Historical reference

The first steps in the search for gold in the Magadan region took place in 1928. Through soil testing, geologists discovered large quantities of gold deposits in the local rock. As soon as the discovery became known, the search process went much faster. Within three years, it was possible to organize gold mining activities in this area on an industrial scale.

The first decade of development of the gold mines of Magadan was carried out at a depth not exceeding 4 meters. Thanks to the fertility of the soil, there was no longer any need to go deeper. Accordingly, processing technologies and technical equipment of the industry developed poorly.

Active work continued until the 40s of the last century. Less than 15 years had passed since the first successful excavations, when the volume of gold production began to gradually decline. Now the introduction of new technologies was hampered by post-war devastation. Precious metal deposits located at a depth of 4-15 meters turned out to be practically inaccessible. A temporary solution was to re-process the already mined materials.

First major finds

From the first years of development, the region began to receive significant income from gold mining. However, the dynamics of industry development over 90 years shows that the peak of production in the Magadan region occurred in 1940. It was then that the total profit of all enterprises in the region provided the country with half of the resources extracted during the year. In 12 months they recovered about 80 tons of gold.

The situation in the 50s

Only a decade later, gold mining enterprises in the region began to operate at full capacity. The time spent was used to modernize the production of factories. The expended financial resources began to pay off in the 50s, when gold mining volumes increased again. New deposits were discovered, including alluvial ones: the Shirokiy, Bilibina, Komsomolsky mines, etc.

Artificial deficit

A survey of companies conducted as part of the EY study “Review of the Russian gold mining industry based on the results of 2021” made it possible to identify the key drivers of production growth over the next several years. This is the development of new deposits, the creation of hubs for processing refractory ores and an increase in production volumes at existing deposits. For several years now there has been a discussion about how to stimulate geological exploration. Gold miners point to the completion of the “Soviet backlog,” which made it possible to buy objects close to completion or drill in close proximity to known deposits. Now this era is ending. Russian companies are just starting to work in the field of geological exploration, while their Western competitors have been working on finding new deposits in Russia for about ten years.

— Today, Russian gold miners are ready to invest in the development of relatively small deposits with low contents of the yellow metal. This is due to the small number of large and medium-sized deposits suitable for exploitation (especially since there have been practically no discoveries of them in recent years), as well as high gold prices, comments independent expert Leonid Khazanov. — At the same time, companies are trying, whenever possible, to bring into production nearby fields. In this case, they do not need to build a processing plant for everyone; it is enough to create one capable of processing ores from all objects. Plus, the emphasis is increasingly being placed on gold recovery using leaching and autoclaves, as the share of the use of refractory ores, which have a complex mineral composition and are not suitable for processing by classical flotation, is growing. In this regard, the attractiveness of dumps and tailings accumulated over many decades increases - the concentration of gold in them is quite sufficient for re-enrichment, but the structure of such technogenic deposits is quite simple and does not require the use of complex equipment, much less the sinking of mine shafts.

— The development of the industry is hampered by an artificially created shortage of mineral resources. Thus, the undistributed fund of Uralnedra contains more than 200 licenses for placer gold. But it is impossible to use them. There are several reasons. The first is that a significant portion of the territory, for example, the Sverdlovsk region, is occupied by specially protected natural areas (SPNA), where, as a rule, economic activity is prohibited. Protected areas are under the control of federal authorities,” said Alexander Yastrebkov, chairman of the Union of Gold Miners of the Urals. — The second is the order of the Government of the Russian Federation No. 849 of May 27, 2013. The document prohibits any mining or exploration work in specially protected forest areas (OPU). According to the Forest Code, OZU are bank protection, soil protection areas of forests located along water bodies, and not necessarily covered with forest. This could be shrubs, floodplain wetlands, etc. The Forest Code allows the development of such areas, but government orders prohibit it. Entrepreneurs cannot place quarries, dumps, industrial sites on them - everything that is necessary for gold mining. For this reason, companies are faced with contradictions: they manage to obtain licenses for the extraction of precious metals, but they are refused approval for forest development projects. Paradox: the state issues a license that is obviously impossible to implement.

And this is one of the main reasons for the decline in precious metals production. For the sake of fairness, it must be said that the government has nevertheless removed some of the problems related to geological exploration.

According to Alexander Yastrebkov, the Union of Gold Miners is trying to change the situation - a letter has been prepared to the head of the Ministry of Natural Resources with a request to eliminate legislative contradictions that threaten the development of the gold mining industry and may even lead to the cessation of the activities of gold mining enterprises:

— Production in the Sverdlovsk region over the past ten years has decreased from 12 to 7.5 tons. In addition to legislative reasons, which primarily concern developers of alluvial gold deposits, such as the Neiva mining team, there are other objective reasons.

