not succeed in cheating, although the temptation was enormous - example Copper Riots of 1662 . in Novgorod and Moscow, when Tsar Alexei Mikhailovich decided to issue copper coins at the price of silver. By the way, the money changers immediately set a “market rate” for them - 6 silver coins for 170 copper, so the tsarist government was unable to deceive the population by 2830%, although it realized this only after the blood was shed).

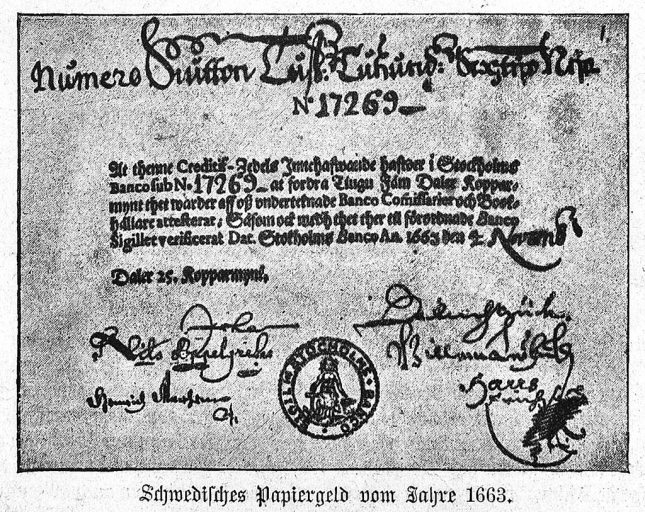

Attempts to deceive the silver (gold) standard also failed in Europe , when in 1661. The first paper money appeared, printed by the Bank of Sweden. Already in 1663 Swedish paper money turned out to be insolvent when they were exchanged for gold and silver, the bank went bankrupt, and paper bills disappeared from circulation.

Pros and cons of ending the gold standard

The consequences of the abolition of the gold standard can be divided into positive and negative.

Minuses

The result of the abolition of the gold standard was inflation. As governments of all countries began to print national currencies on an almost unlimited scale, the purchasing power of money decreased dramatically. There was an opportunity to inflate bubbles and currency speculation. This also led to an increase in the volume of debt obligations. Newly issued banknotes came into circulation through the credit system.

Another negative aspect of the abolition of the gold standard was the breakdown in the correlation between real wages and labor productivity growth. Even if nominal income increased, it did not keep pace with the rate of inflation. This has led to a slowdown in people's quality of life.

With the refusal to back national currencies with gold, the stability of the economy decreased. If a state collapses, the money it issued is completely worthless. It is no longer possible to predict the lower limit of economic decline in the event of a crisis.

I also recommend reading:

Why, when oil becomes cheaper, gasoline becomes more expensive?

Why is gasoline not becoming cheaper in Russia?

pros

However, there were also positive aspects to the abolition of the gold standard. First of all, this is the acceleration of economic growth. It was the ability to issue the money supply without restrictions and quickly increase liquidity that made it possible to overcome the Great Depression at one time. These same actions helped smooth out all subsequent crises.

A strict link between the volume of money supply in circulation and the amount of gold accumulated by central banks leads to the fact that production growth provokes deflation. This process, in turn, forces the production of new products to be reduced and workers to be laid off. The refusal to link banknotes to precious metals made it possible to reverse this situation.

The second positive side of abandoning the gold standard was the opportunity to pursue a flexible financial policy. Thanks to this step, central banks can quickly change the value of national currencies. This allows the use of controlled devaluation to reduce the risk of default. It is also used to increase the competitiveness of domestic producers.

Why was the “gold standard” introduced in Europe instead of the silver one? The role of the Latin American robbery

Gold had been used as a currency for at least the last 2,000 years alongside silver, but was a very rare metal in Europe. The earliest known mention of gold as money is recorded by historians in 600 BC. in Lydia, which is located in the western Asian part of modern Turkey.

By 560 BC. The Lydians experimentally separated gold from silver, creating the first real 980 gold coin. The popular expression “rich as Croesus” (from Herodotus’s “History”) is the best description of the immense wealth of the Lydian king Croesus, thanks to the stability of his monetary gold unit.

Over the next centuries, the value of coins from different countries was based solely on the value of the metal (gold, silver, copper) from which it was made . This was precisely the impetus for the conquest of the New World and the rise of

- first to Spain, whose navigator Christopher Columbus discovered America in 1492, in 1521. Hernan Cortes - “Aztec state” (Mexico), in 1532. Francisco Pizarro - “Inca State” (Peru), etc.

- then Portugal, the Netherlands, France and Great Britain joined the search for “new lands” and precious metals in them, and managed to become leading states in Medieval Europe due to the gold and silver captured in the colonies.

Only for 1530 The Spaniards imported about 100 tons of gold and 330 tons of silver per year into Europe , which allowed the European continent to accumulate gold reserves and gradually move from silver to the “gold standard” of backing money.

On March 29 of this year, the final phase of implementation of the new rules of the Bank for International Settlements began. Some experts believe that returning gold to the status of money should put an end to the omnipotence of the dollar. According to their forecasts, by December the American currency could fall by 40%, and at the beginning of next year it could finally lose its value.

Three events that shook the world of gold

Since 1879, the US monetary system was based on the so-called “gold standard”, which tied the volume of paper money supply to the size of the country's gold reserves, and 20 dollars could be exchanged for a troy ounce of this precious metal at any time.

55 years passed, and in 1934. US President Franklin Roosevelt approved the Gold Reserve Act. According to this document, private ownership of gold was declared illegal, and all precious metal was subject to sale to the US Treasury. A year later, when all the gold passed from private ownership into the hands of the state, Roosevelt raised the price by 70% - to $35 per troy ounce, which gave him the opportunity to print the corresponding amount of paper money.

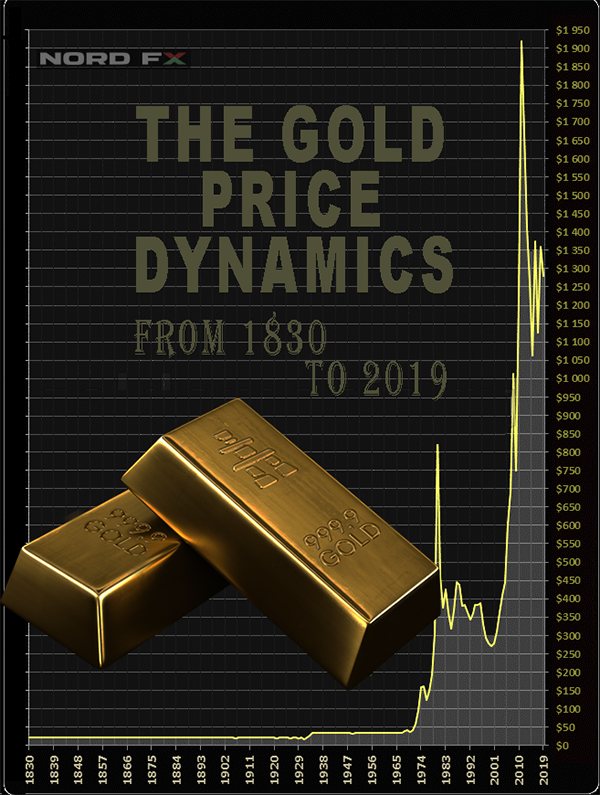

For the next four decades, gold prices remained stable, hovering around $35, until in the early 70s, another president, Richard Nixon, decided to abandon the “gold standard” altogether. This completely freed the government's hands, allowing it to print endless amounts of fiat currency, and the price of gold, which had ceased to be money, to grow exponentially.

And in the spring of this year, 2019, the media spread the news of another revolutionary event - on March 29, the final phase of the implementation of new rules began, according to which the yellow metal again officially became the same first-class asset as cash banknotes and government bonds.

