Gold is a symbol of a happy family life for newlyweds. More than three-quarters of all women in China live in metropolitan areas and own at least one luxurious piece of gold jewelry. But here it is important to take into account that for the Chinese, yellow metal is not only decoration, it is a profitable way to invest money. Chinese gold: how good is it? Do positive or negative reviews about such jewelry prevail among people who have purchased such products?

Gold from China

Is there gold in China?

For a long time, the presence of gold mines in China was completely denied. Only in the early 90s of the last century did the country's government begin careful searches and studies of possible deposits. At the same time, all information about the results was deliberately kept silent. As a result, unexpectedly for everyone, in 2007 China not only increased its own gold reserves, but also immediately became the leader in the world market.

The trend of recent years shows that China continues to actively develop deposits of the precious metal and discover new ones.

Platinum

Let's talk about platinum. You can find gold jewelry with white inserts on store shelves. Many sellers who want to sell their goods at any cost will assure the potential buyer that it is real platinum. However, almost all Chinese are well versed in this issue:

- Working with platinum is quite difficult. It requires special skill;

- It is absolutely impossible to create a filigree product without high-quality specialized equipment;

- platinum products cannot be cheap. The price for such jewelry should be quite high.

Most likely, the white inserts on gold items are nothing more than rhodium plating. Also, such a product can be given a white color due to the presence of nickel particles in the composition. You should not covet such “cheap” platinum products. Don't be fooled.

Historical reference

The People's Republic of China is a state in East Asia, which entered the world gold market only in the 80s of the last century. This is due to the political course of the government, which until 1978 promoted communism. One of the main principles was the denial of commodity-money relations.

With the advent of the new government, the course of the country's development changed dramatically. At the same time, China's gold reserves began to form. And if for the first twenty years the pace of development of gold mining was slowed down due to the solution of other problems, then at the beginning of the new millennium, party leaders were able to pay attention to this issue.

China fake gold

13.07.2020

More than eight dozen tons of counterfeit gold bars have been discovered in China. The Wuhan Kingold Jewelry company was caught defrauding $2.8 billion by offering precious metal bullion as collateral for loans.

As the name suggests, the company that pulled off the 83 tons of fake gold scam is located in the notorious city of Wuhan. The management positions its company as “a company with a golden future.” In the Hubei province of China, it is the largest private refinery, also producing jewelry. The company has a small capitalization, only $10 million, but is public and its securities are publicly traded on the stock market.

Now about what happened. Over the past five years, Wuhan Kingold Jewelry has managed to obtain loans secured by gold in the amount of $2.8 billion (about 20 billion yuan). The company's creditors included 14 large trust funds and shadow banking institutions in China. In fact, the pledged gold bars weighing a total of 83 tons turned out to be counterfeit and consisted of copper coated with gold.

China's counterfeit gold is just one indicator of the massive corruption sweeping the country. Despite the most brutal measures, the communist government is unable to curb the economic chaos. However, he does everything to hide the true situation, including outright statistical manipulation.

China's fake statistics were recently exposed in an article published by Wulf Richter using charts of world merchandise trade indices as an example. The materials show a catastrophic decline in international trade turnover in Europe and America. And only in China everything is good.

The true state of affairs is revealed if you look at the information from transport companies, which indicate a large-scale decline in both exports and imports. The deception of Chinese official statistics lies in the fact that exports from other countries are displayed as import operations, and imports to other countries are displayed as export operations of the PRC itself. But if there was a catastrophic decline in trade around the world, then with whom did China exchange goods? Maybe with aliens?

If we talk about fake gold in China, the scam was discovered at the end of winter. To cover defaulted loans, the shadow banking structure Dongguan Trust attempted to sell the Kingold bars held as collateral. Then it turned out that ordinary copper was hidden under a thin shell of gold. Another major creditor of the company, Minsheng Trust, also conducted an examination of the questionable gold and found that the bars were made of a copper alloy.

The founder and owner of the Kingold company, a certain Mr. Zhia Zhion, does not admit that the gold turned out to be fake. He claims that the bars purchased at the very beginning of the company's activities are simply of low purity. The argument is simple - gold cannot be fake, since they agreed to officially insure it.

Before founding the company, Zhia lived in Hong Kong for several years and previously served in the Chinese army in Guangzhou and Wuhan. For some time, Zhion worked in the management of gold deposits controlled by the Chinese armed forces, where he acquired useful connections in the command.

Friends and acquaintances describe Zhia as a strong man with a loud voice, distinguished by courage, eloquence, recklessness and excessive self-confidence. He has excellent support in Hubei's ruling circles, but his business does not look very reliable. Some claim that they knew from the very beginning that the gold of Gion was counterfeit. Hubei financiers were initially reluctant to do business with him. But the businessman’s high military connections forced them to compromise.

There are several valuable lessons to be learned from China's counterfeit gold story.

All parties to this business scheme were fully aware that the precious metal was of poor quality, but lending to Kingold continued. There is an ingrained corruption component here, using which the communist authorities are trying to maintain their position.

What happened completely lacks unreal stories with reference to external deception, when they talked about some gold bars stuffed with tungsten sent by Bill Clinton to China. And gold itself, as such, turned out to be unimportant here. Because Zhia, thanks to his high connections and pressure, could get a loan even if he offered ordinary bricks painted yellow as collateral.

The most interesting thing is that the fake gold from Wuhan Kingold Jewelry turned out to be part of the Chinese state gold reserve and accounted for 4.2% of its total volume. If the precious metal turned out to be a fiction, then what and in what quantities is now in the bins of the Celestial Empire? Can we trust the official data about 1916.3 tons of gold in the vaults of the People's Bank of China?

Source: Russian online media

More news

- Moscow archaeologists have found medieval coins from the Golden Horde period

- Gold mask to protect against COVID-19

- The Golden Hotel was built in Vietnam

to news list

Main gold deposits of China

There are more than a hundred gold deposits in China. The largest of them is located in the area of the Chinese city of Laizhou, Shandong province.

It is noteworthy that there are layers of gold in all provinces of the PRC, but the eastern regions turned out to be especially rich. The north and west of the country have been little studied, and therefore are considered promising.

In first place in terms of production level are deposits located in the provinces of Gansu, Shaanxi, Xinjiang Uyghur Autonomous Region (AR), as well as the western part of the AR Inner Mongolia.

By whom and how is it mined?

Gold mining in China occurs under state control. Most foreign companies are involved in only small deposits. Permission to carry out the work is issued to them only in exchange for a specific amount of investment made in the development of the field.

Gold mining companies

To control the gold mining industry, China develops the vast majority of large deposits on its own. The work is organized by CNGGC (China National Gold Group Corporation). Another 3 main mines are being explored by Zijin Mining. The third most important company in the country is Zhaojin Mining.

Extraction methods

Gold in China is mined mainly in mines. Technologies and methods depend on the company involved in the development, its technical equipment and experience. For example, at the Jinfeng deposit, bioleaching, cyanide leaching, and flotation are used to extract gold. Heap leaching is being developed in Jilin Province.

Production volumes

Until 2006, the success of Chinese gold mining companies was not very outstanding. However, already in 2007, the state displaced the previous leader in average annual gold production - South Africa. Over the next decade, the volume of precious metal mined increased by 3%.

Today, about 450 tons of gold are extracted from the mines of China during the year (in Russia this parameter barely reaches 270 tons). The government plans to introduce a number of changes aimed at increasing existing indicators (up to 500 tons/year).

Golden vector of Chinese politics

At the same time, experts studying modern China are increasingly connecting various events in the life of the Celestial Empire with the “golden policy” of this country. What is the essence of China’s “golden policy”, its goals, means, results achieved? Gold mining: South Africa has lost its leadership to China.

