Investing in precious metals is one of the best ways to protect your capital from turmoil in the global economy. This is a type of asset that will always be relevant. Ordinary money, if we do not consider a very narrow list of currencies, is essentially just a piece of paper, its value depends on what the government and the country’s regulator come up with, respectively, in the event of a really very serious crisis, anything can happen. Over the past two decades, we have seen a steady trend of growing interest in precious metals, in particular, in investing in silver .

From this article you will learn:

- Investing in Silver: Benefits

- What affects the price of silver?

- TOP 6 ways to invest in silver

- Silver Trading Options

- Conclusion

Silver as an asset

The growth in silver prices promised by analysts in 2021 is in no hurry to come true. The only forecast that the current situation allows us to make is the absence of a forecast. The difficult geopolitical situation, financial instability and economic regression cast doubt on any point of view.

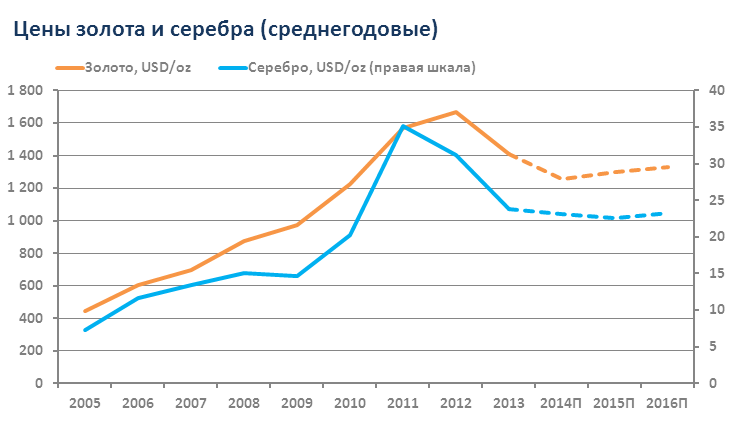

Forecasted prices for gold and silver

The prospects will not console investors: they will have to wait a long time for profits from silver.

They say that in 10 years, silver deposits will be drained of blood by great states with a high level of industrial development. Then we should expect that silver will be appreciated. Obviously, silver will not live up to expectations as a short-term asset. A year, two, five is too short a period to draw conclusions about the return on investment.

Silver is used not only in jewelry, on the contrary: in this area only 30% of the metal is used. Only 5% is spent on the production of investment coins. It's surprising that only 20% is used for developing photographs. 50% silver is used in the aesthetic design of the interior (figurines, photo frames and mirrors, candlesticks, etc.). There is reason to consider this information inaccurate, since a certain percentage of silver is actively used in the IT industry, medicine, and in minute quantities in related industries. It was the connection to the economy that determined the dependence of the precious metal on its condition.

Technical innovations amaze with their diversity. They are in demand, despite the high cost, regardless of the crisis. But the silver used in their production has not risen in price. Low quotes are coming out of the London fixing. The same thing - medicine, the flourishing of photography - all this does not slow down the pace of development, and the price dynamics of the “white metal”, with all its fluctuations, goes lower.

Even an optimistic analyst cannot give a reassuring forecast for 2021. Given the overall long-term downward trend, surprises are unlikely.

Investing in silver for the long term

There is a summary of facts that position silver as a promising asset. Industrial demand will increase, and with it the price per gram of gold. Experts highlight a number of circumstances that open up another side for investors when investing in silver.

- With a high percentage of consumption, the world's silver resources are not that large. The total volume from all currently known deposits is 16 times more than gold. But at the same time, there is 4 times more silver available in the form of various industrial products than gold. If we take into account only the physical volume of the metal that is available on the world market, then there is 10 times less silver! According to rumors, some mining companies are simply abandoning the white metal due to its lack of demand.

Summary

There is a popular belief that investing in silver is a rather dubious idea. In fact, its success depends on what type of investment in this instrument the investor has chosen.

We can only say unequivocally that investments in silver are reliable and low-risk, so at least in this asset you can save money from inflation.

Over the long term, experts promise strong growth for this metal, so if you are a conservative investor who is not in a hurry, then investing in silver may be a good option for you to make money.

Denis HyipHunter Knyazev

Blog creator. Private investor. He has been making money in highly profitable investment projects and cryptocurrencies since 2014. Consults partners. Join the blog's Telegram channel and our chat.

Don't miss other articles from this section:

- 11.06.20204027

Passive income on the Internet: ideas, types

- 27.06.202010109

Safety when working with HYIPs

- 29.06.202027859

Top 15 mistakes of newbies in HYIPs

- 11.06.20203231

What is risk diversification or how not to lose all your money

- 11.06.20203052

How to become an investor from scratch

- 07.06.20203700

Earnings in HYIPs. The moral side of the topic

Jumping silver quotes

A powerful jump in the price per ounce occurred in February 2009. Silver cost $36, and many considered the rise in price irreversible. But the rollback to $27 dispelled the general sentiment. The colossal and massive drain of silver led to a reduction in the price of the ounce in subsequent years. But in 2011, deposits in the metal acquired unprecedented proportions, everyone was in a hurry to invest money in silver.

