It is known that for many years such a precious metal served as money: bars made from it served as a measure by which the value of goods was assessed. But this unit turned out to be impractical from the point of view of international trade, since in many states gold was not a priority among other precious metals, so gold money ceased to exist. However, this does not mean that the precious metal has lost its connection with the circulation of money; there are the concepts of “gold coin standard” and “gold exchange standard”. What do gold coin and gold bullion standards mean?

Story

The gold standard, on the basis of which the gold exchange standard was created, is a monetary system in which all calculations are based on a standardized amount of gold. In economies with a gold standard, each monetary unit, at the request of its owner, could be exchanged without restrictions for an amount of gold that was equal to its value. If we were talking about international trade between countries with the gold standard, then all payments between them were carried out at a fixed exchange rate. This rate was based on the ratio between currencies per unit mass of precious metal.

Gold exchange standard

Supporters of this monetary system saw its advantages in the following aspects:

- the state could not issue money that was not backed by gold, which, in turn, was an effective preventive measure to prevent inflation;

- the gold standard served as a guarantee of a stable economic situation within the state.

The gold standard is also called the gold coin standard. For the first time such a monetary system was introduced in 1774, and this happened in England. The gold coin served as the standard unit in this monetary system. Moreover, this coin had to have a mass and denomination established by the state. The gold coin performed five functions of money:

- measure of value;

- means of storage;

- medium of exchange;

- world money;

- instrument of payment.

In addition to coins, there were also paper money (banknotes) in circulation, which could be exchanged without restrictions for gold coins in accordance with their denomination.

As for the advantages and disadvantages of the gold coin standard from the point of view of international trade, the following can be distinguished among them:

- Advantages: money in the form of gold could freely cross borders between states and, once within the boundaries of one of them, not lose its functions. In addition, the prices of goods in different countries in gold equivalent could be determined with maximum accuracy. The stability of exchange rates in countries with a gold coin standard can also be called an advantage of this monetary system.

- Disadvantages: Stability of exchange rates in countries did not provide for price stability. So, if in one of the states the price level decreased, but the exchange rate remained the same, then the partner state was also forced to reduce the price level, and all in order not to lose its competitive position in the international market. Another disadvantage of the gold coin standard is the uncontrolled movement of gold between the borders of countries, provoked by non-economic reasons. For example, if the political situation in one state is unstable, most of its gold “migrates” to another state. This phenomenon leads to a rapid rise in prices, inflation and an economic crisis in the country, which has received uncontrolled flows of gold.

Due to its shortcomings, the gold coin standard evolutionarily ceased to exist by the beginning of the First World War (in the USA - in 1933). This monetary system was replaced by the gold exchange standard, which provided for the exchange of banknotes for gold, but only for that which existed in the form of bullion. In this case, the minimum mass of one ingot had to be 12.5 kilograms. The bullion itself could be stored exclusively in the central bank of the state, while banknotes and billon coins were present in money circulation. This money could be exchanged for bullion according to the established exchange rate.

The conditions provided for the functioning of the gold bullion standard were as follows:

- the international gold market was to function without any restrictions;

- a specific mass of gold was declared as a monetary unit;

- closed minting of gold coins;

- the state, represented by the central bank, could buy and sell an unlimited amount of gold (bullions);

- banknotes are freely exchanged for bullion.

History[ | ]

Gold prices during and after the gold standard (until 2005) in US dollars per troy ounce (31.1 g)

Early monetary systems were based on bronze and later on silver ( Silver Standard)

.[

source not specified 4107 days

] A pure silver standard existed in Central Europe in the 8th-14th centuries.

With the increase in the volume of trade transactions, gold began to be used more and more often as a means of payment. Beginning in the 15th century, bimetallism was established with a fixed exchange of silver for gold. Due to the gradual change in the value of metals, the exchange rate had to be revised. However, the need to have small silver coins prevented the abandonment of bimetallism. This obstacle was removed only in the 19th century with the transition to paper money and coins made of base metals.

The main reasons for choosing gold as the standard currency:

- high cost of small volume and weight,

- durability, stability during storage,

- divisibility and unification,

- possibility of identification by many characteristics (color, weight, degree of malleability, acoustic properties) [ source not specified 63 days

]

This contributed to the fact that already in ancient states it was gold that was used as money.

Gradually, the direct use of gold began to be abandoned. The main reasons for this:

- the impossibility of rapid additional emission in accordance with the needs of money circulation (with the growth of trade turnover to service it, the need for the money supply also grows),

- transporting gold is a technically difficult and expensive task (signaling and proper security are required; large quantities require high carrying capacity),

- the loss of gold coins led to an imbalance in monetary circulation and to restore it a new, similar amount of gold was required,

- coins made of precious metal are subject to wear during circulation (including the cutting of coins), the real value of the reduced metal content conflicts with the face value of the coin,

- Damage to coins led to deformations of monetary circulation.

The appearance of paper money solved precisely these problems. The gold was kept in one place and strictly guarded. Paper money was essentially a certificate that gave its owner the right to claim. By paying each other with paper money, people transferred ownership of a certain amount of gold without transferring the gold itself. It was much more convenient and safer because:

- gold certificates can have completely different denominations, which allows them to be used equally successfully in both small and large transactions,

- certificates do not lose value due to normal wear and tear,

- Under certain conditions, certificates may be replaced or restored.

Subsequently, paper money also began to be used by governments to control financial activities on their territory.

The abolition of the currency's peg to gold allowed for relatively arbitrary monetary emission. When there is an excess of paper money in the economy, prices begin to rise (inflation). For example, a troy ounce of gold rose in price from 35 to 1900 dollars over the period from 1967 to 2011 (that is, it increased in price by more than 50 times in 44 years).

Dates[ | ]

| This section is missing references to information sources. Information must be verifiable, otherwise it may be questioned and deleted. You may edit this article to include links to authoritative sources. This mark was set on April 22, 2014 . |

Five rubles in gold

(1924—1947)

- From 1821 to 1914, the pound sterling was freely and without restrictions convertible into gold. At this time, the pound is actually the main reserve currency.

- Banking panic of 1907.

- 1914 - with the outbreak of World War I, the US dollar takes the leading position. A dollar zone is emerging in North and Latin America.

- 1922 - Genoa Conference. The creation of a gold standard and a reserve currency system based on the pre-war model was envisaged.

- 1925 - Britain adopts the gold standard based on the pre-war parity of the pound sterling and gold. Reserves were not limited to gold, they also included currencies convertible into gold (such as the US dollar).

- 1929 - US stock market crash. The crisis gave impetus to the development of the “Great Depression” and fundamental changes in the state’s economic policy in financial markets.

- 1931 - England faced major budgetary difficulties associated with a decrease in income as a result of the crisis and an increase in expenses associated with it. European countries (in particular, Holland and Switzerland), as a result of the deteriorating financial situation, withdrew their capital from England. France, dissatisfied with England's position regarding Germany and Austria's desire for a customs union, and wanting to put political pressure on England, began to liquidate its London holdings. Thus, a huge outflow of gold began from England[1]. Panic in the London financial market led to a change in the leaders of the reserve currencies. The dollar came out on top, and the pound took second place.

- September 1931 - Great Britain abolishes the gold standard and introduces a freely floating exchange rate for the pound sterling. In order to manage the exchange rate, a special “Exchange Stabilization Account” was created.

- 1933 - abolition of the gold standard in the United States and the introduction of a freely floating dollar.

- 1933 - formation of the “golden bloc”. It included France, Italy, Switzerland, Holland, Belgium and Luxembourg. The purpose of the creation is to ensure mutual trade to maintain the convertibility of their national currencies into gold at the level of parities fixed in the 1920s.

- January 30, 1934 - ratification of the “Gold Reserve Act” by US President Roosevelt, which fixed the parity of the American currency to gold at $35 per troy ounce.

- March 1935 - exit from the "gold bloc" of Belgium and devaluation of the Belgian franc.

- September 1936 - complete collapse of the “golden bloc”.

- September 25, 1936 - the signing of a trilateral agreement by Great Britain, France and the United States, according to which these countries assumed mutual responsibility for the normal functioning of the exchange market of their currencies. Currency interventions by central banks became official.

- July 1944 - The Bretton Woods Agreement established the “gold-dollar standard.” The currencies of 44 countries were strictly pegged to the US dollar, and the dollar to gold ($35 per troy ounce).

- December 1945 - Bretton Woods agreements enter into force.

- 1947 - Italy introduced a free exchange rate to the US dollar. An underestimated cross rate of the pound to the dollar through the Italian lira appeared (at 2.60, compared to the official rate of 4 dollars per pound).

- July 15, 1947 - British official announcement of the convertibility of the pound sterling, which for the first time since the war restored the conversion of the pound into dollars and into gold.

- August 1947 - the IMF begins its work.

- August 20, 1947 - temporary suspension of the convertibility of the pound sterling.

- June 1948 - monetary reform was carried out in Germany.

- July 1, 1948 - adoption of the Marshall Plan to restore the war-ravaged economies of European countries.

- 1948 - France introduces a free exchange rate to the US dollar.

- April 1949 - monetary reform was carried out in Japan.

- September 18, 1949 - 30% devaluation of the pound against the dollar. The new rate is $2.80 per pound.

- 1950 - The European Payments Union was founded, which became one of the foreign trade policy instruments of the OECD (Organization for European Cooperation and Development). The purpose of creating the ENP is to prepare European currencies for convertibility.

- March 1954 - the introduction by Great Britain of liberalization measures in relation to the exchange of the pound sterling for other currencies. As a result, there was a convergence of the market and official exchange rates of the pound.

- February 1955 - the pound sterling actually became convertible.

- 1958 - devaluation of the French franc by 17.55%.

- December 27, 1958 - Convertibility officially came into force for all currencies of member countries of the European Payments Union. The European Monetary Agreement (EMA) was signed. Convertibility relied on the “dollar-gold”.

- October 20, 1960 - The price of gold in London reached $40 per ounce, which threatened the stability of the dollar.

- 1960 - creation of the “gold pool”. The goal is to curb the rise in gold prices. From the end of 1960 to the end of 1967, the price of gold never exceeded $35.35 an ounce.

- March 1961 - revaluation of the German mark and the Dutch guilder against the US dollar. The reason is the large positive balance of payments of these countries.

- November 18, 1967 - devaluation of the pound sterling by 14.3%. The main reasons are war debts, obligations of the second reserve currency, and the restructuring of the British economy. After the June six-day war in the Middle East, massive sales of pounds by Arab countries began. There was a UK trade deficit. The official pound parity fell from US$2.80 to US$2.40.

- March 15-17, 1968 - collapse of the “gold pool”. The reason is the sharp rise in gold prices.

- May 1968 - social unrest in Paris. The French National Bank has used up most of its foreign exchange reserves. This ultimately led to the subsequent devaluation of the French franc.

- 1969 - Special Drawing Rights (SDR) were created within the IMF. SDRs were originally intended to be used as an alternative to gold to fill official reserves.

- August 8, 1969 - The French franc devalued by 11.1% against the US dollar.

- September 28, 1969 - Germany decided to introduce a floating exchange rate for its currency, which subsequently led to the strengthening of the German mark.

- October 27, 1969 - revaluation of the German mark against the US dollar by 9.3%.

- 1970 - the entire year there was a decrease in interest rates in the United States.

- May 3-5, 1971 - massive sales of US dollars.

- May 9, 1971 - Switzerland and Austria revalued their currencies by 7.1 and 5.1 percent, respectively.

- August 15, 1971 - US President Richard Nixon announces a temporary suspension of the convertibility of the dollar into gold. The reason o is the discrepancy between the real purchasing power of the dollar relative to the declared gold parity, long periods of deficit in the US balance of payments and trade balance. Nevertheless, the dollar remained the main reserve currency, despite the obvious crisis of the Bretton Woods monetary system.

- December 18, 1971 - the “group of ten” countries concluded the “Smithsonian Agreement” in Washington, according to which it was decided to revalue the main currencies against the dollar and allowed maximum fluctuations of 2.25% in one direction or another (currency corridors). The official price of gold was 37-38 dollars per ounce, but the convertibility of the dollar into gold was not restored. In fact, the dollar devalued by 7.66%.

- March 7, 1972 - The six original members of the EEC agreed that fluctuations in the currencies of these countries could not exceed 1.125% on one side or the other of the official parity, amounting to a total of 2.25% against 4.5% stipulated by the Smithsonian Agreement. To maintain the fixed parities, a system of foreign exchange interventions was developed. The German mark is beginning to play a leading role in Europe.

- June 1972 - Great Britain decided to introduce a free floating exchange rate for the pound sterling.

- January 1973 - the Italian government was forced to divide the foreign exchange market into two sectors - commercial and financial.

- February 12, 1973 - devaluation of the dollar against gold from 38 to 42.2 dollars per troy ounce. This decision caused a series of changes in fixed rates and revaluation of currencies against the dollar (Switzerland and Japan revalued their currencies by 12 and 7.5 percent, respectively).

- March 1973 - Japan and European hard currency countries suspended their commitment to fixed exchange rates.

- July 1973 - Managers agreed to replace “managed fluctuations” with a regime of floating exchange rates.

- 1973 - the first abrupt (fourfold) increase in oil prices. Caused severe inflation in all industrialized countries and a sharp economic downturn in 1974-75. In the same year, the price of gold increased significantly.

- 1975 - the first summit of the heads of leading Western states in an unofficial circle (later it became the G7). An agreement was reached to abolish the official price of gold.

- January 1976 - The Jamaican IMF conference noted the impossibility of returning to fixed exchange rates. For the first time, at the official international level, each country was given the option of adopting a fixed or floating exchange rate.

- 1976 - strong “polarization” of European currencies. Traditionally, “weak” currencies (pound sterling, Italian lira, French franc) are subject to strong devaluation, while “strong” currencies (deutsche mark, Swiss franc and Dutch guilder) continue to strengthen.

- January 10, 1977 - The pound officially ceased to serve as a reserve currency.

- April 1978 - Central banks of the leading industrial countries were allowed to buy and sell gold without restrictions on the free market.

- November 1, 1978 - The United States, Germany, Japan and Switzerland agreed on joint action to stabilize exchange rates. The goal is to keep the dollar from falling.

- 1979 - The European Monetary System is created. A single currency of account was introduced - ECU (European Currency Unit), which in 1999 was transformed into the euro.

- 1984 - Reaganomics, the rise of the US dollar due to high interest rates amid moderate inflation.

- 4th quarter 1984 - lowering interest rates in the United States, with the goal of weakening the dollar. However, after a slight decline, the dollar rate rose to another high. American industry began to switch to imported raw materials and transfer production abroad. As a result, the strong dollar became the main problem for the United States.

- September 1985 - The G7 agrees to depreciate the dollar through joint action in the foreign exchange market.

- February 1987 - Louvre Agreement between the G5 countries (USA, Germany, UK, France and Japan) and Canada to coordinate currency interventions to stabilize the US dollar. Broken up after the October 19 stock market crash in the United States.

- 1990 - the reunification of Germany gave rise to increased inflation in the united country and a subsequent increase in interest rates. As a result, the balance of power between the German mark and the other currencies included in the European Monetary System (EMS) was disrupted.

- 1992 - Italy’s exit from the EMU, accompanied by the devaluation of the Italian lira

- September 1992 - after Black Wednesday, the pound sterling is devalued and the UK leaves the EMU.

- April 20, 1995 - Japan lowers its policy rate to a historically low 1%. At the then current inflation rate (about 2%), the Bank of Japan was actually subsidizing commercial banks.

- April 25, 1995 - G7 finance ministers agreed on joint interventions to help the dollar to stem its rapid decline.

- On September 5, 2011, the morning fixing price (AM Fixing) for gold set a record in the entire history of the gold fixing - $1896.5 per troy ounce[2].

Gold standard in Russia[ | ]

Witte reform[ | ]

Main article: Currency reform in Russia (1897)

The last widely used gold standard was introduced in Russia by the Imperial Decree of January 3, 1897. The reform was carried out under the leadership of Finance Minister Sergei Yulievich Witte. The ruble was devalued by one and a half times, and its gold content amounted to 0.774235 g of pure gold. With the outbreak of World War I, the free exchange of paper money for gold was stopped.

Golden chervonets 1923[ | ]

Main article: Currency reform in the USSR (1922–1924)

In order to improve monetary circulation, in 1923 the USSR issued a gold coin with a denomination of “one chervonets”, containing 7.74235 grams of gold, that is, exactly as much as 10 rubles of the 1897 model contained. However, the circulation of the Soviet chervonets was small, and the exchange of paper money for it was very limited. In parallel with the Soviet chervonets, tsarist gold tens were minted and used for foreign trade transactions. However, the gold standard did not last long in the Soviet Union. With the beginning of industrialization, the ruble exchange rate began to fall, and since 1937, a new chervonets was introduced into circulation, which was not convertible into gold, even theoretically.

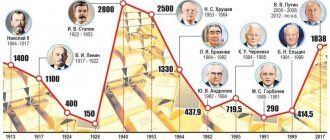

History of the emergence and end of the gold standard era

The first beginnings were laid in England back in 1816. At that time, the pound sterling was the reserve currency of the world. In fact, it was equated to gold. 100 years later, other leading European countries also switched to this system.

Most other countries joined the gold standard after the 1870s.

In 1834, the US set a fixed price for gold: $20.67 per ounce. This price lasted until 1933, after which it was raised to $35.

During World War I, the gold standard was abolished. This is due to the fact that states needed money, and for this they needed high inflation to collect money from the population.

After the end of the war, it was restored for another 6 years: from 1925 to 1931.

In 1933, there were massive seizures of gold from the population in the United States. Those who did not agree to voluntarily exchange it for dollars faced prison. This law was implemented by then-President Franklin Roosevelt. As a result, a huge amount of gold accumulated in US reserves.

From 1946 to 1971 The Bretton Woods agreement was in effect. The gold rate was strictly pegged to the US dollar at $35 per troy ounce (31.1 grams). The American government promised to buy back all the dollars and return the gold. But something went wrong. The financial crisis, a large number of printed and unbacked dollars led to the fact that on August 15, 1971, US President Richard M. Nixon abruptly abandoned this agreement (this happened at the Jamaica Conference of the International Monetary Fund). After this, the gold rate in dollars quickly flew up.

During the period of the Bretton Woods agreement in the United States they said “Dollar is as good as gold,” which means: “the dollar is as good as gold.” Now it is difficult to understand its true value. Robert Kiyosaki conducted a study where he counted all the dollars issued and the amount of gold. According to his prices, it should cost about $15 thousand per ounce.