The “golden vector” of Chinese policy is most clearly manifested in the unprecedentedly high rates of extraction of the yellow metal. Since the turn of the century, China has experienced one of the world's fastest growth rates of gold production (1). If the production volume in 2000 is taken as 100, then in 2011 in China the gold production index was 214.5; in Russia – 149.7, and in South Africa – only 46.3; in the USA – 65.6; in Canada – 69.7; in Australia – 87.5. Over the first decade of the 21st century, there has been a radical change in the positions of leading countries in global gold production. China in 2000 occupied only fourth place (after South Africa, the USA and Australia), and in 2007 it managed to move to first place. This was a landmark event in the world of gold: South Africa lost the title of world leader in gold mining, which it had held since 1896, that is, for 111 years.

Over the ensuing years, China has steadily increased its lead over other countries in terms of gold production... In 2011, China's share in world gold production was 13.4%. Only South Africa has reached such heights in the past. Back in 2000, South Africa's share of world production was 16.5%. It is possible that in 2012 China managed to reach the same level (this will finally become known only after data on world gold production in 2012 appears). According to data published by the Chinese Gold Miners Association in February 2013, in 2012 the volume of precious metal production in China amounted to 403 tons, which confirmed China’s position as the world leader in gold mining. It is noteworthy that in 1949 (the year of the creation of the People's Republic of China) gold production was 4.07 tons. That is, for the period 1949-2012. In China, there was a hundredfold increase in the production of the yellow metal.

Gold consumption and import: China becomes a world leader in 2012

According to the World Gold Council, in 2011 China ranked second in consumption of the yellow metal (811 tons), closely approaching India (933 tons). It is noteworthy that the third place in gold consumption was occupied by the United States - 194.9 tons. That is, the gap between India and China and the United States was multiple. It is noteworthy that in India there is a decrease in consumption volumes (by 7% in 2011 compared to 2010), while in China, on the contrary, there is an increase (by 22% in 2011 compared to 2010). In 2011, China accounted for 26% of global gold demand, up from 6% a decade earlier. According to preliminary data, in 2012, China overtook India and became the country consuming the most yellow metal in the world.

As you can see, domestic gold consumption in China was more than twice the volume of production of the yellow metal in the country in 2011. The deficit is covered by imports. For quite a long time, India was the leader in imports of the yellow metal, which is not surprising, since this country traditionally has a high level of gold consumption, and the volumes of domestic production are very small. In 2011, India reached a record import level of 967 tons. But in 2012, the usual picture changed; China moved to first place in the import of the yellow metal, pushing India to second place. According to calculations by Bloomberg experts, 834.5 tons of gold were imported into mainland China from Hong Kong in 2012, including in the form of scrap and gold coins, compared to approximately 431.2 tons in 2011 (that is, an increase over the year of almost twice).

Many countries both buy and sell gold at the same time. But this story is not about China. Legally, the export of gold from China is extremely difficult. But de facto there is none at all (except, perhaps, for small smuggling). A reputable gold website has the following conclusion on the matter: “Precious metals experts and brokers agree on one thing—they have never seen China sell gold on the world market” (2).

China's official gold import statistics are just the tip of the iceberg

Official statistics on the influx of the yellow metal into China likely understate the scale of this phenomenon.

Firstly, gold imports into China occur not only through Hong Kong (where it is strictly recorded in customs statistics), but also through Singapore and Macau. These are mainly “gray” imports, not taken into account by official Chinese statistics. Since the total length of the Chinese state border exceeds 22 thousand km, and the coastline has a length of 14.5 thousand km, it can be assumed that there are other “corridors” of illegal import. Often such operations represent various commodity exchange transactions without the use of currency. For example, the press has repeatedly mentioned the visits of Chinese merchants to African countries, where they exchange Chinese consumer goods for yellow metal from local residents and entrepreneurs.

Secondly, gold flows into China not only through regular trade channels, but also through international lending agreements between Chinese banks and European banks, in which gold is used as collateral. American financial analyst Jim Willey on the website goldenjackass.com spoke about one scheme to leach gold from large European banks: “Contracts with Asian banks and investment funds that lent them huge amounts of money stipulate that requirements for additional collateral are fulfilled only in the form transfer of physical gold. Due to the fact that Western banks operate with a large financial leverage, the consequences of mistakes for them are catastrophic. In just four months (from March to June 2012), 6 thousand tons of physical gold (mainly from Switzerland and Italy) have already flowed into Asia. At the same time, the banks borrowed gold from their own clients (simply stole it).”

Thirdly, as experts note, gold that comes into the country from mines wholly or partially owned by Chinese companies is also hidden behind the scenes of official statistics. Naturally, such gold is much cheaper than what you have to purchase on regular markets.

China's purchase of gold mines abroad

The insufficient amount of geological reserves of the precious metal in China forces many gold mining companies in the country to look for new resources in other countries. It should be borne in mind that the raw material base for domestic production in China is quite close to exhaustion. Back in March 2010, the World Gold Council announced that existing gold deposits in China would be depleted within six years due to increased mining rates. According to the US Geological Survey, a very authoritative source, in 2011 alone, the Chinese extracted 20% of their proven gold reserves (3).

China has two trump cards that make it easier for it to buy up gold mines around the world. Firstly, China already has quite efficient production technologies. Secondly, he has money. Their main source is extra-budgetary funds from the sovereign fund, managed by the state organization China Investment Corporation (4). Recipients of the money are state-owned companies. China's largest gold producer, China Gold Group, has said it intends to participate in overseas deals to purchase additional gold deposits and collaborate with other companies to develop gold deposits around the world (5).

China's other largest gold mining companies Shandong Gold, Zijing Mining and Zhaojin Mining are actively negotiating the purchase of deposits abroad. Already today, China is a partial owner of major international gold mining companies, such as Norton Gold Fields, A1 Minerals, Gold One International, Zara, YTC Resources, Sovereign Gold (6).

Chinese investors are particularly active in Australia. Here are examples of several transactions to acquire gold mines in this country (7). Chinese mining company Zijin Mining Group announced in April 2012 its intention to buy Australian gold mining company Norton Gold Fields, which operates the Paddington mine near Kalgoorlie, for $299 million. The Chinese purchase of a stake in the Australian gold mining company Norton Gold Fields is just the beginning; they have stated that they will continue to buy shares or entirely Australian gold miners, thereby increasing China's gold reserves. In 2011, the Chinese already bought the Australian gold miner A1 Minerals, operating in Laverton, a suburb of Melbourne. This company has now been renamed Stone Resources Limited after its parent company in Hong Kong. The Chinese also spent $80 million to buy a majority stake in Australia's Zara gold project in Eritrea. Another Chinese company, Yunnan Tin Group, which is the largest tin producer in the country and the world, owns 12.3% of the Australian mining company YTC Resources, which is developing the Hera mine near Cobar in New South Wales. Another Australian gold miner, Sovereign Gold, which has begun developing abandoned mines at the Rocky River-Uralla deposit in northern New South Wales, has signed a cooperation agreement with Chinese exploration company Jiangsu Geology & Engineering, which paid $4 million for a 30% stake in two areas .

There are reports of purchases of gold mining assets in other regions of the world. For example, China National Gold Corp bought half of Coeur d'Alene Mines (CDE), a gold mine in Alaska. Chinese Stone Resources Limited bought a 17.7% stake in the South African gold mining company Gold One International for $79 million. Africa is of particular interest to the Chinese, but many transactions on this continent are kept secret.