These rules, adopted by the Bank for International Settlements (BIS) and called the “Basel III Standard” (based on the location of the BIS - Basel, Switzerland), allowed some experts to declare that once gold is restored to its monetary status, it should become money No. 1 , displacing the unbacked US dollar from the market. Since the responsibility of exchanging bills for precious metal now fell not on the US Treasury, but directly on the banks, they had to begin actively buying gold in order to maintain stability during the collapse of the dollar system. According to the forecasts of these experts, by December the American currency could fall by about 40%, and at the beginning of next year it could finally lose its value.

Fiction or reality: 155,000 USD per ounce?

– And what happened on March 29? – this question is addressed to the leading analyst at the NordFX brokerage company, John Gordon.

“Here’s what,” he points to the chart. – Instead of soaring to the skies, just the day before gold lost more than eight percent in price!

In my opinion, it is clearly premature to talk about the death of the dollar. It should be taken into account that, although the Bank for International Settlements unites more than 60 central banks of different countries, its documents are more advisory than mandatory. Moreover, some sources claim that the decision on the revaluation of gold and the date of introduction of this rule was made not at the general meeting of the BIS, but in a narrow circle of the largest regulators. These are the US Federal Reserve, the ECB, the Bundesbank and the Banks of England and France. And such major gold importers as, for example, China, India, Russia or Japan were not present.

In order for gold to become full-fledged money again, the NordFX analyst continues, it is necessary to establish gold parity, that is, its fixed content, at least in the world’s leading currencies.

Let's do a simple calculation. The current price of gold is $1,280 per ounce, or about $41 per gram. Now let’s calculate how much gold will cost if we establish parity between the dollar supply and the US gold reserve. So, according to data for 2021, the US gold reserve is 8133.5 tons, and the dollar supply, including bank deposits, is about $40 trillion. We divide one by the other and we get that the price of one gram of gold should be $5000, or $155.5 thousand per troy ounce. That is, 120 times more than today.

The US national debt is more than $22 trillion, and it’s hard to imagine what would happen if at least some of the creditors demanded to exchange their fiat money for real gold.

I think that, despite their primitiveness,” John Gordon concludes, “the above calculations clearly show that a return to the times of a century and a half ago, when every dollar, pound, ruble or mark was backed by the country’s gold reserves, is hardly possible.

What else do experts say?

The London Bullion Market Association (LBMA) conducted a survey of 30 analysts, asking them to give a forecast for the price of gold for 2021. If we average their opinions, we can talk about a modest increase of only 1.8%. However, two-thirds of those surveyed believe that at some point during the year the price of this precious metal could reach or even exceed $1,400 per ounce.

The most optimistic was Eddie Nagao from Sumitomo, who named the price at $1,475. In his opinion, gold will be one of the preferred assets among institutional and private investors, as the likelihood of a recession in the United States is constantly growing.

As for the pessimists, Adam Williams from Fastmarkets MB (Metal Bulletin) took the first place. His scenario calls for a decline below $1,200. According to the bears, gold was the decisive factor for investors in November 2018 – February 2021. But if a trade deal is concluded between the US and China, demand for safe-haven assets, including gold, will quickly fall and the price will go down.

If we talk about a longer-term forecast, then an interesting model is built by Gary S. Wagner, an analyst and producer of the daily newsletter “The Gold Forecast”. According to his calculations, the last major bull wave began in late 2015, following a correction to $1,040, and suggests gold could retest its 2011 all-time highs, reaching prices of $2,070-$2,085 an ounce in 2021.

Roman Butko, NordFX

Warning: These materials do not constitute a recommendation for investment or guidance on working in financial markets and are for informational purposes only. Trading in financial markets is risky and may result in a complete loss of your deposited funds.

The emergence of the “classical” gold standard

Occurred in the first half of the 19th century after the end of the Napoleonic wars. The money of most countries was presented in the form of hundreds of different types of coins made of gold, silver or copper, as well as paper banknotes issued by banks.

It was decided to tie the value of coins and banknotes to gold and introduce the gold standard in Great Britain in 1821 (although Isaac Newton, 100 years earlier, being keeper of the Royal Mint from 1699 to 1727, calculated the “fair price” of the pound sterling - £4 .24 per ounce of gold).

In 1854, Portugal switched to the gold standard , in 1871 it was adopted by Germany, and in 1873. Sweden, in 1874 France, Belgium, Switzerland and Italy, in 1892. - Austria-Hungary, in 1897. — Russia, in 1900 the USA after the start of the gold rush (from 1896 in the Klondike, from 1898 in Alaska). Thus, by 1900, almost all the leading countries of the world switched to the gold standard, because

- Gold remained a rare metal;

- To cut off from the number of leading countries in the world the majority of candidates who did not have access to large gold deposits.

Which of these two reasons was the main one, we, alas, will never know.

The gold standard lasted until 1914, when gold could be bought or sold in unlimited quantities at a fixed price in convertible paper money per unit weight of the metal.

With the outbreak of the First World War (1914), the gold standard remained only in international trade (food and weapons) , because All countries began to deplete gold and foreign exchange reserves, directing them to finance their armies, which is why paper money flooded domestic markets and began their sharp devaluation with a ban on the transfer of precious metals abroad. Thus, the Bank of England from 1914 to 1925. banned the export of gold, as well as the melting of gold coins, and the official exchange rate of the pound for gold was abolished.

How gold was replaced with air. Alexander Zapolskis

The abandonment of the “gold standard” launched the mechanism of eternal inflation

44 years ago, on August 15, 1971, US President Richard Nixon, thereby finally nullifying any security for the dollar, and indeed all world currencies in general. From that day on, money turned into pieces of paper and was supported only by the faith of consumers in their solvency. Paradoxically, few people noticed this revolution.

A little history

In its familiar form, the “gold standard” arose in the 19th century in connection with the industrial revolution in European countries. Growing production volumes required expansion of sales markets, which resulted in the rapid development of international trade. And there was a need to find the most convenient tool for mutual settlements. Such a tool was the linking of national currencies to a fixed amount of gold: it made it possible to easily track the mutual rates of any currency pairs and quickly determine the trade balance of each state (the relationship between the value of imports and exports).

In 1867, all this was finally consolidated by the Prague currency system. But at the beginning of the 20th century, most countries could not cope with the costs associated with the First World War, and untied their currencies from gold in order to print money in unlimited quantities. The only currencies that remained pegged to gold were the American dollar and the British pound. They began to acquire the status of an international means of payment. As a result of the Genoa Conference of 1922, the system became official and was called the gold and currency system, or gold exchange system. But then the Great Depression (1929–1933) struck the United States, money depreciated sharply, and the same “leading countries of the world” also refused to link their currencies to gold (England in 1931, the USA in 1933).

This, of course, did not lead to anything good, and a year later, on January 30, 1934, President Roosevelt ratified the Gold Reserve Act, according to which the dollar was again tied to gold at a fixed rate of $35 per troy ounce. In July 1944, at a conference in Bretton Woods (USA, New Hampshire), the monetary system now known as the “gold standard” was finally adopted. The currencies of 44 countries around the world were pegged to the dollar at a rigidly established rate, and the dollar was pegged to gold (according to the “Golden Act”).

Why o?

It is generally accepted that Washington’s abandonment of the “gold standard” was a reaction to French President Charles de Gaulle’s attempt in 1968 to “accumulate a shipload of American currency and immediately demand that the United States exchange it for gold.” By the way, in two years he managed to buy more than 3 thousand tons of this precious metal from the United States. However, the real reasons were completely different.

