For many private clients, mutual funds are the safest investment solution today. Unlike independent investment in securities, investing in the Central Bank and other instruments through funds provides high security, state control of all operations, competent distribution of funds and other advantages.

Sberbank's Gold Mutual Fund, which is managed by Sberbank Asset Management, is no exception: with an average degree of investment risk, it allows you to increase your savings safely and quickly enough.

Mutual funds - what are they?

Mutual funds are a financial investment model that is formed by pooling the funds of investors under the management of professional managers. The goal is to ensure asset growth.

An investment share in the form of a registered paper indicates the investor's ownership of a share of the property. Dividends are distributed among all shareholders in proportion to investments.

Is Gold any different?

The gold version has a number of distinctive features. If we compare it with the standard Sberbank MIR card, we can highlight the following differences:

- The amount of service is several times more expensive (750 rubles versus 3 thousand rubles).

- Gold offers the opportunity to issue additional cards.

- Owners of gold cards are provided with Mobile Banking options free of charge, while owners of classic cards must pay for them at a rate of 60 rubles per month.

- Daily cash limit: Gold card limit – 300 thousand rubles, standard card – 150 thousand rubles.

In addition to the functionality of the card, the external features are also excellent.

As for international alternatives (Sberbank Visa and MasterCard Gold), gold MIR differs significantly from them:

- There is no emergency cash withdrawal. Visa and MasterCard carry out these transactions without commission.

- MIR holders will not be able to withdraw cash or pay for purchases outside of Russia.

Despite such significant differences, the cost of servicing the cards is the same and amounts to 3 thousand rubles.

Current mutual funds of Sberbank and how much they cost

Current mutual funds of Sberbank include:

- Bond mutual funds;

- Share mutual funds;

- Mutual funds of mixed investments;

- Mutual Funds;

- closed mutual funds.

The financial organization makes it possible to control your investments in your Personal Account on the website of the management company. Here you can compare the profitability of mutual funds and check the current state of your portfolio.

The cost of an open fund share is posted on the website, information is updated daily. The price directly depends on the state of the market for a given time period. The value of assets can go down as well as up.

Bond mutual funds

Bond mutual funds are low-risk funds. The minimum investment amount for the first purchase through your Personal Account or mobile application is 1 thousand rubles, through a Sberbank branch - 15 thousand rubles.

Open-end bond funds include:

- Ilya Muromets is the leader in profitability for 2015. The dynamics of the increase in the value of the share over 36 months is 38.3%.

- A perspective bond fund is an alternative to a deposit and savings account. The investment strategy is designed for investors expecting income at an average level of risk. The dynamics of the increase in the value of the share over 3 years is 39.43%. Funds are offered to be placed for any period.

- The Eurobonds Fund invests in government and Russian corporate Eurobonds. The goal is capital gains in US dollars. The dynamics of the increase in the value of the share over 3 years is 45.4%.

- The Global Debt Market Fund invests in corporate and sovereign currency bonds of developed and developing countries. The investment currency is mainly US dollar. The dynamics of the increase in the estimated value is 25.85% over the last 36 months.

- The Money Fund offers the purchase and redemption of shares without commissions. The shareholder can freely manage his funds: deposit and withdraw money. The dynamics of the increase in the value of the share over the six months was 2.45%.

Share mutual funds

Equity funds are high risk. The minimum share contribution is 1 thousand rubles.

Sberbank equity funds:

- Dobrynya Nikitich invests in shares of Russian companies with high growth potential and liquidity. The increase in the value of the share in rubles over 3 years is 41.9%.

- The Small Cap Equity Fund invests in shares of Russian and foreign mid- and small-cap companies with high development potential. The return for 3 years was 38.78%. Ruble and foreign currency investments in assets are accepted.

- An active management fund aims to achieve long-term returns through active portfolio management. Invests in shares and derivatives of Russian companies. The 36-month return was 32.38%.

- Elektroenergetika invests in shares of Russian electric power companies. It has a high yield of 76.06% for 3 years. The fund accepts ruble investments in assets. The recommended period for placing funds is three years.

- “Natural Resources” - investing in companies engaged in the extraction and processing of natural resources (oil, gas, metals, etc.). The increase in the value of the share was 65.71% over 36 months.