One of the largest transactions took place in the fall of 2012 in Venezuela. The government of this country and the Chinese company China International Trust and Investment Corp. entered into an agreement to jointly develop one of the largest Latin American gold mines, Las Cristinas. The Las Cristinas field is located in the south of Venezuela, in the state of Bolivar. Commenting on the agreement, Venezuelan President Hugo Chavez noted that we are talking about the extraction of not only gold, but also copper, since the deposit is rich in both of these metals. At the same time, the direct share of gold, according to preliminary estimates, is 17 million ounces. Previously, a Canadian company was developing gold at the field; the Venezuelan government decided to replace the Canadians with the Chinese (8).

Let us emphasize that China is buying up shares in gold mining companies in different countries in order to guarantee supplies of gold at low prices in the future.

Official gold reserves: “Chinese mathematics”

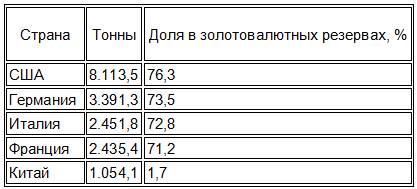

Data on the official reserves of gold - a metal on the balance sheet of the country's monetary authorities - central banks and treasuries (ministries of finance) are as follows. According to official sources, in China these reserves are equal to 1054 tons. Chinese authorities claim that all this gold is on the balance sheet of the country's Central Bank (People's Bank of China). This figure has not changed since 2009, when the Central Bank immediately increased its gold reserves by 75%, but few experts believe that China’s official reserves today really amount to 1,054 tons and that according to this indicator the country is in fifth place in the world.

Official gold reserves as of January 2013 (according to IMF data)

It is known that all gold production in China goes into government reserves. Let us recall that in recent years the volumes of domestic production in China were equal to (t): 2009 – 324; 2010 – 351; 2011 – 369; 2012 - 403. It turns out that after 2009, when the official gold reserves were recorded at 1054 tons, another 1,447 tons of the yellow metal entered state reserves. Consequently, at the beginning of 2013, the state gold reserves in the PRC could be: 1054 tons + 1.447 tons = 2.501 tons. This means that China was not in fifth place in terms of this indicator, as follows from official data, but in third place - after USA and Germany.

But that's not all. Some experts believe that Chinese gold reserves are even greater. Take, for example, the assessments of Insley Matt, editor-in-chief of Daily Resource Hunter, which appeared in the media in February 2013 (9). He takes into account that China's official reserves are replenished not only through domestic production, but also through imports. And it reaches a volume of 3,927 tons. It turns out that China has even surpassed Germany in official gold reserves and is in second place in the world after the United States.

Moreover, Insley Matt believes that it is also necessary to take into account secret supplies of gold from Africa and South America, which are not reflected in the customs statistics of the PRC. As a result, it reaches a value roughly equal to 7,000 tons of gold. That is, if we take these calculations on faith, China has come quite close to the level of the United States, whose official reserves of the yellow metal slightly exceed 8,000 tons.

If in absolute terms even the official figures for China’s gold reserves look impressive, then in relative terms the Celestial Empire still lags behind many countries in the world. The share of the yellow metal in official gold and foreign exchange reserves is 1.7%. Even if we agree with Insley Matt’s estimate (7 thousand tons), the indicated share will be only 11.3%. Chinese leaders have repeatedly stated that it is necessary to change the structure of the country's international reserves in favor of the yellow metal.

In order for, say, in January 2013, China could have 50% in gold (relative to the current volume of gold and foreign exchange reserves), the metal reserves would have to be not 1054 tons, but almost 30 times more, i.e. about 30 thousand tons of gold. And this volume is approximately equal to the official gold reserves of all countries in the world. The amount of foreign currency held today in the official reserves of the People's Bank of China is roughly equivalent to US$3 trillion. At current prices for the yellow metal, this amount of currency is enough to buy about 70 thousand tons of gold. The market cannot offer so much. The global supply of precious metal (both “primary” - mined from the subsoil, and “secondary” - coming in the form of scrap and from previously accumulated reserves) rarely exceeds 4 - 4.5 thousand tons of metal per year. One-time purchases of gold quantities of 100 tons and above on the world market immediately lead to a significant increase in gold prices. And rising gold prices will simultaneously lead to an even greater depreciation of the US dollar. The Chinese leadership, while not harboring any warm feelings towards the United States, is nevertheless not interested in a sharp drop in the American currency, which would devalue China’s gigantic foreign exchange reserves denominated in dollars. Therefore, Beijing is implementing its ambitious plans to accumulate gold very carefully so as not to upset the balance in the currency and yellow metal markets.

However, the Chinese leadership does not set the task of converting 100% of its foreign exchange reserves into gold. Goals were announced “in the long term” to reach a reserve level of approximately 10,000 tons (10). However, taking into account the above, we can assume that the goal of 10 thousand tons is not so distant.

“Golden mobilization”: a version that cannot be ruled out

Of course, not all gold goes to the vaults of the People's Bank of China today. China's domestic consumption of gold is growing rapidly. Both for industrial purposes (primarily the jewelry industry), and for investment purposes - in the form of purchases by the population of jewelry, coins and bars. According to the World Gold Council, in 2011, gold consumption in China was 777.8 tons, and in 2012 - 776.1 tons. Citizens accumulate more and more amounts of the yellow metal every year. How much - no one knows. True, there are expert assessments. According to one of them, the population of the Celestial Empire has 6 thousand tons of gold in their hands. For comparison: in India – 18 thousand tons, in Germany – 7 thousand tons (11). But we must keep in mind that not long ago there was a “cultural revolution” in the country, when private ownership of gold was prohibited. Today, the government encourages all types of gold consumption, so the gap between India and China in terms of accumulated gold will decrease.

But this is not the main thing. Many experts point out that calls from the state to accumulate gold may tomorrow be followed by a command to hand over the accumulated gold to the Chinese treasury. For example, in the event of a sharp deterioration in the economic situation of the country or the outbreak of war. Such confiscations have happened. Suffice it to recall the “gold confiscation” in the United States immediately after F. Roosevelt came to power in 1933, when law-abiding Americans surrendered several thousand tons of the precious metal to the state in a month. In China, such a “golden mobilization” is much easier to carry out. If such a confiscation were carried out at the present time, then the state’s gold reserves would no longer be 7 thousand tons (Insley Matt’s estimate), but 13 thousand tons.

Why does China need so much gold?

The most important question remains to be answered: for what purpose is China so diligently accumulating gold? Ultimately, all answers can be reduced to two main options.

Option 1. China needs gold as a strategic resource in case of a sharp aggravation of the international economic and political situation - external or internal. For example, if the world, as a result of a global currency collapse, finds itself without traditional reserve currencies such as the US dollar or euro, gold will turn into “emergency money.”

It is possible that gold will cover some emergency expenses within the country. By the way, in 2011, Japan was forced to sell 20 trillion worth of gold from its reserves to compensate for the consequences of the tsunami and the accident at the Fukushima nuclear power plant. yen

Gold may also be needed in case of war - and not necessarily war against China. This could be a war against a large and important trading partner of the PRC. Iran can be taken as an example. Neighboring Turkey pays for the Iranian hydrocarbons it receives in yellow metal, since regular US bank transactions have been blocked. China also, bypassing international sanctions, receives a certain amount of hydrocarbons from Iran. It is possible that today China is paying for these supplies in gold.

Option 2. China needs gold to strengthen its national currency and turn the yuan into an international reserve currency. There is even talk that the yuan could become “golden”.

Some analysts and experts (including Chinese) believe that China is pursuing two goals at the same time. For example, the president of the China National Gold Group, Song Zhaoxu, noted in the central party newspaper Zhemin Ribao: “Increasing gold reserves should be one of China’s key strategies, regardless of whether it is required for the economic security of the state or to accelerate the internationalization of the yuan” (12). Let's take a closer look at the second option.

About gold and the Chinese yuan

Some authors argue that when the gold reserves of the People's Bank of China reach a critical mass, the monetary authorities of the PRC will announce that the yuan will become “golden”. That is, the country’s monetary authorities will undertake the obligation to exchange cash, and perhaps non-cash yuan, for the yellow metal. And this will automatically make the yuan the main currency in the world, and the rest will adapt to it. Something reminiscent of a gold exchange standard, when countries accumulate currency that is convertible into yellow metal. Until the 1970s last century in the world there was a gold dollar standard as a type of gold exchange rate. Now, according to some authors, a gold-yuan standard may emerge. The version is beautiful, but unlikely. At least from a formal legal point of view. According to the IMF's first amendment to Article IV of the agreement, ratified in 1978, member countries are not allowed to peg their currencies to gold. Even if there were no such amendment, China, having accepted the obligation to exchange the yuan for gold, would quickly lose its gold reserves, no matter how large they were.

However, indirectly, China is using its gold policy to raise the international profile of the yuan. Recall an axiom of the financial world: confidence in a currency issued by a central bank with a growing supply of gold (even if the gold is not convertible into currency) always increases. And that's not it. The Shanghai Gold Exchange has been operating in China since 2002. The People's Bank of China controls the situation on this exchange not only as a regulator, but also as a participant - not directly, but through Chinese state-owned banks that have received licenses from the Central Bank to operate with the yellow metal (13). For ten years, this trading platform has been “promoted” by the Chinese authorities. Foreign participants were allowed to attend. But at the same time, the authorities announced that gold trading would be conducted for the yuan. Obviously, this increases the demand for the yuan from non-residents (14).

Today, China enters into bilateral agreements with a number of countries on the mutual use of national currencies. For example, with Japan, Russia, and other BRICS countries. Experts expect that over time, the exchange rates of national currencies under such agreements will be determined not by the currency exchange, but by the gold parities of these currencies. Amendments to the IMF Charter abolished such gold parities, but nothing prevents countries from restoring them on a bilateral basis. And the next step in the development of such bilateral relations is the use of yellow metal as a means of equalizing bilateral payments. Gold is quietly returning to international monetary relations. Here is how Russian specialist V. Pavlenko comments on the conclusion of an agreement between China and Japan last year (2012) on the mutual use of the yuan and the yen: “China and Japan have withdrawn from mutual dollar payments since June 1 and will now pay strictly in yuan and yen. This fairy tale, however, is for naive simpletons. The yuan and yen are brought to a single denominator only through an equivalent (EMS - a single measure of value). Previously, this equivalent was the dollar (it is controlled by the Rockefellers). And now? Since it is not said what exactly, it means that the role of the EMC goes to gold. And this gold equivalent (standard), the price of which will be the basis for mutual Sino-Japanese payments, will already be controlled by the Rothschilds” (15).

Let us add on our own behalf: today gold is an EMS, and tomorrow it becomes a means of international payments. It is obvious that confidence in China as a country with large gold reserves and as a partner in international economic relations will be high. Accordingly, confidence in the Chinese yuan will be high.

There is another aspect of the “gold-yuan” problem that is little covered in the media. The latest global financial crisis highlighted the problem of extreme bank instability. The Basel Committee on Banking Supervision has developed the third generation of capital adequacy standards for banks (“Basel 3”). For the first time, these standards state that gold becomes a full-fledged financial asset, which, when calculating equity capital, is quoted as the most reliable treasury securities or cash (legal tender). The Basel 3 rules were to begin to be implemented on January 1, 2013. In fact, this means the return of gold to the world of money. Banks in the United States and Western European countries (with the exception of Switzerland) were not ready to accept the new rules; their introduction there was delayed indefinitely. At the same time, several countries have started Basel 3, among them China. Experts believe that Chinese banks, having gold, will be able to easily fit into the new standards (16). This will dramatically increase their attractiveness and competitiveness against the background of banks in the “golden billion” zone. It is obvious that strengthening the competitive positions of the Chinese banking sector with the help of gold and Basel 3 will inevitably contribute to increasing the prestige of the yuan and its gradual transformation into an international currency.

Conclusion

And one last thing. The financial group of the Rothschilds plays along with China in its gold policy, which is briefly mentioned in a quote from V. Pavlenko’s work “Gold against oil, pound against dollar, Rothschilds against Rockefellers.” It is well known that this group traditionally controls the global market for the yellow metal. The Rothschilds have their own plans for China; their plans include fueling Beijing’s “gold ambitions” and assisting in the implementation of Chinese gold projects. In short, the Rothschilds are now interested in China with its gold potential as a temporary ally to defeat their eternal competitor, the Rockefeller group. The Chinese currency, strengthened by gold reserves, is assigned the role of only a battering ram for the collapse of the US dollar and support for the transition period. The ultimate goal of the Rothschilds is to establish a supranational currency in the world (17).

However, a significant caveat is necessary here. China cannot be considered just an object of behind-the-scenes games of world financial clans. Not all plans of Western capital regarding China are being realized. In particular, the Rothschilds have so far failed to create a “fifth column” in the Chinese economy in the form of an extensive network of their banks. Thus, the number of branches of the largest commercial and industrial bank in China (state-owned Chinese bank) is 16,232 units, while the number of branches of the largest foreign bank HSBC, part of the Rothschild empire, is slightly more than 100. It is noteworthy that today the share of foreign banks accounting for less than 2% of total assets of the Chinese banking system (18). The Chinese leadership has not shown any obvious readiness to make the yuan a gold currency.

A recent Chinese media analysis with the suggestive title “China Announces the Beginning of a New Era” contains the following conclusion from an anonymous author: “China is fully prepared for a hyperinflationary scenario. China is refusing to implement the British plan for a strong global yuan in order to speed up the death of the dollar. China predicts the biggest difficulties in Europe. China has fully protected its financial system with tons of gold reserves. China refuses to play the role of a global commodity donor, except in cases where export supplies are fully met with real goods” (19). Well, if this conclusion reflects the real state of affairs in the Middle Kingdom, then it indicates that China does not want to be a bargaining chip in the hands of the Rothschilds.

China demonstrates the desire and ability to be an influential and active subject in international financial and economic relations...

(1) The following are gold production figures according to the World Gold Council. (2) “Experts: China never sells its gold” //gold.ru (November 6, 2012). (3) www.usgs.gov (4) With approximately €400 billion of capital under management, China's sovereign wealth fund is one of the largest in the world. (5) “The Chinese will continue to buy deposits abroad” // Gold.ru (November 8, 2012) (6) Tatyana Pismennaya. China will lower the dollar // Ugmk.info 08/31/12 (7) According to the article “China is buying shares of gold mines around the world” // Gold.ru (04/12/2012). (8) Until 2008, the Canadian company Crystallex International Corp. held the license to develop gold mines for 16 years. However, in May 2008, the Venezuelan Ministry of Environment and Natural Resources terminated its operation. Canadians estimate the damage caused to them at $3.8 billion and are going to recover this amount through the International Court of Arbitration (https://www.km.ru/economics/2012/09/22/ugo-chaves/692900-kitaiskie-starateli-prishli -na-zolotye-priiski-venesuely) (9) Insley Matt. So how much gold does China really have? // Goldenfront.ru (02.12.2012) (10) In 2008, a special expert group was assembled in China, which recommended increasing the Chinese gold reserve to 6,000 tons in the next 3-5 years and possibly up to 10,000 tons in 8 -10 years. (11) Olesya Pugacheva. Gold and investments. // Zolotonews.ru (07/16/2012). (12) Tatyana Pismennaya. China will lower the dollar // ugmk.info (08/31/2012) (13) In China in 2012, 20 banks received the right to participate in the purchase and sale of gold on the Shanghai Gold Exchange, where a special platform for interbank transactions in gold was created for this purpose. Among them: Industrial and Commercial Bank of China Ltd, China Construction Bank Corp, Bank of China Ltd, Bank of Communications Ltd, HSBC Bank (China) Co Ltd and Standard Chartered Bank (China) Ltd. (https://gold.ru/articles/news/kitaj-zapustil-torgovlju-zolotom-mezhdu-bankami.html). (14) In addition to the Shanghai Gold Exchange, Chinese authorities were working to establish the Pan Asian Gold Exchange (PAGE) in Kunming, China. However, the launch of this exchange in 2012 was not very successful for the Chinese authorities: the only shareholder of the exchange with a foreign listing (in the USA) suddenly and secretly increased its share from 10% to 25%, thereby receiving a blocking stake. This was clearly not the plan of the Chinese leadership. At the same time, it was announced that on this exchange, trading will be conducted not in dollars, but in yuan. (15) V. Pavlenko. Gold versus oil, pound versus dollar, Rothschilds versus Rockefellers // akademiagp.ru (06/19/2012). (16) In Europe, according to media reports, at least some central banks are planning to sell or lease gold to commercial banks to strengthen the latter's position. It is known that in 2011, the Bank of Italy already sold gold to its banks to prepare them for work under Basel 3 conditions. (17) It is worth paying attention to the statements of the famous financial speculator George Soros, who calls for a radical reform of the global financial system by creating a supranational monetary unit similar to the “Special Drawing Rights” (SDR). The issuance of SDRs was started by the International Monetary Fund in 1969, but was later suspended. Today, the volume of this supranational currency is very small. We must remember that Soros acts as an agent and mouthpiece of the Rothschild clan. (18) (E.N. Chebanenko. The evolution of attracting foreign capital to the Chinese banking system // “Problems of modern economics”, No. 1 (41), 2012). (19) “China announces the beginning of a new era” // Telegraphist website, 02.21.2013.

China's gold reserves: dynamics and volume for today

Until 1976, it was believed that China had no government gold reserves at all. However, from 1977 to 2000, the country’s reserves were replenished and amounted to 395-398 tons.

Since 2001, the growth rate of gold reserves has increased by 26% and amounted to 500.8 tons. Over the year, the figure increased by another 15%, reaching 600 tons. It remained this way until 2010.

With the start of large-scale development of gold deposits, the amount of precious metal in the country’s fund began to increase again. For several years now, China has been occupying a leading position in the ranking of world countries with the largest gold reserves (1842.6 tons).

Features of Chinese gold and foreign exchange reserves

- From 1950 to 2004, citizens of this country were officially prohibited by law from owning gold in any form. The long-term ban created an unprecedented demand for gold jewelry from private individuals immediately after the abolition of this law.

- In 1977, China's gold reserves did not exceed 400 tons. A powerful boost to accumulation became noticeable in 2010, when gold and foreign exchange reserves almost doubled in one year. What is significant is that it was at this time that the cost of a troy ounce reached its historical maximum. But, despite the high cost of the precious metal, China purchased it in significant quantities.

- All foreign exchange reserves of the country at the beginning of 2021 amounted to 3.2 trillion. US dollars, while gold accounts for a very modest figure of $74.07 billion. The remaining values are currencies and debt obligations of different countries.

- In October 2021, data on gold production and growth in Chinese storage facilities stopped being published by official publications. Since then, the international community has had to be satisfied with the Chinese government's annual report on current gold bullion reserves. And these reports do not inspire confidence in precious metals market analysts and knowledgeable economists.

- Many experts believe that physical gold in this country is stored in numerous banks and jewelry factories, from where it can be claimed by the state at any time.

Gold rate in China

If you trace the dynamics of gold prices in China over the past 5 years, you can see that only the last year and a half have they been relatively stable. The stabilization of pricing was influenced by the discovery of new deposits, government policy, and the introduction of the national currency into the international currency basket.

The cost of 1 ounce today can be seen on this chart:

Historical Gold Chart by GoldBroker.com

Price per 1 gram

1 ounce = 28.35 grams. The graph below shows the price as of today in China for 1 gram of gold of the highest standard (24 carats):

Chart XAUCNY/31.1034768 provided by TradingView

Gold and Chinese New Year

On January 25, 2021, the Chinese celebrated New Year, which is the most important holiday in the Chinese lunar calendar. This day marked the beginning of the Year of the Rat and a new circle of twelve zodiac signs. The Chinese are now in a festive mood, which means that everything is fine on the country’s gold market.

Gold gifts for Chinese New Year

Purchasing gold items is a long-standing New Year's tradition in China. Firstly, the precious metal has been considered a symbol of good luck for thousands of years, as well as all the best, which all people undoubtedly expect in the new year. This was largely due to the fact that gold and its color were associated with the power of emperors in Chinese history. Secondly, thanks to the New Year's “thirteenth salary”, Chinese consumers can afford to purchase the yellow metal. This is confirmed by the results of a 2021 World Gold Council survey of precious metal consumers worldwide, which found that high incomes increase consumption of the yellow metal.

There is also a tradition of giving gifts during Chinese New Year. For example, after saying the words of congratulation "Gong Xi Fa Cai" (I wish you good luck!) on Chinese New Year's day, the older generation usually distributes red envelopes with money or other valuable gifts such as gold to the youth.

Therefore, a month before the New Year, which is also called the Spring Festival, the gold market experiences a real boom in sales, as many consumers prefer to purchase gold items to bring good luck to themselves and others. Hundreds of millions of people adhere to this tradition, wanting to spend the holidays with dignity after a year of hard work.

According to the above survey, emotional attachment to gold plays a big role in this market: 70% of consumers across all age groups in China have this attachment, while the figure is 57% globally.

Increase in demand for physical gold ahead of Chinese New Year

Thanks to this tradition, December, that is, about a month before the New Year, usually sees a peak in trading activity for gold retailers. According to the National Bureau of Statistics, during the period, sales of gold bars, coins and jewelry averaged the highest level in the last two decades.

The increase in consumption leads to an increase in the volume of gold withdrawn from the Shanghai Gold Exchange, as well as an increase in the amount of imported precious metal. Jewelry manufacturers and processors experience their peak activity in November (and sometimes December if the New Year falls on a later date), while retailers and banks replenish their gold inventory ahead of the Spring Festival. Over the past decade, the increase in gold volumes on the exchange begins in November, and on a monthly basis the growth volume is 22%. According to data from China's customs service, gold imports into the country for November have been 18% higher month-on-month for the past three years.

The domestic premium on the gold rate is also growing as the New Year approaches. The logic is simple: the higher the demand, the less supply, which leads to an increase in domestic prices. On average, local markups in the six weeks leading up to the New Year are 65% higher than the annual average over the past ten years.

Results

The Chinese have a tradition of stocking up on essentials before the New Year, as most stores close for the holidays. Even though the yellow metal is not classified as an essential item, it becomes very popular before the New Year, being a symbol of good luck. The Chinese can afford to pay attention to the precious metal due to increased income towards the end of the year.

Therefore, retail stores selling gold are always crowded before the New Year. December - about a month before Chinese New Year - sees the highest retail sales of any month in 21 years. The purchase of gold, imports and markups on its exchange rate increase during this period. Increasing wealth and the desire to increase long-term savings are the main factors driving demand for physical gold in China ahead of the New Year. Let us recall that in 2019 there was a high volume of gold purchases, imports, as well as an increased local price for the precious metal before the New Year.

Despite the volatility of its exchange rate due to global political tensions, the Chinese are still buying the yellow metal, although in some cases with a delay. All these factors may increase demand for gold in China at the beginning of this year, given the high exchange rate of the precious metal and the economic downturn during 2019.

Characteristics of Chinese 999 gold

Pure gold, without impurities, has a purity of 999, i.e. the precious metal content in it is 99.9%. The remaining part of the composition is occupied by inclusions of copper, which cannot be completely removed. The presence of even such a small particle of impurity provides the precious metal with a red tint, which is why it is also called red. Chinese gold of the highest standard is practically not used in the manufacture of jewelry, since pure precious metal is very ductile and is easily exposed to external influences.

Testing systems

Until the end of the 19th century, different countries had their own test systems for marking precious metals. With the advent of the metric grading system in 1888, states began standardizing the designations. Russia moved away from its own sampling system (spool) only in 1927.

Today, the international market uses the karat designation for the gold content of a piece of jewelry. However, in Russia and the countries of the former USSR the metric standard is still in effect.

Metric

The metric sealing system is widely used in the CIS countries. It corresponds to the percentage of gold in the alloy. For example, if a ring is marked with the numbers “585,” this means that it contains at least 58.5% gold, and the rest is a ligature.

Carat

The carat test is used by foreign jewelry factories and is recognized internationally. The marking of the product in this way displays the amount of gold present in the alloy. Pure precious metal without impurities is marked 24 carats, which corresponds to the domestic 999 standard. When a master alloy is added to the alloy, the number of carats is reduced accordingly.

Zolotnikovaya

The spool sampling system was used in the Russian Empire from 1798 to 1927. The quality of the gold alloy was displayed in accordance with the precious metal content in 1 Russian pound. It corresponded to 96 spools. The lowest sample was considered to be 36 spools, i.e. the amount of gold in the product was 0.375 of the total mass.

Sample table

All sample systems are interconnected by strict ratios to ensure regulated prices for products. You can determine the relationships between certain alloy designations using a table.

| Metric gold standard | British carats | Spool system | Pure gold content |

| 990 | 24 K | 96 | 99% |

| 958 | 23 K | 92 | 95,80% |

| 875 | 21 K | 84 | 87,50% |

| 833 | 20 K | 81 | 83,33% |

| 792 | 19 K | 76 | 79,17% |

| 750 | 18 K | 72 | 75,00% |

| 625 | 15 K | 60 | 62,50% |

| 585 | 14 K | 56 | 58,50% |

| 500 | 12 K | 48 | 50,00% |

| 417 | 10 K | 40 | 41,67% |

| 375 | 9 K | 36 | 37,50% |

| 333 | 8 K | 32 | 33,33% |

Chinese gold market: still at the helm

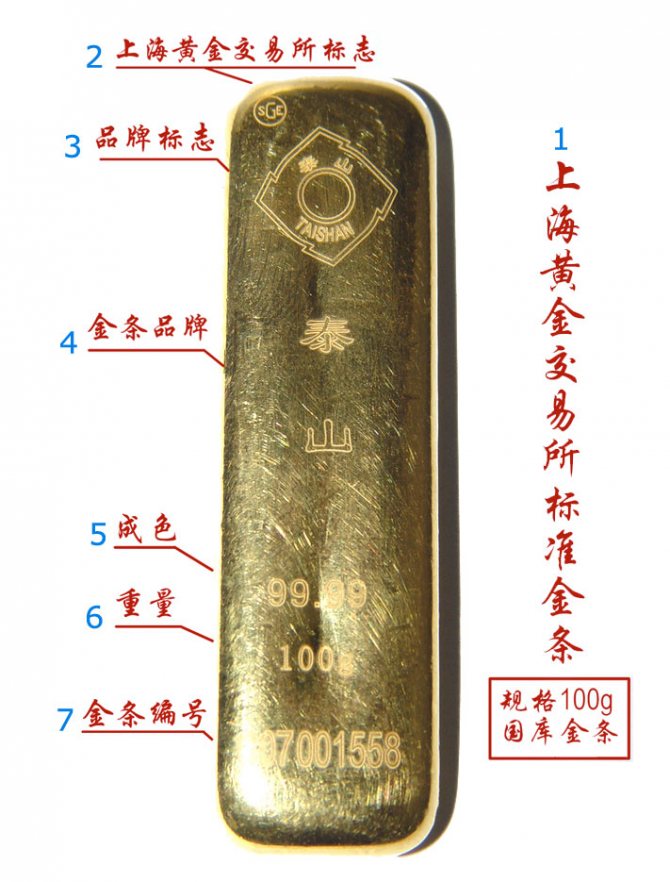

Now that the first half of 2021 is behind us, it's time to take a look at what's been happening in the Chinese gold market. Let us remember that China is the largest gold producer in the world, the largest importer of gold in the world, and the Shanghai Gold Exchange (SGE) in China is the largest physical gold exchange in the world.

For various reasons, such as international trade regulations, VAT regulations and deep liquidity, almost all Chinese physical gold supply passes through the SGE vault network. This includes imported gold, Chinese gold mining and recycled gold. Thus, almost all of China's gold demand must be met by physical gold withdrawals from the SGE, and gold withdrawals from the SGE are a convenient approximation for Chinese wholesale gold demand. So, without going into details:

SGE Physical Gold Supply = SGE Withdrawals = Chinese Wholesale Gold Demand

Gold supply includes gold imports, mining, gold scrap/refining and disinvestment. Disinvestment in SGE is the reverse process of investment. An investment is when an institutional entity or individual directly purchases gold from the SGE. Disinvestment is the sale of gold bars, which are then sent to the refiner and returned to the SGE storage network.

Wholesale gold demand includes consumer demand and institutional demand (direct gold purchases at SGE). For a more complete explanation of this gold supply and demand equation as it applies to the Chinese gold market, see the article “Mechanics of the Chinese Domestic Gold Market” on BullionStar.

Chinese gold market: still vibrant

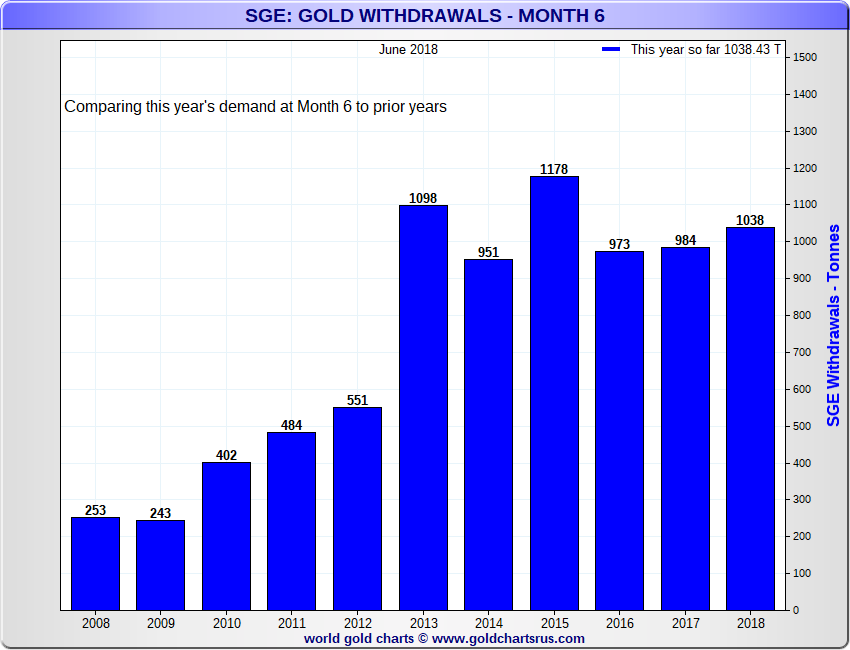

Gold withdrawals from SGE in 2021

Total physical gold withdrawals from SGE in the 6 months to end-June 2021 were 1,038.4 tonnes. This flow represents gold physically withdrawn from SGE's network of vaults across China. The monthly gold withdrawal figures from SGE from January to June 2021 are as follows:

January – 223.6 t

February – 118.4 t

March – 192.6 t

April – 212.6 t

May – 150.6 t

June – 140.6 t

This volume of seizures, 1,038 tons, is the third-largest seizure volume from SGE in the first six months of any year in SGE's lifetime, second only to the 1,098 tons and 1,178 tons recorded at the end of June 2013 and June 2015. respectively. The following graph shows cumulative gold withdrawals from SGE for the first 6 months of each year from 2008 to 2018.

Gold withdrawals from SGE in the first 6 months: 2008-2018. Source: www.GoldChartsRUs.com

SGE: gold withdrawals – first 6 months

June 2021; Since the beginning of this year 1038.43 tons

Comparison of demand for the first 6 months of this year with previous years

Withdrawals from SGE – tons

Gold withdrawals through the end of June this year annualized to 2076, which would be the fourth highest amount of gold withdrawals from the SGE after 2015, 2013 and 2014. Overall, year-to-date gold withdrawal figures from SGE indicate a very vibrant and healthy gold market in China and very strong wholesale demand for gold, with volumes comparable to the last 5 years.

Annual physical gold withdrawals from SGE , 2008-2017 and from the beginning of 2021. Source: www.GoldChartsRUs.com

SGE: annual physical gold withdrawals

Cumulative seizures = 16,094 tons; June 30, 2021; Last year = 1038.43 t

Cumulative seizures (tons)

Withdrawals from SGE (tons)

Importing gold to China

Around the world, monetary gold (i.e., central bank gold) is exempt from customs and trade reporting when moving between countries. This makes it difficult to know how much gold central banks (including the People's Bank of China (PBOC)) actually hold at any given time.

Non-monetary gold is any gold that is not classified as monetary. Generally, non-monetary gold flows can be estimated because it is not exempt from customs and trade reporting. However, China is an exception as it does not publish statistics on its gold imports and exports. Therefore, international non-monetary gold flows involving China are more difficult to measure than for most countries. However, one can estimate China's gold imports by looking at other countries' reports on gold exports to China.

Since the beginning of this year, Hong Kong and Switzerland have expectedly remained the two main suppliers of non-monetary gold to China. Smaller direct gold suppliers to China include the UK, Australia and the US. Although Hong Kong remains China's largest gold supplier, China has been receiving more gold directly from other countries and less through Hong Kong for several years.

If we first consider Switzerland, then in the first 6 months of 2018, from January to June, the Swiss supplied 274.7 tons of non-monetary gold to China. In particular, 41.2 tons in January, 67.2 tons in February, which is a lot, 39.6 tons in March, 26.6 tons in April, 38 tons in May and 62.1 tons in June. In fact, China remained the largest destination for Swiss non-monetary gold imports every month from January to June 2021, ahead of India and Hong Kong.

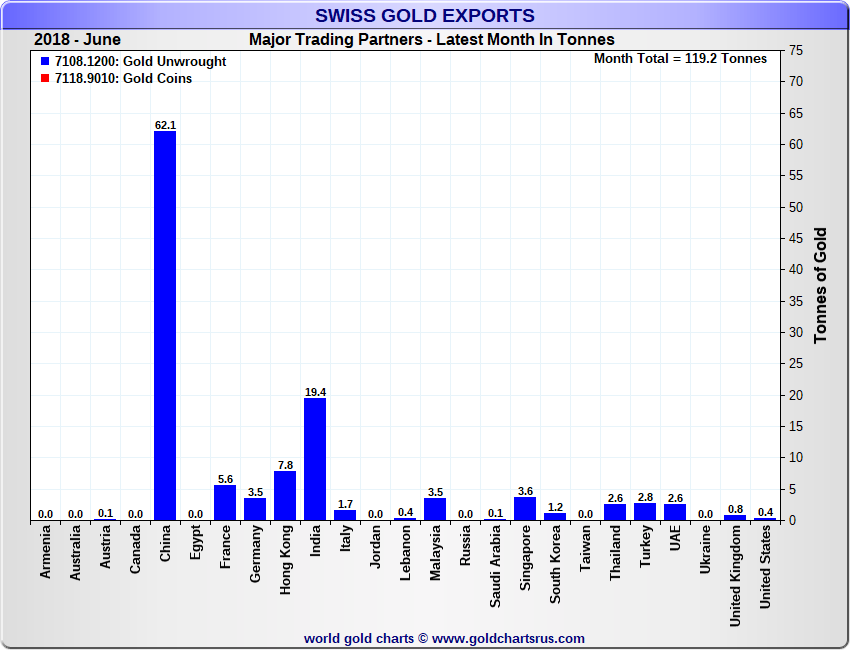

China imported 62.1 tons of gold from Switzerland in June 2018. Source: www.GoldChartsRUs.com

Swiss gold exports

2018 – June; Largest trading partners – last month in tons

Raw gold

Golden coins

Total for the month = 119.2 t

Tons of gold

Armenia; Australia; Austria; Canada; China; Egypt; France; Germany; Hong Kong; India; Italy; Jordan; Lebanon; Malaysia; Russia; Saudi Arabia; Singapore; South Korea; Taiwan; Thailand; Türkiye; UAE; Ukraine; Great Britain; USA

Extrapolating the 6-month flow over a year means that 274.7 tonnes of Swiss gold exports to China from January to June corresponds to approximately 550 tonnes per year. If we compare this with 2021, when China directly imported 299.8 tons of non-monetary gold from Switzerland, we can conclude that there have been significant changes in the sources of gold imports into China this year, with much more direct imports and indirect imports through Hong Kong – less.

Swiss gold exports by destination, 2021 Source: www.GoldChartsRUs.com

Swiss gold exports in 2021

25 main trading partners

Raw gold

Golden coins

Total for the year = 1456.6 tons

Tons of gold

Australia; Austria; China; Egypt; France; Germany; Hong Kong; India; Iran; Italy; Jordan; South Korea; Lebanon; Malaysia; Russia; Saudi Arabia; Singapore; Taiwan; Tajikistan; Thailand; Türkiye; Ukraine; UAE; Great Britain; USA

According to the Hong Kong Ministry of Census and Statistics, in the first 3 months of 2021, net gold exports from Hong Kong to mainland China amounted to 144.2 tons. If this is extrapolated over 6 months, it will be approximately 290 tons, and over a year - 580 tons. Compared to net Gold exports from Hong Kong to China for 2021 are 7.5% less, but such a decrease is expected as China is now gravitating towards increasing direct gold imports from countries other than Hong Kong.

Import of gold to China from Hong Kong. Source: www.GoldChartsRUs.com

China's annual net gold imports from Hong Kong

Total imports = 5729 tons; March 2021 = 144.2 t

Hong Kong exports and re-exports to China less imports

Total imports (tons)

Net imports (tons)

China directly receives gold from a number of other countries such as the UK, Australia, USA and Canada. These other sources are relatively minor gold exporters to China compared to Hong Kong and Switzerland, but based on 2021 figures, together they could have shipped approximately 30-40 tonnes of gold to mainland China in the first half of 2021.

China gold production: 2021

Apart from gold imports, mining remains a critical source of gold supply in China. According to the China Gold Association (CGA), China produced 98.22 tons of gold in the 1st quarter of 2021, which is 3 tons less than in the 1st quarter. 2021. This includes 80.8 tons of direct gold mining and 17.4 tons of gold as a by-product of the extraction of other minerals.

Although CGA has not yet published gold production results for the 2nd quarter. 2021 and its website has not yet been updated, if you extrapolate the figure for the 1st quarter, it turns out that for the 1st half of 2021, Chinese gold production was less than 200 tons, and for the whole year it will be about 400 tons.

Considering that in 2021 China produced 426.14 tons of gold, and 426.14 tons of gold mined in 2021 is, in turn, 27.3 tons, or 6%, less than in 2021, similar to that 2021 will be another year of reduced gold production for the world's number one gold producer. With continued strong demand from the Chinese gold market, this relative production shortfall will need to be offset by increased gold imports or higher gold refining volumes.

SGE surcharges

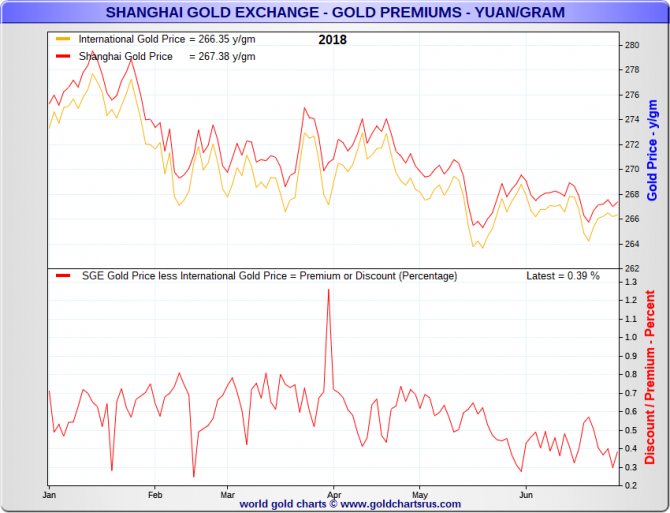

Shanghai gold price premiums relative to the international gold price have remained positive, stable and generally low in 2021, apart from a brief period in late March. SGE's markups since the beginning of the year have been 1-2 yuan per gram, or 0.3-0.8%.

Positive premiums indicate the attractiveness of shipping gold from the West to the East, while generally subdued levels of these premiums in 2021 indicate that there are no significant supply constraints, such as tighter gold import rules, that could support growth at this time markups. Compare this to the end of 2021, when the SGE gold price was 2-3% higher than the international gold price, as a result of rumors that the PBOC was limiting quotas and shipments of gold imports, supposedly in an attempt to control capital outflows.

SGE premiums , 2018 Source: www.GoldChartsRUs.com

Shanghai Gold Exchange - gold premiums - yuan/g

International gold price = 266.35 yuan/g

Shanghai gold price = 267.38 yuan/g

Gold price – yuan/g

SGE gold price minus international gold price = markup or discount (percentage); Last value = 0.39%

Discount/markup – percentage

Jan., Feb., …, June

With Chinese wholesale gold demand exceeding 1,000 tonnes in the first 6 months of 2018, as evidenced by gold withdrawals from SGE, the Chinese gold market should generally meet this demand through key supply sources such as domestic mining, gold imports, refining gold and disinvestment.

It can be considered that from the beginning of the year to the end of June, Chinese gold mining contributed approximately 200 tons to the Chinese gold supply. Imports of non-monetary gold, mainly from Switzerland and Hong Kong, contributed another 560-580 tons. Another 250-300 tons should come from gold processing and scrap passing through the SGE system, and from disinvestment.

Where and how to buy Chinese gold

The easiest way to purchase Chinese-made gold items is online. One of the main online stores for purchasing goods from China and, in particular, jewelry is the Aliexpress website. Here you can find gold earrings, rings, chains, etc.

For an accurate selection, there are filters that sort jewelry by type of metal (yellow, pink, white), type of inlay, type of product, price, etc. When the desired product is selected, you need to add it to the cart and place an order: fill in the contact information, select the method of payment and delivery.

Criteria for choosing quality gold jewelry in China

- Each gold product must have an imprint indicating the sample number and the corresponding design.

- Low-grade gold in China (below 330) is equivalent to costume jewelry. For long-term use, it is recommended to choose jewelry of the best quality with a purity of 585 or 750.

- Products with a matte finish must have a uniform color.

- It is also recommended to check the quality of the weaving before purchasing a chain or bracelet in person. You need to wrap the product around your finger. If the process occurs effortlessly, the knitting is of high quality.

Price level

The state's pricing policy regarding the sale of gold products is relatively stable. This is facilitated by the presence of our own material reserves and the fixing of prices for products within the country...

If we talk about buying jewelry, then wedding rings of classic models on the Aliexpress website are much more expensive than similar Russian-made goods. For a model of 14 carats with a weight of 3.5 g from China they are asking about 25 thousand rubles, and in Moscow a similar piece of jewelry with the same parameters costs up to 15 thousand rubles.

How not to run into a fake

To do this, you can use standard methods: check for the presence of a sample and evaluate the appearance of the metal.

However, most of the jewelry from China is sold through online platforms. In this case, for a safe purchase, you must, among other things, check the rating of the store or seller on Aliexpress, and be sure to study all customer reviews about it. Especially negative ones.

Scrap gold recycling in China

Suppliers of scrap gold are not required to sell through SGE, however, they are incentivized to do so due to taxation provisions that exempt the buyer from paying VAT when transacting through SGE. In this regard, many suppliers cast standard bars and sell them through the Shanghai Exchange.

|

|

To better understand the Chinese market, you need to know that there are two streams of scrap that go to SGE. The first is scrap coming from the population. Damaged gold jewelry or pawned silverware are anything that was once purchased with cash and, as part of the supply in the gold market, affects the price. The second is scrap that comes from jewelry shops or industrial manufacturers who sell the scrap to various smelters and refineries and then buy the same amount from SGE to continue their production. In this case, this gold is both supply and demand, so it does not affect the price of gold, so this type of scrap is not reported as supply by GFMS (Gold Fields Mineral Services, the precious metals research arm of Thomson Reuters).

The Chinese reports mentioned at the beginning of the post use a different methodology for calculating Chinese supply and demand than the GFMS, in which both types of scrap are counted as supply.

Similar to LBMA, SGE adheres to chain integrity. What is she like? Once a bar leaves the SGE vault, it is never re-entered. Finished ingots can only be supplied to SGE by authorized processing companies. Gold sold by other participants must be melted into new bars and undergo purity control before entering the market. From SGE rules:

Article 23

A gold bar that has once left a certified storage facility must not be re-entered.

This rule is very important for understanding the mechanisms of the Chinese gold market.

Is it worth the risk and trying to buy Chinese gold jewelry?

Buying gold jewelry made in China is a good way to make a profitable investment. However, if you decide to purchase your favorite trinket, it is recommended that you study the terms of purchase and information about the supplier as thoroughly as possible. It would be a good idea to study reviews from real customers about the store and the products purchased there.

You can learn more about gold, criteria for choosing jewelry and much other equally useful information by subscribing to our news on social networks. Find out useful nuances yourself and share links to the article with your friends.

Demand

Today, the Celestial Empire is the second country in terms of consumption volumes in the global precious jewelry market. In order to once again emphasize their wealth and success, the Chinese are trying to buy the most flashy and expensive gold items.

But it is worth noting that not only residents of big cities buy a lot of gold jewelry. And the provinces are characterized by similar trends: representatives of the middle class are massively buying products at both relatively low and quite high prices. And experts say that in recent years the market share of jewelry from the Middle Kingdom has begun to exceed 40% and continues to grow.

Italy has always been considered the birthplace of all fashion trends in the field of jewelry. But today Hong Kong has almost caught up with it. Many new Chinese jewelry factories are opening in Malaysia.