Polymetal is optimistic. Despite the fact that the subsidiary “Gold of the Northern Urals” (the largest producer of precious metals in the Sverdlovsk region. - Ed.) has completed open-pit mining of the Vorontsov deposit, its processing capacity is provided with raw materials for the long term.

“Firstly, our geologists were able to increase the deposit’s reserves, and starting next year we plan to begin underground ore mining at Vorontsovskoye,” explained Andrey Novikov, director of the Ural branch of Polymetal. — Secondly, in recent years, a significant reserve of ores has been accumulated, which are now being processed.

In addition, as Andrey Novikov noted, this year the company is starting to build a new enterprise for processing polymetallic ores - Krasnoturinsk-Polymetal. The waste from this new production, containing associated gold, will be supplied to “Gold of the Northern Urals” for the extraction of precious metals. In addition, Polymetal does not slow down the pace of geological exploration, investing about $7.5 million annually in the search and exploration of new deposits in the Urals.

Main gold deposits

According to the results of the gold mining industry in 2017, the leaders in the region were the deposits of Arylakh, Birkachan, Vetrenskoye, Kubaka-zone Tsokolnaya, Nyavlenga, Olcha, Oroch, Pavlik and the Shamanikho-Stolbovskaya promising area.

If we divide the region into sectors, the rating is set as follows:

- Tenkinsky - 9228.2 tons;

- Susumansky - 6884.4 tons;

- Yagodninsky - 6448.8 tons;

- Severo-Evensky – 4741.0 tons;

- Srednekansky - 3120.3 tons;

- Omsukchansky - 2056.1 tons;

- Khasynsky - 291.0 tons;

- Olsky - 180.7 tons.

Field map

The most promising gold mines in the region today are located in the southwestern part of the region, in the Tenkinsky region. The Pavlik, Natalkinskoye and Degdekan deposits, which belong to the group of gold-sulfide-disseminated type, are located here. The Susumansky district, located in the north-west of the region, is also considered promising. In 2021, he broke into the top three, finishing in 2nd place.

By whom and how is gold mined today?

Gold mining in the Magadan region is carried out by large industrial enterprises. Allowing private entrepreneurs to mine mines has been discussed for a long time, but has not yielded results at the legislative level.

Gold mining companies

Today in Magadan and the region there are 168 enterprises licensed to develop gold deposits: 57% of them specialized in placers. The rest accounts for the extraction of precious metals and geological exploration.

The industry leaders at the end of 2021 were:

- JSC Polymetal - 6.7 tons;

- JSC "ZRK Pavlik" - 6.5 tons;

- OJSC Susumanzoloto - 5.0 tons;

- concern "Arbat" - 2.5 tons;

- OJSC "GDK Berelekh" - 1.9 tons.

Extraction methods

The main method of gold extraction at Magadan enterprises is panning. This method is considered one of the most ancient in the world. If in the first years of development the found grains of precious metal were washed in gold-bearing rivers, today a special network of drainages, canals and ebbs is being created for these purposes.

The main advantage of the method is the high extraction speed, because it is possible to process a large piece of earthen rock in a short period of time. One of the disadvantages is the seasonal nature of the work, since with the onset of frost the soil hardens and is difficult to process.

Some enterprises do not use stationary washing units, but dredges - floating vessels operating like a conveyor. Each vessel has 2 belts that operate continuously. Remote control via operator. The design of the first belt has special buckets. Their task is to scoop up soil from the bottom of the river.

The second belt is responsible for grinding pieces of rock from which grains of gold are extracted. Each batch is then washed and cleaned. The final stage must ensure the extraction of all foreign impurities remaining in the metal. To do this, it is heated to a temperature of 1600 degrees.

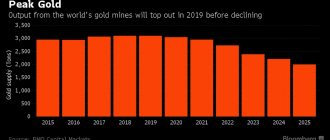

Production volumes

Due to the technical capabilities of gold mining enterprises and the speed of opening new mines, the volume of development is of a wave nature. If we consider the situation that has developed in the mines of the Magadan region, starting from 2004, it can be noted that the most profitable years were 2004 and 2005, as well as the period from 2013. In 2006-2012. the annual profit did not exceed 20 tons of gold.

The decline in gold production during this period was primarily due to the global crisis, decline in production capacity and lack of government funding. Nowadays, the modernization of the industry is constantly developing, which makes it possible to increase the volumes of extracted metal. For example, 2017 was a record year for the region in the new millennium. The total income of the mines provided 32.95 tons of gold.