The fact is that the suspicions that the number of dollars in circulation did not correspond to the volume of US gold reserves were well founded. Although the American economy was the world's leading economy after World War II, in reality its foreign trade led to a drain on gold. On the other hand, according to the established rules, the Americans were not obliged to disclose the size of their gold “piggy bank” and therefore even then they could print slightly more green pieces of paper than was allowed. And, finally, due to the fact that the economies of many countries were so heavily “saturated” with the dollar that even without gold backing they could not refuse it, the idea of something that would finally free the hands of the Americans was literally in the air. Realizing all this, the US government without hesitation took a step unprecedented in its impudence and unilaterally announced a complete abandonment of the “gold standard”.

The following two facts make this situation even more striking. First: at that time, the lion’s share of the world’s gold was stored in the United States, and no one had access to it. (By the way, the Germans still don’t have it.) Second: American money, in essence, is not even American. These are just debt obligations of the 12 largest private commercial banks with federal agency status (FRS).

However, why the US decision did not cause any serious protests from other states is quite understandable. Because everyone wanted to cheat in solving their own economic problems by issuing unsecured banknotes.

What did we pay for this?

Imagine a flying airplane that has 197 controls—one for each country. And everyone is trying to control the winged car in their own way. But the degree and sphere of influence of the helmsmen is different. Some people have a fuel line tap in their hands instead of a steering wheel, others have a curtain for supplying air to the engine, etc. Some pilots want to fly to Honolulu, others want to fly to Nairobi, and others want to land immediately. Can you imagine the final trajectory of this flight? This is the overall rate of the world economy.

The economy, divorced from clear and stable guidelines, has ceased to provide adequate signals for making management decisions. In six years, the United States simply printed money out of thin air in the amount of 23% of its GDP, and the euro system, which at first glance seemed to be more protected from fraud, turned out to be doing the same thing. By the end of 2021, “using American QE technology” it will “print” 10.2% of the EU’s GDP.

And the most important thing is that, no longer having any real restrictions, the Western economic model has finally switched to stimulating its growth only through unlimited loans, that is, current money is simply obliged to depreciate every day. To imagine the scale of inflation, it is enough to return to the “gold standard” and calculate how the value of the dollar has changed in relation to the precious metal. In 1972, one troy ounce of gold on the London Stock Exchange cost $58.42, in 2001 - $277.9, and in 2014 - $1220. For 43 years, gold itself has not changed, the dollar has changed - and it has fallen in price by 20.87 times! And all because it is no longer restrained by any material restrictions, and the Fed's private banks really need profits. At any cost.

Is it any wonder that crises are coming more often, and their scale is becoming more critical?

As an afterword. It must be admitted that the solidarity pension system we are accustomed to is collapsing. They are trying to support her, but the efforts are not particularly successful. It is officially accepted that the cause of the disaster is demography. With each new generation, the number of workers decreases, and the number of retirees increases.

In the 60s, on average in developed countries, there was one pensioner for every 6 to 8 workers, while today there is already 3.5. This is true. But we should not forget that usually, “towards retirement,” a person ran out of large payments (for example, a mortgage, a car, etc.) and began accumulating money “for old age.” In different countries, this mechanism had its own individual differences. In some of them, such as Germany, Great Britain, and the USA, these savings later allowed retirees to travel a lot and have quite active recreation.

She didn’t just decouple money from something specific, quite quickly, in just 15 years, she turned inflation from the result of erroneous decisions of monetary authorities into a mandatory mechanism for the functioning of the economy. Today, the leading countries of the world even have a target minimum value below which they are not allowed to fall. What is inflation? If you set aside, say, one dollar from the money you earned in 1971, then formally today it will still be the same one dollar, only you can buy 5.5 times less with it than then. Those. in fact, you will only have 18 cents left from it, the rest will be eaten up by inflation.

It is absurd to talk about any accumulation in such an economic system. And without savings, no pension system is possible in principle.

Alexander Zapolskis

Ukraine during the year of the war in Donbass. A palette of simple stories

Gold standard in Russia

The gold standard was introduced in Russia in 1897, thanks to the monetary reform of Finance Minister Sergei Witte . The silver ruble and copper pennies were replaced by a gold ruble containing 0.774235 grams of pure gold in gold coins in denominations of 5, 7.5, 10 and 15 rubles.

The gold standard in Russia was abolished on July 29, 1914. by order of the Ministry of Finance No. 2096 (on the day the mobilization was announced). Eventually:

- all 629 million gold rubles instantly disappeared from circulation (this is 22.6% of the country's cash);

- the remaining paper bills (77.4% of cash banknotes) began to devalue, because were not freely exchanged for gold.

Photos of golden ten and five ruble notes of Tsarist Russia

How the gold standard worked

The gold standard was a strict international regulation that determined the value of a country's national currency in terms of foreign currency based on its gold content.

For example, the Russian ruble in 1897-1914. was a freely convertible currency and easily exchanged in banks in Europe, the USA and Russia

- for gold (100 rubles / 0.774235 g = 129.159 grams of pure gold);

- per American dollar (100 rubles = $51.46, because $1 = 1.50463 grams of gold;

- per pound sterling (100 rubles = 10.57 British pounds, since 1 pound cost 7.322382 grams of gold);

- for German marks (100 rubles = 216.03 marks, since 1 mark cost 0.358423 grams of gold);

- into French francs (100 rubles = 266.89 francs, since 1 French franc cost 0.290323 grams of gold).

It is not difficult to calculate the rates of other currencies of the world under the gold standard based on the indicated gold content until 1914. Central banks had to play by strict “rules of the game” and for the influx of capital they de facto had only one tool left to increase the key rate (this is how the Bank of England worked, but not the Central Bank of France or Belgium).

and food for the population were equalized around the world

- fuel and energy carriers: oil, natural gas, fuel oil, gasoline, diesel, coal, kerosene,

- industrial raw materials and metals: palladium, rubber; platinum, nickel, aluminum, copper, lead, tin, zinc, steel, cobalt, iron ore, lithium, molybdenum, brass,

- agricultural products: barley, corn, wheat, rice, soybeans, potatoes, oats, sunflowers, cotton, livestock, sugar, butter, cheese, cocoa, coffee,

Is it realistic to restore the gold standard and who will it help?

The gold coin standard existed in countries whose monetary system was based on gold coins, that is, coins minted from gold. Paper money and small change (made of silver and copper) were issued for the convenience of payments, but upon request they were exchanged for gold. The state guaranteed the free exchange of paper money for gold to any owner of paper money, and mints minted coins for owners of bullion or loose gold for a moderate fee. This monetary system existed in most countries of the world at that time (that is, in the European powers, their colonies and the United States) from the 70s of the 19th century until the First World War. With the outbreak of war, all warring countries suspended the free conversion of banknotes into gold. The exception was the United States, where the gold coin standard existed until 1933 and then was also abolished, but not because of the war, but due to the economic crisis.

In Russia, the gold standard was in effect from 1897 to 1914 and then, as part of the “chervonets” policy, from 1924 to 1929. In European countries, the gold bullion standard was in effect, but after World War II, the exchange of currency for gold was preserved only for Central banks with the US Federal Reserve as the guarantor of this system, which was finally abolished in 1973.

From the point of view of supporters of market freedom and price stability, the gold standard is almost ideal. The transition to the gold standard (or its analogues in the form of strict collateral with any real and valuable assets) helped to stop post-war hyperinflation in Germany and Austria in a matter of weeks, and in Russia over a slightly longer period. With the exception of the period of the small gold rush of 1896-1899, the growth rate of gold reserves was 1.5% per year. Prices for basic goods tended to decline, increasing the standard of living with stable wages. The functions of the Central Bank were limited to maintaining exchange mechanisms and adequate interest rates.

