Silver is the second most popular metal after gold. According to experts, the total volume of proven reserves of this precious metal in the world now reaches 600 thousand tons.

Every year about 20-22 thousand tons of silver are mined in the world. So, in 2018, according to the American Geological Survey, 27 thousand tons were produced on our planet.

Which countries make the greatest contribution to this industry, and what is the importance of Russia in the “silver” world?

Silver in nature

This is what the ore from which silver is mined looks like.

The main share of nuggets is extracted from polymetallic ores, where it is concentrated in the form of sulfide impurities. As for nuggets, they are rare. Their main share is mined from silver ores.

Nuggets of the precious metal are rare due to the tendency of silver to oxidize and form a black coating on it - aconite. In addition, it reacts with AgCl (chlorogarite) and ClBr (embolite), as a result of which it changes its structure and is sprayed into adjacent metals.

Silver extraction methods

In the past, silver nuggets were found more often. The mineral was heated under the influence of fire, purified, and ingots were created. Modern technologies are significantly different.

Extraction is performed in several stages:

- On the territory of the deposit, drillers create holes into which explosives are placed.

- After pyrotechnic work, fossil fragments rise to the surface.

- The ore is carefully examined.

- A special crusher is used to crush the rock.

Precious metals mining methods:

- Cyanidation. Treatment of the rock with a mixture of oxygen and cyanide allows for the dissolution of the target raw material. In liquid form, the metal undergoes filtration. The silver particles are attracted to the zinc, which is used to treat the internal surfaces of the tanks for cleaning. This method allows you to obtain 50% of ready-to-use raw materials. Oxygen and cyanide alone cannot transform the ore. The result can only be obtained through their interaction.

- Amalgamation is the treatment of fossils with mercury, after which you will have to get rid of excess moisture. The ore is exposed to temperatures of 1000 degrees. Chemicals are added to the molten materials to prevent the silver from burning out. After this, repeated heat treatment is performed. As a result, it is possible to obtain in molten form all the metals contained in the ore.

Amalgamation creates a substance from which the liquid must be evaporated. Dry silver dust is mixed with additives and sent back to the furnace. After 4 hours, the substance melts and pours into molds. Separated from other elements, the silver cools in 5 minutes in the casting container.

Scope of application of precious metal

The world's need for the resource is constantly growing, this is due to the fact that the mineral is used in many areas of industry: about 80% of silver bars are used in the production of equipment, mobile devices, computers, batteries and other modern equipment.

All modern microchips contain precious metals, including silver

If previously silver was used only for aesthetic purposes, today it is mainly used for industrial purposes. It is valued for its high conductivity of heat and electricity. In addition, the mineral cannot be oxidized and has good catalytic properties.

Residues from the industry are used in jewelry and for the production of precious coins. The intensive pace of production has led to the fact that there are almost no resource reserves left. Experts believe that they could be depleted in the next 20 to 30 years at this rate of production. At this point, humanity has depleted about 95% of all silver reserves on the planet.

World deposits

Silver is very active when compared to gold. For this reason, it can be found extremely rarely in the form of nuggets. All deposits that are important from an economic point of view are divided into two types:

- Directly silver deposits. The ore in them contains more than 50% Ag.

- Deposits in which other metals are present. The cost of silver in such ores is approximately 15%.

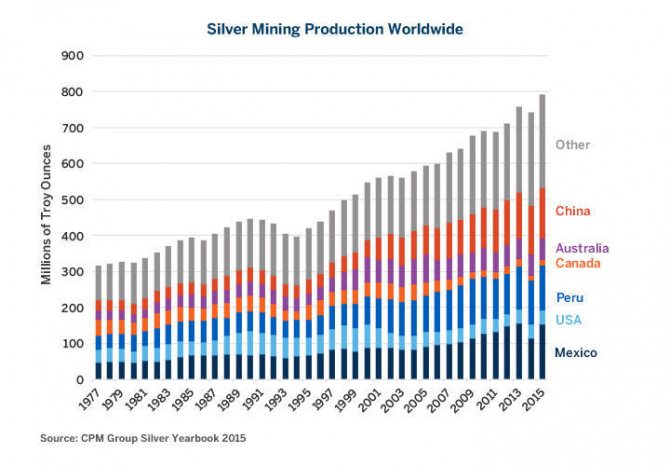

The richest silver deposits are located in Mexico, Peru, China, Russia, Bolivia, Poland and America. These areas are developed using both underground and open-pit methods.