- “Telecommunications and Technologies” - investing in shares of telecommunications companies of the Russian Federation. The fund accepts ruble and foreign currency investments. Investments in this Sberbank mutual fund brought investors a low return of 8.7% over 3 years.

- “Global Internet” is the leader in profitability for 2021 in its line. Engaged in investing in shares of Internet companies. The mutual fund's return was 63.55% over the last 36 months.

- “Consumer Sector” invests in shares of predominantly Russian companies in the consumer sector, which are not among the export-oriented ones. The recommended period for placing funds is 3 years. The increase in the value of the mutual fund amounted to 40.59% over 36 months.

- “Financial Sector” invests in shares of financial organizations (banks, insurance companies, etc.). The return over 3 years is 70.19%.

- "Global Engineering". The fund invests shareholders' funds in shares of companies in the engineering sector. During 3 years of management, the value of shares increased by 15.47%.

Mutual funds of mixed investments

Mixed investment mutual funds include the Balanced fund, which invests in a diversified portfolio of bonds and stocks. Has a medium risk level. The profitable investment period is 3 years. The fund's return was 41.82% over 36 months.

Mutual funds of funds

Mutual funds of funds have a high level of risk (the exception is the “Gold” fund), but they generate significant income. The minimum investment amount when purchasing a share online is 1 thousand rubles, when purchasing through a Sberbank operator - 15 thousand rubles.

Mutual funds of funds and directions of their investment:

- "America" invests in shares of the foreign fund SPDR S&P 500 ETF TRUST. Over the past 3 years, there has been a positive dynamics of growth in the value of the share, amounting to 50.66%.

- Europe invests in units of the db x-trackers fund, class db x-trackers EURO STOXX 50 UCITS ETF (DR). The return over 3 years is 19.13%.

- Biotechnology invests in shares of the foreign investment fund iShares Nasdaq Biotechnology ETF. It has negative dynamics, minus 1.15% over 36 months.

- "Gold" accepts foreign currency investment assets. The fund invests in gold and shares of the PowerShares DB Gold Fund. It has an average level of risk and a corresponding return of 10.55% for 3 years.

- Emerging Markets invests in shares of the iShares Core MSCI Emerging Markets ETF. There is a positive dynamics in the value of the share - 22.8% over 36 months.

Closed mutual funds (closed mutual funds)

The issuance of closed mutual funds is possible only when the fund is created, and redemption is possible only when it is closed. Closed mutual funds are created for a specific purpose and have a high price threshold for entry. The risk level is medium.

Closed mutual funds of Sberbank:

- "Rental Business" invests in high-quality warehouse real estate. The shares are admitted to trading on the Moscow Exchange. The dynamics of the share price is negative - minus 4.93% over 3 years.

- "Rental Business 2" is engaged in investing in high-end commercial real estate. The dynamics of the share price is positive - plus 5.3% over 2 years.

- "Commercial real estate". The purpose of the fund is to acquire real estate to generate income in the form of rental payments and when selling objects. Engaged in investing in commercial buildings in all regions of Russia. During 2015-2018, the value of the share decreased by 34.46%.

- "Residential Real Estate 2" invests in housing in the capital and region with a discount at the construction stage and subsequent sale. During 2014-2017, the value of the share fell by 22.31%.

- “Residential Real Estate 3” has an investment geography of Moscow and the Moscow region. Income is generated through the sale of fund property. The dynamics of the share price is minus 10.42% over 3 years.

The video provides a brief overview of Sberbank mutual funds. Author: Nora Belousova.

A few words about the classic version

The classic MIR payment debit card is no different in appearance from its international counterparts. The only difference is the logo depicted on the plastic. Below are its main characteristics:

- The issue is free of charge.

- Annual maintenance is 750 rubles (for the first year, then the cost is reduced to 450 rubles).

- Service life – 3 years.

- It features increased protection - a special electronic chip is built into the plastic.

- Allows you to pay for purchases online.

- Provides standard Sberbank cards).

- Allows you to participate in the “Thank You” program, accumulating bonus points.

You cannot pay using the classic MIR card outside the Russian Federation.

How mutual funds work

Scheme of operation of mutual funds:

- The management company creates a fund and determines a strategy for generating profit, the scope of investment, on the basis of which it will operate in the future.