Naturally, this “beauty” also had significant drawbacks. Firstly , it is the impossibility of rapid additional emission in accordance with the needs of the authorities and monetary circulation. When gold outflowed from the financial system of a particular country, prices fell, economic activity and wages fell, and there was a need to sharply increase interest rates or carry out devaluation in direct or indirect form. “Damage of coins” by the authorities is not a new phenomenon, and the first theorist of replacing a good coin with a damaged one was Isaac Newton. By introducing a classic gold standard, states must give up the possibility of pursuing their own monetary policy; we can see problems arising in the eurozone. Moreover, many instruments of government intervention in the economy are derived from the ability to “turn on the printing press”: it is not for nothing that one of the most popular works of the ideologist of economic stimulation J.M. Keynes was called “The Economic Consequences of Winston Churchill” and was devoted to the harmfulness of returning to the gold standard in future prime minister and British Chancellor of the Exchequer.

If we imagine that the largest countries agree to switch to gold in international payments, then this process will not be quick. The United States returned to the gold standard after the Civil War for 14 years, Britain, after the end of the First World War, switched to a “skinny” gold-currency form of a gold peg to the pound in seven years. Such a project will require a strong correction of monetary policy instruments and the powers of national and international structures. But it is precisely the need for self-restraint that will most likely be the main factor preventing the transition to the gold standard, which, quite possibly, would be useful for the population and business. It is unlikely that scientists and central bank administrators who believe in their ability to fine-tune monetary policy will agree to such a simple mechanism independent of them.

If we imagine Russia’s position in the “golden world”, it will not be the worst. The gold standard stimulates the exploration and production of gold, and the Central Bank of the Russian Federation has one of the largest gold reserves (about $33 billion at current prices), and even when converting the remaining dollars and euros into gold, the monetary base will be “refunded” with reserves, which will allow:

— strengthen the ruble (which will not be very good),

— start inflation (which is also bad),

— make it possible to feed the economy with reserves, creating incentives for additional growth.

The ideologists of the tsarist “imperial” Sergei Witte and the Soviet “chervonets” Grigory Sokolnikov would be happy - it took them many years of work and putting state finances in order to introduce the gold ruble. But with a probability close to 999, Ignatiev and Kudrin are unlikely to become the fathers of golden Putin coins - they will not replenish our wallets due to the deep-rooted interests of the global bureaucracy in maintaining their powers.

The crisis of the gold standard: why the world has become different forever

The triumphant march of the gold standard was short-lived and lasted fully from the 1870s until the outbreak of World War I (1914), which forced the use of unbacked paper money to finance war efforts and the introduction of restrictions on the export of gold in almost all countries. The measures taken did not help: during the 4 years of the war, the paper US dollar and British pound depreciated by 2 times, the French franc by 3 times, and the Italian lira by 4 times.

The situation was worst in defeated Germany (which began paying indemnity to the Entente countries ) and Bolshevik Russia. Both countries were gripped by hyperinflation. So,

- in Germany in 1923 inflation was 3.25 million% per month (prices doubled every 49 hours). At the denomination of November 1923 $1 was worth 4.2 trillion. old brands;

- in Bolshevik Russia during the denomination of 1924. 1 chervonets was exchanged for 500 billion Soviet rubles in 1918.

The receipt by the Entente countries of part of the indemnity from 100 thousand tons of gold reparations from Germany under the Treaty of Versailles (1918) did not solve the problems of the gold standard. The reason is the discrepancy between the amount of paper money they issued during the war and the real gold reserves in France and Great Britain, multiplied by Germany’s inability to physically pay these “reparations” (as a result, a significant part of Germany’s debts was written off and loans were issued, which began to restore the German (Weimar) economy since November 1923, i.e. 9.5 years before Hitler came to power).

The gold standard was restored in Germany (November 1924-1931), after which the United States invested an astronomical sum of $15 billion in investments (1925-1929), raising Germany's industry to second in the world after the United States itself. In response, Hitler, having received in 1933. such an industrial base was unleashed in 1939. World War 2, he tried to “knock out” the main “creditors” - Great Britain and France; it was not for nothing that the Compiègne Armistice of 1940 with France was signed in the same forest and in the same carriage as the Armistice of 1918.

In Great Britain, the gold standard began again in 1925-1931. , but the “free exchange of pounds sterling for gold” was limited only to large buyers (banks and international corporations), because was produced only for gold bars weighing 400 troy ounces (12 kg of gold). But even such restrictions did not save the stability and free convertibility of the pound. In 1931 a massive exchange of pounds for gold began. The Bank of England even took out a loan of 50 million pounds from the US Federal Reserve, but the money was only enough for 1 month. The gold standard in Great Britain was abolished.

In the USSR, the gold standard was restored in 1923, with the introduction of the gold chervonets , containing 7.74235 grams of gold (equal to 10 gold rubles of Tsarist Russia), used mainly in foreign trade operations with the “capitalist world”. The gold standard system lasted only a few years and was buried by the course of industrialization (1927) and the end of the NEP (1928).

The world economic crisis of 1929-1933 finally finished off the gold standard. , which began on October 23, 1929 with the stock market crash of all stocks and securities on the New York Stock Exchange NYSE in the USA. The world plunged into the chaos of the Great Depression, and the gold standard was officially and finally abandoned by Great Britain (1931), Canada (1931), Germany (1931), USA (1933), Italy (1934), Belgium (1935), Poland (1935) etc.

The gold standard turned out to be an unbearable burden for all the leading countries of the world . By 1937, no country remained on the gold standard. The world was preparing for another world war, not for stable international trade.

Gold is not a standard: how to ensure trust in money

On August 15, 1971, US President Richard Nixon announced that the US dollar would no longer be backed by gold.

Gold standard Photo: investopedia.com

In 1971, Richard Nixon finally abolished the gold backing of the dollar. What the rejection of the standard led to, whether it is necessary to return to it and what alternatives there are to support the stability of national currencies - read on.

Why was the “gold standard” introduced and why was it abandoned?

Today, gold is an investment option, not a means of payment. But this precious metal has long been an independent monetary unit. It was highly valued and relatively easy to handle. But over time, they found a replacement for it - paper money, which was essentially a certificate confirming the presence of gold backing. Such certificates could be exchanged for gold at any time.

Gold certificates were used in the United States as paper money from 1882 to 1933. Photo: reactioner.com

With the development of international trade, there is a need to track cross rates of different currencies. Then, in 1867, the Paris Monetary System pegged the exchange rate of world currencies to gold.

But the losses that arose against the backdrop of the First World War and the Great Recession forced governments to continue printing money not backed by gold. And the standard had to be abandoned.

In 1934, the US currency was again pegged to gold at a rate of $35 per troy ounce. And the currencies of another 44 countries were pegged to the dollar. However, the new “gold standard” also did not last long - America was always suspected of overprinting money not backed by gold. Meanwhile, the dollar was taking root as an international currency. And in 1971, US President Richard Nixon unilaterally, thereby finally nullifying the backing of the dollar with the precious metal.

In the first six years after the abolition of the gold standard in the United States, money was printed in the amount of 23% of GDP. And in 43 years, the dollar has depreciated 20 times against gold.

The cost of one ounce of gold in relation to the dollar:

Is it worth returning to the “gold standard”?

O launched the inflation mechanism, giving the government the opportunity to print more banknotes. However, there is an opinion that there is no need to return to this standard.

In 2012, the Chicago Business School conducted a survey of professors in leading economics departments at American universities, during which they spoke out against the standard.

From an economic point of view, tying the dollar to gold again makes no sense. Gold does not play a big role in the lives of households and in the activities of enterprises. Gold consumption in the jewelry industry is capped at $80 billion per year. In other areas, the precious metal is used even less frequently - for $15–20 billion per year.