It's rare for silver to hit the secondary market without suffering some serious losses. This is due to the fact that most of the demand comes from industry. Therefore, we can say that world reserves will gradually decrease.

Silver mining methods

Throughout human history, mining methods have changed. At first, the precious metal was extracted using an open method, but with the improvement of technology, they switched to a closed method. At the present stage, the resource is extracted in two ways - cyanidation and amalgamation.

- Cyanidation is the extraction of metal using an aqueous solution. The alloys are placed in a special solution consisting of cyanide and oxygen. The mineral is extracted from solution after filtering waste rocks. The resulting impurities on the metal are removed with sulfuric acid. The remaining solids are filtered, washed, evaporated and sent to the production of ingots.

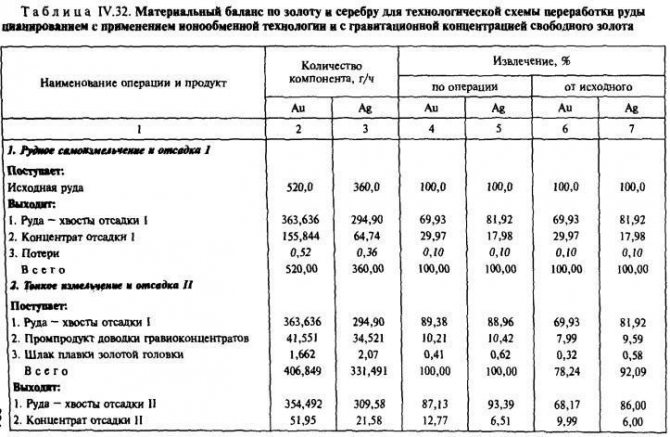

Material balance of gold and silver for the technological scheme of ore processing by cyanidation - Amalgamation is an old method that humanity has been using to extract silver for more than 2 thousand years. The silver ore is passed through an amalgamated surface coated with mercury along with water. Particles of the precious metal enter into a chemical reaction with mercury, forming an amalgam - solid formations. The filtration method is applied to the solidified formations, extracting silver ore from it.

The described methods cannot produce absolutely pure silver. It is extracted at refineries using the method of cleaning, filtration and secondary processing.

Mine Development Methods

Historians believe that silver mining first began about 7 thousand years ago. Ancient people knew only nuggets. It was found with great difficulty, because the ingots were often covered with a coating of sulfide. Until the second century BC, argentum was valued much more than gold. Mines began to form in Spain. In the modern world, people extract most of this metal using pyrometallurgical processing.

Ore mining occurs in open or closed ways. First, geologists, using specialized instruments, determine the presence of various minerals and precious metals in the bowels of the earth. After discovery, development of the site begins. The raised ore is crushed, and then silver is extracted from it using cyanidation or amalgamation.

Amalgamation has been used for more than two thousand years. The method is based on the fact that the metal reacts well with mercury. The crushed rock is passed through liquid metal. After the excess mercury is removed, solid particles of the reacted substance will remain. The evaporation of the mercury will leave behind pure silver, which will later be smelted into ingots.

Cyanidation involves dissolving argentum in cyanide alkalis. After filtering the solution, the metal is precipitated. All other impurities are easily removed with sulfuric acid.

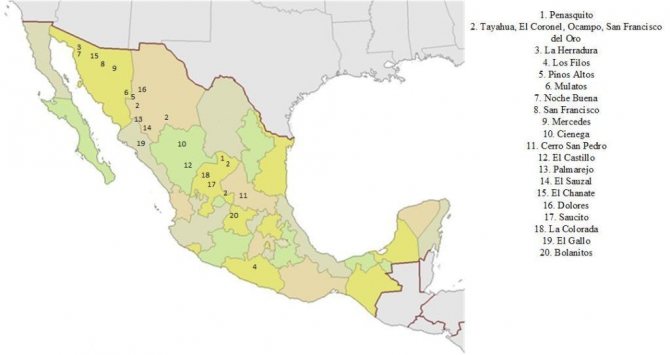

Mexican mines are the richest deposits in the world

Mexico is the world leader in the amount of silver ore and other precious metals mined. On the territory of this state, experts have recorded more than 200 mines where the precious resource is extracted.

Las Torres contains the largest deposits of silver in Mexico. Experts estimate its reserves at 4.3 million tons. The concentration of silver in this region reaches 280 g/t.

The second place in terms of the scale of extracted resources is occupied by the mines of La Encantada, Coahuila state. The total deposit savings amount to about 3.2 million tons of ore.

Relatively large areas of resource extraction are considered to be mines in the states of Hidalgo, Zacatecas and Chihuahua. On the territory of these states there are about 48 small deposits of silver ore, where about 20% of the total volume of mined resource in the state is mined.

It is worth noting that experts noticed a slight decline in exports of the precious metal in Mexico. For the first time in history, the amount of silver mined in the country decreased by 6% as of March 2016. Experts predict a slight decline in production for 2016-2017.

Mexico 4500 tons – 1st place

Based on the results of 2011, Mexico is considered the world leader in silver production, which accounted for 19% of global production in 2011. Despite the government's war with major drug cartels, Mexico's mining companies have the greatest potential when compared to companies in other countries. They stand out for their high level of profitability and good financial statements. The tense situation in the state, of course, is considered another risk factor, but this socially critical orientation has so far practically not affected the operating efficiency of Mexico's mining companies.

Likewise, the value of silver, both in production and as a profitable and good investment, was underestimated. Nowadays, buying silver bars or shares of mining companies can be a very successful investment decision. Since only silver can be used in industry, which is in the form of 999 fine bullion, and their supply is decreasing exponentially due to excessive innovative use, and cannot be adequately replenished, even taking into account the ever-increasing volumes of its global production.

Main silver deposits in Russia

In 1704, the mineral was mined at the state level at the Nerchinsky mines near Lake Baikal in Russia. The government and industrialists made no attempt to discover new deposits until the mid-20th century. During the Second World War and during the Cold War, the development of deposits in the Far East began. Russia ranks first in terms of silver reserves in the world. Almost 10.5% of world savings are concentrated on its territory. The main deposits are located in the Far East, Eastern Siberia and the Southern Urals.

Silver mining in Russia

It is worth noting that Russia does not have such rich deposits of the precious metal as in Canada, Germany or Norway, however, in terms of silver concentration, the Russian Federation surpasses all countries in the world.

Today, silver mining in Russia is carried out in 20 regions in more than 100 deposits. The proportion of silver in the main mines rarely exceeds 100 grams/t. The Dukat deposit (Magadan region) ranks first in the Russian Federation in terms of the number of reserves and the volume of silver production. In second place are the Lunnoe and Juliet deposits of silver deposits in the Magadan region. From these three centers, more than 30% of all silver is mined in Russia. Slightly less is mined in the Urals - about 20%. In third place are the Norilsk and Khakanja deposits, where about 7-10% of the precious metal is excavated.

Silver: silver mining and production

Is the silver market a safe haven during a crisis?

Hello, smartlab readers. We analyzed the global silver market and share the results. I want to say right away that I am not posting the full text of the study here because the results themselves were prepared in a presentation (in the presentation it is clearer and more visual). For anyone interested, on the website of the organization where I work, in the analyst section, you will find a complete study (I highly recommend it, there is a lot of tasty information there), but for now the main thing is:

Silver is one of the oldest metals known to mankind.

Silver in its pure form is a silvery-white metal that has the highest thermal and electrical conductivity among all known metals.

This metal is relatively refractory (melts at 962 °C), but is incredibly ductile. The thinnest wire 2 km long can be obtained from just 1 g of silver.

An important criterion for silver is its property of not oxidizing under the influence of oxygen, which allows it to be classified as a noble metal.

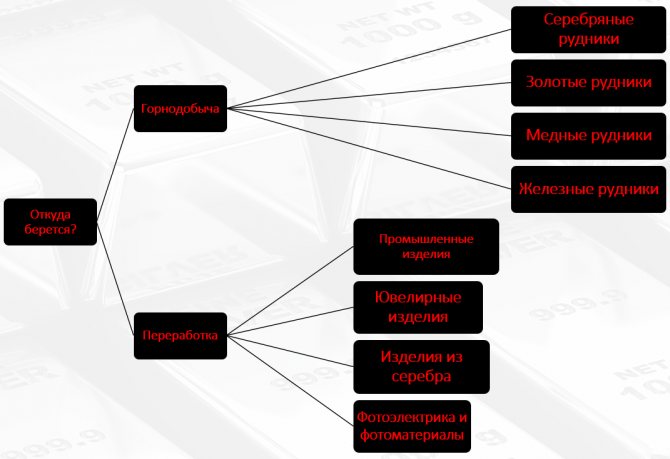

Silver lends itself perfectly to processing: polishing, cutting, twisting, drawing and rolling into the thinnest plates. These properties make it indispensable for the manufacture of jewelry masterpieces, but at the same time they limit the shelf life of soft and delicate products made of pure metal. Therefore, in jewelry, to achieve strength, silver is used in the form of an alloy with the addition of copper. Below is the structure of the silver usage chain

Market analysis: demand

Global silver demand increased slightly in 2021, up 0.4% in 2021 to 991.8 million ounces. Industrial demand remained virtually unchanged at 510.9 million ounces, just 1% below 2021 highs.

Demand for silver for jewelry in 2021 was at historical highs, so it was problematic to show the same excellent results in 2021, resulting in a decrease of 1% to 201.3 million ounces.

Market analysis: supply

Silver mine production fell for the fourth year in a row, falling 1.3% (YoY) in 2021 to 836.5 million ounces. The reason for this decrease is several factors:

1) Copper mines: lower silver grades per tonne, which led to a 3.1% YoY decline in production from these mines to 240 million ounces;

2) Gold mines: output remained unchanged at 132.1 million ounces;

3) Silver mines: production decreased by 3.8% (YoY) to 240 million ounces.

For 2021, silver refining increased by 1.3% to 169.9 million ounces. Processing volumes in industries showed an increase of 2% and reached the highest values over the past 10 years.

Jewelry processing also saw growth in emerging markets, driven by higher dollar-per-ounce prices, but photo processing fell for the second year in a row, down 6% at 21.6 million ounces.

Investing in silver

Investor sentiment regarding silver is likely to recover at the beginning of 2021; in the fourth quarter of 2021 we expect a decline compared to the results of the 3rd quarter.

Key to this will be lower interest rates and unprecedented liquidity injections from central banks, which will ensure that gold and silver have minimal opportunity costs.

The global economic slowdown should also eventually encourage a shift away from stocks and bonds towards safe haven assets. With recent cash flows now looking inflated, silver should benefit eventually. While gold will be the main beneficiary of this new investment influx, silver should also have good spillovers. Meanwhile, low silver prices and a high gold-to-silver ratio (Gold/Silver chart) will also cause the white metal to increasingly appear undervalued, prompting additional investor influx. Once there are strong signs of a continued gold rally, we can expect a more noticeable increase in silver investment.

Silver mining

Global silver production fell for the fourth year in a row in 2021, falling 1.3% YoY to 836.5 million ounces. This happened as a result of:

1) Reducing the silver content in large silver mines;

2) Decrease in silver production in copper mines;

3) Failures for some large src=”https://avatars.mds.yandex.net/get-zen_doc/1884623/pub_5f9ab1842676b1751367334d_5f9c362149505f68119c506c/scale_2400″ class=”aligncenter” width=”1121″ height= "646″[/img]

By country, the largest year-over-year decline occurred in Peru, where production fell by 11.1 million ounces, down nearly 8%. This was largely a result of lower ore grades at the major silver mines along with mine closures.

Other notable year-over-year declines occurred in Mexico (-4.2 million ounces), Indonesia (-2.9 million ounces) and Kazakhstan (-2.8 million ounces). These losses were partially offset by increases in Argentina (+3.9 million ounces), Australia (+2.6 million ounces) and the US (+1.8 million ounces).

Global mine production is expected to decline by 38.8 million ounces, or 4.6% YoY. in 2021. This is a result of the expected disruptions due to the COVID-19 pandemic. Assessing the impact at this stage is challenging, but we have already seen temporary closures of silver mines around the world, so it is likely that this will have significant implications for silver production in 2020.

World silver recycling

Global silver processing rose 1.3% last year to 169.9 million ounces. All key segments of the recyclables supply grew, except photographic materials, which suffered additional structural losses. Industrial scrap has benefited from growth in ethylene oxide (EO) replacement and electricity supply. Elsewhere, higher silver prices have boosted the supply of jewelry and silverware scrap, while coin recycling has increased largely due to the continued melting of unsold commemorative coins. The global figure is expected to fall slightly this year. Low silver prices will hamper processing of price-sensitive jewelry and silver products, while the widespread impact of COVID-19 has led to the closure of some EO mills.

Industrial demand for silver

Global industrial silver demand in 2021 was little changed year-on-year at 510.9 million ounces (the third year in a row of over 500 million ounces), and therefore just 1% below the decade's record high in 2021 year.

The final months of 2021 saw little damage from the US-China trade war, but the overall result was helped by limited substitution and austerity pressures.

The main emerging demand is the demand for silver for photovoltaic (PV) production. Over the past decade, photovoltaic (PV) cells have emerged as a leading option in renewable energy due to both significant cost reductions and supportive measures.

The continued rise in electricity demand, the push towards renewables and power for the foreseeable future all point to increasing solar penetration. While silver penetration will be partially offset by silver mitigation and substitution efforts, we remain optimistic about silver demand in PV over the next few years.

Silverware

Global jewelry production fell 1% in 2021 to 201.3 million ounces. Much of the decline came in India, where a slowing economy and erratic monsoons hit the crucial rural sector. A significant drop was also recorded in China due to the trade war and poor consumer sentiment.

Global demand for silver products fell a notable 9% last year to 59.8 million ounces, but that was still the second-highest total this decade. The decline was almost entirely explained by India's 11% decline. Growth has been rare, with the only notable example being Turkey's 36% increase in exports. Widespread losses remain common this year.

Looking ahead to 2021, demand for silver products is forecast to ultimately decline by 9%, largely due to the negative impact of COVID-19, which will put pressure on an already slowing economy.

While the first half of the year saw a sharp drop in demand, a slight recovery is forecast in the second half of the year driven by holiday and wedding shopping. What's the result?

- Unprecedented liquidity injections from central banks will ensure minimal opportunity costs for gold and silver. The slowdown in the global economy will ultimately stimulate a shift from stocks and bonds to defensive assets - silver will rise in price;

- A high gold to silver ratio will also cause the white metal to increasingly appear undervalued;

- Over the past decade, PV has become a leading option in renewable energy, leading to a doubling of PV demand over this period.

- My personal assessment is that silver should be purchased with a target of $30/ounce for the year

Silver mining industry in the DPRK

The amount of precious metal mined in China fully meets the state’s needs for the resource. The rest is exported to Japan, Korea, Mongolia, Iran and other countries of the world. About 9.6% of the world's silver reserves are concentrated in China. It is found in lead-zinc and copper deposits.

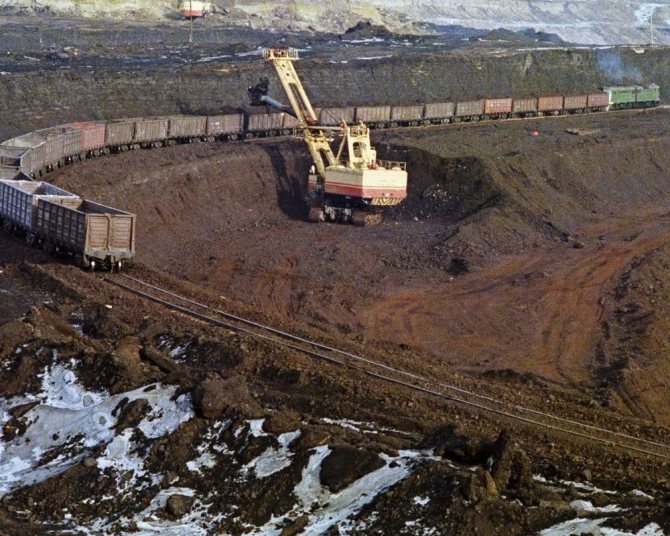

Transportation of soil saturated with silver ore

Main centers of ore mining: Ying region. In this area, precious metal began to be mined in the late Middle Ages. The Ying region holds the record for silver ore in China. It concentrates about 15 million tons, which is almost 35% of the state’s reserves.

The southeastern regions of China are in second place in terms of the amount of silver ore reserves. The Fuwan field in Guangdong Province stands out in this region. Here ore is mined using a closed method. Experts estimate the deposit's reserves at 9 million tons. It is worth noting that Fuwan is one of the most profitable mines, since the concentration of silver in it reaches 190 g/t.

Thus, the territory of China is a promising place for silver mining. According to data, as of 2015, China ranks second in silver production in the world. Experts predict that China will take first place by 2018-2019 if production rates do not decrease.

Silver production

Metal cleaning

- The ore is placed in a tank and treated with zinc dust. As a result, all impurities settle to the bottom, while the target raw material remains at the top. Subsequent cleaning is carried out in factories.

- The pyrometallurgical method produces pure silver. Copper or lead should be used as concentrators. These substances are treated with zinc at a temperature of 450 degrees - this way the metal particles dissolve better. After extracting the frozen substance, the precious metal is separated from it.

- At 1250 degrees, the zinc evaporates, but the remaining silver still contains arsenic and lead. For cleaning, oxygen treatment and heat exposure of 1000 degrees are used. This method is the most profitable, since lead and copper are mined in large quantities. Recycling such elements does not require significant costs.

- The purified precious metal is melted into ingots. No technology can guarantee 100% pure silver. To completely get rid of impurities, the ingots are transported to metallurgical plants for further processing.

If copper or lead is used as the main raw material, a pyrometallurgical purification technique is used. This method is advantageous because these impurities are inexpensive. As a result, the cost of the production process decreases, and the costs of producing less expensive metals are recouped. Electrochemical purification technology is used to separate silver.

Silver mining in Peru

The mining industry in Peru is considered one of the most developed in the country. Experts note that Peru produces about 17% of the world's silver ore reserves. According to data, as of 2015, there are about 784 mines operating in the state. Mines with a total reserve of more than 120 thousand tons remain unopened and unprocessed.

Silver production ramps up in China and Peru

Industrial extraction of the precious resource in the country began in 1991, when the government lifted restrictions on the extraction of the country's national wealth. It is worth noting that almost 75% of all mines belong to foreign investors and their capital.

The largest deposits in Peru are concentrated in San Rafael (Eastern Cordillera). Almost 27% of the country's total reserves are located here. It is worth noting that San Rafael contains the richest reserves with a high concentration of silver up to 230 g/t.

Second place is occupied by 4 mines located in Hulkani, San Cristobal, Gulkenia and Morococha. They account for about 14% of the country's total reserves. The extraction of silver ore in these areas is carried out using a closed method.

The country is considered one of the wealthiest in the world. Remains from industry are exported to neighboring countries. Peru has the closest trade relations with European countries. They supply about 80% of all silver for export.

Australian mining industry

The island nation ranks fourth in the world in terms of the amount of silver mined. Last year, local entrepreneurs produced almost 55.4 million ounces of this resource. It is worth noting that in Australia the mining industry is developing at a fairly rapid pace. The first mine was built by local residents in 1840 in Tasmania (Reed-Rosbury). The valuable resource was mined using a closed method from lead, zinc and gold.

The main deposits are concentrated in the southwest of the mainland - in the state of Western Australia. The largest mines are located near the cities of Kalgoorlie

BHP Billiton is a leading silver and lead mining company in Kirrington, western Queensland. In 2015, the company received approximately 32.12 million ounces of the resource. Currently, BHP Billiton mines and produces about 43% of the resources in the entire territory of Australia.

The second large mine is considered to be Mt. Isa in Queensland. Here, mining companies extract deposits of silver ore using a closed method. The Mac Arthur River mine is the third most important. It produces about 15% of all Australian iron.

It is also worth noting the giant companies Xstrata ADR and Minmetals Recources. They own small deposits in the western lands (South Wales and Broken Hill).