- From the presented funds, the investor selects the appropriate one and submits a purchase application. After which the registrar enters the shareholder into the register.

- Capital from the mutual fund's assets is invested in company shares in accordance with the developed strategy.

- The investor makes a profit.

- The management company takes a share of the financial transactions performed.

The investor can own part of the share, which allows reducing the price threshold for entering the fund.

What are mutual funds?

Mutual investments are a rational alternative to deposits, with the help of which you can not only save your money, but also increase it. Favorable conditions and high profitability of mutual funds are offered by the largest bank in Russia - Sberbank. Before making investments, you need to have a general understanding of what the Sberbank Mutual Investment Fund is.

Sberbank Mutual Fund is an investment complex under the auspices of a management company, the purpose of which is to increase the value of the fund’s property, which in turn consists of shares - units of fund property (investor assets).

How do they work?

The meaning of a mutual fund is its share of investors, the profitability of which is distributed between them and the legal entities of the fund.

Mutual Fund operating algorithm:

- Purchase of shares. Submitting an investor's application to the management company, if approved, transferring funds to the mutual fund account using the issued details.

- Registration of investor data in the register - for the accrual of shares.

- Notification of the investor about the accrual of shares.

- The management company purchases securities on the stock exchange through its broker at the expense of the mutual fund.

- Crediting securities to a mutual fund account and transferring them to the depository.

The work process for all mutual funds is identical. The general algorithm of work gives investors a certain confidence in reliable calculations, since the management company, registrar and depository are interconnected with each other and control the entire work process, and their activities are verified by an auditor.

How to make money on mutual funds

The shareholder's income is formed by the difference in the value of shares at the time of purchase and sale. Earnings largely depend on the activities of the Management Company and the state of the market.

Before purchasing mutual funds you must:

- Read the literature on investing.

- Study the current economic situation.

- Seek help from professionals (you can get advice on the website).

Profitability of Sberbank mutual funds

For financial planning, a mutual fund profitability calculator has been developed; it is located in the user’s personal account.

It is profitable to buy shares of different funds - this will minimize the risk of losses and increase the likelihood of receiving a good income. You can select an investment portfolio using a special calculator on the Sberbank website.

Rating of mutual funds by profitability

The table shows a dozen mutual funds in accordance with their profitability rating:

| mutual fund | Profitability since the beginning of the year (01/01/2018) | Share price in rubles |

| "Global Internet" | 19,23% | 3 444.63 |

| "Biotechnology" | 15,13% | 1 018.94 |

| "Natural resources" | 14,64% | 1 356.41 |

| "America" | 13,44% | 1 662.77 |

| "Eurobonds" | 8,62% | 2 343.43 |

| "Gold" | 5,58% | 1 016.17 |

| "Nikitich" | 5,03% | 9 775.24 |

| "Europe" | 4,37% | 847.49 |

| "Electric power" | 3,76% | 1 032.31 |

| "Rental business" | 3,69% | 285 223.14 |

How many shares to buy in Sberbank so as not to go bankrupt

Among Sberbank funds there are those that relate to investments only in natural resources or only in gold and securities. Mutual funds in the field of telecommunications and the latest technologies are also presented. There are currently 20 of them in total. Each has its own strategy; there is a headquarters of professionals, managers, and financiers. They are engaged in the competent investment of your funds in order to obtain a positive return.

When purchasing a share, one or more, the consultant will tell you about the funds, their performance, and advise where it is better to invest. But these are just recommendations. The client himself chooses what he wants to purchase, he can simply listen to the advice.

Any financier knows that it is better to minimize risks. To do this, it is better to create an investment portfolio for yourself. That is, buy not one or two, but several shares. All of them must be purchased in different mutual funds. Then, if one share leads to a loss, then the income on the other will reset it to zero, or even bring it to profit.

The more different investments there are, the lower the risks. For example, a share in one fund fell in price, leading to a loss of money. And a share in a completely different mutual fund, on the contrary, has increased significantly in value. Then it will cover your losses and only bring income. Your portfolio is formed from these different investments. You can manage and compile it yourself, or involve a trusted one. Manager services are also provided at Sberbank.

How to invest money in Sberbank mutual funds for an individual

An individual can make a contribution to mutual funds in several ways:

- in your Personal Account;

- at the Sberbank Asset Management office;

- through the company's mobile application;

- at a Sberbank branch.