Oil is one of the main instruments of influence on the global economy Photo: forexaw.com

Compared to oil production ($3 trillion per year), this is an insignificant share of global GDP. However, oil is also only part of the consumed basket of goods and services.

Alternative to gold

The world needs reliable assets, the profitability of which can be predicted in relation to the entire consumer basket that makes up the country's GDP. The following assets are offered as an alternative to gold:

- Bimetallic system

The gold standard can also be called unsecured. When the price of the dollar was tied to gold, the value of the precious metal itself was not adjusted in any way. This problem can be solved by adding another precious metal to the set. By determining the price of gold in relation to silver and vice versa. Such an “independent” assessment will help maintain the fair value of currencies.

- Digital gold

According to research conducted by the Bank of Canada, Bitcoin has many similarities with an economy based on the gold standard. Cryptocurrency is even called digital gold due to its high cost and limited emission capabilities.

In addition, it is not controlled by any central bank or other government agency, and the high speed and low cost of transactions makes Bitcoin an almost ideal means of international payments. The price of cryptocurrency has already exceeded the price of gold.

- Dollar or other currency with sufficient credibility

In recent years, the purchasing power of the dollar has remained virtually unchanged. The stability of the US dollar is ensured by the monetary policy of the US Federal Reserve System. As long as the United States Central Bank manages to convince the market that the dollar is a safe asset, other countries will rely on it as the “gold standard.” Instead of the dollar, there may be another currency with sufficient credibility, for example, the euro.

There are many options for improving the gold standard by pegging the value of a currency to other assets. But if the value of a currency is determined only by the demand for it and the goods that can be purchased with it, stability will depend on the state of the economy of the country that issued the money.

YOU WILL BE INTERESTED in - Where to invest money in Ukraine: profitable investments in 2019

Types (stages) of the gold standard

There are three main stages in which the gold standard existed:

- gold-coin (1870-1914) - the first stage before the First World War, characterized by the fact that most money is minted from gold, and paper bills are easily exchanged for bars or coins according to the established exchange rate;

- gold bullion (1925-1931) - an attempt by Great Britain and France after the First World War to return to the gold coin standard was unsuccessful, since the gold reserves in the countries were not enough for exchange, then they decided to exchange the currency only for gold bullion, which they had the currency holders themselves do not agree;

- gold-currency (1944-1976) - a natural continuation of previous systems in the form of the Bretton Woods agreement of 1944. Read more read the main article The Bretton Woods currency system through the eyes of Masterforex-V traders

According to the Jamaican system

The government's solution to a problem is usually as bad as the problem itself, and often makes it worse.

Milton Friedman

In the 20th century, a certain system of international monetary payments emerged, which was called the “Gold Standard”. The essence of the system is that every banknote can be exchanged for gold.

In 1944, the Bretton Woods Agreement was signed, under which the currencies of 44 countries were strictly pegged to the US dollar, and the dollar to gold.

Why was this done?

Because gold is a difficult metal to mine. Therefore, it is possible to predict how much gold will be mined. The growth of gold production roughly coincided with the growth of the global economy, so everything was balanced.

But in the 1960s, an event occurred that changed the entire human civilization. In 1964, IBM released the so-called System 360 (IBM System/360) - a unified series of third-generation computers. This meant a revolution in production. Usually they talk about the following trends of that time:

- Automation

- Electronization

- Cybernetization

Automated production began to produce goods with characteristics that were previously impossible. The newest technologies were expensive, and this led to a serious financial contradiction:

The rate of gold production began to lag behind the growth rate of the global economy.

The volume of world gold reserves became insufficient to support financial transactions. Many solutions have been proposed to solve this problem, but all of them have had very unpleasant consequences.

And then the economist Milton Friedman, who is called the most influential economist of the 20th century, appeared on the scene. Friedman was a categorical opponent of government intervention in the economic process. He believed that as soon as the state interferes in money management, it will mess up in any way:

- Or it will print little money and slow down economic growth.

- Or it will print a lot of money, cause inflation and set the economy back.

The only option for a normal solution to the issue is the withdrawal of the state from money management in general, and, consequently, the abolition of the gold standard. Transition to the market of freely convertible currencies.

In 1968, Friedman became an adviser to President Nixon, long urged him to abandon government regulation and convinced him.

In 1971, Nixon staged the so-called “Nixon Shock.” He announced economic reform, which was based on the abandonment of the gold standard.

Other countries tried to look for different ways to solve the financial contradiction, but in the end they recognized Friedman was right. In 1973, at the Jamaica International Conference, exchange rates were subject to free market regulation.

After some time, the so-called “Jamaican currency system” was formed, which is still in effect today.

Now let's see why this is important for your wallet.

Benefits of the Gold Standard System

The advantages of the gold standard were that

- in the heyday of international trade and direct investment, which gave a powerful impetus to the industrial boom throughout Europe;

- the stability of the financial system, when all governments printed exactly as much money as the country had gold reserves;

- there was no strong inflation, rising prices for goods and services, or devaluation of currencies, because there was no excessive issue of paper money,

- this prevented the formation of a budget deficit and an increase in external debt;

- this stimulated exports, since as they increased, gold and foreign exchange earnings grew;

- countries received a fixed exchange rate structure.

The Gold Standard – Job Creator and Protector

The abandonment of the gold standard in 1971 is closely linked to the massive unemployment that has plagued advanced economies in recent years; Mexico, even with a lower level of industrialization than developed countries, also experienced many job losses due to business closures; the creation of new manufacturing jobs in recent years has been sluggish at best.

The world financial press, where leading economists and analysts are published, never pays attention to the connection between the abandonment of the gold standard and unemployment, deindustrialization and huge chronic foreign trade deficits in the leading Western powers. Is this really due to ignorance? I wouldn't like to think so, given that the articles that appear in the world's leading financial media are written by pretty smart analysts. Most likely, as we see it, there is self-censorship here, so as not to incur the displeasure of important financial and geopolitical interests that stand behind the financial press.

In this article we discuss the connection between the end of the gold standard and the current financial chaos, which is accompanied by serious "structural imbalances" between the historically dominant industrial powers and their new rivals in Asia.

World trade before 1971

From the end of World War II until the 1960s, all well-governed countries in the world sought to maintain a constant balance between the volume of exports and imports. All of them sought to ensure that imports exceeded exports in order to accumulate reserves in gold or in dollars, which, under the terms accepted by the United States at the signing of the Bretton Woods agreement in 1944, could be exchanged at any Central Bank that demanded gold in exchange for dollars.

To maintain accuracy, we cannot fail to mention one exception. This exception to the rule was the States themselves. All well-governed states wanted to export more than they imported, except the United States.

The States didn't care about the balance of exports and imports because—under Bretton Woods—they could pay off their trade deficits the simple way by sending more dollars to their creditors. As the sole source of this currency, the United States had a clear advantage over the rest of the world; they could pay their debts with (barterable) dollars, which they printed themselves.

Economists of the time warned of the dangers of such practices, which led to constant losses in American gold. From more than 20,000 tons at the end of World War II, U.S. reserves dwindled year by year as some countries, especially France, insisted on exchanging their dollars for gold at a rate of $35 an ounce. Washington and New York were very unhappy with this French demand; Some analysts link the unrest in France in the spring of 1968 to covert operations by American intelligence agencies to demonstrate American disapproval of the behavior of France, which was then led by General Charles de Gaulle .

The US did nothing to slow the flow of gold. In early 1971, Henry Hazlitt , a staunch classical economist, predicted that the dollar would have to be devalued; he said that the US Treasury would need to increase the dollar value of an ounce of gold. Just months after his warning, the “dam broke,” and in August 1971 the United States was forced to devalue its currency because gold reserves had fallen to dangerous levels. (Today, many doubt that the United States still has these 8 thousand tons of gold, which allegedly lie in the vaults of Fort Knox and the US Military Academy in West Point, New York).

Paul Samuelson had recommended a week before August 15, 1971 - President Nixon would follow the advice of Milton Friedman and announce that, starting On this day, the United States will no longer exchange dollars held by the world's central banks at any rate. The states unilaterally violated the terms of the Bretton Woods agreement. In fact, it was financial bankruptcy.

Since then, all world trade - or most of it, since the euro, pound sterling and, to a lesser extent, the yen, compete with the dollar - is conducted in dollars, which in themselves are just money not backed by gold, a sham. Since the rest of the world's currencies were pegged to gold through the dollar, they also simultaneously became fiat currencies, that is, counterfeits without any backing.

Consequences of abandoning the gold standard

The consequences of this fateful day disrupted the order and harmony in economic relations between world states, while at the same time stimulating and accelerating the growth of global lending, as part of the dollars exported by the United States remained in the reserves of Central Banks around the world.

Countries began hoarding dollars as US lending inexorably increased, freed from the Bretton Woods constraint. The rest of the world was forced to accumulate dollar reserves because if a country had an insufficient supply of dollars or its reserves were not growing, or worse, declining, currency speculators would attack that country's currency and destroy it through depreciation.

Once the gold run was no longer a constraint, so too were the last constraints on credit growth. The powerful influx of dollars into all parts of the world spurred growth in global credit, which did not stop until 2007. The international banking elite always strived to increase profits, for which they constantly tried to increase lending volumes. Since 1971, freed from the need to pay international bills in gold or dollars redeemable for gold, lending has grown steadily and without limit. It's boom time in the US.

The states, which paid the world with their own non-convertible dollars without intrinsic value, praised “free trade” and “globalization.” America could buy anything, anywhere, in any quantity, at any price. Since the 1990s, the foreign trade deficit has reached a critical level, but nothing has been done to reduce it; on the contrary, it grew every year.

Mexico, following the example of the United States, joined NAFTA - the North American Free Trade Association. Down with import tariffs! Free trade around the world! The new view painted a seductive picture of a globalized world without borders, where everyone could buy and sell freely wherever they wanted. The 90s were years of rampant optimistic expectations of globalization!

There is no doubt that free trade is generally good for humanity. It's good to be able to buy goods where they are cheapest; some countries enjoy conditions that enable them to profitably produce certain goods; each country must produce those goods that give it an advantage over all others. This way, the whole world can benefit from something good that every country has to offer. This is an attractive and logical doctrine, but... there is a serious pitfall in it: the doctrine of free trade was formulated for a world where the only means of payment was gold. When the doctrines of “free trade” and “comparative advantage of countries” were developed, economists of the time could not imagine a world in which gold was not used, but instead fiat money created at the will of one country.

“Globalization” of the 1980s, 1990s and today is based on the ideas of “free trade”. However, in the absence of the gold standard that existed at the time the doctrine was created, “globalization” led to absolutely destructive consequences that caused the deindustrialization of the West and the rise of Asia.

For decades before 2007, a huge fleet of cargo ships was created that sailed to the United States and Europe - that is, to the West, including Mexico - and carried various cheap and high-quality goods produced in Asia. This flow was so great that local factories in the Western world were forced to move to Asia to take advantage of cheap labor and still be able to sell their products in the West.

Readers will learn how many businesses, large and small, have ceased to exist in the United States and the West in general because they were destroyed by Chinese competitors. They also learn how difficult it is to find a product that can be produced profitably in developed countries. It is very difficult to find a niche for any product to produce locally. Factories moving to Asia to profit from cheap labor led to unemployment where factories closed. For the same reason, new jobs were either not created or appeared slowly.

A taxi driver in Barcelona told us: “Spain is a service economy. Industry no longer brings us income. If tourists stop coming, we will die." For a similar reason, the same thing is said about Greece: “It produces oil and tourism, and nothing else.” The United States, the industrial colossus of the postwar world, was deindustrialized. Will developing countries now create jobs?

Diagnosing the causes of deindustrialization and unemployment

These misfortunes arose because gold disappeared as: a) a deterrent to credit and money creation, and b) the only form of payment for international debt.

Under the gold standard, all participants in international trade knew that they could only sell to a country that sold something in return. It was not allowed to buy anything from a country that did not buy anything. This restriction naturally balanced trade. Nobody had heard of “structural imbalances” that are commonly heard today.

For example, in 1900, Mexico could export coffee to Germany because Germany, in turn, could export production equipment to Mexico. Germany could buy coffee from Mexico because Mexico, in turn, bought machine tools from Germany. All transactions were carried out in gold, and the result was an equilibrium based on economic reality. Since there was a balance in international trade relations, a very small amount of gold was required to maintain it. The World Financial Centre, which operated as a "world clearing house", was located in London. Several hundred tons of gold were enough to meet the needs of this “clearing house.” You can read more about how London was a center for servicing world trade in the article "Valid Bills" and similar materials on Antal E. Fekete's www.professorfekete.com.

Another example. In 1930, the US could sell very little to China because the Chinese were poor and had very little purchasing power. Since the United States sold very little to China, it could at the same time buy little from it. Although the prices of Chinese products were very low, the States could not buy much from China because China could not buy from the States - China was very poor and could not afford American goods. Thus, trade between China and the US was balanced by the need to pay transaction balances in gold. Balance was extremely important. The potential for “structural imbalance” did not exist.

In free trade under the gold standard, the vast majority of transactions did not require the movement of gold to complete the exchange of goods. At the same time, they paid with some goods for others. Only small balances had to be paid in gold. Accordingly, international trade was limited to the extent of mutual purchases between parties; for example, Chinese silk was used to pay for imported American machines, and vice versa.

Thanks to the gold standard, there was order and harmony. If President Nixon had not “closed the golden window” in 1971, the world today would be a very different place. It would take another century for China to reach today's level. China couldn't buy much from America because it was poor; thus, China could not sell to America.

With the abandonment of the gold standard, the situation changed radically.

Everything changed because the United States, having removed gold from the world monetary system, could “pay” for everything in dollars, and without the restrictive mechanism of the gold standard, it could print dollars ad libitum—in unlimited quantities. Thus, in the 1970s, the United States began buying up huge volumes of high-quality products from Japan, while the Japanese boasted, “Japan sells, Japan doesn’t buy.” A situation that was impossible under the gold standard became possible under the fiat dollar standard. The Japanese became giant manufacturers, their country on the islands turned into a factory. Japan accumulated huge reserves of dollars, which were sent from the United States in exchange for Japanese products. This, in turn, led to deindustrialization in the United States.

Take, for example, American television manufacturers. Famous American factories that produced television receivers by the millions included Philco, Admiral, Zenith, and Motorola. The Japanese products were better and cheaper, and since going off the gold standard allowed the Japanese to sell and buy nothing in return, and allowed the US to buy without selling anything in return, the result was the closure of the huge factories that made these TVs in the US. This is how the “gold abandonment” destroyed American industry.

Unlimited quantities of goods from Japan flowed into the United States and all other countries because they were paid for in dollars, which could be printed in unlimited quantities. The equilibrium that the gold standard maintained disappeared, and imbalance took its place.

After 1971, the United States began large-scale long-term lending. Since high-paying jobs in industry disappeared due to the deindustrialization of the country, the lack of free income for the population was replaced with accessible and cheap credit to hide the stagnation of per capita income. Consumer lending stimulated imports from Asia, and further exacerbated the destruction of industry. Such a huge volume of American loans was made possible thanks to the abandonment of the gold standard, which limited the issuance of loans by the banking system. It is no coincidence that analysts noted that American workers have not received a real wage increase since 1970.