They won't rust

The driving force is the top ten largest gold producers in the Russian Federation. They hold about 67% of the market and determine the key directions for industry development. Thus, (has the second largest gold reserves in the world, assets are located in four regions) in 2019 increased gold production by 16% to 2.841 million ounces (88.3 tons). This is due to the bringing of the Natalka deposit (Magadan region) to its designed capacity, as well as the increase in production capacity at the Verninskoye deposit (Irkutsk region) and the Kuranakh ore field (Yakutia). The recovery rate was 82.3%, an increase of 1.5 percentage points. compared to 2021. Sales revenue increased by 38% to $3.9 billion, with an average gold price of $1,403 per ounce (an increase of 11%).

Over 20 years, gold production in Russia has more than tripled

Polymetal (the second largest producer in the Russian Federation, has assets in Kazakhstan and Russia, including the Sverdlovsk region) increased gold production by 8% to 1.316 million ounces (40.9 tons). Annual revenue rose by 19% against the background of rising prices and reached $2.2 billion. “Fourth quarter results help exceed original and updated production guidance for the eighth consecutive year. Production indicators and positive dynamics of gold prices contributed to a significant increase in cash flow,” said the head of the company, Vitaly Nesis. “The implementation of the Nezhdaninskoye and AGMK-2 projects will allow us to resume production growth in 2022.”

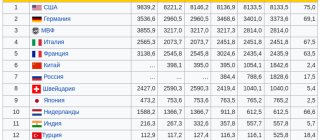

The ten largest countries account for about 70% of the world's gold reserves. According to the US Geological Survey, Russia's reserves are about 5.3 thousand tons (9.8% of the world total)

Another example of increasing volumes is Nordgold (ten operating mines in Russia, Kazakhstan, Guinea and Burkina Faso): the company of businessman Alexey Mordashov at the end of 2021 increased total gold production in Russia and abroad by 15% - to 1.041 million ounces (32 ,4 tons). The growth in indicators was due to the Gross project (Yakutia) reaching full production capacity, as well as an increase in output at the Berezitovoye mine (Amur Region) due to the transition to underground mining. Nordgold increased its net profit by 82% to $166.9 million. Geological exploration costs amounted to $46.1 million, which is 13% higher than in 2021.

The most gold is mined in China - 399.7 tons at the end of 2018

“Production growth was ensured by the fact that the largest companies continued to invest in the expansion and modernization of capacities,” states Finam Group analyst Alexey Kalachev. — Polyus completed the construction of the Natalka gold processing plant back in 2018 and began developing the Natalka field. In the future, the company will develop the largest gold deposit, Sukhoi Log, in the Irkutsk region, thanks to which, from 2026, the company will be able to double its performance and enter the top three of the world's largest. Increased returns from the Kyzyl project and continued construction at the Nezhdaninskoye deposit and AGMK-2. The company's capital expenditures increased 27% in 2021 to $436 million.

The main reserves of gold in complex ores are concentrated in copper-pyrite and copper-nickel deposits of the Urals and Norilsk region

— We have been preparing a comparative analysis of gold mining companies in Russia for several years, and we see that over the past year, six out of eight companies have increased investments in fixed assets. This suggests that the process of modernizing facilities and launching new sites is quite active and often requires significant funds due to factors such as inaccessibility of reserves, high proportion of refractory ores or low gold content in the ore, confirms the trend Alexey Fomin. — There are other trends that determine the development of the industry: digitalization, which is increasingly relevant for traditional industries, and new mining technologies, such as the processing of refractory ores, and attempts to consolidate the industry.

Despite the increase in the number of gold mining companies in Russia (by 6.9% to 577 companies), the share of production of the ten largest still provides the majority of the market

The latest trend is evidenced, for example, by the completion of the acquisition of Yuzhuralzoloto Group of Companies (one of the top 5 market leaders in terms of production volume and reserves) from Aeon Corporation of a 28.34% stake in the capital of Petropavlovsk PLC, one of the largest gold mining companies in Russia. Petropavlovsk has a unique technology for autoclave leaching of refractory gold ores. “The Pokrovsky autoclave complex, owned by Petropavlovsk, demonstrates good technical performance, and our board of directors expects that this technology, which makes it possible to develop deposits of refractory ores, the share of which in the company’s total reserves is significant, will bring gold mining in Russia to a fundamentally new level of growth,” - says the president of Yuzhuralzoloto, Konstantin Strukov.