This is due to the sharp rise in price of an ounce in April 2011 – $47.8. The heyday of the silver market has reached its apogee, and many scientists and financial experts are talking about a shortage of silver reserves in the world with undiminished industrial demand. Then the same thing as always - a massive drain of silver, a drop in prices.

Silver quotation in Sberbank of Russia

Three years have passed since then, and the price of an ounce of silver has not reached such a high level. By the end of 2012, the situation with quotes stabilized for short periods, and then stagnation set in again.

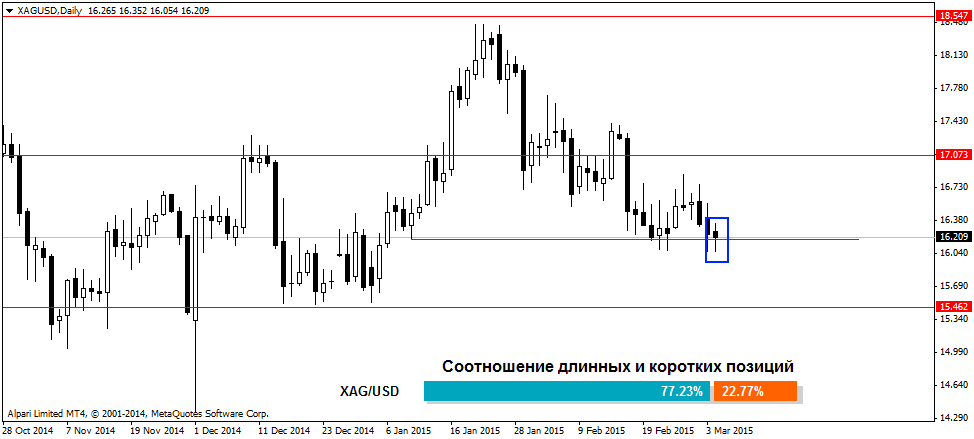

Current silver quotes

Silver prices are set by the London Fixing daily. London fixing is a procedure during which the price for any precious metal is agreed upon, according to the dollar exchange rate and other factors. The fixing is established by the Association of Traders on the London Bullion Market.

All national banks are equal to the resulting quote.

In the Russian Federation, the silver rate is set by the Central Bank, and its price level changes daily. The Central Bank fixes the price per gram, despite the fact that it is more convenient to measure precious metals in troy ounces, which is the world standard.

The price in ruble equivalent of 1 gram of silver fluctuates between 40 rubles, namely 38.49 (purchase) and 38.56 rubles. (sale). Consequently, the cost of a troy ounce is 1197 rubles. During technical analysis, you can see minor fluctuations within 2-5 rubles.

In dollars, the cost of an ounce is equal to 17.23 (purchase) and 17.26 rubles. (sale) on the international silver market. We remind you that investing in silver should be based on an analysis of fundamental factors, since fluctuations on the stock exchange affect the rate to a small extent.

Is it profitable to buy silver?

Before answering this question, it is worth understanding for what purpose the purchase is being made. As you may have noticed earlier, buying silver for the purpose of investment and further resale is not very profitable. Even if we assume that the purchase of 1 bar weighing 1000 grams was made during the greatest decline in price, for example, 28.11 rubles, and the sale during the largest jump, at a price of 36.48, the benefit will be only 8,370 rubles.

If this amount is significant for the person being invested and he is willing to wait and constantly monitor the rise and fall of the exchange rate, it is definitely worth investing. True, you will have to wait about 6-12 months .

It happens that the purchase of pure metal is necessary for a person to develop his own business (for example, making handmade silver beads). Buying with a purpose is a great investment. Everyone understands that having purchased the same 1000 grams, even at the highest price of 31.90 rubles, the sale of the finished product for 1 bead weighing, for example, 5 grams will start from at least 300-700 rubles .

Silver prices coming soon

The rosy forecasts associated with the reduction of world silver reserves are not being realized. In general, the trends inherent in the dynamics of silver prices are reflected in other precious metals.

Even the world's leading consulting companies, the main consumers of silver, and banks did not expect this. DeutscheBank first predicted $34, then $20. HSBC predicted a minimum of $21 per ounce of silver (initially it was $27). These prices have shifted due to decreased demand from Chinese industry. After this, it became clear to many that the price of silver would not jump beyond $25. $19-20 is the ceiling. But these numbers also indicate an overvaluation of silver, since today the chart stopped at $17.

Silver to dollar price chart

The dynamics of the downtrend are unpredictable, and perhaps the silver rate will balance out. A huge amount of metal has accumulated in reserve funds and on the market during the general crisis. Industrial demand fell. As for mining companies, the situation is not optimistic: silver mining is problematic and expensive, and the extracted raw materials do not cover the costs of its extraction. Given the high cost of silver, selling it at $20 per ounce is unprofitable.

What can we expect in the future?

It is impossible to promise rapid growth in stock prices in 2021. A positive change in the chart at least to the level of $18.8 will make it clear that not all is lost. But many investors, seeing that there is no shortage of silver due to the regression of the world's strongest industrial corporations, are leaving the precious metals market for exchange-traded funds.

The right investment in silver

Each investment method is limited by its own disadvantages and advantages. Therefore, there are no safe and 100% profitable investments; you just have to choose a reliable organization where transactions with precious metals will take place.

Buy bullion

925 bank silver is sold in small (from 1 g) and large (up to 1 kg) bars. It is not profitable to invest small amounts by purchasing small bars. The larger the bar, the less the cost per gram of silver in it. Moreover, the cheapness of silver makes large bars available.

One of the disadvantages is the labor-intensive and lengthy procedure for selling physical metal. It only takes a week for a bank expert to establish the authenticity of the bullion for a fee. A fee for storing silver in a bank is also charged to the owner of the bullion. Purchased silver is charged 0.5% of its value, which is also very little.

Investment coins

Their prices rise almost independently of the current silver rate. But many people confuse an investment coin with a collectible coin, and the difference is significant. A collector's coin acts as a work of art and is intended to be sold to collectors. Its price depends on the circulation, historical value and other “coin” factors. The investment coin is created to facilitate investments in precious metals. It can be made from various precious materials, interspersed with stones, alloys, etc.

Opening an impersonal metal account

There is no need for silver bullion, so all the costs associated with the physical metal disappear. You buy grams of silver formally, and accumulate it in a silver account. If the bank you are investing with goes bankrupt, you may be given an amount of silver equal to the amount of your account, provided the bank has the metal. In the opposite situation, no financial compensation is due, because compulsory medical insurance is not subject to insurance.

Another drawback is that the price of silver on compulsory medical insurance is far from its true value, which is established in the physical metal market. The bank manages the value of the metal in accordance with the state of affairs on the futures exchanges. It is important to choose a reliable bank with reasonable prices if you are planning to open a compulsory medical insurance.

Investing in silver is one of the most controversial financial instruments. On the one hand, this precious metal is the most affordable of the entire group, and perhaps in 5-10 years it will become much more expensive. On the other hand, if price dynamics have been negative for three years, is it worth expecting improvements later? In any case, by investing your savings in silver, you will protect your money from inflation with a low degree of risk.

WHERE and HOW to invest money?

Investing in silver requires prior study of the financial market. It is important to know where and how to make a down payment.

WHERE?

One of the main criteria for choosing a bank should be price, but this is far from the only criterion. When purchasing, you will also need to resolve issues with its storage: you can store the bullion in the bank where you bought it, in some other bank, or at home. If you are taking over a bank, give preference not to the one where the metal is sold cheaper, but to the one that you can trust. You need to choose a bank to open impersonal or safekeeping because your funds in so-called metal accounts are not deposits, and therefore are not covered by insurance. But if a bank goes bankrupt, has its license revoked, or doesn't have physical silver, you could lose not just some, but all of your investment.

When storing at home, keep a cache or buy a special safe for this, which will protect the treasure from damage to the metal (and this reduces its value) and from theft.

HOW?

Buying bullion. This is one of the possible options. Your task is to choose a bank with a license to conduct operations with precious metals. In this case, be prepared for significant purchase costs.

The attractiveness of this option is that you will really feel like the owner of the precious metal. This investment method is most often chosen by those who are absolutely confident in the active growth of material prices.

Buying coins. You can purchase them not only at the bank, but also at the numismatic market. To invest in coins, you can come to any bank branch with documents that confirm your identity, as well as the amount for which the purchase will be made.

You can purchase both Russian and foreign coins. Be careful, because prices differ not only in different banks, but also in different branches of the same bank. You can also purchase metal through online auctions or bulletin boards, but there is a high risk of fraud.

This purchase is tax-free, and the investment itself is considered long-term. The bank will buy the coins at lower prices, so many people wait until the price increases. This allows you not to lose your investment.

Popular investment coins are “St. George the Victorious”, “Sable” and “Zodiac Signs”. But, in most regional banks it is quite difficult to find them, because they are bought from Sberbank and resold at an inflated price. The most acceptable option in terms of the difference in purchase and sale is “St. George the Victorious”, since Sobol’s spreads often reach 50%.

Bank deposits. In this case, the income is slightly lower than from placing your capital in foreign currency or rubles. But, do not rush to abandon this option: this deposit is rightfully considered very reliable, since it is not subject to inflation. The physical amount of silver is less than the mass in a bank account, and this is one of the disadvantages. Additionally, you may have difficulty obtaining your silver savings.

Compulsory medical insurance. If we talk about costs, compulsory medical insurance remains one of the most attractive options. Here you will only need to pay taxes on the profit after the sale. But such accounts are not always backed by real metal, and the bank can set its own price, which is far from the real value.