All leading economists considered the abolition of the gold standard to be completely acceptable. They still do not see, or do not want to see, that the “Law of Unintended Consequences” has worked: the huge advantage that the United States received due to the ability to pay for unlimited volumes with non-convertible dollars became the fatal cause of industrial destruction of the United States, and the entire West, in general. A Mexican proverb says: en el pecado llevas la penitencia - “sin will punish itself.”

Current illnesses: financial crisis, industrial crisis, unemployment crisis

Today's situation is much worse. China, with a population of 1.3 billion, has become a formidable force. Nobody can compete with China on price. This country sells huge volumes of goods to the rest of the world, and no one has the ability to sell the same volumes to China. China can do this because today's trade deficits are not "paid" in gold, but in dollars or euros, pounds or yen, which have never been uncommon: they are created at the will of the US, the European Central Bank, the Bank of England or the Bank of Japan.

The terrible monster arose as a result of the abolition of the gold standard, which set the restriction: “You can sell only to those who sell to you; You can only buy from those who buy from you.” This restriction no longer applies; everything is in a state of chaos, impermanence, imbalance; "structural deficit" prevails because we no longer have a gold standard.

The credit boom ended, and instead we got a global financial crisis. Today, the problem of “structural deficit” and the deindustrialization and unemployment it has caused in previously industrialized states is becoming more important every day. What to do with the mass of unemployed men and women? Nobody knows the answer, because the answer is not acceptable to today's thinkers: the correction of "structural imbalances" and re-industrialization, in other words, the creation of new jobs, lies in a return to the gold standard throughout the world.

“Globalization,” so ardently praised by the financial press in recent years, has become the worst possible nightmare. It is no longer possible to provide government support to the unemployed. The sovereign state is close to bankruptcy. Thus, nature takes revenge on those who dare to violate its laws, trying to impose counterfeit money on the world.

Richard Nixon 's abolition of the gold standard was the best possible strategic gift to China and the rest of Asia. Today, China has a colossal industrial base that could take centuries to build, while the US has largely lost its factories and is unable to recapture its former glory. What a tragic fate for the United States!

International and domestic trade

The word "trade" is defined in the Oxford English Dictionary as "the exchange of goods or services, especially on a large scale."

Note that "exchange of goods or services" cannot include as an addendum a fictitious payment in fiat money that is neither a good nor a service, but rather a paper note or figures representing a promissory note payable with nothing. In the case of the dollar, the debt obligation is an obligation of the Federal Reserve, and it is recorded accordingly on the balance sheet. Debt cannot be repaid by offering a debt instrument (which, in any case, is paid for by nothing), and, accordingly, there has been no repayment of foreign trade balance debts in international trade since 1971.

The failure to pay foreign trade arrears since 1971 has caused the accumulation of huge imaginary dollar reserves in exporting countries. The same applies to fictitious payments of foreign trade deficit debt in euros, pounds, yen or any existing currency. Consider the following graph:

Before the Bretton Woods Agreement of 1944, gold appeared as a complement to the international exchange of goods or services, and paid off the outstanding balance of payment deficits because the commodity or raw material was used as money.

Under the terms of the Bretton Woods agreement, the fiat dollar was used on an equal basis with gold, and central banks were trusted to be able to exchange it for gold. From 1944 to 1971, these uncovered dollars were held in Central Bank reserves as a credit claim on US gold; the final payment was not made and was deferred as a loan extended to the US until the dollars in reserves were cashed in gold sometime in the future.

It turned out that trust was placed in the wrong country, since in 1971 the United States withdrew from the 1944 Bretton Woods agreements, “closed the golden window” and deceived creditor countries. There was no final settlement of international trade in 1971, and there still hasn't been; the truth of this statement is obscured by the erroneous idea that the provision of fiat currency in payment of a foreign debt is a substitute for the repayment of that debt .

Once this false idea - that fiat money can be used to pay off debts - is accepted as truth, the problem of huge "imbalances" in world trade becomes an insurmountable problem. The best and brightest economists of our time are trying in vain to find a solution to a problem that cannot be solved in any other way than a return to gold as the international medium of trade.

The same principles apply to domestic trade. In reality, no one who trades today in any country in the world pays for purchases, that is, no real repayment of debt is made. All people, corporations and government institutions simply exchange debts (repayable with nothing) among themselves in the form of either paper bills or digital bank money, be it dollars or any other world currency.

In domestic state trade, small silver coins were popular in daily transactions, which served as a legal means of repaying debt when making payments, since silver is a commodity or raw material that, like gold, can participate in trade exchange.

Today, China and other major Asian exporters have belatedly realized that the dollars they received as “payment” for their huge export volumes amounted to nothing more than numbers on American computers. If the Chinese do not make concessions, the New York bankers will erase these numbers in half an hour, and China will be left without reserves. For this reason, the Chinese and other Asians are buying gold, and will continue to buy it indefinitely: computers will not be able to destroy gold reserves.

The terrible truth about China is that the Chinese acquired such formidable industrial power in such a short period of time—thirty years—at an incredible cost: for thirty years they worked for free. The volume of Chinese reserves is $2.5 trillion; They are of no use to China, they have no real value, and the Chinese do not know how to get rid of them in exchange for something worthwhile; these reserves are just numbers in the computers of the Western world. What a trap: China has worked for thirty years, providing the world with a huge amount of goods, in exchange for nothing! Thirty years of slavery to create an industrial empire!

Mexico forced to use protectionist 'Band-Aid'

There is oil in Mexico, and there may be more of it than we are told. Let's hope so! Our economy is not as complex and intricate as the US. According to a 2007 study by the Mexican Ministry of Finance, 85% of Mexicans do not have a bank account - a sure sign that they can live on paper money and not go into debt through credit card problems. The Mexican economy appears to us to be like a wide, low pyramid. It is more stable than the American skyscraper economy, a very complex economy. Mexico is better equipped to weather the current crisis than the United States.

In times of great global financial crisis of counterfeit money, countries around the world are likely to resort to protectionism: and the first to do so will be the very countries that so recently praised “globalization.” In this likely scenario, Mexico will have to do the same. This scenario is far from ideal, but it is necessary in the absence of a gold standard. Protectionism limits productive efficiency in any country because it regulates the domestic market by protecting products. Restricting the market hinders efficiency. The supply of goods available to the public will be limited and likely at inflated prices with reduced quality (Protectionism will have a similar impact in the US).

Mexico will have to restrict imports in the near future or face serial currency devaluation. Protectionism is not a good policy, but Mexico will likely be forced to adopt it due to the lack of a gold standard, which would be the best way to create jobs in the US and the rest of the "developed" world.

Effective treatment

If Mexico wants more, it will have to wait for the restoring of the gold standard throughout the world. Neither demagoguery nor socialism will solve its problems. Only the gold standard can do this.

In order for its production capacity to have access to international markets, and Mexicans to have access to the products of international markets, it is necessary to return to the gold standard. Bilateral trade agreements are not an optimal solution. The optimum is a world as a market, where payments for export goods are balanced by imports, and the remaining balances are paid in gold. Payment of foreign trade deficits in gold and accumulation of a foreign trade surplus in gold is an indispensable condition. Under the gold standard, Mexico would achieve significant prosperity and full employment.

Products from China and Asia in general, which today undermine our industrial potential and cause unemployment because we cannot compete with the extremely low wages of Asian countries, will cease to be a problem under the gold standard; If the Asian countries that are now conquering our markets do not buy the same volume of Mexican products - and today they do not - they will not be able to import their goods into Mexico. The gold standard will balance exports and imports; it will prevent the strategic destruction of our industry and protect us naturally, without the need for protectionist barriers.

The rest of the world needs the same treatment that Mexico received: it is the gold standard that will restore economic health and promote lasting prosperity.

With a return to the gold standard, Americans would not be able to buy Chinese goods unless China bought the same amount of American goods. If the Chinese don't want to buy anything from the US, Americans won't be able to buy Chinese goods. It's very simple! To continue selling to the West, the Chinese will have to open their doors to imports!

If Americans find that they cannot purchase goods from China, they will produce those goods locally. Industry and new jobs will mushroom to meet demand. International balance will be restored and unemployment will disappear.

Protectionism is not a cure, it is a band-aid. Mexico will not achieve prosperity through protectionism or socialist measures that undermine human creativity. We also cannot sacrifice our national identity and accept absorption by the United States by imitating the (very costly) measures that the US administration currently imposes on its citizens. Mexico's ideal combination includes a moderate dose of nationalism, a government that does not create deficits, the introduction of a one-ounce silver coin, "freedom" to encourage and protect hoarding, and the opportunity to participate in the new global gold standard.

Disadvantages of the gold standard system

- The gold standard was too conservative a financial system. For example, Russia took out international loans (from France, Belgium, the USA) for the construction of the Trans-Siberian Railway and the coal regions of Donbass, although it could... finance these projects itself through the devaluation of the national currency;

- countries found themselves in unequal competitive conditions. Gold-mining states (USA, UK, Canada, Australia, Russia) received advantages, since they could always replenish their reserves with new gold production;

- The gold standard forces countries to focus on maintaining their gold reserves and ignore the more important goal of improving the business climate. Thus, during the Great Depression, the Federal Reserve, in order to prevent people from exchanging dollars for gold, raised interest rates, while it should have lowered them to stimulate the economy.

General declares war

It is not surprising that there are more and more proposals to tie money to the gold standard. Actually, in 1944, the American currency became global thanks to the dollar being pegged to gold. At the Bretton Woods Conference, it was decided that 1 troy ounce of gold is equal to 35 dollars. On the green banknote was the phrase: “Backed by gold.” Anyone could exchange their dollars for precious metal, however, only in the United States. This is what French President General de Gaulle did in 1965 - he brought a ship loaded with $750 million to the port of New York and demanded to exchange it for gold at the approved rate. In essence, this was a declaration of war on the dollar - the general did not agree with the post-war financial redistribution of the world. Here we must remember that the USSR and other countries of the anti-Hitler coalition paid the States for food, equipment and weapons in gold. Therefore, by the end of the war, America had the largest gold reserves, and the dollar as a result became the world currency. De Gaulle, although with a great scandal, managed to exchange the brought dollars for gold. Following France, other powers lined up for the precious metal. But far more dollars had already been printed than what America's gold reserves could guarantee, and in the early 70s the United States abandoned the gold standard. There was nothing stopping the Federal Reserve System (FRS) from printing more and more green notes.

See also: Where is Russia's gold reserves stored →

“The speculative nature of the global financial economy began to grow especially actively since the late 90s,” Igor Nikolaev, director of the department of the FBK company, . “Everything has been turned upside down.” Having relegated real production to the background, financial speculation came to the fore. And this trend has spread to Russia - in our country now even the word “earn” means resell something, and not at all produce it. According to the results of the first half of the year, 10 (!) times more money is circulating in the financial sector in Russia than in the manufacturing sector. With such proportions, a crisis is inevitable.”

Is it possible to return to the gold standard?

Really, no. The last time US President Ronald Reagan (1980-1988) convened a commission to restore the gold standard, the commission voted overwhelmingly against introducing a new gold standard. After all, just to maintain all the $2.7 trillion in cash available would require gold prices to rise to $10,000 an ounce, which would lead to massive inflation.

Many are in favor of returning to the gold standard. This will ensure fiscal discipline, balance the budget and limit government intervention, they note. Those who favor the gold standard are attracted by the simplicity of its basic rule. Others see it as an effective anchor for global price levels. Still others look back wistfully at the constancy of exchange rates.

However, a fixed money supply dependent only on gold reserves will limit economic growth . Many businesses will not be financed due to lack of capital. Moreover, the United States alone will not be able to unilaterally switch to the gold standard if other countries do not do so. If this happens, everyone in the world may demand that the United States redeem its dollars in gold. This has already happened once in history.

Why should the gold standard be returned? Part three

Translation of excerpts from the article “The Populist Case for the Gold Standard” by Kristoffer Musten Hansen. The first part is here, the second is here.

A Project for a Gold Standard for

the 21st Century

This should not simply be a return to the gold standard that existed before 1914 or 1933, when authorities and central banks could influence monetary policy in certain ways. It is necessary to establish complete freedom of the monetary sphere, that is, to deprive the authorities of the ability to create money and manage monetary affairs.

As a basis for the project of a new gold standard, we will take the plan of Ludwig von Mises (1883-1953), an economist and supporter of classical liberalism. He wrote about two simple actions that need to be taken: 1) eliminate inflation, which also means fully providing reserves for all future bank deposits; 2) as soon as the market price of gold stabilizes, it will be adopted as the basis of the new legal parity for the dollar and the latter will be converted into gold at the parity price. To do this, a conversion institution should be created, independent of the Federal Reserve. The purpose of this reform is not only to stabilize the value of the dollar, but also to ensure the functioning of gold coins as money and the distribution of gold among the population. In this way, every person will understand the importance of commodity money and will be on alert in case of inflationary schemes. It is therefore important that all $5, $10, and $20 dollar bills be removed from circulation and replaced by new gold coins during the first year of reform.

The first action of the reform should be to stop the inflation of the money supply. The market will only be able to form adequate prices when all distorting factors are eliminated and the goals of the reform are openly discussed. Therefore, it is also necessary that all legal tender laws and taxes that prevent the use of gold as money should be repealed. Naturally, all regulations prohibiting or restricting the private coinage of gold and silver coins should also be eliminated. In this case, the process of production and distribution of coins will be significantly facilitated, which will create conditions for the complete privatization of the monetary system.

Once these measures are implemented and the decision to restore the gold standard is openly and decisively announced, the dollar-gold ratio will be established in the markets, which will then rise to the new legal parity. It is impossible to predict in advance what this new price will be. Mises believed that the gold rate would be at $36-38 per ounce, but this figure was far from the current market price. The legal price of $42.22 per ounce is also inappropriate, although that is what the US Treasury uses to calculate the value of its reserves. It can be assumed that the return of gold to the status of money will lead to additional demand for the precious metal. However, it should be noted that much of the current demand for it points to the role of gold as money or as a profitable investment item: for example, 4,490 tons of gold were mined in 2021, of which 1,810 tons were purchased by investors and central banks. Most likely, a significant portion of the remaining 2,200 tons went to jewelry, which in fact is also an investment demand; however, it is impossible to say for sure exactly what volume we are talking about.

Let's assume that the reform will lead to an increase in the rate of the precious metal to $1,700 per ounce, that is, to a level slightly higher than the current level. This rate will be declared a new legalized parity, that is, the dollar will be valued through 1 ounce of gold, which costs $1,700 per ounce. The currency exchange institution Mises wrote about would be required to exchange all paper dollars for gold Eagles at a legal parity price.

However, there are a few things to note in the context of this plan. First of all, how much money substitute can be accepted for redemption in gold? Whether we are talking about all liquid (cash) and less liquid (savings, certificates, deposits) forms of money, or just the liquid component, then it is clear that the Ministry of Finance will not have enough gold to redeem all existing paper money. Taking into account the exchange rate of $1,700, the volume of US gold reserves - 8,140 tons - will be worth approximately $600 billion (accuracy in measurements is not important now). This would be enough to redeem about a quarter of the volume of currencies, or 1/10 of all liquid money, or 1/36 of all less liquid money, provided that official statistics adequately reflect the number of dollars in circulation inside and outside the United States.