When visiting a bank or management company office in person, you must have your passport with you. In order to become a shareholder remotely, you should ensure that you have a confirmed account on the State Services portal.

The video talks about the individual experience of a private individual investing in Sberbank mutual funds. Posted on the channel “Asset Management Mutual Funds”.

How to withdraw your money from a mutual fund?

An application for redemption of shares is submitted to Sberbank on any working day based on the following documents:

- depositor's passport;

- application for the acquisition of a share by an individual.

The main condition for withdrawing funds from a closed mutual fund is the termination of the fund. You cannot withdraw money before this procedure.

The maximum period for transferring money to the investor's account after redemption of shares is 13 business days from the date of application.

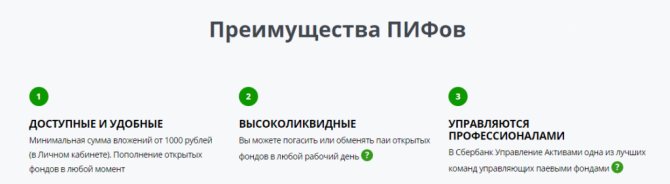

Mutual funds of Sberbank of Russia - advantages of choice

Advantages of Sberbank mutual funds:

- The yield is higher than on bank deposits. Accordingly, investing in mutual funds is more profitable.

- Availability. Anyone can open a mutual fund. It is not necessary to have management skills or understand stocks and other securities; these functions are assigned to the management company.

- Low share price.

- Ease of purchase and sale.

- Variety of mutual funds. Here you should not forget about the rule: the higher the profitability, the higher the risk.

- Investment security. This process is controlled at the state level. Shareholders' money is stored in a special depository.

- Taxes are paid by the management company itself at a rate of 13%; there is no need to file a declaration. Ownership of shares for more than three years exempts income from taxation.

How commissions destroy capital

For clarity, I made a small table showing the profitability of investments at different investment periods.

How much percent of the capital will you have to pay for owning a gold instrument for different investment periods? Taking into account one-time and permanent (annual) commissions.

For simplicity, I did all the calculations “practically on my knees.” Do not judge strictly. It is clear that as quotes rise, the percentage of ownership, in absolute money, will increase. When falling, descend.

The main thing is to see the big picture and directions of thought...

- According to compulsory medical insurance, I took the average spread on the market - 6% (purchase + sale).

- Mutual Fund - excluding agency fees. Only annual ownership fee is 3%.

- ETF - 0.45% per year - unit ownership. Plus purchase and sale costs - 0.4%.

in red , the best option is highlighted in green ...

Disadvantages of investing in mutual funds

Based on reviews from Sberbank clients, we can talk about the following disadvantages of investing in mutual funds:

- No guarantee of profit. There is always a risk of losing part of the invested funds.

- Artificially inflating the value of a share to attract investors.

- Commission for the purchase of mutual funds. You can buy a share at a cost increased by 1% for amounts up to 3 million rubles, by 0.5% for purchases over three million rubles. The commission is also taken upon redemption: 2% - ownership of shares from 0 to 180 days, 1% - from 181 to 731 days, over these periods - 0%.

- Investments in mutual funds are not covered by the deposit insurance program. If the fund is liquidated during a crisis, shareholders will suffer significant losses.

Characteristics of gold funds

To make an informed decision, the shareholder needs to imagine the structure of the fund’s assets. In the case of mutual funds for gold, it is very simple and is directly tied to the price of the metal on the commodity exchange. To measure the price most accurately, commodity futures are used as a tool. They allow you to evaluate an asset taking into account expectations for the future. As a conservative option in a calm market, the fund demonstrates moderate growth in value. In addition, it can delight owners with sharp jumps in profitability during periods of high volatility. When uncertainty rises, so does the price of gold. The movement is in antiphase with respect to risky assets.

Video

The video talks about whether it is worth investing in mutual funds. Filmed by the “Your Potential” channel.

Loading …

Was this article helpful?

Thank you for your opinion!

The article was useful. Please share the information with your friends.

Yes (50.00%)

No (50.00%)

X

Please write what is wrong and leave recommendations on the article

Cancel reply

Rate the benefit of the article: Rate the author ( 2 votes, average: 4.50 out of 5)

Discuss the article: